VeriSign Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VeriSign Bundle

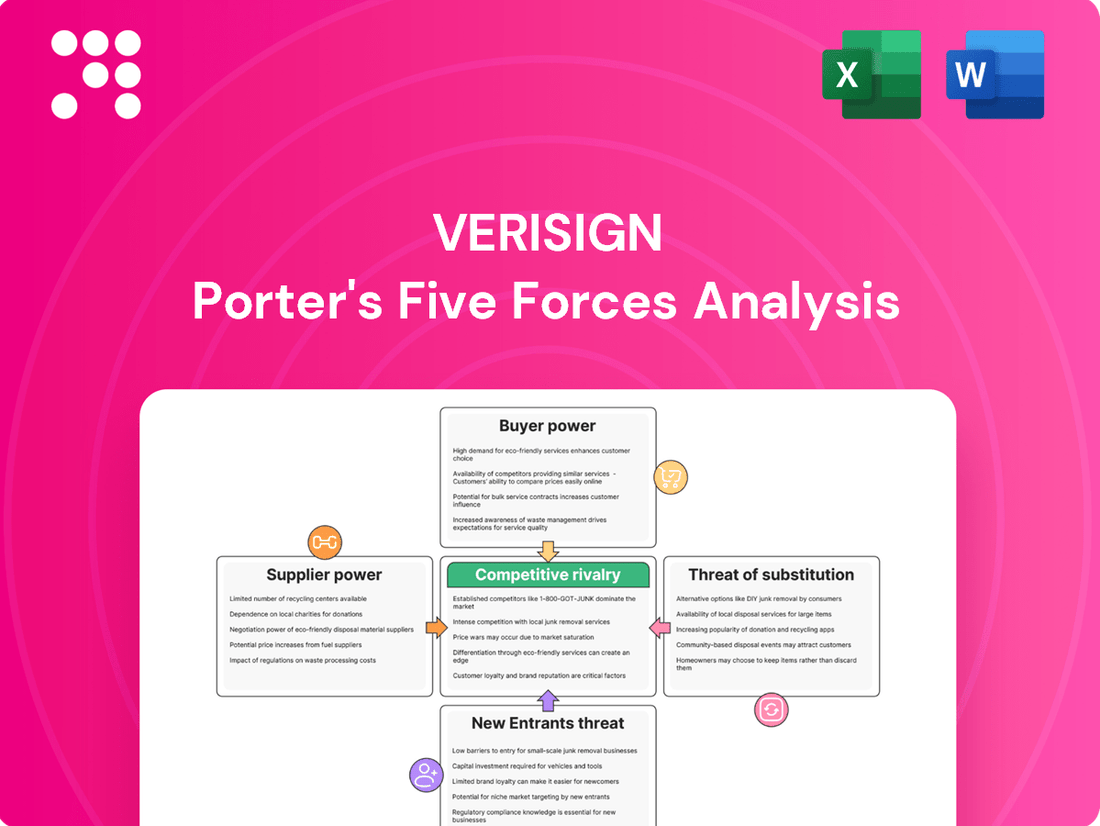

VeriSign, a dominant force in domain name registration and security, faces a complex competitive landscape. Understanding the interplay of buyer power, supplier leverage, and the threat of new entrants is crucial for navigating its market. This brief overview only scratches the surface of these dynamics.

The complete Porter's Five Forces Analysis for VeriSign reveals the real forces shaping its industry—from the intense rivalry among existing players to the ever-present threat of substitutes. Gain actionable insights to drive smarter decision-making and secure your strategic advantage.

Suppliers Bargaining Power

VeriSign depends on a select group of highly specialized firms for essential infrastructure, including global data centers, high-capacity network links, and resilient power systems. The absolute necessity of uninterrupted service for core internet functions provides these suppliers with a degree of influence, given the substantial expense and intricacy involved in finding alternatives or building such capabilities internally.

VeriSign's reliance on specialized technical talent for critical internet infrastructure like DNS and root zone management grants these professionals considerable bargaining power. The demand for cybersecurity experts and engineers with this niche skillset is intense, driving up labor costs and influencing VeriSign's operational expenditures.

Proprietary software and hardware vendors hold a degree of bargaining power over VeriSign. While VeriSign crafts significant proprietary technology, it relies on external suppliers for critical network infrastructure, security hardware, and operational software. For instance, in 2024, the cybersecurity hardware market saw continued consolidation, potentially strengthening the position of remaining specialized vendors.

Limited alternative options for critical components

VeriSign's bargaining power of suppliers is significantly influenced by the scarcity of providers for critical infrastructure components. For essential services like maintaining the authoritative root zone and top-level domains such as .com and .net, VeriSign relies on a very small pool of highly specialized and trusted suppliers.

This limited availability of qualified vendors for such crucial services grants these suppliers considerable leverage. When reliability and security are non-negotiable, as they are for VeriSign's core operations, the few available suppliers can command stronger terms.

- Limited Qualified Suppliers: The pool of entities capable of providing and securing critical internet infrastructure components, such as root zone management services, is exceptionally small.

- High Switching Costs: Transitioning to a new supplier for these foundational services involves extensive security audits, technical integration, and regulatory approvals, making it a costly and time-consuming process.

- Essential Nature of Services: The services provided by these suppliers are fundamental to VeriSign's business model and the stability of the internet's domain name system, increasing their indispensability.

Regulatory and compliance service providers

VeriSign operates within a highly regulated global landscape, particularly concerning its crucial role in managing .com and .net domain names under contracts with the Internet Corporation for Assigned Names and Numbers (ICANN). This dependency on specialized legal, compliance, and auditing services, which possess unique expertise in internet governance and regulatory frameworks, grants these providers significant leverage. The intricate nature of maintaining compliance and navigating complex international agreements means VeriSign must rely on these niche service providers, potentially increasing their bargaining power.

The bargaining power of these regulatory and compliance service providers is amplified by the critical nature of their work. Ensuring adherence to ICANN policies and other governmental regulations is paramount to VeriSign's operations and reputation. Failure in this area could lead to severe penalties or loss of operational rights, making VeriSign highly sensitive to the terms offered by these essential partners. For instance, the cost of specialized legal counsel for regulatory matters can be substantial, impacting VeriSign’s operational expenses.

- High Switching Costs: VeriSign faces significant costs and disruptions if it were to switch its regulatory and compliance service providers due to the specialized knowledge and established relationships required.

- Limited Number of Experts: The pool of service providers with deep expertise in ICANN contracts and global internet governance is relatively small, concentrating bargaining power among them.

- Criticality of Service: The essential nature of regulatory compliance for VeriSign's core business means that disruptions in these services are highly impactful, giving providers leverage.

- Information Asymmetry: Specialized service providers often possess more detailed knowledge of the regulatory landscape than VeriSign, which can be used to their advantage in negotiations.

VeriSign's bargaining power of suppliers is influenced by the limited availability of specialized providers for critical internet infrastructure and niche technical talent. The high switching costs and the essential nature of services like root zone management mean that a few key suppliers hold significant leverage, potentially driving up operational expenses for VeriSign.

In 2024, the cybersecurity hardware market continued its trend of consolidation, which could further strengthen the negotiating position of remaining specialized vendors that VeriSign relies on for network infrastructure and security. Similarly, the intense demand for cybersecurity experts with niche skillsets in areas like DNS management means VeriSign faces upward pressure on labor costs.

The bargaining power of suppliers for regulatory and compliance services is also substantial due to the specialized knowledge required for ICANN contracts and global internet governance. VeriSign's reliance on these few experts, coupled with the high impact of non-compliance, grants these providers considerable leverage in negotiations.

| Supplier Category | Key Dependencies for VeriSign | Factors Influencing Bargaining Power | Impact on VeriSign |

| Infrastructure Providers | Global Data Centers, Network Links, Power Systems | Scarcity of specialized providers, High switching costs, Essential nature of services | Potential for higher operational costs, reliance on vendor reliability |

| Technical Talent | DNS Management, Cybersecurity Experts | Intense demand for niche skills, High labor costs | Increased personnel expenses, challenges in talent acquisition |

| Hardware/Software Vendors | Network Infrastructure, Security Hardware, Operational Software | Market consolidation, Proprietary technologies | Potential for increased procurement costs, dependence on vendor roadmaps |

| Regulatory & Compliance Services | ICANN Contract Adherence, Internet Governance Expertise | Limited number of experts, High switching costs, Criticality of service | Significant legal and compliance expenses, reputational risk |

What is included in the product

This analysis of VeriSign's competitive environment examines the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly identify and mitigate competitive threats by visualizing the impact of each of Porter's Five Forces on VeriSign's market position.

Customers Bargaining Power

For VeriSign's core .com and .net domain registry services, customers, primarily domain registrars and end-users, face effectively infinite switching costs. There simply isn't another registry that can offer the same .com or .net domain names, making alternatives non-existent for these essential internet identifiers.

While VeriSign's domain name registry business serves a relatively concentrated group of large registrars, its cybersecurity offerings, such as DDoS mitigation and managed DNS, target a much broader and more fragmented enterprise market. This wide distribution of customers for its security services significantly dilutes the bargaining power of any single client.

The sheer number of businesses and organizations requiring robust cybersecurity solutions means that individual customers have limited leverage to demand preferential pricing or customized terms from VeriSign. For instance, in 2024, the global cybersecurity market was valued at over $200 billion, showcasing the vast customer base VeriSign serves with its security products.

VeriSign's services, particularly its .com and .net domain name system (DNS) registry, are absolutely critical for internet functionality. This indispensable nature means customers, ranging from businesses to individuals, have very little leverage to demand price reductions or other concessions. Their own online presence and operations depend entirely on the stable and secure resolution of domain names, making them highly reliant on VeriSign's consistent performance.

Limited backward integration capability

VeriSign's customers, even substantial entities like major internet service providers or large enterprises, face virtually insurmountable obstacles in attempting to backward integrate and manage the .com or .net root zone infrastructure. This lack of capability significantly limits their bargaining power.

The sheer technical intricacy involved in operating a root zone, coupled with stringent regulatory oversight and exclusive contracts with the Internet Corporation for Assigned Names and Numbers (ICANN), creates prohibitive barriers to entry. Consequently, customers are largely dependent on VeriSign for these critical services.

- Technical Complexity: Managing the global Domain Name System (DNS) infrastructure requires specialized expertise and infrastructure that is beyond the scope of most organizations.

- Regulatory Hurdles: The operation of critical internet infrastructure is subject to international regulations and governance frameworks, making it difficult for individual entities to replicate.

- ICANN Contracts: VeriSign holds exclusive contracts with ICANN for the operation of the .com and .net top-level domains, preventing direct competition or replication by customers.

- High Capital Investment: Establishing and maintaining the necessary global network of servers and security protocols for root zone management would demand an enormous capital outlay.

Price inelasticity for core registry services

The bargaining power of customers for VeriSign's core registry services, specifically .com and .net domains, is notably low due to significant price inelasticity. This inelasticity stems from the essential nature of these domain extensions and the virtual absence of viable direct substitutes for businesses and individuals seeking an online presence.

VeriSign has historically leveraged this inelastic demand to implement price increases for .com domain renewals. For instance, in 2021, VeriSign announced a price hike for .com domain registrations and renewals, which went into effect in 2022. Such actions highlight the company's pricing power, as customers typically absorb these costs because maintaining their established domain names is a necessity for their ongoing operations and brand identity.

- Price Inelasticity: Demand for .com and .net domains is largely insensitive to price changes due to their essential role and lack of direct substitutes.

- VeriSign's Pricing Power: The company has demonstrated the ability to increase prices for core registry services, such as .com renewals.

- Customer Acceptance: Businesses and individuals generally accept these price adjustments, as domain ownership is critical for online presence and brand continuity.

VeriSign's customers, particularly for its .com and .net domain registry services, possess minimal bargaining power. This is largely due to the critical nature of these domain extensions, which have no direct substitutes, making demand highly inelastic. For example, in 2024, the continued reliance on established .com domains for brand identity and online presence means businesses will absorb price increases, as seen with past renewal fee adjustments by VeriSign.

The technical complexity, regulatory oversight, and exclusive ICANN contracts for managing the .com and .net root zone infrastructure create insurmountable barriers for customers to backward integrate or replicate these services. This dependency significantly limits their ability to negotiate terms or prices.

While VeriSign's cybersecurity segment serves a broader market, the core registry business, which is VeriSign's dominant revenue driver, benefits from customers' inability to switch or replicate the essential .com and .net domain services, effectively neutralizing customer bargaining power.

| Service Segment | Customer Bargaining Power | Key Factors |

|---|---|---|

| .com & .net Domain Registry | Very Low | No direct substitutes, high switching costs, critical for online presence, VeriSign's exclusive ICANN contracts. |

| Cybersecurity Services (DDoS, Managed DNS) | Low to Moderate | Fragmented enterprise market, broad customer base dilutes individual leverage, but some large clients may have negotiation capacity. |

Full Version Awaits

VeriSign Porter's Five Forces Analysis

This preview showcases the complete VeriSign Porter's Five Forces analysis, offering a detailed examination of the competitive landscape within its industry. The document you see here is precisely what you will receive instantly after purchase, providing actionable insights without any discrepancies or hidden elements. You're looking at the actual, professionally formatted analysis, ready for immediate download and utilization to inform your strategic decisions.

Rivalry Among Competitors

VeriSign's competitive rivalry in its core .com and .net domain registry business is exceptionally low due to its exclusive, long-term contracts with ICANN. This creates a near-monopolistic position, effectively barring direct competitors from operating these highly sought-after top-level domains. For instance, in 2023, VeriSign processed approximately 160 million .com domain name registrations, highlighting the sheer volume and dominance within this segment.

The market for DDoS mitigation, managed DNS, and security intelligence is a battleground with many players, making it a highly competitive and fragmented space. VeriSign contends with numerous rivals such as Cloudflare, Corero, and MazeBolt. This intense rivalry means competition often centers on the quality of service features, overall performance, and, of course, pricing, especially in these more contested segments of the cybersecurity market.

VeriSign's core registry business for .com and .net domains faces incredibly high barriers to entry. Significant capital is needed for infrastructure, alongside specialized technical know-how. Crucially, obtaining and maintaining contracts with ICANN, the governing body for domain names, is a complex and lengthy process that new entrants would struggle to navigate.

Differentiation in security offerings

In the fiercely competitive cybersecurity landscape, VeriSign distinguishes itself by offering specialized security services rooted in its deep expertise in internet infrastructure. This focus on foundational elements like Domain Name System (DNS) security and Distributed Denial of Service (DDoS) mitigation provides a unique value proposition.

Rivalry intensifies as companies strive to differentiate through superior threat intelligence, more effective mitigation strategies, and faster response times. VeriSign’s ability to integrate these advanced capabilities seamlessly with existing IT environments is a key competitive advantage.

- VeriSign's DNS Security: VeriSign operates the .com and .net domain name registries, providing a critical layer of internet security.

- DDoS Mitigation: The company offers robust DDoS protection services, essential for maintaining online availability.

- Market Position: VeriSign's security services are vital for businesses relying on the stability and security of the internet's core infrastructure.

Global operational scale and reputation

VeriSign benefits immensely from its decades-long history in managing critical internet infrastructure. This longevity has allowed the company to build an unparalleled operational scale and a sterling reputation for 100% availability and security.

This established trust and reliability create a formidable barrier for competitors, particularly in the domain name registry services. It's incredibly difficult for rivals to achieve a comparable market share when VeriSign is synonymous with dependable internet operations.

- Decades of Experience: VeriSign has been a cornerstone of internet infrastructure management for over 25 years.

- Operational Scale: The company processes billions of DNS queries daily, showcasing its vast operational capacity.

- Reputation for Reliability: VeriSign boasts a long-standing track record of near-perfect uptime and robust security for its services like .com and .net domain registries.

- Market Dominance: In 2023, VeriSign continued to manage the .com and .net domain name systems, representing a significant portion of the global domain market.

VeriSign's competitive rivalry is bifurcated. In the .com and .net domain registry space, rivalry is virtually non-existent due to VeriSign's exclusive contracts with ICANN, creating a de facto monopoly. However, in its security services like DDoS mitigation and managed DNS, VeriSign faces intense competition from numerous established players.

In 2023, VeriSign continued its dominance in domain name registrations, processing approximately 160 million .com domains. This highlights the immense scale and lack of direct competition in its core registry business. Conversely, the cybersecurity market where VeriSign offers managed DNS and DDoS protection is highly fragmented, with companies like Cloudflare and Akamai offering similar services.

| Market Segment | Key Competitors | VeriSign's Position |

|---|---|---|

| Domain Registry (.com, .net) | None (due to ICANN contracts) | Exclusive operator, near-monopoly |

| DDoS Mitigation & Managed DNS | Cloudflare, Akamai, Corero, MazeBolt | One of several key providers in a fragmented market |

SSubstitutes Threaten

For most internet users and businesses, .com and .net domain names are the de facto standard for establishing an online presence. There are currently no widely adopted, functionally equivalent substitutes that offer the same level of recognition and ease of access for identifying and navigating websites.

While alternative domain extensions exist, they lack the widespread familiarity and trust associated with .com and .net. Direct use of IP addresses to access websites is technically possible but remains impractical and is not a viable mass-market alternative due to its complexity and lack of memorability.

Emerging decentralized naming systems, such as those built on blockchain technology like the Ethereum Name Service (ENS), present a nascent but potential threat of substitution for VeriSign's traditional Domain Name System (DNS) services. While ENS and similar projects are still in their early stages and face considerable challenges in terms of scalability, user adoption, and seamless integration with existing internet infrastructure, they offer an alternative model for digital identity and naming. For example, by mid-2024, ENS had registered over 2 million domain names, indicating growing interest, though this is a fraction of the hundreds of millions of domains managed by traditional DNS.

While the digital landscape has seen a surge in new generic Top-Level Domains, or gTLDs, like .club and .online, these new options largely serve to expand choice rather than directly replace the foundational .com and .net domains. Many businesses continue to view .com as the gold standard for their primary online presence, reflecting its deep-rooted brand recognition and user familiarity.

In-house security solutions as substitutes for managed services

Large enterprises with significant IT budgets and in-house expertise might opt to build their own security infrastructure, including DDoS mitigation and managed DNS. This internal capability directly competes with VeriSign's managed services, offering an alternative for companies prioritizing control and customization.

For instance, major financial institutions or tech giants with dedicated cybersecurity departments could find it more cost-effective or strategically advantageous to develop proprietary solutions rather than relying on third-party providers. This trend is particularly relevant as the complexity and cost of cybersecurity tools continue to evolve.

- Internal Development: Companies can build custom security solutions tailored to their specific needs, bypassing external vendors.

- Cost Control: For large organizations, in-house development might offer long-term cost savings compared to ongoing managed service fees.

- Data Sovereignty: Maintaining data within an organization's own infrastructure can be a key driver for developing internal solutions.

- Talent Acquisition: The availability of skilled cybersecurity professionals within an enterprise can facilitate the adoption of in-house security strategies.

Alternative security vendors are rivals, not direct substitutes

Other cybersecurity companies offering DDoS mitigation or managed DNS are direct competitors within the same market, providing the same type of service. These rivals are vying for market share rather than true substitutes that offer an entirely different way to achieve the same end goal. For instance, in 2024, the cybersecurity market, particularly the DDoS protection segment, saw significant competition, with companies like Akamai and Cloudflare offering comparable services to VeriSign’s offerings.

These competitors directly challenge VeriSign by providing similar solutions, meaning customers can switch between them with relative ease if pricing or features become more attractive. This intense rivalry underscores that while there are many players, they are not substitutes in the sense of offering a fundamentally different approach to security.

- Rivalry in DDoS Mitigation: Companies like Akamai and Cloudflare directly compete with VeriSign's DDoS protection services, offering similar functionalities and targeting the same customer base.

- Managed DNS Competition: In the managed DNS space, providers such as Cloudflare and Google Cloud DNS present direct competitive alternatives to VeriSign's Domain Name System services.

- Market Share Focus: The threat lies in competitors gaining market share by offering comparable services, rather than customers finding entirely different solutions to their security needs.

While .com and .net domains remain dominant, emerging decentralized naming systems like Ethereum Name Service (ENS) represent a nascent threat. By mid-2024, ENS had over 2 million registered domains, indicating growing adoption, though still a fraction of VeriSign's managed domains.

Large enterprises may develop in-house security solutions, bypassing managed services. This internal capability competes with VeriSign's offerings, particularly for companies prioritizing control and customization, a trend amplified by evolving cybersecurity costs.

Direct competitors like Akamai and Cloudflare offer similar DDoS mitigation and managed DNS services, intensifying rivalry for market share rather than presenting true substitutes. This competition means customers can switch providers based on pricing and features.

Entrants Threaten

New entrants face virtually insurmountable barriers in the .com and .net domain name registry market. VeriSign holds exclusive, long-term contracts with ICANN, the Internet Corporation for Assigned Names and Numbers, which are the gatekeepers for top-level domains. These contracts are not typically re-bid, meaning the established player has a locked-in position.

The global internet governance framework itself is incredibly complex and requires deep understanding and established relationships, further deterring newcomers. These regulatory and contractual hurdles effectively create a near-monopoly for VeriSign in these critical internet infrastructure spaces, making it exceedingly difficult for any new entity to gain a foothold.

Establishing the global, redundant, and highly secure infrastructure needed for critical internet services like DNS for major TLDs requires immense capital. For instance, building out the network and security protocols to manage millions of daily queries for a top-level domain is a multi-billion dollar undertaking.

This substantial financial barrier significantly deters most potential new entrants. The sheer scale of investment needed to replicate VeriSign's robust infrastructure makes it nearly impossible for smaller companies to compete effectively, thereby limiting the threat of new players.

The threat of new entrants in VeriSign's market is significantly dampened by the extreme need for deep technical expertise. Operating foundational internet infrastructure, like the Domain Name System (DNS) and critical security protocols, requires unparalleled knowledge in distributed systems, network security, and global operations. For instance, maintaining the stability and security of the .com and .net top-level domains demands constant vigilance and advanced engineering capabilities.

Furthermore, building the necessary trust from the global internet community is a monumental hurdle for any newcomer. VeriSign has cultivated this trust over decades of reliable service and robust security, a reputation that cannot be easily replicated. In 2023, VeriSign's DNS services handled trillions of DNS queries, underscoring the scale and reliability expected by users worldwide. This established trust is a formidable barrier to entry.

Economies of scale and scope for established players

VeriSign enjoys substantial economies of scale in running its massive domain name registry and security infrastructure. This cost advantage makes it difficult for newcomers to compete on price. For instance, in 2024, VeriSign processed billions of domain name queries daily, a volume that would require immense investment for a new player to replicate efficiently.

The company also benefits from economies of scope due to its established global operational network and expertise in related security services. This allows VeriSign to offer a broader suite of services more cost-effectively than a specialized new entrant could. Its existing infrastructure, developed over decades, provides a significant barrier.

- Economies of Scale: VeriSign's vast domain registry operations lead to lower per-unit costs in managing and processing domain names, a benefit not easily matched by new entrants.

- Economies of Scope: The integration of domain registry services with security solutions provides VeriSign with operational efficiencies and a broader value proposition.

- Infrastructure Investment: The significant capital expenditure required to build and maintain a global, high-availability infrastructure acts as a deterrent to potential new competitors.

Brand recognition and network effects

The pervasive nature of .com and .net domains fosters significant network effects, solidifying VeriSign's commanding market share. These established domains are deeply embedded in the global internet infrastructure, making it incredibly difficult for newcomers to replicate the widespread adoption and familiarity that VeriSign benefits from.

VeriSign's brand recognition as the trusted and secure manager of these foundational internet identifiers acts as a formidable barrier to entry. Potential competitors would struggle immensely to cultivate the same level of trust and market acceptance that VeriSign has built over decades of reliable service.

- Network Effects: The widespread adoption of .com and .net domains creates a powerful network effect, where the value of these domains increases with each additional user and registrant, making it harder for new domain extensions to gain traction.

- Brand Trust: VeriSign's long-standing reputation for security and stability in managing the Domain Name System (DNS) is a critical differentiator that new entrants would find challenging to match.

- Incumbency Advantage: As the sole provider for .com and .net, VeriSign benefits from deep integration into the internet's core infrastructure, a position that offers significant operational and strategic advantages over any potential new entrant.

The threat of new entrants in VeriSign's core .com and .net domain registry market is exceptionally low. VeriSign's exclusive, long-term contracts with ICANN, coupled with the immense capital required for global infrastructure and deep technical expertise, create formidable barriers. For instance, the ongoing investment in network security and redundancy for these critical internet functions represents a multi-billion dollar undertaking.

The established network effects and VeriSign's decades-long brand trust further solidify its position, making it nearly impossible for newcomers to gain traction. In 2024, VeriSign continued to manage trillions of DNS queries annually, demonstrating the scale and reliability expected by the global internet community, a level of trust that cannot be quickly replicated.

| Barrier Type | Description | VeriSign's Advantage | Impact on New Entrants |

|---|---|---|---|

| Contractual/Regulatory | Exclusive, long-term contracts with ICANN for .com and .net. | Locked-in position, no re-bidding process. | Virtually insurmountable hurdle for new players. |

| Capital Requirements | Building global, secure, and redundant infrastructure. | Multi-billion dollar investment already made and maintained. | Prohibitive cost for new entrants to replicate. |

| Technical Expertise | Deep knowledge in distributed systems, network security, and global operations. | Decades of experience managing critical internet infrastructure. | New entrants lack the necessary skills and operational history. |

| Brand Trust & Network Effects | Established reputation for security and stability, widespread adoption of .com/.net. | High user confidence and embeddedness in internet ecosystem. | Difficult for new domain extensions to gain acceptance and value. |

Porter's Five Forces Analysis Data Sources

Our VeriSign Porter's Five Forces analysis is built upon a robust foundation of data, drawing from VeriSign's annual reports, SEC filings, and investor relations materials. We supplement this with industry-specific market research reports and competitive intelligence from reputable sources to provide a comprehensive view of the competitive landscape.