Limoneira Bundle

How Does Limoneira Company Operate?

Limoneira Company, a long-standing agribusiness and real estate developer, is a major player in the production, marketing, and sale of lemons and avocados. A significant recent development is the merger of its citrus sales and marketing operations with Sunkist Growers, set to take effect in early fiscal year 2026.

This strategic move is anticipated to generate approximately $5 million in annual cost savings for selling and marketing, while also enhancing its reach into crucial food service and retail markets. This integration highlights Limoneira's commitment to refining its operations and expanding its market presence.

In the second quarter of fiscal year 2025, Limoneira reported total net revenue of $35.1 million. This figure represents a decrease compared to the $44.6 million earned in the same period of the prior fiscal year, largely due to reduced lemon revenues, though this was partly offset by increased avocado and orange agribusiness earnings. Despite a net loss of $3.5 million applicable to common stock in Q2 FY2025, the company's real estate development segment remains a strong contributor. The joint venture 'Harvest at Limoneira' recently received approval to increase its master-planned community from 1,500 to 2,050 dwelling units. Understanding Limoneira's dual focus on agriculture and real estate is key to grasping its value drivers and long-term viability. For a deeper dive into its market position, consider a Limoneira Porter's Five Forces Analysis.

What Are the Key Operations Driving Limoneira’s Success?

The Limoneira Company operates on a dual foundation of agribusiness and real estate development, creating and delivering value through both. Its agribusiness segment focuses on producing, marketing, and selling lemons and avocados, alongside other specialty crops like oranges and mandarins.

The company's agribusiness value proposition is built upon extensive land holdings, approximately 10,500 to 11,100 acres across California, Arizona, Chile, and Argentina, complemented by significant water rights. This provides a robust base for sustainable agricultural production, encompassing growing, harvesting, packing, and marketing fresh produce.

A key strategic shift involves moving towards an 'asset-lighter' citrus model, aiming for 80% of supply from grower partners. Simultaneously, the company is expanding its own avocado production by 1,000 acres through fiscal year 2027 to meet growing consumer demand.

The merger of its citrus sales and marketing operations with Sunkist Growers, effective in Q1 fiscal year 2026, is designed to leverage Sunkist's extensive distribution network and brand influence. This collaboration aims to improve market access and operational efficiencies for Limoneira's citrus products.

In real estate, the Harvest at Limoneira joint venture focuses on developing agricultural land for residential and commercial use. This segment capitalizes on prime Southern California coastal locations, offering new housing and community amenities while monetizing valuable land and water assets.

Limoneira Company's integrated business model, which combines deep agricultural expertise with strategic real estate development, allows it to serve a wide array of customers. This diversification, coupled with a commitment to sustainability, distinguishes its operations in both the global produce markets and the residential development sector. Understanding the Brief History of Limoneira provides further context to its current business model and operational strategies.

The Limoneira business model is characterized by its dual focus on agribusiness and real estate. This approach leverages the company's substantial land and water assets to generate diverse revenue streams and mitigate risks associated with single-industry operations.

- Primary focus on lemons and avocados, with expansion in avocado production.

- Strategic shift towards an 'asset-lighter' citrus model, relying more on grower partners.

- Real estate development through joint ventures in desirable locations.

- Emphasis on sustainable farming practices and quality control.

Limoneira SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Limoneira Make Money?

Limoneira Company's financial performance is driven by its diverse revenue streams, primarily from agribusiness and real estate development, with total net revenue of $69.4 million for the six months ended April 30, 2025. This demonstrates a multifaceted business model designed to leverage its agricultural assets and land holdings.

The agribusiness segment is the core of Limoneira's operations, generating revenue from the sale of fresh produce. For the second quarter of fiscal year 2025, this segment contributed $33.6 million to the company's total net revenue.

Fresh packed lemon sales are the largest component of agribusiness revenue. In Q2 FY2025, these sales amounted to $19.7 million from approximately 1,357,000 cartons sold, with an average price of $14.52 per carton.

Avocado revenue saw an increase to $2.8 million in Q2 FY2025, up from $2.3 million in the prior year. This growth was driven by higher prices, with the company expecting 2025 volumes between 7.0 million and 8.0 million pounds.

Sales of oranges and specialty citrus also contribute to revenue. Orange sales in Q2 FY2025 were $1.6 million from 92,000 cartons, and specialty citrus and wine grapes generated $671,000.

The company monetizes its land assets through real estate development, notably the 'Harvest at Limoneira' joint venture. This segment generates revenue from the sale of residential homesites and other development activities.

Limoneira diversifies its income through various strategies, including the sale of water pumping rights and an organic waste recycling joint venture. These initiatives aim to create additional income streams and enhance operational efficiency.

Limoneira Company's business model is characterized by a strategic approach to revenue generation, combining its core agricultural operations with opportunistic real estate development and asset monetization. This diversification is key to its long-term financial health and resilience in the agricultural market. The company's Growth Strategy of Limoneira further outlines its plans for expansion and value creation.

Limoneira's financial performance is closely tied to its agricultural output and real estate ventures. The company is actively pursuing strategic initiatives to bolster its revenue and profitability.

- Total net revenue for the six months ended April 30, 2025, was $69.4 million, a decrease from $84.3 million in the same period of fiscal year 2024.

- Fresh packed lemon sales in Q2 FY2025 were $19.7 million, with an average price of $14.52 per carton.

- Avocado sales in Q2 FY2025 reached $2.8 million, with an anticipated 2025 volume of 7.0 million to 8.0 million pounds.

- Real estate development, particularly the 'Harvest at Limoneira' joint venture, is expected to yield approximately $180 million in proceeds over seven fiscal years.

- A strategic merger with Sunkist Growers, effective in Q1 FY2026, is projected to generate $5 million in annual cost savings and EBITDA improvement.

- The sale of water pumping rights, such as a $1.7 million transaction in January 2025, represents another avenue for monetization.

Limoneira PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Limoneira’s Business Model?

Limoneira Company has a history marked by significant strategic shifts and operational adjustments. A recent major development involves its citrus sales and marketing operations, aiming to streamline processes and enhance market access.

In June 2025, Limoneira announced a merger of its citrus sales and marketing operations with Sunkist Growers, effective early fiscal year 2026. This move positions Limoneira as a major lemon grower and private licensed packer for Sunkist, projected to save $5 million annually in selling and marketing costs.

The company achieved a key real estate milestone in April 2024 with the sale of 554 residential homesites at Harvest at Limoneira, generating $16.6 million in equity earnings and a $15.0 million cash distribution. An expansion approved in April 2024 increased the total entitled lots to 2,050, including 250 additional single-family homesites and 300 multi-family rental homes.

Facing pricing pressure in an oversupplied lemon market in Q2 FY2025, Limoneira is optimizing its revenue mix and shifting to an 'asset-lighter' agribusiness model, sourcing 80% of its citrus from grower partners. The company is also expanding avocado production by 1,000 acres by fiscal year 2027, targeting 30 million pounds annually.

Limoneira's competitive edge lies in its established brand, extensive land and water rights across multiple countries, and an integrated business model. Its expertise in real estate development, particularly through joint ventures, allows for strategic land monetization. The company is actively exploring alternatives to maximize shareholder value, leveraging its diverse asset portfolio.

Limoneira Company's business model is multifaceted, generating revenue from both agricultural operations and real estate development. This diversified approach helps mitigate risks associated with single-market dependencies.

- Citrus sales and marketing

- Real estate sales and development

- Avocado production and sales

- Other agricultural products

Limoneira Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Limoneira Positioning Itself for Continued Success?

Limoneira Company holds a significant position in agribusiness, primarily as a major producer and marketer of lemons and avocados, leveraging extensive land and water assets. Its strategic merger with Sunkist Growers, set for Q1 FY2026, aims to bolster its market presence in food service and retail, while its real estate development, notably the Harvest at Limoneira project, marks it as a key player in master-planned communities.

Limoneira is a prominent agribusiness entity, specializing in lemons and avocados, supported by substantial land and water resources. The company's real estate ventures, particularly the Harvest at Limoneira, also contribute to its diversified business model.

The company faces risks inherent in agricultural markets, including commodity price volatility and supply fluctuations. Regulatory changes, water availability, crop diseases, and global supply chain issues also present challenges to Limoneira Company operations.

Limoneira is focused on expanding avocado production and leveraging strategic partnerships to drive growth. Monetizing real estate assets and adopting an 'asset-lighter' model for citrus are key components of its forward-looking strategy.

The merger with Sunkist Growers is anticipated to generate $5 million in annual cost savings and improved EBITDA from FY2026. Real estate ventures are projected to yield approximately $180 million in total proceeds over seven fiscal years.

Limoneira Company functions through a diversified business model that balances agribusiness with real estate development. The company is actively expanding its avocado production, aiming for 7.0 million to 8.0 million pounds in FY2025, and plans to increase this by 1,000 acres through FY2027, expecting significant EBITDA growth. This expansion, coupled with the anticipated $5 million in annual cost savings and improved EBITDA from the Sunkist merger starting in FY2026, underscores its strategy for sustained revenue generation. Understanding Limoneira Company's revenue streams reveals a multifaceted approach, including the monetization of land and water assets, with an estimated $180 million in proceeds expected from real estate ventures over seven fiscal years. Furthermore, Limoneira is exploring additional asset monetization and implementing an 'asset-lighter' model for its citrus business by collaborating with third-party growers, which enhances its operational flexibility and market reach.

- Expansion of avocado production by 1,000 acres through FY2027.

- Projected avocado volumes of 7.0 million to 8.0 million pounds in FY2025.

- Expected $5 million in annual cost savings from the Sunkist merger.

- Anticipated $180 million in total proceeds from real estate ventures over seven fiscal years.

- Implementation of an 'asset-lighter' model for the citrus business.

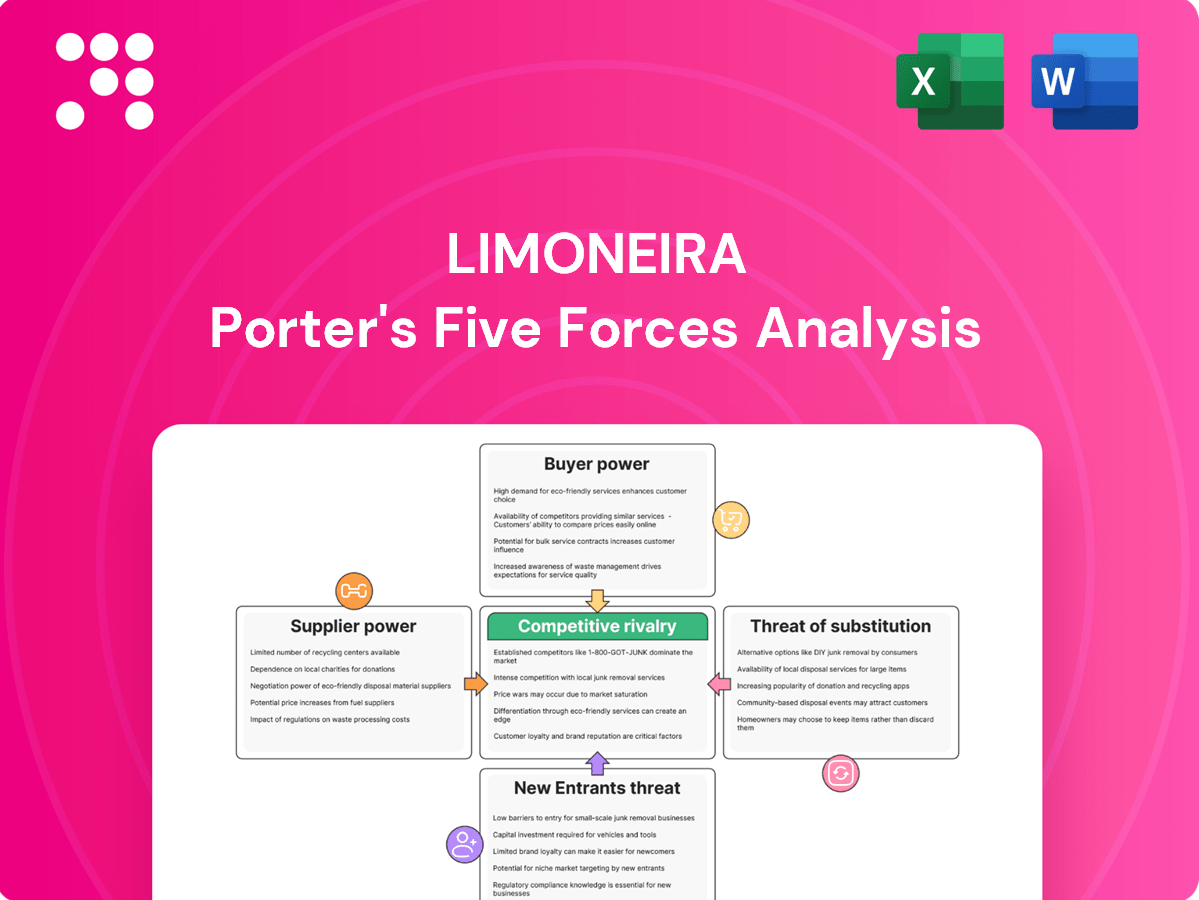

Limoneira Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

- What is Brief History of Limoneira Company?

- What is Competitive Landscape of Limoneira Company?

- What is Growth Strategy and Future Prospects of Limoneira Company?

- What is Sales and Marketing Strategy of Limoneira Company?

- What are Mission Vision & Core Values of Limoneira Company?

- Who Owns Limoneira Company?

- What is Customer Demographics and Target Market of Limoneira Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.