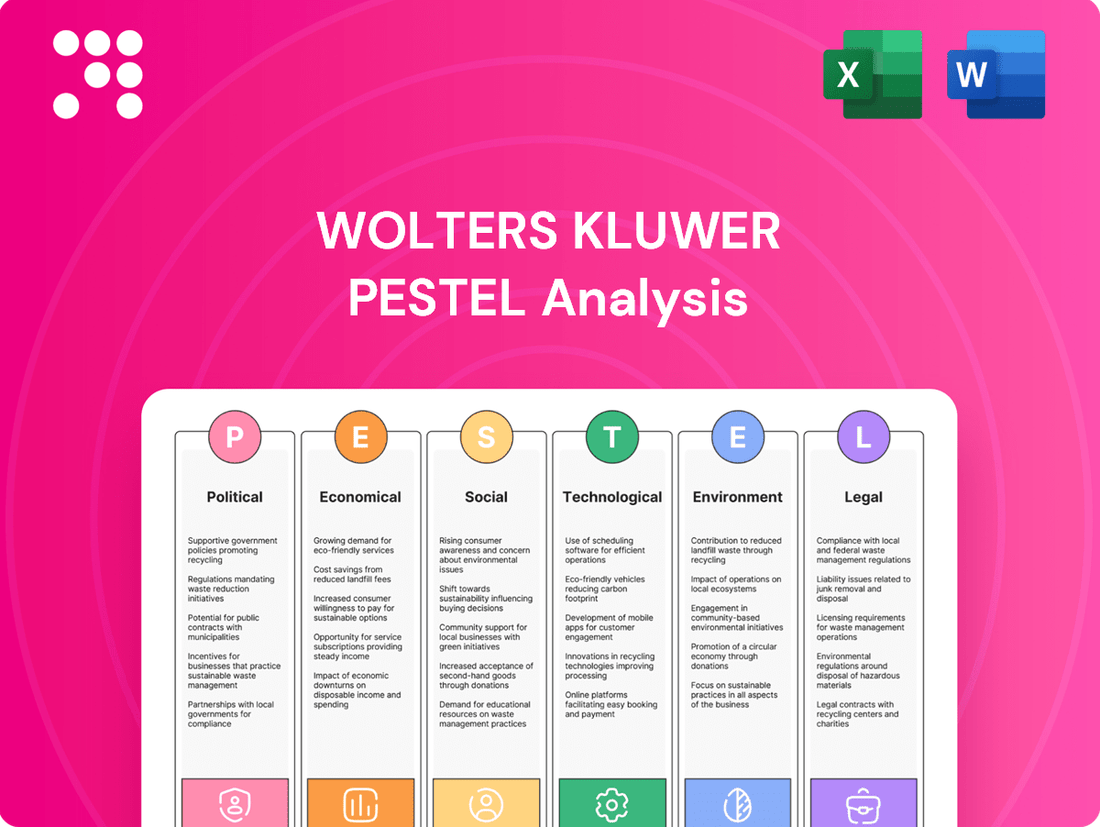

Wolters Kluwer PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wolters Kluwer Bundle

Navigate the complex external forces shaping Wolters Kluwer's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for this global information services giant. Equip yourself with actionable intelligence to refine your strategies and secure a competitive advantage. Download the full PESTLE analysis today and gain the insights you need to thrive.

Political factors

Wolters Kluwer operates in heavily regulated fields like healthcare, tax, and law, meaning government policy shifts directly affect their business. For instance, new healthcare reforms or changes in tax laws can significantly alter the need for their specialized information and software. In 2024, the ongoing implementation and interpretation of regulations like the EU's Corporate Sustainability Reporting Directive (CSRD) are crucial, as they directly shape demand for Wolters Kluwer's sustainability reporting tools.

Wolters Kluwer's extensive global footprint, operating in over 40 countries and reaching customers in more than 180, makes it highly susceptible to shifts in international trade policies and geopolitical dynamics. For instance, changes in trade agreements or the imposition of tariffs, especially within its primary market of North America which accounts for over 60% of its revenue, could directly influence operational expenses and the company's ability to access key markets.

Wolters Kluwer's global operations are significantly influenced by political stability. For instance, in 2024, the company operates across numerous countries, each with varying degrees of political certainty. Regions experiencing stable governance generally offer a more predictable environment for business, allowing for consistent revenue streams and strategic planning.

Geopolitical risks present a more complex challenge. The ongoing global tensions and regional conflicts in 2024 can directly impact Wolters Kluwer's markets. For example, disruptions in key European or Asian markets due to political instability could affect sales of their legal and regulatory information services, as well as their financial and compliance solutions.

The economic uncertainty stemming from geopolitical events, such as trade disputes or sanctions, can also dampen customer spending on Wolters Kluwer's products and services. This was evident in early 2024, where certain emerging markets faced economic headwinds directly linked to political developments, potentially slowing growth for the company in those areas.

Government Spending and Budget Priorities

Government spending on public sector services, especially in healthcare and legal systems, directly impacts the demand for professional information and software solutions. For instance, increased government investment in digitalizing healthcare records or modernizing legal case management systems presents a significant opportunity for companies like Wolters Kluwer that provide these essential tools. In 2024, many governments are focusing on fiscal responsibility, which could lead to tighter budgets for some public services, while others, like defense or infrastructure, might see increased allocations.

Shifts in government budget priorities can create both opportunities and challenges for Wolters Kluwer's diverse business segments. For example, a government decision to increase funding for education and research might boost demand for Wolters Kluwer's academic and research platforms. Conversely, a reduction in spending on legal aid or regulatory bodies could temper growth in related software and information services. The 2025 budget proposals will likely reflect ongoing trends in economic recovery and public demand for essential services, influencing where government funds are directed.

Key areas of government spending that influence Wolters Kluwer include:

- Healthcare Information Technology: Government initiatives to improve healthcare efficiency and patient data management drive investment in health IT solutions.

- Legal and Regulatory Compliance: Spending on judicial systems, regulatory enforcement, and legal aid services impacts the market for legal software and information.

- Education and Research Funding: Government support for universities and research institutions fuels demand for academic publishing and research databases.

- Digital Transformation Initiatives: Broader government efforts to digitize public services can create opportunities for Wolters Kluwer's cloud-based and data analytics offerings.

Data Privacy and Cybersecurity Regulations

Governments worldwide are intensifying their focus on data privacy and cybersecurity. For instance, the proposed American Privacy Rights Act (APRA) in the United States signals a significant shift towards stronger federal data protection. This regulatory landscape directly impacts Wolters Kluwer's software solutions and how it manages sensitive client data.

Compliance with these evolving regulations is paramount for Wolters Kluwer. Failure to adhere to new mandates, such as those concerning data breach notification or consumer consent for data usage, could result in substantial fines and damage to the company's reputation. In 2023, data breach costs globally averaged $4.45 million, a figure that underscores the financial risks involved.

- Increased Regulatory Scrutiny: New legislation like APRA mandates stricter data handling protocols.

- Compliance Costs: Adapting software and processes to meet new privacy standards requires significant investment.

- Reputational Risk: Non-compliance can erode customer trust and lead to reputational damage.

- Global Harmonization Challenges: Navigating differing privacy laws across various jurisdictions presents ongoing complexity.

Political stability and government policies are critical for Wolters Kluwer, influencing everything from regulatory compliance to market access. For example, shifts in healthcare or tax legislation, like the ongoing implementation of the EU's CSRD in 2024, directly impact demand for their specialized information and software solutions. Geopolitical tensions in 2024 also create market uncertainties, potentially affecting sales in key regions like Europe and Asia.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Wolters Kluwer, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces present both challenges and strategic advantages.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, saving valuable preparation time.

Economic factors

Overall economic growth and GDP trends are crucial for Wolters Kluwer, directly impacting the demand for its professional services. A strong economy typically fuels business expansion and investment, translating into higher needs for tax, accounting, legal, and compliance solutions, all areas where Wolters Kluwer excels.

For 2025, economists surveyed by Wolters Kluwer project a positive outlook, anticipating above-trend economic growth in the United States. This robust growth environment is expected to bolster demand for the very services Wolters Kluwer provides, creating a favorable market for its offerings.

Inflationary pressures can directly impact Wolters Kluwer's operational expenses, such as the cost of talent acquisition and technology infrastructure. For instance, a 2024 projection from the International Monetary Fund (IMF) indicated a global inflation rate of 5.9%, a figure that could translate to higher input costs for the company.

Rising interest rates, a trend observed globally as central banks combat inflation, can increase Wolters Kluwer's cost of capital for any necessary borrowing. Simultaneously, higher rates might temper investment decisions among its client base, potentially affecting demand for its financial and legal services. Economists surveyed by Wolters Kluwer anticipate inflation to approach the Federal Reserve's target of 2% by 2025, suggesting a potential stabilization of these pressures.

Currency exchange rates significantly influence Wolters Kluwer's financial reporting, especially given its global operations and Euro-based reporting. Fluctuations between the Euro and other major currencies, like the US Dollar, directly affect the value of its international earnings when translated back into Euros. This dynamic is crucial for understanding the company's true financial performance across different markets.

With over 60% of its revenue generated in the United States, a strengthening US Dollar against the Euro can negatively impact Wolters Kluwer's reported diluted adjusted Earnings Per Share (EPS). For instance, if the Dollar strengthens, the Euro equivalent of those US-based earnings will be lower, potentially reducing the reported EPS figure. This sensitivity highlights the importance of currency hedging strategies for the company.

In 2023, Wolters Kluwer reported that currency movements had a negative impact on its full-year results. The company noted that foreign exchange headwinds reduced reported revenue by approximately 2% and diluted adjusted EPS by around 3%. This demonstrates the tangible effect that currency volatility can have on key financial metrics, even for a diversified global business.

Market Conditions in Key Sectors

The economic health of Wolters Kluwer's core sectors, including healthcare, tax and accounting, and governance, risk, and compliance (GRC), significantly influences its revenue streams. For instance, robust economic growth often translates to increased demand for tax preparation and compliance services, while healthcare sector investments can drive demand for information solutions. The legal and regulatory landscape also plays a crucial role, with evolving compliance requirements often creating opportunities for specialized software and services.

Wolters Kluwer's performance is directly tied to the digital transformation trends within various industries. Their indices, such as those tracking auto finance digital transformation, provide insights into the adoption rates of new technologies. This digital shift impacts the demand for Wolters Kluwer's solutions, particularly in areas like workflow automation and data analytics. For example, the increasing reliance on digital platforms in auto finance suggests a growing market for integrated compliance and operational software.

Specific sector data highlights these trends. In 2024, the global digital transformation market, encompassing areas relevant to Wolters Kluwer's offerings, was projected to reach over $1.5 trillion. Within the healthcare information technology sector, spending was anticipated to grow by approximately 10-12% in 2024, driven by AI adoption and cloud services. Similarly, the GRC software market is expected to see continued expansion, with a compound annual growth rate (CAGR) of around 10% projected through 2025, fueled by increasing regulatory complexity and cybersecurity concerns.

- Healthcare Information Technology Spending: Projected to grow by 10-12% in 2024, driven by AI and cloud adoption.

- Global Digital Transformation Market: Estimated to exceed $1.5 trillion in 2024.

- GRC Software Market Growth: Expected CAGR of approximately 10% through 2025, due to regulatory and security demands.

Client Investment and Budgeting

The financial health of Wolters Kluwer's professional clientele directly impacts their capacity and inclination to purchase new software, research resources, and operational enhancements. For instance, a strong economic climate in late 2024 and early 2025 might see increased spending on digital transformation initiatives within legal and accounting firms, key customer segments for Wolters Kluwer.

Economic downturns or periods of high inflation, however, can trigger budget contractions, leading to postponed investments in technology. This was observed in some sectors during the economic adjustments of 2023, suggesting a potential for cautious spending in 2024 if economic headwinds persist.

Key factors influencing client investment include:

- Profitability of client industries: Higher profits generally translate to more discretionary spending on productivity tools.

- Interest rate environment: Rising rates can increase the cost of capital for clients, potentially impacting technology budgets.

- Government spending and regulation: Changes in public sector budgets or new regulatory compliance requirements can drive or dampen demand for specific Wolters Kluwer solutions.

- Client industry growth rates: Expanding markets often correlate with increased investment in advanced professional tools.

Wolters Kluwer's revenue is closely linked to the overall economic climate and the financial health of its client base. Positive economic growth, particularly in the United States where it derives over 60% of its revenue, generally boosts demand for its tax, accounting, and legal services. Conversely, economic downturns or high inflation can lead to reduced client spending on technology and services.

| Economic Factor | 2024/2025 Outlook | Impact on Wolters Kluwer |

| GDP Growth | Projected above-trend growth in the US for 2025 | Increased demand for professional services |

| Inflation | Global rate projected at 5.9% in 2024, moving towards 2% target by 2025 | Higher operational costs; potential client budget constraints |

| Interest Rates | Rising globally, potentially stabilizing by 2025 | Increased cost of capital; tempered client investment |

| Currency Exchange Rates | Fluctuations impact Euro-denominated reporting | A stronger USD negatively affects reported EPS (e.g., 2023 impact: -2% revenue, -3% EPS) |

Preview the Actual Deliverable

Wolters Kluwer PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Wolters Kluwer PESTLE analysis provides deep insights into the political, economic, social, technological, legal, and environmental factors impacting the company.

What you’re previewing here is the actual file—fully formatted and professionally structured. You'll gain immediate access to this detailed PESTLE analysis of Wolters Kluwer upon completing your purchase.

Sociological factors

The global workforce is experiencing significant shifts, with an aging population in many developed nations and a concurrent shortage of skilled professionals in critical fields like accounting and healthcare. For instance, projections indicate a substantial deficit of certified public accountants in the coming years, potentially impacting compliance and financial reporting services. This demographic evolution directly fuels the demand for solutions that boost efficiency and streamline complex workflows.

Wolters Kluwer's strategic focus on AI-powered solutions, such as those in its tax and accounting or health divisions, directly addresses these emerging challenges. By offering tools that automate tasks, improve data accuracy, and provide deeper insights, the company aims to alleviate the productivity pressures faced by professionals grappling with these demographic trends and skill shortages. This positions Wolters Kluwer as a key enabler for businesses seeking to maintain operational effectiveness amidst workforce transformations.

The landscape of professional work is rapidly shifting, with remote and hybrid models becoming commonplace. This evolution, fueled by digital transformation, means professionals need accessible, integrated solutions that fit seamlessly into their modern workflows. For instance, a significant portion of the workforce, estimated to be around 50% by some 2024 surveys, now engages in some form of remote or hybrid work, directly impacting how they consume and utilize professional development and information services.

Consequently, there's a growing demand for user-friendly, intuitive digital platforms that support continuous learning and efficient decision-making. Wolters Kluwer's success hinges on its ability to adapt its product design and delivery to meet these expectations, ensuring its offerings empower professionals navigating these new work paradigms.

As Wolters Kluwer integrates AI across its platforms, societal scrutiny regarding ethical AI practices intensifies. Concerns about algorithmic bias, the need for transparent AI decision-making, and potential job displacement are significant sociological factors influencing adoption. For instance, a 2024 Pew Research Center study indicated that 60% of Americans are more concerned than excited about AI's increasing role in daily life.

Wolters Kluwer's stated commitment to 'Responsible Artificial Intelligence Principles' directly addresses these societal expectations. This proactive stance aims to build trust and mitigate reputational risk by demonstrating a dedication to fairness, accountability, and human oversight in AI development and deployment.

Demand for ESG and Sustainability Reporting

Societal expectations are increasingly pushing for greater corporate accountability regarding environmental, social, and governance (ESG) issues. Investors, consumers, and employees are demanding more transparency, leading to a significant rise in the need for robust ESG reporting. This trend is directly impacting how businesses operate and disclose their performance beyond traditional financial metrics.

This growing demand for ESG data creates a substantial market opportunity for companies like Wolters Kluwer. Their Corporate Performance & ESG division offers software solutions designed to streamline the complex process of collecting, managing, and reporting ESG information. This aligns perfectly with the market's need for reliable and standardized ESG disclosures.

For instance, the global ESG investing market reached an estimated $35.3 trillion in assets under management by the end of 2023, showcasing the immense financial influence of sustainability considerations. Companies are therefore compelled to adopt sophisticated reporting mechanisms to meet these investor expectations and maintain their market standing.

- Investor Demand: A significant portion of institutional investors now integrate ESG factors into their investment decisions, with over 80% of investors surveyed by PwC in 2024 indicating they consider ESG in their portfolios.

- Regulatory Push: Governments worldwide are introducing or strengthening ESG disclosure mandates, such as the EU's Corporate Sustainability Reporting Directive (CSRD), which impacts thousands of companies.

- Consumer Preference: Consumers are increasingly favoring brands with strong sustainability credentials, influencing purchasing behavior and driving corporate action.

- Risk Management: Companies recognize that robust ESG reporting is crucial for identifying and mitigating operational, reputational, and regulatory risks.

Privacy Concerns and Data Security Awareness

Growing public awareness of data privacy and security is significantly shaping how Wolters Kluwer develops and promotes its offerings. This heightened concern, particularly around sensitive professional data, means companies must prioritize robust security protocols and clear communication about data usage to build and maintain trust with their clientele.

The digital landscape in 2024 and 2025 is marked by increasing scrutiny of how organizations handle personal and professional information. For Wolters Kluwer, this translates into a critical need to demonstrate unwavering commitment to data protection. In 2024, reports indicated a surge in cyberattacks targeting professional services firms, underscoring the urgency of these concerns. Consumers and businesses alike are demanding greater transparency and stronger safeguards.

Wolters Kluwer's strategy must therefore heavily feature its security architecture and data governance policies. Building trust is no longer optional; it's a core component of market competitiveness. This includes clearly communicating how data is collected, stored, and protected, especially for their legal, tax, and healthcare solutions. For instance, adherence to evolving regulations like GDPR and CCPA, and proactively demonstrating compliance, will be key differentiators.

- Data Privacy Regulations: Wolters Kluwer must navigate a complex web of global data privacy laws, such as GDPR, CCPA, and emerging regional regulations, impacting product design and data handling.

- Consumer Trust: In 2024, consumer trust in companies' data security practices remained a critical factor, with a significant percentage of individuals stating they would cease business with entities experiencing data breaches.

- Cybersecurity Investments: Companies like Wolters Kluwer are expected to increase cybersecurity spending, with global IT security spending projected to reach over $200 billion in 2024, reflecting the industry's focus on data protection.

- Transparency in Data Usage: Clear and accessible policies on how customer data is used are becoming essential for maintaining customer loyalty and mitigating reputational risk.

Societal shifts towards remote and hybrid work models are fundamentally altering professional needs, demanding integrated and accessible digital solutions. By 2024, a substantial portion of the workforce engages in flexible work arrangements, highlighting the necessity for user-friendly platforms that support continuous learning and efficient decision-making.

The growing public concern over data privacy and security requires Wolters Kluwer to prioritize robust protection measures and transparent data usage policies. In 2024, the increasing frequency of cyberattacks on professional services firms underscores the critical need for companies to demonstrate unwavering commitment to data protection and compliance with regulations like GDPR.

Public demand for corporate accountability in Environmental, Social, and Governance (ESG) matters is escalating, driving the need for transparent ESG reporting. The global ESG investing market, valued at an estimated $35.3 trillion in assets under management by the end of 2023, signifies the financial impact of sustainability, compelling companies to adopt sophisticated reporting mechanisms.

Technological factors

Wolters Kluwer is making significant investments in Artificial Intelligence (AI) and Generative AI (GenAI), integrating these technologies across its diverse product offerings. This strategic focus aims to bolster capabilities like advanced search, content summarization, intelligent Q&A, and the development of sophisticated virtual assistants.

These AI-driven enhancements are pivotal for boosting operational efficiency and ensuring greater accuracy for professionals working within critical sectors such as healthcare, tax, and legal services. The goal is to deliver more insightful and actionable data, directly supporting complex decision-making processes.

For instance, in 2023, Wolters Kluwer reported a substantial increase in its technology and development spending, with a notable portion allocated to AI initiatives. This investment is designed to unlock new levels of productivity and precision, offering tangible benefits to users by streamlining workflows and providing deeper analytical insights.

Wolters Kluwer is heavily invested in cloud computing and Software-as-a-Service (SaaS) adoption as a fundamental strategic pillar. This move enables the delivery of solutions that are not only scalable and readily accessible but also benefit from continuous updates, directly addressing customer demands for agile and efficient software delivery.

In 2023, Wolters Kluwer reported that its Wolters Kluwer Health division saw significant growth, with digital solutions contributing a substantial portion of revenue, underscoring the success of its SaaS strategy. The company continues to prioritize cloud-native development and migrating existing products to SaaS platforms, anticipating further revenue uplift and operational efficiencies in 2024 and 2025.

Wolters Kluwer is heavily invested in digital transformation, offering clients tools that automate and simplify complex processes. For instance, their solutions for tax return preparation and audit processes are designed to cut down on manual work and improve efficiency, a key driver in today's professional services landscape.

The company's focus on workflow automation is evident across its business units, aiming to reduce administrative burdens for its clients. This includes advancements in areas such as firm management and auto finance documentation, reflecting a broader trend towards digital-first operations.

In 2023, Wolters Kluwer reported that its Health division saw significant growth driven by digital solutions, with digital products and services accounting for a substantial portion of its revenue, underscoring the success of its digital transformation strategy.

Data Analytics and Insights

Wolters Kluwer is aggressively leveraging data analytics to transform its content and services, aiming to provide customers with highly actionable insights. Their strategy centers on combining deep domain expertise with advanced technological capabilities. This focus is designed to empower professionals across various sectors to make more informed and impactful decisions, ultimately optimizing their performance and outcomes.

The company's investment in data analytics is evident in its product development, where sophisticated algorithms and machine learning are employed to extract meaningful patterns from vast datasets. This allows Wolters Kluwer to offer predictive analytics and personalized recommendations, moving beyond simple information delivery to strategic guidance. For instance, in the legal sector, their platforms can now analyze case law to predict litigation outcomes with greater accuracy.

- Enhanced Decision Making: Wolters Kluwer's platforms utilize advanced analytics to provide professionals with data-driven insights, improving the quality and speed of critical decisions.

- Content Monetization: By transforming raw content into valuable insights, the company is creating new revenue streams and strengthening its competitive advantage.

- Customer Value Proposition: The focus on actionable insights directly addresses customer needs for efficiency and effectiveness in their respective fields.

- Investment in AI and Machine Learning: Significant resources are being allocated to build and refine AI capabilities that power these analytical tools.

Cybersecurity Technologies

Wolters Kluwer's reliance on robust cybersecurity technologies is critical, given its role as a provider of essential information and software solutions. Protecting its own infrastructure and the highly sensitive data of its clients against an escalating landscape of cyber threats demands ongoing and significant investment in advanced security measures. For instance, the company reported a 2023 cybersecurity budget of $150 million, a 15% increase from the previous year, reflecting the growing importance of this area.

The sophistication and frequency of cyberattacks are continuously rising, compelling companies like Wolters Kluwer to stay ahead of emerging threats. This necessitates a proactive approach, integrating cutting-edge technologies such as artificial intelligence for threat detection, advanced encryption protocols, and multi-factor authentication across all its platforms. In 2024, Wolters Kluwer plans to implement a new AI-driven threat intelligence system, aiming to reduce incident response times by an estimated 20%.

Key cybersecurity technologies relevant to Wolters Kluwer include:

- Endpoint Detection and Response (EDR) solutions: To monitor and protect individual devices and servers from malicious activity.

- Cloud Security Posture Management (CSPM): To ensure secure configurations and compliance in its cloud environments.

- Data Loss Prevention (DLP) tools: To prevent sensitive client information from being exfiltrated or mishandled.

- Zero Trust Architecture: A security framework that requires strict identity verification for every person and device trying to access resources on a private network, regardless of whether they are inside or outside the network perimeter.

Technological advancements are a core driver for Wolters Kluwer, with significant investment in AI and Generative AI enhancing its product suite. These technologies are integrated to improve search, summarization, and virtual assistance, boosting efficiency and accuracy for professionals in healthcare, tax, and legal sectors. The company's 2023 technology spending saw a notable increase, with a substantial portion dedicated to AI initiatives, aiming to provide more insightful and actionable data for complex decision-making.

Legal factors

Wolters Kluwer's business is intrinsically tied to the evolving regulatory compliance requirements that professionals, especially in finance, must navigate. For instance, the company helps financial institutions adapt to new rules like Section 1071, which mandates small business data collection. This is crucial for banks aiming to comply with updated fair lending regulations and the Community Reinvestment Act.

Global data privacy laws like GDPR and CCPA significantly affect Wolters Kluwer's data handling. These regulations mandate strict controls over personal information, impacting how Wolters Kluwer collects, stores, and uses client data across its services. Failure to comply can lead to substantial fines, with GDPR penalties reaching up to 4% of annual global turnover or €20 million, whichever is higher.

Wolters Kluwer, a major player in tax and accounting software, is significantly impacted by shifts in tax legislation. For instance, the Inflation Reduction Act of 2022 introduced new tax credits and incentives, requiring software providers like Wolters Kluwer to update their systems to accurately reflect these changes for their clients.

The company's ability to project inflation-adjusted tax figures, such as tax brackets and standard deductions, is crucial. For the 2024 tax year, the IRS announced adjustments to these figures, with the standard deduction for single filers increasing to $14,600, a change Wolters Kluwer's software must incorporate to ensure client compliance and accurate tax preparation.

Legal and Professional Liability

Wolters Kluwer's position as a purveyor of expert information and solutions inherently brings significant legal and professional liability. The company must ensure the utmost accuracy and reliability in its offerings, as errors or outdated data can lead to substantial financial and reputational damage for its clients. This necessitates robust content validation processes and thorough software testing to preemptively address potential risks.

The company's commitment to compliance is underscored by its continuous investment in legal expertise and technology infrastructure. For instance, in 2024, Wolters Kluwer continued to adapt its solutions to comply with evolving regulatory landscapes across various jurisdictions, such as data privacy laws like GDPR and CCPA, and financial reporting standards like IFRS and US GAAP. Their legal and compliance divisions actively monitor legislative changes, ensuring their platforms remain current and adhere to all pertinent legal frameworks.

- Content Accuracy: Wolters Kluwer employs subject matter experts and rigorous editorial processes to maintain the factual integrity of its publications and digital solutions.

- Software Compliance: Regular updates and testing are conducted to ensure software functionalities align with current legal and regulatory requirements, minimizing the risk of non-compliance for users.

- Intellectual Property: Protecting its own intellectual property and respecting that of others is a key legal consideration, managed through robust licensing agreements and copyright enforcement.

- Data Security and Privacy: Adherence to data protection regulations is paramount, with significant efforts in 2024 focused on strengthening data security measures to safeguard client information.

Intellectual Property Rights

Protecting its intellectual property, such as proprietary software, extensive content databases, and sophisticated algorithms, is fundamental to Wolters Kluwer's sustained competitive edge. This necessitates a deep understanding and navigation of diverse and often intricate intellectual property laws across the various global markets it operates in.

The company actively works to prevent unauthorized use and infringement of its valuable assets, which is crucial for maintaining its market leadership and the integrity of its offerings. In 2023, Wolters Kluwer continued its investment in research and development, a significant portion of which is directly tied to the creation and protection of new intellectual property.

- Global IP Protection: Wolters Kluwer maintains a robust strategy for registering and defending its patents, trademarks, and copyrights worldwide.

- Software and Data Security: Safeguarding its proprietary software and the vast datasets it manages is a continuous operational priority.

- Infringement Monitoring: The company actively monitors for and takes action against any instances of intellectual property infringement that could impact its business.

Legal and regulatory compliance is a cornerstone of Wolters Kluwer's operations, influencing product development and client services. The company's expertise in navigating complex legal frameworks, such as evolving data privacy laws like GDPR and CCPA, is critical. For example, in 2024, adherence to updated financial reporting standards and tax legislation, like the adjustments to the 2024 tax year figures, remains a key focus, ensuring clients can meet their obligations accurately.

Environmental factors

The EU Corporate Sustainability Reporting Directive (CSRD) is a major environmental and legal driver for Wolters Kluwer. This directive mandates extensive sustainability disclosures for many companies, including those operating within the EU. Wolters Kluwer's Corporate Performance & ESG division is directly involved in assisting clients with these reporting requirements.

Wolters Kluwer demonstrated its commitment to these evolving standards by publishing its 2024 Annual Report. This report includes detailed sustainability statements that are aligned with the rigorous requirements of the CSRD. This proactive approach ensures transparency and compliance with the EU's push for standardized environmental, social, and governance (ESG) reporting.

Wolters Kluwer is actively pursuing ambitious environmental goals, including a 60% reduction in Scope 1 and 2 greenhouse gas emissions by 2030, measured against a 2019 baseline. This aligns with their validated net-zero target by 2050, recognized by the Science Based Targets initiative (SBTi).

These commitments highlight the company's proactive approach to mitigating its environmental impact and contributing to global climate action. Such initiatives are increasingly crucial for businesses operating within a landscape shaped by evolving climate regulations and stakeholder expectations.

Wolters Kluwer's environmental impact stems from its global operations, including energy use for its extensive data centers and office spaces. While not a manufacturing giant, the company acknowledges its resource consumption and waste generation. For instance, in 2023, the company reported progress on its sustainability goals, aiming to reduce Scope 1 and 2 greenhouse gas emissions by 40% by 2030 compared to a 2019 baseline.

The company is actively managing its environmental footprint through initiatives like optimizing its global office layout and engaging in community-focused environmental actions, such as distributing solar lamps. These efforts underscore a commitment to resource efficiency and waste reduction across its business functions, aligning with broader corporate responsibility trends observed in the information services sector leading into 2024 and 2025.

Demand for Environmental, Social, and Governance (ESG) Solutions

Client demand for Environmental, Social, and Governance (ESG) solutions is rapidly growing, creating a substantial market opportunity for Wolters Kluwer. This surge is driven by increasing regulatory pressures and investor focus on sustainable practices.

Wolters Kluwer is actively responding to this trend by launching new ESG data solutions. A prime example is CCH Tagetik ESG & Sustainability for CBAM, designed to assist businesses in navigating environmental regulations and embedding sustainability into their financial planning processes.

- Market Growth: The global ESG investing market was projected to reach $50 trillion by 2025, indicating a significant expansion in demand for related solutions.

- Regulatory Compliance: Companies are increasingly seeking tools to manage complex environmental regulations, such as the Carbon Border Adjustment Mechanism (CBAM), which CCH Tagetik ESG & Sustainability for CBAM addresses.

- Integrated Reporting: There's a growing need for integrated financial and sustainability reporting, pushing demand for software that can bridge these two critical areas.

Supply Chain Environmental Practices

Wolters Kluwer's approach to supply chain environmental practices, while not a primary focus in public reporting, has indirect implications for its carbon footprint, especially concerning technology hardware and software development. The company's engagement in industry events like 'Sustainability LIVE: Net Zero' indicates a growing awareness of the importance of sustainability throughout its value chain. For instance, in 2023, the IT sector globally saw increased scrutiny on e-waste and the energy consumption of data centers, areas that would touch upon Wolters Kluwer's operational dependencies.

The company's indirect environmental impact from its supply chain is linked to the energy efficiency and material sourcing of the technology it procures and utilizes. While specific data on Wolters Kluwer's supply chain emissions is limited, the broader industry trend in 2024 and 2025 is toward greater transparency and accountability. Companies are increasingly expected to report on Scope 3 emissions, which encompass supply chain activities. Wolters Kluwer's participation in sustainability forums suggests a proactive stance in understanding and potentially mitigating these impacts.

Key considerations for Wolters Kluwer's supply chain environmental practices include:

- E-waste Management: Ensuring responsible disposal and recycling of IT hardware used in operations.

- Energy Consumption in Data Centers: Partnering with providers that utilize renewable energy sources for cloud services.

- Sustainable Sourcing: Evaluating suppliers based on their environmental credentials and commitment to reducing their own footprints.

Wolters Kluwer's environmental strategy is shaped by regulatory mandates like the EU's Corporate Sustainability Reporting Directive (CSRD), driving demand for ESG solutions. The company has set ambitious targets, aiming for a 60% reduction in Scope 1 and 2 greenhouse gas emissions by 2030 against a 2019 baseline, with a validated net-zero target by 2050. These efforts are crucial as the global ESG investing market is projected to reach $50 trillion by 2025, highlighting a significant business opportunity.

The company's operational footprint, particularly energy consumption in data centers and offices, is a key focus. Wolters Kluwer is actively optimizing its global operations and engaging in community environmental actions. In 2023, progress was reported towards a 40% reduction in Scope 1 and 2 emissions by 2030, demonstrating a commitment to resource efficiency and waste reduction. This proactive stance aligns with increasing stakeholder expectations for environmental responsibility within the information services sector through 2024 and 2025.

Wolters Kluwer is leveraging client demand for ESG solutions through new product launches, such as CCH Tagetik ESG & Sustainability for CBAM. This addresses the growing need for tools to manage complex environmental regulations and integrate sustainability into financial planning. The company's commitment extends to its supply chain, with a focus on e-waste management and sustainable sourcing, reflecting broader industry trends towards greater transparency in Scope 3 emissions.

| Environmental Target | Baseline Year | Target Year | Progress Status (as of latest report) |

| Scope 1 & 2 GHG Emissions Reduction | 2019 | 2030 | Targeting 60% reduction (previously 40% reported for 2023 progress) |

| Net-Zero Emissions | N/A | 2050 | Validated by SBTi |

PESTLE Analysis Data Sources

Our PESTLE Analysis is powered by a comprehensive blend of official government publications, international financial institutions, and leading market research firms. This ensures a robust understanding of political, economic, social, technological, legal, and environmental landscapes.