Valero Energy Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Valero Energy Bundle

Valero Energy's marketing strategy is a complex interplay of product, price, place, and promotion. Understanding how they position their diverse fuel and petrochemical products, set competitive pricing, leverage their extensive retail and wholesale network, and communicate their brand value is crucial for grasping their market dominance.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Valero Energy's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into the energy sector.

Product

Valero Energy's core product is a wide array of refined petroleum products, vital for transportation and industry. This includes gasoline, diesel fuels, jet fuel, and asphalt, catering to diverse consumer and business needs.

With a substantial refining capacity spread across 15 refineries in the U.S., Canada, and the U.K., Valero can produce significant volumes. For instance, in the first quarter of 2024, Valero's throughput averaged 3.2 million barrels per day, demonstrating its ability to meet broad market demands.

Valero is a significant player in the low-carbon fuel market, with renewable diesel being a core product. Through its Diamond Green Diesel (DGD) joint venture, the company processes a variety of feedstocks like used cooking oil and animal fats to create this cleaner-burning fuel.

Expanding into Sustainable Aviation Fuel (SAF) is a key strategic move. The DGD Port Arthur facility's SAF project, completed in Q4 2024, allows Valero to repurpose existing renewable diesel capacity for SAF production, tapping into a growing demand sector.

Valero is a major player in the renewable fuels market, operating 12 ethanol plants primarily in the U.S. Mid-Continent. Their corn ethanol is a clean-burning, high-octane fuel blended with gasoline, contributing to cleaner air and energy independence.

Beyond ethanol, Valero diversifies its revenue streams through valuable co-products. These include distillers grains, a sought-after ingredient in livestock feed, and corn oil, which finds applications in both feed and renewable diesel production. This integrated approach maximizes the value derived from each bushel of corn.

Petrochemical s

Valero Energy's product portfolio extends beyond transportation fuels to include a range of petrochemicals. These are vital components for many industries, showcasing Valero's diversified market presence.

Key petrochemical offerings include aromatics such as benzene, toluene, and mixed xylenes. These serve as essential feedstocks for manufacturing adhesives, coatings, paints, and fuel additives, highlighting their broad industrial utility.

This segment diversifies Valero's revenue streams, tapping into a wider industrial market. For instance, in 2024, the global petrochemical market size was valued at approximately $610 billion, with aromatics representing a significant portion.

- Benzene: A fundamental building block for plastics like polystyrene and nylon.

- Toluene: Used in the production of polyurethane foams and as a solvent.

- Mixed Xylenes: Essential for producing polyester fibers and films.

- Industrial Applications: These petrochemicals are critical for sectors ranging from automotive to construction.

Specialty s and Infrastructure Services

Valero Energy's product line extends beyond traditional fuels to include valuable specialty products like natural gas liquids (NGLs). These include propane, normal butane, isobutane, and propylene, all refined at their facilities. In 2024, Valero continued to be a significant producer of these NGLs, contributing to their overall revenue diversification.

Complementing its product offerings, Valero provides essential infrastructure services. This leverages their vast network of pipelines and storage terminals, crucial for the efficient movement and storage of energy products. These infrastructure assets are a vital component of their value proposition, facilitating market access for their refined products and NGLs.

The company's infrastructure services are not merely an add-on but a strategic element of its business model. By controlling key transportation and storage points, Valero enhances its operational efficiency and market reach. This integrated approach allows them to capture value across the entire energy supply chain.

- Specialty Products: Valero refines and markets NGLs such as propane, normal butane, isobutane, and propylene.

- Infrastructure Services: The company utilizes its extensive pipeline and storage terminal network to support its operations and customer needs.

- Value Chain Integration: These services are integral to Valero's overall offering, enhancing logistical capabilities and market access.

- Strategic Importance: Infrastructure assets are key to Valero's competitive advantage, ensuring reliable product delivery and storage.

Valero Energy's product strategy centers on a diversified portfolio of refined petroleum products, including gasoline, diesel, and jet fuel, essential for global transportation and industry. This core offering is augmented by a significant push into renewable fuels, such as renewable diesel and sustainable aviation fuel (SAF), leveraging their extensive refining capabilities and strategic joint ventures like Diamond Green Diesel.

The company also produces valuable petrochemicals, like benzene and toluene, which are critical feedstocks for various manufacturing sectors, and natural gas liquids (NGLs) such as propane and butane. This broad product range, supported by robust infrastructure services including pipelines and storage, ensures Valero meets diverse market demands and captures value across the energy supply chain.

| Product Category | Key Products | 2024/2025 Data/Context |

|---|---|---|

| Refined Petroleum Products | Gasoline, Diesel, Jet Fuel, Asphalt | Valero's refining capacity averaged 3.2 million barrels per day in Q1 2024. |

| Renewable Fuels | Renewable Diesel, Sustainable Aviation Fuel (SAF), Ethanol | SAF project at Port Arthur completed Q4 2024; operates 12 ethanol plants. |

| Petrochemicals | Benzene, Toluene, Mixed Xylenes | Global petrochemical market valued around $610 billion in 2024. |

| Natural Gas Liquids (NGLs) | Propane, Normal Butane, Isobutane, Propylene | Valero is a significant producer of NGLs, contributing to revenue diversification. |

| Infrastructure Services | Pipeline and Storage Terminal Network | Integral to operations, enhancing logistical capabilities and market access. |

What is included in the product

This analysis provides a comprehensive breakdown of Valero Energy's marketing strategies, examining its product offerings, pricing tactics, distribution channels, and promotional activities.

It offers a detailed look at Valero Energy's marketing positioning, perfect for professionals seeking to understand their competitive landscape and strategic approach.

Simplifies complex marketing strategies by clearly outlining Valero's Product, Price, Place, and Promotion decisions, alleviating the pain of strategic ambiguity.

Provides a clear, actionable framework for understanding Valero's market positioning, easing the burden of developing effective marketing campaigns.

Place

Valero's extensive refining network is a cornerstone of its marketing strategy, featuring 15 strategically positioned petroleum refineries across the United States, Canada, and the United Kingdom. This vast infrastructure boasts a combined throughput capacity of approximately 3.2 million barrels per day as of early 2024, enabling efficient processing of diverse crude oil grades.

The geographical spread of these refineries is crucial for minimizing transportation costs and optimizing supply chain logistics, ensuring proximity to key consumer markets. This strategic placement allows Valero to respond effectively to regional demand fluctuations and maintain a competitive edge in product distribution.

Valero leverages an integrated distribution network encompassing pipelines, storage terminals, and branded wholesale outlets. This multi-modal approach ensures broad market reach for its fuels and petrochemicals.

The company's extensive infrastructure, including strategically located terminals and a robust pipeline system, facilitates efficient product delivery to various customer segments. This integrated system is crucial for maintaining supply chain reliability and cost-effectiveness.

In 2024, Valero's refining segment processed an average of 3.2 million barrels per day, highlighting the scale and importance of its distribution capabilities in moving refined products to market.

Valero Energy's wholesale and bulk markets are a cornerstone of its operations, facilitating the sale of substantial fuel volumes directly to other businesses. This B2B channel is vital for distributing products to retailers, industrial users, and large-scale consumers, underscoring its importance in Valero's overall distribution network.

In 2023, Valero's wholesale segment generated approximately $89.9 billion in revenue, highlighting the sheer scale of its B2B fuel sales. This segment is critical for moving large quantities of gasoline, diesel, and jet fuel, ensuring consistent market presence and supply chain efficiency.

Branded Retail Outlets

Although Valero divested its direct retail operations in 2013, its brand continues to be a significant presence through fuel supply agreements. Valero provides fuel to more than 7,000 retail locations that proudly display its brand names, including Valero, Beacon, Diamond Shamrock, Shamrock, Ultramar, and Texaco. This extensive network ensures that Valero branded fuels are readily available to millions of individual motorists across North America.

This strategy allows Valero to maintain a powerful consumer-facing brand without the operational complexities of directly managing thousands of individual service stations. The continued association with these well-recognized brands reinforces Valero's market penetration and product visibility at the point of sale.

- Brand Reach: Over 7,000 retail locations supplied by Valero.

- Key Brands: Valero, Beacon, Diamond Shamrock, Shamrock, Ultramar, Texaco.

- Market Presence: Maintains strong consumer-level brand visibility.

Global and Regional Market Presence

Valero Energy strategically positions itself across major international markets, ensuring a robust global and regional footprint. This expansive presence is crucial for distributing its diverse portfolio of refined products, renewable fuels, and petrochemicals to a wide customer base.

The company's operational reach extends significantly throughout North America, including the United States and Canada, and into Europe with operations in the United Kingdom and Ireland. Furthermore, Valero maintains a notable presence in Latin America, demonstrating its commitment to serving varied energy needs across these key economic zones.

As of early 2024, Valero operates approximately 15,000 branded Valero, Beacon, and Shamrock retail outlets across the United States, Canada, and the UK. This extensive retail network is a testament to its place strategy, facilitating direct access to consumers and reinforcing brand visibility.

- United States: Extensive refining and retail operations.

- Canada: Significant presence in refining and fuel distribution.

- United Kingdom: Key market for refined products and fuels.

- Ireland: Growing market presence for energy products.

- Latin America: Strategic expansion into key regional markets.

Valero's place strategy is defined by its vast network of refineries and distribution channels, ensuring products reach consumers efficiently. This includes 15 refineries with a combined throughput of 3.2 million barrels per day as of early 2024, strategically located to minimize logistics costs.

The company's integrated distribution system, featuring pipelines and terminals, supports its wholesale operations which generated $89.9 billion in revenue in 2023. This robust infrastructure underpins its market presence across North America and Europe.

Valero's brand visibility is maintained through supply agreements with over 7,000 retail locations, featuring brands like Valero, Diamond Shamrock, and Ultramar. This broad reach ensures Valero fuels are accessible to millions of consumers.

| Geographic Focus | Key Infrastructure Elements | Market Reach |

| North America (US, Canada) | 15 Refineries (3.2M bpd capacity, early 2024) | 7,000+ Branded Retail Locations |

| Europe (UK, Ireland) | Pipelines, Storage Terminals | Wholesale & Bulk Markets |

| Latin America | Integrated Distribution Network | Direct Consumer Access (via branded sites) |

What You See Is What You Get

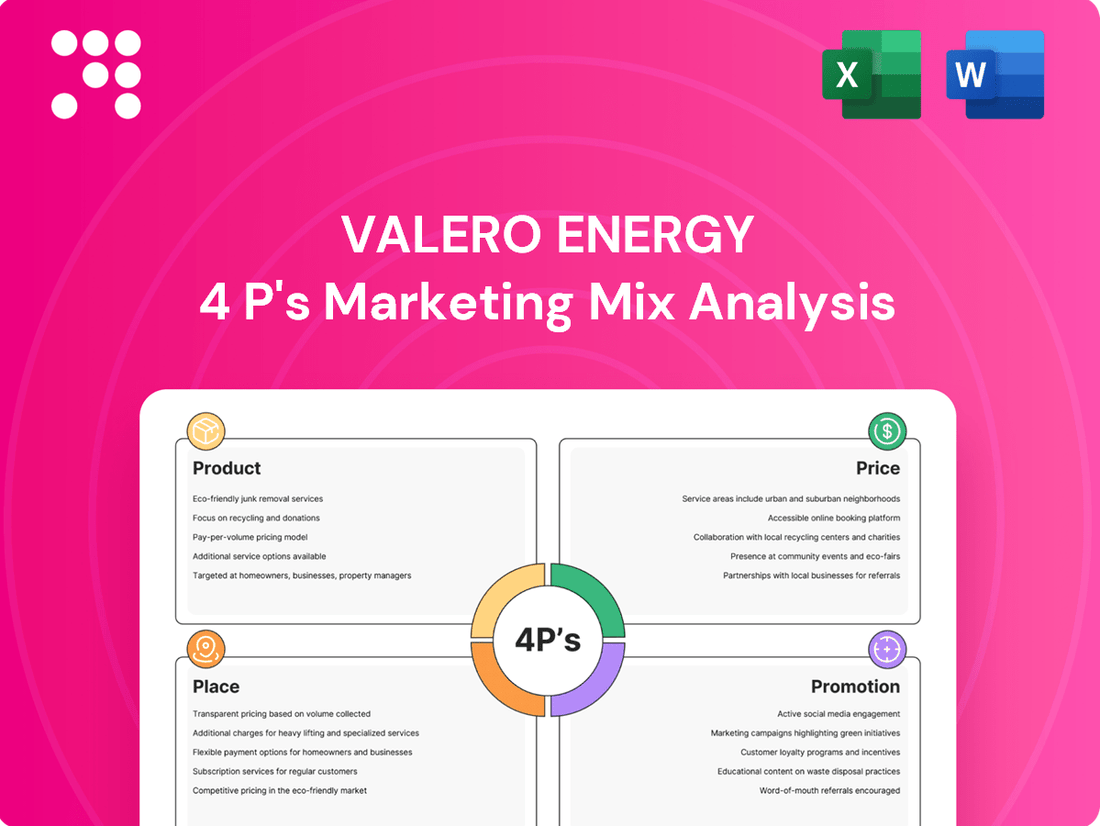

Valero Energy 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Valero Energy 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

Valero Energy prioritizes transparent communication with its investor base, a key element of its marketing mix. This commitment is demonstrated through robust investor relations programs designed to keep financially-literate stakeholders informed.

The company actively engages its audience via quarterly earnings calls, where it presents financial results and discusses strategic initiatives. In 2023, Valero reported a net income of $11.8 billion, showcasing strong operational performance that is meticulously communicated to investors.

Annual shareholder meetings and frequent investor presentations further solidify this communication strategy. These platforms allow Valero to share operational highlights and financial performance updates, ensuring a clear understanding of its business for analysts and investors alike.

Valero Energy's B2B engagement is crucial for its wholesale operations, focusing on direct outreach to commercial entities. This includes dedicated sales teams fostering relationships with fleet operators and industrial clients, ensuring consistent fuel supply and tailored solutions. In 2024, Valero continued its emphasis on these direct channels to secure large-volume contracts, a key driver of its revenue.

Valero actively communicates its dedication to sustainability and its expanding range of low-carbon fuels, including renewable diesel and sustainable aviation fuel. This commitment is frequently showcased in their ESG reports and public pronouncements, underscoring their focus on environmental responsibility and efforts to lower greenhouse gas emissions.

In 2023, Valero's renewable diesel production reached 3.5 billion gallons, a significant increase that highlights their investment in lower-carbon alternatives. This strategic communication aims to resonate with stakeholders who prioritize environmental consciousness and to showcase the company's commitment to responsible corporate citizenship.

Corporate Social Responsibility (CSR) and Community Engagement

Valero Energy actively demonstrates its commitment to Corporate Social Responsibility (CSR) and community engagement, which significantly bolsters its brand image. The company's involvement in volunteerism and charitable giving within its operating regions directly contributes to its reputation as a responsible corporate citizen.

These efforts foster positive public perception and goodwill, ultimately enhancing Valero's overall brand reputation. For instance, in 2023, Valero employees contributed over 75,000 volunteer hours, underscoring a tangible commitment to community well-being.

- Brand Image Enhancement: CSR initiatives position Valero as a company that cares about more than just profits, improving its standing with consumers and stakeholders.

- Community Investment: Valero's charitable giving, which reached $50 million in 2023 supporting various causes, directly benefits the communities where it operates.

- Employee Engagement: Encouraging volunteerism not only helps communities but also boosts employee morale and loyalty, creating a more engaged workforce.

- Reputation Building: Consistent and visible CSR activities build trust and loyalty, which are invaluable assets in the competitive energy sector.

Digital Presence and Brand Awareness

Valero Energy actively cultivates its digital presence, primarily through its corporate website, which serves as a hub for investor relations, company news, and operational updates. While engagement levels may vary across social media platforms, the company leverages these channels to communicate its brand message and engage with stakeholders.

For its retail segment, Valero utilizes digital advertising and explores loyalty programs and mobile app integration to enhance customer interaction and build brand awareness. These initiatives aim to connect directly with consumers, fostering a stronger brand identity and encouraging repeat business.

In 2024, Valero continued to invest in its digital infrastructure. For instance, the company reported ongoing enhancements to its website user experience and explored targeted digital campaigns. While specific figures for digital ad spend are not publicly detailed, the focus on customer engagement through digital means remains a priority.

Key aspects of Valero's digital presence include:

- Corporate Website: A central platform for news, financial reports, and sustainability initiatives.

- Social Media Engagement: Utilizing platforms to share company updates and brand messaging.

- Digital Advertising: Targeted campaigns to reach B2C customers and promote brand recognition.

- Customer Loyalty & Mobile Apps: Initiatives designed to drive customer retention and interaction at the retail level.

Valero's promotional strategy encompasses investor relations, B2B outreach, sustainability messaging, and digital engagement. The company actively communicates its financial performance, such as its $11.8 billion net income in 2023, to its investor base through earnings calls and shareholder meetings. Their commitment to low-carbon fuels, with 3.5 billion gallons of renewable diesel produced in 2023, is also a key part of their public messaging.

Valero also emphasizes its Corporate Social Responsibility (CSR) efforts, including over 75,000 employee volunteer hours in 2023 and $50 million in charitable giving, to enhance its brand image and community relations. Digitally, Valero maintains a comprehensive corporate website and utilizes targeted campaigns to engage both B2B and B2C audiences, focusing on customer loyalty programs and mobile app integration for its retail segment.

Price

Valero's pricing strategy is intrinsically linked to the unpredictable nature of global crude oil markets. The company actively modifies its refined product prices to mirror shifts in crude oil costs, which are its primary expense. For instance, as of early 2024, Brent crude oil prices have seen significant volatility, trading in a range that directly impacts Valero's cost of goods sold and, consequently, its consumer-facing prices.

Valero actively engages in competitive benchmarking across its petroleum and renewable energy sectors to inform its pricing strategies. This meticulous process involves continuously tracking competitor pricing for key products such as gasoline, diesel, renewable diesel, and ethanol. For instance, in early 2024, average retail gasoline prices fluctuated, with Valero likely adjusting its pricing to remain competitive with major brands like ExxonMobil and Shell, whose prices often serve as industry benchmarks.

Valero's pricing strategy is intrinsically linked to its refining margins, which reflect the difference between the cost of crude oil and the selling price of refined products. These margins are a crucial driver of the company's profitability and directly influence its ability to compete on price.

The company's commitment to operational efficiency, exemplified by initiatives such as the FCC Unit optimization at its St. Charles Refinery, directly targets cost reduction. By lowering production costs, Valero enhances its refining margins, which in turn provides greater flexibility in its pricing decisions and strengthens its market competitiveness.

For instance, during the first quarter of 2024, Valero reported adjusted refining margins of $9.74 per barrel, a slight decrease from $10.06 per barrel in the first quarter of 2023, highlighting the dynamic nature of these margins and the ongoing importance of operational improvements to maintain profitability and competitive pricing.

Market Demand and Supply Conditions

Valero's pricing strategy is closely tied to the ebb and flow of market demand and supply for its diverse fuel and product portfolio. When demand for key products like diesel or gasoline surges, and global inventories are lean, Valero often sees an opportunity to exercise greater pricing power. For instance, in early 2024, tight diesel inventories in North America, exacerbated by strong seasonal demand and some refinery maintenance, allowed refiners like Valero to achieve stronger margins.

Factors such as planned refinery closures, whether for maintenance or strategic reasons, can further tighten supply and positively impact Valero's pricing. This dynamic was evident in periods where refinery utilization rates were high, indicating robust operational output but also signaling limited spare capacity. For example, during the spring 2024 refinery turnaround season, the reduced supply of refined products in certain regions supported higher pricing for Valero's offerings.

- Strong demand periods, like summer driving seasons, typically boost Valero's pricing power.

- Low product inventories, particularly for distillates, have historically led to improved pricing for Valero.

- Planned refinery outages, while temporarily reducing output, can create favorable pricing conditions for remaining production.

- Global geopolitical events impacting crude supply or refinery operations can indirectly influence Valero's product pricing.

Financial Discipline and Shareholder Returns

Valero Energy's financial discipline is a cornerstone of its strategy, directly impacting how it approaches pricing. The company prioritizes disciplined capital management, ensuring that its operations generate robust cash flow. This focus on efficiency allows Valero to consistently return value to its shareholders through dividends and share repurchases.

For instance, in the first quarter of 2024, Valero announced a quarterly dividend of $1.00 per share and continued its share repurchase program. This commitment to shareholder returns is enabled by strong operational performance and strategic pricing that supports healthy cash flow generation. Efficient pricing, therefore, isn't just about market competitiveness; it's intrinsically linked to Valero's ability to meet its financial obligations and reward investors.

- Disciplined Capital Allocation: Valero maintains a strong focus on managing its investments and operational expenditures efficiently.

- Shareholder Value: The company actively returns capital to shareholders via dividends and share buybacks, demonstrating financial health.

- Cash Flow Generation: Effective pricing strategies contribute to the robust cash flow necessary to fund these shareholder returns and ongoing operations.

- Financial Strength: Valero's commitment to financial discipline underpins its ability to navigate market fluctuations and maintain investor confidence.

Valero's pricing is a direct reflection of its cost structure, heavily influenced by fluctuating crude oil prices. The company's strategy involves adjusting refined product prices to align with these upstream costs, ensuring that refining margins remain viable. For example, in Q1 2024, Valero reported adjusted refining margins of $9.74 per barrel, demonstrating the direct link between crude costs and product pricing.

Competitive pricing is paramount, with Valero constantly monitoring rivals like ExxonMobil and Shell. This benchmarking ensures its gasoline, diesel, and renewable fuel prices remain attractive. The company's operational efficiency, such as FCC Unit optimization, further bolsters its ability to compete by reducing production costs and allowing for more flexible pricing.

Market dynamics, including demand and supply levels for products like diesel, significantly impact Valero's pricing power. Tight inventories, as seen in early 2024 with North American diesel supply, enable Valero to achieve stronger margins. Similarly, planned refinery outages, which reduce overall supply, can create favorable pricing conditions for Valero’s output.

Valero's financial discipline underpins its pricing strategy by ensuring robust cash flow, which supports shareholder returns like its Q1 2024 dividend of $1.00 per share. Effective pricing, therefore, is crucial for maintaining financial strength and investor confidence amidst market volatility.

| Metric | Q1 2024 | Q1 2023 | Change |

|---|---|---|---|

| Adjusted Refining Margin (per barrel) | $9.74 | $10.06 | -3.2% |

| Brent Crude Oil Price (average, per barrel) | ~$83.50 (estimated) | ~$77.00 (estimated) | +8.4% |

| Gasoline Price (average US retail, per gallon) | ~$3.50 (estimated) | ~$3.55 (estimated) | -1.4% |

4P's Marketing Mix Analysis Data Sources

Our Valero Energy 4P's Marketing Mix Analysis is grounded in a comprehensive review of public financial disclosures, including SEC filings and annual reports. We also leverage investor presentations, press releases, and industry-specific market research to capture their product, pricing, distribution, and promotional strategies.