Wolters Kluwer SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wolters Kluwer Bundle

Wolters Kluwer leverages its strong brand and recurring revenue models, but faces intense competition and evolving digital landscapes. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind Wolters Kluwer’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Wolters Kluwer's deep domain expertise in highly regulated industries like healthcare, tax, and legal is a significant strength. This specialized knowledge allows them to create authoritative and trusted content, essential for professionals who need accurate, up-to-date information for critical decisions. Their established brands, such as Wolters Kluwer Health and CCH Tagetik, foster strong client loyalty and create a substantial competitive advantage.

Wolters Kluwer benefits significantly from a robust recurring revenue model, largely driven by subscriptions to its specialized expert solutions and cloud-based software offerings. This predictable income stream is a cornerstone of its financial stability.

As of the first quarter of 2025, recurring revenues constituted a substantial 83% of Wolters Kluwer's total sales. This high proportion underscores the company's ability to generate consistent and dependable income, insulating it from the volatility often seen in other business sectors.

The strength of this recurring revenue model provides Wolters Kluwer with a resilient business structure, making it less vulnerable to economic downturns and ensuring a steady flow of cash to support ongoing operations and strategic investments.

Wolters Kluwer's long-standing commitment to AI and cloud solutions is a major strength. They've been investing in these advanced technologies for over ten years, demonstrating a clear strategic vision. This proactive approach has positioned them well in the evolving digital landscape.

The company's focus on cloud migration is paying off, with cloud software revenue seeing a solid 16% organic growth in 2024. This growth highlights the market's demand for their cloud-based offerings and their ability to deliver value through these platforms.

Furthermore, Wolters Kluwer is actively integrating Generative AI, exemplified by features in VitalLaw AI for legal research. This forward-thinking integration of cutting-edge AI ensures their solutions remain relevant and enhance client productivity and insights, keeping them competitive.

Global Reach and Diversified Portfolio

Wolters Kluwer's extensive global footprint is a key strength, with operations spanning over 40 countries and serving customers in more than 180 nations. This wide reach mitigates risks associated with any single market downturn. In 2023, the company reported revenue from North America as 46% of total revenue, with Europe contributing 40%, and the rest of the world accounting for 14%, demonstrating a balanced geographic distribution.

The company's diversified portfolio is another significant advantage. Wolters Kluwer operates across vital professional sectors, including healthcare, tax and accounting, legal, and governance, risk, and compliance (GRC). This multi-sector approach reduces reliance on any one industry, fostering stability. For instance, their Health segment generated €1.3 billion in revenue in the first half of 2024, while the Tax & Accounting segment brought in €1.1 billion during the same period, showcasing the strength of their varied offerings.

- Global Operations: Serves customers in over 180 countries, with a physical presence in more than 40.

- Diversified Revenue Streams: Operates across healthcare, tax, accounting, legal, and GRC sectors.

- Market Resilience: Reduced dependence on any single market or industry due to broad geographic and sectoral reach.

- Cross-Selling Opportunities: The diverse portfolio allows for synergistic growth and integrated solutions for clients.

Robust Financial Performance and Shareholder Returns

Wolters Kluwer consistently showcases robust financial performance, a key strength that underpins its market position. In 2024, the company achieved a solid 6% organic revenue growth, demonstrating its ability to expand its top line effectively. This financial health is further evidenced by a proposed 12% increase in the 2024 total dividend, bringing it to €2.33 per share, and a planned €1 billion share buyback program for 2025. These actions highlight a strong commitment to shareholder returns and confidence in the company's valuation.

This financial resilience translates into tangible benefits for stakeholders.

- Consistent Organic Growth: Achieved 6% organic revenue growth in 2024.

- Shareholder Returns: Proposed a 12% increase in the 2024 total dividend to €2.33 per share.

- Capital Allocation: Plans a €1 billion share buyback program for 2025.

- Financial Stability: Provides resources for ongoing investment and strategic initiatives.

Wolters Kluwer's deep expertise in regulated industries like healthcare and legal is a significant strength, enabling the creation of authoritative content. Their robust recurring revenue model, with 83% of sales from subscriptions as of Q1 2025, provides financial stability. The company's long-standing investment in AI and cloud solutions, reflected in 16% organic growth for cloud software in 2024, positions it for future success.

| Strength | Description | Supporting Data (2024/2025) |

|---|---|---|

| Domain Expertise | Authoritative content in regulated sectors (healthcare, tax, legal). | N/A (qualitative) |

| Recurring Revenue Model | High proportion of subscription-based income. | 83% of total sales in Q1 2025. |

| AI & Cloud Focus | Early and sustained investment in advanced technologies. | 16% organic growth in cloud software revenue (2024). |

What is included in the product

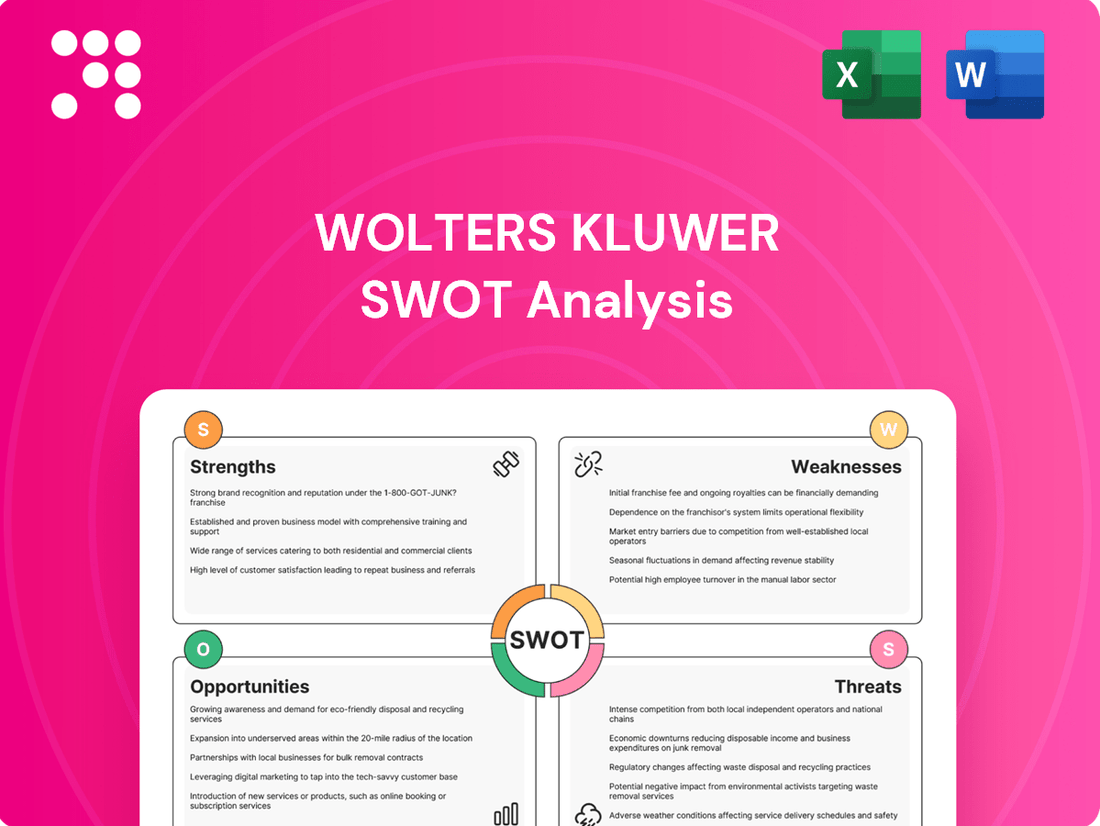

Provides a comprehensive assessment of Wolters Kluwer's internal strengths and weaknesses alongside external market opportunities and threats.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential weaknesses into opportunities.

Weaknesses

Wolters Kluwer's performance, while robust overall, faces headwinds in certain mature segments. For instance, legacy print sales within the Health division are seeing a slowdown or even a decline, impacting the pace of expansion in these established areas.

The company's financial projections for 2025 reflect this, with anticipated more modest organic growth in the Health and Tax & Accounting segments during the initial two quarters. This is partly due to tougher year-over-year comparisons from prior strong performance.

These mature segments, if not strategically managed or effectively transitioned to newer digital offerings, could potentially dampen the company's overall growth trajectory.

Wolters Kluwer's significant presence in highly regulated sectors like legal, tax, and healthcare presents a double-edged sword. While these regulations can create a moat, they also expose the company to considerable risk from evolving governmental policies. For instance, changes in tax laws or healthcare compliance requirements can directly affect the demand for Wolters Kluwer's essential software and information services, demanding constant vigilance and costly adaptation.

Wolters Kluwer’s aggressive acquisition strategy, evidenced by two significant acquisitions in 2025 and a cumulative total of 49, primarily within Finance & Accounting Tech and Legal Tech, presents inherent integration challenges. The recent additions of Registered Agent Solutions, Inc. (RASi) and Brightflag in 2025 highlight this, as merging disparate technologies, corporate cultures, and operational frameworks can be complex. These integration hurdles can potentially impact short-term financial performance by diverting management attention and resources, or by incurring unexpected costs.

Exposure to Currency Fluctuations

Wolters Kluwer's significant global presence, with over 60% of its revenue and adjusted operating profit stemming from North America, leaves it vulnerable to currency fluctuations. The EUR/USD exchange rate is a key concern.

A mere one U.S. cent shift in the average EUR/USD exchange rate can translate to an approximate 4.5 euro cent impact on diluted adjusted earnings per share (EPS). This sensitivity highlights the potential for currency movements to distort reported financial performance.

- Global Revenue Exposure: Over 60% of Wolters Kluwer's revenues are generated in North America.

- Profitability Impact: More than 60% of adjusted operating profit also originates from North America.

- EPS Sensitivity: A 1-cent change in the EUR/USD exchange rate can alter diluted adjusted EPS by approximately 4.5 euro cents.

- Financial Reporting Risk: Currency volatility poses a direct risk to the consistency and predictability of reported financial results.

Competition in Evolving Tech Landscape

Wolters Kluwer faces intense competition as AI and cloud technologies rapidly evolve, challenging its position against both tech behemoths and nimble startups. The company's investments in AI are crucial, but the need for ongoing, significant R&D spending to maintain a competitive edge in this dynamic environment is a notable weakness. This pressure demands swift innovation, potentially impacting profitability and market share.

The increasing pace of technological change, particularly in areas like artificial intelligence and cloud computing, presents a significant competitive hurdle. Wolters Kluwer must continually adapt and invest to keep pace with industry leaders and emerging players. For instance, in 2023, global spending on AI is projected to reach over $500 billion, highlighting the scale of investment required to remain relevant.

- Intensified Rivalry: Established tech giants and agile startups are aggressively developing AI and cloud solutions, directly competing with Wolters Kluwer's offerings.

- R&D Investment Demands: Staying ahead necessitates substantial and continuous investment in research and development, potentially straining financial resources.

- Innovation Pace: The rapid evolution of technology requires a faster innovation cycle than the company may be accustomed to, creating pressure to deliver cutting-edge solutions quickly.

- Market Disruption Risk: Competitors leveraging advanced AI or novel cloud architectures could disrupt existing market segments, impacting Wolters Kluwer's revenue streams.

Wolters Kluwer's reliance on mature print-based revenue streams, particularly within its Health division, presents a clear weakness. These segments are experiencing a noticeable slowdown, potentially hindering overall growth, as indicated by the more modest organic growth projections for Health and Tax & Accounting in early 2025 due to tough prior-year comparisons.

What You See Is What You Get

Wolters Kluwer SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

Wolters Kluwer is well-positioned to capitalize on the growing demand for AI-driven solutions. The company has already seen success with its GenAI features in VitalLaw AI, enhancing legal research capabilities. This demonstrates a clear path to integrating advanced AI across its professional segments, including healthcare, where AI for clinical decision support is a key focus.

Further investment in AI innovation presents a significant opportunity for Wolters Kluwer to not only improve its current product suite but also to develop entirely new offerings. By leveraging AI, the company can deliver enhanced efficiency and productivity gains to its clients, reinforcing its standing as a market leader in providing expert solutions.

The continued move towards cloud-based Software-as-a-Service (SaaS) models offers a significant avenue for expansion. Wolters Kluwer experienced robust organic growth in its cloud software revenue, reporting a 14% increase in the first quarter of 2025.

By speeding up its cloud migration and broadening its SaaS portfolio, Wolters Kluwer can boost its scalability and strengthen its recurring revenue streams. This strategic focus also positions the company to attract new clients who value adaptable and easily accessible technological solutions.

Wolters Kluwer's history of successful strategic acquisitions, like the integration of RASi and Brightflag in 2025, demonstrates a clear pattern of strengthening its market presence and broadening its product and service offerings. This approach is central to their growth strategy, aiming to complement internal development with acquisitions that align with their overall vision and deliver added value.

The company actively seeks opportunities to expand into new, high-growth adjacent markets through strategic acquisitions and partnerships. This proactive exploration allows Wolters Kluwer to not only penetrate new markets more rapidly but also to diversify its revenue streams and enhance its competitive advantage.

Leveraging ESG and Regulatory Compliance Demands

The intensifying global emphasis on Environmental, Social, and Governance (ESG) factors, coupled with evolving regulatory requirements, presents a significant opportunity for Wolters Kluwer. This trend directly fuels the demand for sophisticated compliance and reporting solutions, an area where the company possesses deep expertise.

Wolters Kluwer is strategically positioned to benefit from this growing market. Their established leadership in Governance, Risk, and Compliance (GRC) and their dedicated corporate performance and ESG solutions align perfectly with these emerging client needs. The company has actively communicated its commitment to leading in ESG and sustainability reporting software, underscoring this strategic focus.

- Growing ESG Market: The global ESG investing market is projected to reach $50 trillion by 2025, creating a substantial demand for related software and services.

- Regulatory Tailwinds: New regulations, such as the EU's Corporate Sustainability Reporting Directive (CSRD), mandate more comprehensive ESG disclosures, driving adoption of compliance tools.

- Wolters Kluwer's Strengths: The company's existing GRC platform and specialized ESG reporting capabilities provide a strong foundation to capture this expanding market share.

Geographic Expansion and Market Penetration

Wolters Kluwer can strengthen its global position by focusing on deeper market penetration within its current operational areas. This includes a strategic push into emerging markets, particularly targeting high-growth sectors like its Tax & Accounting cloud subscriptions in Europe.

Tailoring its offerings to meet the unique regulatory requirements and specific market demands of different regions presents a significant avenue for unlocking additional revenue streams and expanding its customer base.

- Deepen penetration in existing European markets, especially for cloud-based Tax & Accounting solutions.

- Expand into new emerging markets with customized regulatory and market-specific product adaptations.

- Leverage existing global infrastructure to efficiently scale operations in targeted new geographies.

The company is capitalizing on the increasing demand for AI-powered solutions, evidenced by the success of VitalLaw AI. This trend offers a significant opportunity to integrate AI across its healthcare and legal segments, enhancing client productivity and solidifying its market leadership.

Expanding its cloud-based Software-as-a-Service (SaaS) offerings presents another key opportunity, with cloud software revenue already showing a 14% increase in Q1 2025. This strategic shift enhances scalability and strengthens recurring revenue streams.

Strategic acquisitions, such as RASi and Brightflag in 2025, demonstrate Wolters Kluwer's ability to expand its market presence and product portfolio. The company's proactive approach to acquiring complementary businesses in high-growth adjacent markets is a core growth driver.

The growing emphasis on Environmental, Social, and Governance (ESG) factors and related regulatory requirements creates a substantial market for Wolters Kluwer's compliance and reporting solutions. The global ESG investing market is projected to reach $50 trillion by 2025, and new regulations like the EU's CSRD are driving demand.

Wolters Kluwer can further strengthen its global position by deepening penetration in existing markets, particularly with its Tax & Accounting cloud solutions in Europe. Expanding into new emerging markets with tailored offerings will also unlock additional revenue streams.

| Opportunity Area | Key Driver | Wolters Kluwer's Advantage | 2024/2025 Data Point |

| AI Integration | Demand for AI-driven solutions | Existing GenAI success (VitalLaw AI) | 14% increase in cloud software revenue (Q1 2025) |

| SaaS Expansion | Shift to cloud-based models | Scalability and recurring revenue focus | - |

| Strategic Acquisitions | Market expansion and portfolio enhancement | Proven track record (RASi, Brightflag 2025) | - |

| ESG Solutions | Growing ESG importance and regulation | Expertise in GRC and ESG reporting | Global ESG market projected to reach $50 trillion by 2025 |

| Market Penetration | Growth in emerging markets | Tailored solutions for regional needs | Focus on European Tax & Accounting cloud subscriptions |

Threats

Wolters Kluwer faces a significant threat from tech innovators, particularly those leveraging artificial intelligence. The professional information and software solutions market is already crowded, but the rapid evolution of AI is lowering entry barriers. This allows new players, or even existing rivals, to create more advanced and cheaper offerings, potentially chipping away at Wolters Kluwer's market share if it doesn't adapt quickly.

The relentless pace of technological evolution, particularly in areas like artificial intelligence and cloud infrastructure, presents a significant threat of obsolescence for Wolters Kluwer. Failure to consistently innovate and integrate cutting-edge advancements into its product suite could render its solutions outdated.

For instance, if a competitor emerges with AI-powered legal research tools that significantly outperform current offerings, Wolters Kluwer risks losing market share. In 2024, the legal tech market saw substantial investment in AI, with companies reporting efficiency gains of up to 30% in document review processes, highlighting the urgency for adaptation.

Wolters Kluwer's reliance on regulated industries, while a strength, also presents a significant threat. Unexpected shifts in global financial, healthcare, or legal regulations could necessitate costly updates to its software and services, potentially impacting revenue streams. For instance, the ongoing evolution of data privacy laws like GDPR and CCPA requires continuous adaptation, with compliance costs potentially rising.

Data Security and Privacy Risks

Wolters Kluwer's reliance on sensitive client data presents significant cybersecurity threats. A data breach could lead to substantial financial penalties, with regulatory fines for data privacy violations, like those under GDPR, reaching up to 4% of global annual revenue. The company's reputation, built on trust and reliability, could be severely undermined by a security incident, impacting customer retention and new business acquisition.

Key threats include:

- Ransomware attacks: Disrupting operations and demanding payment.

- Phishing and social engineering: Exploiting human vulnerabilities to gain access.

- Insider threats: Malicious or accidental data leaks by employees.

- Third-party vendor risks: Vulnerabilities introduced through integrated service providers.

Economic Downturns Impacting Client Spending

Economic downturns pose a significant threat, potentially curbing client spending on essential information solutions and software. While Wolters Kluwer benefits from a strong recurring revenue base, non-recurring revenue streams are particularly vulnerable to economic contractions. This could lead to delayed upgrades or new subscriptions.

For instance, during periods of economic stress, businesses may scrutinize discretionary spending, impacting the adoption of new software or premium information services. This could slow down Wolters Kluwer's growth, as seen in past economic slowdowns where IT and information service budgets were among the first to be cut.

- Reduced Client Budgets: Professionals and businesses facing economic headwinds are likely to reduce their spending on information solutions and software, directly impacting Wolters Kluwer's revenue.

- Impact on Non-Recurring Revenue: While recurring revenue offers stability, non-recurring revenue, such as one-time purchases or project-based services, is more susceptible to economic fluctuations, potentially hindering short-term growth.

- Delayed Investment Cycles: Clients might postpone investments in new technologies or upgrades to existing software, waiting for economic conditions to improve, which can affect Wolters Kluwer's sales pipeline and profitability.

Wolters Kluwer faces a significant threat from emerging AI technologies that could disrupt its core markets. Competitors leveraging AI may offer more advanced or cost-effective solutions, potentially eroding market share. For example, advancements in generative AI for legal drafting and research could challenge existing workflows and software providers.

The company's reliance on established, regulated industries also exposes it to risks from sudden regulatory shifts. Changes in data privacy laws or industry-specific compliance requirements could necessitate costly and rapid adaptation of its products and services. In 2024, the global regulatory landscape continued to evolve, with increased scrutiny on data handling and AI ethics across finance and healthcare sectors.

Cybersecurity remains a critical threat, with the potential for data breaches carrying severe financial and reputational consequences. Regulatory fines for non-compliance, such as under GDPR, can be substantial. The increasing sophistication of cyberattacks, including ransomware and phishing, demands continuous investment in robust security measures.

Economic downturns also pose a risk, as clients may reduce spending on information solutions and software. While Wolters Kluwer has a strong recurring revenue base, non-recurring revenue streams are more vulnerable. This could lead to delayed adoption of new products or services, impacting overall growth.

SWOT Analysis Data Sources

This Wolters Kluwer SWOT analysis is built on a foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations, ensuring a robust and data-driven assessment.