3M PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3M Bundle

Unlock the external forces impacting 3M's success with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping the company's trajectory. Gain the strategic foresight needed to navigate these complexities and identify emerging opportunities. Download the full PESTLE analysis now for actionable intelligence that empowers your decision-making.

Political factors

Government regulations are a huge deal for 3M, affecting everything from their environmental practices to how safe their products are, especially in healthcare. For instance, in 2023, 3M faced significant legal settlements related to PFAS "forever chemicals," totaling billions of dollars, highlighting the direct financial impact of environmental regulations.

Staying compliant with these rules in different countries is essential for 3M to even sell its products and operate smoothly. A prime example is the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation, which requires extensive data on chemical substances and can impact product formulations and market availability.

Changes in how strict these regulations are or how they're enforced can really shake things up for 3M. For example, increased scrutiny on medical devices in the US by the FDA can lead to longer product approval times and higher R&D costs, directly influencing their go-to-market strategies.

As a global company, 3M is significantly impacted by international trade policies and tariffs. For instance, in 2023, the U.S. continued to maintain tariffs on goods from China, affecting the cost of certain imported components that 3M might utilize. These trade dynamics directly influence 3M's supply chain costs and the competitiveness of its products in international markets.

Geopolitical stability is a major concern for 3M. For instance, the ongoing conflict in Eastern Europe, which began in early 2022, has continued to impact global supply chains and energy prices throughout 2024. This instability can directly affect 3M's manufacturing facilities and the sourcing of raw materials, potentially leading to increased costs and delivery delays.

Regional conflicts and political unrest in other key markets could also pose risks. In 2024, several regions experienced heightened tensions, which can disrupt market demand for 3M's diverse product portfolio, ranging from healthcare to industrial adhesives. Such disruptions necessitate robust risk management strategies to safeguard operations and maintain market access.

The financial implications of geopolitical instability are significant. Increased operational risks can translate into higher insurance premiums for 3M's global assets. Furthermore, potential loss of market access due to sanctions or trade restrictions in affected regions could impact revenue streams, underscoring the need for continuous geopolitical risk assessment and mitigation planning.

Government Spending and Infrastructure Initiatives

Government spending on infrastructure, like the Bipartisan Infrastructure Law enacted in the US, which allocates $1.2 trillion, directly impacts demand for 3M's materials in construction and transportation. This increased investment in public health and industrial development, such as semiconductor manufacturing incentives, creates new avenues for 3M's products in healthcare and electronics sectors. Conversely, shifts towards fiscal conservatism or reduced public investment can lead to a slowdown in these project-driven sales.

Healthcare Policy and Reimbursement Changes

Healthcare policy and reimbursement changes significantly influence 3M's Health Care segment. For instance, shifts in Medicare and Medicaid reimbursement rates directly affect the profitability of medical devices and supplies. In 2024, ongoing discussions around drug pricing and potential reforms to the Affordable Care Act could alter demand for 3M's diverse product portfolio, impacting revenue streams.

Policy changes can create both opportunities and challenges. For example, government initiatives promoting value-based care might favor innovative solutions that 3M offers, potentially boosting sales. Conversely, increased regulatory scrutiny on medical device approvals or stricter pricing controls could dampen market growth.

- 2024 Healthcare Spending Projections: Global healthcare spending is projected to continue its upward trend, with significant government investment in public health initiatives.

- Impact of Inflation Reduction Act: The IRA's provisions on drug pricing negotiations could indirectly influence the market for medical devices and supplies by altering overall healthcare cost structures.

- Reimbursement Rate Adjustments: Anticipated adjustments to reimbursement rates for various medical procedures in 2025 will be closely watched by 3M for their impact on device utilization.

Government regulations significantly shape 3M's operational landscape, impacting everything from product safety standards to environmental compliance. The company's substantial settlements in 2023, amounting to billions related to PFAS, underscore the financial weight of environmental rules. Navigating diverse international regulations, like the EU's REACH, is crucial for market access and product formulation.

Trade policies and geopolitical stability present ongoing challenges and opportunities for 3M. Tariffs on imported goods, as seen in 2023, affect supply chain costs. Geopolitical conflicts, like the one in Eastern Europe, continue to disrupt global supply chains and energy prices, impacting 3M's operations and raw material sourcing throughout 2024.

Government spending on infrastructure and healthcare policy directly influences demand for 3M's products. The US Bipartisan Infrastructure Law, with its $1.2 trillion allocation, boosts demand for materials in construction and transportation. Changes in healthcare reimbursement rates, particularly for Medicare and Medicaid, critically affect the profitability of 3M's Health Care segment.

| Political Factor | Impact on 3M | Relevant Data/Examples (2023-2025) |

| Regulatory Compliance | Affects product development, market entry, and operational costs. | 3M's ~$10.3 billion settlement in 2023 for PFAS litigation. EU REACH compliance impacts chemical use. |

| Trade Policies & Tariffs | Influences supply chain costs and product pricing in global markets. | Continued US tariffs on Chinese goods in 2023 affected component costs. |

| Geopolitical Instability | Disrupts supply chains, increases operational risks, and affects market demand. | Ongoing conflicts in Eastern Europe impacting energy prices and logistics in 2024. |

| Government Spending | Drives demand for materials in infrastructure, healthcare, and technology sectors. | US Bipartisan Infrastructure Law ($1.2 trillion) supports demand for construction materials. |

| Healthcare Policy | Impacts revenue and profitability of the Health Care segment through reimbursement and pricing. | 2024 projections show continued global healthcare spending growth; IRA drug pricing impacts considered. |

What is included in the product

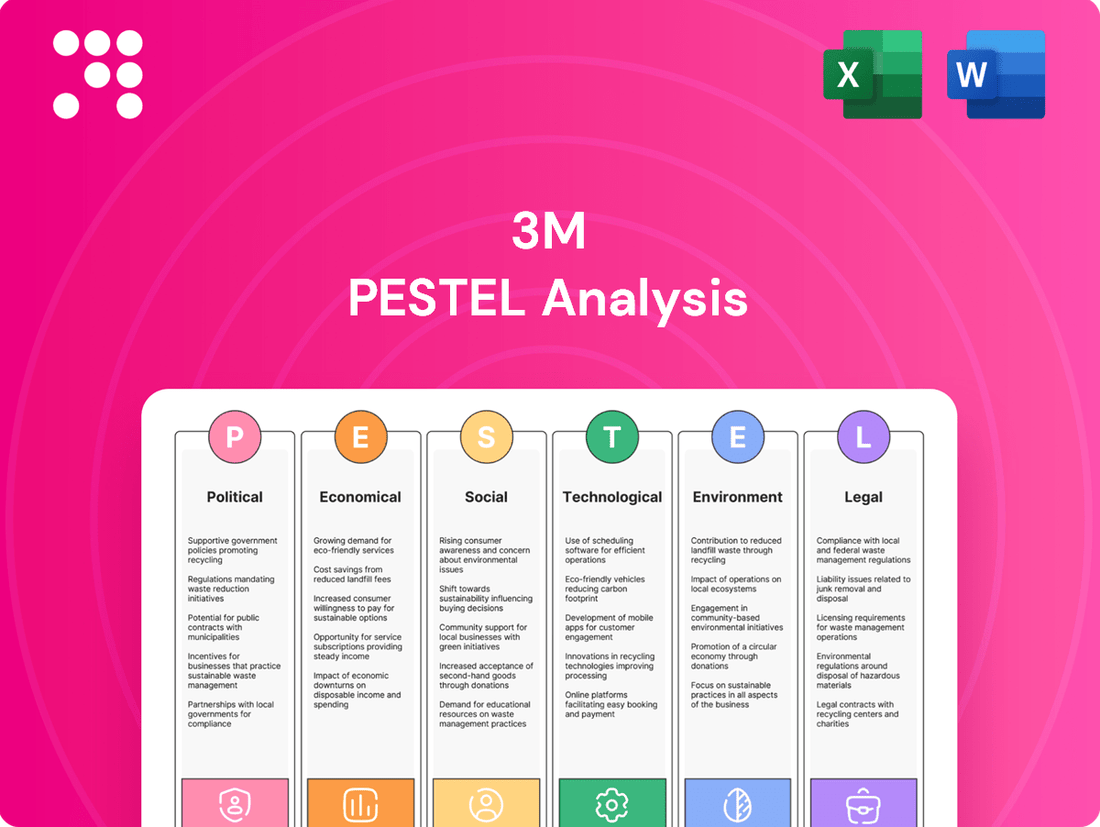

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing 3M, categorized into Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities arising from these dynamic global forces.

The 3M PESTLE analysis offers a structured framework to identify and address external challenges, acting as a pain point reliever by providing clarity on potential disruptions and opportunities.

It simplifies complex external factors into actionable insights, enabling proactive strategy development and mitigating risks that could otherwise hinder business growth.

Economic factors

3M's revenue is significantly influenced by global economic growth trends. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023, indicating a mixed economic environment. This growth rate directly impacts demand for 3M's products in sectors like manufacturing and automotive.

Recessionary risks, however, pose a considerable threat. A potential economic slowdown in major markets like the US or Europe could dampen industrial production and consumer spending, directly affecting 3M's sales volumes. For example, if key markets experience a contraction, demand for 3M's adhesives, abrasives, and safety equipment would likely decrease.

Persistent inflationary pressures have a direct impact on 3M's operational costs. For example, the Producer Price Index for manufactured goods in the US saw a notable increase throughout 2023 and into early 2024, directly affecting the cost of chemicals, metals, and other essential inputs for 3M's diverse product lines. This surge in raw material and energy prices can squeeze profit margins if not effectively managed through pricing adjustments or enhanced operational efficiencies.

3M's extensive global supply chain, crucial for sourcing a wide array of components, is particularly vulnerable to these cost escalations. Managing these rising input costs requires sophisticated supply chain strategies, including long-term supplier contracts and exploring alternative material sourcing. Furthermore, 3M's ability to pass these increased costs onto consumers through pricing strategies is vital for maintaining its competitive edge and profitability in a dynamic market environment.

As a global company, 3M is significantly influenced by currency exchange rate fluctuations. For instance, in the first quarter of 2024, 3M reported that unfavorable currency movements negatively impacted sales by 0.7%, highlighting the real-world effect of these shifts on their top line.

When foreign currencies weaken against the U.S. dollar, the value of 3M's overseas earnings and assets decreases when converted back into dollars. This can directly reduce reported profits and make their products more expensive in those local markets, potentially impacting sales volume.

Conversely, a stronger dollar can make imported materials cheaper for 3M, but it also diminishes the dollar value of earnings generated in countries with weaker currencies. Managing this volatility through hedging and diversification is crucial for maintaining stable financial performance.

Consumer Spending Patterns and Disposable Income

Consumer spending patterns significantly impact 3M's diverse product portfolio. In 2024, a notable trend is the continued consumer focus on value and durability, particularly in categories like home improvement and automotive aftermarket, where 3M has a strong presence. Disposable income levels, influenced by inflation and employment rates, directly correlate with demand for 3M's non-essential goods, such as certain consumer electronics accessories and craft supplies.

For instance, the U.S. Bureau of Economic Analysis reported that personal consumption expenditures increased by an annualized rate of 3.1% in the first quarter of 2024, indicating robust consumer activity. This suggests a favorable environment for 3M's consumer-facing segments. However, shifts towards sustainability and eco-friendly products are also shaping purchasing decisions, requiring 3M to adapt its product development and marketing to meet these evolving preferences.

- Increased discretionary spending in Q1 2024: Personal consumption expenditures rose by 3.1% annually in the US.

- Value-driven purchasing: Consumers are prioritizing durability and cost-effectiveness in home and automotive goods.

- Sustainability demand: Growing consumer preference for eco-friendly products influences buying choices across various categories.

- Impact on 3M's segments: Trends affect demand for DIY products, office supplies, and household items.

Interest Rates and Access to Capital

Fluctuations in interest rates directly impact 3M's cost of capital. For instance, the Federal Reserve's benchmark interest rate, which influences borrowing costs across the economy, saw increases through 2023 and early 2024, potentially raising the expense for 3M to secure loans for R&D or capital projects. This environment can temper investment in growth opportunities.

The broader credit market's health, influenced by interest rate policies, also plays a role. A tightening credit environment can make it harder for 3M's customers to access financing, potentially dampening demand for its products. Similarly, suppliers facing higher borrowing costs might see their own financial stability affected, creating ripple effects in 3M's supply chain.

- Impact on Borrowing Costs: Rising interest rates increase the cost of debt for 3M, affecting the feasibility of new investments.

- R&D and Capital Expenditure Financing: Higher borrowing costs can limit funding available for innovation and facility upgrades.

- Customer and Supplier Financial Health: The credit environment influences the ability of 3M's partners to conduct business, impacting demand and supply.

- Federal Reserve Policy: Actions by central banks, such as adjusting the federal funds rate, directly shape the interest rate landscape.

Global economic growth is a primary driver for 3M's revenue. The IMF projected 3.2% global growth for 2024, a slight dip from 2023, impacting demand across 3M's industrial and automotive sectors. Conversely, recessionary fears in major economies could significantly reduce sales volumes for adhesives, abrasives, and safety equipment.

Inflationary pressures directly increase 3M's input costs. The US Producer Price Index for manufactured goods saw considerable increases through early 2024, raising expenses for raw materials and energy, which can pressure profit margins if not offset by price increases or efficiency gains.

Currency exchange rates also affect 3M's financial performance. In Q1 2024, unfavorable currency movements negatively impacted 3M's sales by 0.7%, illustrating the tangible effect of currency fluctuations on the company's top line.

Consumer spending, particularly on durable and value-oriented goods, influences 3M's consumer segments. US personal consumption expenditures increased by 3.1% annually in Q1 2024, suggesting a positive environment for 3M's consumer products, though demand for eco-friendly options is also growing.

| Economic Factor | 2024 Projection/Trend | Impact on 3M | Example Data/Event |

|---|---|---|---|

| Global Economic Growth | Projected 3.2% (IMF) | Influences demand for industrial and automotive products. | IMF forecast for 2024. |

| Inflation | Persistent Pressure | Increases raw material and energy costs, potentially squeezing margins. | US Producer Price Index increases through early 2024. |

| Currency Exchange Rates | Volatile | Affects reported sales and profitability of international operations. | Q1 2024: 0.7% negative impact on sales due to currency. |

| Consumer Spending | Increased in Q1 2024 | Boosts demand for consumer-facing segments; sustainability is a growing factor. | US Personal Consumption Expenditures up 3.1% annually in Q1 2024. |

What You See Is What You Get

3M PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive 3M PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a deep understanding of the external forces shaping 3M's strategic landscape.

Sociological factors

Consumers increasingly prioritize sustainability, with a growing demand for eco-friendly materials and processes. For instance, by early 2024, reports indicated that over 70% of consumers considered sustainability when making purchasing decisions, directly impacting 3M's need to innovate in areas like biodegradable adhesives and recyclable components.

The desire for convenience and personalized products is also reshaping markets. 3M's investment in smart home technologies and customized healthcare solutions reflects this trend, aiming to capture a segment of consumers seeking tailored experiences and simplified living, a market projected to grow by double digits annually through 2025.

These evolving lifestyles necessitate continuous adaptation across 3M's diverse product lines. The company's strategic focus on health and wellness, evident in its 2024 product development pipeline, directly addresses consumer shifts towards healthier living and preventative care, a sector showing robust growth.

Global demographic shifts, like the aging populations in countries such as Japan and Germany, present a dual challenge for 3M. By 2025, the proportion of people aged 65 and over is projected to reach 19% globally, impacting labor availability and increasing demand for healthcare solutions. This necessitates investment in automation and a strategic focus on products catering to an older demographic.

Growing public and industrial concern for health and safety significantly boosts demand for 3M's Safety & Industrial offerings, such as personal protective equipment and workplace safety systems. For instance, in 2024, global spending on industrial safety equipment was projected to reach over $60 billion, a figure expected to climb as awareness intensifies.

Stricter workplace safety regulations and a greater emphasis on employee well-being are key drivers for innovation within 3M's safety segment. The company's investment in R&D for advanced respiratory protection and high-visibility materials directly addresses these evolving standards and public expectations for a safer working environment.

Labor Market Trends and Skills Availability

The availability of skilled labor, especially in areas like advanced manufacturing, engineering, and R&D, is a major sociological consideration for 3M. As of early 2024, the U.S. Bureau of Labor Statistics reported a persistent demand for engineers, with projected job growth of 4% between 2022 and 2032, indicating a competitive landscape for talent. This trend directly impacts 3M's ability to innovate and maintain its operational edge.

Shifting labor market dynamics, including the rise of the gig economy and the increasing prevalence of remote work, present both opportunities and challenges for 3M. While remote work can broaden the talent pool, it also requires adapting management styles and ensuring cybersecurity. Furthermore, the demand for specialized technical skills, such as data analytics and artificial intelligence, means 3M must actively cultivate these competencies within its workforce to stay ahead.

To address these labor market trends, 3M's strategy must include robust talent development programs and flexible employment models. Investing in continuous learning and upskilling initiatives is crucial. For instance, many companies in the manufacturing sector are partnering with educational institutions to create pipelines for skilled technicians, a model 3M could further leverage to attract and retain a competitive workforce in the coming years.

- Skilled Labor Demand: High demand for engineers and R&D professionals impacts recruitment for 3M.

- Workforce Trends: Gig economy and remote work necessitate adaptive employment strategies.

- Talent Development: Continuous investment in upskilling and specialized technical skills is vital.

- Competitive Landscape: Adapting employment models is key to attracting and retaining top talent.

Social Responsibility and Ethical Consumerism

Consumers and investors are increasingly scrutinizing companies' social responsibility. In 2024, a significant portion of consumers, estimated to be over 60%, reported that they would switch brands if a competitor offered a comparable product with a stronger ethical stance. This trend directly impacts 3M's brand reputation and its ability to attract socially conscious customers and investors.

Ethical consumerism means that 3M's sourcing practices and overall transparency are under a microscope. For instance, 3M's 2023 sustainability report highlighted a 15% reduction in water usage across its global operations, a move directly responding to environmental concerns. Such initiatives are crucial for maintaining trust and appealing to a growing market segment that prioritizes environmental and social impact in their purchasing decisions.

Furthermore, 3M's commitment to fair labor practices and community engagement is vital. Reports from 2024 indicate that companies with strong ESG (Environmental, Social, and Governance) scores, which often encompass these areas, saw a 10-15% higher valuation compared to their peers with weaker ESG performance. This financial incentive underscores the importance of 3M actively demonstrating its dedication to these principles.

Key areas influencing 3M's social standing include:

- Ethical Sourcing: Ensuring raw materials are obtained responsibly and without exploitation.

- Environmental Impact: Minimizing pollution, waste, and resource depletion.

- Labor Practices: Upholding fair wages, safe working conditions, and diversity.

- Community Engagement: Contributing positively to the communities where 3M operates.

Sociological factors significantly shape consumer preferences and market demands, pushing companies like 3M towards greater sustainability and personalization. By early 2024, over 70% of consumers considered sustainability in their purchases, driving 3M's innovation in eco-friendly materials. Similarly, the demand for convenience fuels 3M's expansion into smart home and tailored healthcare solutions, a market expected to see double-digit annual growth through 2025.

Demographic shifts, such as aging populations, present both challenges and opportunities. By 2025, individuals aged 65 and over are projected to constitute 19% of the global population, increasing demand for healthcare products while potentially impacting labor availability. 3M's strategic focus on health and wellness solutions directly addresses these evolving consumer needs.

Workplace safety and employee well-being are increasingly prioritized, boosting demand for 3M's safety equipment. Global spending on industrial safety equipment was projected to exceed $60 billion in 2024, a figure expected to rise with heightened awareness. Stricter regulations also compel 3M to invest in advanced protective gear, aligning with public expectations for safer work environments.

| Sociological Factor | Impact on 3M | Supporting Data (2024-2025) |

|---|---|---|

| Sustainability Focus | Drives demand for eco-friendly products; necessitates R&D in recyclable materials. | Over 70% of consumers consider sustainability in purchasing decisions (early 2024). |

| Demand for Personalization | Encourages investment in customized solutions like smart home tech and healthcare. | Personalized product markets projected for double-digit annual growth through 2025. |

| Aging Global Population | Increases demand for healthcare solutions; impacts labor markets. | Global 65+ population projected to reach 19% by 2025. |

| Workplace Safety Emphasis | Boosts sales of safety and industrial products; requires innovation in protective gear. | Global industrial safety equipment spending projected over $60 billion in 2024. |

Technological factors

3M's commitment to materials science and advanced manufacturing is a key driver of its success. In 2023, the company continued to invest heavily in R&D, with a significant portion allocated to developing novel materials and improving production processes. This focus on innovation allows 3M to create products with superior performance, such as advanced adhesives and filtration technologies, which are critical in sectors like automotive and healthcare.

The company's expertise in areas like nanotechnology is particularly impactful. For instance, 3M's advancements in nanoscale materials contribute to lighter, stronger, and more efficient products. This translates to tangible benefits for customers, such as improved fuel efficiency in vehicles due to lighter components or enhanced diagnostic capabilities in medical imaging. The ongoing development in these fields directly supports 3M's diverse product portfolio and its ability to adapt to evolving market demands.

The continuous push towards digitalization and automation, core tenets of Industry 4.0, significantly shapes 3M's operational landscape and its product innovation pipeline. By integrating smart manufacturing, robotics, and advanced data analytics, 3M aims to streamline production, cut expenses, and elevate product quality across its diverse portfolio.

In 2023, 3M continued to invest in advanced manufacturing technologies, with capital expenditures for manufacturing and environmental initiatives totaling $1.2 billion, reflecting a commitment to operational efficiency. The company's own adoption of these technologies is crucial, but 3M also actively develops solutions, such as adhesives and materials for electronics and automation systems, that enable its industrial clients to embrace these digital transformations, thereby unlocking new revenue streams.

3M's commitment to innovation is evident in its substantial R&D spending. In 2023, the company invested $2.0 billion in research and development, a figure that underscores its dedication to developing new technologies and products. This sustained investment is critical for maintaining its competitive edge and ensuring a steady stream of new offerings that meet evolving market demands.

The company's innovation pipeline is a key driver of its long-term growth strategy. By focusing on translating scientific advancements into commercially viable solutions, 3M aims to capture new market opportunities and address emerging customer needs. This forward-looking approach, supported by a robust patent portfolio, is fundamental to its ability to adapt and thrive in dynamic industries.

Emerging Technologies such as AI and IoT Integration

The integration of emerging technologies like Artificial Intelligence (AI) and the Internet of Things (IoT) offers substantial avenues for 3M's growth. AI can be leveraged to refine product development, streamline logistics, and implement predictive maintenance solutions for their industrial customer base.

IoT capabilities enable the creation of smart product functionalities and enhanced connectivity, unlocking new value propositions across 3M's varied business segments. This ranges from advanced healthcare monitoring systems to interconnected sensors for industrial applications.

- AI in R&D: 3M is actively exploring AI for accelerating material discovery and simulation, potentially reducing development cycles by years.

- IoT for Connected Solutions: The company is expanding its portfolio of connected products, such as smart building materials and advanced healthcare monitoring devices, aiming to capture a larger share of the growing IoT market, which is projected to reach trillions of connected devices by 2025.

- Operational Efficiency: AI-driven analytics are being deployed in manufacturing to optimize production processes, reduce waste, and improve energy efficiency, contributing to cost savings and sustainability goals.

Cybersecurity and Data Protection Requirements

As 3M's operations become more digitized, from advanced manufacturing processes to intricate supply chain management and direct customer engagement, the importance of strong cybersecurity cannot be overstated. The company's reliance on digital infrastructure means that safeguarding sensitive corporate data, invaluable intellectual property, and crucial customer information from ever-evolving cyber threats is paramount for uninterrupted business operations and preserving stakeholder trust.

The increasing frequency and sophistication of cyberattacks, with global costs projected to reach $10.5 trillion annually by 2025, underscore the critical need for 3M to invest heavily in advanced security protocols. Furthermore, staying ahead of the curve on data protection regulations, such as GDPR and CCPA, which mandate stringent requirements for handling personal information, directly influences the necessity for robust and adaptable security frameworks.

Key technological factors impacting 3M regarding cybersecurity and data protection include:

- Increased Ransomware Attacks: In 2024, the manufacturing sector, a core area for 3M, experienced a significant rise in ransomware attacks, with average recovery costs escalating.

- Evolving Data Privacy Laws: New regulations in major markets continue to impose stricter penalties for data breaches, requiring continuous updates to data handling and protection policies.

- Supply Chain Vulnerabilities: As 3M integrates digital solutions across its supply chain, ensuring the cybersecurity of third-party vendors becomes a critical risk management area.

- Intellectual Property Theft: The protection of proprietary research and development, a cornerstone of 3M's innovation, is a primary target for cyber espionage, necessitating advanced defensive measures.

3M's technological trajectory is heavily influenced by its substantial investments in research and development, totaling $2.0 billion in 2023, to drive innovation in materials science and advanced manufacturing. The company is actively integrating AI and IoT into its operations and product offerings, aiming to enhance efficiency and create connected solutions, with IoT market growth projected to be substantial by 2025.

The company's focus on digitalization and automation, including smart manufacturing and data analytics, is supported by capital expenditures for manufacturing initiatives of $1.2 billion in 2023, underscoring a commitment to operational improvement and developing solutions for clients embracing digital transformation.

Emerging technologies like AI are being explored for accelerated material discovery, while IoT enables smart product functionalities, such as advanced healthcare monitoring. These advancements are crucial for maintaining a competitive edge and adapting to evolving market demands.

3M's increasing reliance on digital infrastructure necessitates robust cybersecurity measures, especially given the projected $10.5 trillion annual cost of cyberattacks by 2025, with manufacturing sectors facing heightened risks in 2024.

Legal factors

3M is heavily exposed to product liability lawsuits, notably concerning PFAS chemicals and Combat Arms Earplugs. These legal battles pose a significant financial risk, with potential for substantial penalties and settlements that could impact investor confidence.

The ongoing litigation, particularly the estimated $6 billion settlement for PFAS, highlights the immense financial burden. Successfully navigating these legal challenges is crucial for 3M's financial stability and its capacity for future operations and investments.

Intellectual property rights are fundamental to 3M's business model, which thrives on innovation. The company actively protects its extensive portfolio of patents, trademarks, and trade secrets to maintain its competitive edge. In 2023, 3M reported spending over $2 billion on research and development, underscoring the critical role of IP in safeguarding these investments.

As a global giant, 3M navigates a complex web of antitrust and competition laws across all its operating regions. This means any potential mergers, acquisitions, or even everyday market strategies are carefully examined to ensure they don't stifle fair competition. For instance, in 2023, the European Commission continued its scrutiny of various industries for anti-competitive practices, a landscape 3M actively monitors.

Failure to comply with these regulations carries significant risks. Companies like 3M can face substantial financial penalties, be forced to sell off parts of their business, and suffer considerable damage to their public image. Staying ahead requires constant legal oversight and expert advice to integrate compliance seamlessly into their strategic planning.

Data Privacy Regulations and Compliance

The intensifying focus on data privacy globally, highlighted by regulations such as the EU's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), significantly shapes 3M's practices in handling customer and employee data. Adhering to these rigorous privacy mandates is crucial for 3M to prevent substantial fines and preserve the confidence of its consumers and stakeholders.

3M's compliance efforts are underscored by the substantial financial implications of data breaches and regulatory violations. For instance, in 2023, companies faced an average cost of $4.45 million per data breach, according to IBM's Cost of a Data Breach Report. This highlights the critical need for 3M to invest in and maintain strong data governance frameworks and advanced security protocols across all its digital touchpoints.

- GDPR Fines: Non-compliance can result in fines of up to €20 million or 4% of global annual turnover, whichever is higher.

- CCPA Impact: Businesses operating in California must comply with CCPA, which grants consumers rights over their personal information.

- Data Security Investment: Companies are increasing cybersecurity spending; global spending on cybersecurity is projected to reach $215 billion in 2024, an increase from $188 billion in 2023, according to Gartner.

- Consumer Trust: A strong data privacy posture is directly linked to consumer trust, a key intangible asset for companies like 3M.

Labor and Employment Laws

3M navigates a complex web of labor and employment laws across its global operations, with each country imposing unique rules on wages, working conditions, and employee rights. For instance, in 2024, minimum wage adjustments in countries like Germany and Canada directly impact 3M's operational costs and compensation strategies. Ensuring adherence to these varied regulations, which also cover anti-discrimination and unionization, is paramount to preventing costly legal battles and reputational damage.

The company's commitment to fair employment practices is tested by these diverse legal frameworks. In 2025, for example, new legislation in the UK regarding worker consultation on technological changes will require careful implementation. Proactive management of this global workforce necessitates a deep understanding of local labor legislation, ensuring equitable and compliant employment practices worldwide.

Key considerations for 3M's labor and employment legal compliance include:

- Compliance with minimum wage laws: Staying updated on and adhering to varying minimum wage rates across operating countries, such as the projected increase in France for 2025.

- Workplace safety regulations: Meeting diverse occupational health and safety standards, including specific requirements for chemical handling in the US and EU.

- Anti-discrimination and equal opportunity laws: Implementing policies that align with local legislation prohibiting discrimination based on age, gender, race, and other protected characteristics.

- Union relations and collective bargaining: Managing relationships with labor unions and complying with collective bargaining agreements in regions where they are prevalent, such as certain European countries.

Legal factors significantly shape 3M's operational landscape, primarily through extensive product liability litigation, particularly concerning PFAS chemicals and Combat Arms Earplugs. These legal challenges represent a substantial financial risk, with potential for significant settlements and penalties that could impact investor confidence and future investments. The company's intellectual property protection is also a key legal concern, with over $2 billion invested in R&D in 2023 to safeguard its innovations.

Environmental factors

3M faces a significant burden from environmental regulations governing emissions, waste, and chemical management across its worldwide operations. For instance, the company has been involved in significant legal settlements related to PFAS contamination, with a major agreement in 2023 involving up to $12.5 billion to address water contamination. Staying compliant with these ever-changing rules, especially concerning substances like PFAS, is essential to prevent hefty fines, legal challenges, and damage to its public image.

Growing pressure from consumers, investors, and regulators is pushing companies like 3M to prioritize sustainability. This means 3M is actively working to lessen its environmental impact, focusing on areas such as cutting greenhouse gas emissions and reducing waste. For instance, 3M has set ambitious goals to reduce its absolute greenhouse gas emissions by 50% by 2030, compared to a 2019 baseline.

Integrating these sustainability efforts into its core business strategy is crucial for 3M. It helps build a stronger brand image, making the company more attractive to top talent and ensuring it meets the expectations of its stakeholders. By investing in renewable energy, 3M aims to source 100% of its purchased electricity from renewable sources by 2030, a significant step towards its environmental goals.

The availability and cost of crucial raw materials, frequently sourced internationally, present significant environmental challenges for 3M. For instance, the increasing global demand for rare earth elements, vital for many advanced materials, is subject to geopolitical stability and extraction impacts, directly affecting production costs and material accessibility for 3M's diverse product lines.

Resource scarcity, exacerbated by climate change impacts like extreme weather events disrupting mining or agricultural output, can severely strain 3M's supply chains and escalate manufacturing expenses. In 2023, disruptions in the supply of specific polymers due to drought conditions in key producing regions led to price hikes, illustrating this vulnerability.

To counter these risks, 3M is actively investing in supply chain resilience by identifying and qualifying alternative materials, such as bio-based or recycled feedstocks, and championing circular economy models. This strategic shift aims to secure long-term material availability and lessen dependence on increasingly scarce, finite resources, a move supported by their 2024 sustainability report highlighting a 15% increase in recycled content across key product lines.

Climate Change Impacts and Adaptation Strategies

Climate change presents significant physical risks to 3M. Extreme weather events, such as floods and hurricanes, can disrupt manufacturing operations and supply chains. For instance, the increasing frequency of severe weather in regions where 3M operates could lead to production downtime and increased logistics costs. The company’s global footprint means it’s exposed to a variety of regional climate impacts.

The global shift towards a low-carbon economy also affects 3M. This transition can lead to higher energy costs as carbon pricing mechanisms are implemented and regulations around emissions tighten. For example, many countries are setting ambitious renewable energy targets, which may impact the cost and availability of traditional energy sources.

To address these challenges, 3M is focusing on adaptation strategies. This includes investing in energy efficiency measures across its facilities and increasing its use of renewable energy sources. By 2023, 3M had achieved a 25% reduction in greenhouse gas emissions intensity compared to its 2019 baseline, demonstrating its commitment to climate resilience and a lower-carbon future.

- Physical Risks: Increased frequency of extreme weather events impacting manufacturing and supply chains.

- Transition Risks: Rising energy costs and evolving regulatory landscapes due to the low-carbon economy transition.

- Adaptation Investments: Focus on energy efficiency and renewable energy sources to mitigate climate-related risks.

- Performance Metric: 3M achieved a 25% reduction in GHG emissions intensity by 2023 (vs. 2019 baseline).

Consumer and Investor Pressure for Green Products

Consumers and investors are increasingly prioritizing environmental responsibility, which directly impacts 3M's product development. This trend is pushing the company to innovate in creating goods with a smaller ecological footprint. For instance, 3M is actively developing solutions that utilize reduced chemical compositions or are designed for enhanced recyclability and incorporate recycled materials.

This growing demand for "green" products is not just a consumer preference but a significant market driver. In 2024, sustainable product sales for many companies saw robust growth, with some reporting double-digit increases in revenue from their eco-friendly lines. For 3M, aligning with this movement is vital for staying competitive and attracting both environmentally aware customers and socially responsible investors who increasingly factor ESG (Environmental, Social, and Governance) performance into their decisions.

3M's response to this pressure is evident in its strategic focus on sustainability initiatives. By 2025, the company aims to further integrate circular economy principles into its operations, which includes designing products for longevity and end-of-life recyclability. This proactive approach helps 3M capture market share within the expanding segment of consumers and businesses seeking sustainable alternatives.

Key areas of focus for 3M in response to this pressure include:

- Development of bio-based materials: Exploring alternatives to traditional petroleum-based inputs.

- Reduction of hazardous substances: Innovating to create products with fewer or no harmful chemicals.

- Enhanced product recyclability: Designing for easier disassembly and material recovery at end-of-life.

- Increased use of post-consumer recycled content: Incorporating recycled materials into new product formulations.

Environmental regulations significantly impact 3M's operations, particularly concerning emissions, waste, and chemical management. The company's commitment to sustainability is driven by increasing pressure from stakeholders, leading to goals like reducing greenhouse gas emissions by 50% by 2030 from a 2019 baseline.

Resource scarcity and climate change pose supply chain risks, affecting raw material availability and costs. 3M is addressing this by investing in supply chain resilience and exploring alternative materials, evidenced by a 15% increase in recycled content across key product lines in 2024.

Climate change brings physical risks like extreme weather, disrupting operations, and transition risks from a low-carbon economy. 3M is adapting through energy efficiency and renewable energy adoption, achieving a 25% reduction in GHG emissions intensity by 2023 compared to 2019.

Market demand for sustainable products is a key driver for 3M's innovation, focusing on reduced chemical compositions and enhanced recyclability. The company aims to integrate circular economy principles by 2025 to stay competitive and meet evolving consumer and investor expectations.

PESTLE Analysis Data Sources

Our PESTLE analysis is built on a robust foundation of data, drawing from official government publications, leading economic indicators, and reputable industry research firms. We meticulously gather insights on political stability, economic trends, technological advancements, environmental regulations, and social shifts to ensure comprehensive and accurate analysis.