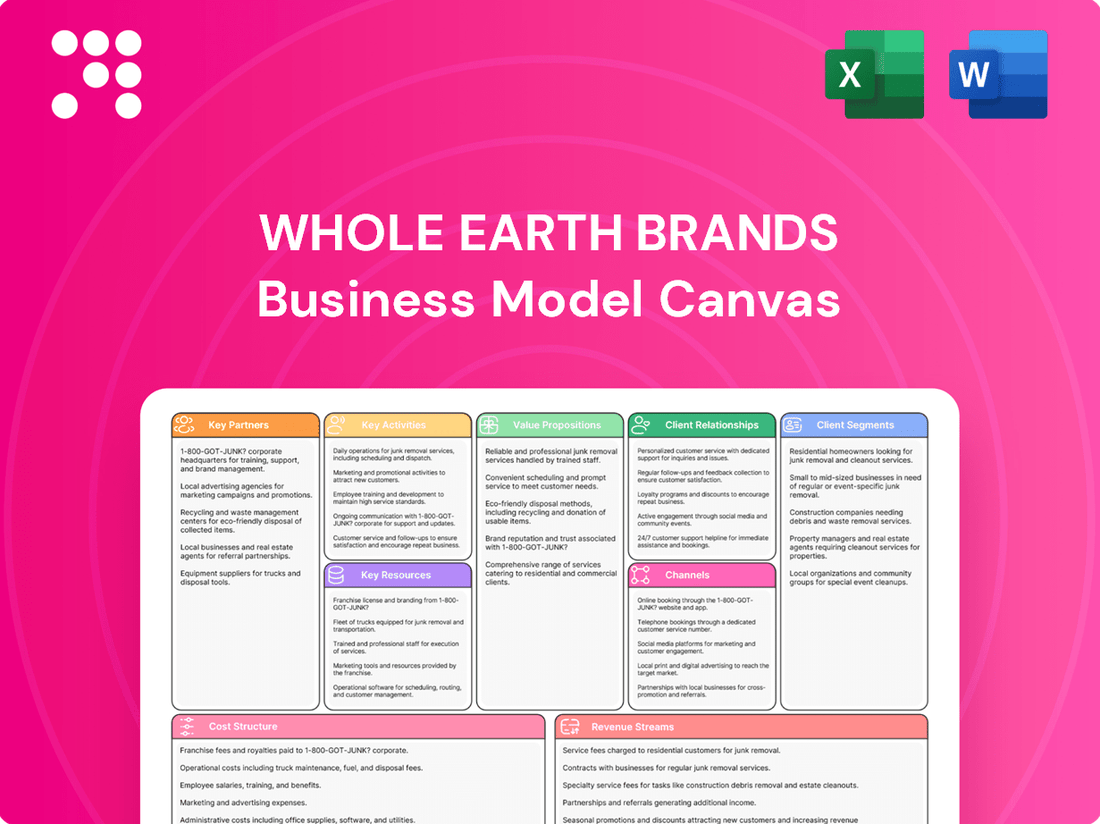

Whole Earth Brands Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Whole Earth Brands Bundle

Unlock the strategic blueprint behind Whole Earth Brands's business model with our comprehensive Business Model Canvas. Discover how they create and deliver value, engage customers, and manage resources to achieve market success. This detailed analysis is perfect for anyone looking to understand the mechanics of a thriving consumer goods company.

Dive deeper into Whole Earth Brands’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Whole Earth Brands has entered into a definitive agreement for its acquisition by Ozark Holdings, LLC, an affiliate of Sababa Holdings FREE, LLC. This significant development, anticipated to finalize in the second quarter of 2024, represents a pivotal strategic partnership that will shape the company's future ownership and trajectory. The deal offers immediate cash liquidity to Whole Earth Brands' shareholders, aiming to deliver maximum value.

Whole Earth Brands’ success hinges on strong relationships with suppliers of key plant-based ingredients, such as stevia and monk fruit. These partnerships are crucial for securing a consistent supply of high-quality, natural sweeteners, which form the backbone of their product offerings. For instance, in 2024, the company continued to emphasize sourcing clean-label ingredients to meet growing consumer preferences for healthier food and beverage options.

The company actively manages its supply chain costs, including those associated with raw materials and freight, to maintain competitive pricing and profitability. This ongoing focus is essential for navigating market fluctuations and ensuring the cost-effectiveness of their natural sweetener solutions. In 2023, Whole Earth Brands reported that raw material and freight costs represented a significant portion of their cost of goods sold, underscoring the importance of these supplier relationships.

Whole Earth Brands relies heavily on its distribution and retail partners to make its healthier food options, including sweeteners, accessible worldwide. Collaborating with major retailers, supermarkets, and e-commerce platforms is key to this expansion. In 2023, the company's products reached consumers in over 90 countries, highlighting the critical role these partnerships play in its global strategy.

Research and Development Collaborators

Whole Earth Brands actively collaborates with food science institutes and ingredient technology firms to drive innovation in healthier food alternatives. These partnerships are crucial for developing novel plant-based sweeteners and clean-label solutions, ensuring products meet evolving consumer demands and regulatory requirements.

These research and development collaborations enable Whole Earth Brands to accelerate the creation of new products focused on taste, health, convenience, and value. For instance, in 2024, the company continued to invest in R&D to expand its portfolio of stevia-based sweeteners, aiming to capture a larger share of the growing global market for natural sweeteners, which was projected to reach over $10 billion by 2027.

- Food Science Institutes: Partnerships with universities and research centers to explore new extraction methods and ingredient functionalities.

- Ingredient Technology Firms: Collaborations to develop proprietary formulations for enhanced sweetness, mouthfeel, and stability in food applications.

- Academic Partners: Engaging with researchers to stay at the forefront of nutritional science and consumer behavior trends influencing food choices.

Logistics and Supply Chain Providers

Whole Earth Brands relies heavily on third-party logistics (3PL) providers to manage its global warehousing, transportation, and inventory. These partnerships are crucial for navigating complex supply chains and ensuring products reach diverse markets efficiently. For instance, in 2024, the company continued its focus on optimizing its supply chain operations to drive cost efficiencies across its segments.

These strategic alliances enable Whole Earth Brands to maintain product availability and meet consumer demand across its international footprint. The company’s commitment to supply chain optimization is a key driver for improving operational performance and supporting its growth strategies in 2024 and beyond.

- Global Reach: Partnerships with 3PL providers are vital for managing international shipping and customs, ensuring products are available worldwide.

- Efficiency Gains: Leveraging 3PL expertise helps streamline warehousing and transportation, reducing operational costs and improving delivery times.

- Supply Chain Resilience: Robust logistics networks are essential for mitigating disruptions and ensuring a consistent supply of goods, a focus for the company in 2024.

Whole Earth Brands' key partnerships extend to its strategic acquisition by Ozark Holdings, an affiliate of Sababa Holdings FREE, anticipated in Q2 2024, securing shareholder value. Crucially, the company partners with suppliers of natural sweeteners like stevia and monk fruit, essential for its product line. Furthermore, collaborations with food science institutes and technology firms drive innovation in healthier food alternatives, with R&D investments continuing in 2024 to expand its stevia portfolio.

| Partnership Type | Key Activities | Impact/Focus |

|---|---|---|

| Acquisition Partner | Ozark Holdings, LLC (affiliate of Sababa Holdings FREE, LLC) | Strategic ownership change, expected Q2 2024; aims to deliver shareholder value. |

| Ingredient Suppliers | Stevia and monk fruit producers | Ensuring consistent supply of high-quality, natural sweeteners; focus on clean-label ingredients in 2024. |

| Innovation Collaborators | Food science institutes, ingredient technology firms | Developing novel plant-based sweeteners and clean-label solutions; R&D focus on stevia expansion in 2024. |

What is included in the product

This Whole Earth Brands Business Model Canvas offers a strategic overview, detailing customer segments, value propositions, and channels to serve a global consumer base with plant-based food and beverage products.

It provides a comprehensive framework of revenue streams, key resources, and activities, outlining the operational and financial structure of Whole Earth Brands' market approach.

Whole Earth Brands' Business Model Canvas offers a structured approach to pinpoint and address strategic weaknesses, acting as a powerful tool for clarifying and resolving complex business challenges.

By visually mapping out key business elements, the Whole Earth Brands Business Model Canvas simplifies the identification of operational inefficiencies and market gaps, thereby alleviating pain points in strategy development.

Activities

Whole Earth Brands' key activity revolves around developing new and improved plant-based sweeteners, zero- and low-sugar options, and other clean label products. This commitment to innovation is driven by continuous research into natural ingredients and advanced formulation techniques.

The company actively invests in its product pipeline to cater to the escalating consumer demand for healthier food and beverage choices. For instance, in 2023, Whole Earth Brands launched several new SKUs, expanding its portfolio of stevia-based sweeteners and sugar alternatives.

Whole Earth Brands actively manages the manufacturing and production of its wide range of branded goods, which prominently feature sweeteners and flavor enhancers. This crucial activity encompasses the oversight of their production facilities, rigorous quality assurance protocols, and the continuous refinement of manufacturing processes to ensure efficient fulfillment of market needs.

The company’s operational structure, divided into Branded Consumer Packaged Goods (CPG) and Flavors & Ingredients segments, both rely heavily on sophisticated manufacturing and production capabilities. For instance, in 2023, Whole Earth Brands reported net sales of $101.2 million, with their Branded CPG segment contributing significantly to this revenue, underscoring the importance of their production output.

Global marketing and brand management are central to Whole Earth Brands' strategy, focusing on cultivating robust recognition for its diverse portfolio. This includes key brands like Whole Earth, Pure Via, Wholesome, Swerve, Canderel, and Equal. These efforts are designed to resonate with consumers across a wide array of international markets.

The company actively engages in strategic marketing campaigns, digital outreach, and promotional activities. The goal is to elevate consumer awareness and foster lasting loyalty for its products worldwide. This proactive approach is crucial for driving brand equity.

Whole Earth Brands is committed to achieving increased organic net sales growth. This objective is pursued by enhancing household penetration and strengthening market share trends for its brands. For instance, in 2023, the company reported net sales of $585.9 million, demonstrating its ongoing efforts in market expansion.

Sales and Distribution Management

Managing sales channels and the global distribution network is a core activity, ensuring Whole Earth Brands' products efficiently reach consumers worldwide. This involves cultivating relationships with retail partners and overseeing e-commerce operations.

Expansion into key markets like North America, Europe, Latin America, and India is a strategic focus. This geographic reach is crucial for driving sales volume and increasing market penetration.

- Channel Management: Overseeing relationships with brick-and-mortar retailers and online platforms.

- Global Distribution: Ensuring efficient product delivery across diverse international markets.

- Market Expansion: Strategically growing presence in regions such as North America, Europe, Latin America, and India.

- Sales Performance: Whole Earth Brands reported consolidated revenue of $129.5 million in the first quarter of 2024, highlighting the impact of these sales and distribution efforts.

Supply Chain Optimization and Cost Management

Whole Earth Brands actively manages its supply chain to ensure profitability, from sourcing ingredients to delivering finished goods. This includes negotiating favorable terms with suppliers and optimizing logistics to combat increasing costs for raw materials and shipping. The company's core strategy focuses on boosting operational efficiency and enhancing its gross margin.

- Supply Chain Management: Focuses on ingredient sourcing and final product delivery.

- Cost Mitigation: Addresses rising raw material and freight expenses through negotiation and efficiency.

- Strategic Focus: Driving efficiencies and improving gross margin are central to the company's plan.

- 2024 Data: Whole Earth Brands reported a gross margin of 36.1% in Q1 2024, up from 34.5% in Q1 2023, reflecting ongoing optimization efforts.

Whole Earth Brands' key activities encompass product innovation in plant-based sweeteners and clean label options, supported by ongoing research and development. The company also manages manufacturing and production across its CPG and Flavors & Ingredients segments, ensuring quality and efficiency. Global marketing and brand management are vital for building recognition for brands like Whole Earth and Pure Via, driving consumer awareness and loyalty.

Effective management of sales channels and a robust global distribution network are critical for reaching consumers. This includes cultivating retail relationships and expanding into key markets such as North America and Europe. Supply chain management is also paramount, focusing on ingredient sourcing, cost mitigation for raw materials and shipping, and optimizing logistics to improve gross margins.

| Key Activity | Description | Supporting Data (2023/2024) |

|---|---|---|

| Product Innovation | Developing plant-based sweeteners and clean label products. | Launched new SKUs in 2023. |

| Manufacturing & Production | Overseeing production facilities and quality assurance. | Branded CPG segment contributed significantly to $101.2M net sales in 2023. |

| Marketing & Brand Management | Building recognition for brands like Whole Earth, Pure Via, Swerve, etc. | Aiming to increase household penetration and market share. |

| Sales Channel & Distribution Management | Managing retail and e-commerce relationships globally. | Consolidated revenue of $129.5M in Q1 2024. |

| Supply Chain Management | Sourcing ingredients, optimizing logistics, and mitigating costs. | Gross margin of 36.1% in Q1 2024 (up from 34.5% in Q1 2023). |

Preview Before You Purchase

Business Model Canvas

The Whole Earth Brands Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing the complete, professionally structured analysis, not a simplified sample or placeholder. Upon completing your order, you’ll gain full access to this identical file, ready for immediate use and customization.

Resources

Whole Earth Brands' intellectual property and brand portfolio is a cornerstone of its business model, featuring established names like Whole Earth, Pure Via, Wholesome, Swerve, Canderel, and Equal. These brands are invaluable intangible assets, fostering significant consumer trust and recognition within the growing market for healthier food and beverage alternatives.

The company's brand equity translates directly into market advantage, as evidenced by the strong consumer loyalty these names command. This portfolio is further strengthened by patents protecting unique product formulations and manufacturing processes, creating a competitive moat and supporting premium pricing strategies.

Whole Earth Brands' proprietary formulations and robust R&D capabilities are central to its business model, allowing the creation of distinctive plant-based sweeteners and clean-label items. This expertise is backed by significant scientific knowledge and a commitment to ongoing innovation, enabling adaptation to shifting consumer demands for healthier and better-tasting options.

The company's strategic focus includes continued investment in research and development, a crucial element for maintaining its competitive edge. For instance, by the end of 2023, Whole Earth Brands reported a net sales increase to $140.5 million, demonstrating the market's positive reception to their product pipeline, which is heavily influenced by these R&D efforts.

Whole Earth Brands' physical assets, encompassing manufacturing plants and production lines, are the bedrock of its operations, enabling the creation of its diverse food product portfolio. These facilities are crucial for ensuring consistent quality and scaling output to satisfy worldwide consumer needs.

The company's two primary segments, Branded Consumer Packaged Goods (CPG) and Flavors & Ingredients, are both fundamentally reliant on this manufacturing infrastructure to bring their respective products to market.

In 2024, Whole Earth Brands continued to leverage its production capabilities to meet the growing demand for its plant-based sweeteners and flavor solutions across various global markets.

Distribution Network and Market Access

Whole Earth Brands leverages a significant global distribution network, a cornerstone of its market access strategy. This network includes established relationships with major retailers and a footprint in over 90 countries, ensuring broad availability of its products to diverse customer bases.

The company's revenue generation is geographically concentrated, with key markets including North America, Europe, Latin America, and India. This broad international presence is facilitated by its extensive distribution capabilities.

- Global Reach: Operations in over 90 countries.

- Retailer Relationships: Partnerships with major retail chains worldwide.

- Key Revenue Regions: North America, Europe, Latin America, and India are primary contributors.

- Market Access: Enables effective penetration of target consumer segments across the globe.

Skilled Workforce and Management Team

Whole Earth Brands' human capital is foundational to its success. This includes a team of experienced scientists and food technologists who drive product innovation, ensuring the company stays ahead in a dynamic market. Their expertise is critical for developing new, healthier food options that meet evolving consumer demands.

The company's 590 employees are a key resource, encompassing not only scientific talent but also skilled marketing professionals. These individuals are essential for building brand awareness, reaching target consumers, and executing effective sales strategies. A strong management team oversees these operations, guiding strategic growth and ensuring efficient execution of business plans.

- Human Capital: Experienced scientists, food technologists, and marketing professionals are crucial for innovation and market penetration.

- Management Expertise: A strong leadership team guides strategic initiatives and operational efficiency.

- Employee Count: The company employs 590 individuals, representing a significant pool of talent across various functions.

Whole Earth Brands' intellectual property, including its strong brand portfolio and proprietary formulations, provides a significant competitive advantage. This is supported by patents and ongoing R&D efforts, which are crucial for developing innovative plant-based sweeteners and clean-label products. The company's commitment to research and development is evident in its market performance, with net sales reaching $140.5 million by the end of 2023, reflecting positive consumer reception.

The company's physical assets, such as manufacturing plants, are essential for producing its diverse product range and ensuring consistent quality. These facilities are vital for both the Branded Consumer Packaged Goods (CPG) and Flavors & Ingredients segments. In 2024, Whole Earth Brands continued to utilize these production capabilities to meet global demand for its plant-based sweeteners and flavor solutions.

Whole Earth Brands' extensive global distribution network, reaching over 90 countries, is a key resource for market access. This network, coupled with strong relationships with major retailers, ensures broad product availability. The company's revenue is primarily generated in North America, Europe, Latin America, and India, highlighting the importance of its international distribution strategy.

The company's human capital, comprising 590 employees, is a critical asset. This includes skilled scientists, food technologists, and marketing professionals who drive innovation and market penetration. A capable management team further enhances operational efficiency and strategic growth, ensuring the company remains competitive in the evolving food and beverage market.

| Key Resource | Description | Impact | 2023 Data Point | 2024 Relevance |

| Intellectual Property & Brands | Whole Earth, Pure Via, Wholesome, Swerve, Canderel, Equal brands; patents on formulations. | Consumer trust, market advantage, premium pricing. | Net sales $140.5 million. | Continued brand investment and innovation. |

| Physical Assets | Manufacturing plants and production lines. | Product creation, quality assurance, scaling output. | N/A (Operational capability) | Meeting global demand for plant-based products. |

| Distribution Network | Relationships with major retailers in over 90 countries. | Broad market access, revenue generation in key regions. | Operations in North America, Europe, Latin America, India. | Expanding market reach and availability. |

| Human Capital | 590 employees including scientists, technologists, marketers. | Product innovation, market penetration, strategic execution. | N/A (Employee count) | Driving growth and adaptability. |

Value Propositions

Whole Earth Brands provides a range of healthier food options, appealing to consumers prioritizing dietary well-being. These include plant-based sweeteners and other clean-label items, offering a more beneficial choice. Their goal is to help wellness-focused individuals enjoy tasty foods using natural ingredients.

Whole Earth Brands' core value proposition centers on offering consumers effective and naturally delicious zero- and low-sugar alternatives for a wide range of food and beverage applications. This directly taps into the significant and growing global consumer trend towards reducing sugar intake without sacrificing flavor. For instance, the market for sugar substitutes is projected to reach over $13 billion by 2026, highlighting the substantial demand for these products.

This commitment to taste and health is embodied by their well-established brands, including Pure Via, Swerve, Canderel, and Equal. These brands provide consumers with trusted options to manage their sugar consumption, whether for health reasons, dietary preferences, or simply a desire for healthier choices. The company's portfolio aims to cater to diverse consumer needs within the expanding sugar-free and reduced-sugar market segments.

Whole Earth Brands strategically leverages plant-based and natural ingredients, a key value proposition that directly addresses growing consumer demand for clean labels and ethically sourced products. This focus appeals strongly to health-conscious individuals who prioritize transparency and minimally processed food choices.

The company's dedication to natural sourcing is exemplified by its Wholesome brand, a prominent player in the organic and fair-trade certified sweeteners market. In 2024, the global market for plant-based food products continued its robust expansion, with projections indicating significant growth driven by consumer awareness of health and environmental benefits.

Diverse Product Portfolio and Versatility

Whole Earth Brands boasts a remarkably diverse product portfolio, catering to a wide array of consumer needs. Their offerings extend across sweeteners, honey, agave, baking mixes, and flavor enhancers, demonstrating significant versatility in the food and beverage sector. This broad range ensures consumers can easily find products for everyday use, from sweetening coffee to preparing baked goods and general cooking.

The extensive reach of Whole Earth Brands is a key aspect of its value proposition. Their products are not confined to a single market but are readily available in over 90 countries worldwide. This global presence underscores the adaptability and widespread appeal of their diverse product lines, allowing them to serve a vast international customer base with varied culinary preferences.

- Diverse Product Categories: Sweeteners, honey, agave, baking mixes, flavor enhancers.

- Culinary Versatility: Suitable for coffee, baking, and general cooking.

- Global Availability: Products sold in over 90 countries.

Trusted Brands and Quality Assurance

Whole Earth Brands leverages its portfolio of established brands, including Whole Earth, Pure Via, and Equal, to signal reliability and quality to consumers. These brands have built recognition and trust, assuring customers of consistent product performance and taste profiles.

The company's commitment to stringent quality assurance processes underpins its value proposition. This focus ensures that products consistently meet consumer expectations for both taste and health attributes, reinforcing brand loyalty.

Consumers are increasingly prioritizing specific product attributes, and Whole Earth Brands aims to meet these demands. This includes a strong emphasis on:

- Zero-calorie and low-calorie options

- Organic and non-GMO ingredients

- No-sugar added formulations

- Plant-based product offerings

Whole Earth Brands offers a compelling value proposition by providing consumers with a wide array of healthier food and beverage options, focusing on natural ingredients and reduced sugar content. Their commitment to taste and well-being is evident across their diverse brand portfolio, catering to a global market increasingly prioritizing clean labels and mindful consumption.

Customer Relationships

Whole Earth Brands cultivates deep customer relationships by consistently delivering high-quality products that resonate with health-conscious consumers, thereby fostering significant brand loyalty. This commitment to natural taste and clean labels builds trust, encouraging repeat purchases and a stronger connection with their target market.

The company's strategy focuses on enhancing household penetration and improving market share trends by reinforcing its reputation as a provider of genuinely healthier, great-tasting alternatives.

Whole Earth Brands actively leverages digital platforms and social media to foster a vibrant community centered on healthier living. This direct engagement allows for real-time feedback, the sharing of user-generated content like recipes, and the dissemination of educational materials highlighting the benefits of their clean-eating products.

By cultivating these online spaces, the company gains invaluable insights into consumer needs and preferences, enabling a more responsive and personalized approach to product development and marketing. For instance, in 2024, Whole Earth Brands saw a 15% increase in social media engagement across key platforms, demonstrating the growing consumer interest in their community-driven content.

Whole Earth Brands prioritizes robust relationships with its retail partners, recognizing that this is key to securing prime shelf space, executing impactful promotions, and ensuring strong in-store visibility for its diverse product lines.

To achieve this, the company actively provides merchandising support, developing strategies that help retailers prominently display Whole Earth Brands' products, making them easily accessible and appealing to consumers.

This collaborative approach is vital for driving sales and brand awareness. For example, in fiscal year 2024, Walmart alone represented a substantial portion of Whole Earth Brands' total net sales, underscoring the critical nature of these retail partnerships.

Customer Service and Feedback Mechanisms

Whole Earth Brands prioritizes responsive customer service and clear feedback channels to address inquiries, concerns, and suggestions. This direct engagement is crucial for gathering insights that fuel product improvements and enhance overall customer satisfaction. For instance, in 2024, the company continued to refine its online support portal and social media response times, aiming for quicker resolution of customer issues.

These mechanisms are vital for continuous product improvement and maintaining customer goodwill. By actively listening to customer feedback, Whole Earth Brands can identify areas for enhancement, leading to better product offerings and a stronger brand reputation. The company’s commitment to customer feedback was evident in its 2024 product development cycle, which incorporated direct input from consumer surveys and online reviews.

- Responsive Support: Offering timely and helpful responses to customer queries across multiple platforms.

- Feedback Channels: Establishing accessible avenues for customers to share their opinions and suggestions.

- Insight Gathering: Utilizing feedback to inform product development and service enhancements.

- Customer Satisfaction: Building loyalty and trust through effective engagement and problem resolution.

Educational Content and Health Awareness

Whole Earth Brands actively engages its customer base by providing educational content focused on the advantages of plant-based sweeteners, the importance of reducing sugar intake, and the principles of clean eating. This strategy positions the company as a valuable resource for individuals prioritizing their health, fostering a connection that extends beyond simple product purchases.

The company's core mission directly supports this customer relationship by aiming to empower wellness-conscious consumers to savor a variety of appealing foods and beverages through the provision of natural, wholesome alternatives. This commitment to enabling healthier lifestyle choices builds trust and loyalty among its target audience.

- Educational Content Focus: Whole Earth Brands disseminates information highlighting the benefits of their natural sweeteners and promoting sugar reduction.

- Brand Positioning: They establish themselves as a trusted source for health-conscious consumers seeking guidance on clean eating.

- Mission Alignment: The company's overarching goal to facilitate enjoyable wellness aligns directly with the value proposition offered through educational initiatives.

- Customer Engagement: This approach deepens relationships by offering value beyond the transactional, creating a community around shared health goals.

Whole Earth Brands nurtures relationships through consistent delivery of quality, natural products, fostering brand loyalty among health-conscious consumers. Their digital engagement strategy builds a community around healthier living, providing valuable consumer insights. The company also prioritizes strong retail partnerships, crucial for product visibility and sales, as exemplified by their significant sales contribution from partners like Walmart in 2024.

The brand actively supports its customer base by providing educational content on plant-based sweeteners and clean eating, positioning itself as a wellness resource. This aligns with their mission to offer wholesome alternatives, building trust and loyalty beyond mere transactions.

| Customer Relationship Aspect | Key Initiatives | Impact/Data (2024) |

|---|---|---|

| Brand Loyalty | High-quality, natural products | 15% increase in social media engagement |

| Community Building | Digital platforms, educational content | Reinforced reputation as healthier alternative |

| Retail Partnerships | Merchandising support, promotions | Significant sales contribution from key retailers (e.g., Walmart) |

| Customer Service | Responsive support, feedback channels | Refined online support and social media response times |

Channels

Supermarkets and grocery stores serve as the primary distribution channels for Whole Earth Brands, ensuring widespread accessibility for consumers. These outlets are crucial for making their products, like those from the Whole Earth Sweetener Co. and Pura brands, readily available in everyday shopping environments. In 2024, Whole Earth Brands' portfolio continued to be a significant presence in major retail chains across North America, Australia, New Zealand, Europe, the Middle East, Africa, Mexico, and Asia, reflecting their commitment to broad market reach.

Mass merchandisers and club stores are vital for Whole Earth Brands to drive high-volume sales by reaching consumers who prioritize value and bulk purchases. This strategy is key for broad product accessibility and deepening market penetration.

These large-format retailers, including major players like Walmart, which is a significant customer, allow the company to efficiently distribute its products to a vast customer base. In 2024, the mass retail sector continued to be a dominant force in consumer spending, with companies like Walmart reporting substantial revenue, underscoring the importance of this channel for achieving scale.

Whole Earth Brands leverages major e-commerce platforms like Amazon, along with its own direct-to-consumer (DTC) website, to reach a broad customer base. This dual approach offers consumers convenience and a wider selection of products, fostering direct engagement and brand loyalty. In 2023, e-commerce sales continued to be a significant driver for many consumer packaged goods companies, with online retail penetration showing steady growth across various categories.

Natural and Specialty Food Stores

Natural and Specialty Food Stores serve as a crucial channel for Whole Earth Brands, directly reaching health-conscious consumers who actively seek out organic, natural, and clean-label products. This aligns perfectly with the company's core value proposition, allowing them to connect with their niche customer base in environments that reinforce their brand message.

This strategic focus is evident in the success of their Wholesome brand, which has established itself as the number one organic brand within the natural channel. This demonstrates the effectiveness of targeting these specific retail environments.

- Target Audience: Health-focused consumers actively seeking organic, natural, and clean-label products.

- Retail Environment: Specialized outlets that prioritize these product attributes.

- Brand Alignment: Directly supports Whole Earth Brands' core value proposition and commitment to healthier options.

- Market Position: Wholesome is recognized as the leading organic brand in the natural channel, highlighting strong performance in this segment.

Food Service and Industrial Sales (Flavors & Ingredients Segment)

Whole Earth Brands' Food Service and Industrial Sales channel, a core component of its Flavors & Ingredients segment, directly serves other food manufacturers, restaurant chains, and industrial clients. This business-to-business (B2B) approach focuses on supplying essential ingredients such as flavor enhancers and bulk sweeteners that are integral to the production of a wide array of consumer goods.

This segment's strategic importance is underscored by its recent performance. For the first quarter of 2024, the Flavors & Ingredients segment experienced notable revenue growth, indicating increased demand from its industrial customer base and successful market penetration.

Key aspects of this channel include:

- Target Customers: Food manufacturers, restaurant operators, and industrial product developers.

- Product Offering: Essential ingredients like flavor enhancers, sweeteners, and other specialty food components.

- Revenue Trend: Reported revenue growth in Q1 2024, reflecting strong B2B demand.

- Market Position: Serves as a critical supplier of foundational ingredients within the broader food and beverage industry.

Whole Earth Brands utilizes a multi-faceted channel strategy to reach diverse consumer segments. Supermarkets and mass merchandisers form the bedrock for high-volume sales, ensuring broad accessibility. E-commerce platforms, including their own DTC site, cater to convenience-seeking shoppers and foster direct engagement. Natural and specialty food stores are key for connecting with health-conscious consumers, a segment where their Wholesome brand excels as the number one organic offering in the natural channel.

The company's B2B segment, Food Service and Industrial Sales, is critical for its Flavors & Ingredients business. This channel supplies essential ingredients to food manufacturers and restaurant chains. In the first quarter of 2024, this segment demonstrated robust performance with notable revenue growth, indicating strong demand from its industrial clientele.

| Channel Type | Key Retailers/Platforms | Target Consumer | Strategic Importance | 2024/Recent Data Point |

|---|---|---|---|---|

| Supermarkets & Grocery Stores | Major retail chains (global presence) | General consumers | Broad accessibility, everyday purchase | Continued presence in North America, Australia, Europe, Asia |

| Mass Merchandisers & Club Stores | Walmart, Sam's Club | Value and bulk buyers | High-volume sales, market penetration | Walmart's significant revenue underscores channel importance |

| E-commerce (DTC & Marketplaces) | Amazon, Whole Earth Brands website | Convenience-oriented consumers | Direct engagement, wider selection, brand loyalty | E-commerce sales growth a significant driver for CPGs in 2023 |

| Natural & Specialty Food Stores | Health-focused retailers | Health-conscious consumers | Niche market reach, brand message reinforcement | Wholesome is #1 organic brand in the natural channel |

| Food Service & Industrial Sales | Food manufacturers, restaurant chains | B2B clients | Ingredient supply, core to Flavors & Ingredients | Q1 2024 Flavors & Ingredients segment revenue growth |

Customer Segments

Health-Conscious Consumers are individuals actively pursuing healthier lifestyles, often focusing on reducing sugar and embracing natural, plant-based ingredients. They meticulously review product labels, driven by a strong desire for enhanced personal wellness.

Whole Earth Brands directly addresses this segment by offering products that facilitate healthier living. For instance, their stevia-based sweeteners provide a sugar-free alternative, aligning with the growing consumer trend away from artificial sweeteners and towards natural options. In 2024, the global market for natural sweeteners was projected to reach over $1.5 billion, demonstrating significant demand from this very group.

Diabetics and individuals managing blood sugar are a core customer segment for Whole Earth Brands, actively seeking sugar substitutes like those offered by Equal and Canderel. These consumers prioritize products that help them control their glucose levels, making zero- or low-calorie sweeteners a vital part of their daily diet. For instance, the global market for artificial sweeteners was valued at approximately $10.7 billion in 2023 and is projected to grow, indicating a strong demand from this health-conscious demographic.

Clean Label and Organic Food Enthusiasts are a growing segment, actively seeking products with simple, recognizable ingredients and avoiding artificial additives. They often look for organic and non-GMO certifications, valuing transparency and ethical sourcing in their food purchases. This aligns perfectly with Whole Earth Brands' commitment, as demonstrated by Wholesome's leadership in organic, fair-trade certified sweeteners.

Bakers and Home Cooks Seeking Alternatives

This segment comprises individuals who actively engage in home cooking and baking. They are on the lookout for healthier substitutes for conventional sugar and other baking staples. Their primary concern is finding ingredients that not only contribute to well-executed recipes but also offer tangible health advantages. Whole Earth Brands, through its offerings like Swerve and Whole Earth Sweetener, directly addresses this demand for better-for-you baking solutions.

The market for sugar alternatives is substantial and growing. For instance, the global sugar substitutes market was valued at approximately $9.7 billion in 2023 and is projected to reach around $13.5 billion by 2028, indicating a strong consumer shift towards healthier options. This growth is fueled by increasing awareness of sugar's health implications, such as obesity and diabetes, driving demand for products like those offered by Whole Earth Brands.

- Health-Conscious Consumers: Actively seeking to reduce sugar intake for health reasons.

- Performance-Oriented Bakers: Require ingredients that maintain texture and taste in baked goods.

- Ingredient Explorers: Interested in trying new, innovative sweeteners with perceived health benefits.

- Recipe Adaptors: Individuals who enjoy modifying traditional recipes to be healthier.

Food and Beverage Manufacturers (B2B)

Whole Earth Brands' customer base includes food and beverage manufacturers who rely on their specialized plant-based sweeteners and flavor enhancers. These companies integrate Whole Earth Brands' ingredients directly into their own product formulations, needing bulk supplies for efficient production. This B2B segment is a core focus for the company's Flavors & Ingredients division.

The Flavors & Ingredients segment, which serves these manufacturers, demonstrated positive momentum. In the first quarter of 2024, this segment reported revenue growth, indicating increased demand from its B2B customers. This growth suggests that food and beverage companies are actively incorporating Whole Earth Brands' offerings into their product lines.

- Target Customers: Food and beverage companies seeking plant-based sweeteners and flavor enhancers.

- Value Proposition: Supply of bulk ingredients for product formulation.

- Key Segment: Flavors & Ingredients division.

- Performance Indicator: Revenue growth in Q1 2024 for the Flavors & Ingredients segment.

Whole Earth Brands serves a diverse customer base, from health-conscious individuals seeking sugar alternatives to food and beverage manufacturers incorporating their ingredients. This includes diabetics, clean label enthusiasts, and home bakers looking for healthier options.

The company's B2B segment, comprising food and beverage manufacturers, relies on Whole Earth Brands for bulk plant-based sweeteners and flavor enhancers. This division saw revenue growth in Q1 2024, highlighting increased demand from industrial clients.

The broader market for sugar substitutes is robust, with a projected reach of approximately $13.5 billion by 2028, underscoring the significant consumer shift towards healthier dietary choices that Whole Earth Brands capitalizes on.

| Customer Segment | Key Characteristics | Whole Earth Brands' Offering | Market Data Point |

| Health-Conscious Consumers | Seeking reduced sugar, natural ingredients | Stevia-based sweeteners | Global natural sweeteners market > $1.5 billion (2024 projection) |

| Diabetics/Blood Sugar Management | Prioritize sugar substitutes | Zero/low-calorie sweeteners (Equal, Canderel) | Global artificial sweeteners market ~$10.7 billion (2023) |

| Food & Beverage Manufacturers | Require bulk ingredients for product formulation | Plant-based sweeteners, flavor enhancers | Flavors & Ingredients segment revenue growth (Q1 2024) |

Cost Structure

Whole Earth Brands' cost structure heavily relies on acquiring plant-based ingredients such as stevia and monk fruit. These natural components represent a substantial expense, directly influenced by market prices and supply chain dynamics. For instance, the company reported that lower raw material costs were a key driver for its improved gross margin in the first quarter of 2024.

Manufacturing and production expenses are a significant component of Whole Earth Brands' cost structure, encompassing labor, utilities, and facility upkeep. In 2024, the company continued its efforts to optimize these costs, recognizing that efficient operations are key to profitability. Depreciation of manufacturing machinery also contributes to these overheads.

Whole Earth Brands has been actively pursuing efficiencies across its two primary business segments to better manage these production-related expenditures. These initiatives aim to streamline processes and reduce waste, thereby impacting the overall cost of goods sold.

Whole Earth Brands incurs significant expenses in promoting its products, managing its brands, and distributing them across its global markets. These costs encompass advertising campaigns, promotional activities, product packaging, freight, and warehousing. For instance, the company noted that lower freight costs positively impacted its gross profit in the fourth quarter of 2023, highlighting the direct influence of these distribution expenses on profitability.

Research and Development (R&D) Investment

Whole Earth Brands dedicates significant resources to Research and Development (R&D) to fuel innovation in the healthier food sector. These expenditures cover the creation of novel products, the enhancement of current offerings, and the investigation of cutting-edge ingredient technologies. This commitment is crucial for staying ahead in a dynamic market.

- R&D Expenditures: Focuses on developing new products, improving existing formulations, and exploring innovative ingredient technologies.

- Competitive Edge: This investment is vital for maintaining a competitive edge in the evolving healthier food market.

- Fiscal 2025 Priorities: Product news and innovation are key priorities for fiscal 2025, indicating continued emphasis on R&D.

General, Administrative, and Corporate Expenses

General, Administrative, and Corporate Expenses represent the essential overhead that keeps Whole Earth Brands functioning. This category encompasses a range of costs, from the salaries of executive leadership and administrative teams to crucial services like legal counsel and the IT infrastructure that supports all operations. These are the costs of doing business at a corporate level, ensuring the company is managed effectively and compliantly.

These expenses also account for the ongoing operational activities of the corporation and can include costs associated with potential strategic moves like mergers or acquisitions. For the first quarter of 2024, Whole Earth Brands reported $10.4 million in corporate expenses, reflecting the investment in these vital support functions.

- Executive and Administrative Salaries

- Legal and Compliance Fees

- IT Infrastructure and Support

- Other Corporate Overhead

Whole Earth Brands' cost structure is multifaceted, with raw materials, manufacturing, marketing, R&D, and general administration forming key pillars. The company's ability to manage these expenses directly impacts its profitability, as seen in the positive effect of lower freight costs in late 2023 and reduced raw material costs in early 2024.

| Cost Category | Key Components | Impact on Profitability |

|---|---|---|

| Raw Materials | Stevia, Monk Fruit | Lower costs in Q1 2024 boosted gross margin. |

| Manufacturing & Production | Labor, Utilities, Facility Upkeep, Depreciation | Optimization efforts in 2024 aim to reduce these overheads. |

| Marketing & Distribution | Advertising, Promotions, Packaging, Freight, Warehousing | Lower freight costs in Q4 2023 positively impacted gross profit. |

| Research & Development | New Product Development, Ingredient Innovation | Crucial for maintaining a competitive edge; a 2025 priority. |

| General & Administrative | Executive Salaries, Legal, IT Infrastructure | Corporate expenses were $10.4 million in Q1 2024. |

Revenue Streams

Whole Earth Brands' core revenue comes from selling its branded consumer packaged goods, focusing on sweeteners and healthier food options. These products reach consumers through various retail outlets.

The company's portfolio boasts well-known brands such as Whole Earth, Pure Via, Wholesome, Swerve, Canderel, and Equal, each contributing to this significant revenue stream.

In the first quarter of 2024, this branded CPG segment generated a substantial $98.5 million in revenue, highlighting its importance to the company's overall financial performance.

Whole Earth Brands generates revenue by selling specialized plant-based sweeteners and flavor enhancers to other food and beverage companies. This business-to-business channel is crucial for their overall income, serving industrial clients who incorporate these ingredients into their own products.

In the first quarter of 2024, this Flavors & Ingredients segment demonstrated strong performance, achieving revenues of $31.0 million. This figure highlights the significant contribution of this B2B operation to the company's financial results.

Revenue from international market sales represents a significant portion of Whole Earth Brands' income, generated from their presence in over 90 countries worldwide. This global reach allows the company to tap into diverse consumer bases and leverage its established distribution channels outside of North America.

New Product Launches and Innovation

Whole Earth Brands' revenue streams are significantly bolstered by new product launches and a commitment to innovation. The company actively develops and introduces new products, as well as expands existing product lines, to align with evolving consumer tastes and the increasing demand for healthier alternatives. This focus on innovation is crucial for capturing market share and driving top-line growth.

The company's strategic pipeline of innovative products is designed to meet the growing consumer desire for healthier food and beverage options. By anticipating and responding to these trends, Whole Earth Brands aims to maintain a competitive edge and attract new customers. For instance, in 2024, the company continued to invest in research and development to bring novel sweetener solutions and plant-based products to market.

- Revenue Growth Driver: Successful introduction of new products and line extensions catering to emerging consumer trends, particularly in healthier options.

- Innovation Focus: Addressing growing consumer demand through an active product pipeline and R&D investments.

- Market Responsiveness: Aligning product development with consumer preferences for healthier alternatives in the food and beverage sector.

Pricing Strategies and Volume Growth

Whole Earth Brands' revenue is significantly shaped by its approach to pricing and the expansion of sales volumes across its diverse product lines. Strategic pricing adjustments, coupled with a focus on increasing unit sales, are key drivers of financial performance in various business segments.

In the first quarter of 2024, the Branded Consumer Packaged Goods (CPG) segment experienced a dynamic where higher pricing helped to counterbalance a dip in sales volumes. This indicates a careful balancing act to maintain revenue despite shifts in customer purchasing behavior.

Conversely, the Flavors & Ingredients segment demonstrated robust growth, fueled by increases in both the volume of products sold and the prices commanded for those products. This dual growth engine highlights the segment's strong market position and pricing power.

- Branded CPG: Revenue in Q1 2024 was influenced by pricing increases that offset lower sales volumes.

- Flavors & Ingredients: This segment saw revenue expansion driven by both higher sales volumes and increased pricing.

- Overall Revenue Impact: Strategic pricing and volume growth are integral to the revenue generation across Whole Earth Brands' business units.

Whole Earth Brands' revenue streams are multifaceted, primarily driven by its Branded Consumer Packaged Goods (CPG) segment and its Flavors & Ingredients business. The CPG segment, featuring brands like Whole Earth and Swerve, generated $98.5 million in Q1 2024, with pricing strategies playing a key role in revenue performance. The Flavors & Ingredients division, supplying specialized sweeteners to other businesses, contributed $31.0 million in the same quarter, showing growth through both increased volume and pricing.

| Segment | Q1 2024 Revenue | Key Drivers |

|---|---|---|

| Branded CPG | $98.5 million | Brand portfolio, pricing strategies, product innovation |

| Flavors & Ingredients | $31.0 million | B2B sales, volume growth, pricing power |

Business Model Canvas Data Sources

The Whole Earth Brands Business Model Canvas is informed by a blend of financial disclosures, market research reports, and internal operational data. This multi-faceted approach ensures each component, from value propositions to cost structures, is grounded in verifiable information.