Valero Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Valero Energy Bundle

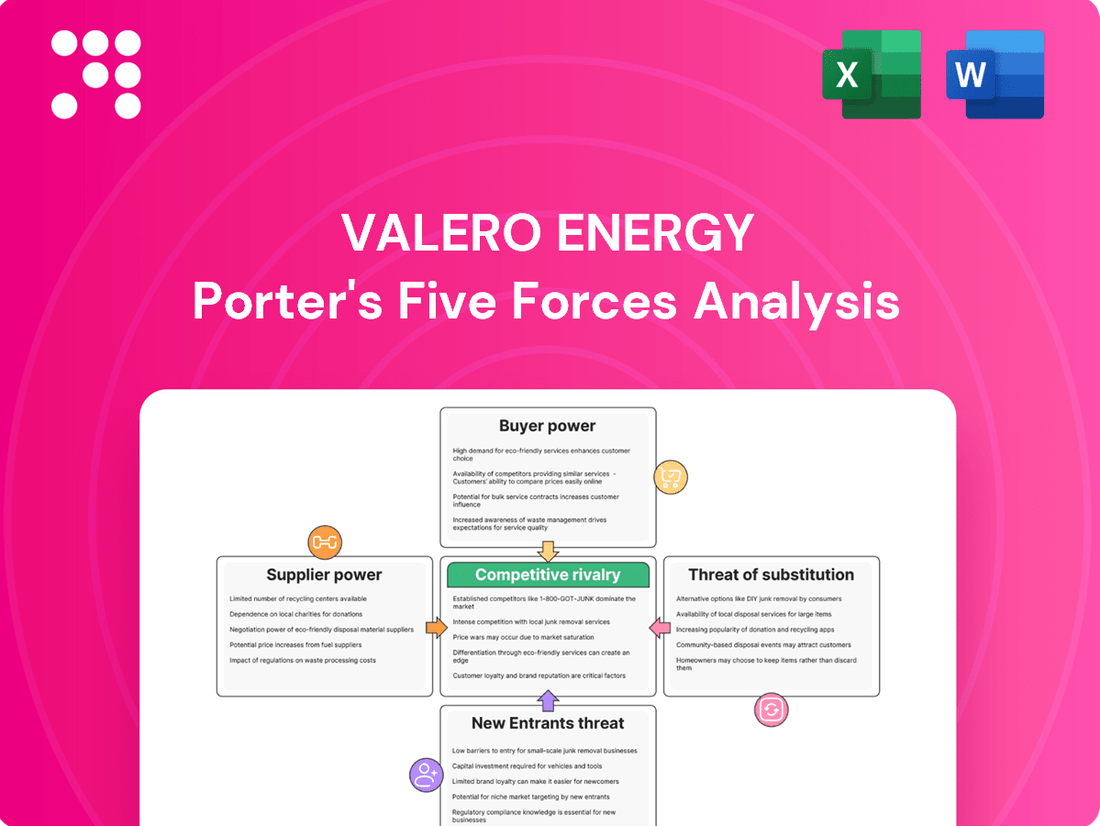

Valero Energy operates within a dynamic energy sector, facing significant pressures from intense rivalry and the bargaining power of its buyers. Understanding these forces is crucial for navigating the complex landscape of refining and marketing fuels.

The complete report reveals the real forces shaping Valero Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of crude oil suppliers significantly impacts Valero Energy, as crude oil is its main input. The global market is dominated by major producing countries and groups like OPEC+. For instance, OPEC+ announced production cuts in late 2023, influencing global supply and pricing, which directly benefits these suppliers by increasing their leverage.

Geopolitical events and supply disruptions further amplify supplier power. The U.S. is also seeing shifts in its crude oil import landscape, with projections indicating a decrease in overall imports by the close of 2025. This evolving dynamic could tighten domestic supply availability, potentially strengthening the hand of domestic crude oil producers and suppliers.

Valero's expansion into renewable fuels, specifically renewable diesel and ethanol, introduces a new set of feedstock dynamics. For renewable diesel, this includes materials like vegetable oils, used cooking oil, and animal fats. Ethanol production primarily relies on corn.

The availability and price fluctuations of these agricultural commodities directly influence the profitability of Valero's renewable fuels operations. For instance, in 2023, the cost of soybean oil, a key feedstock for renewable diesel, saw significant volatility, impacting margins.

The renewable diesel sector, more than traditional refining, is highly susceptible to feedstock supply chain disruptions and price swings. These factors have presented operational challenges for Valero's renewable diesel segment, as seen in its performance in early 2024.

Switching crude oil suppliers presents significant hurdles for refineries like Valero. The need to process specific crude grades requires specialized refinery configurations and can lead to substantial costs if these configurations need to be altered. This operational impact directly affects efficiency and profitability.

While Valero operates a diversified refining portfolio, adapting to drastically different crude types or establishing new, long-term supply agreements is not a simple task. The complexity and cost associated with such transitions can be considerable, impacting operational flexibility.

Potential shifts in import patterns, such as a hypothetical decrease in U.S. crude oil imports from Canada and Mexico due to tariffs, could necessitate Valero and other U.S. refiners to reconfigure their supply chains. For instance, in 2023, the U.S. imported approximately 3.7 million barrels per day of crude oil from Canada. A significant tariff would force a costly search for alternative sources.

Uniqueness of Feedstock

For traditional refining, crude oil is largely a standardized commodity, meaning individual suppliers have limited uniqueness and thus less bargaining power. However, in the realm of renewable fuels, the specific type and quality of feedstock, such as certain vegetable oils, can significantly impact the final product's quality and the efficiency of production. This difference grants suppliers of specialized or certified sustainable feedstocks a notable degree of leverage.

This leverage is evident as the demand for renewable fuels grows. For instance, by early 2024, the price of soybean oil, a key feedstock for biodiesel, had seen fluctuations influenced by global supply and demand dynamics, demonstrating how feedstock availability and cost directly affect renewable fuel producers like Valero. The ability to secure consistent, high-quality, and sustainably sourced feedstocks can become a competitive advantage, allowing suppliers to command better terms.

- Feedstock Standardization: Crude oil is generally a uniform commodity, reducing supplier uniqueness.

- Renewable Feedstock Variation: Specific vegetable oils or other bio-based materials can vary in quality and impact production.

- Supplier Leverage: Suppliers of specialized or certified sustainable feedstocks gain bargaining power.

- Market Influence: In 2024, the price of key renewable feedstocks like soybean oil reflected supply chain sensitivities, impacting producer costs.

Supplier's Ability to Forward Integrate

Major crude oil producers possess the inherent capability to integrate forward into refining and marketing operations. This potential threat means that large oil companies could theoretically reduce the demand for independent refiners like Valero by handling the entire process themselves.

While the technical and capital requirements for global refining are substantial, limiting full forward integration by all crude suppliers, national oil companies have been actively investing across the entire energy value chain. For instance, Saudi Aramco continues its strategic expansion into downstream assets, including refining and petrochemicals, demonstrating a clear intent to capture more value beyond crude extraction.

- Forward Integration Threat: Major crude oil producers can potentially enter refining and marketing, bypassing independent refiners.

- Scale and Complexity: The significant capital and operational expertise required for refining limit the feasibility of widespread forward integration by all suppliers.

- National Oil Company Strategy: Nations like Saudi Arabia are increasingly investing in downstream assets, including refineries, to control more of the value chain.

- Valero's Position: Valero, as a large independent refiner, must contend with the possibility of its suppliers becoming direct competitors in the refining market.

The bargaining power of Valero's crude oil suppliers is significant due to the commodity's essential nature and market concentration, with entities like OPEC+ wielding considerable influence over pricing and supply. For renewable fuels, the power shifts to suppliers of specialized feedstocks like vegetable oils, whose availability and price volatility, as seen with soybean oil in early 2024, directly impact Valero's margins.

Valero faces limited switching options for crude oil due to refinery configurations and the substantial costs associated with altering them, which strengthens supplier leverage. While crude oil is largely standardized, renewable feedstock quality and sustainability certifications grant specific suppliers greater bargaining power.

Major crude oil producers can pose a threat by integrating forward into refining, a strategy pursued by national oil companies like Saudi Aramco to capture more value. This potential competition necessitates Valero's continuous adaptation and strategic sourcing.

What is included in the product

This analysis unpacks the competitive forces impacting Valero Energy, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the energy sector.

Instantly visualize the competitive landscape of the refining and marketing sector, pinpointing key threats and opportunities for Valero Energy.

Customers Bargaining Power

Valero's customer base is quite varied, encompassing wholesale distributors, branded marketers, and industrial clients. This fragmentation typically dilutes the bargaining power of any individual customer. For instance, in 2024, Valero's diverse product sales across numerous channels meant that no single customer segment represented an overwhelmingly dominant portion of their revenue, thereby limiting individual customer leverage.

The demand for transportation fuels, such as gasoline and diesel, is notably price-sensitive. This sensitivity is largely driven by the fluctuating global crude oil prices and the prevailing economic conditions. For Valero, this means that significant price swings can directly impact how much fuel consumers purchase or even encourage a shift towards alternative transportation, a trend gaining momentum.

In 2024, the average price of gasoline in the United States saw considerable volatility, reflecting global supply and demand dynamics. For instance, while prices might have averaged around $3.60 per gallon in early 2024, they experienced fluctuations throughout the year, impacting consumer spending on fuel. This price elasticity means that even small increases can lead to noticeable changes in consumption patterns.

The growing popularity of electric vehicles (EVs) presents a substantial threat to Valero Energy's core business. As more consumers switch to EVs, the demand for gasoline and diesel, Valero's main products, will naturally decline. Projections suggest that by 2030, EVs could be displacing millions of barrels of oil daily, directly impacting Valero's sales volume and pricing power.

This shift towards alternative transportation fuels significantly increases the bargaining power of customers. Consumers have a viable and increasingly attractive substitute for traditional internal combustion engine vehicles, giving them more leverage when making purchasing decisions. This means Valero faces pressure to maintain competitive pricing and explore new revenue streams.

Valero is actively investing in renewable diesel and sustainable aviation fuel (SAF) as a strategic move to counter this threat. While these investments are crucial for future growth, these markets are still in their nascent stages. The success and scale of these new ventures will be critical in mitigating the long-term impact of declining demand for fossil fuels.

Customer Information and Transparency

Customers in the transportation fuels market, especially at the wholesale level, benefit from readily available real-time pricing information. This high degree of price transparency significantly empowers buyers, making it harder for companies like Valero to charge premium prices for their commodity products.

For instance, in 2024, the average retail gasoline price fluctuated, with readily accessible data through apps and online platforms allowing consumers to compare prices across different stations instantly. This constant visibility puts pressure on retailers to maintain competitive pricing, directly impacting Valero's pricing power.

- Increased Price Transparency: Real-time pricing data for transportation fuels is widely accessible to customers, particularly at the wholesale level.

- Buyer Empowerment: This transparency gives buyers more leverage in price negotiations, limiting Valero's ability to set higher prices.

- Impact on Commodity Products: For standardized fuel products, this transparency directly hinders Valero's capacity to achieve premium pricing.

Switching Costs for Customers

For the average driver, switching between Valero's retail fuel stations or other brands involves minimal effort and cost, meaning customers have high bargaining power here. However, for large commercial clients, such as fleet operators or industrial businesses, the decision to switch fuel suppliers can be more involved. These customers might face logistical hurdles, the need to renegotiate contracts, or even adapt equipment, which can introduce moderate switching costs.

The energy landscape is also evolving, with a significant shift towards low-carbon and sustainable fuel options. This trend empowers customers who prioritize environmental impact, as they may be willing to pay a premium for greener alternatives. For instance, in 2024, the demand for renewable diesel and electric vehicle charging infrastructure continues to grow, giving these customers more leverage in choosing suppliers that align with their sustainability goals.

The bargaining power of customers in the fuel sector is generally high due to low retail switching costs. However, this can be mitigated for Valero when dealing with larger, more integrated commercial accounts where switching involves greater complexity.

- Retail Customers: Minimal switching costs, high bargaining power.

- Commercial Customers: Moderate switching costs due to logistics and contracts.

- Sustainability Trend: Growing customer willingness to pay more for low-carbon fuels, increasing their influence.

Valero's customers, particularly at the retail level, exhibit strong bargaining power due to the commodity nature of gasoline and diesel. The widespread availability of price comparison tools in 2024 meant consumers could easily switch brands, limiting Valero's pricing flexibility. For instance, average gasoline prices in the US saw significant fluctuations throughout 2024, with consumers actively seeking out the lowest prices available.

The increasing adoption of electric vehicles (EVs) is a key factor amplifying customer power, offering a viable alternative to traditional fuels. This trend is projected to continue, with EV market share expected to grow significantly by 2030, directly impacting demand for Valero's core products and increasing customer leverage.

| Customer Segment | Bargaining Power Factor | 2024 Impact Example |

|---|---|---|

| Retail Consumers | Low switching costs, high price sensitivity | Easy access to price apps led to frequent brand switching based on minor price differences. |

| Wholesale Distributors | High price transparency, access to real-time pricing | Ability to compare bulk fuel prices across suppliers limited Valero's margin potential. |

| Industrial/Fleet Operators | Moderate switching costs (logistics, contracts) | While more complex to switch, a growing preference for lower-carbon fuels gave these customers more negotiation leverage. |

Preview Before You Purchase

Valero Energy Porter's Five Forces Analysis

This preview showcases the comprehensive Valero Energy Porter's Five Forces Analysis, detailing the competitive landscape of the energy sector. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing actionable insights into industry rivalry, buyer and supplier power, and the threat of new entrants and substitutes.

Rivalry Among Competitors

The refining sector is a competitive arena featuring several substantial, long-standing companies like Marathon Petroleum and ExxonMobil, in addition to Valero. These major players possess considerable operational capacity, meaning the number and size of competitors directly contribute to intense rivalry.

While U.S. refining capacity saw only a slight increase in 2023, reaching approximately 18.0 million barrels per day, the sheer scale of existing competitors means any new entrant faces significant hurdles. For instance, Marathon Petroleum, a direct competitor, reported refining and marketing segment income of $4.9 billion in 2023, illustrating the substantial resources at play.

The global demand for traditional transportation fuels is expected to see a modest increase, with projections indicating growth between 2024 and 2034. However, this growth is at a slower pace, and overall oil demand could potentially plateau during this period, intensifying competition among players like Valero Energy.

This scenario means that companies are increasingly competing for market share within a mature, and in some regions, potentially shrinking core market for gasoline and diesel. The pressure to capture and retain customers in such an environment naturally heightens competitive rivalry.

Valero's core products like gasoline, diesel, and jet fuel are largely indistinguishable in terms of features, making it challenging for them to stand out solely on product characteristics. This commoditization means price and availability often dictate customer choice.

While Valero is expanding into renewable diesel and sustainable aviation fuel (SAF), these represent emerging markets. Although these greener alternatives offer a degree of differentiation, they still constitute a smaller portion of the overall fuel demand compared to traditional fossil fuels. For instance, in 2023, Valero produced approximately 3.3 billion gallons of renewable diesel.

The company's competitive strategy hinges more on operational excellence and strategic asset placement. By optimizing refinery operations and locating facilities near key demand centers or transportation hubs, Valero aims to reduce costs and improve delivery times, thereby securing an advantage in a market where product differentiation is minimal.

Exit Barriers

The refining industry, where Valero Energy operates, is characterized by substantial exit barriers due to its incredibly capital-intensive nature. Building and maintaining refineries requires massive upfront investment and ongoing high fixed costs, making it economically challenging for companies to simply shut down operations and leave the market.

These high barriers can trap companies in a market even when profitability is low. For instance, Valero's decision to permanently close its Benicia, California refinery in 2024, citing economic challenges and regulatory pressures, highlights the difficulty of exiting, even when necessary. Such closures often occur after significant periods of struggle.

When companies find it hard to exit, it can lead to persistent overcapacity in the market. This oversupply, especially during times of weaker demand for refined products, can intensify price competition, forcing all players, including Valero, to operate on thinner margins and potentially engage in price wars.

- High Capital Investment: The cost to build a new refinery can run into billions of dollars, creating a significant financial hurdle for new entrants and a sunk cost for existing players.

- Specialized Assets: Refinery equipment is highly specialized and often cannot be easily repurposed or sold for alternative uses, increasing the loss upon exit.

- Environmental Regulations: Decommissioning a refinery involves strict environmental cleanup protocols, adding substantial costs and complexity to any exit strategy.

- Long-Term Contracts: Refiners often have long-term supply and offtake agreements that can be costly to break, further complicating an exit.

Strategic Objectives of Competitors

Competitors are sharpening their focus on making their current operations more efficient. They are also channeling investments into developing lower-carbon fuel alternatives, a clear response to evolving market demands and environmental pressures. Furthermore, managing the complexities of geopolitical shifts and changing regulations remains a critical strategic objective for many in the sector.

Valero Energy itself is actively participating in this industry-wide strategic realignment. For example, Valero is making significant investments in the production of Sustainable Aviation Fuel (SAF) and is exploring carbon capture technologies. These initiatives demonstrate a proactive approach to aligning with the broader energy transition, mirroring a strategic pivot seen across many energy companies as they navigate future market landscapes.

- Asset Optimization: Focus on maximizing efficiency and output from existing refineries and infrastructure.

- Low-Carbon Fuel Investment: Significant capital allocation towards renewable diesel, SAF, and other alternative fuels.

- Risk Management: Proactive strategies to mitigate impacts from geopolitical instability and evolving environmental regulations.

- Strategic Alignment: Investments in SAF production and carbon capture projects, such as Valero's initiatives, reflect a broader industry trend towards decarbonization and energy transition.

The competitive rivalry within the refining sector is intense, driven by a handful of large, established players like Marathon Petroleum and ExxonMobil, alongside Valero. These companies possess substantial operational scale, and the commoditized nature of core products like gasoline means competition often centers on price and availability.

Companies are investing heavily in operational efficiency and expanding into lower-carbon fuels, such as renewable diesel and sustainable aviation fuel (SAF). Valero, for instance, produced approximately 3.3 billion gallons of renewable diesel in 2023, highlighting this strategic shift. This focus on differentiation and cost management is crucial in a market where traditional fuel demand growth is moderating.

| Competitor | 2023 Refining Segment Income (USD billions) | Key Strategic Focus |

|---|---|---|

| Valero Energy | N/A (Consolidated reporting) | Operational excellence, renewable fuels expansion (3.3B gallons renewable diesel in 2023) |

| Marathon Petroleum | 4.9 | Refining efficiency, investments in lower-carbon fuels |

| ExxonMobil | N/A (Refining segment data separate) | Integrated operations, energy transition investments |

SSubstitutes Threaten

Electric vehicles (EVs) pose a significant threat to Valero Energy by directly reducing demand for gasoline and diesel. As of early 2024, global EV sales have continued their upward trajectory, with projections suggesting a substantial impact on oil consumption in the coming years. This shift impacts Valero’s core refining operations, as the market for its primary products shrinks.

Biofuels like ethanol and renewable diesel present a dual role for Valero. On one hand, they are substitutes for Valero's core gasoline and conventional diesel products, potentially eroding demand. For instance, the U.S. Energy Information Administration reported that renewable diesel production in the U.S. reached approximately 5.7 billion gallons in 2023, a significant increase.

However, Valero is also a major producer of these biofuels, particularly ethanol and renewable diesel. This positions biofuels not just as a threat but also as a strategic diversification and growth area for the company. The company's investment in renewable diesel capacity, aiming to produce around 12 million barrels annually by 2025, highlights this strategic pivot.

The growing demand for lower-carbon fuels, fueled by government mandates and corporate sustainability goals, makes the renewable diesel market attractive. Yet, this segment faces hurdles. Securing consistent and cost-effective feedstock, such as soybean oil or used cooking oil, remains a challenge, impacting the profitability and scalability of renewable diesel production.

Beyond electric vehicles, alternative transportation technologies like hydrogen fuel cells and enhanced public transit systems pose a long-term threat to demand for liquid fuels. While their current market penetration is low, these innovations could significantly reduce reliance on traditional gasoline and diesel in the future. For instance, by the end of 2023, the global hydrogen fuel cell vehicle market was projected to reach approximately $2.5 billion, indicating early but growing adoption.

Energy Efficiency Improvements

Improvements in vehicle fuel efficiency represent a significant substitute threat to traditional fuels like those produced by Valero. For instance, advancements in internal combustion engine technology have led to vehicles achieving higher miles per gallon, directly impacting fuel demand. By 2024, the average fuel economy for new passenger vehicles sold in the U.S. has continued to trend upwards, making each gallon of fuel stretch further.

Furthermore, evolving consumer preferences and increased adoption of carpooling or ride-sharing services further diminish the need for individual vehicle fuel consumption. This shift in behavior, amplified by rising fuel prices and environmental consciousness, creates a persistent, albeit gradual, erosion of demand for gasoline and diesel. A 2024 study indicated a notable percentage of commuters actively participating in carpooling arrangements, a trend that directly substitutes for individual fuel purchases.

- Increased Fuel Efficiency: New vehicles in 2024 are achieving better MPG ratings than in previous years.

- Behavioral Shifts: More consumers are embracing carpooling and reducing personal driving.

- Reduced Demand: These factors collectively lead to a lower overall demand for refined fuels.

- Substitute Threat: This incremental reduction in fuel consumption acts as a direct substitute threat.

Impact of Regulatory Environment

Government policies and regulations significantly influence the threat of substitutes for Valero Energy. Mandates like Corporate Average Fuel Economy (CAFE) standards in the US, which aim to improve vehicle fuel efficiency, directly encourage the use of more efficient gasoline engines and, by extension, reduce demand for traditional gasoline. For instance, the CAFE standards for model year 2026 are projected to require an average fuel economy of approximately 49 miles per gallon for passenger cars and light trucks, a substantial increase from earlier standards.

Furthermore, carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems implemented in various regions, make fossil fuels more expensive. This economic pressure accelerates the adoption of lower-carbon alternatives. In 2024, the European Union's Emissions Trading System (EU ETS) continued to price carbon emissions, impacting the cost-effectiveness of gasoline and diesel.

Incentives for renewable energy and electric vehicles (EVs) also directly promote substitutes. Government subsidies, tax credits, and charging infrastructure investments make EVs a more attractive option for consumers, thereby diminishing reliance on gasoline. By the end of 2023, global EV sales surpassed 13 million units, a significant jump from previous years, indicating a growing market share for electric mobility.

- Fuel Efficiency Standards: CAFE standards pushing for higher MPG reduce gasoline demand.

- Carbon Pricing: Taxes and trading systems increase fossil fuel costs, favoring alternatives.

- Renewable Energy & EV Incentives: Subsidies and infrastructure development boost EV adoption.

The threat of substitutes for Valero Energy is multifaceted, encompassing technological advancements and evolving consumer behaviors. Electric vehicles (EVs) are a primary concern, with global sales continuing to rise, impacting gasoline and diesel demand. For instance, by early 2024, EV adoption was accelerating, with projections indicating a significant reduction in oil consumption in the coming years.

Biofuels, such as ethanol and renewable diesel, also represent substitutes, though Valero is actively involved in their production, turning a threat into a strategic opportunity. The U.S. produced approximately 5.7 billion gallons of renewable diesel in 2023, a testament to the growing market for these alternatives. Valero itself aims to produce around 12 million barrels of renewable diesel annually by 2025.

Beyond EVs and biofuels, advancements in vehicle fuel efficiency and shifts towards public transit or ride-sharing further dilute demand for traditional fuels. By 2024, new vehicles in the U.S. were achieving higher average miles per gallon, making each gallon of fuel last longer. These combined factors create a persistent, albeit gradual, erosion of demand for Valero’s core products.

| Substitute Category | Key Drivers | Impact on Valero | 2023/2024 Data Point |

|---|---|---|---|

| Electric Vehicles (EVs) | Government incentives, falling battery costs, environmental consciousness | Reduced demand for gasoline and diesel | Global EV sales surpassed 13 million units by end of 2023 |

| Biofuels (Renewable Diesel, Ethanol) | Government mandates (e.g., RFS), corporate sustainability goals | Potential demand erosion, but also growth opportunity for Valero | U.S. renewable diesel production reached ~5.7 billion gallons in 2023 |

| Fuel Efficiency Improvements | Stricter CAFE standards, technological advancements in ICE | Lower fuel consumption per vehicle | Average fuel economy for new U.S. passenger vehicles trending upwards in 2024 |

| Alternative Transportation | Hydrogen fuel cells, enhanced public transit, ride-sharing | Long-term reduction in reliance on liquid fuels | Global hydrogen fuel cell vehicle market projected at ~$2.5 billion by end of 2023 |

Entrants Threaten

The oil refining sector demands immense capital, with new refineries costing billions of dollars to construct. For instance, a new, large-scale refinery project could easily exceed $10 billion, a figure that dwarfs the resources of most potential competitors. This enormous upfront investment acts as a significant deterrent, making it exceptionally difficult for new players to enter the market and challenge established giants like Valero Energy.

Established players like Valero Energy benefit immensely from significant economies of scale in their refining operations, bulk procurement of crude oil, and extensive distribution networks. This scale allows them to spread fixed costs over a larger output, leading to lower per-unit production costs.

New entrants would face a steep uphill battle to match these cost efficiencies. Without substantial initial capital investment to build comparable infrastructure and achieve significant market penetration, they would struggle to compete on price against incumbents like Valero, which in 2023 reported revenues of $144.9 billion.

Valero Energy benefits from a robust and established distribution network, encompassing pipelines, terminals, and wholesale outlets. This extensive infrastructure allows for the efficient and cost-effective delivery of its refined products to market. In 2024, the sheer scale of such an operation presents a significant barrier; for instance, building a new, comparable pipeline system can cost billions of dollars and take years to permit and construct.

New competitors would find it exceedingly difficult and prohibitively expensive to replicate Valero's existing distribution capabilities. The capital expenditure required to build out a comparable network, or even to secure access to existing, limited third-party infrastructure, would be immense. This high cost of entry for distribution significantly deters potential new entrants into the refined products market.

Government Regulations and Environmental Hurdles

The threat of new entrants in the refining sector, particularly for companies like Valero Energy, is significantly dampened by substantial government regulations and environmental hurdles. These stringent standards, encompassing emissions control, waste management, and safety protocols, demand massive capital investment and specialized expertise, making it exceedingly difficult for newcomers to establish a competitive foothold.

The permitting process itself is a formidable barrier. Building a new refinery or even undertaking a major expansion requires navigating a complex web of federal, state, and local regulations, often involving lengthy environmental impact assessments and public hearings. For instance, the construction of new refineries in the United States has been exceptionally rare in recent decades due to these very challenges.

- High Capital Requirements: Building a modern refinery can cost billions of dollars, a sum that deters many potential entrants.

- Stringent Environmental Standards: Compliance with regulations like the Clean Air Act and various state-level environmental mandates necessitates advanced, costly technologies.

- Complex Permitting Processes: Obtaining all necessary permits can take years and involves significant legal and consulting fees.

- Political and Social Opposition: New refinery projects often face considerable public scrutiny and opposition, further complicating approvals.

Access to Feedstock and Technology

New entrants face significant hurdles in securing reliable and cost-effective crude oil supplies, particularly differentiated grades crucial for efficient refining. For instance, in 2024, the global crude oil market continued to be influenced by geopolitical factors and OPEC+ production decisions, making consistent access for newcomers a complex proposition.

The sophisticated nature of refining technologies presents another formidable barrier. Existing players like Valero have invested heavily over decades in proprietary processes and intellectual property, creating a knowledge and capital gap that new entrants must overcome. This advanced technological know-how is not easily replicated.

Furthermore, the burgeoning renewable fuels sector also presents feedstock challenges for new entrants. Ensuring a consistent supply of quality feedstocks, such as corn or soybean oil for biodiesel, is critical, and established players often have more robust and integrated supply chains in place. In 2024, the demand for these feedstocks continued to rise, intensifying competition.

- Feedstock Access: Newcomers struggle to secure cost-effective and consistent supplies of crude oil and renewable feedstocks.

- Technology Barriers: Decades of investment in proprietary refining technologies and intellectual property create a significant advantage for incumbents.

- Market Volatility: Geopolitical events and production policies in 2024 continued to impact crude oil availability and pricing, increasing risk for new market entrants.

The threat of new entrants in the oil refining industry, as it pertains to Valero Energy, is considerably low. This is primarily due to the immense capital required to establish a new refinery, which can easily run into billions of dollars. For instance, building a modern, large-scale refinery in 2024 would likely cost well over $10 billion. This massive financial barrier, coupled with established players' economies of scale and extensive distribution networks, makes it exceptionally difficult for newcomers to compete effectively.

| Barrier to Entry | Estimated Cost/Impact (Illustrative) | Impact on New Entrants |

| New Refinery Construction | $10+ Billion (2024 Estimate) | Extremely High Barrier |

| Distribution Network Development | Billions of Dollars, Years for Permitting | Prohibitively Expensive and Time-Consuming |

| Regulatory Compliance & Permitting | Significant Capital & Legal Costs | Lengthy, Complex, and Uncertain Approval Process |

| Proprietary Technology & Know-How | Decades of R&D Investment | Difficult to Replicate |

Porter's Five Forces Analysis Data Sources

Our Valero Energy Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Valero's SEC filings, industry-specific reports from organizations like the EIA and API, and financial data from platforms such as Bloomberg and S&P Capital IQ.