3M Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3M Bundle

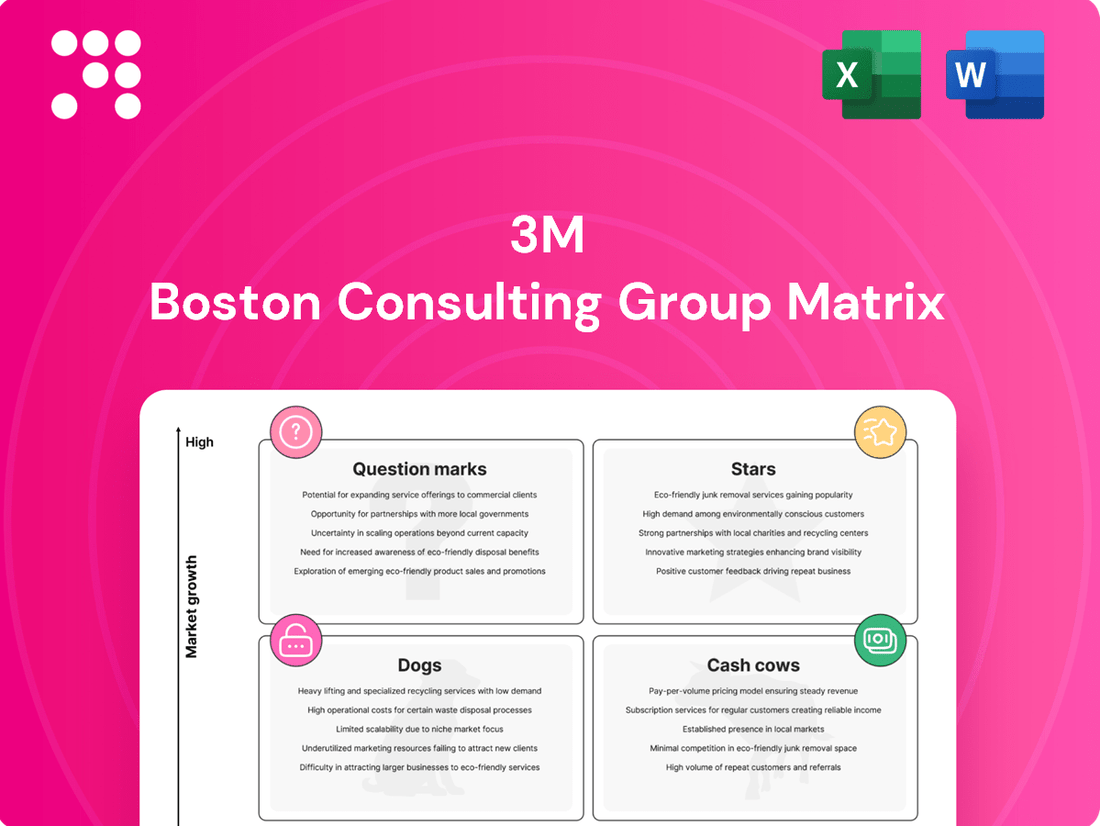

Understanding the 3M BCG Matrix is crucial for any business aiming for strategic growth and efficient resource allocation. This powerful framework helps identify Stars, Cash Cows, Dogs, and Question Marks within a company's product portfolio, offering a clear visual of market performance and potential. Don't settle for a partial view; unlock the full strategic advantage.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

3M is heavily investing in advanced materials crucial for EV and automotive electrification, focusing on battery, adhesive, and display technologies. These innovations aim to make electric vehicles lighter, safer, and more user-friendly. For instance, 3M's Glass Bubbles are incorporated into composite materials, demonstrably reducing vehicle weight and thereby enhancing energy efficiency.

The company's specialized adhesives play a vital role in the lifecycle of EV battery packs. These materials facilitate more efficient disassembly, which is critical for effective waste reduction and robust recycling processes within the burgeoning EV sector. This focus on circularity underscores 3M's commitment to sustainable automotive solutions.

3M is well-positioned to capitalize on the booming demand for AI and data center infrastructure, a market segment experiencing significant expansion. The company's innovation in electronic materials and solid-state drive connectors directly addresses the critical need for energy efficiency and sustainability within these rapidly growing facilities. This strategic focus aligns perfectly with the accelerating adoption of AI and advanced computational technologies, creating a strong growth opportunity for 3M.

3M is making significant strides in next-generation electronics components, particularly with advanced adhesives and display films. These innovations are crucial for enhancing products like foldable phone displays and premium notebooks, areas experiencing rapid consumer adoption and technological evolution.

The company’s recent launch of a low sparkle optical film for notebooks demonstrates a commitment to improving user experience in a competitive laptop market. Furthermore, 3M is actively developing novel materials designed to enable foldable phone displays to bend repeatedly without showing signs of stress or cracking, a key challenge for this burgeoning segment.

These targeted advancements position 3M to capitalize on the high-growth potential within the broader electronics industry. The demand for more durable, flexible, and visually appealing electronic devices continues to drive innovation, and 3M’s component technologies are directly addressing these market needs.

Industrial Automation Technologies

Industrial Automation Technologies are a significant area of focus for 3M, aligning with the company's strategic growth initiatives. As factories become smarter, 3M is developing advanced solutions designed to streamline operations and improve worker safety. This segment is poised for considerable expansion within the broader Safety & Industrial business.

3M's commitment to industrial automation is evident in its ongoing product development. These innovations are geared towards creating more efficient and responsive manufacturing environments. For instance, the company is investing in solutions that enable real-time monitoring and adaptive control of production processes, aiming to reduce waste and enhance overall output.

- Growth Driver: Industrial automation is a key growth area for 3M, contributing to the expansion of its Safety & Industrial segment.

- Innovation Focus: 3M is actively developing new products for smarter factory systems, emphasizing optimization and efficiency.

- Market Opportunity: The increasing adoption of automation technologies presents a substantial market opportunity for 3M's solutions.

- Safety Enhancement: Innovations in this sector also aim to improve workplace safety through real-time condition monitoring and adaptive operational adjustments.

High-Performance Safety and Roadway Solutions

3M's High-Performance Safety and Roadway Solutions, primarily within its Safety & Industrial segment, represent a significant area of focus. The company is dedicated to creating advanced safety products, such as its well-known N95 respirators and innovative reflective materials for roadways. These offerings directly address the increasing global demand for enhanced occupational and public safety measures.

This segment has demonstrated robust performance, with strong organic growth reported. For instance, in the first quarter of 2024, 3M's Safety & Industrial segment saw a notable increase in sales, driven by demand for its personal protective equipment and industrial adhesives. This growth underscores the market's reliance on 3M's solutions for critical safety applications.

- Strong Organic Growth: The Safety & Industrial segment experienced a significant sales increase in Q1 2024, reflecting sustained demand.

- Product Innovation: Continued development of high-performance safety gear, including respirators and advanced roadway materials, supports market leadership.

- Market Focus: Alignment with global safety trends, particularly in occupational health and infrastructure, positions these solutions favorably.

Stars in the BCG matrix represent business units with high market share in high-growth industries. For 3M, this includes segments like electric vehicle components and AI/data center infrastructure. These areas are experiencing rapid expansion, and 3M's innovative materials and solutions are well-positioned to capture significant market share. The company's investments in these technologies are crucial for future revenue generation and overall growth.

What is included in the product

The 3M BCG Matrix categorizes products into Stars, Cash Cows, Question Marks, and Dogs based on market growth and share.

It guides strategic decisions on investment, holding, or divesting business units.

The 3M BCG Matrix offers a clear, visual representation of your portfolio, easing the pain of strategic uncertainty.

It simplifies complex business unit performance into actionable quadrants, relieving the burden of overwhelming data.

Cash Cows

The Scotch™ brand, a cornerstone of 3M's portfolio, represents a classic Cash Cow. Its extensive range of adhesive tapes, from everyday packing tape to specialized industrial solutions, enjoys a dominant market share in mature consumer and industrial adhesive sectors. This strong brand recognition and deep market penetration translate directly into consistent, robust cash flow generation, a hallmark of a successful Cash Cow.

In 2024, Scotch™ tapes continue to be a significant contributor to 3M's financial performance. The brand's established loyalty and the essential nature of its products mean that marketing and development investments are relatively low, allowing for substantial cash to be extracted. This reliable income stream is crucial for funding 3M's more innovative, high-growth ventures.

Post-it® Notes, a flagship 3M innovation, command a significant market share in stationery. Their widespread adoption in offices and homes fuels consistent revenue, solidifying their status as a prime example of a cash cow within 3M's portfolio.

Despite operating in a mature market, the enduring brand loyalty and ubiquitous utility of Post-it® Notes translate into robust profit margins. This product line consistently generates substantial cash flow, a hallmark of a successful cash cow.

In 2023, 3M's Stationery and Business Solutions segment, which includes Post-it® Notes, reported sales of approximately $3.3 billion, demonstrating the continued financial strength of these established product lines.

The Command™ brand, a prominent player in damage-free hanging solutions, holds a substantial market share within the home improvement and organization sectors. This strong position is bolstered by considerable consumer trust and a history of repeat purchases in what is a relatively stable market. In 2024, the brand continues to leverage its innovative adhesive technology as a key competitive advantage, ensuring a consistent and reliable source of cash flow for 3M.

Scotch-Brite® Cleaning Tools

Scotch-Brite cleaning tools, encompassing sponges and scrubbers, represent a significant Cash Cow for 3M. This product line dominates the consumer cleaning market, benefiting from stable demand in a mature industry. The consistent revenue generated requires little new investment, allowing 3M to leverage this strong market position.

The Scotch-Brite brand is a household staple, contributing reliably to 3M's overall financial performance. In 2024, the cleaning and adhesives division, which includes Scotch-Brite, continued to be a significant contributor to 3M's revenue streams, demonstrating the enduring strength of these established products.

- Market Dominance: Scotch-Brite holds a leading share in the consumer cleaning tools segment.

- Mature Market: The product category experiences consistent, predictable demand.

- Revenue Generation: Provides a stable and substantial income for 3M.

- Low Investment Needs: Minimal capital is required for growth or maintenance.

Core Industrial Adhesives and Abrasives

Within 3M's Safety & Industrial segment, its core industrial adhesives and abrasives stand out as significant cash cows. These products have a deep history and are essential in many manufacturing operations, benefiting from widespread use and consistent demand. Their dependable performance is a key driver of 3M's financial success.

These established product lines consistently generate substantial profits, underscoring their role as cash cows in 3M's portfolio. Their mature market position and critical function in industrial applications ensure a steady revenue stream for the company.

- High Market Penetration: Industrial adhesives and abrasives are used across a wide array of manufacturing sectors, indicating broad adoption and a strong existing customer base.

- Stable Demand: As foundational components in many production processes, these products experience relatively inelastic demand, providing a predictable revenue source.

- Profitability Contribution: Their consistent sales and established production efficiencies contribute a significant portion to 3M's overall profitability, funding other business ventures.

Cash Cows, as defined by the BCG Matrix, are products or business units with high market share in low-growth industries. They generate more cash than they consume, providing a stable income stream to fund other ventures.

3M's Scotch™ brand, Post-it® Notes, Command™ adhesives, and Scotch-Brite cleaning tools are prime examples of Cash Cows. These products benefit from strong brand recognition, widespread adoption, and mature markets, ensuring consistent revenue with minimal investment.

In 2023, 3M's Stationery and Business Solutions segment, which includes Post-it® Notes, achieved sales of approximately $3.3 billion. This highlights the continued financial strength and reliable cash generation from these established product lines.

The industrial adhesives and abrasives also represent significant Cash Cows, with high market penetration and stable demand across various manufacturing sectors, contributing substantially to 3M's overall profitability.

| Product/Brand | Market Share | Growth Rate | Cash Flow Contribution |

|---|---|---|---|

| Scotch™ Tapes | Dominant | Low | High |

| Post-it® Notes | Leading | Low | High |

| Command™ Adhesives | Substantial | Low | High |

| Scotch-Brite Cleaning Tools | Leading | Low | High |

| Industrial Adhesives & Abrasives | High Penetration | Low | High |

Delivered as Shown

3M BCG Matrix

The 3M BCG Matrix document you see here is the complete, unwatermarked version you will receive immediately after purchase. This preview accurately represents the final, professionally formatted report, ready for immediate strategic application and decision-making. You can confidently expect the same high-quality analysis and presentation that will empower your business planning. This is your direct path to a fully functional BCG Matrix tool.

Dogs

Certain older electronic components within 3M's Transportation & Electronics segment are experiencing soft demand. These legacy products, often less differentiated, operate in a competitive and cyclical market where newer technologies are gaining traction.

While 3M is actively investing in next-generation electronics, some of these established components may hold a low market share. In 2024, the electronics industry continued its rapid evolution, making it challenging for older technologies to maintain relevance and profitability.

These products could be operating at break-even or even consuming cash without substantial future growth potential. This situation aligns with the characteristics of a 'Dog' in the BCG matrix, suggesting a need for careful evaluation of their future role in 3M's portfolio.

As 3M exits PFAS manufacturing by the end of 2025, products heavily reliant on these chemicals, particularly those in legacy applications where reformulation is challenging, face significant disruption. These could include certain legacy firefighting foams and specialized industrial coatings. The company's strategic shift away from PFAS means these product lines may see declining sales and market relevance as alternatives are sought or regulations tighten.

Undifferentiated consumer products in niche markets often find themselves in the Dogs category of the BCG Matrix. These items, lacking distinct features or robust brand loyalty, struggle to gain significant traction. For instance, a generic brand of pet grooming supplies sold in a highly specialized pet boutique might represent such a product.

These products typically operate within niche markets that are either saturated or experiencing very slow growth. Think of a small producer of niche artisanal soaps; if the market for handmade soaps is already crowded and consumer interest isn't expanding, this product could be a Dog. In 2024, the global market for artisanal soaps, while growing, faces intense competition, with many small players offering similar products, limiting individual market share potential.

Such products usually contribute minimally to a company's overall revenue and profitability. A company like 3M might have a line of specialized cleaning cloths for a very specific industrial application that has seen declining demand. If this product line generated less than 1% of 3M's total revenue in 2024 and showed no signs of recovery, it would likely be classified as a Dog, potentially a candidate for divestment.

Products Facing Intense Commoditization

In some segments, products that have become commoditized due to widespread availability and intense price competition can be categorized as Dogs. These products typically offer low margins and require constant cost management to remain viable. They may have low market share if 3M's offerings are not sufficiently differentiated or cost-competitive. For instance, certain types of basic adhesives or cleaning supplies, where many competitors offer similar formulations, could fall into this category. In 2023, the global adhesives market, excluding specialized industrial applications, saw significant price pressure.

- Commoditized Products: Basic adhesives, certain cleaning solutions, and generic abrasives.

- Low Margins: Intense price competition erodes profitability for these items.

- Market Share Risk: Differentiation is key to maintaining or growing share in these crowded markets.

- Cost Management Focus: Survival depends on efficient production and supply chain operations.

Underperforming Products from Older Innovation Cycles

Products originating from older innovation cycles that haven't seen recent investment are often categorized as Dogs in the BCG Matrix. These offerings, like some legacy adhesive tapes from 3M's earlier product lines, may struggle to compete as newer, more advanced materials emerge. For instance, while 3M's advanced materials division is a growth driver, older product segments might show stagnant or declining sales figures, potentially impacting overall profitability.

These underperforming products can lead to a drain on company resources, diverting capital and attention away from more promising ventures. Consider 3M's historical presence in certain consumer electronics components; if these haven't been re-engineered to meet current technological demands, they could represent a classic Dog scenario. In 2023, 3M continued its strategic review of underperforming assets, a common practice for companies managing diverse product portfolios.

- Declining Market Share: Products lacking recent innovation often see their market share erode as competitors introduce superior alternatives.

- Resource Drain: Continued investment in R&D, marketing, or manufacturing for these products can divert funds from higher-growth areas.

- Outdated Technology: Reliance on older technology makes these products less appealing to customers seeking modern solutions.

Dogs in the BCG Matrix represent products with low market share in slow-growing industries. These offerings often generate minimal revenue and profitability, potentially consuming resources without significant future upside. For 3M, this could include legacy components in electronics or commoditized consumer goods facing intense competition.

In 2024, the challenge for these products is amplified by rapid technological advancements and evolving consumer preferences. Companies must carefully assess whether to divest, harvest, or attempt to revitalize these underperforming assets to optimize their portfolio.

For instance, a historical product line with declining sales, such as certain basic industrial tapes that have been superseded by advanced materials, could be classified as a Dog. These items may contribute less than 1% of overall revenue and lack a clear path for growth.

3M's strategic review of its business units in 2023 highlighted the ongoing need to manage such products, ensuring capital is allocated to areas with higher potential for returns.

| BCG Category | Market Growth | Relative Market Share | Example for 3M | Strategic Implication |

| Dogs | Low | Low | Legacy electronic components, commoditized adhesives | Divest, harvest, or reposition |

Question Marks

3M's new climate tech solutions, like those supporting the burgeoning hydrogen economy and advanced recyclable filters, represent promising Stars in the BCG matrix. These sectors are experiencing rapid growth, fueled by a global push for sustainability. For instance, the global hydrogen market was valued at approximately $130 billion in 2023 and is projected to reach over $300 billion by 2030, showcasing immense potential.

However, as these markets are still developing, 3M's current market share is likely modest, characteristic of a Star. The significant capital required to innovate and scale these technologies means substantial ongoing investment is crucial. This strategic focus positions these ventures for future market leadership, provided 3M can maintain its investment and competitive edge.

3M is actively developing advanced materials for the burgeoning AR/VR sector, a field poised for significant growth. For instance, the global AR/VR market was valued at approximately $28.3 billion in 2023 and is projected to reach $200 billion by 2028, demonstrating its rapid expansion. 3M's current market share in these nascent AR/VR material applications is likely minimal, reflecting the early stage of their involvement.

These AR/VR material and application ventures demand considerable investment in research and development, alongside dedicated market cultivation efforts. Without substantial market penetration and established revenue streams, these promising areas are best categorized as Question Marks within the BCG matrix, indicating their high potential but uncertain future success.

3M's R&D pipeline is yielding early-stage innovations, with a significant portion expected to be question marks in the BCG matrix. These are products targeting high-growth sectors where the company is actively establishing its market footprint. For instance, in 2024, 3M invested $1.9 billion in R&D, aiming to fuel such future growth engines.

The success of these early-stage innovations hinges on robust market adoption and sustained investment to capture substantial market share. 3M's target of 215 new product launches by 2025 underscores its commitment to this strategy, with many of these innovations positioned to become future stars if they gain traction.

Specific Solutions for Automotive OEM Market Recovery

While 3M's transportation segment is showing signs of recovery, the automotive original equipment manufacturer (OEM) market continues to experience softness. 3M's financial outlook for 2024 acknowledges potential declines in this specific area, reflecting the ongoing challenges. To address this, 3M is focusing on developing new, targeted solutions tailored for this recovering yet volatile market.

These specific solutions could include advanced lightweighting materials to improve fuel efficiency and electric vehicle range, as well as specialized adhesives and sealants designed for the evolving demands of EV battery pack assembly and structural integrity. Another area of focus is advanced filtration technologies for cabin air quality and powertrain efficiency. The success of these initiatives hinges not only on the broader automotive industry's rebound but also on 3M's strategic efforts to capture increased market share with these innovative offerings.

- Advanced Lightweighting Materials

- Specialized Adhesives and Sealants for EV applications

- Enhanced Filtration Technologies

New Digital and Connected Solutions for Industrial Use

As industries increasingly adopt digital technologies, 3M is strategically positioning itself with new connected solutions that build upon its core material science strengths. These innovations are likely targeted at rapidly expanding digital transformation markets, areas where 3M might be considered a more recent participant.

These connected solutions, such as advanced sensors integrated into industrial equipment or smart materials that monitor environmental conditions, represent a significant investment. This investment extends beyond traditional manufacturing into software development, data analytics, and ensuring seamless integration with existing customer systems. Capturing substantial market share and demonstrating long-term viability in these nascent digital sectors requires dedicated focus and substantial upfront capital.

- Market Focus: High-growth digital transformation sectors where 3M is expanding its footprint.

- Investment Needs: Significant capital allocation for software, data integration, and customer support.

- Potential: Opportunity to leverage material science expertise in emerging connected industrial applications.

- Challenges: Requires substantial customer adoption and proving long-term value in competitive digital markets.

Question Marks represent business units or products in high-growth markets where 3M has a low market share. These ventures require significant investment to increase market share and can potentially become Stars. For instance, 3M's investments in emerging battery materials for electric vehicles, a sector projected for substantial growth, fall into this category. The company's commitment to R&D, with $1.9 billion allocated in 2024, directly supports these high-potential but unproven areas.

| Business Area | Market Growth | 3M Market Share | Investment Needs | Potential Outcome |

|---|---|---|---|---|

| AR/VR Materials | High | Low | High | Star or Dog |

| Hydrogen Economy Solutions | High | Low | High | Star or Dog |

| Connected Industrial Sensors | High | Low | High | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix is informed by comprehensive market data, integrating financial reports, sales figures, and industry trend analysis to provide a clear strategic overview.