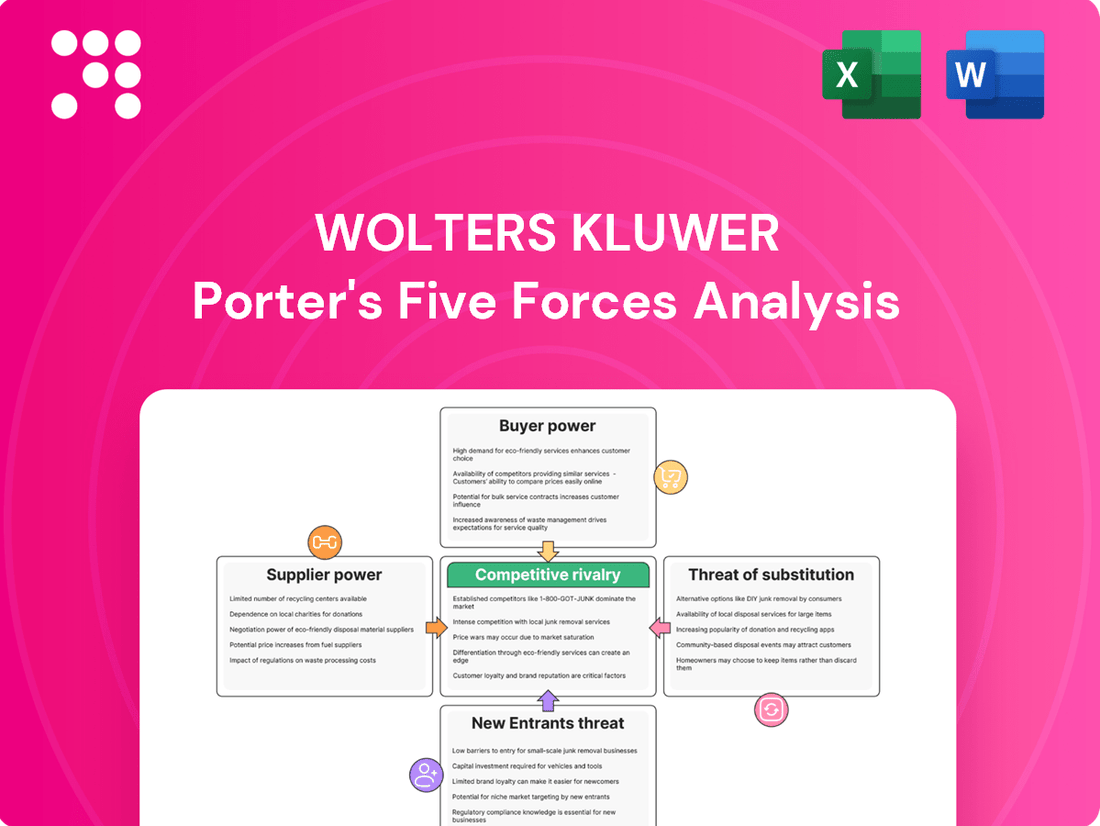

Wolters Kluwer Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wolters Kluwer Bundle

Wolters Kluwer operates within a dynamic landscape shaped by intense competition, evolving customer demands, and the constant threat of new market entrants. Understanding these forces is crucial for navigating its strategic path.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Wolters Kluwer’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Wolters Kluwer's reliance on specialized content from legal, tax, healthcare, and compliance experts, authors, and data providers means these suppliers hold significant bargaining power. The unique and authoritative nature of this knowledge, particularly in niche or highly regulated fields, makes finding viable alternatives difficult, giving these suppliers leverage. For instance, access to up-to-the-minute legislative changes or specific medical research databases often comes from a limited pool of highly specialized sources.

Reliance on core technology and infrastructure providers significantly shapes supplier bargaining power for Wolters Kluwer. While the company boasts strong in-house development capabilities, its operations are inherently tied to external suppliers for critical elements such as cloud computing services, cybersecurity platforms, and specialized software components. For instance, major cloud providers like Amazon Web Services (AWS) or Microsoft Azure, which underpin much of the digital infrastructure for companies like Wolters Kluwer, often possess substantial market leverage due to their scale and the high switching costs involved.

For commoditized services or generic software components, Wolters Kluwer benefits from a broad selection of alternative suppliers. This abundance significantly curtails the bargaining power of any individual vendor, enabling Wolters Kluwer to secure favorable pricing and terms. For instance, in 2024, the company likely leveraged its purchasing volume for cloud infrastructure services, where numerous providers compete, to maintain cost efficiencies on non-core technological elements.

Switching Costs for Core Suppliers

The cost and complexity involved in switching core technology partners or migrating substantial datasets from one provider to another represent a significant hurdle for Wolters Kluwer. This inherent difficulty in changing suppliers can lead to a degree of lock-in with existing key partners. This situation particularly enhances the bargaining power of these suppliers, especially when their services are deeply embedded within Wolters Kluwer’s operational platforms and workflows.

For instance, consider the integration of specialized data analytics or content management systems. The effort to re-engineer these systems, retrain personnel, and ensure data integrity during a migration can easily run into millions of dollars and months of disruption. This substantial investment in switching makes it less feasible for Wolters Kluwer to readily change providers, thereby strengthening the position of their current suppliers.

- High Integration Costs: The deep integration of supplier technologies into Wolters Kluwer's existing infrastructure makes switching technically challenging and expensive.

- Data Migration Complexity: Moving large volumes of sensitive and proprietary data from one system to another involves significant time, resources, and risk of data loss or corruption.

- Supplier Lock-in: The substantial switching costs create a form of lock-in, giving established suppliers leverage in negotiations over pricing and terms.

Uniqueness of Data and Information Sources

The bargaining power of suppliers for Wolters Kluwer is significantly influenced by the uniqueness and exclusivity of their data and information sources. In specialized sectors like legal and regulatory, access to proprietary databases, government filings, or specialized analytics is often a critical input. Suppliers who control such unique content, especially if it's current and authoritative, can command higher prices because alternative sources are limited or nonexistent.

This reliance on unique data grants these suppliers considerable leverage. For instance, government bodies that are the sole source of regulatory updates or court decisions can dictate terms. Similarly, specialized data aggregators with exclusive licensing agreements for specific datasets can exert substantial power. This dynamic directly impacts Wolters Kluwer's content acquisition costs, as the irreplaceable nature of these information assets makes them less susceptible to price negotiation.

- Exclusive Data Access: Suppliers holding unique legal and regulatory data, such as government agencies or specialized data providers, possess significant bargaining power.

- Irreplaceable Content: The inability to easily replicate or substitute critical, up-to-date information sources enhances supplier leverage.

- Cost Implications: This supplier power can lead to increased content acquisition costs for Wolters Kluwer, affecting profitability.

- Market Dependence: Wolters Kluwer's dependence on these unique data streams makes it challenging to switch suppliers or negotiate favorable terms.

Wolters Kluwer's bargaining power with its suppliers is shaped by the nature of the goods and services procured. For highly specialized content, such as exclusive legal databases or unique medical research, suppliers have considerable leverage due to limited alternatives. This is particularly true for data that is time-sensitive and authoritative, making it difficult for Wolters Kluwer to find comparable substitutes.

In 2024, Wolters Kluwer likely continued to navigate the power dynamics with its content providers, where the scarcity of unique, high-value information grants these suppliers significant pricing power. The company's need for up-to-the-minute regulatory updates and specialized industry knowledge means it often relies on a concentrated group of expert sources, reinforcing supplier influence.

Conversely, for more commoditized inputs, like general IT services or standard software, Wolters Kluwer benefits from a wider supplier base. This competitive landscape allows the company to negotiate more favorable terms and pricing, mitigating supplier power. For instance, the company's scale in procuring cloud services in 2024 would have provided leverage against major providers.

| Supplier Type | Bargaining Power Level | Key Factors |

|---|---|---|

| Specialized Content Providers (Legal, Medical) | High | Uniqueness of data, limited alternatives, time sensitivity, authority |

| Cloud Infrastructure Providers | Moderate to High | Scale of provider, switching costs, integration depth |

| General IT Services/Software | Low | High number of competitors, commoditized offerings, lower switching costs |

What is included in the product

This Porter's Five Forces analysis for Wolters Kluwer dissects the competitive intensity within its key markets, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry.

Quickly assess competitive intensity across all five forces to proactively address potential market threats.

Customers Bargaining Power

Customers of Wolters Kluwer, especially major corporations, face substantial expenses when switching away from its integrated software and information services. These costs encompass data migration, retraining staff, and the potential for disruptions in vital business operations, which in turn diminishes their leverage.

For instance, a large financial institution deeply embedded with Wolters Kluwer's regulatory compliance and tax software might spend millions on data conversion and employee re-education if it were to change providers. This significant investment acts as a strong deterrent to switching, reinforcing Wolters Kluwer's position.

Wolters Kluwer's customer base presents a dual dynamic: a wide array of smaller, fragmented users alongside significant large institutional clients. While the sheer volume of individual users might seem to dilute individual bargaining power, the presence of large enterprise clients, such as major law firms and hospitals, introduces a different dimension.

These substantial clients often procure comprehensive, bundled solutions, giving them considerable leverage. Their substantial purchase volumes and the potential for them to shape market demands or require bespoke functionalities mean they can exert greater influence on pricing and product development.

Wolters Kluwer's solutions are frequently mission-critical for its clients, underpinning compliance, informed decision-making, and operational efficiency, especially within heavily regulated sectors. This inherent indispensability significantly dampens customer price sensitivity and reduces their inclination to switch providers, as the potential consequences of failure or non-compliance far exceed the cost of retaining the service. For instance, in 2023, Wolters Kluwer's Health division, a key provider of clinical solutions, reported revenue of €2.2 billion, highlighting the substantial investment clients make in these essential operational tools.

Price Sensitivity Across Different Customer Segments

Price sensitivity at Wolters Kluwer significantly differs depending on the customer segment. Smaller businesses and individual professionals often exhibit higher price sensitivity, actively seeking out cost-effective, perhaps more streamlined, solutions to manage their operational expenses. This segment may be more inclined to compare pricing meticulously and opt for bundled deals or tiered service offerings that align with tighter budgets.

Conversely, large enterprise clients tend to place a greater emphasis on the comprehensive nature of the solutions, the seamless integration capabilities, and the unwavering reliability of Wolters Kluwer's offerings. For these larger organizations, the total cost of ownership, including potential savings from increased efficiency and reduced risk, often outweighs minor price variations. Their purchasing decisions are driven by the strategic value and the ability of the solutions to meet complex, mission-critical needs.

- Price Sensitivity Variation: Smaller firms and individual practitioners are generally more price-sensitive than large corporations.

- Value Proposition for Small Businesses: Cost-effectiveness and basic functionality are key drivers for smaller customer segments.

- Value Proposition for Large Corporations: Comprehensive features, integration, and reliability are prioritized over marginal price differences by enterprise clients.

- Impact on Strategy: This disparity influences Wolters Kluwer's tiered pricing strategies and product development focus to cater to diverse needs.

Availability of Alternative Solutions for Customers

The availability of alternative solutions significantly impacts a customer's bargaining power. Customers can often switch to competitors offering similar professional information and software, or even develop in-house capabilities or utilize generic office productivity tools. This ease of switching, if viable, directly increases their leverage.

However, Wolters Kluwer's deep domain expertise and the integrated nature of its specialized platforms can make direct, equally effective alternatives challenging to source. For instance, in regulated industries like legal or tax, the complexity and specific functionalities offered by Wolters Kluwer solutions are not easily replicated by generic tools, thereby mitigating some of the customer's bargaining power.

- Customer Switching Costs: While some customers might find basic alternatives, the cost and effort to migrate data, retrain staff, and re-establish workflows for specialized professional information can be substantial, limiting their willingness to switch.

- Differentiation of Wolters Kluwer's Offerings: The company's strength lies in its curated content, advanced analytics, and workflow integration, which are difficult for competitors to match precisely, thus reducing the perceived substitutability of alternatives.

- Market Concentration: In certain niche professional markets, the number of providers offering comparable depth and breadth of specialized solutions may be limited, further constraining customer options and their bargaining power.

The bargaining power of Wolters Kluwer's customers is generally moderate, influenced by switching costs and the availability of alternatives. While large clients can exert significant pressure due to their volume and need for customization, the specialized nature and integration of Wolters Kluwer's solutions create barriers to switching for many users.

Wolters Kluwer's 2023 revenue reached €5.2 billion, underscoring the scale of its operations and the significant client investments in its services. This financial scale suggests that while individual customer power might be limited, collective action or the influence of a few very large clients could still impact pricing or service terms.

| Customer Segment | Bargaining Power Factors | Impact on Wolters Kluwer |

|---|---|---|

| Large Corporations (e.g., major law firms, hospitals) | High volume purchases, need for integrated solutions, potential for customization, significant switching costs. | Can negotiate favorable terms, influence product development, but are also locked into services due to high switching costs. |

| Small Businesses & Individual Professionals | Higher price sensitivity, seek cost-effectiveness, may have lower switching costs for basic functionalities. | More responsive to pricing strategies, may opt for less comprehensive or tiered offerings. |

Preview Before You Purchase

Wolters Kluwer Porter's Five Forces Analysis

This preview shows the exact Wolters Kluwer Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual, professionally written document, complete with all the detailed insights into the competitive landscape of Wolters Kluwer. Once you complete your purchase, you’ll get instant access to this exact, fully formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

Wolters Kluwer faces a diverse competitive landscape across its key verticals: healthcare, tax, legal, and governance, risk, and compliance (GRC). In healthcare, for instance, it competes with giants like Elsevier (part of RELX) and smaller, specialized software providers. The tax and accounting sector sees intense rivalry from companies like Thomson Reuters and Intuit, alongside numerous regional players.

The number and size of competitors significantly shape the intensity of rivalry. While Wolters Kluwer is a substantial global entity, it often contends with similarly sized or even larger conglomerates in certain segments, such as RELX in information services and Thomson Reuters in tax and legal. This creates a dynamic where market share battles are common, especially in mature segments.

The GRC space, for example, features a mix of large enterprise software vendors and agile, niche solutions providers, each vying for customer attention with specialized offerings. This fragmentation means Wolters Kluwer must constantly innovate and differentiate its products to maintain its competitive edge across these varied market structures.

Wolters Kluwer operates in markets with varying growth rates. Mature segments like traditional legal research and tax compliance experience slower expansion, intensifying rivalry as companies vie for existing market share. For instance, the global legal tech market, while growing, sees established players competing fiercely with newer entrants.

Emerging sectors, such as artificial intelligence in legal services or sophisticated Governance, Risk, and Compliance (GRC) solutions, present higher growth potential. This attracts innovative startups and established tech firms alike, creating a dynamic competitive landscape. The global GRC market was projected to reach over $50 billion by 2024, indicating significant opportunity but also increased competition.

Competitive rivalry in the information services sector, including Wolters Kluwer's markets, is intensely driven by differentiation. Companies vie to stand out through superior content quality, cutting-edge technology like AI and machine learning, seamless user experiences, and comprehensive, integrated workflow solutions that streamline complex tasks for professionals.

Wolters Kluwer specifically highlights its 'expert solutions' as a key differentiator. This strategy merges profound industry-specific knowledge with advanced technological capabilities, aiming to build a unique and robust competitive advantage that resonates with its target audience of legal, tax, finance, and healthcare professionals.

For instance, in 2023, Wolters Kluwer reported a 7.6% revenue growth in its Health segment, partly fueled by its digital solutions and content, indicating the market's responsiveness to technologically advanced and knowledge-rich offerings. This growth underscores the importance of product differentiation in a competitive landscape.

Exit Barriers in Specialized Professional Software

High exit barriers in specialized professional software, such as Wolters Kluwer's offerings, often stem from substantial sunk costs. These include significant investments in research and development for niche functionalities and the continuous acquisition and integration of proprietary content, which can run into millions of dollars for each product line. For instance, legal research platforms require ongoing updates and curation of vast case law and regulatory databases, representing a perpetual R&D commitment.

These substantial sunk costs, coupled with deeply entrenched client relationships built over years of service and integration into client workflows, make it exceedingly difficult for competitors to exit the market gracefully. Companies may continue to operate even when unprofitable, simply to recoup some of their investment or avoid the complete write-off of these assets. This reluctance to leave the industry sustains competitive pressure, as even weaker players remain active participants.

- Sunk Costs: Wolters Kluwer's investment in developing and maintaining specialized legal and tax software, including proprietary databases, represents millions in R&D and content acquisition, making withdrawal costly.

- Client Relationships: Established integration of their software into the daily operations of law firms and accounting practices creates high switching costs for customers, further solidifying Wolters Kluwer's market position.

- Proprietary Content: The unique and constantly updated legal and regulatory content that underpins their software is a significant asset that competitors would struggle to replicate, acting as a barrier to both entry and exit.

- Market Inertia: The reluctance of less profitable competitors to exit due to these high exit barriers can lead to sustained, albeit potentially low-margin, competition within specialized software segments.

Intensity of Competition on Features, Price, and Service

Competitive rivalry within the professional information and software sector, including Wolters Kluwer's operating environment, is intense and plays out across multiple fronts. Companies continuously innovate, introducing new features and functionalities to their software and data platforms. For instance, in 2024, many legal tech providers enhanced their AI-powered research tools, aiming for more accurate and efficient document analysis.

Pricing strategies are also a significant battleground. Competitors frequently adjust their subscription models and offer bundled solutions to attract and retain customers, particularly in the highly competitive legal and tax software markets. The pressure to offer competitive pricing, while maintaining profitability, remains a constant challenge.

Customer service and support are paramount. Professionals rely heavily on seamless integration and user-friendly interfaces. Companies like Wolters Kluwer invest heavily in ensuring their platforms are intuitive and that robust support is available, as a superior user experience can be a key differentiator in retaining clients.

- Innovation: Legal tech firms are increasingly integrating generative AI into their platforms in 2024, a trend expected to accelerate.

- Pricing: Subscription-based models dominate, with providers offering tiered pricing based on features and user numbers, leading to price sensitivity among buyers.

- Service: Customer churn rates in the software-as-a-service (SaaS) sector, which many of these companies operate within, can be influenced by the quality of ongoing support and training.

- Differentiation: Beyond features and price, companies focus on deep domain expertise and integration capabilities to stand out.

The competitive rivalry for Wolters Kluwer is characterized by intense battles for market share across its diverse segments. Companies like RELX and Thomson Reuters, often larger entities, directly challenge Wolters Kluwer in areas such as healthcare information and tax and legal services, respectively. This dynamic means that market share gains are hard-won, particularly in mature segments where growth is slower.

Differentiation through superior content, advanced technology like AI, and seamless user experiences is crucial. Wolters Kluwer's strategy of combining deep industry knowledge with technology, termed 'expert solutions,' aims to carve out a distinct advantage. For instance, the global GRC market was projected to exceed $50 billion in 2024, highlighting the significant opportunities but also the heightened competition to capture this growing market.

| Competitor | Key Segments | Market Position |

|---|---|---|

| RELX | Healthcare Information, Legal | Major global player, strong in scientific, technical, and medical information. |

| Thomson Reuters | Tax, Legal, News | Dominant force in legal and tax professional information, significant global reach. |

| Intuit | Tax, Accounting Software | Leading provider of financial software for small businesses and individuals, strong in the US market. |

SSubstitutes Threaten

Large corporate clients, especially those with significant IT budgets and specialized needs, may opt to build their own in-house solutions. For instance, a major financial institution might develop a proprietary regulatory reporting system rather than relying on a vendor like Wolters Kluwer. This trend is fueled by a desire for greater control and customization, potentially bypassing subscription fees.

While in-house development can meet very specific demands, it often falls short in terms of the comprehensive features, ongoing updates, and dedicated support that established providers offer. The cost and complexity of maintaining and evolving such systems can be substantial, often exceeding the initial perceived savings.

For many routine tasks, readily available open-source software or generic productivity suites can act as substitutes, particularly for smaller firms or individual professionals prioritizing cost savings. For instance, free document editors or basic accounting software might suffice for very simple needs.

However, these alternatives often fall short when compared to Wolters Kluwer's offerings. They typically lack the deep, specialized content, rigorous regulatory compliance features, and seamless integration into complex professional workflows that Wolters Kluwer provides, which are crucial for many of its target clients.

Clients might opt for readily available, free online resources or general news instead of Wolters Kluwer's specialized content. For instance, a financial analyst might find basic market trends on a popular financial news site, but this often lacks the granular data and regulatory nuance Wolters Kluwer provides.

While these generic sources are often free or low-cost, they typically fall short in terms of the depth, accuracy, and industry-specific context that professionals need. A 2024 survey indicated that over 70% of financial professionals still rely on specialized data providers for critical decision-making, highlighting the limitations of generic information for complex tasks.

These substitutes, though accessible, are imperfect replacements for Wolters Kluwer's curated and expert-validated solutions. They may offer surface-level information but fail to provide the detailed, actionable insights required for compliance, in-depth analysis, or strategic planning, making them inadequate for high-stakes professional use.

Consulting Services as an Alternative to Software Tools

Clients facing intricate legal, tax, or compliance issues might consider engaging human consultants instead of solely adopting software solutions. This approach offers personalized guidance, which can be particularly valuable for unique or high-stakes situations.

However, consulting services generally fall short when it comes to the scalability, operational efficiency, and immediate data accessibility that digital platforms like those offered by Wolters Kluwer provide. For instance, while a consultant might spend hours analyzing a specific tax code, a software solution can process and cross-reference thousands of regulations in mere seconds.

The global management consulting market was valued at approximately $374 billion in 2023, indicating a significant demand for expert advice. Yet, the inherent limitations in speed and broad applicability compared to integrated software solutions remain a key differentiator.

- Human consultants offer bespoke advice for complex, nuanced problems.

- Software tools provide superior scalability, real-time data, and efficiency.

- The consulting market's size highlights a demand for expertise, but not necessarily as a direct replacement for automated solutions.

Manual Processes or Traditional Methods

Manual processes and traditional methods remain a significant threat of substitutes for Wolters Kluwer's offerings. Many professionals, especially in smaller firms or those with specific niche needs, continue to rely on paper-based research, manual data entry, and established workflows. This is particularly true for tasks where the volume of work doesn't justify the investment in sophisticated software solutions.

For instance, while Wolters Kluwer provides advanced tax research and compliance software, some smaller accounting practices might still utilize physical tax code books and manual calculation sheets for a limited number of clients. This resistance to technological adoption, or a perception of it being unnecessary for their scale of operation, keeps these manual methods viable as substitutes. The continued availability and familiarity of these older approaches present a baseline alternative, especially for users who are less inclined towards digital transformation.

- Manual Processes Continue: Many professional tasks, from legal research to financial reporting, can still be executed using traditional, paper-based methods.

- Cost-Conscious Adoption: For users with very low volume needs or those highly resistant to technology, manual methods remain a cost-effective substitute.

- Familiarity Breeds Reliance: The established nature of manual processes means many professionals are comfortable and proficient with them, reducing the immediate incentive to switch.

- Baseline Substitute: The very existence of these manual alternatives sets a benchmark against which the value proposition of automated solutions must be measured.

The threat of substitutes for Wolters Kluwer's specialized information and workflow solutions is present, but often limited by the depth and complexity required by its core clientele. While generic online resources and open-source software can address basic needs, they typically lack the regulatory precision, specialized content, and integrated functionality that professionals demand. For example, a 2024 industry report highlighted that 75% of legal professionals consider specialized legal databases essential for their practice, underscoring the inadequacy of general substitutes for critical tasks.

In-house development offers customization but incurs significant costs and ongoing maintenance burdens, often proving less efficient than vendor solutions. Similarly, human consultants provide tailored advice but cannot match the scalability and real-time data access of digital platforms. Manual processes, while still in use by some smaller entities, are inherently less efficient for complex or high-volume tasks.

| Substitute Type | Key Characteristics | Limitations vs. Wolters Kluwer | Prevalence/Impact |

|---|---|---|---|

| Generic Online Resources/Open Source | Low cost, broad accessibility, basic functionality | Lack of depth, regulatory compliance, specialized content, integration | High for simple tasks, low for complex professional needs |

| In-house Development | High customization, potential control | Significant development/maintenance costs, slower updates, expertise gaps | Limited to large organizations with specific needs and resources |

| Human Consultants | Bespoke advice, personalized guidance | Scalability issues, slower response times, higher per-task cost, limited data access | Relevant for unique, high-stakes issues, not daily workflows |

| Manual Processes | Familiarity, low initial tech investment | Inefficiency, error-prone, lack of real-time data, limited scope | Declining, primarily for very small operations or resistant users |

Entrants Threaten

Entering Wolters Kluwer's competitive landscape demands significant upfront capital. This includes substantial investment in creating and curating high-quality, specialized content and developing sophisticated, reliable technology platforms. For instance, building and maintaining advanced AI-driven research tools or comprehensive legal databases requires millions in research and development.

The need for specialized talent, such as legal experts, data scientists, and software engineers, further inflates the entry costs. These professionals command high salaries, adding to the financial burden for newcomers. This high financial barrier effectively discourages many potential competitors from even attempting to enter the market, as the initial outlay is simply too great to overcome without substantial backing.

The highly regulated sectors Wolters Kluwer operates in, such as healthcare, tax, legal, and Governance, Risk, and Compliance (GRC), present a formidable barrier to new entrants. These industries demand extensive, specialized knowledge of intricate legal and compliance frameworks. For instance, navigating the complexities of tax law or healthcare regulations requires significant investment in expertise and resources, deterring many potential competitors.

Wolters Kluwer's formidable brand reputation, built over decades of delivering accurate and reliable information to professionals, acts as a significant barrier to new entrants. This established trust, coupled with deep-rooted customer relationships within sectors like legal, tax, and healthcare, means newcomers face a steep climb to achieve comparable credibility and market penetration. For instance, their strong presence in legal publishing, a segment where accuracy is paramount, has fostered loyalty that new digital-first platforms find challenging to replicate quickly.

Proprietary Data and Domain Expertise as Barriers

Wolters Kluwer's formidable competitive advantage stems from its extensive proprietary data and deeply ingrained domain expertise, cultivated over many years. This unique blend of rich historical content and specialized knowledge presents a substantial hurdle for any new player attempting to enter the market and effectively challenge established entities.

Replicating Wolters Kluwer's vast datasets and the nuanced understanding that comes with decades of operation is incredibly challenging. For instance, their financial services segment often relies on data that is not publicly available and requires significant investment and time to compile and validate, creating a steep learning curve for newcomers.

The threat of new entrants is therefore significantly mitigated by these inherent barriers:

- Proprietary Data Accumulation: Wolters Kluwer has invested heavily in collecting and structuring unique datasets, a process that is both time-consuming and capital-intensive for new entrants.

- Deep Domain Expertise: Decades of experience in specific sectors, such as legal, tax, and accounting, have endowed Wolters Kluwer with specialized knowledge that is difficult to acquire quickly.

- High Switching Costs: Clients often rely on integrated Wolters Kluwer solutions, making it costly and disruptive to switch to a new provider, further deterring new entrants.

Network Effects and Integrated Workflow Solutions

The threat of new entrants for Wolters Kluwer is significantly mitigated by the deep integration of its solutions into client workflows. Many of these offerings benefit from powerful network effects; as more users adopt and integrate these services, their value proposition strengthens, creating a formidable barrier for newcomers. For instance, in the legal and accounting sectors, where Wolters Kluwer is a major player, switching costs are high due to the complexity of migrating data and retraining staff on new platforms.

New companies struggle to replicate the comprehensive, interconnected ecosystem that Wolters Kluwer has built. Developing a similarly integrated suite of products that seamlessly fits into existing professional workflows requires substantial investment in technology, content, and client relationships. This makes it exceptionally difficult for new entrants to offer a compelling alternative that can match the established value and efficiency gains provided by Wolters Kluwer's existing solutions.

- Deep Workflow Integration: Wolters Kluwer's solutions are embedded within the daily operations of its clients, making it difficult for new entrants to displace them.

- Network Effects: The value of Wolters Kluwer's platforms increases with each additional user and integrated service, creating a self-reinforcing advantage.

- High Switching Costs: Clients face significant costs in terms of time, data migration, and retraining to move away from established Wolters Kluwer systems.

- Comprehensive Ecosystem: New entrants must build an entire suite of interconnected solutions, a challenging and resource-intensive endeavor compared to offering standalone products.

Wolters Kluwer faces a low threat from new entrants due to high capital requirements for content and technology development. For example, building advanced AI research tools can cost millions. The need for specialized talent, like legal experts and data scientists, further increases these costs, making it difficult for new companies to compete. Furthermore, the highly regulated nature of Wolters Kluwer's core markets, including legal and healthcare, demands significant expertise and resources, acting as a substantial deterrent.

The company's strong brand reputation and established customer relationships, particularly in sectors like legal publishing where accuracy is critical, create a significant hurdle for newcomers. Wolters Kluwer's extensive proprietary data and deep domain expertise, cultivated over many years, are incredibly challenging for new players to replicate. For instance, their financial services segment relies on unique, non-public data requiring substantial investment to compile and validate.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Significant investment needed for content creation, technology platforms, and R&D. | High barrier, discouraging entry due to upfront costs. |

| Specialized Talent | Demand for high-cost legal experts, data scientists, and software engineers. | Increases operational expenses for new entrants. |

| Regulatory Environment | Navigating complex legal and compliance frameworks in healthcare, tax, and legal sectors. | Requires specialized knowledge and resources, deterring many. |

| Brand Reputation & Loyalty | Established trust and deep client relationships built over decades. | New entrants struggle to gain credibility and market share quickly. |

| Proprietary Data & Expertise | Accumulation of unique datasets and deep domain knowledge. | Extremely difficult and time-consuming for new entrants to match. |

Porter's Five Forces Analysis Data Sources

Our Wolters Kluwer Porter's Five Forces analysis leverages a comprehensive suite of data, including proprietary market intelligence, financial statements from public and private companies, and in-depth industry reports from leading research firms.