Whole Earth Brands Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Whole Earth Brands Bundle

Whole Earth Brands' current product portfolio is a fascinating mix, with some brands clearly leading the pack and others requiring a closer look. Understanding where each fits within the BCG Matrix is crucial for making informed strategic decisions about resource allocation and future growth.

This preview offers a glimpse into their market positioning, but to truly unlock the strategic advantages, you need the full picture. Purchase the complete BCG Matrix report to gain detailed quadrant placements, actionable insights, and a clear roadmap for optimizing Whole Earth Brands' product strategy and maximizing profitability.

Stars

Whole Earth Brands is well-placed in the natural sweeteners market, a sector experiencing robust expansion. This market is expected to climb from $6.09 billion in 2024 to $6.5 billion in 2025 and reach $8.51 billion by 2029, indicating strong future potential.

This substantial market growth suggests Whole Earth Brands' established sweetener brands could be considered stars. Continued investment will be crucial to solidify their leadership position as consumer preferences increasingly favor healthier, low-calorie, and clean-label options, which perfectly matches the company's offerings.

Whole Earth Brands' focus on plant-based sweeteners and clean-label products is a smart move, tapping into a booming market. Consumers are increasingly seeking healthier options and natural ingredients, and brands like Whole Earth®, Pure Via®, and Swerve® are perfectly positioned to meet this demand. This strategic direction is crucial for their growth.

The market for plant-based sweeteners is experiencing significant expansion. For instance, the global market size was valued at approximately $1.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 6.5% from 2024 to 2030. This robust growth underscores the potential for Whole Earth Brands’ offerings to become strong performers.

By continuing to invest in innovation and expanding market reach for these key product lines, Whole Earth Brands can solidify their position as Stars in the BCG matrix. This strategic focus not only capitalizes on current consumer trends but also lays the groundwork for these brands to transition into future Cash Cows, generating consistent revenue for the company.

Whole Earth Brands' Flavors & Ingredients segment showed promising growth, with revenues up 2.1% in Q1 2024. This uptick was driven by both increased sales volume and higher pricing. This performance suggests the segment is a strong contender for a Star position within the company's BCG matrix, provided it can sustain or grow its market share.

Strategic Acquisitions for Portfolio Expansion

Whole Earth Brands has strategically expanded its portfolio through acquisitions, notably bringing Wholesome Sweeteners into the fold in February 2021. This move was a clear play to enter the burgeoning market for organic and fair-trade sweeteners, tapping into consumer demand for healthier options.

This expansion into high-growth, health-focused niches is crucial for Whole Earth Brands' overall strategy. By integrating these acquired brands, particularly within the expanding natural sweetener market, the company aims to create new revenue streams and solidify its market position. For instance, the natural sweeteners market is projected to grow significantly, with some reports indicating a compound annual growth rate (CAGR) of over 5% in the coming years, driven by increasing consumer awareness of health and wellness.

- Acquisition of Wholesome Sweeteners: February 2021 marked the integration of a key player in the organic and fair-trade sweetener segment.

- Focus on Health-Conscious Niches: This strategy targets expanding consumer preferences for natural and healthier food ingredients.

- Market Growth Potential: The natural sweetener market is experiencing robust growth, offering significant opportunities for acquired brands.

- Integration and Leverage: Continued success hinges on effectively integrating and capitalizing on the strengths of these acquired assets for sustained growth.

Global Market Reach and Brand Recognition

Whole Earth Brands boasts a significant global market reach, evident in its portfolio of well-established brands like Canderel® and Equal®. These brands have a strong presence in numerous international markets, catering to a wide consumer base seeking sweetener alternatives.

While precise market share figures for private entities are often undisclosed, the widespread availability of their products suggests a substantial foothold. The global market for natural sweeteners, a sector Whole Earth Brands actively participates in, experienced robust growth, with projections indicating continued expansion through 2024 and beyond. This trend supports the notion that their leading brands likely hold strong positions in their respective regions.

- Global Presence: Whole Earth Brands' products are distributed across multiple continents.

- Brand Strength: Canderel® and Equal® are recognized names in the sweetener market.

- Market Trend Alignment: The company benefits from the increasing global demand for natural and low-calorie sweeteners.

- Growth Potential: Expansion of their international distribution and marketing efforts is crucial for continued success.

Whole Earth Brands' established sweetener brands, such as Whole Earth®, Pure Via®, and Swerve®, are well-positioned to be considered Stars in the BCG matrix. These brands operate within the rapidly expanding natural sweeteners market, which is projected to grow from $6.09 billion in 2024 to $8.51 billion by 2029. Their focus on plant-based, clean-label ingredients directly aligns with increasing consumer demand for healthier alternatives.

The company's strategic acquisitions, like Wholesome Sweeteners in February 2021, further bolster its Star potential by entering high-growth, health-focused niches. The global plant-based sweetener market, valued at approximately $1.7 billion in 2023, is expected to grow at a CAGR of around 6.5% through 2030. Continued investment in innovation and market expansion for these brands is vital to maintain their leadership and transition them into future cash cows.

The Flavors & Ingredients segment, showing a 2.1% revenue increase in Q1 2024 driven by volume and pricing, also exhibits Star characteristics. Coupled with the global reach of brands like Canderel® and Equal®, Whole Earth Brands is capitalizing on the growing demand for sweetener alternatives worldwide, reinforcing the Star status of its key offerings.

| Brand/Segment | BCG Category | Market Growth | Company Strength | Strategic Implication |

| Whole Earth® Sweeteners | Star | High (Natural Sweeteners Market) | Strong alignment with consumer health trends | Maintain investment for market leadership |

| Pure Via® | Star | High (Natural Sweeteners Market) | Focus on plant-based and clean-label | Capitalize on growing demand |

| Swerve® | Star | High (Natural Sweeteners Market) | Meets demand for healthier options | Expand market reach and product innovation |

| Canderel® / Equal® | Star | Moderate to High (Global Sweetener Market) | Established global presence and brand recognition | Leverage international distribution for growth |

| Flavors & Ingredients Segment | Star | High (Projected Growth) | Recent revenue growth (2.1% in Q1 2024) | Sustain performance through strategic focus |

What is included in the product

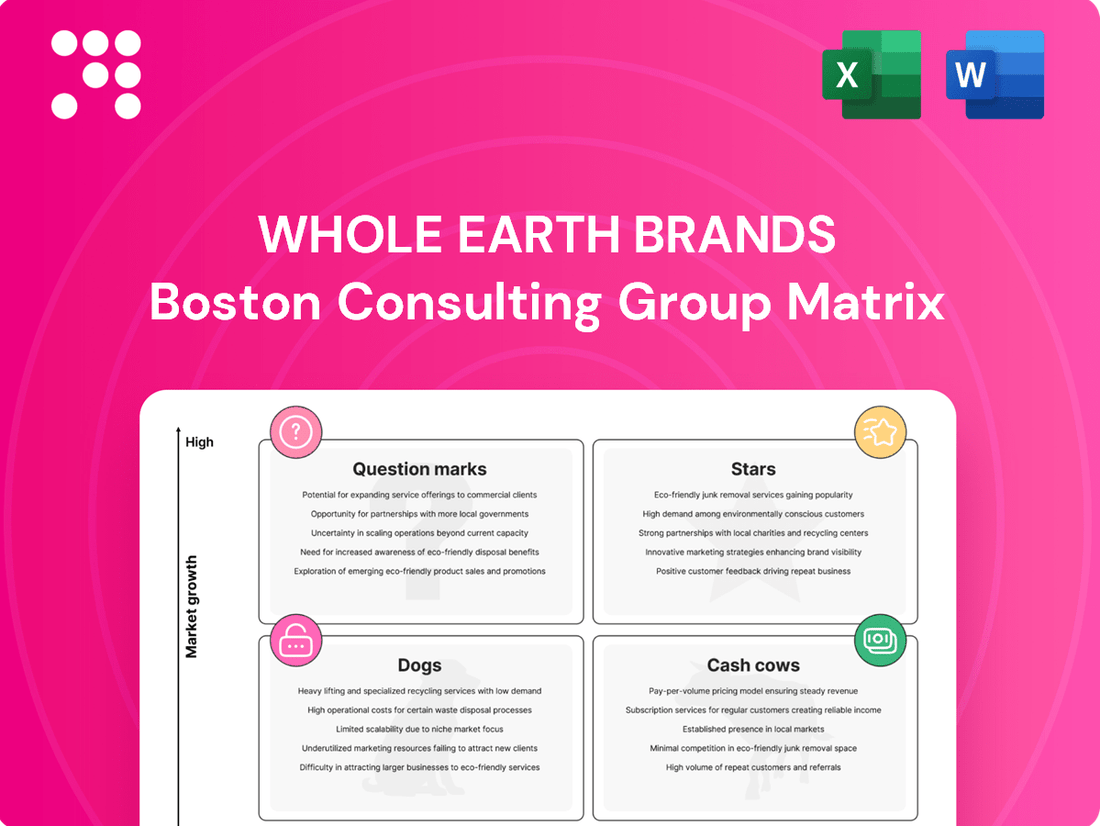

This BCG Matrix overview details Whole Earth Brands' product portfolio, categorizing each into Stars, Cash Cows, Question Marks, or Dogs.

It provides strategic guidance on investment, holding, or divesting each business unit for optimal growth.

Whole Earth Brands BCG Matrix: A clear, visual tool to identify underperforming brands, alleviating the pain of resource misallocation.

Cash Cows

Brands such as Equal® and Canderel®, long-standing leaders in the artificial and low-calorie sweetener space, function as cash cows for Whole Earth Brands in specific mature markets and among certain consumer groups. While the broader natural sweetener market is expanding, these established brands are likely to hold significant market share with more modest growth rates in well-penetrated segments.

Their consistent cash flow is a direct result of robust brand loyalty and extensive distribution networks. For instance, in 2024, the global market for artificial sweeteners was valued at approximately $4.5 billion, with established brands like Equal® continuing to capture a substantial portion of this segment due to their widespread availability and consumer recognition.

Whole Earth Brands' core sweetener portfolio, despite a minor dip in Branded CPG revenue to $98.5 million in Q1 2024, remains a bedrock of consistent income. This segment, representing a substantial part of the company's total product revenue, highlights the enduring demand for its established sweetener offerings.

These dependable products act as a financial anchor, generating the stable cash flow necessary to fuel investments in more dynamic, high-growth ventures within the company's portfolio.

Whole Earth Brands is demonstrating a strong focus on operational efficiency, which is a hallmark of a Cash Cow. The company's gross profit margin saw a notable increase to 28.8% in the first quarter of 2024, up from 24.4% in the same period of the previous year.

This improvement in gross margin, attributed to factors like reduced raw material and freight expenses, indicates effective cost management even within established product lines. Such optimization directly contributes to enhanced cash flow generation from these mature segments.

Licorice Products (MAFCO)

The MAFCO brand, a key player in Whole Earth Brands' Flavors & Ingredients segment, focuses on licorice products. This niche likely represents a mature market, characterized by stable demand and consistent revenue generation, fitting the profile of a Cash Cow.

While the broader Flavors & Ingredients segment experiences growth, MAFCO's licorice offerings can be seen as a reliable income stream. This steady cash flow is crucial, as it can be reinvested to fuel growth in other, more dynamic areas of Whole Earth Brands' portfolio without requiring substantial marketing or development expenditure.

- MAFCO's licorice products contribute to Whole Earth Brands' Flavors & Ingredients segment.

- The licorice market is typically mature, offering stable demand.

- These products act as a consistent revenue generator for the company.

- The cash generated can support investments in other business units.

Revenue from B2B Ingredients

The Flavors & Ingredients segment, encompassing B2B ingredient sales, acts as a Cash Cow for Whole Earth Brands. This stability stems from businesses needing dependable ingredient suppliers, fostering repeat business and consistent cash flow. In Q1 2024, this segment saw growth, bolstered by both increased volume and pricing strategies, indicating a robust, cash-generating aspect of the company.

- Stable Revenue: The B2B ingredients segment provides a predictable income stream, characteristic of a Cash Cow.

- Repeat Business: Client reliance on consistent ingredient sourcing drives recurring orders.

- Q1 2024 Growth: The segment's performance in early 2024, driven by volume and pricing, highlights its cash-generating potential.

Whole Earth Brands' established sweetener brands, like Equal® and Canderel®, are prime examples of cash cows. These brands dominate mature segments of the artificial sweetener market, which was valued around $4.5 billion in 2024. Their consistent revenue generation, despite modest growth, is a result of strong brand recognition and extensive distribution.

The company's focus on operational efficiency, evidenced by a gross profit margin increase to 28.8% in Q1 2024, further enhances the cash flow from these mature lines. This financial stability allows Whole Earth Brands to fund growth initiatives in other areas of its business.

The MAFCO brand, specializing in licorice products within the Flavors & Ingredients segment, also functions as a cash cow. This niche market provides a stable, predictable income stream, reinforcing its role as a reliable generator of cash for the company.

| Business Unit | Product Type | BCG Category | Key Characteristics | 2024 Data Point |

| Branded CPG | Artificial Sweeteners (e.g., Equal®, Canderel®) | Cash Cow | Mature market, strong brand loyalty, extensive distribution | Global artificial sweetener market valued at ~$4.5 billion |

| Flavors & Ingredients | Licorice Products (MAFCO) | Cash Cow | Niche market, stable demand, consistent revenue | Part of a segment showing growth, indicating reliable income |

| Flavors & Ingredients | B2B Ingredients | Cash Cow | Dependable supplier relationships, repeat business | Segment grew in Q1 2024 due to volume and pricing |

Delivered as Shown

Whole Earth Brands BCG Matrix

The Whole Earth Brands BCG Matrix preview you are viewing is the identical, fully comprehensive document you will receive upon purchase. This means you can confidently assess the depth of analysis and strategic insights without any hidden surprises or altered content.

Dogs

Whole Earth Brands' Branded Consumer Packaged Goods (CPG) segment saw a 3.5% dip in product revenues during the first quarter of 2024. This decline was largely driven by reduced sales volumes, suggesting that several brands within their consumer-facing portfolio are facing challenges in maintaining or growing their market presence. These underperforming CPG lines could be considered dogs in the BCG matrix, tying up capital and management attention without generating substantial returns.

Within Whole Earth Brands' portfolio, there might be legacy sweetener products or older formulations that are no longer resonating with consumers. These products likely hold a small slice of a mature or even shrinking market segment. For instance, if a particular sugar substitute saw its peak popularity a decade ago and now faces competition from newer, more innovative options, it could fit this category.

These 'Dog' products, characterized by low market share in slow-growth or declining markets, represent an opportunity for strategic divestment. By identifying and potentially phasing out these underperformers, the company can reallocate capital and management focus towards its Stars and Cash Cows. Without specific product sales data for 2024, this assessment is based on general market trends for established, less differentiated sweetener categories.

Products with limited geographic reach, particularly those relevant only within specific regions, can struggle to achieve substantial scale or growth. If these regional markets are also experiencing low growth, such products might be classified as Dogs in the BCG matrix.

Whole Earth Brands' strategic emphasis on global expansion highlights a commitment to overcoming these geographic limitations and optimizing performance across diverse markets. For instance, in 2024, the company continued its efforts to broaden the availability of its plant-based products, aiming to tap into new consumer bases beyond its established territories.

Unsuccessful Product Line Extensions

Whole Earth Brands, like many consumer goods companies, faces the challenge of unsuccessful product line extensions. When these extensions fail to gain market traction, especially in slower-growing segments, they can become cash cows with declining potential. For instance, if a new flavor of a legacy snack product doesn't resonate with consumers, it might tie up capital without generating significant returns.

These underperforming extensions represent a drain on resources that could be better allocated. Companies must regularly assess their product portfolios to identify such candidates for discontinuation. This strategic pruning is crucial for maintaining financial health and focusing on more promising ventures.

- Identifying Underperformers: Products with declining sales or market share in mature or slow-growing markets are prime candidates.

- Resource Reallocation: Discontinuing unsuccessful extensions frees up capital, marketing spend, and management attention for more viable products.

- Portfolio Optimization: Regularly reviewing the product lineup ensures that the company invests in areas with the highest potential for growth and profitability.

- Market Realities: For example, in 2024, the snack industry saw innovation in healthier options, meaning traditional extensions might struggle if they don't align with these evolving consumer preferences.

Non-Strategic or Divested Assets

Whole Earth Brands' strategic review following its acquisition likely identified non-strategic or divested assets. These are typically businesses with low market share and limited growth potential, not aligning with the new parent company's core objectives. For instance, if the company previously held smaller, niche food additive businesses outside of its main focus, these would fall into this category.

The current emphasis is firmly on expanding its core plant-based sweeteners and flavor enhancers portfolio. Any assets that do not contribute significantly to this strategic direction, or that have been earmarked for sale, would be classified as non-strategic.

- Low Market Share: These assets likely represent a small fraction of their respective markets.

- Limited Growth Prospects: Their future revenue and profit growth is expected to be minimal.

- Divestiture Candidates: They are often considered for sale to unlock capital or streamline operations.

- Non-Core to Strategy: They do not fit the long-term vision of the acquiring entity, which is focused on plant-based ingredients.

Dogs in Whole Earth Brands' portfolio are products with low market share in slow-growing or declining markets. These might include older sweetener formulations or less popular regional brands that are not aligning with current consumer trends. For example, a legacy sugar substitute that has been overshadowed by newer, innovative options could be considered a dog, tying up resources without significant returns.

The company's 2024 performance data, showing a 3.5% dip in CPG product revenues, suggests that some of these underperforming brands are indeed struggling. These dogs represent an opportunity for strategic divestment or discontinuation, allowing Whole Earth Brands to reallocate capital and management focus towards its more promising Stars and Cash Cows.

Identifying these dogs is crucial for portfolio optimization. By pruning these less profitable lines, the company can streamline operations and invest more effectively in areas with higher growth potential, such as its expanding plant-based sweetener offerings. This strategic pruning is vital for maintaining financial health and driving overall company performance.

Question Marks

Whole Earth Brands is actively pursuing new clean label innovations and dietary options, recognizing the significant shift in consumer preferences towards healthier, more natural ingredients. This focus places them squarely in a high-growth market segment. For instance, the global clean label market was valued at approximately $50 billion in 2023 and is projected to grow at a CAGR of over 7% through 2030, according to industry reports.

Products in this category, especially those newly introduced or still gaining traction, would likely be considered question marks on the BCG matrix. These represent opportunities for significant future growth if they can capture market share, but they also carry higher risk due to their nascent stage of adoption and the competitive landscape.

The natural sweeteners market is buzzing with innovation, constantly introducing new plant-based options beyond the familiar stevia and monk fruit. Whole Earth Brands' involvement with these emerging varieties, like allulose or certain rare sugars, would place them firmly in the Question Mark quadrant of the BCG Matrix. These ingredients offer exciting high-growth potential, but they also demand significant investment to build consumer awareness and carve out market share.

Whole Earth Brands' mission to enhance health through appealing food and beverage solutions opens doors for expanding beyond sweeteners. This suggests a strategic move into broader food and beverage applications where their naturally tasting products can offer unique value.

The company's potential lies in targeting new application areas with currently low market share but significant growth prospects. For instance, exploring functional ingredients for beverages or developing naturally flavored snack components could represent promising avenues for expansion.

Geographic Market Entry Initiatives

Whole Earth Brands' geographic market entry initiatives represent a strategic push into new territories, particularly in high-growth emerging markets. These ventures, while promising, demand substantial capital outlay to establish a foothold and compete with entrenched players.

For instance, expanding into Southeast Asian markets, which are experiencing robust economic growth, would necessitate significant investment in distribution networks and localized marketing. The company might face challenges in building brand awareness and market share against established food and beverage giants.

- High Investment Needs: Entering new geographies requires substantial capital for infrastructure, marketing, and regulatory compliance.

- Competitive Landscape: Established competitors in these high-growth markets can pose a significant barrier to entry and market share acquisition.

- Potential for Growth: Despite the challenges, these initiatives target regions with strong consumer demand and untapped potential for Whole Earth Brands' product portfolio.

- Risk Mitigation: Careful market research and phased entry strategies are crucial to manage the inherent risks associated with international expansion.

Partnerships and Collaborations for Novel Ingredients

Whole Earth Brands could forge strategic alliances to pioneer and launch innovative ingredients or technologies within the health and wellness sector. These collaborations are crucial for accessing specialized expertise and sharing the development costs associated with cutting-edge products.

Products emerging from these partnerships, especially those addressing emerging trends or specialized consumer needs, would likely be classified as question marks in the BCG matrix. This designation reflects their high market growth potential but currently low market share.

- Innovation Focus: Partnerships enable access to novel ingredient technologies, potentially accelerating product development timelines.

- Market Entry Strategy: Collaborations can provide a pathway to enter high-growth, niche markets with differentiated offerings.

- Investment Needs: These ventures typically require substantial investment in research, development, and market penetration to establish a foothold.

- Potential for Growth: Successful question mark products can transition into stars if they gain significant market traction and capitalize on market growth.

Question Marks for Whole Earth Brands represent new ventures or product lines with high growth potential but currently low market share. These are often in emerging markets or involve novel ingredient technologies where significant investment is needed to build awareness and gain traction. The success of these question marks hinges on their ability to capture market share and transition into Stars.

For example, Whole Earth Brands' expansion into new geographic regions, such as the burgeoning Southeast Asian market, exemplifies a question mark. These markets offer substantial growth prospects, but require considerable investment in distribution and marketing to compete with established players. The global food and beverage market in Southeast Asia is projected to reach over $1 trillion by 2027, highlighting the opportunity.

Similarly, the company's exploration of innovative, clean-label ingredients beyond traditional sweeteners, like rare sugars or functional food components, places them in the question mark category. These areas are experiencing rapid growth, with the global functional food ingredients market expected to exceed $100 billion by 2027, indicating a strong demand for such innovations.

Strategic partnerships aimed at developing cutting-edge health and wellness products also fall under question marks. These collaborations allow Whole Earth Brands to access specialized expertise and share R&D costs, crucial for pioneering new offerings in a competitive landscape.

| Category | Market Growth Potential | Current Market Share | Investment Required | Strategic Focus |

| New Geographic Markets (e.g., Southeast Asia) | High | Low | High | Market penetration, brand building |

| Innovative Clean-Label Ingredients (e.g., rare sugars) | High | Low | High | Product development, consumer education |

| Strategic Partnerships for New Products | High | Low | High | R&D, market entry support |

BCG Matrix Data Sources

Our Whole Earth Brands BCG Matrix is constructed using a blend of financial disclosures, market research reports, and industry growth forecasts to provide a comprehensive view of business unit performance.