Whole Earth Brands SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Whole Earth Brands Bundle

Whole Earth Brands possesses a unique blend of established brands and a growing focus on health-conscious consumers, presenting significant market opportunities. However, navigating evolving consumer preferences and competitive pressures requires a deeper understanding of their strategic positioning.

Want the full story behind Whole Earth Brands' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Whole Earth Brands' strength lies in its direct connection to prevailing health trends, with a business model built around healthier food and beverage options like plant-based sweeteners and zero-sugar products. This focus resonates strongly with consumers increasingly prioritizing wellness. For instance, the global market for plant-based foods was valued at approximately $44.1 billion in 2022 and is projected to reach $162.2 billion by 2030, demonstrating a significant growth trajectory that Whole Earth Brands is well-positioned to capitalize on.

Whole Earth Brands boasts a strong lineup of recognized brands including Equal, Whole Earth, Pure Via, Wholesome, Swerve, and Canderel. This diversification enables the company to serve a broad spectrum of consumer tastes within the growing healthier sweetener and food markets. For instance, in Q1 2024, Whole Earth Brands reported net sales of $110.7 million, with its sweetener segment showing particular resilience.

Whole Earth Brands boasts an established global distribution network, recognized as the largest provider of plant-based sweeteners, reaching over 100 countries. This expansive reach is a critical strength, ensuring broad product availability and a significant competitive edge in diverse markets.

Commitment to Product Innovation

Whole Earth Brands demonstrates a strong commitment to product innovation, consistently developing new offerings to meet shifting consumer preferences. Their focus on an innovative pipeline addresses the growing demand for diverse dietary options, including baking ingredients and a wider range of taste profiles. This dedication to continuous development is key to maintaining relevance and competitiveness in a fast-paced market.

The company's innovation efforts are particularly geared towards healthier food solutions, a critical area for achieving sustained growth and adapting to evolving consumer needs. For instance, the company has been actively expanding its portfolio in the sweetener category, a segment that saw significant growth driven by health-conscious consumers. In 2023, the global market for natural sweeteners was valued at over $12 billion, with projected compound annual growth rates indicating strong future demand for innovative products in this space.

- Focus on evolving consumer demand for diverse dietary options and taste profiles.

- Continuous product development to maintain market relevance and competitiveness.

- Innovation in healthier food solutions is vital for sustained growth.

- Expansion in high-growth segments like natural sweeteners supports innovation strategy.

Benefits of Private Ownership

Following its acquisition by an affiliate of Sababa Holdings FREE, LLC in 2024, Whole Earth Brands now operates as a privately held entity. This shift can shield the company from the intense scrutiny and market fluctuations often associated with public trading, which saw Whole Earth Brands' stock price experience significant volatility in the preceding years.

Private ownership allows Whole Earth Brands to prioritize long-term strategic goals and investments. This focus can be more effective away from the immediate pressure of quarterly earnings reports and the demands of public shareholders, fostering a more stable environment for growth initiatives.

The benefits of this private status include:

- Reduced Public Scrutiny: Less pressure from quarterly earnings calls and analyst expectations.

- Long-Term Focus: Ability to invest in strategic initiatives without immediate market reaction.

- Flexibility: Greater agility in decision-making and capital allocation.

Whole Earth Brands' primary strength is its alignment with the growing consumer demand for healthier food and beverage options, particularly in the sweetener and plant-based categories. This strategic focus is supported by a robust portfolio of well-recognized brands such as Equal, Whole Earth, and Canderel, which cater to a wide range of consumer preferences. The company's global distribution network, reaching over 100 countries, further solidifies its market position.

The company's commitment to innovation is evident in its continuous development of new products designed to meet evolving dietary needs and taste profiles. This includes expanding offerings in areas like natural sweeteners and baking ingredients, tapping into a market that saw global valuations exceeding $12 billion in 2023. This dedication to innovation is crucial for maintaining competitiveness and driving sustained growth.

Operating as a privately held entity since its acquisition in 2024, Whole Earth Brands benefits from reduced public scrutiny and increased flexibility. This allows the company to concentrate on long-term strategic investments and growth initiatives without the immediate pressures of public market expectations, fostering a more stable environment for development.

What is included in the product

Delivers a strategic overview of Whole Earth Brands’s internal and external business factors, highlighting its brand portfolio, market position, and potential growth avenues amidst competitive pressures and evolving consumer preferences.

Provides a clear, actionable SWOT analysis for Whole Earth Brands, highlighting key vulnerabilities and opportunities to alleviate strategic uncertainty.

Weaknesses

Whole Earth Brands faced a challenging financial period leading up to its privatization. For the first nine months of fiscal year 2023, the company reported consolidated product revenues that remained largely unchanged, indicating a lack of significant sales growth.

Furthermore, during the same period, consolidated adjusted EBITDA saw a decline. This drop in profitability suggests that the company was struggling to maintain its earnings power, potentially due to rising costs or increased competition.

Whole Earth Brands faces a significant weakness in its increased debt load following its acquisition by Sweet Oak. As of March 31, 2024, the company reported $422.4 million in long-term debt, with an additional $69 million drawn on its revolving credit facility. This substantial financial leverage, amplified by the $862 million in senior secured financing used to support the acquisition, could constrain future capital allocation for growth initiatives and heighten overall financial vulnerability.

Whole Earth Brands faces a significant challenge with 242 active competitors in the sweetener processing industry. This high level of competition can put downward pressure on pricing, potentially impacting profit margins.

The crowded market necessitates substantial investment in marketing and product innovation to stand out and maintain market share. Without continuous differentiation, Whole Earth Brands risks losing ground to rivals.

Vulnerability to Supply Chain Issues

Whole Earth Brands' vulnerability to supply chain disruptions is a significant weakness, a factor that contributed to its decision to go private. As a global food company, it faces inherent risks in sourcing raw materials, manufacturing, and getting products to market. These global supply chain challenges, exacerbated by inflation, can directly impact its operational costs and product availability.

The company's reliance on a global network means it's susceptible to events like port congestion, shipping delays, and fluctuations in commodity prices. For instance, in 2023, many food manufacturers experienced increased costs for key ingredients due to these persistent issues. This susceptibility can lead to:

- Increased Cost of Goods Sold: Higher prices for raw materials and transportation directly reduce profit margins.

- Production Inefficiencies: Delays in receiving necessary components can halt or slow down manufacturing processes.

- Product Shortages and Stockouts: Inability to secure sufficient ingredients or manage logistics can lead to empty shelves for consumers and lost sales opportunities.

Integration Challenges Post-Merger

Whole Earth Brands faces significant integration challenges following its acquisition by Ozark Holdings, LLC (now Sweet Oak Parent) in early 2024. Merging disparate operational systems, distinct corporate cultures, and potentially conflicting strategic roadmaps requires meticulous planning and execution. This process can be lengthy and resource-intensive, impacting short-term efficiency and profitability.

Key hurdles in this integration phase include:

- Operational Streamlining: Consolidating supply chains, IT infrastructure, and administrative functions from both Whole Earth Brands and the acquired entities presents a complex task to achieve economies of scale and operational synergy.

- Talent Retention: Ensuring the retention of key personnel from both organizations is crucial for maintaining institutional knowledge and driving the combined business forward. Uncertainty during mergers often leads to employee attrition.

- Cultural Alignment: Bridging cultural differences between the merging companies is vital for fostering collaboration and a unified approach to business strategy. A mismatch in cultures can impede effective decision-making and execution.

Whole Earth Brands' significant debt load, with $422.4 million in long-term debt and an additional $69 million drawn on its revolving credit facility as of March 31, 2024, presents a major weakness. This leverage, stemming from the acquisition financing, could restrict future investments in growth and increase financial risk.

The company operates in a highly competitive sweetener processing market with 242 active competitors, which can suppress pricing and profit margins. This necessitates substantial investment in differentiation to maintain market share.

Whole Earth Brands is also vulnerable to global supply chain disruptions, a factor that contributed to its privatization. Inflation and logistical challenges in 2023 impacted ingredient costs and product availability for many food manufacturers, directly affecting operational efficiency and profitability.

Integration challenges following the acquisition by Sweet Oak Parent are a key weakness, involving the complex merging of operations, cultures, and strategies, which can be resource-intensive and impact short-term performance.

Same Document Delivered

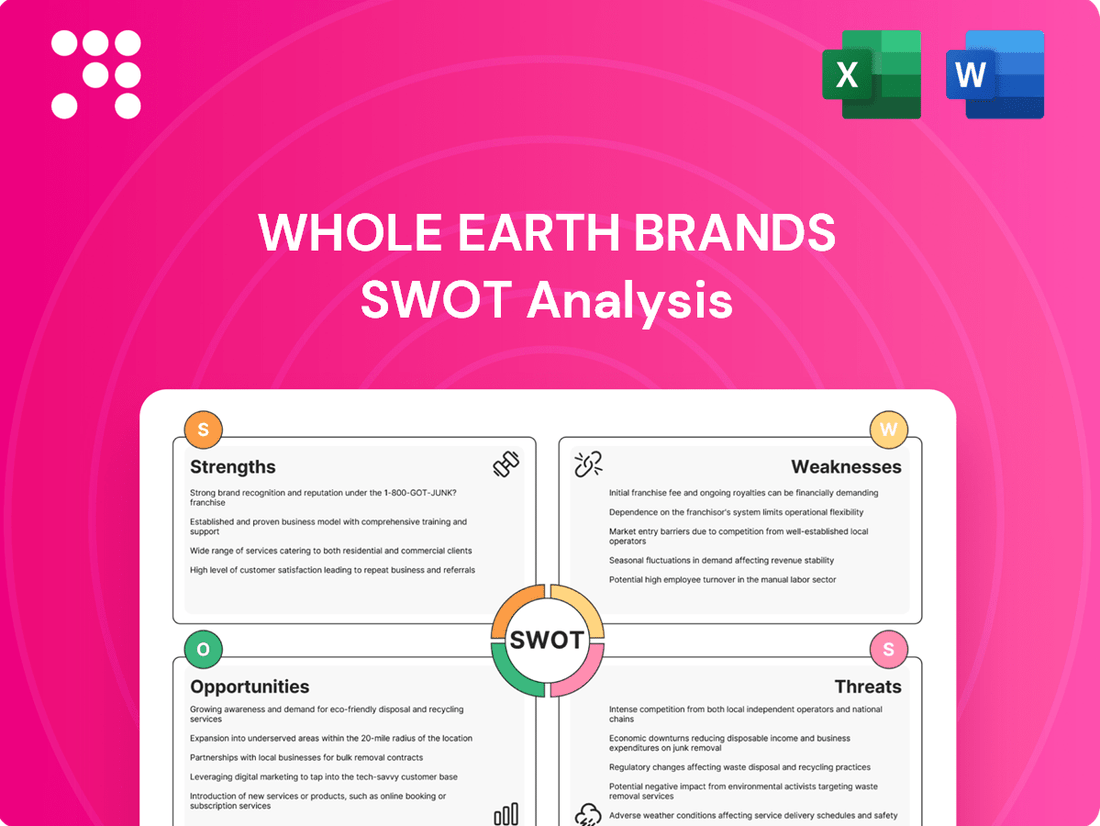

Whole Earth Brands SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Whole Earth Brands' Strengths, Weaknesses, Opportunities, and Threats, providing actionable insights.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive understanding of Whole Earth Brands' strategic position.

Opportunities

The global health and wellness market is booming, expected to hit almost $14 trillion by 2032. This surge is driven by consumers actively seeking better health and prioritizing well-being, leading them to functional foods and natural ingredients.

Whole Earth Brands is strategically positioned to leverage this powerful consumer demand. By offering products that cater to these evolving preferences for healthier options and natural components, the company can effectively tap into this expanding market.

Under private ownership, Whole Earth Brands can pursue strategic acquisitions with greater agility, potentially expanding its product range or market presence. For instance, its acquisition history includes brands like Swerve and Wholesome Sweeteners, demonstrating a strategy to broaden its portfolio.

Forming key partnerships can also unlock new market segments or bolster its existing clean label and plant-based product lines. This flexibility under private ownership allows for more focused investment in growth opportunities, aligning with evolving consumer preferences for healthier options.

The transition to private ownership offers Whole Earth Brands a significant opportunity to bolster its research and development (R&D) initiatives. Without the quarterly pressures of public market expectations, the company can strategically allocate more capital towards innovation, potentially accelerating the launch of new plant-based sweeteners and flavor enhancers. This increased R&D focus is crucial for developing clean label products that align with evolving consumer demands for healthier and more sustainable options, thereby creating a competitive edge in the market.

Global Market Penetration

Whole Earth Brands' existing global distribution network, which reaches over 100 countries, presents a significant opportunity to increase its foothold in current markets and venture into new, rapidly expanding international territories. This extensive reach is a powerful asset for future global growth.

By adapting its product offerings to align with local tastes and capitalizing on worldwide health and wellness trends, the company can tap into substantial growth potential. For instance, in 2023, the global health and wellness market was valued at over $5.1 trillion, with emerging markets showing particularly strong growth trajectories.

- Deepen Penetration: Leverage the established network to gain greater market share in over 100 existing countries.

- Expand Reach: Target high-growth emerging markets where consumer demand for health-focused products is increasing.

- Product Localization: Tailor product formulations and marketing to resonate with diverse cultural preferences and dietary habits.

- Leverage Trends: Capitalize on global shifts towards natural sweeteners and plant-based ingredients, areas where Whole Earth Brands has a strong portfolio.

Responding to Specific Dietary Trends

Emerging health and nutrition trends for 2025, such as the focus on 'Nutrition Forward' and 'Natural Well-Being,' present clear opportunities for Whole Earth Brands. These trends highlight a growing consumer interest in proactive health management and the use of natural ingredients.

Whole Earth Brands can further innovate within categories like gut health, protein power-ups, and natural sweeteners to capitalize on these trends. For instance, the global gut health market was valued at approximately $50 billion in 2023 and is projected to grow significantly, offering a prime area for new product development. Similarly, the demand for plant-based protein alternatives continues to surge, with the market expected to reach over $70 billion by 2027.

- Capitalize on 'Nutrition Forward' trends by developing fortified products.

- Leverage 'Natural Well-Being' preferences through ingredient transparency and sourcing.

- Expand into gut health solutions with innovative probiotic and prebiotic offerings.

- Innovate in protein-enhanced products catering to the growing plant-based and active lifestyle segments.

Developing products that specifically address these nuanced consumer demands can capture new market segments and drive revenue growth for Whole Earth Brands, aligning with the projected expansion of the global functional foods market, which is anticipated to exceed $300 billion by 2027.

Whole Earth Brands has a strong opportunity to capitalize on the booming global health and wellness market, which was valued at over $5.1 trillion in 2023. Its existing distribution network reaching over 100 countries allows for deepening penetration in current markets and expanding into high-growth emerging territories. The company can also leverage evolving consumer trends like 'Nutrition Forward' and 'Natural Well-Being' by innovating in areas such as gut health and plant-based protein, tapping into markets projected for significant growth.

| Opportunity Area | Market Trend/Data Point | Whole Earth Brands' Advantage |

|---|---|---|

| Global Health & Wellness Market | Valued at over $5.1 trillion in 2023; expected to grow significantly. | Positioned to meet increasing consumer demand for healthier options. |

| Emerging Market Expansion | Emerging markets show strong growth trajectories for health-focused products. | Extensive global distribution network (100+ countries) can be leveraged. |

| Product Innovation & Trends | 'Nutrition Forward' and 'Natural Well-Being' trends; gut health market ~ $50 billion (2023); plant-based protein market > $70 billion (2027 proj.). | Ability to innovate in plant-based sweeteners, flavor enhancers, and functional ingredients. |

| Private Ownership Agility | Allows for focused investment in R&D and strategic acquisitions. | Can accelerate development of new clean label and plant-based products. |

Threats

Whole Earth Brands operates in a fiercely competitive food industry, especially within the healthier alternatives and sweeteners niche. Established giants and nimble startups alike are vying for consumer attention, creating a challenging landscape. This intense rivalry can trigger price wars and necessitate higher marketing investments to stand out.

For instance, the global sugar substitute market, a key area for Whole Earth Brands, was valued at approximately $10.5 billion in 2023 and is projected to grow, indicating significant competitive activity. To combat this, the company must consistently innovate its product offerings and cultivate a distinct brand identity to retain and grow its market share.

Consumer tastes are always changing, and while healthier options are generally popular, the specifics can shift quickly. For example, the increasing use of GLP-1 weight loss medications is anticipated to alter food consumption patterns, potentially affecting demand for particular diet-centric items.

Whole Earth Brands needs to be nimble, adjusting its product innovation and promotional approaches to keep pace with these dynamic shifts in consumer desires. This agility is crucial for maintaining relevance and market share in a competitive landscape.

Whole Earth Brands faces significant threats from the food and beverage industry's dynamic regulatory landscape, particularly concerning ingredients and health claims. For instance, the ongoing debate and potential new classifications around artificial versus natural sweeteners could directly impact their core product offerings, requiring costly adjustments. The company must also navigate the complexities of international regulations, which vary widely across markets and can necessitate significant product and labeling modifications to ensure compliance.

Input Cost Volatility

Whole Earth Brands, operating in the food sector, faces significant challenges due to the volatility of input costs. Fluctuations in the prices of key ingredients, such as plant-based components and natural extracts, directly impact its operational expenses. For instance, the cost of sugar, a primary ingredient for many sweeteners, saw considerable price increases in late 2023 and early 2024, driven by weather patterns affecting crop yields in major producing regions.

Global supply chain disruptions and persistent inflation further exacerbate these cost pressures, squeezing production expenses and potentially narrowing gross margins. Companies like Whole Earth Brands must navigate these economic headwinds, which can erode profitability if not proactively managed.

- Raw Material Price Swings: The company is susceptible to unpredictable price changes for plant-based ingredients and natural extracts, impacting its cost of goods sold.

- Inflationary Impact: Rising general inflation in 2024 continues to affect the cost of packaging, transportation, and labor, adding to overall production expenses.

- Margin Erosion Risk: Without effective pricing adjustments or hedging strategies, volatile input costs can directly reduce Whole Earth Brands' profit margins.

- Supply Chain Vulnerability: Geopolitical events and climate-related issues can disrupt the availability and cost of essential raw materials, posing a continuous threat.

Economic Uncertainties and Inflation

Broader economic shifts, including rising inflation and increased consumer price sensitivity, present a significant challenge for Whole Earth Brands. As the cost of living rises, consumers, especially those with tighter budgets, may cut back on discretionary spending, including premium or specialized health-focused products. This could directly affect the company's sales volumes and force strategic pricing adjustments, potentially squeezing profit margins.

For instance, the U.S. Consumer Price Index (CPI) saw a notable increase, with inflation reaching 3.4% year-over-year as of April 2024, according to the Bureau of Labor Statistics. This economic backdrop means consumers are more likely to scrutinize purchases, potentially opting for lower-cost alternatives over Whole Earth Brands' offerings.

- Inflationary Pressures: Persistent inflation erodes consumer purchasing power, making premium products like those offered by Whole Earth Brands more susceptible to demand reduction.

- Consumer Spending Habits: Economic downturns typically lead consumers to prioritize essential goods, impacting sales for non-essential or premium health and wellness items.

- Pricing Strategy Impact: The need to potentially lower prices to remain competitive in a price-sensitive market could negatively affect the company's profitability and margins.

Whole Earth Brands faces intense competition from both established food giants and emerging brands in the health-focused sweetener market, a sector valued at over $10.5 billion in 2023. Shifting consumer preferences, such as the growing adoption of GLP-1 medications, could also alter demand for diet-centric products, requiring agile product development and marketing strategies to maintain relevance.

The company must also contend with volatile input costs, exemplified by sugar price surges in late 2023 and early 2024 due to adverse weather impacting crop yields. Persistent inflation on packaging, transport, and labor further squeezes margins, while supply chain disruptions remain a constant threat to raw material availability and cost.

Broader economic pressures, including a 3.4% year-over-year CPI increase in the U.S. as of April 2024, reduce consumer purchasing power. This heightened price sensitivity could lead shoppers to favor lower-cost alternatives over Whole Earth Brands' premium offerings, potentially impacting sales volume and forcing difficult pricing decisions.

| Threat Category | Specific Challenge | Potential Impact | Example/Data Point (2023-2024) |

|---|---|---|---|

| Competition | Rivalry in sweetener market | Price wars, increased marketing costs | Global sugar substitute market valued at ~$10.5 billion (2023) |

| Consumer Preferences | Evolving tastes, impact of weight-loss drugs | Reduced demand for certain products | Increased interest in GLP-1 medications affecting food consumption patterns |

| Input Costs | Raw material price volatility, inflation | Higher production expenses, margin erosion | Sugar price increases in late 2023/early 2024; U.S. CPI at 3.4% (April 2024) |

| Economic Environment | Inflationary pressures, price sensitivity | Lower sales volume, pressure on pricing strategy | Consumers prioritizing essentials due to rising cost of living |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of publicly available financial statements, comprehensive market research reports, and credible industry news to provide a well-rounded view of Whole Earth Brands' strategic position.