Limoneira Bundle

What is Limoneira Company's Growth Strategy?

Limoneira Company is strategically merging its citrus sales and marketing operations with Sunkist Growers in early fiscal year 2026. This move is expected to yield approximately $5 million in annual cost savings and improve access to major retail and food service markets.

This significant realignment highlights the company's proactive approach to growth in the competitive agribusiness sector. Limoneira's history, dating back to 1893, is rooted in citrus cultivation, evolving into a diversified agribusiness and real estate developer.

The company manages substantial acreage across multiple countries, focusing on lemons and avocados. This strategic re-engagement with Sunkist, alongside ongoing expansion and innovation, is key to Limoneira's future success. We will examine how Limoneira plans to achieve sustained growth through expansion, technology, and financial management, including insights from a Limoneira Porter's Five Forces Analysis.

How Is Limoneira Expanding Its Reach?

Limoneira's growth strategy is multifaceted, focusing on enhancing its core agricultural operations and diversifying into real estate development. The company aims to leverage strategic partnerships and operational efficiencies to bolster its market position and financial performance.

A key element of Limoneira's Limoneira growth strategy involves merging its citrus sales and marketing operations with Sunkist Growers. This initiative, effective in early fiscal year 2026, is expected to yield significant cost savings and improve market access.

To capitalize on strong consumer demand, Limoneira plans to increase its avocado production by 1,000 acres by fiscal year 2027. For fiscal year 2025, the company projects avocado volumes between 7.0 million and 8.0 million pounds.

Limoneira is refining its citrus go-to-market approach and expanding its international lemon supply sources. The company is also actively exploring acquisition opportunities within the agricultural sector to fuel further expansion.

The company is making progress on its real estate ventures, notably the 'Harvest at Limoneira' joint venture. Residential unit approvals have increased, with plans for both single-family homesites and multi-family rental units.

Limoneira is actively generating revenue from its water assets. This includes a fallowing program and recent sales of water pumping rights, demonstrating a strategic approach to diversifying income streams.

- The Santa Paula City Council approved an increase in residential units for 'Harvest at Limoneira' from 1,500 to 2,050 in May 2024.

- The joint venture has sold 1,261 residential lots to date.

- Limoneira received a $10.0 million cash distribution from this real estate joint venture in April 2025.

- Recent sales of water pumping rights totaled $1.7 million, resulting in a $1.5 million gain in January 2025.

These expansion initiatives are central to Limoneira's Limoneira company future prospects, aiming to solidify its Limoneira agricultural business and enhance its overall Limoneira business prospects. Understanding these Revenue Streams & Business Model of Limoneira provides insight into the company's long-term outlook and its strategy for increasing revenue.

Limoneira SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Limoneira Invest in Innovation?

Limoneira Company is deeply invested in innovation and technology to drive its growth strategy. This commitment is evident in its focus on sustainable agricultural practices and strategic collaborations. The company prioritizes renewable energy, biodiversity, soil health, water conservation, and food safety across all its operations.

Limoneira integrates renewable energy, biodiversity, and soil health into its core operations. Water stewardship and food safety are also key pillars of its approach.

A significant joint venture with Agromin, announced in April 2025, expands an organic recycling facility. This venture converts waste into valuable agricultural resources.

The company consistently invests in cutting-edge technology and advanced farming methods. This continuous improvement enhances efficiency and environmental performance.

These technological advancements contribute to improved farming efficiencies. They also bolster the company's packing capabilities, supporting its integrated agribusiness model.

The organic recycling facility expansion is projected to generate substantial EBITDA for both Limoneira and its partner. This highlights the financial benefits of their sustainability efforts.

The company builds upon the innovative spirit established by its early general managers. This legacy of leadership continues to guide its forward-thinking strategies.

Limoneira's innovation and technology strategy is a key component of its overall Limoneira growth strategy. It underpins the company's future prospects in the agricultural sector.

- Focus on renewable energy sources.

- Commitment to biodiversity and soil health.

- Advancements in water stewardship.

- Investment in state-of-the-art farming practices.

- Strategic partnerships for resource optimization.

Limoneira PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Limoneira’s Growth Forecast?

Limoneira Company's financial performance in the second quarter of fiscal year 2025 showed a decrease in total net revenue to $35.1 million, down from $44.6 million in the prior year's comparable period. The company reported a net loss applicable to common stock of $3.5 million for the quarter.

Total net revenue for Q2 FY2025 was $35.1 million, with agribusiness contributing $33.6 million. The company experienced a net loss of $3.5 million, or $0.20 per diluted share, contrasting with a net income of $6.4 million in Q2 FY2024.

For the first six months of fiscal year 2025, total net revenue reached $69.4 million, a decrease from $84.3 million in the same period of fiscal year 2024. This was primarily due to lower lemon revenues, partially offset by gains in avocado and orange revenues.

Limoneira reaffirms its fiscal year 2025 guidance for fresh lemon volumes between 4.5 million and 5.0 million cartons and avocado volumes from 7.0 million to 8.0 million pounds.

The company anticipates approximately $180 million from its real estate development joint ventures over seven fiscal years, with $10 million received in April 2025. A strategic merger is expected to yield $5 million in annual cost savings and EBITDA improvement starting in fiscal year 2026.

Limoneira's financial position as of April 30, 2025, shows long-term debt at $54.9 million, resulting in a net debt of $52.9 million. Analyst projections indicate a significant annual earnings growth of 98.6%, with profitability expected within the next three years. The average twelve-month stock price forecast is $25.50, suggesting a potential upside of 59.67%.

The decrease in revenue for the first six months of fiscal year 2025 was primarily driven by lower lemon sales. This aligns with the challenges faced in the citrus market, impacting the Limoneira citrus strategy.

Increases in avocado and orange agribusiness revenues provided some offset to the overall revenue decline. This diversification is a key element of Limoneira's growth plan, contributing to its Limoneira business prospects.

Future revenue streams are bolstered by expected proceeds from real estate development joint ventures. This strategic initiative is part of Limoneira's expansion plans, contributing to its long-term business outlook.

The anticipated merger with Sunkist Growers is projected to deliver substantial annual selling and marketing cost savings. These synergies are crucial for improving the Limoneira company financial future and enhancing its market position.

Analysts are optimistic about Limoneira's future, forecasting significant earnings growth and a return to profitability. This positive outlook supports the understanding of Limoneira's growth initiatives and its strategy for increasing revenue.

The average stock price forecast suggests considerable potential upside, indicating strong investor confidence in Limoneira's growth strategy. This forecast is a key indicator for Limoneira company future prospects in agriculture.

Limoneira Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Limoneira’s Growth?

Limoneira's ambitious growth strategy faces several potential risks, primarily stemming from its core agribusiness operations and real estate ventures. Environmental factors, pest infestations, and market volatility are significant concerns that could impact the company's financial performance and future prospects.

The company's reliance on agriculture makes it susceptible to adverse weather, natural disasters, and climate change impacts. These can disrupt production and affect overall business outcomes.

Ongoing threats from pests like the Asian Citrus Psyllid and diseases such as Huanglongbing pose a continuous risk to crop yields and the company's citrus strategy.

The competitive agribusiness sector means supply and demand fluctuations directly impact pricing. An oversupplied lemon market, as seen in Q2 fiscal year 2025, can lead to lower sales and pricing pressure.

Evolving environmental regulations, immigration laws, and increasing labor costs can elevate operational expenses. Real estate development also faces extensive regulatory oversight, potentially causing project delays.

With long-term debt reported at $54.9 million as of April 30, 2025, the company's ability to service debt is crucial. Exposure to variable interest rates could increase borrowing costs.

Reliance on key personnel and the growing threat of system security breaches and cyber-attacks are operational risks. These could impact the company's expansion plans and overall business prospects.

To counter these challenges and bolster its Limoneira company future, management is actively diversifying its agricultural portfolio with expanded avocado production and utilizing third-party growers to mitigate lemon pricing volatility. Strategic alliances, such as the merger with Sunkist Growers, are intended to boost efficiency and reduce costs. Furthermore, the ongoing monetization of land and water assets provides crucial revenue diversification and enhances financial resilience, supporting Limoneira's long-term business outlook.

Expanding avocado production and working with third-party growers are key to reducing reliance on single crops and mitigating price fluctuations, a core part of Limoneira's growth strategy.

Mergers and collaborations, like the one with Sunkist Growers, aim to improve operational efficiency and achieve cost reductions, enhancing Limoneira's competitive advantages and future growth.

The strategic sale of land and water assets generates additional revenue streams and strengthens the company's financial position, contributing to its sustainable growth.

Awareness of consumer preferences, food safety perceptions, and market trends is vital for adapting the Limoneira citrus strategy and ensuring continued success in the agricultural business.

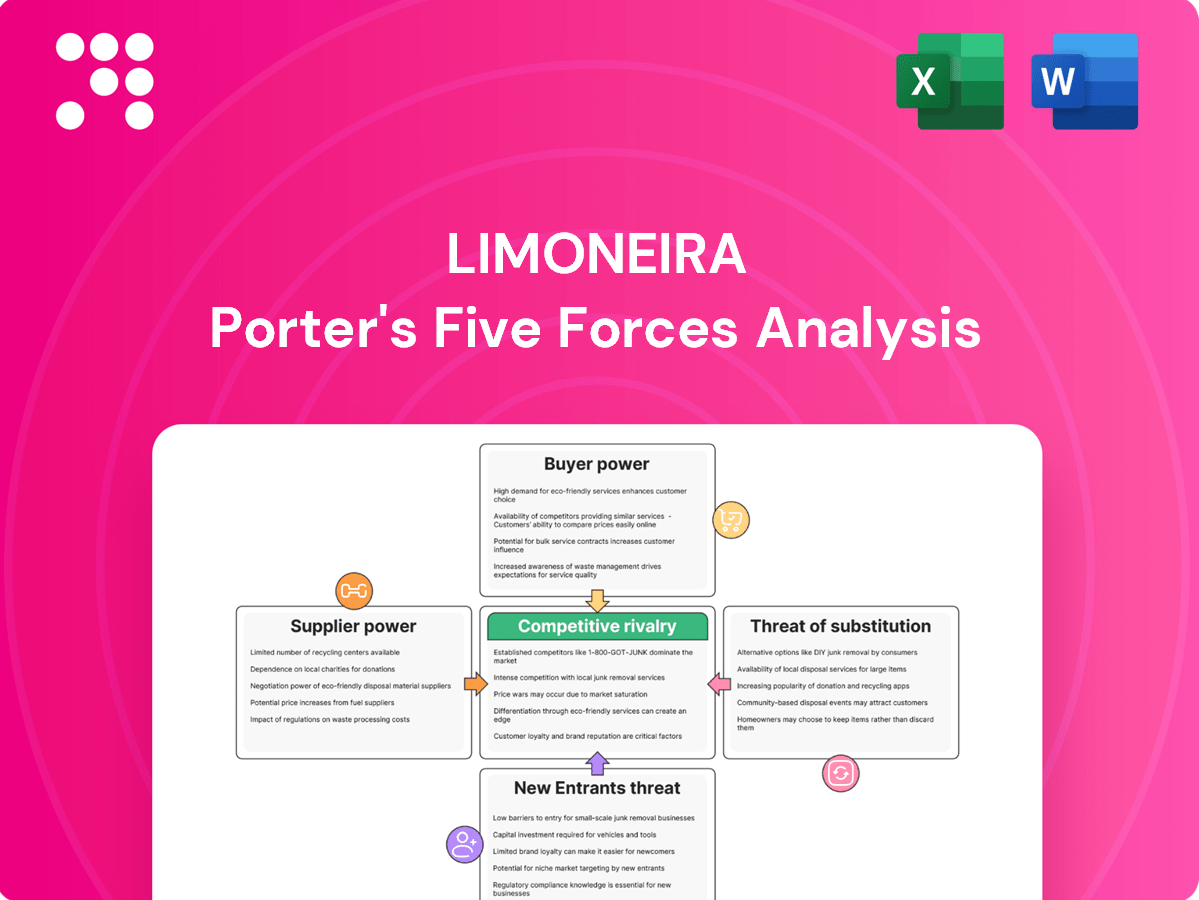

Limoneira Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

- What is Brief History of Limoneira Company?

- What is Competitive Landscape of Limoneira Company?

- How Does Limoneira Company Work?

- What is Sales and Marketing Strategy of Limoneira Company?

- What are Mission Vision & Core Values of Limoneira Company?

- Who Owns Limoneira Company?

- What is Customer Demographics and Target Market of Limoneira Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.