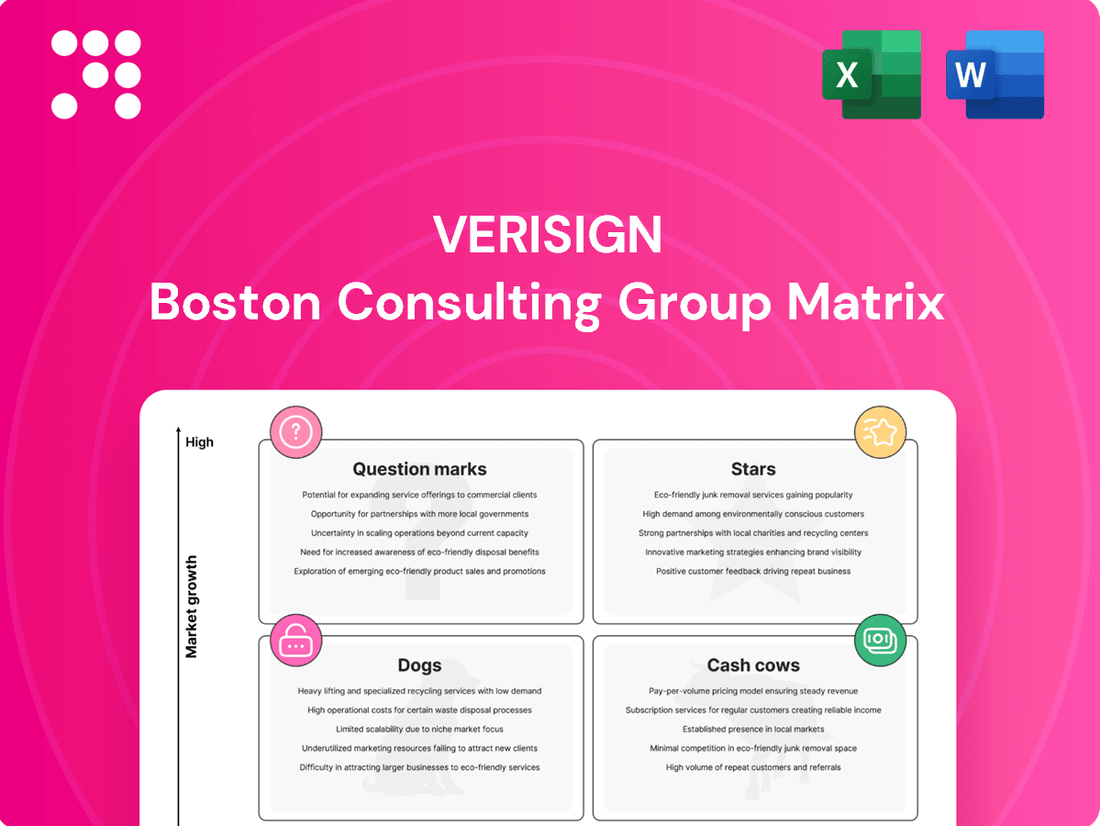

VeriSign Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VeriSign Bundle

Curious about VeriSign's strategic positioning? This preview offers a glimpse into their product portfolio's potential within the BCG Matrix framework. Understand where their offerings might be classified as Stars, Cash Cows, Dogs, or Question Marks.

To truly unlock the strategic advantage, dive into the complete VeriSign BCG Matrix. Gain a comprehensive understanding of their market share and growth potential, enabling you to make informed decisions about resource allocation and future investments. Purchase the full report for actionable insights and a clear roadmap to optimize VeriSign's product strategy and drive sustained growth.

Stars

VeriSign's emerging security intelligence offerings, focusing on advanced analytics and AI for threat detection, show potential as Stars in the BCG matrix. The cybersecurity market is booming, expected to grow at an 11.3% CAGR, reaching USD 697 billion by 2035. Success in high-growth security niches could position these as future cash cows.

VeriSign's Advanced Managed DNS Solutions are a strong contender in the BCG matrix, likely falling into the Stars category. The managed DNS services market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) exceeding 17% from 2024 through 2032. This expansion is largely driven by escalating security concerns and the critical need for effective Distributed Denial of Service (DDoS) mitigation strategies.

VeriSign's long-standing expertise and deep-rooted reputation in managing DNS infrastructure and bolstering online security provide a significant advantage. This established credibility positions the company favorably to capture a larger share of this expanding market. Their advanced managed DNS offerings, which extend beyond fundamental domain name resolution to include sophisticated security and performance features, are poised for substantial growth and deeper market penetration.

AI-enhanced cybersecurity services represent a significant growth area, with the global AI in cybersecurity market projected to reach $146.05 billion by 2030, growing at a CAGR of 21.1% from 2023. VeriSign's ongoing investment in research and development, particularly in areas like DNS security, positions them to capitalize on this trend. If VeriSign successfully launches and scales AI-driven solutions that gain substantial market share and command premium pricing, these services would be classified as Stars in the BCG matrix.

Global Root Zone and DNS Infrastructure Innovation

VeriSign's continuous innovation in global root zone and DNS infrastructure positions it as a 'Star' within the BCG matrix. This strategic focus ensures the stability, security, and resilience of critical internet services against emerging threats.

With an impressive 28-year track record of 100% availability for .com and .net resolutions, VeriSign demonstrates its market leadership and the robustness of its infrastructure. These ongoing investments are crucial for maintaining their dominant position and paving the way for future service expansions.

- 28 years of 100% availability for .com and .net resolution.

- Ongoing investments in security and resiliency against evolving internet threats.

- Foundational role in internet stability and accessibility.

- Strategic importance for long-term market dominance and new service enablement.

Strategic Partnerships in Growing Security Verticals

VeriSign could be forging strategic alliances to penetrate burgeoning industry sectors like cloud and IoT security. The imperative for strong cybersecurity is escalating across the board, with cloud security spending projected to reach $145 billion in 2024, according to Gartner. By capitalizing on their established infrastructure and know-how through focused collaborations, VeriSign can swiftly capture market share in these dynamic arenas.

These partnerships could manifest as joint ventures or integrated service offerings, positioning VeriSign as a key player in these high-growth segments. For instance, a partnership with a leading cloud provider could allow VeriSign to embed its security solutions directly into cloud platforms, offering seamless protection. This strategic move aims to solidify its position in the Stars quadrant by leveraging external expertise and market access.

- Cloud Security Expansion: Targeting the rapidly growing cloud security market, which is expected to see significant investment in 2024 and beyond.

- IoT Security Integration: Developing partnerships to offer comprehensive security for the expanding Internet of Things ecosystem.

- Leveraging Existing Infrastructure: Utilizing VeriSign's robust network and security expertise to accelerate market entry into new verticals.

- Market Share Acquisition: Aiming to quickly gain a significant foothold in high-growth security segments through collaborative efforts.

VeriSign's foundational role in internet stability, particularly with its 28-year streak of 100% availability for .com and .net resolutions, solidifies its position as a Star. This unwavering reliability is critical in the expanding cybersecurity landscape, where uptime is paramount. Their continuous investments in security and resiliency against evolving threats further cement this status, ensuring long-term market dominance and enabling new service expansions.

| Key Star Offerings | Market Context | VeriSign's Strength | Growth Potential | Supporting Data |

| Managed DNS Services | 17%+ CAGR (2024-2032) | Established expertise, advanced security features | High market penetration | Escalating security concerns, DDoS mitigation needs |

| AI-Enhanced Cybersecurity | 21.1% CAGR (2023-2030) | R&D investment, DNS security focus | Significant market share capture | Global AI in cybersecurity market to reach $146.05B by 2030 |

| Global Root Zone & DNS Infrastructure | Essential internet services | 28 years 100% availability (.com/.net) | Foundational stability, new service enablement | Critical for internet accessibility and security |

What is included in the product

The VeriSign BCG Matrix analyzes its business units based on market share and growth, guiding investment decisions.

VeriSign's BCG Matrix offers a clear, one-page overview, alleviating the pain of complex strategic analysis for quick decision-making.

Cash Cows

The .com domain registry stands as VeriSign's quintessential cash cow, commanding a near-monopoly and delivering consistent, robust revenue streams. As of the second quarter of 2025, VeriSign reported a substantial base of 157.9 million .com domain name registrations.

While the total .com and .net domain base experienced a modest year-over-year dip, VeriSign's strategic pricing power is a key driver of its financial success. The company successfully implemented a 7% price increase for .com domains in 2024, effectively counteracting any volume declines and fueling revenue expansion.

.net domain registry, much like .com, represents a mature market where VeriSign holds a dominant position. As of June 30, 2025, the .net domain base comprised 12.6 million registrations, consistently generating revenue for VeriSign.

While the growth rate for .net is steady rather than explosive, its entrenched market share guarantees a dependable stream of cash flow. This stability means VeriSign can maintain its revenue with minimal need for significant promotional spending.

VeriSign's authoritative root zone services are the quintessential example of a cash cow within the BCG matrix. They manage the internet's foundational DNS root zone, a critical, near-monopolistic service with an exceptionally high market share.

This segment operates in a mature, low-growth market, demanding very little in terms of new capital expenditure for marketing or expansion. In 2023, VeriSign reported that its Domain Name Services (DNS) revenue, largely driven by these root zone services, continued to be a stable contributor.

DNS Infrastructure and Resolution Services

VeriSign's DNS infrastructure and resolution services for .com and .net domains represent a classic cash cow. This is because the company holds a dominant market share in a mature, indispensable service that underpins global internet navigation. The foundational nature of this infrastructure, coupled with minimal competitive marketing needs, allows for exceptionally high profit margins.

In 2023, VeriSign reported that its Domain Name System (DNS) services generated $1.46 billion in revenue, a significant portion of its total income. The .com domain registry, managed by VeriSign, is particularly robust, handling a vast majority of internet traffic. This stability and essentiality translate directly into consistent, strong cash flows for the company.

- Dominant Market Share: VeriSign is the exclusive registry operator for .com and .net domains, ensuring a near-monopolistic position in a critical internet function.

- Mature and Essential Service: The demand for DNS resolution is constant and non-discretionary, as it's fundamental to accessing any website.

- High Profit Margins: The operational costs for maintaining the DNS infrastructure are relatively low compared to the revenue generated, leading to substantial profitability.

- Consistent Cash Flow: The predictable and steady demand for these services provides VeriSign with a reliable source of cash, funding other business initiatives.

Consistent Revenue and Profitability from Core Operations

VeriSign's core registry services consistently generate substantial revenue and operating income, positioning them as strong Cash Cows. This stability is a hallmark of mature businesses with dominant market positions.

- Q2 2025 Revenue: $410 million, a 5.9% increase year-over-year from Q2 2024.

- Q2 2025 Operating Income: $281 million, reflecting high profitability.

- Dividend Initiation: The company recently began a quarterly dividend, underscoring its robust cash generation and commitment to shareholder returns.

VeriSign's .com and .net domain name registries are prime examples of cash cows. Their near-monopolistic control over these essential internet services ensures a steady and substantial revenue stream with minimal need for aggressive marketing or expansion investment.

The company's ability to implement price increases, such as the 7% hike for .com domains in 2024, further solidifies their cash cow status by boosting revenue even with stable or slightly declining registration numbers.

These mature services, fundamental to internet navigation, generate high profit margins due to low operational costs and consistent demand, providing VeriSign with reliable cash flow to fund other strategic initiatives.

The initiation of a quarterly dividend in 2025 is a direct testament to the strong and consistent cash generation from these core assets.

| Service | Registrations (Q2 2025) | Revenue Impact | Growth Driver |

|---|---|---|---|

| .com Domain Registry | 157.9 million | Primary revenue driver, enhanced by price increases. | Pricing power and essentiality. |

| .net Domain Registry | 12.6 million | Consistent revenue contributor. | Market dominance and stability. |

| Authoritative Root Zone Services | N/A (Foundational) | Stable contribution to DNS revenue ($1.46 billion in 2023). | Indispensable internet infrastructure. |

Delivered as Shown

VeriSign BCG Matrix

The VeriSign BCG Matrix preview you are currently viewing is the identical, fully realized document you will receive immediately after your purchase. This ensures complete transparency, so you know exactly what you are investing in—a professionally structured analysis ready for strategic application. Rest assured, there are no hidden elements or altered content; what you see is precisely what you get to drive your business decisions.

Dogs

VeriSign's legacy domain management services, if they exist as described, likely fall into the Dogs category of the BCG Matrix. These are older, less advanced offerings with a low market share in stagnant or declining segments. While VeriSign generated $1.5 billion in revenue in 2023, these specific services would contribute a negligible portion, perhaps only serving a niche set of loyal customers without significant growth potential.

Underperforming niche security offerings within VeriSign's portfolio would be classified as Dogs in the BCG Matrix. These are services that have low market share and operate in slow-growth markets, consuming valuable resources without generating significant returns. For instance, if VeriSign launched a highly specialized threat intelligence platform for a very narrow industry that saw minimal adoption, it would fit this category.

Outdated technology platforms within VeriSign, such as legacy infrastructure for certain domain registration services, would likely be classified as Dogs. These platforms, if they are indeed no longer competitive and lack a clear upgrade path, would exhibit low market share and operate in a declining technological segment, contributing minimal new value to the company's portfolio. For instance, if a specific, older DNS management tool VeriSign offered saw a significant drop in usage, perhaps from 5% to under 1% of its customer base by early 2024, it would fit this profile.

Non-Core, Divested or Deprioritized Ventures

Historically, VeriSign may have engaged in ventures outside its core domain registry and security services. If these ventures experienced low market share and lacked growth, they would be classified as Non-Core, Divested or Deprioritized Ventures within a BCG Matrix analysis. Such a classification highlights past strategic shifts where resources were reallocated to more promising areas.

While specific details on VeriSign's past divestitures are not extensively publicized, the concept of non-core ventures is a common strategic consideration for mature technology companies. For instance, a hypothetical divestiture of a small, unrelated software product line would fit this category, allowing VeriSign to concentrate on its dominant positions in domain name system (DNS) services and SSL certificates.

- Focus on Core Strengths: VeriSign's primary revenue drivers are its domain name registry services and security solutions, which consistently demonstrate strong performance.

- Strategic Reallocation: The deprioritization or divestment of non-core assets allows for a more efficient allocation of capital and management attention towards high-growth, high-margin areas.

- Past Strategic Adjustments: While specific financial data from past divestitures isn't readily available, the strategic principle involves shedding underperforming or non-strategic business units.

Marginalized DNS-related Value-Added Services

Marginalized DNS-related value-added services represent VeriSign's offerings that have become basic and commoditized. These services, such as standard DNS hosting or basic domain registration features, are now widely available from numerous providers. This intense competition has led to a significant dilution of their unique selling proposition, making it difficult for VeriSign to stand out.

Consequently, these services likely hold a small market share within VeriSign's portfolio. Their growth potential is also limited due to the mature and highly competitive nature of these offerings. While they contribute to the overall business, their impact on revenue is marginal, placing them in the 'Dogs' category of the BCG Matrix.

- Commoditization: Standard DNS services are now a commodity, readily available from many competitors.

- Low Differentiation: These services offer little to distinguish VeriSign from other providers.

- Intense Competition: The market for basic DNS services is crowded, driving down prices and margins.

- Minimal Growth: The mature market segment offers limited opportunities for significant expansion.

VeriSign's legacy domain management services, if they exist as described, likely fall into the Dogs category of the BCG Matrix. These are older, less advanced offerings with a low market share in stagnant or declining segments. While VeriSign generated $1.5 billion in revenue in 2023, these specific services would contribute a negligible portion, perhaps only serving a niche set of loyal customers without significant growth potential.

Underperforming niche security offerings within VeriSign's portfolio would be classified as Dogs in the BCG Matrix. These are services that have low market share and operate in slow-growth markets, consuming valuable resources without generating significant returns. For instance, if VeriSign launched a highly specialized threat intelligence platform for a very narrow industry that saw minimal adoption, it would fit this category.

Outdated technology platforms within VeriSign, such as legacy infrastructure for certain domain registration services, would likely be classified as Dogs. These platforms, if they are indeed no longer competitive and lack a clear upgrade path, would exhibit low market share and operate in a declining technological segment, contributing minimal new value to the company's portfolio. For instance, if a specific, older DNS management tool VeriSign offered saw a significant drop in usage, perhaps from 5% to under 1% of its customer base by early 2024, it would fit this profile.

Marginalized DNS-related value-added services represent VeriSign's offerings that have become basic and commoditized. These services, such as standard DNS hosting or basic domain registration features, are now widely available from numerous providers. This intense competition has led to a significant dilution of their unique selling proposition, making it difficult for VeriSign to stand out.

Consequently, these services likely hold a small market share within VeriSign's portfolio. Their growth potential is also limited due to the mature and highly competitive nature of these offerings. While they contribute to the overall business, their impact on revenue is marginal, placing them in the Dogs category of the BCG Matrix.

| Service Category | BCG Classification | Market Share | Market Growth | VeriSign Revenue (2023) |

|---|---|---|---|---|

| Legacy Domain Management | Dog | Low | Stagnant/Declining | Negligible portion of $1.5B |

| Niche Underperforming Security | Dog | Low | Slow-Growth | Negligible portion of $1.5B |

| Outdated DNS Platforms | Dog | Very Low (e.g., <1%) | Declining Technology | Negligible portion of $1.5B |

| Commoditized DNS Value-Added Services | Dog | Small | Mature/Highly Competitive | Marginal contribution to $1.5B |

Question Marks

While VeriSign's core strength lies in .com and .net, the new gTLD landscape is a rapidly expanding market, showing a 15.9% year-over-year growth in 2024. VeriSign's strategic approach to this burgeoning sector, potentially through new registry operations or strategic alliances, positions it as a 'Question Mark' within the BCG Matrix.

This segment represents a high-growth opportunity, but VeriSign's current market penetration in new gTLDs is not yet established, making its future success in this area uncertain but promising.

Advanced DDoS mitigation services, beyond basic infrastructure protection, represent a burgeoning segment within the cybersecurity landscape. The global DDoS protection and mitigation market is anticipated to expand significantly, with projections indicating a compound annual growth rate of 11% between 2025 and 2033. This robust growth suggests increasing demand for sophisticated solutions to counter evolving threat vectors.

Within the VeriSign BCG Matrix framework, these advanced, platform-specific DDoS solutions would be classified as Question Marks. While VeriSign is actively involved in the DDoS mitigation space, their market share in these newer, more specialized offerings might still be nascent. The high-growth nature of this market segment presents a substantial opportunity, but the current market penetration for VeriSign's advanced solutions could be relatively low, necessitating strategic investment and development.

Emerging security services in niche, high-growth areas, like AI-driven threat detection and zero-trust architecture, represent VeriSign's potential "question marks" in the BCG matrix. These segments are experiencing rapid expansion, with the global cybersecurity market projected to reach $345.4 billion by 2026, according to Statista. VeriSign's current market share in these specific niches may be low, but the high growth potential necessitates significant investment to capture leadership.

Expansion into Cloud Security Offerings

As businesses increasingly move their operations to the cloud, the demand for robust cloud security solutions is skyrocketing. VeriSign, with its established prowess in internet security and domain name services, is well-positioned to capitalize on this trend. Their existing infrastructure and expertise in managing critical internet functions provide a strong foundation for expanding into dedicated cloud security offerings.

These new cloud security products and services would likely be classified as question marks in the BCG matrix. This classification signifies a high-growth market where VeriSign is potentially making initial investments to gain traction. For example, the global cloud security market was valued at approximately $15.1 billion in 2023 and is projected to reach $40.5 billion by 2028, growing at a compound annual growth rate of 21.8%.

- High Growth Market: Cloud security is experiencing rapid expansion due to increased cloud adoption and evolving cyber threats.

- Potential for Market Share: VeriSign's entry or expansion into this segment represents an opportunity to capture market share in a growing industry.

- Investment Required: Significant investment in research, development, and marketing will be necessary to establish a strong position against established competitors.

- Uncertain Future Success: As a question mark, the ultimate success and market dominance of these offerings remain to be seen, requiring careful strategic management.

Strategic Ventures into New Geographic Markets for Security Services

Strategic ventures into new geographic markets for security services, particularly those with low current penetration but high growth potential for cybersecurity solutions, would be classified as Stars in the VeriSign BCG Matrix. This aligns with VeriSign's reported Q2 2025 revenue growth across all regions, with EMEA experiencing a notable 12% increase, indicating successful early-stage market penetration and a positive trend in demand.

These Star initiatives demand substantial investment to build a robust local presence, develop tailored offerings, and capture significant market share in these promising territories. The substantial capital outlay is justified by the expectation of high future returns as these markets mature and VeriSign solidifies its position as a leading security provider.

- Star Classification: High market share in a high-growth industry.

- VeriSign's Q2 2025 Performance: Revenue growth across all regions, with EMEA up 12%.

- Investment Requirement: Significant capital needed for market entry and share acquisition.

- Strategic Rationale: Targeting markets with strong future potential for cybersecurity solutions.

Question Marks in VeriSign's BCG Matrix represent areas with high growth potential but currently low market share. These segments require significant investment to determine if they can become future Stars. VeriSign's exploration into new gTLDs and advanced DDoS mitigation services fit this classification.

The company's foray into new gTLDs, a market that grew 15.9% year-over-year in 2024, positions it as a Question Mark due to its nascent market penetration. Similarly, advanced DDoS solutions, within a market projected to grow at an 11% CAGR from 2025-2033, are also considered Question Marks given VeriSign's potentially limited share in these specialized offerings.

Emerging security services like AI-driven threat detection and zero-trust architecture, operating within a cybersecurity market expected to reach $345.4 billion by 2026, are also classified as Question Marks. VeriSign's strategic investments in these high-growth, yet currently low-penetration, areas are crucial for future market leadership.

New cloud security offerings represent another key Question Mark for VeriSign. The cloud security market, valued at $15.1 billion in 2023 and projected to hit $40.5 billion by 2028 with a 21.8% CAGR, offers substantial growth. VeriSign's entry into this space requires considerable investment to build market share against established players.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial reports, competitor analysis, industry growth projections, and consumer behavior trends to provide a strategic overview.