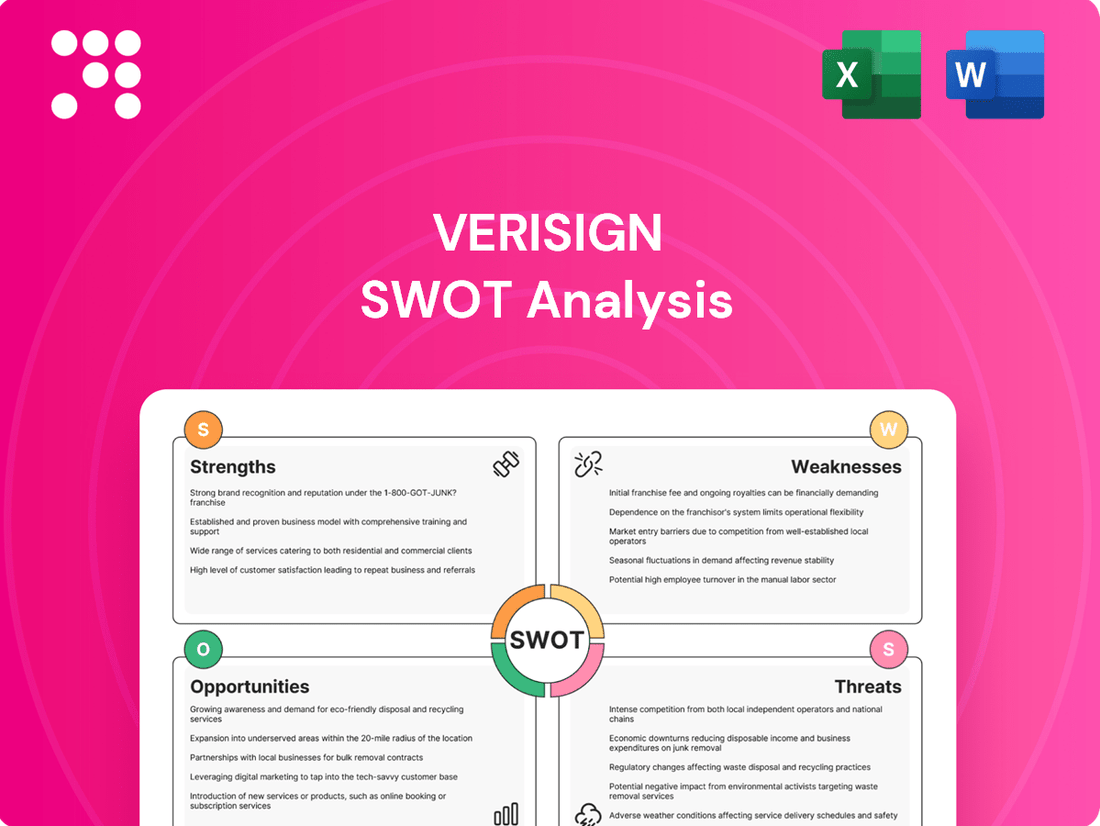

VeriSign SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VeriSign Bundle

VeriSign's dominance in domain name registration and security services presents significant strengths, but understanding their competitive landscape and potential threats is crucial for strategic planning.

Want the full story behind VeriSign's unique market position, potential vulnerabilities, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

VeriSign enjoys a near-monopoly in the domain name system, operating the .com and .net registries. This gives it a foundational role in global internet commerce, a position reinforced by its long-standing contract with ICANN. This critical infrastructure role creates a powerful, almost unassailable competitive moat for the company.

VeriSign demonstrates exceptional financial strength with remarkably high operating margins, hitting 67.95% in the first quarter of 2025. This impressive profitability is a direct result of its efficient, capital-light infrastructure, which minimizes operational costs.

The company's robust net margins further underscore its ability to translate revenue into profit. VeriSign consistently generates substantial free cash flow, a testament to its strong financial performance and operational efficiency.

This consistent cash generation allows VeriSign to actively engage in strategic share repurchases, enhancing shareholder value. Furthermore, the recent initiation of a quarterly dividend signals strong confidence in the company's ongoing financial health and its commitment to returning capital to its investors.

VeriSign's operational reliability is a cornerstone strength, evidenced by its flawless 28-year track record of 100% availability for the .com and .net domain name resolution systems. This exceptional uptime is not merely a statistic; it represents a fundamental trust factor for the entire global internet infrastructure.

This proven stability underpins VeriSign's critical role in maintaining the integrity and accessibility of the internet's most vital domain spaces. The company's ability to consistently deliver these essential services without interruption is a significant competitive advantage.

Pricing Power

VeriSign exhibits strong pricing power, a key strength. This is evident in its ability to implement price increases, such as the 7% hike for .com domain registrations in 2024. This strategic pricing capability is supported by its long-term agreements with ICANN, providing a predictable revenue stream.

- Contractual Pricing Authority: VeriSign's pricing is governed by agreements with ICANN, allowing for regular, pre-defined price adjustments.

- Revenue Growth Despite Volume: The company can grow revenue even if domain registration numbers experience minor fluctuations, due to its pricing leverage.

- 2024 .com Price Increase: A 7% increase on .com domain prices in 2024 underscores this pricing power.

Strategic Shareholder Returns

VeriSign demonstrates a strong commitment to enhancing shareholder value through strategic capital allocation. The company executed significant share repurchases, spending $1.21 billion on buybacks in 2024. Furthermore, an additional $913.1 million was authorized for share repurchases in the second quarter of 2025, underscoring a consistent effort to return capital to investors.

Beyond buybacks, VeriSign diversified its shareholder return strategy by initiating a quarterly cash dividend in the first quarter of 2025. This move provides a regular income stream for shareholders, complementing the capital appreciation potential from share repurchases.

- Share Repurchases: $1.21 billion in 2024 and $913.1 million authorized in Q2 2025.

- Dividend Initiation: Quarterly cash dividend commenced in Q1 2025.

- Capital Allocation: Active management of capital to reward shareholders.

VeriSign's dominance in operating the .com and .net domain registries, secured by its ICANN contract, creates a powerful, almost unassailable competitive moat. This foundational role in global internet commerce is further solidified by its exceptional operational reliability, boasting a 28-year track record of 100% availability for these critical domain systems.

The company's financial strength is remarkable, with operating margins reaching 67.95% in Q1 2025, driven by an efficient, capital-light infrastructure. This translates into robust net margins and consistent free cash flow generation, enabling significant shareholder returns.

VeriSign also exhibits strong pricing power, underscored by its ability to implement price increases, such as the 7% hike for .com domain registrations in 2024, facilitated by its contractual agreements with ICANN. This pricing leverage allows for revenue growth even with minor volume fluctuations.

The company actively enhances shareholder value through strategic capital allocation, evidenced by $1.21 billion spent on share repurchases in 2024 and an additional $913.1 million authorized in Q2 2025. The initiation of a quarterly cash dividend in Q1 2025 further demonstrates confidence in its financial health and commitment to returning capital.

| Metric | Value (Q1 2025 or 2024) | Significance |

|---|---|---|

| Operating Margin | 67.95% | Highlights exceptional profitability and efficiency. |

| .com Price Increase | 7% (in 2024) | Demonstrates significant pricing power. |

| Share Repurchases (2024) | $1.21 billion | Strong commitment to returning capital to shareholders. |

| Share Repurchases (Authorized Q2 2025) | $913.1 million | Continued focus on shareholder value enhancement. |

| Domain Availability Track Record | 100% (28 years) | Underpins critical internet infrastructure reliability. |

What is included in the product

This SWOT analysis provides a comprehensive look at VeriSign's internal strengths and weaknesses, alongside external opportunities and threats, to understand its strategic position in the market.

Offers a clear breakdown of VeriSign's competitive landscape, helping to identify and mitigate potential threats.

Weaknesses

VeriSign's business model leans heavily on the .com and .net domain name extensions, which account for a significant portion, around 85%, of its revenue. This concentration, while currently a strength due to their market dominance, presents a notable weakness.

This singular focus makes VeriSign susceptible to external shocks. A decline in demand for these specific domain types or adverse regulatory changes impacting their operation could disproportionately affect the company's financial performance.

VeriSign's core domain business, particularly .com and .net, faced a slight year-over-year decline in registrations during the first half of 2025. This slowdown, observed in both Q1 and Q2 2025, indicates a maturing market for these established domain extensions. While new registrations are showing some stability, the overall growth of VeriSign's foundational domain base is becoming a significant hurdle.

VeriSign's dominant position in the domain name system, particularly with .com and .net, naturally draws increased regulatory attention. This scrutiny often centers on its pricing power and how it conducts business in a market with limited alternatives.

For instance, the U.S. Department of Commerce's relationship with VeriSign, governing the .com registry, is a constant point of oversight. Any shifts in governmental policies or the rules set by the Internet Corporation for Assigned Names and Numbers (ICANN) could directly affect VeriSign's operational flexibility and its established revenue streams.

Limited Diversification Beyond Core Registry

VeriSign's reliance on its domain registry operations means its revenue streams are heavily concentrated. While it does offer security services, such as distributed denial-of-service (DDoS) mitigation, the financial specifics and revenue contribution from this cybersecurity segment are less prominently detailed. This lack of significant diversification beyond its core registry business could present a challenge for VeriSign aiming for more aggressive expansion into the broader cybersecurity market.

The company's cybersecurity offerings, while valuable, represent a smaller piece of the overall revenue pie compared to the substantial income generated by its domain name system (DNS) registry services. For instance, in the first quarter of 2024, VeriSign reported total revenue of $382 million, with the domain name registry segment being the primary driver. This concentration highlights a potential weakness in its ability to pivot or scale rapidly in diverse cybersecurity sectors.

- Revenue Concentration: VeriSign's revenue is predominantly derived from its domain name registry operations, limiting its exposure to other market segments.

- Cybersecurity Segment Contribution: The cybersecurity division, while present, contributes a smaller, less quantitatively detailed portion of overall revenue compared to the core registry business.

- Growth Hindrance: This limited diversification could impede VeriSign's capacity for aggressive growth and market share capture within the wider cybersecurity landscape.

Macroeconomic Headwinds

Lingering macroeconomic uncertainties present a significant challenge for VeriSign. Reduced corporate IT spending, a direct consequence of global economic slowdowns, can dampen demand for domain name renewals and new registrations. This is a critical factor as VeriSign's core business relies on the consistent growth of internet presence.

VeriSign's cautious guidance for 2025, projecting a potential slowdown in domain name growth, directly reflects these external economic pressures. For instance, if businesses cut back on digital infrastructure investments, the need for new domain names or the renewal of existing ones could decrease, impacting VeriSign's revenue streams.

- Reduced Corporate IT Budgets: Companies may scale back investments in new online ventures or digital infrastructure, directly impacting domain name demand.

- Global Economic Slowdown: A broader economic downturn can lead to decreased consumer and business spending, indirectly affecting the need for online services and thus domain registrations.

- Impact on Renewal Rates: Economic hardship could force some businesses to cut costs, potentially leading to a lower domain name renewal rate for VeriSign.

VeriSign's heavy reliance on the .com and .net domain extensions, which constitute approximately 85% of its revenue, presents a significant vulnerability. This concentration, while currently a strength due to market dominance, makes the company susceptible to shifts in demand or adverse regulatory changes impacting these specific extensions.

The company's cybersecurity segment, though present, contributes a smaller and less detailed portion of its overall revenue compared to its core domain registry business. This limited diversification could hinder VeriSign's ability to aggressively expand and capture market share in the broader cybersecurity sector.

Macroeconomic uncertainties pose a challenge, as reduced corporate IT spending due to global economic slowdowns can dampen demand for domain name renewals and new registrations. VeriSign's cautious guidance for 2025, projecting a potential slowdown in domain name growth, reflects these external economic pressures.

Preview the Actual Deliverable

VeriSign SWOT Analysis

This is the same VeriSign SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real VeriSign SWOT analysis you'll download post-purchase, in full detail.

Opportunities

VeriSign can capitalize on its established reputation in internet infrastructure to broaden its security offerings. This includes advanced DDoS mitigation, managed DNS, and security intelligence, tapping into a market driven by increasingly sophisticated cyber threats.

The ongoing expansion of internet access worldwide, particularly in developing nations, fuels a sustained demand for domain name registrations. This trend directly benefits VeriSign, as more people and businesses establishing an online presence require .com and .net domains, its core offerings.

VeriSign can strengthen its market position and revenue by forming strategic alliances or acquiring companies in complementary areas like cybersecurity services or cloud infrastructure. This diversification is crucial as its core domain registration business matures. For instance, a partnership with a leading cloud security provider could offer bundled services, tapping into the projected 15% compound annual growth rate (CAGR) of the global cybersecurity market through 2027.

Leveraging Data and Security Intelligence

VeriSign's position running essential internet infrastructure provides a unique opportunity to enhance and profit from its security intelligence. By offering sophisticated threat intelligence services to businesses and governments, VeriSign can tap into lucrative new markets.

This strategic move leverages VeriSign's deep understanding of internet traffic patterns and security threats. The company can develop advanced analytics and reporting tools, turning raw data into actionable insights for clients.

- Monetization of Security Intelligence: VeriSign can offer tiered subscription services for its threat intelligence, catering to different enterprise needs.

- New Revenue Streams: In 2024, the global cybersecurity market was projected to reach over $200 billion, highlighting the demand for such services.

- Enhanced Value Proposition: Providing security intelligence strengthens VeriSign's core business by offering a more comprehensive security solution.

- Government Contracts: VeriSign could secure high-value contracts with national security agencies and critical infrastructure operators.

Potential for New Top-Level Domains (TLDs) or Services

VeriSign, primarily known for its .com and .net domain operations, has a significant opportunity in the evolving landscape of new top-level domains (TLDs). As the Internet Corporation for Assigned Names and Numbers (ICANN) continues to approve new gTLDs, VeriSign could leverage its expertise to operate these new registries or offer enhanced digital identity services. This expansion could tap into niche markets and diversify its revenue streams beyond its core offerings.

The potential for new TLDs represents a chance for VeriSign to broaden its service portfolio. For instance, specialized TLDs catering to specific industries or geographical regions could be managed by VeriSign, creating new avenues for growth. Furthermore, advancements in internet protocols might necessitate new forms of digital identity management, a space where VeriSign could innovate and lead.

- ICANN's New gTLD Program: VeriSign can actively participate in future rounds of new gTLD applications, securing rights to operate potentially lucrative domain extensions.

- Digital Identity Solutions: Beyond domain registration, VeriSign could develop and offer advanced digital identity verification and management services, capitalizing on increasing cybersecurity concerns.

- Market Expansion: Operating new TLDs allows VeriSign to reach new customer segments and geographic markets, thereby increasing its overall addressable market.

- Partnerships: Collaborating with entities seeking to launch their own TLDs or digital identity platforms presents another avenue for revenue generation and market penetration.

VeriSign can leverage its deep understanding of internet infrastructure to expand into adjacent cybersecurity services. This includes offering advanced DDoS protection, managed DNS, and threat intelligence, capitalizing on the growing demand for robust online security solutions. The global cybersecurity market is projected to reach $376 billion by 2027, presenting a substantial opportunity for VeriSign to diversify its revenue streams beyond domain registration.

The continuous growth of the internet, particularly in emerging markets, drives consistent demand for domain name registrations. As more individuals and businesses establish an online presence, VeriSign's core .com and .net domains remain essential. This ongoing expansion of internet users directly translates to increased domain registrations, a fundamental driver of VeriSign's business.

Strategic partnerships and acquisitions in complementary sectors, such as cloud security or identity management, can bolster VeriSign's market position. Diversifying its service offerings is key as its core domain business matures. For example, a collaboration with a cloud security provider could bundle services, tapping into the projected 15% CAGR of the global cybersecurity market through 2027.

VeriSign's unique position managing critical internet infrastructure allows it to develop and monetize its security intelligence capabilities. By offering sophisticated threat intelligence services to enterprises and governments, VeriSign can tap into lucrative new markets. This leverages its extensive data on internet traffic patterns and security threats, turning insights into valuable client services.

| Opportunity Area | Description | Market Relevance | Potential Impact |

|---|---|---|---|

| Cybersecurity Services Expansion | Offering advanced DDoS mitigation, managed DNS, and security intelligence. | Global cybersecurity market projected to reach $376 billion by 2027. | Diversifies revenue, leverages existing infrastructure expertise. |

| New Top-Level Domains (TLDs) | Operating new gTLDs and offering enhanced digital identity services. | ICANN's ongoing gTLD program expansion. | Access to niche markets, diversification beyond .com/.net. |

| Strategic Alliances & Acquisitions | Partnerships or acquisitions in cybersecurity or cloud infrastructure. | Cybersecurity market CAGR of 15% through 2027. | Strengthens market position, broadens service portfolio. |

| Monetization of Security Intelligence | Developing and selling threat intelligence and analytics services. | Increasing sophistication of cyber threats globally. | Creates new revenue streams, enhances value proposition. |

Threats

The proliferation of new generic top-level domains (gTLDs), like .xyz, .app, and .shop, introduced by ICANN, presents a significant competitive challenge to VeriSign's established .com and .net franchises. These alternatives offer businesses and individuals more branding options, potentially diverting registrations away from VeriSign's core services. For instance, as of early 2024, there are over 1,200 active gTLDs, providing a vast landscape of choices that were not previously available.

The cyber threat landscape is constantly shifting, with increasingly sophisticated attacks like AI-driven malware and advanced ransomware posing significant risks to internet infrastructure. VeriSign, despite its security offerings, is not immune; a major breach of its core systems could have severe repercussions.

For instance, the cost of data breaches continues to climb, with IBM's 2023 Cost of a Data Breach Report indicating an average global cost of $4.45 million, a figure likely to increase with more sophisticated threats in 2024 and 2025.

Supply chain vulnerabilities, a growing concern, could also be exploited to compromise VeriSign's operations or the services it provides, potentially impacting the stability of the internet itself.

Future regulatory shifts from entities like ICANN or national governments pose a significant threat, potentially introducing new compliance burdens, limiting VeriSign's ability to adjust pricing for its domain name services, or modifying the foundational terms of its essential registry agreements. For instance, ongoing discussions around domain name system governance could lead to unexpected operational or financial impacts.

While VeriSign's long-standing contracts offer a degree of stability, the inherent risk lies in the renegotiation phases. These periods could see unfavorable terms introduced, impacting revenue streams or operational flexibility, especially as global digital governance frameworks evolve.

Technological Disruptions (e.g., Decentralized Domains)

Emerging technologies like blockchain-based decentralized naming systems, such as Ethereum Name Service (ENS) and Handshake, present a long-term threat to traditional domain registries. These systems offer alternative methods for online identity and navigation, potentially diminishing the reliance on centralized Domain Name System (DNS) infrastructure that VeriSign currently operates.

While the widespread adoption of decentralized domains is still in its early stages, the underlying technology could fundamentally alter how users access and interact online. For instance, ENS saw a significant surge in registrations in late 2021 and early 2022, indicating growing developer and user interest in alternative naming solutions.

- Decentralized Naming Systems: Blockchain-based alternatives like ENS and Handshake offer potential competition to VeriSign's core business.

- Shifting User Behavior: A long-term shift towards decentralized identity management could reduce demand for traditional .com and .net domains.

- Early Adoption Trends: While still nascent, the growth in registrations for systems like ENS signals potential future disruption.

Decline in Domain Renewal Rates

While VeriSign's domain renewal rates have historically been robust, a notable downturn poses a significant threat. Macroeconomic headwinds, intensified competition from alternative domain providers, or increased customer price sensitivity could lead to a direct erosion of VeriSign's predictable recurring revenue and overall profitability. For instance, although VeriSign has implemented price adjustments, this strategy could inadvertently accelerate domain attrition if customers opt for more budget-friendly solutions. In 2023, VeriSign reported a renewal rate of 74.6% for .com and .net domains, a slight dip from previous periods, highlighting the sensitivity of this metric.

The company's reliance on a subscription-based model makes it particularly vulnerable to shifts in renewal behavior. A sustained decline in these rates could impact the company's ability to invest in infrastructure and innovation, further exacerbating the competitive disadvantage.

- Threat: Declining Domain Renewal Rates

- Impact: Reduced recurring revenue and profitability

- Contributing Factors: Macroeconomic pressures, increased competition, price sensitivity

- Risk Mitigation: Balancing price increases with value proposition

Emerging decentralized naming systems, such as Ethereum Name Service (ENS) and Handshake, represent a significant long-term threat. These blockchain-based alternatives offer different approaches to online identity, potentially reducing reliance on VeriSign's traditional Domain Name System (DNS) infrastructure. While early adoption is still developing, the growing interest in these systems, evidenced by a surge in ENS registrations in late 2021 and early 2022, signals a potential shift in user behavior and a challenge to VeriSign's established market position.

SWOT Analysis Data Sources

This VeriSign SWOT analysis is built upon a foundation of robust data, including its official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.