3M Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3M Bundle

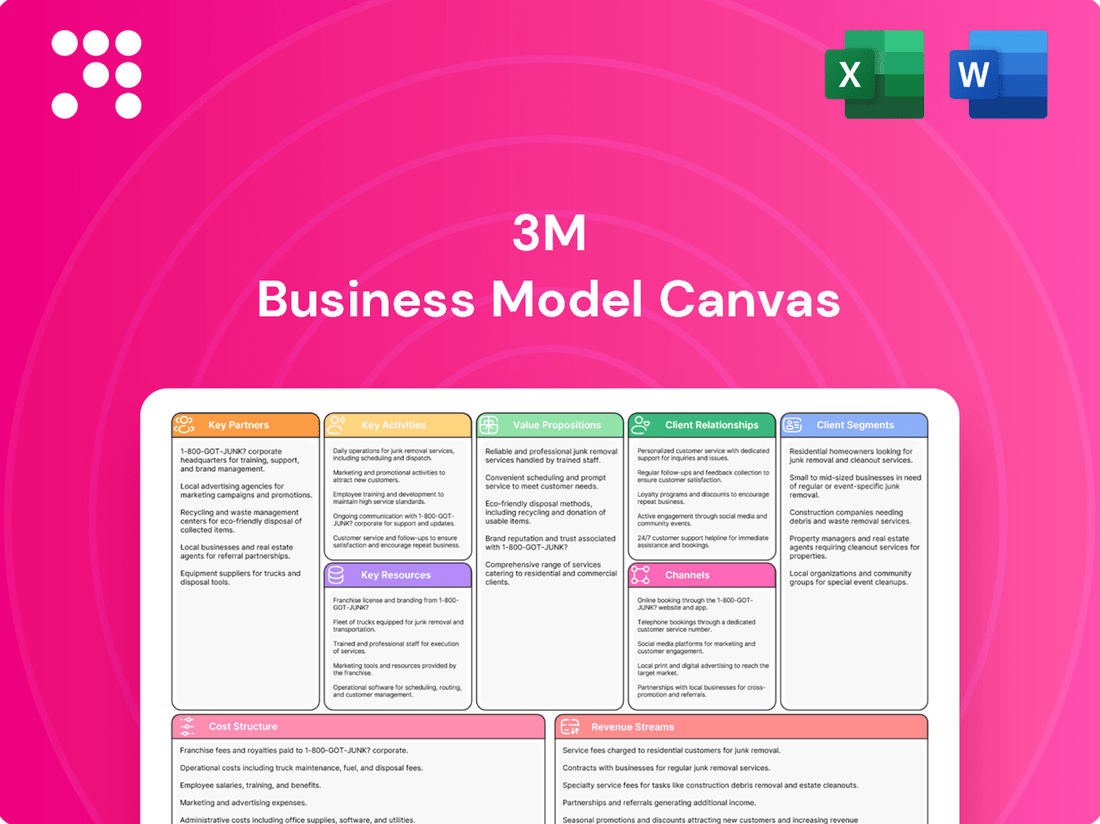

Unlock the strategic genius behind 3M's innovation powerhouse. This comprehensive Business Model Canvas breaks down how they leverage diverse customer segments, build strong partnerships, and deliver compelling value propositions across their vast product portfolio. Discover the core activities and revenue streams that fuel their enduring success.

Partnerships

3M's business model hinges on a robust global network of raw material suppliers, providing everything from specialty chemicals to advanced polymers. In 2024, the company continued to emphasize these relationships to ensure supply chain resilience, a crucial factor given the volatile global economic landscape. Strong partnerships allow 3M to secure materials at competitive prices, directly impacting the cost-effectiveness of its vast product lines.

3M actively collaborates with universities and research institutions worldwide, fostering a dynamic innovation ecosystem. These partnerships provide access to groundbreaking scientific discoveries and specialized knowledge, crucial for developing next-generation products. For instance, 3M has ongoing research collaborations focused on advanced materials science and digital health technologies, areas expected to drive significant growth in the coming years.

3M actively cultivates technology and licensing partnerships to broaden its innovation and market access. For instance, in 2024, 3M continued to leverage its extensive patent portfolio, with over 70,000 patents globally, by engaging in licensing agreements that allow other companies to utilize its proprietary technologies in various applications, thereby generating royalty revenue and expanding the reach of its innovations.

These collaborations often involve co-development projects, where 3M works with other firms to create novel solutions, sharing expertise and resources. This strategy was evident in its 2024 efforts to advance materials science, partnering with specialized firms to integrate new functionalities into existing product lines, accelerating the pace of product development and market entry.

Distribution and Retail Partners

3M relies heavily on a vast network of distributors, wholesalers, and retailers to effectively deliver its extensive product portfolio to a global customer base. This crucial partnership layer ensures that everything from advanced industrial adhesives to everyday consumer products, like Scotch-Brite sponges, reaches the end-user efficiently. For instance, in 2024, 3M continued to leverage its established relationships with major retail chains, contributing to its reported sales figures across various consumer segments.

These distribution channels are fundamental to 3M's market penetration strategy, enabling access to diverse customer segments, including industrial manufacturers, healthcare providers, and individual consumers. The company's ability to maintain strong ties with these partners is a key enabler for its broad market reach and product availability worldwide. In 2024, 3M's supply chain efficiency, bolstered by these partnerships, was a significant factor in navigating global logistics challenges.

- Global Reach: Distribution partners are vital for 3M's presence in over 70 countries, ensuring product availability across diverse markets.

- Product Diversification: These partnerships facilitate the movement of a wide array of products, from automotive tapes to personal safety equipment.

- Market Access: Retailers and wholesalers provide direct access to millions of consumers and businesses, driving sales volume.

- Supply Chain Efficiency: Collaborations with distributors optimize logistics, reducing costs and improving delivery times for 3M's extensive product lines.

Industry Collaborations and Alliances

3M actively cultivates strategic partnerships across key sectors like automotive, electronics, and healthcare. These alliances are crucial for tackling intricate industry problems and fostering broad-based innovation. For instance, in 2024, 3M continued its work with automotive manufacturers to develop advanced materials for electric vehicles, aiming to improve battery efficiency and vehicle lightweighting.

These collaborations often take the form of joint ventures or participation in industry consortia. Through these shared efforts, 3M contributes to establishing new industry benchmarks, pioneering novel technologies, and promoting environmentally sound practices. A notable example from 2024 involved a consortium focused on developing next-generation semiconductor manufacturing processes, where 3M's expertise in advanced materials played a pivotal role.

- Automotive Sector: Collaborations focused on lightweighting materials and advanced adhesives for electric vehicles, contributing to improved energy efficiency and range.

- Electronics Industry: Partnerships aimed at developing advanced display technologies and high-performance materials for consumer electronics and telecommunications.

- Healthcare Innovations: Alliances with medical device manufacturers and research institutions to co-create solutions for wound care, infection prevention, and diagnostic imaging.

- Sustainability Initiatives: Joint projects with industry peers and environmental organizations to advance circular economy principles and reduce the environmental footprint of manufacturing processes.

3M's key partnerships are multifaceted, encompassing suppliers, research institutions, technology licensors, distributors, and strategic industry collaborators. These relationships are fundamental to its innovation pipeline, market reach, and operational efficiency. For instance, in 2024, the company continued to strengthen its global supply chain by securing critical raw materials through long-term agreements with key chemical and polymer providers.

Collaborations with universities and research bodies fuel 3M's innovation engine, providing access to cutting-edge scientific advancements. In 2024, these partnerships were instrumental in developing new materials for sectors like electric vehicles and advanced electronics. Furthermore, 3M leverages its extensive patent portfolio through technology licensing, generating revenue and expanding the application of its innovations across various industries.

The company's vast distribution network, including wholesalers and retailers, is critical for delivering its diverse product range to global customers. These partnerships ensure efficient market penetration and customer access. In 2024, 3M's strategic alliances within the automotive, healthcare, and electronics sectors drove the development of specialized solutions, addressing complex industry challenges and fostering cross-sector innovation.

| Partnership Type | Focus Area | 2024 Relevance |

|---|---|---|

| Raw Material Suppliers | Specialty Chemicals, Polymers | Ensuring supply chain resilience and cost-effectiveness. |

| Universities & Research Institutions | Materials Science, Digital Health | Accessing groundbreaking discoveries for next-generation products. |

| Technology & Licensing Partners | Proprietary Technologies | Expanding market access and generating royalty revenue. |

| Distributors & Retailers | Global Product Delivery | Facilitating market penetration and customer access. |

| Strategic Industry Collaborators | Automotive, Healthcare, Electronics | Co-developing solutions for complex industry problems. |

What is included in the product

A detailed 3M Business Model Canvas that outlines its diverse customer segments, multi-channel approach, and broad value propositions across various industries.

This canvas offers a strategic overview of 3M's innovation-driven model, highlighting its key resources, activities, and partnerships that enable its global reach and product diversification.

The 3M Business Model Canvas acts as a pain point reliever by providing a clear, visual framework that simplifies complex business strategies.

It streamlines the process of understanding and communicating a company's core components, reducing the pain of opaque or disorganized strategic planning.

Activities

3M's engine for growth is its robust Research and Development (R&D) and innovation. This core activity involves leveraging its deep scientific expertise to develop entirely new products and enhance its existing portfolio.

The company has a clear strategic focus on innovation, with plans to invest heavily in R&D. A key objective is the launch of 1,000 new products within the next three years, underscoring a commitment to staying at the forefront of technological advancement and market needs.

Manufacturing and production are central to 3M's operations, encompassing the creation of a wide spectrum of products, from specialized industrial adhesives and abrasives to everyday consumer items like Post-it Notes and Scotch tape. This core activity requires continuous optimization of complex production processes across its numerous global facilities.

In 2023, 3M maintained a significant global manufacturing presence, operating hundreds of facilities worldwide. The company's commitment to quality control is paramount, ensuring that its diverse product portfolio meets stringent performance standards demanded by various industries and consumers alike. This operational efficiency is crucial for meeting the dynamic needs of its global customer base.

3M's marketing and sales efforts are vital for connecting its vast array of products with diverse customer bases. This involves crafting specific campaigns for different market segments, from industrial clients to consumers, ensuring each product's value is clearly communicated.

The company utilizes a multi-channel approach, employing direct sales forces, distributors, and online platforms to reach its global audience. In 2024, 3M continued to invest in digital marketing and data analytics to refine customer targeting and enhance sales efficiency across its business units.

Supply Chain Management

3M's key activities heavily rely on managing its intricate global supply chain. This involves everything from procuring raw materials to ensuring finished goods reach customers worldwide. In 2024, 3M continued to focus on optimizing this network to maintain product availability and manage costs effectively.

Efficient supply chain operations are fundamental to 3M's ability to deliver on its promises. This focus directly supports the company's commitment to operational excellence and high levels of customer satisfaction. For instance, robust supply chain management helps mitigate disruptions, ensuring that critical products are available to industries that depend on them.

- Global Sourcing: Procuring a diverse range of raw materials from international suppliers.

- Logistics and Distribution: Managing the transportation and warehousing of goods across the globe.

- Inventory Management: Optimizing stock levels to balance availability with carrying costs.

- Supplier Relationship Management: Building strong partnerships to ensure quality and reliability.

Sustainability Initiatives and Environmental Stewardship

3M is deeply invested in sustainability, actively working to reduce its environmental footprint. This includes ambitious targets for lowering greenhouse gas emissions and improving water efficiency across its operations.

A significant commitment is the planned exit from PFAS manufacturing by the end of 2025, underscoring a strategic shift towards more environmentally sound product portfolios and processes. The company is also focused on decreasing its reliance on virgin fossil-based plastics.

- Greenhouse Gas Emissions Reduction: 3M aims to reduce its Scope 1 and Scope 2 greenhouse gas emissions by 50% by 2030, against a 2019 baseline.

- Water Stewardship: The company targets a 25% improvement in water efficiency by 2030, also measured against a 2019 baseline.

- Plastic Reduction: 3M is working to reduce its use of virgin fossil-based plastics by 25% by 2030.

- PFAS Exit: A definitive commitment to cease all PFAS manufacturing by the end of 2025.

3M's key activities are centered around its strong R&D and innovation engine, driving the development of new products and enhancements to its existing offerings. This commitment is evident in its goal to launch 1,000 new products in the next three years. Complementing innovation, efficient manufacturing and production across its global facilities are crucial for delivering its diverse product range to market, with a continued focus on quality control. Furthermore, strategic marketing and sales efforts, increasingly leveraging digital channels and data analytics in 2024, are vital for reaching and serving its broad customer base effectively.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Research & Development / Innovation | Developing new products and enhancing existing ones. | Aiming for 1,000 new product launches in three years. |

| Manufacturing & Production | Creating a wide spectrum of products globally. | Maintaining hundreds of global facilities with a focus on quality control. |

| Marketing & Sales | Connecting products with diverse customer bases. | Investing in digital marketing and data analytics for enhanced efficiency. |

| Supply Chain Management | Managing global sourcing, logistics, and inventory. | Optimizing the network for product availability and cost management. |

| Sustainability Initiatives | Reducing environmental footprint and transitioning away from certain materials. | On track to exit PFAS manufacturing by end of 2025; targeting 50% GHG emission reduction by 2030. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas preview you are seeing is an exact representation of the document you will receive upon purchase. This means all sections, formatting, and content are identical to the final deliverable, ensuring no surprises. You'll gain immediate access to this comprehensive tool, ready for your strategic planning and analysis.

Resources

3M's intellectual property, particularly its extensive patent portfolio, stands as a cornerstone of its business model. As of mid-2024, 3M held over 69,000 global patents, a testament to its continuous innovation and commitment to research and development. This vast collection of patents safeguards its diverse range of products, from adhesives and abrasives to healthcare solutions and advanced materials, providing a significant competitive advantage.

Beyond patents, 3M's strong brand recognition, built over decades, acts as a powerful intangible asset. Brands like Post-it and Scotch are household names, fostering customer loyalty and enabling premium pricing. This robust intellectual property strategy protects 3M's market share and supports its revenue streams by preventing competitors from easily replicating its unique technologies and products.

3M operates a vast global network of research and development (R&D) centers and manufacturing facilities. This extensive infrastructure is the backbone of their innovation engine, allowing them to develop new products and solutions tailored to local market needs. For instance, in 2023, 3M continued to invest heavily in its R&D capabilities, a crucial element for its competitive edge.

These facilities are not just about creation; they are vital for efficient production and global distribution. Having manufacturing plants strategically located worldwide allows 3M to scale production effectively and deliver its diverse product portfolio to customers across various regions, minimizing lead times and logistical complexities. This global footprint is key to serving a broad customer base.

3M's skilled workforce, especially its scientists and engineers, is a cornerstone of its business model. In 2024, the company continued to leverage its deep bench of talent in material science and chemistry to drive product development and maintain its competitive edge.

This scientific expertise is directly responsible for 3M's ability to innovate across diverse sectors, from healthcare to electronics. The company's significant investment in research and development, often fueled by these skilled professionals, underpins its reputation for scientific leadership and product differentiation.

Strong Brands and Brand Equity

3M's strong brands, including iconic names like Scotch™, Post-it®, Command™, and Scotch-Brite®, are foundational to its business model. These brands represent significant intangible assets, cultivating deep customer loyalty and trust across diverse markets. In 2023, 3M's consumer segment, heavily reliant on these brands, continued to be a significant contributor to its overall revenue. For example, the Post-it® brand alone has achieved remarkable global recognition, becoming synonymous with note-taking and organization.

The brand equity built around these products provides 3M with a substantial competitive advantage. This allows for easier market penetration and premium pricing power in both consumer and industrial sectors. This brand strength translates into predictable revenue streams and supports 3M's innovation pipeline, as consumers and businesses are more likely to adopt new products from trusted brands. The enduring appeal of these brands is a testament to decades of consistent quality and effective marketing.

- Iconic Brand Recognition: Scotch™, Post-it®, Command™, and Scotch-Brite® are household names, driving significant consumer and business purchasing decisions.

- Customer Loyalty and Trust: These brands foster repeat purchases and a strong preference over competitors, reducing customer acquisition costs.

- Market Penetration: Brand strength enables 3M to effectively enter and expand within various consumer and industrial market segments.

- Competitive Moat: The established reputation and familiarity of these brands create a barrier to entry for new market participants.

Financial Capital and Investment Capacity

3M's access to substantial financial capital is a cornerstone of its business model, enabling significant investments in research and development. In 2023, the company reported R&D expenses of approximately $1.9 billion, underscoring its commitment to innovation. This financial capacity also fuels the expansion of manufacturing capabilities and supports strategic acquisitions, bolstering its competitive position.

This robust financial strength is crucial for 3M's long-term growth trajectory and its ability to navigate the complexities of a constantly evolving global market. The company's investment capacity allows it to weather economic downturns and capitalize on emerging opportunities.

- Financial Capital Access: 3M leverages its strong balance sheet and access to capital markets to fund its operations and growth initiatives.

- R&D Investment: Significant financial resources are allocated to research and development, driving product innovation and technological advancements. For instance, in 2023, R&D spending was around $1.9 billion.

- Strategic Expansion: Capital is deployed to expand manufacturing facilities and upgrade existing infrastructure, ensuring efficient production and supply chain resilience.

- Acquisition Capacity: Financial strength permits 3M to pursue strategic acquisitions, integrating new technologies and market access to enhance its portfolio.

3M's key resources are multifaceted, encompassing a vast intellectual property portfolio, strong brand equity, extensive global infrastructure, a highly skilled workforce, and significant financial capital. These elements collectively enable 3M to innovate, produce, and market its diverse range of products effectively across the globe.

The company's intellectual property, including over 69,000 global patents as of mid-2024, protects its unique technologies and provides a competitive edge. Complementing this is the powerful brand recognition of names like Post-it and Scotch, fostering customer loyalty and premium pricing power.

3M's global network of R&D centers and manufacturing facilities, supported by a skilled workforce of scientists and engineers, drives its innovation engine and ensures efficient production and distribution. This operational backbone, combined with financial capital of approximately $1.9 billion invested in R&D in 2023, underpins 3M's sustained market leadership.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Intellectual Property | Extensive patent portfolio safeguarding unique technologies. | Over 69,000 global patents (mid-2024). |

| Brand Equity | Household names fostering customer loyalty and premium pricing. | Iconic brands like Scotch™, Post-it®. |

| Global Infrastructure | R&D centers and manufacturing facilities worldwide. | Extensive global network for innovation and production. |

| Skilled Workforce | Scientists and engineers driving product development. | Deep talent in material science and chemistry. |

| Financial Capital | Resources for R&D, expansion, and acquisitions. | ~$1.9 billion in R&D expenses (2023). |

Value Propositions

3M consistently delivers a broad portfolio of unique products, addressing intricate challenges for customers across sectors like healthcare, electronics, and consumer goods. This commitment to innovation stems from a robust R&D engine, which in 2023 fueled the introduction of numerous new offerings, reinforcing their market differentiation.

3M leverages its deep scientific expertise and technological innovation to solve complex problems across diverse industries. This core value proposition translates into practical, effective solutions that address tangible needs, whether it's improving workplace safety with advanced materials or making consumer products more efficient.

For instance, in 2023, 3M's Safety and Industrial segment, a significant area where science and technology are applied, generated $12.7 billion in revenue, underscoring the market's demand for these problem-solving innovations.

Customers consistently choose 3M for its unwavering commitment to quality, performance, and reliability. This reputation is a cornerstone of their value proposition, fostering deep trust and enduring customer loyalty.

In 2023, 3M's dedication to quality was reflected in its robust financial performance, with total sales reaching $32.6 billion. This financial strength underscores the market's confidence in their dependable product offerings.

Diverse Portfolio for Multiple Industries

3M's diverse portfolio is a cornerstone of its business model, providing tailored solutions across multiple industries. In 2024, the company continued to serve key sectors like Safety & Industrial, Transportation & Electronics, and Consumer. This broad reach across different markets significantly mitigates risk by preventing over-dependence on any single economic segment.

This strategic diversification is evident in 3M's revenue streams. For instance, the Safety & Industrial segment, a major contributor, offers products ranging from abrasives and adhesives to personal protective equipment. Meanwhile, the Transportation & Electronics segment provides advanced materials for automotive, aerospace, and electronic applications. This multi-industry approach ensures resilience, even when specific sectors face downturns.

- Broad Market Penetration: Serving Safety & Industrial, Transportation & Electronics, and Consumer segments.

- Risk Mitigation: Diversification reduces reliance on any single industry's performance.

- Tailored Solutions: Offering specific products and innovations for varied applications within each sector.

Sustainability and Environmental Responsibility

3M's dedication to sustainability, demonstrated through initiatives like reducing greenhouse gas emissions and developing products with lower environmental footprints, increasingly appeals to customers and partners who prioritize eco-friendly choices. This commitment goes beyond mere product utility, creating a significant value proposition.

For instance, in 2023, 3M reported a 20% reduction in absolute Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline. This focus on environmental responsibility enhances brand reputation and fosters stronger relationships with stakeholders who share these values.

- Environmental Stewardship: 3M actively works to minimize its operational impact, investing in technologies and processes that reduce waste and pollution.

- Eco-Innovative Products: The company develops and markets products designed for environmental performance, such as those made with recycled content or that enable energy savings for customers.

- Customer Alignment: By prioritizing sustainability, 3M attracts and retains customers who are increasingly making purchasing decisions based on environmental considerations.

- Regulatory Preparedness: A strong sustainability program helps 3M stay ahead of evolving environmental regulations and anticipate future market demands.

3M's value proposition centers on leveraging its deep scientific expertise to provide innovative solutions that solve complex customer problems across diverse industries. This commitment to innovation is backed by significant R&D investment, with the company consistently introducing new products. For example, in 2023, 3M's Safety & Industrial segment alone generated $12.7 billion in revenue, showcasing strong market demand for these science-driven solutions.

Customers trust 3M for its unwavering commitment to quality, performance, and reliability, which translates into enduring customer loyalty. This reputation is a key differentiator, as evidenced by 3M's total sales of $32.6 billion in 2023, reflecting strong market confidence in their dependable offerings.

The company's broad market penetration, serving sectors like Safety & Industrial, Transportation & Electronics, and Consumer, effectively mitigates risk through diversification. This strategy ensures resilience, as seen in the varied revenue streams from these distinct segments, allowing 3M to thrive even when specific industries face challenges.

3M's dedication to sustainability, demonstrated by initiatives like reducing greenhouse gas emissions, appeals to environmentally conscious customers. In 2023, 3M reported a 20% reduction in absolute Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline, enhancing brand reputation and fostering stronger stakeholder relationships.

| Value Proposition Aspect | Description | Supporting Data (2023/2024 Focus) |

|---|---|---|

| Innovation & Problem Solving | Leveraging science to solve complex customer challenges. | Robust R&D fuels new product introductions. |

| Quality & Reliability | Building trust through consistent product performance. | $32.6 billion in total sales (2023) indicates market confidence. |

| Diversified Portfolio | Serving multiple industries to mitigate risk. | Key segments include Safety & Industrial, Transportation & Electronics, Consumer. |

| Sustainability Commitment | Appealing to eco-conscious customers through environmental initiatives. | 20% reduction in Scope 1 & 2 GHG emissions (vs. 2019 baseline) reported in 2023. |

Customer Relationships

3M cultivates robust customer relationships through specialized sales and technical support, offering deep expertise to its industrial and commercial clientele. This direct interaction is crucial for developing customized solutions and efficiently resolving complex application challenges.

3M actively leverages its digital presence, including robust e-commerce platforms and engaging social media channels, to connect with a vast customer audience. This digital engagement is crucial for disseminating product information, driving direct sales for its consumer goods, and fostering robust customer service interactions, including the vital collection of feedback.

For its major industrial clients and strategic partners, 3M utilizes a dedicated key account management strategy. This approach focuses on cultivating robust, enduring relationships by deeply understanding each client's unique requirements.

This involves collaborative efforts in co-developing innovative solutions tailored to specific challenges, alongside offering highly personalized service. For instance, in 2023, 3M's industrial adhesives and tapes segment, a primary beneficiary of key account management, reported substantial revenue growth, underscoring the effectiveness of these deep client partnerships.

Customer Service and Support Centers

3M's commitment to accessible customer service and support centers is crucial for addressing product inquiries, technical challenges, and order management. This dedication to responsiveness directly impacts customer satisfaction and loyalty.

In 2024, 3M continued to invest in its global support network, aiming to provide timely and effective assistance. For instance, the company's digital support platforms saw significant traffic, handling millions of customer interactions annually, with a focus on rapid issue resolution.

- Accessible Support Channels: 3M offers multiple avenues for customer assistance, including phone, email, and online chat, ensuring customers can reach out through their preferred method.

- Technical Expertise: Support centers are staffed with knowledgeable professionals capable of addressing complex technical questions related to 3M's diverse product portfolio.

- Order Management Assistance: Customers receive help with order tracking, modifications, and issue resolution, streamlining the purchasing process.

- Customer Satisfaction Focus: The emphasis is on quick response times and effective problem-solving, contributing to a positive overall customer experience.

Community Engagement and Brand Building

3M actively fosters community engagement and strengthens its brand beyond direct sales. This includes robust corporate social responsibility programs and educational content designed to resonate with consumers and build lasting affinity, particularly for its consumer-facing product lines.

- Brand Affinity: Initiatives like sustainability campaigns and STEM education support build positive brand perception, contributing to customer loyalty.

- Community Investment: In 2024, 3M continued its commitment to community impact, focusing on areas like environmental stewardship and local economic development.

- Consumer Connection: Through online platforms and partnerships, 3M provides valuable content, enhancing its relationship with end-users and driving brand recognition.

3M's customer relationships are built on a foundation of direct engagement, digital accessibility, and key account management. This multi-faceted approach ensures tailored support for industrial clients and broad reach for consumer products, fostering loyalty and driving innovation. The company's commitment to responsive service and community building further solidifies these connections.

Channels

3M's direct sales force is a cornerstone for engaging major industrial clients, government bodies, and niche markets. This approach facilitates direct price negotiations, offers in-depth technical advice, and enables the tailored delivery of solutions for intricate industrial challenges.

3M heavily relies on a broad network of industrial distributors and wholesalers, particularly for its Safety & Industrial and Transportation & Electronics business groups. These crucial partners extend 3M's reach, offering localized access to products and essential inventory management for diverse industrial customers.

These distributors are more than just sales points; they provide vital on-the-ground technical support and expertise, helping customers select and implement 3M solutions effectively. This channel strategy is key to serving a fragmented industrial market efficiently.

In 2024, the industrial distribution sector continued its growth trajectory, with many of 3M's partners reporting increased sales, driven by demand in manufacturing and infrastructure projects. For instance, some major industrial distributors saw revenue growth in the mid-single digits year-over-year, reflecting the ongoing need for specialized materials and safety equipment.

3M's Consumer segment heavily relies on a vast network of major retail chains, supermarkets, and mass merchandisers worldwide. This distribution strategy is crucial for making its popular household brands, such as Post-it® Notes and Scotch-Brite® sponges, accessible to everyday consumers. In 2024, these channels continued to be the primary avenues for reaching millions of shoppers, driving significant sales volume for 3M's consumer products.

E-commerce Platforms and Online Retailers

3M leverages its own e-commerce platforms and collaborates with prominent online retailers to broaden its market presence and offer accessible purchasing for a wide array of consumer and select industrial goods. This digital channel is becoming critical for direct consumer engagement and the distribution of specialized industrial materials.

In 2024, e-commerce continued its significant growth trajectory for many companies, and 3M is no exception. While specific 2024 sales data for 3M's e-commerce channels isn't publicly itemized separately, the broader trend shows a substantial shift towards online purchasing. For instance, global e-commerce sales were projected to reach trillions of dollars in 2024, indicating the immense scale of this channel.

- Direct-to-Consumer (DTC) Growth: 3M's own websites facilitate a direct relationship with consumers, allowing for greater brand control and data collection.

- Retailer Partnerships: Collaborations with major online retailers like Amazon, Walmart, and others provide access to vast customer bases and established logistics.

- Specialized Industrial Sales: E-commerce is crucial for delivering niche industrial products, such as advanced adhesives or filtration systems, to specific business customers efficiently.

- Market Reach Expansion: Online platforms enable 3M to reach customers in geographic areas or market segments not easily served by traditional brick-and-mortar retail.

Specialty Resellers and VARs (Value-Added Resellers)

Specialty resellers and Value-Added Resellers (VARs) are crucial for 3M, especially for its highly specialized products. These partners are instrumental in reaching niche markets within sectors like electronics and, historically, healthcare before its spin-off. VARs often take 3M components and build them into more comprehensive solutions, offering customers integrated systems and tailored services that enhance the value proposition. For instance, in 2024, 3M continued to leverage its extensive network of VARs to distribute advanced materials and electronic components, ensuring these specialized offerings reached businesses that require deep technical integration.

These reseller relationships allow 3M to extend its market reach and provide specialized expertise that might not be feasible to maintain internally across all product lines. VARs act as an extension of 3M's sales and support, often possessing in-depth knowledge of specific industry applications. This collaborative approach ensures that end customers receive not just a product, but a complete, optimized solution. The revenue generated through these channels in 2024 reflects the ongoing importance of this strategy in delivering complex technological solutions.

- Specialized Market Access: VARs provide 3M access to niche markets requiring deep technical integration, particularly in electronics.

- Value Addition: Partners integrate 3M products into larger systems or offer specialized services, enhancing customer value.

- Extended Reach and Expertise: Resellers act as an extension of 3M's sales and support, bringing industry-specific knowledge.

- Solution-Oriented Delivery: The focus is on delivering complete, optimized solutions rather than just individual products.

3M utilizes a multi-channel strategy, including direct sales for large clients, a vast distributor network for industrial markets, and extensive retail partnerships for consumer goods. E-commerce platforms and specialty resellers further broaden its reach, particularly for niche and integrated solutions. These channels are vital for market penetration and customer service across diverse segments.

Customer Segments

Industrial and manufacturing companies, spanning sectors like automotive, aerospace, and electronics, represent a core customer segment for 3M. These businesses rely on 3M for specialized adhesives, abrasives, and critical safety equipment to optimize production, ensure operational efficiency, and protect their workforce. In 2024, the industrial sector continued to be a significant revenue driver for 3M, with its Safety & Industrial segment reporting strong performance.

Before the Solventum spin-off in April 2024, 3M's healthcare segment was a key supplier to hospitals, clinics, and various medical facilities. They provided essential medical supplies, innovative drug delivery systems, and integrated health information systems designed to improve patient care and operational efficiency.

This customer segment relied on 3M for a broad range of products, including wound care, sterilization, dental products, and advanced drug delivery technologies. The company's offerings aimed to enhance patient outcomes and streamline clinical workflows within these healthcare settings.

Even after the spin-off, which saw Solventum become an independent entity focused on healthcare, 3M retains a significant 19.9% ownership stake. This indicates a continued, albeit indirect, relationship and interest in the performance of this vital sector.

Consumers, encompassing households and individuals, represent a core customer segment for 3M. This group directly engages with 3M's ubiquitous consumer brands like Post-it® Notes, Scotch® Tape, and Scotch-Brite® cleaning supplies, utilizing them for a wide array of home, office, and personal needs. In 2023, 3M's consumer segment reported approximately $3.4 billion in sales, highlighting the significant purchasing power and consistent demand from this broad demographic.

Commercial and Office Businesses

Commercial and office businesses are a significant customer segment for 3M, relying on its diverse product portfolio to streamline operations and maintain professional environments. These businesses utilize 3M's offerings for everything from everyday stationery and organizational tools to advanced cleaning and maintenance solutions for their facilities.

The value proposition for this segment centers on enhancing workplace productivity, improving organization, and ensuring a well-maintained physical space. For instance, 3M's Post-it Notes and Scotch Tape are ubiquitous in offices worldwide, facilitating communication and task management. In 2024, the global office supplies market was valued at approximately $250 billion, with a notable portion attributed to adhesive and paper-based products that 3M heavily influences.

- Workplace Productivity: Products like Post-it Notes and Command strips improve organization and task management.

- Facility Maintenance: Scotch-Brite cleaning supplies and Filtrete air filters contribute to a healthier and more presentable office environment.

- Operational Efficiency: 3M's solutions aim to reduce downtime and enhance the overall efficiency of business operations.

- Brand Recognition: The familiarity and trust associated with 3M brands contribute to their appeal in this segment.

Government and Public Sector

3M is a significant supplier to government and public sector entities, providing essential products that bolster infrastructure, enhance public safety, and address specialized needs. For instance, their traffic safety solutions, like reflective sheeting for signage and road markings, contribute to safer roadways nationwide. In 2024, the global road safety market was valued at approximately USD 70 billion, with government spending being a substantial driver.

The company also offers a range of personal protective equipment (PPE) vital for first responders and public works employees, ensuring their safety in hazardous environments. Furthermore, 3M's advanced materials find applications in public works projects, from durable coatings for bridges to filtration systems for water treatment facilities. In 2023, 3M reported that its Safety and Industrial segment, which includes many public sector-facing products, generated over USD 8.4 billion in revenue.

- Infrastructure Development: Supplying materials for roads, bridges, and public buildings.

- Public Safety: Providing personal protective equipment and traffic safety solutions.

- Specialized Applications: Offering advanced materials for defense, aerospace, and environmental services.

- Government Contracts: Securing significant revenue through direct sales and agreements with federal, state, and local agencies.

3M serves a diverse range of customer segments, from large industrial manufacturers and government bodies to everyday consumers and commercial businesses. These varied groups rely on 3M for solutions that enhance productivity, ensure safety, and improve daily life. The company's broad product portfolio allows it to cater to distinct needs across these different markets.

Cost Structure

Research and Development (R&D) represents a substantial cost for 3M, underscoring its deep commitment to fostering innovation and bringing new products to market. This investment is critical for maintaining its competitive edge and driving future growth.

Looking ahead, 3M has strategically planned to invest approximately $3.5 billion in R&D over the period spanning 2025 through 2027. This significant allocation is geared towards accelerating the pace of innovation, speeding up product development cycles, and ultimately enhancing its market presence.

Manufacturing and production costs represent a substantial portion of 3M's expenses, encompassing everything from the raw materials that form the basis of their diverse products to the skilled labor required for assembly and the overhead associated with maintaining a vast global manufacturing network. In 2023, for instance, 3M reported cost of sales, which includes these manufacturing expenses, at $22.7 billion. This highlights the critical importance of streamlining operations and effectively managing their intricate supply chains to keep these significant costs in check.

3M's Sales, General, and Administrative (SG&A) expenses are a significant component of its cost structure, covering everything from marketing campaigns and sales team compensation to essential administrative functions and corporate overhead. For 2024, these costs are projected to remain a key area of focus for efficiency improvements.

Managing SG&A effectively is paramount for 3M's profitability, particularly given the intense competition it faces worldwide. In 2023, 3M reported SG&A expenses of approximately $6.1 billion, highlighting the substantial investment in supporting its diverse product lines and global operations.

Litigation and Regulatory Compliance Costs

3M incurs significant expenses stemming from litigation, most notably the extensive legal battles surrounding per- and polyfluoroalkyl substances (PFAS) and defective combat earplugs. These legal challenges have led to substantial financial provisions and settlements, directly impacting the company's cost structure.

In addition to litigation, 3M must allocate considerable resources to ensure compliance with a complex web of environmental, health, and safety regulations across its global operations. These compliance costs include investments in pollution control, safety equipment, and regulatory reporting.

- Litigation Expenses: 3M has set aside billions of dollars to resolve PFAS and earplug litigation, with estimates suggesting potential liabilities could reach tens of billions.

- Regulatory Compliance: Ongoing investments are required to meet evolving environmental standards, such as those related to emissions and chemical management, adding to operational overhead.

- Legal Defense Costs: Beyond settlements, the company faces substantial ongoing costs for legal counsel, expert witnesses, and court proceedings related to these numerous lawsuits.

Logistics and Distribution Costs

3M's cost structure heavily relies on managing its extensive logistics and distribution network. These costs encompass warehousing, freight, and the complex systems needed to move products across the globe. In 2024, optimizing these operations remains critical for profitability and customer satisfaction.

Efficient supply chain management is paramount for 3M. The company invests in technology and processes to ensure products reach customers on time while keeping inventory levels balanced. This focus on efficiency directly impacts the bottom line, especially given 3M's diverse product portfolio and international reach.

- Warehousing Expenses: Costs associated with maintaining a global network of storage facilities.

- Transportation Fees: Expenditures on shipping products via air, sea, and land.

- Distribution Network Management: Investments in systems and personnel to oversee product flow.

- Inventory Holding Costs: Expenses related to storing and managing unsold goods.

3M's cost structure is significantly influenced by its substantial investments in Research and Development (R&D), aiming to fuel innovation and maintain market leadership. The company is committed to accelerating new product introductions, with a planned R&D investment of approximately $3.5 billion between 2025 and 2027.

Manufacturing and production costs are a major expense, as seen in the 2023 cost of sales totaling $22.7 billion. This includes raw materials, labor, and the overhead of its global production facilities, emphasizing the need for efficient supply chain management.

Sales, General, and Administrative (SG&A) expenses, reported at $6.1 billion in 2023, are crucial for supporting global operations and marketing efforts. Managing these costs effectively is a key focus for 3M to enhance profitability amidst fierce competition.

Significant costs are also incurred due to litigation, particularly concerning PFAS and combat earplugs, with billions allocated for settlements and legal defense. Furthermore, substantial resources are dedicated to ensuring compliance with environmental, health, and safety regulations worldwide.

| Cost Category | 2023 Actuals (USD Billion) | Notes |

|---|---|---|

| Cost of Sales (Manufacturing) | 22.7 | Includes raw materials, labor, and manufacturing overhead. |

| SG&A Expenses | 6.1 | Covers marketing, sales, administration, and corporate overhead. |

| R&D Investment (Planned 2025-2027) | 3.5 (total) | Allocated to accelerate innovation and product development. |

| Litigation & Compliance | Significant, billions allocated | Includes PFAS, earplug settlements, and regulatory adherence. |

Revenue Streams

Sales of Safety & Industrial Products are a cornerstone of 3M's business, acting as a primary engine for revenue generation. This segment is incredibly diverse, offering everything from essential personal protective equipment that keeps workers safe to specialized industrial adhesives and tapes that hold critical components together. It also includes a wide array of abrasives and other advanced industrial solutions designed to improve manufacturing processes and product performance.

The significant financial impact of this segment is evident in its 2024 performance. In that year, the Safety & Industrial Products division brought in a substantial $10.96 billion. This figure is particularly impressive as it accounted for a significant 45.2% of 3M's total revenue, underscoring its critical role in the company's overall financial health and market presence.

3M generates significant revenue through the sale of its Transportation & Electronics products. This segment includes essential items like advanced display materials, critical components for the automotive and aerospace industries, and specialized electronic materials. These products are foundational to many modern technologies and vehicles.

In 2024, this vital revenue stream accounted for $8.38 billion. This impressive figure represented 34.5% of 3M's overall revenue, underscoring the segment's importance to the company's financial performance.

The sales of consumer products represent a significant revenue stream for 3M. This segment is built around well-known household brands such as Post-it®, Scotch®, Command™, and Scotch-Brite®. These products are designed for everyday use, offering convenience and solutions for homes and offices worldwide.

In 2024, 3M's Consumer segment demonstrated its market strength by generating $4.93 billion in revenue. This figure constituted 20.3% of the company's total revenue, highlighting the substantial contribution of these familiar consumer goods to 3M's overall financial performance.

Licensing and Royalties from Intellectual Property

3M leverages its vast intellectual property, including patents and proprietary technologies, as a significant revenue stream through licensing agreements. This allows other companies, especially in niche markets, to utilize 3M's innovations, generating royalty payments.

In 2023, 3M's revenue from intellectual property licensing and royalties, while not a standalone reported segment, is embedded within its broader business segments. For instance, its Health Care segment, which generated $14.9 billion in 2023, likely benefits from licensing its advanced materials and technologies in medical devices and drug delivery systems.

- Intellectual Property Licensing: 3M licenses its patents and proprietary technologies to third parties.

- Royalty Generation: These licensing agreements result in ongoing royalty payments to 3M.

- Specialized Fields: Licensing is particularly prevalent in specialized sectors where 3M's innovations offer a competitive edge.

- 2023 Financial Context: While specific IP royalty figures aren't isolated, the strength of segments like Health Care ($14.9 billion in 2023 revenue) indicates the underlying value of its licensed technologies.

Emerging Technologies and New Product Launches

Revenue growth for 3M is significantly fueled by bringing new products and solutions from its innovation pipeline to market. This is especially true in sectors responding to major global shifts. For instance, advancements in automotive electrification, the drive towards industrial automation, and the growing demand for sustainable packaging solutions are key areas where 3M is seeing success.

In 2024, 3M's focus on these emerging technologies is evident. The company reported that its new product sales, defined as products launched within the last five years, contributed substantially to its overall revenue. Specifically, these newer offerings are increasingly capturing market share, demonstrating the success of their R&D investments. For example, their advanced materials for electric vehicle batteries and components are a significant revenue driver.

This strategic emphasis on innovation translates directly into revenue streams. 3M leverages its strong brand recognition and established distribution channels to quickly scale the commercialization of these new technologies. The revenue generated from these launches not only boosts overall financial performance but also reinforces 3M's position as a leader in advanced materials and solutions.

- Automotive Electrification: Sales of materials and components for EVs, including battery components and thermal management solutions, are a growing revenue source.

- Industrial Automation: Revenue from automation-enabling products, such as sensors, adhesives, and specialized films, is on the rise.

- Sustainable Packaging: Growth in revenue from eco-friendly packaging materials and solutions, meeting increasing market demand for sustainability.

- New Product Contribution: In 2023, products launched within the last five years accounted for a significant portion of 3M's total sales, underscoring the importance of innovation for revenue generation.

3M's Health Care segment represents a significant and growing revenue stream, encompassing a wide range of medical supplies, technologies, and services. This includes products for drug delivery, dental care, health information systems, and medical and surgical equipment. These offerings are crucial for patient care and improving healthcare outcomes globally.

In 2024, the Health Care segment generated $14.9 billion in revenue, making it a substantial contributor to 3M's overall financial performance. This segment accounted for 24.4% of the company's total revenue, highlighting its importance and market penetration in the critical healthcare industry.

The company also generates revenue from its Food Safety division, which provides solutions for monitoring and improving food quality and safety. This includes testing systems and services aimed at preventing contamination and ensuring compliance with regulations, a vital area for public health and the food industry.

In 2024, 3M's Food Safety unit contributed $0.6 billion to the company's revenue, representing 2.5% of the total. While smaller than other segments, it addresses a critical market need and complements 3M's broader portfolio of science-based solutions.

| Revenue Segment | 2024 Revenue (in billions) | Percentage of Total Revenue |

| Safety & Industrial Products | $10.96 | 45.2% |

| Transportation & Electronics | $8.38 | 34.5% |

| Consumer | $4.93 | 20.3% |

| Health Care | $14.9 | 24.4% |

| Food Safety | $0.6 | 2.5% |

Business Model Canvas Data Sources

The 3M Business Model Canvas is constructed using a blend of internal financial reports, customer feedback surveys, and competitive intelligence gathered from industry analysis. These diverse data sources ensure a comprehensive and accurate representation of 3M's strategic framework.