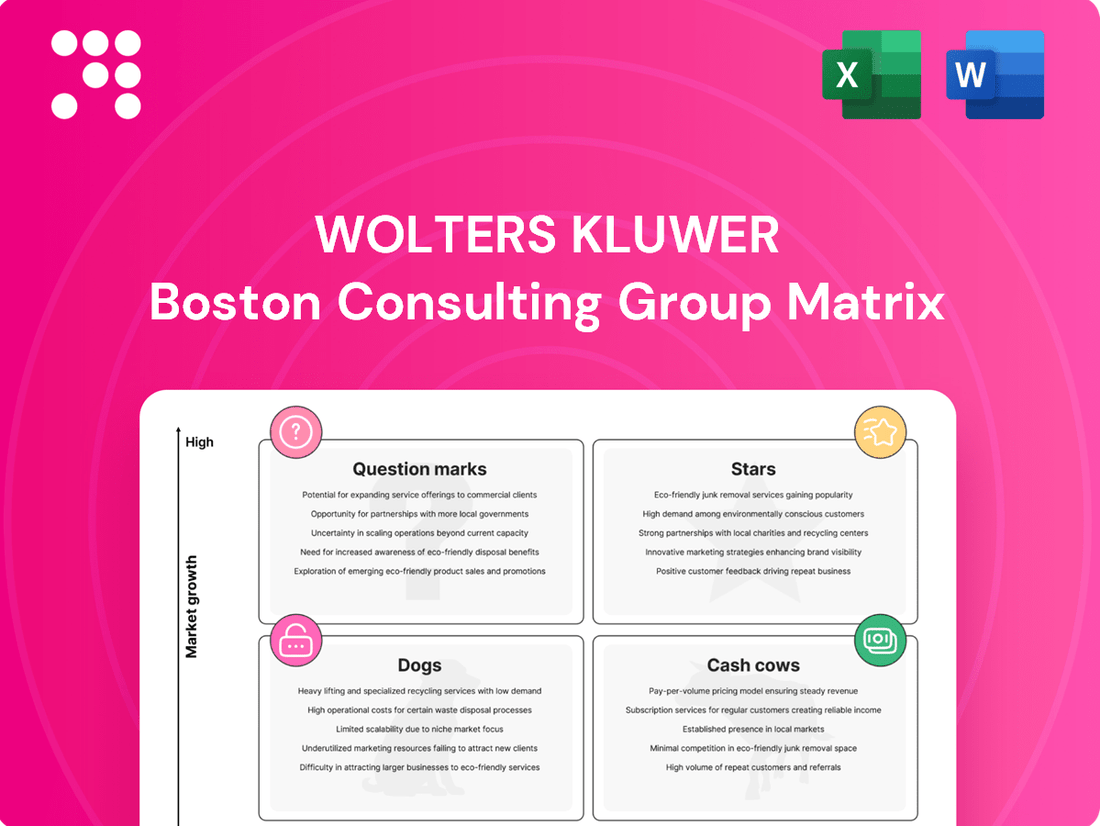

Wolters Kluwer Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wolters Kluwer Bundle

Curious about how this company navigates its product portfolio? Our BCG Matrix preview highlights key areas, but the full report unlocks the complete strategic picture. Understand precisely which products are your Stars, Cash Cows, Dogs, and Question Marks, and gain actionable insights to optimize your business strategy.

Don't settle for a glimpse when a comprehensive analysis awaits. Purchase the full BCG Matrix to receive detailed quadrant placements, data-driven recommendations, and a clear roadmap for smart investment and product decisions. Elevate your strategic planning with the complete tool.

Stars

Wolters Kluwer's Cloud Software Solutions are performing exceptionally well, demonstrating robust organic revenue growth. In 2024, this segment saw a 16% organic increase, followed by a strong 14% organic growth in the first quarter of 2025. This outpaces the company's overall revenue expansion, highlighting the strategic importance of these offerings.

The rapid expansion of the cloud-based professional tools market provides a fertile ground for these solutions. Wolters Kluwer's commitment to a 'cloud first' strategy and continuous product innovation is driving customer acquisition and solidifying its position in this dynamic sector.

Expert solutions, a significant driver for Wolters Kluwer, represented 59% of the company's total revenues in 2024, showcasing robust market presence. These solutions experienced a healthy 7% organic growth, underscoring their continued relevance and demand in professional sectors.

The strategic integration of Generative AI (GenAI) into key platforms like UpToDate Enterprise for healthcare and CCH AnswerConnect for tax highlights Wolters Kluwer's commitment to innovation. This focus on AI-powered solutions aims to deliver enhanced value and productivity to customers.

Wolters Kluwer is making significant strides in healthcare with AI integration. Their solutions like Ovid Guidelines AI and AI-powered UpToDate Enterprise are transforming clinical decision-making and operational efficiency. The healthcare sector is rapidly adopting AI, recognizing its potential to improve patient outcomes and streamline workflows.

Ovid Guidelines AI, a collaboration with Google Cloud and ASCO, is designed to dramatically shorten the time it takes to develop clinical guidelines. This innovation is a prime example of a high-growth, high-impact offering within the healthcare AI space. The ability to accelerate guideline development is crucial for keeping medical practices up-to-date with the latest research and best practices.

The company's strategic focus on AI for healthcare workflows, clinician development, and patient safety positions them strongly for future growth. The global AI in healthcare market was valued at approximately $15.4 billion in 2023 and is projected to reach over $187 billion by 2030, demonstrating a substantial opportunity for companies like Wolters Kluwer.

Corporate Performance & ESG Solutions (e.g., Enablon, CCH Tagetik)

The Corporate Performance & ESG Solutions division, encompassing brands like Enablon and CCH Tagetik, demonstrates robust expansion. In the first quarter of 2025, this segment achieved a notable 10% organic growth. This upward trend is largely fueled by the increasing demand for integrated solutions that manage financial performance alongside environmental, social, and governance (ESG) factors.

Key drivers behind this performance include the double-digit organic growth in recurring cloud subscriptions for Enablon's Environmental, Health, and Safety (EHS) and ESG offerings. Furthermore, CCH Tagetik's Corporate Performance Management (CPM) platform saw an impressive 13% organic growth. These figures highlight the market's increasing focus on comprehensive risk management and regulatory reporting capabilities.

- Strong Organic Growth: 10% organic growth in Q1 2025 for the Corporate Performance & ESG Solutions division.

- Cloud Subscription Momentum: Double-digit organic growth in recurring cloud subscriptions for EHS & ESG solutions (Enablon).

- CPM Platform Success: 13% organic growth for the CCH Tagetik CPM platform.

- Market Demand: Addresses a growing market need for integrated financial and sustainability performance, risk, and regulatory reporting solutions.

Legal & Regulatory Technology Solutions with GenAI Adoption

Wolters Kluwer's legal and regulatory technology solutions are positioned as Stars within the BCG matrix, driven by robust market growth and the company's strategic embrace of generative AI. The legal technology sector is booming, with Wolters Kluwer leading the charge. Their 2024 Future Ready Lawyer Survey reveals substantial GenAI adoption: 76% of corporate legal departments and 68% of law firms are using it weekly.

This high adoption rate underscores the demand for AI-enhanced legal services. Wolters Kluwer's commitment to investing in AI-driven efficiencies and adapting workflows to new technologies directly addresses this market need. This proactive approach ensures their offerings remain competitive and relevant in a fast-evolving landscape.

- Market Growth: The legal technology market is experiencing significant expansion.

- GenAI Adoption: High weekly usage of GenAI by legal professionals, as per the 2024 survey.

- Strategic Investment: Wolters Kluwer's focus on AI for efficiency positions them strongly.

- Adaptability: The company's ability to adapt practices to new technologies is key to its Star status.

Wolters Kluwer's legal and regulatory technology solutions are firmly positioned as Stars in the BCG matrix. This is due to the rapid growth of the legal technology market and the company's proactive integration of generative AI. Their 2024 Future Ready Lawyer Survey highlights this trend, showing that 76% of corporate legal departments and 68% of law firms are utilizing GenAI weekly.

| Segment | 2024 Organic Growth | Q1 2025 Organic Growth | Key Drivers |

|---|---|---|---|

| Cloud Software Solutions | 16% | 14% | Cloud-first strategy, product innovation, AI integration |

| Expert Solutions | 7% | N/A (reported as part of overall) | Market relevance, demand in professional sectors |

| Corporate Performance & ESG | N/A (reported as part of overall) | 10% | Demand for integrated financial/ESG solutions, cloud subscriptions |

| Legal & Regulatory Tech | N/A (reported as part of overall) | N/A (qualitative assessment) | Legal tech market growth, GenAI adoption |

What is included in the product

Strategic analysis of Wolters Kluwer's portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

A clear BCG Matrix visualizes Wolters Kluwer's portfolio, easing the pain of strategic resource allocation.

Cash Cows

Wolters Kluwer's Tax & Accounting division boasts a robust market position with flagship products like CCH Axcess Tax and CCH ProSystem fx. These platforms are a go-to for many AICPA members, underscoring their established credibility and widespread adoption.

While the broader tax software market might not be experiencing explosive growth, these established solutions are powerhouses for recurring revenue and predictable cash flow. For instance, in 2023, Wolters Kluwer's Health division, which includes some of its software offerings, saw a 7% organic revenue increase, highlighting the consistent performance of its established software assets.

The company isn't resting on its laurels; it's actively integrating AI into these mature platforms. This strategic enhancement ensures CCH Axcess Tax and CCH ProSystem fx remain competitive and profitable by meeting evolving user needs in a well-established market.

Wolters Kluwer's subscription models are a significant driver of its financial stability, with recurring revenue accounting for a substantial 82% of its total revenues in 2024. This segment experienced a healthy 7% organic growth, underscoring the strong demand and customer loyalty.

The high percentage of recurring revenue, primarily from subscriptions across its diverse business units, signals a predictable and consistent cash flow. This predictability is a hallmark of strong Cash Cows, requiring minimal additional investment to maintain their market position.

These subscription-based revenue streams, particularly within Wolters Kluwer's more established markets, are designed for sustained cash generation. The predictable nature of these cash flows allows for efficient capital allocation, as less is needed for aggressive marketing or market penetration efforts.

Wolters Kluwer's traditional information and research platforms are its bedrock, consistently generating significant revenue across healthcare, legal, and tax domains. These established services, while not experiencing the hyper-growth of newer digital offerings, represent a stable income source.

In 2024, these platforms continue to be indispensable tools for professionals, solidifying their demand in mature markets. For example, their legal research databases are critical for legal professionals, ensuring ongoing subscription revenue.

Financial Services Compliance Solutions (excluding FRR)

Wolters Kluwer's Financial Services Compliance Solutions, excluding FRR, are a classic cash cow. This segment, encompassing U.S. banking compliance and corporate legal and compliance services, holds a dominant market share in a mature, highly regulated environment. The strategic divestment of their Finance, Risk and Regulatory Reporting (FRR) unit underscores a concentrated effort on these core, cash-generating compliance areas.

This focus on stable, high-market-share businesses within regulated sectors is a hallmark of cash cow strategies. For instance, the U.S. financial services industry faces continuous regulatory evolution, creating a persistent demand for compliance solutions. Wolters Kluwer's established presence and comprehensive offerings in this space allow them to generate substantial and reliable cash flows.

- High Market Share: Wolters Kluwer's U.S. banking compliance and corporate legal services are leaders in their respective fields.

- Mature Market: The demand for compliance solutions in financial services is consistent due to ongoing regulatory requirements.

- Divestment Strategy: Exiting FRR sharpens the company's focus on these predictable, cash-generating assets.

- Stable Cash Flows: These businesses are expected to provide a steady stream of income, supporting other company initiatives.

Certain On-Premise Software Licenses and Print Publications

Certain on-premise software licenses and print publications, while not the primary growth engines for Wolters Kluwer, still represent a stable revenue source. These offerings are in mature markets, meaning their growth potential is limited, but they benefit from established customer bases.

Despite the shift towards cloud-based solutions, these legacy products continue to generate consistent cash flow. For instance, while Wolters Kluwer's digital offerings are expanding rapidly, their print publications and older software versions still capture a segment of the market that values traditional formats or requires specific on-premise functionalities. This cash generation, though potentially lower than cloud services, supports overall company operations and investment in newer ventures.

- Mature Market Presence: These products serve established segments where Wolters Kluwer holds significant market share, providing a reliable, albeit slower-growing, revenue stream.

- Cash Flow Contribution: Despite lower growth prospects, these offerings remain important contributors to the company's overall cash flow, funding innovation in other areas.

- Customer Retention: Existing customer loyalty and the continued need for specific functionalities in certain on-premise software and print formats ensure ongoing revenue generation.

Wolters Kluwer's Tax & Accounting software, like CCH Axcess Tax, represents a strong cash cow. These established platforms, used by a significant portion of AICPA members, provide predictable recurring revenue. In 2023, the company's Health division, which includes software, saw a 7% organic revenue increase, demonstrating the consistent performance of its mature software assets.

The company's subscription models are a cornerstone of its financial stability, with recurring revenue making up 82% of its total revenues in 2024, experiencing 7% organic growth. This high percentage of predictable income, particularly from established markets, signifies robust cash cows that require minimal investment to maintain their position.

Wolters Kluwer's financial services compliance solutions, excluding the divested FRR unit, are prime examples of cash cows. These services, dominant in mature, regulated sectors like U.S. banking compliance, generate substantial and reliable cash flows due to persistent demand driven by regulatory evolution.

Mature offerings such as certain on-premise software licenses and print publications, while not growth drivers, contribute stable cash flow from established customer bases. These legacy products, despite the market shift to cloud, continue to generate consistent income, supporting overall operations and investment in newer ventures.

| Business Segment | BCG Matrix Category | Key Characteristics | 2024 Revenue Contribution (Est.) | Growth Outlook |

| Tax & Accounting Software (e.g., CCH Axcess Tax) | Cash Cow | High market share, recurring revenue from subscriptions, mature market | Significant | Low to Moderate |

| Financial Services Compliance Solutions | Cash Cow | Dominant market share in regulated sectors, consistent demand | Significant | Low to Moderate |

| On-premise Software & Print Publications | Cash Cow | Established customer base, stable revenue streams | Moderate | Low |

What You’re Viewing Is Included

Wolters Kluwer BCG Matrix

The Wolters Kluwer BCG Matrix report you are previewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no alterations—just the complete, analysis-ready strategic tool delivered directly to you. You can trust that the insights and structure presented here are precisely what you'll utilize for your business planning and decision-making. Rest assured, this preview accurately represents the professional-grade BCG Matrix you'll instantly download and can immediately apply.

Dogs

Wolters Kluwer is divesting its Finance, Risk and Regulatory Reporting (FRR) unit to Regnology Group GmbH. This strategic move, with an expected completion in fall 2025, signals a shift in focus for Wolters Kluwer.

In 2024, the FRR unit brought in €123 million in revenue, accounting for roughly 10% of the Financial & Corporate Compliance division's total earnings. This divestment highlights the unit's classification as a lower-growth, lower-return asset within the company's portfolio.

The FRR unit required substantial cash investment to keep pace with evolving regulatory demands. This ongoing need for capital, coupled with its growth and return profile, made it a logical candidate for sale, allowing Wolters Kluwer to reallocate resources more effectively.

Traditional on-premise software, especially those lagging in cloud migration, are showing signs of being in a low-growth phase. This is evidenced by recurring cloud software surpassing on-premise software revenues for the first time in 2024, highlighting a significant market shift.

The strategic emphasis on cloud-first initiatives means these legacy systems, if not actively transitioning, risk declining market share and could become financial burdens. Companies are increasingly viewing these as potential divestment candidates if they cannot adapt to the cloud-centric landscape.

Wolters Kluwer's print books and print journals are experiencing a significant downturn. Revenue trends for these traditional formats reversed to historic rates of decline in Q1 2025, signaling a tough market. This suggests a low-growth environment where their market share is shrinking as more professionals shift to digital information sources.

These print products likely generate very little new cash. They may also require continuous investment for upkeep without yielding substantial returns. Consequently, print books and journals fit squarely into the 'Dog' quadrant of the BCG Matrix, representing a business segment with low growth and low market share.

Products with Discontinuations or Slowing Growth in Mature Segments

In Q1 2025, Wolters Kluwer identified product discontinuations within its Clinical Solutions segment. This indicates a strategic move away from older offerings that may no longer align with market demands or are being phased out.

Certain areas, such as Learning, Research & Practice, experienced slower organic growth compared to robust performance in previous periods. This deceleration is often seen in mature segments where innovation cycles lengthen or competition intensifies.

Products falling into the 'Dogs' category of the BCG matrix are characterized by low returns in low-growth markets. These are typically older products facing obsolescence due to market shifts or competitive pressures, and have not been sufficiently revitalized to regain market share or relevance. For instance, if a legacy software platform in the Learning segment sees declining user adoption and minimal new feature development, it would likely be classified as a Dog.

- Clinical Solutions Segment: Noted 'product discontinuations' in Q1 2025.

- Learning, Research & Practice: Experienced slower organic growth against strong prior periods.

- Dog Category Characteristics: Low returns in low-growth segments, facing obsolescence or competitive pressure.

- Example: Legacy software platforms with declining user adoption and minimal updates.

Certain Non-Recurring Software Licenses and Implementation Services

Certain non-recurring software licenses and implementation services experienced a 6% organic decline in Q1 2025. This downturn reflects a strategic shift by Wolters Kluwer away from perpetual licenses and towards its cloud-based, recurring revenue models. Such a segment, characterized by low growth and potentially declining market share, would be classified as a Cash Cow.

These Cash Cows, while not driving significant future growth, still generate substantial cash flow. This cash can then be reinvested into more promising areas of the business, such as their Stars products. The company's focus on cloud migration is a key factor in this market evolution.

- Organic decline: 6% in Q1 2025 for non-recurring licenses and implementation services.

- Strategic shift: Company moving towards recurring cloud-based models.

- BCG Matrix classification: This segment would be considered a Cash Cow due to low growth and cash generation.

- Implication: Cash generated can be used to fund growth in other business areas.

Products classified as Dogs in the BCG Matrix are those with low market share in low-growth industries. Wolters Kluwer's print books and journals fit this description, as their revenue trends reversed to historic rates of decline in Q1 2025. The FRR unit, with €123 million in revenue in 2024 but requiring significant investment and showing lower growth, also aligns with the characteristics of a Dog. These segments often require ongoing investment without substantial returns, making them candidates for divestment.

| Business Segment | BCG Category | Key Indicators | Rationale |

| Print Books & Journals | Dog | Revenue trends reversed to historic rates of decline (Q1 2025) | Low growth, shrinking market share due to shift to digital. Low returns, potential for divestment. |

| Finance, Risk & Regulatory Reporting (FRR) Unit | Dog | €123 million revenue (2024), 10% of divisional earnings | Low growth, lower return asset requiring substantial cash investment for regulatory compliance. Divested to Regnology Group GmbH in fall 2025. |

Question Marks

Wolters Kluwer is significantly investing in Generative AI (GenAI), rolling out new capabilities like CCH AnswerConnect Gen AI and AI-driven upgrades for UpToDate. These advancements target high-growth potential in nascent AI markets, but their market share is still in its early stages, necessitating considerable investment to establish a strong foothold and demonstrate long-term value.

Wolters Kluwer's acquisition of Registered Agent Solutions, Inc. (RASi) in March 2025 for €387 million positions RASi as a potential question mark within the BCG matrix. RASi's 2024 revenue of approximately $52 million indicates a solid existing business, but its recent integration means its long-term strategic fit and growth trajectory within Wolters Kluwer are still under evaluation.

Wolters Kluwer is proactively developing and launching solutions to help clients navigate complex new regulations, including the U.S. Corporate Transparency Act and the E.U. Corporate Sustainability Reporting Directive (CSRD). These offerings are designed to meet the increasing demand for compliance tools as new mandates take effect.

The market adoption for these regulatory solutions is currently in its nascent stages, reflecting the early phases of these evolving compliance landscapes. Significant strategic investment is crucial for Wolters Kluwer to solidify its position and achieve substantial market penetration in these developing areas.

Expansion into New Geographical Markets or Adjacent Segments via M&A or Organic Growth

Wolters Kluwer's strategic focus on accelerating growth through partnerships and exploring adjacent opportunities, including potential M&A or organic expansion, directly aligns with the "Question Mark" quadrant of the BCG Matrix. This involves venturing into new geographical markets or product segments where the company might have a low initial market share but anticipates high future growth.

For instance, Wolters Kluwer's reported revenue for the first quarter of 2024 reached €1.5 billion, demonstrating a solid financial base to support such strategic initiatives. The company has consistently invested in innovation and market expansion, as evidenced by its ongoing digital transformation efforts and acquisitions in areas like regulatory compliance and health informatics.

- Strategic Expansion: Pursuing new geographical markets or adjacent segments represents a classic "Question Mark" strategy, requiring significant investment to capture nascent market potential.

- Growth Potential: Success in these ventures could transform them into "Stars," driving substantial future revenue and market leadership for Wolters Kluwer.

- Investment Needs: These initiatives demand careful resource allocation and strategic planning to overcome initial low market share and high operational costs.

- Market Dynamics: The success hinges on accurately assessing market growth rates and competitive landscapes to ensure investments yield desired returns.

Innovation in Retail Pharmacy and Medication Surveillance

Wolters Kluwer's healthcare division anticipates significant innovation in retail pharmacy, medication surveillance, and pharmacy compliance by 2025, largely fueled by advancements in artificial intelligence. These sectors are poised for substantial growth as new AI-driven solutions are introduced and scaled within the market.

These areas represent emerging frontiers for AI integration, where current market share for specific products might still be developing. Consequently, they are strategic investment opportunities to secure substantial future market positions.

- AI-Powered Retail Pharmacy: Expect enhanced patient engagement through personalized recommendations and streamlined prescription management, potentially boosting customer loyalty and sales.

- Advanced Medication Surveillance: AI will enable proactive identification of adverse drug events and drug interactions, improving patient safety and reducing healthcare costs. For instance, by mid-2024, AI tools are already being piloted to analyze electronic health records for early detection of potential patient risks.

- Enhanced Pharmacy Compliance: Automation of regulatory checks and reporting through AI can significantly reduce administrative burdens and minimize compliance errors for pharmacies.

Question Marks in Wolters Kluwer's portfolio represent ventures with high growth potential but currently low market share. These are areas where the company is investing heavily to establish a future leadership position. Success in these segments could transform them into Stars, but they also carry a higher risk of not gaining sufficient traction, potentially becoming Dogs if market growth falters or competition proves too intense.

The company's foray into Generative AI solutions and its acquisition of Registered Agent Solutions, Inc. (RASi) are prime examples of Question Marks. While RASi reported approximately $52 million in revenue for 2024, its integration into Wolters Kluwer is recent, making its long-term market share and growth trajectory uncertain. Similarly, AI-driven healthcare innovations, while promising significant growth, are still in early market adoption phases.

Wolters Kluwer's strategic investments in new regulatory compliance areas, such as those driven by the U.S. Corporate Transparency Act and the E.U. CSRD, also fall into the Question Mark category. These markets are nascent, requiring substantial investment to build share against evolving landscapes and competitive pressures. The company's first-quarter 2024 revenue of €1.5 billion provides the financial backing for these strategic bets.

| Business Area | Market Growth Potential | Current Market Share | Investment Strategy | Potential Outcome |

|---|---|---|---|---|

| Generative AI Solutions | High | Low | Significant Investment, Product Development | Star or Dog |

| Registered Agent Solutions, Inc. (RASi) | Moderate to High (post-integration) | Developing | Integration, Market Penetration | Star or Dog |

| New Regulatory Compliance Tools (e.g., CSRD) | High | Low | Strategic Investment, Market Education | Star or Dog |

| AI in Retail Pharmacy & Medication Surveillance | High | Developing | Innovation, Partnerships | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of proprietary market research, financial statements, and industry-specific growth projections to provide a comprehensive view of portfolio performance.