Limoneira Bundle

What is the Competitive Landscape of Limoneira Company?

Limoneira Company, a long-standing agribusiness and real estate developer, announced in June 2025 a merger of its citrus sales and marketing operations with Sunkist Growers, Inc. This move marks a significant strategic shift for the company.

Founded in 1893, Limoneira has grown from 413 acres to approximately 11,100 acres across multiple countries, becoming a global agribusiness leader. The company is a major producer and marketer of lemons and avocados.

Understanding the competitive forces shaping Limoneira's market is crucial. This analysis delves into the Limoneira Porter's Five Forces Analysis to identify key rivals and Limoneira's unique strengths.

Where Does Limoneira’ Stand in the Current Market?

Limoneira Company operates with a diversified business model, encompassing agribusiness and real estate development. Its core agricultural products include lemons, avocados, and oranges, supported by operations in California, Arizona, Chile, and Argentina. The company is a significant player in the U.S. lemon and avocado markets.

Limoneira's agribusiness centers on the cultivation and sale of lemons, avocados, and oranges. The company is recognized as one of the largest U.S. suppliers for lemons and avocados.

Beyond agriculture, Limoneira engages in real estate development, notably with its Harvest at Limoneira project. This segment has seen strong performance with significant lot sales and expansion plans.

The company's agricultural operations are spread across key regions, including California, Arizona, Chile, and Argentina. This broad footprint aids in managing supply and market access.

A significant strategic move involves merging citrus sales and marketing with Sunkist Growers, aiming to bolster market reach and reduce exposure to volatile lemon pricing.

Limoneira's market position reflects a dynamic interplay between its agricultural output and real estate ventures. While the company is a major supplier of lemons and avocados, its overall market share saw a reduction to approximately 2.04% in the first quarter of fiscal year 2025, coinciding with a 21.27% year-over-year revenue decrease. This financial performance indicates challenges within its core agribusiness, particularly in the lemon segment which experienced oversupply and pricing pressure in Q2 FY2025. Conversely, the avocado business demonstrated robust pricing, and the real estate segment, specifically Harvest at Limoneira, has shown strong sales velocity, with 1,261 residential lots sold and plans for further expansion. The company's Growth Strategy of Limoneira includes expanding avocado production and leveraging its real estate assets. As of April 30, 2025, Limoneira reported trailing 12-month revenue of $177 million and a net debt of $52.9 million. For the second quarter of fiscal year 2025, net revenue was $35.1 million, resulting in a net loss per diluted share of $0.20. The first six months of fiscal year 2025 saw net revenue of $69.4 million, with a net loss per diluted share of $0.38.

Limoneira's market position is influenced by recent financial performance and strategic initiatives. The company is navigating market fluctuations while pursuing growth opportunities.

- Trailing 12-month revenue: $177 million (as of April 30, 2025)

- Q2 FY2025 Net Revenue: $35.1 million (down 21% YoY)

- Q2 FY2025 Net Loss per Diluted Share: $0.20

- First six months FY2025 Net Revenue: $69.4 million

- Net Debt: $52.9 million (as of April 30, 2025)

- Market Capitalization: $278 million (as of August 15, 2025)

- Harvest at Limoneira lots sold: 1,261

Limoneira SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Limoneira?

Limoneira Company navigates a competitive agribusiness and real estate sector. In its core agribusiness, direct rivals are primarily citrus and avocado producers situated in key growing regions like California, Mexico, Chile, Argentina, and Florida. Many of these entities operate as large cooperatives, with Limoneira itself strategically rejoining Sunkist Growers for sales and marketing. Additionally, established relationships with major distributors such as Calavo Growers influence the competitive landscape.

Publicly traded agricultural companies like Alico Inc. and Mission Produce Inc. represent significant competitors. Alico Inc. focuses on citrus and sugarcane cultivation and sales, while Mission Produce Inc. is a vertically integrated avocado producer and distributor with a broad global supply chain. These companies compete through their scale, established distribution networks, and specialized product offerings, impacting Limoneira's market position.

Indirect competition arises from a wide array of other fruits and vegetables vying for consumer spending in the fresh produce market. Limoneira's business strategy must account for these broader market dynamics. A notable development is Limoneira's merger of citrus sales and marketing operations with Sunkist Growers, effective in the first quarter of fiscal year 2026. This alliance is projected to yield approximately $5 million in annual selling and marketing cost savings and enhance EBITDA starting in fiscal year 2026, creating operational synergies through shared infrastructure.

Other citrus producers in California, Mexico, Chile, Argentina, and Florida are key rivals. Many operate within large cooperatives.

Companies specializing in avocado production and distribution, like Mission Produce Inc., present significant competition due to their global supply chains.

Alico Inc., involved in citrus and sugarcane, and Mission Produce Inc., focused on avocados, are key publicly traded competitors impacting Limoneira's financial performance.

Limoneira also competes with a broad range of other fruits and vegetables for consumer spending in the fresh produce sector.

The strategic merger of citrus sales and marketing with Sunkist Growers is expected to generate $5 million in annual cost savings and improve EBITDA.

This alliance positions Limoneira as a major lemon grower for Sunkist, potentially altering market share through enhanced access to retail and foodservice channels.

Limoneira's competitive edge is being reshaped by its strategic alliance with Sunkist Growers. This move is designed to leverage shared storage, washing, and packing capabilities, aiming for significant operational synergies. This partnership is a key element of Limoneira's business strategy to bolster its market position, particularly in the lemon market, and enhance its overall Limoneira company profile within the agriculture industry.

- Strengthened access to foodservice and retail channels.

- Exclusive Sunkist private licensed packer status for lemons.

- Projected $5 million in annual selling and marketing cost savings.

- Anticipated EBITDA improvement starting in fiscal year 2026.

- Enhanced operational efficiencies through shared infrastructure.

- A deeper understanding of Limoneira's trajectory can be found in its Brief History of Limoneira.

Limoneira PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Limoneira a Competitive Edge Over Its Rivals?

The company's integrated agribusiness model is a cornerstone of its competitive advantage. This model spans from cultivation and packing to marketing and sales, offering enhanced control over the supply chain and superior customer service. This comprehensive approach allows for greater efficiency and responsiveness to market demands, distinguishing it from less integrated competitors in the agriculture industry.

With a history dating back to 1893, the company possesses deep-seated expertise in crop cultivation. This long-standing experience translates into refined growing techniques and a thorough understanding of market dynamics, contributing to its strong Limoneira market position.

The company holds approximately 11,100 acres of agricultural and real estate properties, with about 90% of its agricultural land owned. This significant land ownership, often acquired at lower historical costs, provides a substantial competitive edge in terms of cost structure and operational flexibility.

Crucially, most of its properties rely on independent water resources, minimizing dependence on state or federal water projects. This water security is a significant advantage, especially in regions facing water scarcity, and the company actively monetizes these rights, generating $1.7 million in Q1 FY2025.

The successful partnership for the 'Harvest at Limoneira' master-planned community, which has seen 1,261 residential lots sold, showcases its capability in land development and monetization. The approval for an additional 550 units in Phase 3 further highlights this strategic advantage.

Adherence to GLOBALGAP Certification and significant investments in ESG practices, including renewable energy powering over 44% of operations as of its 2023 report, underscore its dedication to sustainable farming practices competitive edge. This focus appeals to environmentally conscious consumers and investors.

The company's workforce stability, bolstered by a unique employee housing rental business and a retentive labor force with many employees boasting over 30 years of service, contributes to operational consistency and expertise. This human capital advantage is a key factor in maintaining its Limoneira company strengths and weaknesses compared to rivals. Understanding these elements is crucial for a comprehensive Limoneira competitive analysis, especially when considering Limoneira vs Sunkist competitive landscape and who are Limoneira's main competitors in the citrus market. The company's strategic positioning and operational efficiencies are vital for its Limoneira financial performance and its ability to navigate the complexities of the global fruit market, including Limoneira challenges in the global fruit market.

The company's competitive edge is built on several key pillars that set it apart from Limoneira industry competitors.

- Integrated agribusiness model for supply chain control.

- Significant ownership of agricultural land with a low cost basis.

- Independent water rights providing operational security.

- Successful real estate development partnerships.

- Strong commitment to sustainability and ESG practices.

- Experienced and stable workforce due to employee housing initiatives.

Limoneira Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Limoneira’s Competitive Landscape?

The competitive landscape for Limoneira is significantly influenced by evolving consumer preferences and agricultural practices. A key industry trend is the increasing demand for healthy foods, with avocados showing a projected global consumption growth of 3.2% CAGR through 2030. This aligns with Limoneira's strategic expansion in avocado production. Concurrently, there's a growing emphasis on sustainability and climate-smart agriculture, an area where Limoneira is actively engaged through its ESG initiatives and certifications. Understanding these dynamics is crucial for a comprehensive Limoneira competitive analysis.

However, the company faces headwinds, including persistent oversupply in the lemon market, which caused pricing pressure and reduced revenues in Q2 FY2025. Avocado volumes are also expected to be lower in FY2025 compared to FY2024 due to the natural alternate bearing cycle of the trees. Increased long-term debt could also present financial challenges, impacting Limoneira's financial performance and flexibility within the agriculture industry.

Consumer preference for avocados continues to rise globally. This trend presents a significant opportunity for Limoneira to expand its production and capitalize on this robust market demand.

The industry is increasingly focused on sustainable and climate-smart farming. Limoneira's commitment to ESG initiatives and certifications positions it favorably in this evolving landscape.

Oversupply in the lemon market has led to pricing pressures and decreased revenues. This market dynamic poses an ongoing challenge for Limoneira's lemon segment.

The natural alternate bearing cycle of avocado trees is expected to impact volumes in FY2025. This cyclical nature requires careful management and strategic planning for Limoneira's avocado market competition.

Limoneira is pursuing several strategic initiatives to enhance its market position and mitigate risks. These efforts aim to build long-term value and resilience in the competitive global fruit market.

- The merger of citrus sales and marketing operations with Sunkist Growers, effective Q1 FY2026, is projected to yield $5 million in annual cost savings and EBITDA improvement, enhancing access to key customers.

- Expansion of avocado production by an additional 1,000 acres through FY2027 is planned to meet growing consumer demand, a key aspect of Limoneira's business strategy.

- Monetization of land and water assets, including the Harvest at Limoneira real estate development (expected to generate $155 million over six years) and water rights sales, provides significant non-agribusiness revenue streams.

- A transition to an 'asset-lighter' business model and leveraging third-party growers are strategies to optimize revenue mix and reduce pricing volatility, crucial for Limoneira's supply chain competitive advantages.

- The company's focus on expanding avocado production and enhancing its citrus go-to-market plan, alongside real estate development, shapes its Target Market of Limoneira and overall competitive outlook.

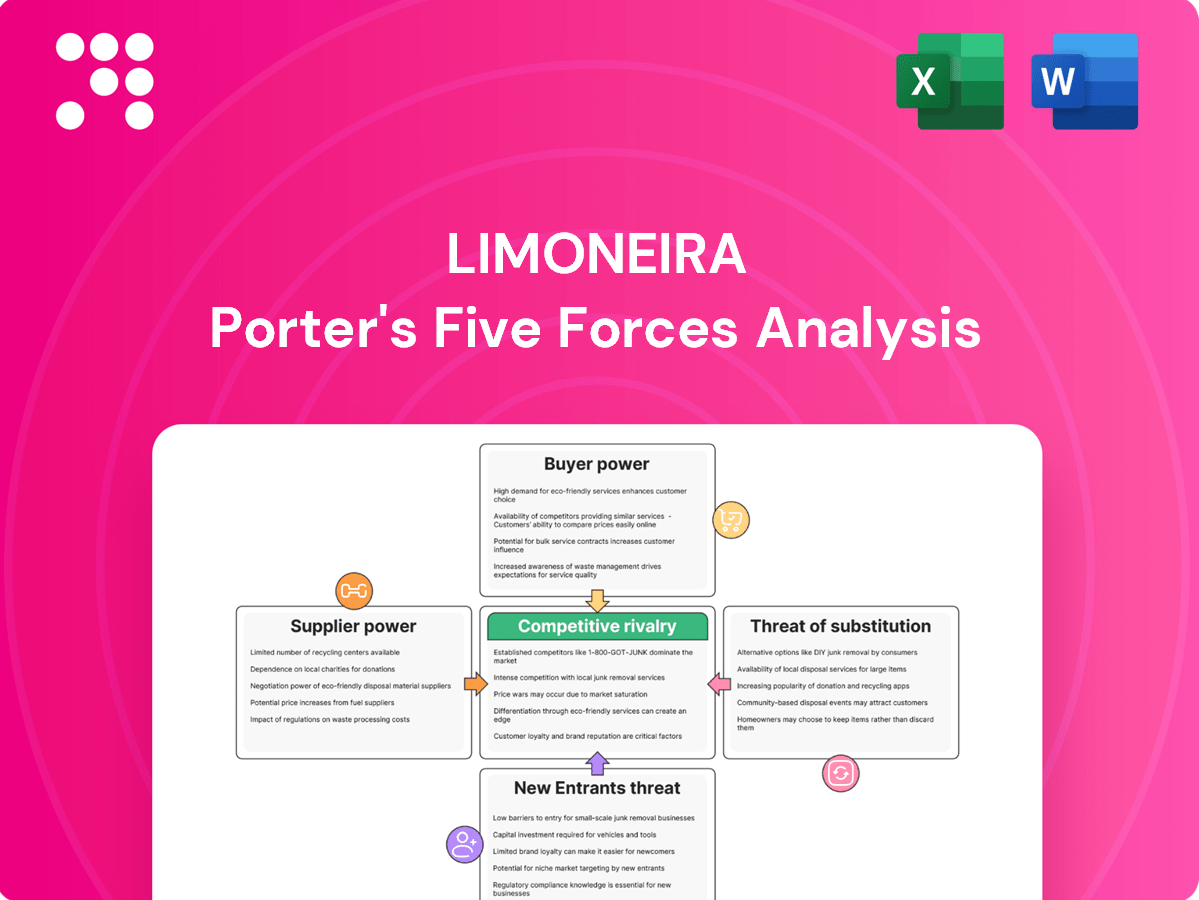

Limoneira Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

- What is Brief History of Limoneira Company?

- What is Growth Strategy and Future Prospects of Limoneira Company?

- How Does Limoneira Company Work?

- What is Sales and Marketing Strategy of Limoneira Company?

- What are Mission Vision & Core Values of Limoneira Company?

- Who Owns Limoneira Company?

- What is Customer Demographics and Target Market of Limoneira Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.