VeriSign PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VeriSign Bundle

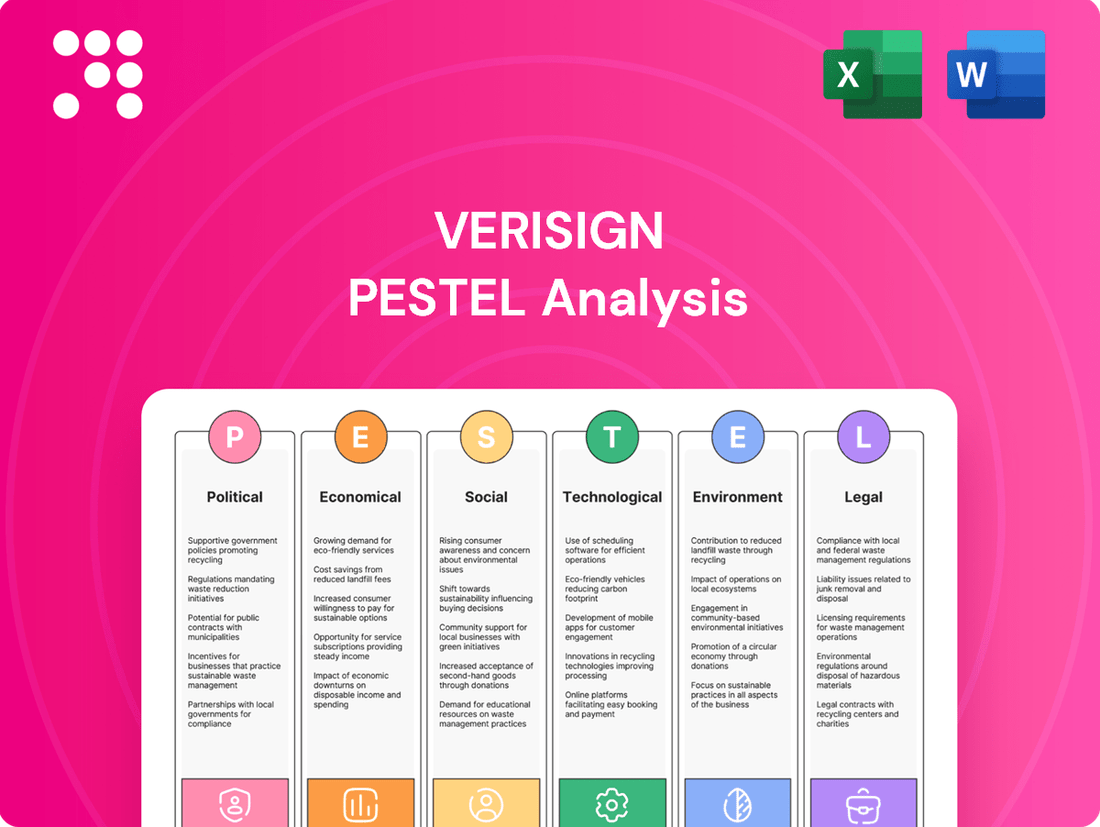

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping VeriSign's trajectory. This comprehensive PESTLE analysis provides the strategic foresight you need to anticipate market shifts and capitalize on emerging opportunities. Download the full report now to gain actionable intelligence and elevate your decision-making.

Political factors

VeriSign, as a key player in internet infrastructure, navigates a landscape heavily shaped by governmental internet governance policies. These regulations, particularly concerning domain name system (DNS) management and cybersecurity, directly influence VeriSign's operational framework and long-term strategy. For instance, the U.S. government's oversight of the .com and .net domains through its contract with VeriSign underscores the profound impact of these political decisions.

VeriSign's operation of critical internet infrastructure like the .com and .net domain name systems (DNS) places it directly in the path of international relations and geopolitical shifts. As of early 2024, ongoing global conflicts and trade tensions highlight the vulnerability of interconnected digital systems. Any escalation could lead to demands for greater national control over internet governance, potentially impacting VeriSign's operational agreements.

Geopolitical instability can manifest as increased scrutiny of cross-border data flows and demands for data localization, directly affecting how VeriSign manages its global domain registration data. For example, concerns over data privacy and national security, prevalent in discussions between major economic blocs in 2024, could translate into regulatory pressures on companies like VeriSign to segregate or nationalize data storage. This could complicate operations and increase compliance costs.

Governments globally are tightening cybersecurity rules and focusing on national digital security. This trend, spurred by worries about cyberattacks and protecting essential services, means VeriSign faces new compliance demands, reporting obligations, and operational benchmarks.

For instance, the U.S. Cybersecurity and Infrastructure Security Agency (CISA) continues to enhance its directives for securing critical infrastructure, impacting companies like VeriSign that manage vital internet services. In 2024, CISA's budget saw an increase, reflecting the growing emphasis on these national security agendas.

VeriSign must therefore consistently update its security offerings and systems to align with these evolving national security requirements, ensuring it meets the standards set by various governmental bodies to safeguard digital assets and maintain operational integrity.

Regulatory Oversight by ICANN and Other Bodies

VeriSign's operations are significantly shaped by international bodies like ICANN, which governs the Domain Name System (DNS). Political shifts or changes in ICANN's multi-stakeholder governance can directly alter VeriSign's contractual agreements, pricing for services like .com and .net domain registrations, and the overall scope of its business. For instance, ICANN's policy decisions directly influence the revenue VeriSign generates from its registry services, a core component of its financial performance.

These regulatory frameworks are crucial. In 2023, VeriSign's revenue from its Domain Name Services segment was $1.46 billion, underscoring how policy decisions by bodies like ICANN can have a substantial financial impact. Potential changes in domain registration policies or pricing structures, driven by political considerations within these organizations, could directly affect VeriSign's profitability and market position. The stability and predictability of these regulatory environments are therefore paramount for VeriSign's long-term strategic planning and financial forecasting.

- ICANN's Role: Sets global policies for domain names and IP addresses, directly impacting VeriSign's core business.

- Political Influence: Changes in government representation or policy priorities within ICANN can alter VeriSign's operational landscape.

- Contractual Impact: ICANN's decisions can affect VeriSign's agreements, including pricing and service scope for .com and .net domains.

- Financial Implications: Policy shifts can influence VeriSign's revenue streams, as seen in its $1.46 billion Domain Name Services revenue in 2023.

Trade Policies and Digital Economy Agreements

VeriSign's global reach is significantly shaped by international trade policies and digital economy agreements. For instance, the European Union's General Data Protection Regulation (GDPR), enacted in 2018 and continually updated, impacts how VeriSign handles data across borders, potentially affecting its service delivery to European clients.

Navigating varying data localization requirements, such as those in China or Russia, presents operational challenges. These policies can restrict VeriSign's ability to centralize data processing, increasing costs and complexity. The ongoing discussions around digital service taxes in various jurisdictions also pose a risk to revenue streams and pricing strategies.

VeriSign must actively monitor and adapt to these evolving trade landscapes. For example, as of early 2024, the United States and the European Union continue to refine data transfer frameworks like the EU-U.S. Data Privacy Framework, which directly impacts companies like VeriSign that operate across these regions.

- Data Localization Mandates: Countries like Vietnam have implemented data localization laws requiring certain types of data to be stored within their borders, affecting global cloud service providers and domain registrars.

- Cross-Border Data Transfer Regulations: The Schrems II ruling by the Court of Justice of the European Union in 2020 significantly impacted data transfers between the EU and the US, necessitating new compliance measures for companies.

- Digital Service Taxes: Several countries, including France and India, have introduced or are considering digital service taxes, which could increase the cost of providing digital services internationally.

- Trade Agreement Evolution: Ongoing negotiations for new trade agreements, such as potential updates to the CPTPP or new bilateral agreements, could introduce new rules impacting the digital economy and VeriSign's market access.

Governmental internet governance policies are central to VeriSign's operations, particularly concerning the .com and .net domains. The U.S. government's oversight through its contract with VeriSign highlights the direct impact of political decisions on the company's core business. In 2023, VeriSign's Domain Name Services segment generated $1.46 billion in revenue, demonstrating the financial significance of these political agreements.

Geopolitical shifts and international relations can influence demands for greater national control over internet governance, potentially affecting VeriSign's operational agreements. Concerns over data privacy and national security, prominent in global discussions in 2024, could lead to regulatory pressures for data localization, complicating VeriSign's operations and increasing compliance costs.

VeriSign must adhere to evolving national cybersecurity regulations and reporting obligations, driven by government initiatives to protect critical infrastructure. The U.S. Cybersecurity and Infrastructure Security Agency (CISA), for instance, continues to strengthen its directives, with its 2024 budget reflecting an increased focus on national security agendas impacting companies like VeriSign.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing VeriSign, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The VeriSign PESTLE Analysis provides a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations, thus relieving the pain point of sifting through extensive data.

Economic factors

Global economic growth directly impacts VeriSign's performance, as its revenue is tied to IT spending. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a stable outlook that generally supports IT investment. This economic environment encourages businesses and individuals to invest in digital infrastructure, including domain name registrations and cybersecurity services, which are VeriSign's primary revenue drivers.

When economies are expanding, companies tend to increase their IT budgets, leading to higher demand for services like domain registration and DNS security. For instance, the continued digital transformation across industries in 2024 and into 2025 is expected to sustain the need for robust online presence and security solutions. This trend directly benefits VeriSign by increasing the volume of new domain registrations and renewals.

Conversely, economic slowdowns or recessions can dampen IT spending, negatively affecting VeriSign. During downturns, businesses often cut discretionary spending, which can include new domain acquisitions or premium security features. A projected slowdown in certain regions in late 2024 or early 2025 could therefore present a headwind for VeriSign's growth trajectory.

Rising inflation presents a significant challenge for VeriSign, directly impacting its operational expenses. For instance, the cost of electricity to power its data centers, a critical component of its infrastructure, has seen upward pressure. In 2024, global energy prices have remained volatile, with some regions experiencing increases of 5-10% year-over-year, directly affecting VeriSign's utility bills.

Furthermore, the demand for highly skilled cybersecurity professionals continues to drive up salary expectations. As inflation erodes purchasing power, companies like VeriSign must offer competitive compensation packages to attract and retain top talent, potentially increasing its personnel costs by 3-6% in 2024.

While VeriSign benefits from a robust business model with typically high profit margins, sustained inflationary trends could begin to chip away at this profitability. If VeriSign cannot effectively pass on increased costs through strategic price adjustments for its domain name registration and security services, or achieve substantial efficiency gains, its net income could be impacted. The company's ability to monitor key macroeconomic indicators, such as the Consumer Price Index (CPI) and producer price indices, will be crucial in anticipating and mitigating these cost fluctuations.

Currency exchange rate fluctuations present a notable economic factor for VeriSign. As a company with a global footprint, its financial performance is inherently tied to the conversion of revenues and expenses earned in various international currencies back into its reporting currency, the U.S. dollar.

Significant swings in exchange rates can introduce considerable volatility into VeriSign's reported earnings. For instance, if the U.S. dollar strengthens considerably against other major currencies, VeriSign's international revenue, when translated back, would appear lower. This unpredictability can complicate revenue forecasting and potentially impact the overall profitability of its international business segments.

In 2024, the U.S. dollar experienced moderate strength against several key trading partners. For example, the Euro depreciated by approximately 3% against the dollar year-to-date as of mid-2024, while the British Pound saw a similar decline. This environment necessitates robust financial management strategies, including potential currency hedging, to mitigate the adverse effects of such volatility on VeriSign's financial statements and strategic planning.

Competition and Pricing Pressures

While VeriSign enjoys a commanding presence in the .com and .net domain sectors, the wider domain name and cybersecurity landscapes are inherently competitive. Economic downturns or shifts can amplify pricing competition from alternative Top-Level Domains (TLDs) or other cybersecurity service providers, potentially challenging VeriSign's pricing power and market share. For instance, in 2023, the global cybersecurity market was valued at approximately $214.1 billion, with projections indicating continued growth, highlighting the intense competition VeriSign faces beyond its core domain services.

This competitive environment necessitates that VeriSign consistently prove the value proposition of its services to justify its pricing structure. As of early 2024, the average registration price for a .com domain remains a key consideration for businesses and individuals, and any perceived lack of value compared to alternatives could lead to customer attrition.

- Market Dominance vs. Broader Competition: VeriSign's strength in .com and .net contrasts with the highly competitive nature of the overall domain and cybersecurity markets.

- Economic Impact on Pricing: Economic pressures can intensify price competition from alternative TLDs and security service providers, potentially limiting VeriSign's pricing flexibility.

- Value Justification: Continuous demonstration of value is crucial for VeriSign to maintain its service fees and market position amidst competitive pressures.

Interest Rates and Investment Climate

Fluctuations in global interest rates significantly impact VeriSign's financial strategy. For instance, if the U.S. Federal Reserve maintains its benchmark interest rate at the current range, say around 5.25%-5.50% as of early 2024, it directly affects VeriSign's cost of borrowing for essential infrastructure upgrades or potential acquisitions. Higher rates would naturally increase the expense of capital, potentially making new projects less appealing.

The broader investment climate, shaped by economic sentiment, plays a crucial role in how investors view companies like VeriSign, which manage critical digital infrastructure. A positive economic outlook, often reflected in robust GDP growth forecasts, can boost investor confidence, making VeriSign's stock more attractive. Conversely, economic uncertainty can lead to a more cautious investment approach.

- Interest Rate Environment: As of mid-2024, major central banks like the Federal Reserve and the European Central Bank have signaled a cautious approach to rate cuts, with inflation still a primary concern. This suggests interest rates may remain elevated for longer than initially anticipated, increasing borrowing costs for companies like VeriSign.

- Impact on Capital Expenditure: Higher borrowing costs directly influence VeriSign's ability to finance large-scale infrastructure investments. For example, a 1% increase in interest rates on a $500 million debt issuance could add $5 million annually to interest expenses.

- Investor Perception: A stable or improving global economic outlook generally supports a positive investment climate. However, geopolitical tensions or unexpected economic downturns can dampen investor enthusiasm, impacting VeriSign's market valuation.

- Cost of Capital: The weighted average cost of capital (WACC) for companies in the tech and infrastructure sectors is sensitive to interest rate changes. If VeriSign's WACC rises due to higher rates, it could reduce the attractiveness of future projects evaluated on a discounted cash flow basis.

Global economic growth directly influences VeriSign's revenue, as demand for domain registrations and cybersecurity services is tied to IT spending. The IMF's 2024 global growth projection of 3.2% suggests a stable environment conducive to digital investments. This sustained digital transformation trend into 2025 is expected to bolster demand for VeriSign's core offerings.

Preview Before You Purchase

VeriSign PESTLE Analysis

The VeriSign PESTLE analysis previewed here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of VeriSign covers Political, Economic, Social, Technological, Legal, and Environmental factors, providing a complete strategic overview.

What you’re previewing here is the actual file, offering deep insights into VeriSign's operational landscape, fully formatted and professionally structured.

Sociological factors

The relentless global surge in internet penetration and digital adoption directly boosts demand for domain names and secure online services, VeriSign's primary revenue streams. As of early 2025, over 5.3 billion people are online, representing approximately 66% of the world's population, a figure that continues to climb.

This expanding digital footprint necessitates robust and secure Domain Name System (DNS) infrastructure, directly benefiting VeriSign's core operations. The increasing reliance on digital platforms for commerce, communication, and information exchange solidifies VeriSign's foundational role in the global digital economy.

Societal reliance on the internet for daily activities, commerce, and communication has never been higher. In 2024, an estimated 5.3 billion people, or roughly 66% of the global population, are internet users. This deep integration means that public trust in the internet's security and stability is absolutely crucial for its continued growth and adoption.

Major cybersecurity breaches, like the widespread ransomware attacks seen in 2023 and early 2024 impacting critical infrastructure and businesses, can significantly erode this trust. Such events can lead to public demand for more stringent government regulations on data protection and cybersecurity practices, potentially altering how individuals and businesses engage online.

VeriSign's role in managing critical internet infrastructure, such as domain name system (DNS) services, makes its reputation for security and stability paramount. Maintaining public confidence in these foundational services is essential for VeriSign's business and for the overall health of the internet ecosystem.

Public and corporate understanding of advanced cyber threats like distributed denial-of-service (DDoS) attacks and phishing is on the rise. This heightened awareness directly fuels the need for VeriSign's security solutions.

As individuals and businesses become more cognizant of digital vulnerabilities, they are increasingly inclined to invest in strong defenses for their online presence. This trend translates into a larger market opportunity for VeriSign's specialized services, including DDoS mitigation and managed DNS.

For instance, reports from 2024 indicate a significant increase in the frequency and sophistication of cyberattacks targeting businesses globally. This surge in threats makes robust cybersecurity a non-negotiable for many organizations, directly benefiting companies like VeriSign that provide essential security infrastructure.

Digital Literacy and Online Behavior Trends

Digital literacy is on the rise globally, with more people comfortable navigating online spaces. This shift fuels the expansion of e-commerce, remote work, and digital content consumption. For instance, Statista reported that global e-commerce sales are projected to reach $8.1 trillion by 2026, a significant increase from previous years.

These evolving online behaviors directly influence the demand for robust internet infrastructure. As more transactions and interactions occur online, the need for secure and scalable domain name systems and cybersecurity services intensifies. VeriSign's role in managing critical internet infrastructure becomes even more vital in this landscape.

VeriSign's service planning must account for these trends to ensure continued reliability and growth. Key considerations include:

- Increasing internet traffic: As more users engage online, the volume of data processed escalates, requiring enhanced network capacity.

- Growth in online transactions: The proliferation of e-commerce and digital payments necessitates secure and efficient transaction processing.

- Demand for digital security: With more sensitive data online, the need for advanced cybersecurity solutions to protect against threats is paramount.

- Adaptation to remote work: The sustained trend of remote work increases reliance on stable and secure online platforms for business operations.

Societal Reliance on Digital Infrastructure

Modern societies are deeply intertwined with digital infrastructure, relying on it for everything from banking and communication to healthcare and government services. This reliance means that the stability and security of the internet's foundational elements are paramount. VeriSign's stewardship of the .com and .net domain name systems (DNS) is therefore critical, as these are the gateways to a vast array of online activities. For instance, in 2024, it's estimated that over 5.3 billion people globally are active internet users, underscoring the sheer scale of this digital dependency.

The continuous operation of services like DNS is not just a technical requirement; it's a societal necessity. VeriSign's role in maintaining the integrity and availability of these core internet functions is essential to the smooth functioning of economies and daily life. Any compromise to these systems could lead to widespread disruption, impacting everything from e-commerce transactions, which are projected to reach $7.4 trillion globally by 2025, to the accessibility of emergency services.

This societal dependence places a significant responsibility on VeriSign. Ensuring the security and reliability of the .com and .net domains is not merely about business operations; it's about safeguarding the digital backbone that supports global connectivity and economic activity. The company's commitment to cybersecurity and operational excellence directly translates to societal resilience in an increasingly digital world.

- Societal Dependence: Over 5.3 billion global internet users in 2024 rely on digital infrastructure for critical services.

- Economic Impact: Global e-commerce is projected to hit $7.4 trillion by 2025, highlighting the financial reliance on digital access.

- VeriSign's Role: Ensuring the security and availability of .com and .net domains is crucial for societal and economic stability.

Societal reliance on digital services continues to grow, with over 5.3 billion internet users globally in 2024. This deep integration means public trust in internet stability and security is paramount for VeriSign. Cybersecurity breaches, like those seen in 2023-2024, can erode this trust and lead to calls for stricter regulations.

Increased awareness of cyber threats like DDoS attacks fuels demand for VeriSign's security solutions. As organizations invest more in online defenses, VeriSign's specialized services become increasingly valuable. For instance, global e-commerce sales are projected to reach $8.1 trillion by 2026, underscoring the need for secure online transactions.

Technological factors

Continuous advancements in DNS technology, like DNSSEC for improved security and new protocols such as DNS over HTTPS (DoH) and DNS over TLS (DoT), directly influence VeriSign's fundamental operations. These innovations are vital for ensuring the integrity and privacy of domain name resolution.

VeriSign's commitment to integrating these evolving DNS standards is paramount to sustaining its leadership in domain name services. By adopting technologies like DoH, which encrypts DNS queries, VeriSign can offer enhanced user privacy and security, a key differentiator in the market.

The company's ability to adapt and implement these technological shifts, such as expanding DNSSEC adoption, is critical for maintaining its authoritative position. For instance, as of early 2024, the adoption of DNSSEC continues to grow, with a significant percentage of top-level domains now supporting it, underscoring the ongoing need for VeriSign to remain at the cutting edge.

VeriSign faces an ever-shifting cybersecurity threat landscape. Sophisticated attacks like advanced Distributed Denial of Service (DDoS), zero-day exploits, and escalating ransomware demands require continuous adaptation. For instance, the average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report, highlighting the significant financial implications of security failures.

To counter these evolving threats, VeriSign must consistently invest in cutting-edge threat intelligence, robust mitigation strategies, and dedicated security research. This ongoing arms race against cybercriminals is critical for safeguarding its own infrastructure and ensuring the reliability of the security services it offers to its global customer base.

Emerging technologies like AI and quantum computing are reshaping the digital landscape, presenting significant implications for VeriSign. AI offers substantial opportunities for enhancing VeriSign's security services, particularly in threat detection and automated response systems. For instance, AI-powered analytics can process vast amounts of network data to identify anomalies and potential cyber threats with greater speed and accuracy than traditional methods.

However, quantum computing poses a long-term challenge to current encryption standards, which are fundamental to VeriSign's domain name system (DNS) and security services. The potential for quantum computers to break existing encryption algorithms necessitates proactive planning for future cryptographic transitions. VeriSign must invest in research and development to prepare for post-quantum cryptography to maintain the integrity and security of its operations.

Cloud Computing and Distributed Infrastructure

The increasing reliance on cloud computing and the shift towards a more distributed internet infrastructure significantly shape VeriSign's operational strategies. The company needs to design its Domain Name System (DNS) and security services to thrive in this evolving landscape. By embracing cloud technologies, VeriSign can boost the scalability and resilience of its critical internet infrastructure services, ensuring they can handle massive growth and maintain high availability. For instance, as of early 2024, major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud continue to expand their global footprint, offering VeriSign opportunities for more robust and geographically dispersed service delivery.

VeriSign's architecture must be agile enough to integrate seamlessly with this distributed cloud environment. This means adapting its systems to leverage the benefits of cloud-native principles, such as microservices and containerization, to enhance efficiency and speed of deployment. The company's ability to manage and secure DNS records and digital certificates within this complex, multi-cloud, and edge-computing-influenced ecosystem is paramount for maintaining trust and operational integrity. The global cloud computing market was projected to reach over $1 trillion in 2024, underscoring the scale of this technological shift.

- Cloud Adoption: VeriSign's services must be compatible with major cloud platforms to ensure broad accessibility and operational flexibility.

- Infrastructure Evolution: The trend towards edge computing and distributed data centers requires VeriSign to optimize its DNS resolution and security protocols for lower latency and higher resilience.

- Scalability and Efficiency: Leveraging cloud infrastructure allows VeriSign to dynamically scale its resources to meet fluctuating global demand for its services, such as .com and .net domain registrations.

- Security Integration: Adapting security offerings to integrate with cloud-based security frameworks is crucial for protecting against emerging cyber threats in a distributed environment.

Innovation in Internet Protocols and Standards

The evolution of internet protocols, such as the ongoing transition to IPv6, directly influences VeriSign's core business. As of late 2024, IPv6 adoption continues to climb globally, with some regions seeing significant increases, impacting the underlying infrastructure VeriSign manages. These shifts necessitate continuous investment in technical expertise and system upgrades to maintain compatibility and performance for services like DNS.

Innovations in routing protocols and broader internet architecture also present both opportunities and challenges for VeriSign. Staying ahead of these changes, including advancements in network security and data transmission, is crucial for VeriSign's ability to provide reliable and secure domain name registry services. The company's participation in standards bodies underscores its commitment to adapting to a dynamic technological landscape.

- IPv6 Adoption Growth: Global IPv6 deployment rates have steadily increased, with projections indicating continued growth through 2025, impacting the IP address ecosystem VeriSign operates within.

- Protocol Evolution Impact: Changes in routing protocols and internet backbone technologies can affect the speed, reliability, and security of DNS resolution, a key service VeriSign provides.

- Standards Participation: VeriSign's active involvement in organizations like the Internet Engineering Task Force (IETF) ensures it remains aligned with and can influence emerging internet standards.

Technological advancements, particularly in DNS security like DNSSEC and encrypted protocols such as DoH and DoT, are fundamental to VeriSign's operations, ensuring the integrity and privacy of domain name resolution.

VeriSign's proactive integration of these evolving standards, including expanding DNSSEC support, is crucial for maintaining its market leadership and offering enhanced user privacy, a key competitive advantage.

The company must continuously adapt to a dynamic cybersecurity landscape, investing in threat intelligence and mitigation strategies to counter sophisticated attacks, especially given the rising costs associated with data breaches, which averaged $4.45 million in 2024.

Emerging technologies like AI offer opportunities to bolster VeriSign's security services through improved threat detection, while quantum computing presents a long-term challenge to current encryption standards, necessitating research into post-quantum cryptography.

Legal factors

VeriSign's operations are fundamentally shaped by its agreements with ICANN, the Internet Corporation for Assigned Names and Numbers. These contracts, especially for the .com and .net domains, dictate VeriSign's operational mandates and legal standing. For instance, VeriSign's latest renewal of its .com registry agreement with the U.S. Department of Commerce, which oversees ICANN, was finalized in 2023, extending its operations through 2029. This agreement includes specific pricing flexibility and service level requirements.

Any modifications to these foundational ICANN contracts, whether concerning renewal periods, price adjustments, or performance benchmarks, carry substantial legal and financial weight for VeriSign. The company's ability to maintain its exclusive rights to operate these critical top-level domains hinges entirely on its adherence to these legally binding terms. For example, the .com registry agreement allows for annual price increases capped at 7% for the first six years and 3% for the subsequent four years, a crucial factor in VeriSign's revenue forecasting.

Global data privacy laws like GDPR and CCPA significantly impact VeriSign's operations, particularly concerning domain registration and security services. These regulations dictate strict rules for data collection, processing, and storage, requiring VeriSign to maintain robust data governance and privacy-by-design principles. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

VeriSign, as a key player in the domain name system, frequently navigates intellectual property challenges, particularly trademark disputes and instances of domain name hijacking. These legal entanglements are inherent to its role as a registry.

While VeriSign maintains a neutral stance, it is bound by legal mandates and established dispute resolution mechanisms such as the Uniform Domain-Name Dispute-Resolution Policy (UDRP). These policies directly influence domain ownership and usage, underscoring VeriSign's role in upholding the system's integrity.

The increasing volume of online transactions and digital branding intensifies the need for robust legal frameworks governing domain names. For instance, the number of UDRP cases filed in 2023 saw a slight increase, highlighting the ongoing importance of these dispute resolution processes for brand protection.

Cybersecurity Compliance and Liability

Governments worldwide are intensifying their focus on cybersecurity, imposing stricter legal obligations on companies like VeriSign. These include mandatory incident reporting, timely data breach notifications, and adherence to specific security standards. For instance, the EU’s General Data Protection Regulation (GDPR) can levy fines up to 4% of global annual revenue for non-compliance.

Failing to meet these evolving legal mandates exposes VeriSign to substantial financial penalties, legal liabilities, and significant reputational harm. The company’s proactive approach to cybersecurity is therefore crucial for mitigating these risks and ensuring continued operational integrity.

- Increased Regulatory Scrutiny: Governments are enacting more stringent cybersecurity laws, impacting data handling and breach protocols.

- Potential for Hefty Fines: Non-compliance can lead to substantial financial penalties, as seen with regulations like GDPR.

- Reputational Risk: Security failures and non-compliance can severely damage public trust and brand image.

- Evolving Legal Landscape: VeriSign must continuously adapt its security measures to align with new and changing legal requirements.

Antitrust and Competition Laws

VeriSign's significant market share in the .com and .net domain name system (DNS) registry services places it under the watchful eye of antitrust and competition regulators globally. For instance, the U.S. Department of Justice and the Federal Trade Commission actively monitor industries for monopolistic practices. Any perceived anti-competitive behavior, such as exploitative pricing or leveraging its .com dominance to stifle innovation in related services, could trigger investigations and potential legal action. These legal challenges can result in hefty fines, mandated operational changes, or even limitations on future business expansion.

Maintaining fair and transparent practices is paramount for VeriSign to avoid regulatory penalties. In 2023, the U.S. government continued its focus on tech sector competition, with ongoing discussions and potential legislative actions aimed at regulating dominant online platforms. While specific actions against VeriSign were not prominent in recent news, the general regulatory climate emphasizes the need for companies with critical infrastructure roles to demonstrate adherence to competition principles.

- Regulatory Scrutiny: VeriSign's near-monopoly in .com and .net registries attracts attention from antitrust authorities like the FTC and DOJ.

- Risk of Legal Challenges: Actions deemed anti-competitive could lead to investigations, lawsuits, and significant financial penalties.

- Operational Restrictions: Adverse legal outcomes might impose limitations on VeriSign's pricing strategies, service offerings, and market expansion.

- Compliance Imperative: Adherence to fair competition laws is crucial for VeriSign's continued operational freedom and market stability.

VeriSign's core business is governed by its agreements with ICANN, particularly for the .com and .net domains. These contracts, renewed through 2029 for .com, dictate operational terms and pricing. Any changes to these agreements, including the 7% annual price cap for .com in the initial years of the current contract, directly impact VeriSign's financial outlook and legal standing.

Global data privacy regulations like GDPR and CCPA impose strict data handling requirements on VeriSign, with potential fines up to 4% of global annual revenue for non-compliance. The company must also navigate intellectual property disputes and adhere to policies like the UDRP, which governs domain name disputes and impacts ownership.

VeriSign faces increasing legal obligations related to cybersecurity, including mandatory breach notifications and adherence to security standards. Failure to comply with these evolving mandates, such as those under GDPR, can result in substantial financial penalties and reputational damage.

As a dominant player in the domain name system, VeriSign is subject to antitrust scrutiny from bodies like the FTC and DOJ. Anti-competitive practices could lead to investigations, fines, and restrictions on its operations and expansion, necessitating a commitment to fair competition principles.

Environmental factors

VeriSign's global data centers, crucial for its domain name registry and security services, are substantial electricity users. This significant energy demand places VeriSign under increasing scrutiny regarding its environmental impact and carbon footprint, especially with growing global awareness of climate change.

The company faces pressure to actively manage and reduce its energy consumption. This involves strategic investments in energy-efficient technologies and a commitment to sourcing power from renewable energy providers, making sustainability a key environmental factor in its operations.

Investor and public pressure for VeriSign to embrace corporate social responsibility and environmental sustainability is a significant factor. This translates into expectations for the company to actively implement and report on initiatives like waste reduction and greener supply chain management.

VeriSign's commitment to environmental stewardship, including optimizing resource usage, is increasingly seen as a way to bolster its brand image and attract investors. For instance, companies in the tech infrastructure sector are increasingly disclosing their Scope 1, 2, and 3 emissions, with many aiming for carbon neutrality by 2030 or 2040, a trend VeriSign is likely to align with to maintain competitive appeal.

Climate change presents significant risks to VeriSign's physical infrastructure. Extreme weather events like hurricanes and floods, which are becoming more frequent and intense, could disrupt data center operations and network links. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023, causing widespread damage.

VeriSign must prioritize climate resilience in its strategic planning. This includes careful site selection for new data centers, considering factors like flood plains and seismic activity, and designing existing facilities to withstand anticipated environmental stresses. Ensuring robust disaster recovery plans are in place is paramount for maintaining continuous service availability, a core requirement for the company's security and identity services.

Waste Management and Electronic Waste (e-waste)

VeriSign's IT operations inherently produce electronic waste, or e-waste, throughout the lifecycle of its equipment. Effective management of this waste, encompassing responsible disposal, recycling, and refurbishment, is a critical environmental responsibility. For instance, the global e-waste generated in 2023 reached an estimated 13.8 million metric tons, highlighting the scale of this challenge. Companies like VeriSign are increasingly focused on minimizing the environmental footprint of their hardware.

Adherence to e-waste regulations and a commitment to reducing environmental impact are integral to VeriSign's sustainability strategy. This includes exploring partnerships with certified recyclers and implementing internal policies for asset disposition. In 2024, many regions strengthened their e-waste directives, pushing companies to adopt more circular economy principles for IT assets.

- Global e-waste generation is a significant environmental concern, with projections indicating continued growth.

- VeriSign's commitment to responsible e-waste management aligns with evolving environmental regulations.

- Hardware lifecycle management and recycling are key components of VeriSign's sustainability initiatives.

Regulatory Pressure for Green IT Practices

Governments globally are intensifying regulatory pressure for environmentally conscious IT operations, often termed Green IT. This trend is evident in new mandates and incentives pushing companies toward sustainable technology adoption and resource management. For instance, the European Union's Ecodesign Directive continues to influence energy efficiency standards for IT equipment, impacting procurement and operational choices.

VeriSign, like many tech companies, can anticipate increased scrutiny and potential requirements related to energy consumption, carbon emissions, and waste management within its data centers and operations. A 2024 report by the International Energy Agency highlighted that data centers, while vital for digital infrastructure, are significant energy consumers, prompting governments to set stricter efficiency benchmarks.

Proactively integrating green IT practices can serve as a strategic advantage for VeriSign. By aligning with evolving environmental regulations and anticipating future compliance demands, the company can reduce the risk of penalties and operational disruptions. This forward-thinking approach also positions VeriSign favorably in terms of corporate social responsibility and investor relations, especially as ESG (Environmental, Social, and Governance) factors gain prominence in investment decisions. For example, many institutional investors in 2025 are increasingly factoring a company's environmental performance into their portfolio allocations.

- Increased regulatory focus on data center energy efficiency and carbon footprint reporting.

- Potential mandates for VeriSign to meet specific energy consumption targets or emission reduction goals.

- Growing investor and stakeholder demand for demonstrable commitment to Green IT practices.

- Opportunities for VeriSign to gain competitive advantage through early adoption of sustainable IT solutions.

VeriSign's extensive data center operations are significant energy consumers, placing it under scrutiny for its environmental impact and carbon footprint. The company is responding by investing in energy-efficient technologies and renewable energy sources, a trend driven by increasing global awareness of climate change and investor pressure for corporate social responsibility.

Climate change poses physical risks to VeriSign's infrastructure, with extreme weather events potentially disrupting operations, as evidenced by the 28 billion-dollar weather disasters in the U.S. in 2023. This necessitates robust climate resilience strategies, including careful site selection and disaster recovery planning, to ensure service continuity.

The company also faces the challenge of managing electronic waste (e-waste), with global generation reaching an estimated 13.8 million metric tons in 2023. VeriSign's commitment to responsible disposal, recycling, and adherence to strengthening e-waste regulations in regions like the EU in 2024 is crucial for its sustainability efforts.

Governments worldwide are increasing regulatory pressure for Green IT, pushing companies like VeriSign towards sustainable technology adoption and resource management. This includes meeting stricter energy efficiency benchmarks, as highlighted by the International Energy Agency's 2024 report on data center energy consumption, with many institutional investors in 2025 factoring environmental performance into decisions.

| Environmental Factor | VeriSign's Position/Challenge | Relevant Data/Trend (2023-2025) |

|---|---|---|

| Energy Consumption & Carbon Footprint | High energy demand from data centers; pressure to reduce emissions. | Global data centers are significant energy consumers; increasing focus on Scope 1, 2, 3 emissions reporting; many tech companies targeting carbon neutrality by 2030/2040. |

| Climate Change Risks | Vulnerability of physical infrastructure to extreme weather. | 28 billion-dollar weather and climate disasters in the U.S. in 2023; need for climate resilience in site selection and facility design. |

| Electronic Waste (E-waste) | Generation of e-waste from IT equipment lifecycle. | Estimated 13.8 million metric tons of global e-waste generated in 2023; strengthening e-waste directives in various regions in 2024. |

| Green IT & Regulatory Compliance | Increasing government mandates and investor demand for sustainable IT. | EU's Ecodesign Directive influencing IT equipment efficiency; growing investor preference for ESG factors in 2025. |

PESTLE Analysis Data Sources

Our VeriSign PESTLE Analysis is meticulously constructed using data from reputable sources including government regulatory bodies, international financial institutions, and leading market research firms. This ensures a comprehensive and accurate understanding of the political, economic, social, technological, legal, and environmental landscapes impacting VeriSign.