Limoneira Bundle

What is Limoneira's recent strategic move?

Limoneira Company, a prominent agribusiness and real estate firm, recently made a significant strategic decision in June 2025 to merge its citrus sales and marketing operations with Sunkist Growers. This move is anticipated to yield substantial benefits, including an estimated $5 million in annual cost savings commencing in fiscal year 2026.

Founded in 1893, Limoneira has evolved from its initial focus on citrus production to become a diversified global agribusiness. The company's extensive holdings now span approximately 11,100 acres across multiple countries.

Limoneira's history began in Santa Paula, California, with a vision to establish a large-scale citrus enterprise. Today, it remains a key player in the market, offering products like Limoneira Porter's Five Forces Analysis, and continues to adapt to market dynamics.

What is the Limoneira Founding Story?

The Limoneira Company's history began in 1893, a pivotal year that saw the formal establishment of the enterprise in Ventura County, California. This significant undertaking was the brainchild of Nathan W. Blanchard and Wallace L. Hardison, two ambitious individuals who converged with a shared vision for large-scale citrus cultivation.

The Limoneira Company's origins trace back to the entrepreneurial spirit of Nathan W. Blanchard and Wallace L. Hardison. Their collaboration in 1893 marked the formal beginning of an agricultural venture that would significantly shape the citrus industry.

- Founded in 1893 in Ventura County, California.

- Co-founded by Nathan W. Blanchard and Wallace L. Hardison.

- Initial focus on citrus cultivation and walnuts.

- Established with $1 million in startup capital.

- Pioneered industrial-scale agriculture for Eastern markets.

The Limoneira Company was formally established in 1893 in Ventura County, California, by the visionary partnership of Nathan W. Blanchard and Wallace L. Hardison. Both men, though two decades apart in age and originating from Maine, converged in Santa Paula with ambitious dreams; Blanchard, a town founder, had already experimented with citrus since 1875, while Hardison had built an oil empire, co-founding Union Oil Company. Their shared ambition was to capitalize on the burgeoning opportunity to supply citrus to Eastern markets by operating agriculture on an industrial scale, a novel concept at the time. The initial venture involved the purchase of 413 acres of land from J.K. Gries. The founders christened their new enterprise 'Limoneira,' a Portuguese word meaning 'lemon lands' or 'lemon tree,' indicative of their primary crop focus. The original business model centered on cultivating lemons, Valencia oranges, and walnuts. The company was founded with $1 million in startup funds, a substantial sum for the era. Early challenges included competing with lemons imported from Italy, which Blanchard addressed by budding lemons onto orange trees and leveraging the arrival of the railroad for efficient shipping. Beyond their direct operations, Blanchard and Hardison were instrumental in laying the groundwork for key institutions that still thrive today, including Sunkist Growers, Fruit Growers Supply, and Diamond Walnut. This early period of Limoneira Company's history laid the foundation for its future growth and influence in the agricultural sector, demonstrating a keen understanding of market needs and innovative solutions, as detailed in the Marketing Strategy of Limoneira.

Limoneira SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Limoneira?

The Limoneira Company's early history is marked by significant growth and diversification, laying the foundation for its future success in agriculture. From its initial focus on lemons, the company rapidly expanded its citrus groves and ventured into other crops, demonstrating a keen ability to adapt and grow.

The Limoneira Company's journey began with a strong focus on lemons, but quickly evolved. By 1898, its orchards boasted nearly 50,000 trees, including a substantial number of lemon, grapefruit, and orange trees, showcasing early diversification in its citrus operations.

The turn of the century marked key financial achievements for Limoneira, with its first net profit in 1901 and the initiation of dividend payments in 1902. The appointment of C.C. Teague as General Manager in 1901 was pivotal, ushering in an era of innovative farming practices and industry leadership.

In 1907, Limoneira significantly broadened its agricultural base by acquiring the 2,300-acre Olivelands Tract, diversifying into crops like walnuts, olives, beans, corn, and hay. This expansion also necessitated the purchase of the Santa Paula Horse and Feed Company in 1908 to support livestock.

By the 1920s, Limoneira's cultivated acreage had quadrupled, establishing it as the largest lemon shipper in California and prompting extensive building projects. The company began planting avocado trees in the 1940s, a crop that would become increasingly important to its portfolio, and initiated international expansion in the 1970s, becoming a key lemon supplier to Japan and other Asian markets.

The company's strategic growth continued through partnerships and acquisitions, including a cross-equity agreement with Calavo Growers in 2005. Further acquisitions, such as Associated Citrus Packers, Inc. in 2013 for $18.6 million and Marlin Ranching Company in 2014 for $1.4 million, bolstered its operations. In 2017, Limoneira acquired 90% of Pan de Azucar S.A. in Chile for $5.8 million, demonstrating its ongoing commitment to expanding its global reach and exploring new avenues for growth, as detailed in its Growth Strategy of Limoneira.

Limoneira PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Limoneira history?

The Limoneira Company's journey is marked by significant achievements in large-scale citrus production and a deep commitment to sustainable agriculture, dating back to its founding. The company has consistently innovated, from establishing beneficial insect pest control in 1928 to modern investments in water, solar, and soil health. Recent expansions include a state-of-the-art packing facility and diversification into real estate development, showcasing a strategic evolution over its Limoneira Company history.

| Year | Milestone |

|---|---|

| Founding | Established large-scale citrus production, marking the Limoneira Company origins. |

| 1928 | Co-founded the Associates Insectary to pioneer pest control using beneficial insects. |

| 2018 | Expanded annual packing capacity to eight million cartons with a new facility. |

| February 2023 | Sold Northern Properties for $100 million as part of a strategic shift. |

| June 2025 | Announced a strategic merger of citrus sales and marketing with Sunkist Growers. |

Limoneira has consistently focused on agricultural innovation, notably through its long-standing Integrated Pest Management (IPM) system and early adoption of biological pest control. The company is also actively expanding its avocado production, aiming to reach 2,000 acres by 2027, demonstrating its adaptability in crop diversification.

Limoneira has maintained a comprehensive IPM system for decades, emphasizing sustainable pest control methods. This includes the early establishment of biological pest control through the Associates Insectary.

The company has made strategic investments in water conservation, solar energy, and soil health for over a century. This long-term commitment underscores its dedication to environmentally responsible operations.

Limoneira is aggressively expanding its avocado cultivation, with plans to add 500 acres by fiscal year 2027. This strategic move diversifies its revenue streams and capitalizes on growing market demand.

The company has ventured into real estate development with projects like the Harvest at Limoneira. Recent approvals allow for an increase in residential units from 1,500 to 2,050, adding another dimension to its business model.

A strategic merger of citrus sales and marketing operations with Sunkist Growers was announced in June 2025, aiming for significant annual cost savings. This collaboration is expected to enhance market reach and operational efficiency.

The company invested in a new, state-of-the-art packing facility in Santa Paula, significantly boosting its processing capabilities. This upgrade is crucial for handling increased production volumes and maintaining product quality.

Limoneira has navigated significant challenges throughout its Limoneira Company growth, including early competition over product branding and economic downturns like the Great Depression. More recently, the COVID-19 pandemic impacted export markets, and an oversupplied lemon market in 2025 led to pricing pressures and a net loss of $3.5 million in the second quarter of fiscal year 2025.

In the second quarter of fiscal year 2025, an oversupplied lemon market resulted in pricing pressure. This contributed to a net loss of $3.5 million, a notable shift from the $6.4 million net income reported in the same period of fiscal year 2024.

The global pandemic severely affected the export market for fresh produce. This disruption led to reduced sales and profitability, highlighting the company's vulnerability to external market shocks.

Recognizing a disconnect between its public market value and intrinsic asset value, the Board of Directors initiated a process in December 2023 to explore strategic alternatives, including a potential sale or merger.

In its early Limoneira Company business development, the company faced intense competition, notably a branding dispute with Sunkist in 1916. This early challenge shaped its approach to market positioning.

The company demonstrated resilience by navigating economic hardships, including the challenges posed by the Great Depression and the 1940s. These periods tested its operational and financial fortitude.

To adapt and enhance shareholder value, the company is transitioning towards an 'asset-lighter' business model. The sale of its Northern Properties for $100 million in February 2023 is a key example of this strategic pivot.

Limoneira Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Limoneira?

The Limoneira Company's journey began in 1893 in Santa Paula, California, marking the start of its significant Limoneira Company history. From its Limoneira Company founding, the company has experienced consistent growth and strategic adaptations, evolving into a major player in the agricultural sector. The early history of Limoneira Company highlights a commitment to innovation and expansion, laying the groundwork for its future success.

| Year | Key Event |

|---|---|

| 1893 | Limoneira Company founded in Santa Paula, California, establishing its Limoneira Company origins. |

| 1901 | Achieved first net profit and C.C. Teague appointed General Manager, signaling early Limoneira Company business development. |

| 1907 | Acquired the 2,300-acre Olivelands Tract, diversifying crops and landholdings as part of its Limoneira Company expansion over time. |

| 1921 | Became the largest shipper of lemons in California, a key milestone in Limoneira Company's history and its impact on the citrus industry. |

| 1928 | Co-founded the Associates Insectary, pioneering integrated pest management and showcasing the story behind Limoneira Company's innovative approach. |

| 1940s | Began planting avocado trees, a significant step in Limoneira Company's journey in agriculture and a prelude to when Limoneira Company start selling avocados. |

| 1970s | Established itself as a leading lemon supplier to Japan and other Asian markets, demonstrating Limoneira Company growth. |

| 2003 | Harold Edwards took the helm as President and CEO, guiding the company through further evolution. |

| 2009 | Became a publicly traded company on the NASDAQ stock exchange (LMNR), a major step in its Limoneira Company business development. |

| 2013 | Acquired Associated Citrus Packers, Inc. of Yuma, Arizona, for $18.6 million, continuing its Limoneira Company expansion over time. |

| 2017 | Acquired 90% of Pan de Azucar S.A. in Chile for $5.8 million, expanding international operations and demonstrating Limoneira Company growth. |

| February 2023 | Sold Northern Properties for $100 million as part of an asset-lighter strategy, reflecting strategic adjustments. |

| December 2023 | Announced exploration of strategic alternatives to maximize stockholder value, indicating a forward-looking approach. |

| April 2024 | Sold 554 residential homesites at Harvest at Limoneira, highlighting its real estate segment's contribution. |

| June 2025 | Announced strategic merger of citrus sales and marketing operations with Sunkist Growers, effective Q1 fiscal year 2026, a significant development for Limoneira Company citrus. |

The upcoming merger of citrus sales and marketing operations with Sunkist Growers is projected to yield approximately $5 million in annual selling and marketing cost savings. This strategic move is also expected to improve EBITDA starting in fiscal year 2026.

The company plans a substantial expansion of its avocado production, aiming to add 500 acres by fiscal year 2027. The long-term objective is to reach 2,000 acres by 2027, with full bearing capacity anticipated by 2030.

Future revenue from real estate developments, including Harvest and East Area II, is estimated at an additional $155 million over the next six fiscal years. This is further supported by an increase in approved residential units at Harvest at Limoneira.

The company is prioritizing higher-margin services like packing and farm management. Additionally, it is actively exploring opportunities to monetize and lease its valuable water rights, aligning with its diversified agribusiness model and Target Market of Limoneira.

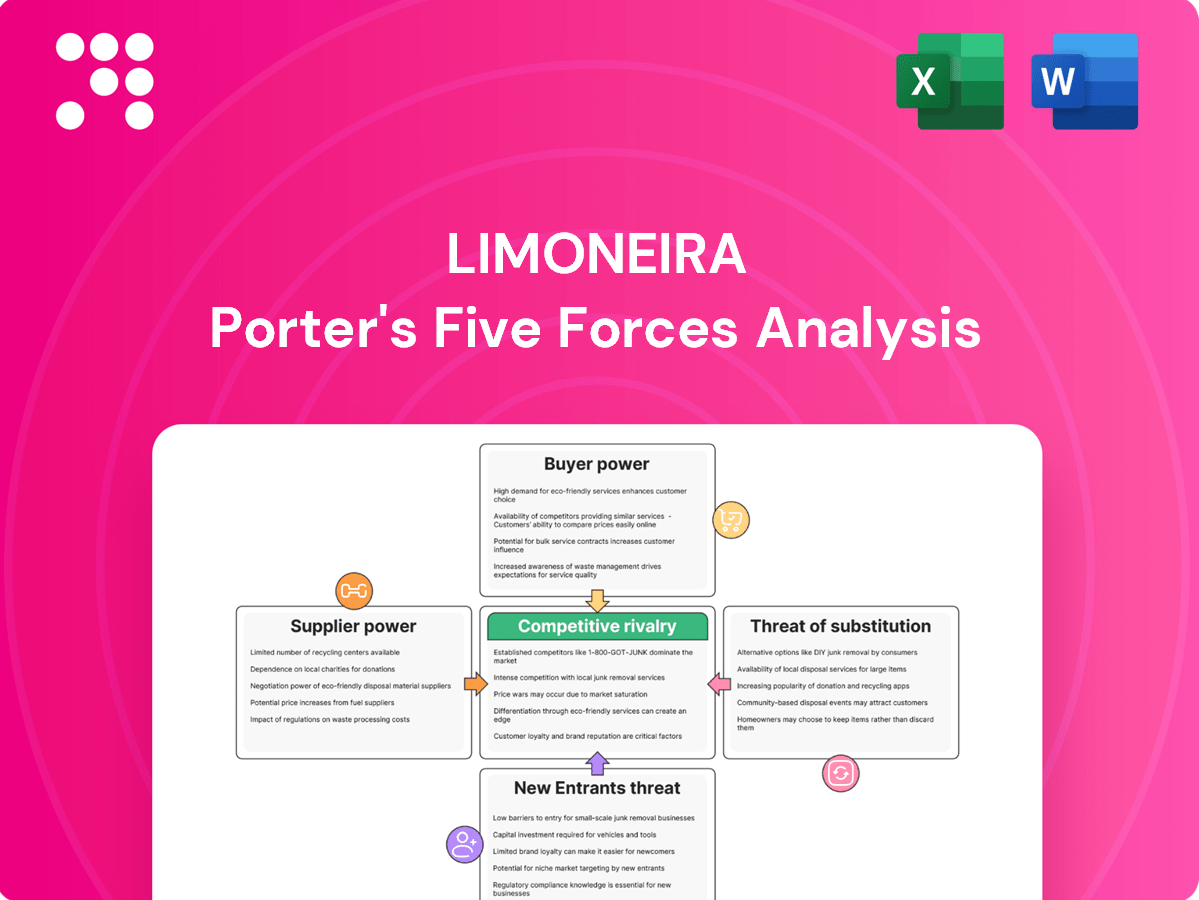

Limoneira Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

- What is Competitive Landscape of Limoneira Company?

- What is Growth Strategy and Future Prospects of Limoneira Company?

- How Does Limoneira Company Work?

- What is Sales and Marketing Strategy of Limoneira Company?

- What are Mission Vision & Core Values of Limoneira Company?

- Who Owns Limoneira Company?

- What is Customer Demographics and Target Market of Limoneira Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.