Valero Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Valero Energy Bundle

Navigate the complex external forces impacting Valero Energy with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are shaping the energy landscape. This in-depth report offers actionable intelligence for strategic planning and investment decisions. Download the full version now to gain a critical competitive advantage.

Political factors

Valero's business is heavily shaped by government policies, especially those concerning energy and environmental standards. The Inflation Reduction Act of 2022, with its significant clean energy funding, directly impacts Valero's core refining operations and its ventures into renewable fuels, like its St. Charles refinery's renewable diesel production which is expected to reach 1.2 billion gallons per year by 2025.

Mandates such as the Renewable Fuel Standard (RFS) require specific volumes of renewable fuels to be blended into gasoline and diesel. This directly influences Valero's production and profitability in renewable diesel and ethanol, supporting its strategic shift towards lower-carbon energy solutions.

Global geopolitical tensions, particularly in the Middle East, continue to pose a significant risk to crude oil supply chains. For instance, ongoing conflicts in 2024 have led to heightened volatility in oil prices, with Brent crude futures fluctuating between $75 and $90 per barrel at various points. These disruptions directly impact Valero's costs for acquiring feedstock and can compress refining margins if product prices don't keep pace.

U.S. trade policies, including tariffs on certain imported goods and the potential for retaliatory measures, also influence Valero's operations. While specific tariffs on refined products directly affecting Valero were limited in 2024, broader trade disputes can indirectly impact global demand for refined fuels and create uncertainty in international markets where Valero operates and exports. The company's ability to export refined products is therefore sensitive to these evolving trade dynamics.

Governments globally are pushing for renewable energy and decarbonization, impacting Valero's operations. For instance, California's Low Carbon Fuel Standard (LCFS) and federal renewable fuel blending mandates directly shape Valero's strategic investments in renewable diesel and sustainable aviation fuel (SAF). These policies are crucial drivers for Valero's transition towards lower-carbon products.

Incentives like the 45Z Clean Fuel Production Credit, enacted as part of the Inflation Reduction Act, are designed to encourage companies like Valero to invest in the production of low-carbon fuels. For 2024, this credit offers up to $1.75 per gallon for sustainable aviation fuel and $1 per gallon for renewable diesel, significantly de-risking capital expenditures for new production facilities.

Refinery Capacity and Regulatory Hurdles

Government decisions on refinery operations and permitting are crucial for Valero. For instance, California's move to keep Valero's Benicia refinery open in 2023 underscored state concerns about fuel supply, directly impacting operational continuity.

Extended timelines for facility modification permits, a common issue, introduce uncertainty for Valero's planned technological upgrades and capacity expansions. This regulatory environment can slow down investments and affect the company's ability to adapt to market demands or environmental standards.

- California's intervention in 2023 to prevent the closure of Valero's Benicia refinery demonstrated direct government influence on refinery operations due to supply concerns.

- Delays in obtaining permits for facility modifications can hinder Valero's ability to implement technological upgrades, potentially impacting efficiency and emissions control.

- The permitting process is a key political factor, with varying state and federal regulations influencing the pace of new projects and upgrades.

Political Lobbying and Influence

Valero Energy actively participates in the political arena through lobbying to shape energy policies and regulations that impact its operations. The company's substantial political contributions and its employment of lobbyists with government backgrounds underscore its commitment to influencing the legislative environment. For instance, in the 2022 election cycle, Valero's PAC contributed over $1.5 million to federal candidates and committees, demonstrating a significant investment in political advocacy. This engagement is crucial for navigating the complex regulatory landscape affecting its refining, renewable diesel, and ethanol businesses.

The company's lobbying efforts often focus on issues such as fuel economy standards, tax incentives for renewable fuels, and environmental regulations. These policies directly influence Valero's profitability and strategic direction. For example, the Renewable Fuel Standard (RFS) and tax credits for biodiesel and renewable diesel are key areas where Valero seeks favorable outcomes. In 2023, Valero reported spending approximately $3.5 million on federal lobbying activities, highlighting the ongoing importance of political engagement for the company.

- Lobbying Expenditures: Valero reported spending $3.5 million on federal lobbying in 2023.

- Political Contributions: The company's PAC contributed over $1.5 million to federal campaigns in the 2022 election cycle.

- Policy Focus: Key areas of influence include fuel economy standards, renewable fuel tax credits, and environmental regulations.

- Impact on Segments: Political influence directly affects Valero's refining, renewable diesel, and ethanol business segments.

Government policies significantly shape Valero's operational landscape, particularly through environmental regulations and incentives for renewable fuels. The Inflation Reduction Act of 2022, for instance, provides substantial credits like the 45Z Clean Fuel Production Credit, offering up to $1.75 per gallon for sustainable aviation fuel in 2024, directly encouraging Valero's investments in lower-carbon alternatives.

Mandates such as the Renewable Fuel Standard (RFS) and state-level programs like California's Low Carbon Fuel Standard (LCFS) compel the blending of renewable fuels, influencing Valero's production strategies and profitability in this growing sector. These regulations are critical drivers for the company's strategic pivot towards decarbonization.

Political engagement through lobbying is a key strategy for Valero, with the company investing heavily to influence policy. In 2023, Valero spent approximately $3.5 million on federal lobbying, and its PAC contributed over $1.5 million to federal campaigns in the 2022 cycle, underscoring its commitment to shaping regulations impacting its refining and renewable fuel businesses.

| Policy/Regulation | Impact on Valero | Data Point (2023/2024) |

|---|---|---|

| Inflation Reduction Act (IRA) - 45Z Credit | Incentivizes renewable fuel production | Up to $1.75/gallon for SAF, $1/gallon for renewable diesel |

| Renewable Fuel Standard (RFS) | Mandates renewable fuel blending | Directly influences renewable diesel and ethanol demand |

| California LCFS | Drives demand for low-carbon fuels | Affects Valero's renewable diesel and SAF market opportunities |

| Federal Lobbying Expenditure | Influences policy and regulatory outcomes | ~$3.5 million spent in 2023 |

| PAC Political Contributions | Supports candidates aligned with industry interests | >$1.5 million in 2022 election cycle |

What is included in the product

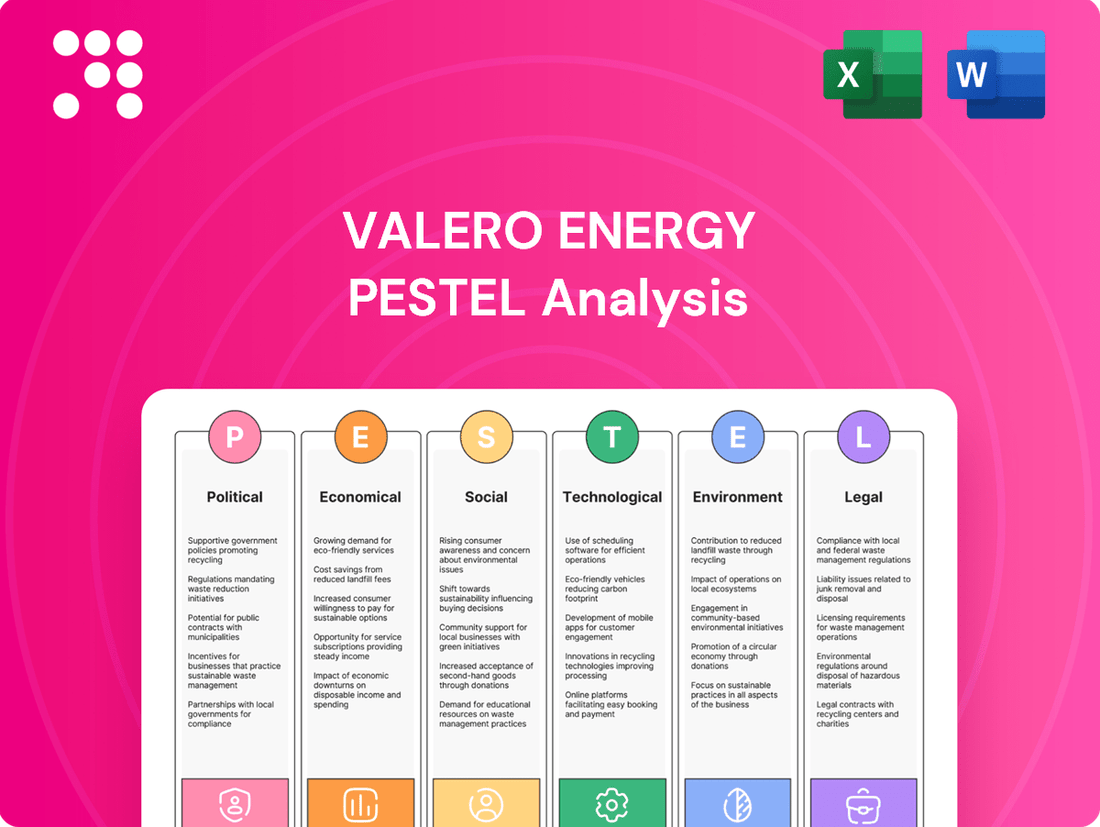

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Valero Energy's operations and strategic planning.

It provides a comprehensive overview of external forces shaping the energy sector, offering actionable insights for competitive advantage and risk mitigation.

Provides a concise version of the Valero Energy PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Valero Energy's financial health is closely tied to global energy demand, which directly influences the prices of crude oil and refined products. For instance, in the first quarter of 2024, Valero reported a net income of $1.5 billion, a figure heavily influenced by the prevailing market conditions for gasoline and diesel.

The company's profitability is particularly sensitive to fluctuations in crude oil differentials and refining margins. These variances, as evidenced by Valero's reported earnings, can significantly impact revenue streams and operational efficiency, making them a critical factor in their performance.

The economic viability of Valero's renewable diesel and ethanol segments is directly tied to the fluctuating market dynamics for low-carbon fuels. Key influences include the cost of feedstocks, such as soybean oil and corn, and the growing demand for sustainable products driven by environmental regulations and consumer preference.

In 2023, Valero's renewable diesel segment demonstrated robust performance, contributing significantly to operating income. However, this segment has also faced periods of loss, notably in Q4 2023, where it reported a $120 million operating loss. This was attributed to factors like planned maintenance activities and elevated feedstock costs, highlighting the sensitivity of renewable fuel economics to input prices and operational efficiency.

Inflationary pressures directly affect Valero's profitability by increasing the cost of raw materials, energy, and labor across its refining, renewable diesel, and ethanol operations. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year in April 2024, indicating a broader trend of rising costs that impacts Valero's input expenses.

Managing operating costs, such as general and administrative expenses and depreciation, becomes paramount for Valero to maintain healthy margins amidst this economic backdrop. A focus on operational efficiency and cost control is essential to navigate the volatility of commodity prices and the broader inflationary environment, ensuring sustained profitability.

Capital Investments and Shareholder Returns

Valero's strategic capital investments are geared towards improving operational efficiency and expanding into new markets. Projects like the FCC Unit optimization at the St. Charles Refinery are designed to boost product yields, while investments in Sustainable Aviation Fuel (SAF) production signal a diversification of its energy portfolio. These initiatives underscore a commitment to long-term value creation.

The company's robust financial health provides a solid foundation for shareholder returns. As of the first quarter of 2024, Valero reported significant cash reserves and maintained a healthy debt-to-capitalization ratio, enabling consistent dividend payments and share repurchase programs. For instance, Valero returned approximately $1.1 billion to shareholders through dividends and buybacks in Q1 2024.

- FCC Unit Optimization: Enhances refining efficiency and product output.

- SAF Production: Diversifies revenue streams into renewable fuels.

- Shareholder Returns: Demonstrated through consistent dividends and buybacks, with $1.1 billion returned in Q1 2024.

- Financial Strength: Supported by strong cash reserves and a manageable debt-to-capitalization ratio.

Economic Activity Levels and Consumer Spending

Overall economic activity is a primary driver for Valero Energy. Higher economic activity translates to increased demand for transportation fuels like gasoline and diesel, as well as petrochemical products used in various industries. This directly impacts Valero's sales volumes and, consequently, its revenue.

Consumer spending habits and the general economic climate are also critical. When consumers feel confident about the economy, they tend to spend more on goods and services, which often includes travel and transportation. This increased demand benefits Valero. For instance, in the first quarter of 2024, U.S. real GDP grew at an annualized rate of 1.3%, indicating a moderate but present level of economic expansion that supports fuel consumption.

- Economic Growth: A robust economy typically leads to higher demand for refined products.

- Consumer Confidence: Positive consumer sentiment often correlates with increased travel and spending, boosting fuel sales.

- Industrial Production: Growth in manufacturing and other industrial sectors increases demand for petrochemicals and industrial fuels.

- Inflationary Pressures: While impacting costs, persistent inflation can also influence consumer spending patterns on discretionary items like travel.

Valero's performance is intrinsically linked to global economic health, which dictates energy consumption. For example, the U.S. economy's moderate growth, with real GDP expanding at a 1.3% annualized rate in Q1 2024, directly fuels demand for Valero's gasoline and diesel products. Inflationary trends, such as the 3.4% year-over-year CPI increase in April 2024, influence both operating costs and consumer spending on fuel.

The company's profitability hinges on refining margins and crude oil differentials, which are subject to global supply and demand dynamics. Valero's Q1 2024 net income of $1.5 billion reflects these market forces. Furthermore, the economic viability of its renewable diesel segment is sensitive to feedstock costs and the evolving regulatory landscape for low-carbon fuels, as seen in its $120 million operating loss in that segment during Q4 2023 due to elevated costs.

| Economic Factor | Impact on Valero | 2024/2025 Data/Trend |

|---|---|---|

| Global Economic Activity | Drives demand for refined products and petrochemicals. | U.S. real GDP growth of 1.3% (annualized) in Q1 2024 indicates moderate demand. |

| Inflation | Increases operating costs (raw materials, labor) and can affect consumer spending. | U.S. CPI at 3.4% (year-over-year) in April 2024 signals rising input expenses. |

| Refining Margins & Crude Differentials | Directly impact profitability and revenue. | Subject to market volatility; Q1 2024 net income of $1.5 billion reflects current margins. |

| Renewable Fuel Economics | Dependent on feedstock costs and demand for sustainable fuels. | Q4 2023 operating loss of $120 million in renewables highlights feedstock cost sensitivity. |

Same Document Delivered

Valero Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Valero Energy PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the critical external forces shaping Valero's strategic landscape.

Sociological factors

Consumers are increasingly prioritizing environmentally friendly options, with a significant portion of the global population expressing concern about climate change. This sentiment translates directly into demand for cleaner energy sources.

Valero Energy has responded to this trend by investing heavily in renewable fuels. For instance, in 2024, the company announced plans to expand its renewable diesel capacity, aiming to capture a larger share of this growing market. By 2025, renewable diesel production is projected to represent a substantial portion of their fuel output.

Valero's dedication to corporate social responsibility, encompassing environmental stewardship, safety protocols, and active community involvement, is crucial for cultivating a favorable public image and fostering stakeholder confidence. In 2023, Valero invested over $50 million in community outreach and environmental initiatives, demonstrating a tangible commitment to these areas.

The company's philanthropic endeavors and employee volunteerism directly bolster its social license to operate, ensuring continued acceptance and support from the communities where it conducts business. Valero employees contributed over 100,000 volunteer hours in 2023, a significant increase from the previous year, highlighting a growing engagement.

Valero Energy, operating large industrial facilities, must actively manage its relationships with local communities, especially regarding environmental impacts. In 2023, Valero reported investing $150 million in environmental projects, with a significant portion directed towards community-focused initiatives aimed at mitigating local concerns.

The company's commitment to environmental justice is evident through its engagement with fence-line neighbors and the execution of environmental justice audits. These efforts aim to proactively address community concerns and ensure equitable distribution of environmental benefits and burdens, a critical aspect of maintaining social license to operate.

Workforce Safety and Employee Well-being

Valero Energy, as a significant player in the energy sector, places a strong emphasis on workforce safety and employee well-being, recognizing these as fundamental sociological drivers. A robust safety culture is paramount for maintaining operational efficiency and preventing incidents, which directly impacts productivity and public perception. In 2024, Valero reported a Total Recordable Incident Rate (TRIR) of 0.26, a testament to their ongoing safety initiatives.

Fostering a supportive work environment is equally crucial for employee retention and morale. Valero's commitment extends to providing resources and programs aimed at enhancing overall employee health and mental well-being. For instance, their employee assistance programs offer confidential counseling and support services. This focus on well-being not only benefits the individual but also contributes to a more engaged and productive workforce, which is vital for sustained business success in the competitive energy landscape.

- Valero’s 2024 Total Recordable Incident Rate (TRIR): 0.26

- Emphasis on Safety Culture: Essential for operational excellence and accident prevention.

- Employee Well-being Programs: Includes Employee Assistance Programs (EAP) for mental and physical health support.

- Impact on Retention: A supportive environment is key to retaining talent in the energy industry.

Shifting Transportation Habits

Sociological factors are increasingly influencing the energy sector, and Valero Energy is navigating these shifts. A significant trend is the evolving transportation habits of consumers. The long-term adoption of electric vehicles (EVs) presents a clear challenge to traditional gasoline and diesel demand. For instance, by the end of 2024, it's projected that over 30 million EVs will be on the road globally, a substantial increase from just a few years prior.

Valero's strategic response includes adapting to these changing consumer needs. The company is actively exploring and investing in diversification into low-carbon fuels. This includes renewable diesel and sustainable aviation fuel (SAF), aiming to capture market share in emerging segments. By 2025, the global market for renewable diesel is expected to reach over 15 billion gallons, highlighting the growth potential Valero is targeting.

- EV Adoption Growth: Global EV sales are projected to exceed 15 million units in 2024, indicating a significant shift away from internal combustion engine vehicles.

- Renewable Fuel Demand: The demand for renewable diesel is anticipated to grow by over 10% annually through 2027, presenting a key opportunity for Valero.

- Consumer Preferences: Growing environmental awareness among consumers is driving preferences for more sustainable transportation options.

Societal expectations regarding corporate responsibility are intensifying, pushing companies like Valero Energy to demonstrate tangible commitments to environmental and social causes. This includes proactive engagement with communities surrounding their operations to address concerns about emissions and local impact. In 2023, Valero invested $150 million in environmental projects, with a focus on community-benefit initiatives.

Workforce safety and employee well-being are paramount sociological drivers for Valero. A strong safety culture not only prevents accidents but also enhances operational efficiency and public perception. In 2024, Valero reported a Total Recordable Incident Rate (TRIR) of 0.26, reflecting their commitment to a safe working environment.

Consumer preferences are shifting towards sustainability, impacting demand for traditional fuels. Valero is responding by expanding its renewable diesel capacity, recognizing the growing market for cleaner energy alternatives. By 2025, renewable diesel production is projected to form a significant part of their fuel output.

Valero's community engagement and philanthropic efforts are vital for maintaining its social license to operate. In 2023, the company invested over $50 million in community outreach and environmental initiatives, underscoring its dedication to being a responsible corporate citizen.

| Sociological Factor | Valero's Response/Data | Impact |

|---|---|---|

| Environmental Consciousness | $150M invested in environmental projects (2023) | Drives demand for cleaner fuels, influences public perception. |

| Workforce Safety | TRIR of 0.26 (2024) | Enhances operational efficiency, reduces risk, improves employee morale. |

| Consumer Preferences | Expanding renewable diesel capacity | Adapts to changing market demands, captures growth in sustainable fuels. |

| Community Relations | >$50M in community outreach (2023) | Maintains social license to operate, builds trust and support. |

Technological factors

Valero consistently invests in refining technology to boost efficiency and product yield. For instance, their St. Charles Refinery has seen upgrades to its Fluid Catalytic Cracking (FCC) unit, a key process for converting heavier oil fractions into more valuable gasoline and diesel. These ongoing improvements are crucial for maintaining a competitive edge in a dynamic market.

Valero's commitment to renewable fuels is evident in its significant investments and expansions in renewable diesel and sustainable aviation fuel (SAF) production. These efforts showcase its embrace of cutting-edge biofuel technologies.

A prime example is the successful completion of the SAF project at Valero's DGD Port Arthur plant. This facility demonstrates the company's ability to enhance its existing renewable diesel infrastructure to produce SAF, a key component in decarbonizing the aviation sector.

Valero is investing in carbon capture and storage (CCS) technologies, recognizing their importance in reducing emissions. For instance, its collaboration with Navigator Energy Services and Summit Carbon Solutions on CO2 pipelines is a key part of this strategy. These projects are designed to significantly lower the carbon intensity of its ethanol production and other industrial processes, aligning with evolving environmental regulations and market demands.

Low-Carbon Hydrogen Production

Valero is exploring the use of low-carbon hydrogen in its manufacturing processes to reduce the carbon footprint of its renewable fuels. This technological shift is crucial for decreasing the carbon intensity of products like renewable diesel, renewable propane, and renewable naphtha. By integrating cleaner hydrogen sources, Valero aims to enhance the sustainability profile of its renewable product offerings, aligning with evolving environmental standards and market demands for greener energy solutions.

The adoption of low-carbon hydrogen production technologies directly supports Valero's strategy to decarbonize its operations. This includes advancements in:

- Green Hydrogen Production: Utilizing electrolysis powered by renewable electricity.

- Blue Hydrogen Production: Employing natural gas with carbon capture, utilization, and storage (CCUS).

- Hydrogen Infrastructure Development: Investing in pipelines and storage for efficient hydrogen transport and integration.

Digitalization and Operational Optimization

Valero Energy's commitment to operational excellence is increasingly intertwined with digitalization and advanced analytics. This trend allows for more efficient resource management, predictive maintenance to minimize downtime, and enhanced overall performance across its refining and ethanol operations. For instance, the company's investment in digital technologies supports its goal of optimizing refinery throughput and product yields.

The energy sector's broader embrace of digital transformation provides Valero with opportunities to leverage data for smarter decision-making. This includes using sophisticated analytics to improve supply chain logistics, manage energy consumption more effectively, and enhance safety protocols. By integrating these technologies, Valero aims to achieve greater cost efficiencies and maintain a competitive edge.

- Digitalization: Valero likely employs digital tools for real-time monitoring and control of its complex refining processes, aiming to boost efficiency and reduce waste.

- Advanced Analytics: The use of predictive analytics can forecast equipment failures, enabling proactive maintenance and preventing costly unplanned outages, a key aspect of operational excellence.

- Operational Optimization: These technological advancements directly support Valero's strategic objective of maximizing profitability through streamlined operations and improved asset utilization.

Valero is actively integrating advanced technologies to enhance its refining processes and expand into renewable fuels. Investments in areas like carbon capture and low-carbon hydrogen production are central to its strategy for reducing emissions and improving the sustainability of its product portfolio.

The company's focus on digitalization and advanced analytics is driving operational efficiencies, from predictive maintenance to optimized supply chain management. This technological adoption is key to maintaining a competitive edge and achieving greater cost-effectiveness across its diverse operations.

Valero's commitment to innovation is evident in its renewable diesel and sustainable aviation fuel (SAF) projects, such as the SAF facility at its DGD Port Arthur plant. These initiatives highlight its ability to leverage new technologies to meet growing demand for cleaner energy solutions.

Valero Energy's technological advancements in 2024-2025 are geared towards both operational efficiency and decarbonization. The company is investing in technologies that support its renewable fuels business, including the production of sustainable aviation fuel (SAF) and renewable diesel, while also exploring carbon capture and low-carbon hydrogen solutions.

| Technology Area | Key Initiatives/Investments | Impact/Goal |

|---|---|---|

| Renewable Fuels | SAF production at DGD Port Arthur; Renewable diesel capacity expansions | Meeting demand for lower-carbon transportation fuels; Decarbonizing aviation |

| Decarbonization | Carbon Capture and Storage (CCS) pipeline collaborations; Low-carbon hydrogen integration | Reducing operational emissions; Lowering carbon intensity of products |

| Digitalization & Analytics | Investments in digital tools for process control and predictive maintenance | Improving refinery efficiency; Minimizing downtime; Enhancing safety |

Legal factors

Valero Energy operates within a landscape of increasingly strict environmental regulations, covering areas like carbon intensity reduction, air quality monitoring, and limitations on water discharge. For instance, the U.S. Environmental Protection Agency (EPA) continues to refine standards for emissions from refineries, impacting operational costs.

Adhering to these mandates necessitates substantial capital investments, potentially affecting the financial feasibility of existing and planned facilities. In 2024, the energy sector continues to see significant investment in emissions control technologies, with companies like Valero allocating billions towards compliance and sustainability initiatives.

Legal mandates such as the Renewable Fuel Standard (RFS) in the United States and state-level initiatives like California's Low Carbon Fuel Standard (LCFS) directly impact Valero's operations by requiring specific volumes of renewable fuels to be blended into its gasoline and diesel products. For instance, the RFS program mandates the annual blending of billions of gallons of renewable fuels, influencing the demand for feedstocks like corn and soybean oil. These regulations shape Valero's product mix and necessitate strategic investments in renewable fuel production capacity and advanced biofuel technologies to meet compliance obligations.

Valero Energy, as a major operator of refineries and ethanol plants, is subject to stringent health and safety regulations designed to safeguard its workforce and the public. These regulations, often enforced by bodies like the Occupational Safety and Health Administration (OSHA) in the U.S., mandate rigorous safety protocols, emergency preparedness plans, and environmental protection measures. For instance, OSHA's Process Safety Management (PSM) standard is critical for facilities handling highly hazardous chemicals, requiring comprehensive hazard analyses and employee training.

Trade Laws and Tariffs

International trade laws and tariffs significantly influence Valero Energy's operations. For instance, tariffs on refined petroleum products can make Valero's exports less competitive in international markets, potentially impacting its revenue streams. In 2024, the global trade landscape continues to be shaped by evolving regulations and protectionist measures in various regions, directly affecting Valero's market access and profitability.

Changes in these legal frameworks can create both challenges and opportunities. Valero must remain agile to navigate shifting trade policies, such as those impacting the import and export of gasoline, diesel, and jet fuel. For example, the U.S. International Trade Commission’s ongoing reviews of trade remedies can alter the cost of imported refined products, influencing domestic competition.

- Impact on Exports: Tariffs can increase the landed cost of Valero's refined products in foreign markets, reducing demand and potentially forcing price adjustments.

- Market Access: Evolving trade agreements and sanctions can either open new export opportunities or restrict access to previously accessible markets for Valero's output.

- Competitive Landscape: Tariffs on imported refined fuels can provide a competitive advantage to domestic refiners like Valero by making foreign products more expensive.

- Regulatory Compliance: Valero must ensure compliance with a complex web of international trade laws, including those related to product standards and origin, which can add operational costs.

Litigation and Legal Challenges

Valero Energy, like any major energy company, navigates a complex legal environment. Potential litigation can arise from environmental incidents, such as spills or emissions violations, which carry significant financial penalties and reputational damage. For instance, in 2023, Valero settled with the Environmental Protection Agency for $3.5 million over Clean Air Act violations at its Port Arthur, Texas refinery.

Regulatory non-compliance presents another substantial legal risk. Adherence to evolving environmental regulations, workplace safety standards, and energy market rules is critical. Failure to comply can lead to fines, operational disruptions, and costly legal battles.

The company's legal challenges can also extend to contract disputes, intellectual property issues, and employee-related litigation. These matters can divert management attention and impact financial performance.

- Environmental Litigation: Potential fines and cleanup costs stemming from spills or emissions exceed millions, impacting profitability and operational continuity.

- Regulatory Fines: Non-compliance with EPA or OSHA regulations can result in penalties, with past instances showing settlements in the millions of dollars.

- Reputational Risk: Legal challenges, particularly those involving environmental harm, can significantly damage Valero's brand image and public trust.

Valero Energy faces significant legal obligations related to environmental protection, including adherence to EPA standards for refinery emissions and state-level mandates like California's Low Carbon Fuel Standard. These regulations necessitate substantial capital outlays for compliance technologies, with the energy sector investing billions in 2024 to meet these evolving requirements.

The company must also comply with health and safety laws, such as OSHA's Process Safety Management standard, to ensure worker safety in its refining and ethanol operations, a critical aspect given the hazardous materials involved.

International trade laws and tariffs directly affect Valero's market access and competitiveness, as seen in 2024 with ongoing trade policy shifts impacting refined product exports and imports.

Legal risks also encompass potential litigation from environmental incidents, with past settlements reaching millions, and penalties for regulatory non-compliance, impacting both financial performance and brand reputation.

Environmental factors

Valero is actively tackling climate change by setting significant greenhouse gas (GHG) emissions reduction goals. The company aims to cut its global refinery Scope 1 and 2 emissions by 2035, with an overarching ambition to achieve company-wide emissions reductions by 2050.

These commitments are directly fueling investments in projects designed to lower carbon intensity. For instance, Valero is investing in renewable diesel production, which is a key component of their strategy to meet these environmental targets and adapt to evolving market demands.

The global shift towards lower-carbon fuels is a major environmental force impacting Valero's operations and future planning. This transition necessitates strategic adjustments in how energy is produced and consumed worldwide.

Valero is proactively responding by investing heavily in renewable energy sources. The company is increasing its capacity for renewable diesel, ethanol, and sustainable aviation fuel, demonstrating a commitment to diversifying its energy offerings beyond traditional fossil fuels.

For instance, Valero's investments in renewable diesel production are substantial, with expansions at facilities like its St. Paul Park, Minnesota refinery. By 2024, Valero aims to significantly boost its renewable diesel output, reflecting a direct response to environmental pressures and market demand for cleaner alternatives.

Water scarcity is a growing concern for the refining industry, impacting operations that require significant water for cooling and processing. Valero, like other major refiners, faces the challenge of ensuring reliable water access and implementing efficient water management strategies to mitigate operational risks and environmental impact.

In 2024, the global water stress index highlights regions where water availability is a critical issue, potentially affecting Valero's facilities in those areas. Companies are increasingly investing in technologies for water recycling and conservation, aiming to reduce their freshwater footprint and comply with stricter environmental regulations.

Waste Management and Pollution Control

Valero Energy's extensive refining and marketing operations inherently produce waste streams and emissions, making effective waste management and pollution control critical. The company actively invests in technologies and processes to mitigate these impacts, aligning with increasing regulatory scrutiny and stakeholder expectations for environmental responsibility.

Valero's commitment to reducing its environmental footprint is evident in its ongoing efforts to lower greenhouse gas emissions and improve air and water quality. For instance, in 2023, Valero reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity compared to its 2019 baseline, demonstrating progress in its environmental stewardship goals.

- Emissions Reduction: Valero is focused on lowering sulfur dioxide (SO2) and nitrogen oxide (NOx) emissions from its facilities, key components of air pollution.

- Water Management: The company implements strategies for responsible water usage and wastewater treatment to minimize impact on local water resources.

- Waste Minimization: Valero aims to reduce the generation of hazardous and non-hazardous waste through operational efficiencies and recycling programs.

- Environmental Compliance: Adherence to stringent environmental regulations, such as those set by the EPA, is a fundamental aspect of Valero's operational strategy.

Biodiversity and Ecosystem Impact

Valero Energy demonstrates a commitment to environmental stewardship by actively participating in ecological and conservation projects, underscoring its awareness of its impact on biodiversity. This proactive approach extends beyond mere regulatory adherence, contributing to a more robust environmental performance record.

For instance, in 2023, Valero reported supporting over 20 conservation initiatives across its operating regions. These projects often focus on habitat restoration and wildlife protection, areas directly linked to maintaining local biodiversity. Such efforts reflect a strategic understanding that ecosystem health can indirectly influence operational stability and community relations.

- Habitat Restoration: Valero's initiatives in 2024 included planting over 50,000 native trees in areas surrounding its refineries, aimed at improving local ecosystems.

- Wildlife Protection: The company continued its partnerships with conservation groups in 2023 to protect endangered species in key operational corridors.

- Waterway Health: Investments were made in 2024 to enhance water quality monitoring and management systems, crucial for aquatic biodiversity.

- Biodiversity Impact Assessments: Valero conducted updated biodiversity impact assessments at 15 of its major facilities in 2023 to identify and mitigate potential risks.

Valero is actively addressing climate change with ambitious goals to reduce its global refinery Scope 1 and 2 greenhouse gas emissions by 2035 and company-wide emissions by 2050. This commitment drives investments in renewable diesel, ethanol, and sustainable aviation fuel, aiming to lower carbon intensity and meet evolving market demands for cleaner energy alternatives.

Water scarcity poses a significant challenge, with global water stress indices in 2024 highlighting potential impacts on Valero's operations. The company is investing in water recycling and conservation technologies to mitigate risks and comply with environmental regulations.

Valero's operations generate waste and emissions, necessitating robust waste management and pollution control. For instance, in 2023, the company reported a reduction in its Scope 1 and 2 greenhouse gas emissions intensity compared to its 2019 baseline, demonstrating progress in environmental stewardship.

The company actively engages in ecological and conservation projects, with over 20 initiatives supported in 2023, including planting over 50,000 native trees in 2024 to improve local ecosystems and protect biodiversity.

| Environmental Factor | Valero's Response/Action | Data/Statistic (2023-2024) |

|---|---|---|

| Greenhouse Gas Emissions | Setting Scope 1 & 2 reduction goals by 2035; company-wide by 2050. Investing in renewable fuels. | Reduced GHG emissions intensity (Scope 1 & 2) vs. 2019 baseline in 2023. |

| Water Management | Investing in water recycling and conservation technologies. | Addressing water stress in operational regions; implementing efficient water management. |

| Waste & Pollution Control | Investing in technologies for waste minimization and pollution mitigation. | Focus on reducing SO2 and NOx emissions; wastewater treatment. |

| Biodiversity & Conservation | Participating in ecological projects; habitat restoration. | Supported over 20 conservation initiatives in 2023; planted 50,000+ native trees in 2024. |

PESTLE Analysis Data Sources

Our Valero Energy PESTLE Analysis is grounded in comprehensive data from official government reports, reputable financial institutions, and leading energy industry publications. We ensure every insight into political, economic, social, technological, legal, and environmental factors is supported by credible and current information.