Valero Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Valero Energy Bundle

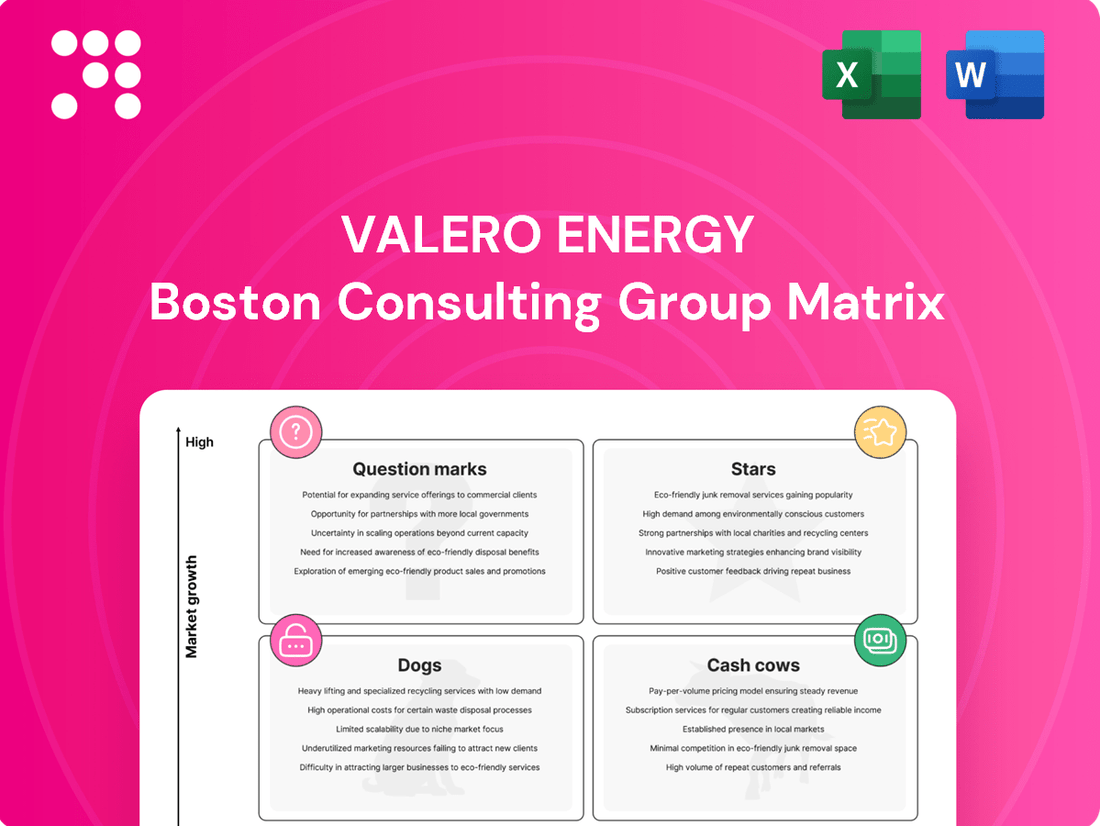

Valero Energy's BCG Matrix offers a crucial snapshot of its diverse business segments, highlighting potential Stars, stable Cash Cows, underperforming Dogs, and promising Question Marks. Understanding these dynamics is key to unlocking strategic growth and optimizing resource allocation.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Valero Energy.

Stars

Valero's Diamond Green Diesel (DGD) joint venture is a prime example of a 'Star' in the BCG matrix, fueled by the booming renewable diesel sector. This market is expected to see robust expansion, with projections indicating a compound annual growth rate of 8.1% between 2025 and 2034. This growth is underpinned by strong environmental drivers and the ease with which renewable diesel integrates into existing fuel systems.

With a substantial production capacity of around 1.2 billion gallons annually concentrated in the U.S. Gulf Coast, DGD holds a commanding position. This significant market share within a high-growth industry means DGD is a cash consumer for ongoing expansion, but its future profitability looks exceptionally bright.

Valero's venture into Sustainable Aviation Fuel (SAF) production at its Port Arthur DGD plant firmly places it in the 'Star' category of the BCG Matrix. This strategic move capitalizes on the burgeoning demand for environmentally friendly aviation solutions, a sector poised for substantial expansion.

The Port Arthur facility, commencing SAF operations in Q4 2024 and achieving full functionality by January 2025, demonstrates Valero's commitment to this high-growth area. The plant possesses the flexibility to repurpose up to half of its 470 million gallons per year renewable diesel capacity for SAF production, highlighting its adaptability to market shifts.

While initial airline interest in SAF has been somewhat tempered, the long-term forecast remains exceptionally robust. Projections indicate an annual SAF demand growth rate of 15% through 2030, further bolstered by upcoming European SAF mandates. This early-mover advantage and operational agility are key to Valero capturing a significant share of this nascent, high-potential market.

Valero's significant capital investments, particularly those aimed at expanding renewable fuels and optimizing refinery performance, represent strategic growth initiatives. The company anticipated $2 billion in capital investments for 2025, with $611 million invested in Q1 2025, demonstrating a strong push towards these key areas. These investments are crucial for maintaining and expanding market share in growing segments like renewable diesel and sustainable aviation fuel (SAF), which are vital for future cash generation.

U.S. Gulf Coast Refining Operations

Valero's U.S. Gulf Coast refining operations are a standout performer, even as the broader refining industry navigates headwinds. This segment achieved record throughput rates, demonstrating remarkable efficiency and adaptability to fluctuating regional demand for transportation fuels.

Despite a challenging margin environment in the first quarter of 2025, Valero's operational prowess in this critical area allowed it to optimize profitability and solidify its competitive edge. The strategic positioning and substantial capacity of these refineries enable them to effectively meet demand for a wide array of fuel products.

- Record Throughput: Valero's U.S. Gulf Coast refineries consistently achieved record throughput levels throughout 2024, underscoring their operational excellence.

- Q1 2025 Performance: Even with compressed margins in early 2025, the segment's efficiency translated into strong profitability.

- Strategic Advantage: The location and scale of these facilities are key to capturing demand for gasoline, diesel, and jet fuel.

- Adaptability: The segment has shown a strong ability to adjust operations to meet evolving regional fuel needs.

Advanced Biofuel Technologies and Diversification

Valero's commitment to advanced biofuel technologies, including its exploration of ethanol-to-jet fuel processes, positions these ventures as potential Stars within its business portfolio. These initiatives are poised for significant growth, tapping into the expanding market for sustainable aviation fuels and contributing to Valero's diversification strategy.

These investments directly address the increasing demand for lower-carbon intensity fuels, aligning with global decarbonization targets and opening new avenues for revenue generation. For instance, by 2024, the demand for sustainable aviation fuel (SAF) is projected to reach 6 billion liters globally, a substantial increase from previous years.

- Ethanol-to-Jet Fuel Potential: Valero is actively investigating pathways to convert ethanol into sustainable aviation fuel, a high-growth sector.

- Carbon Intensity Reduction: These technologies offer a direct route to significantly lower the carbon footprint of fuels.

- Market Diversification: Expansion into advanced biofuels, particularly SAF, diversifies Valero's product offerings beyond traditional refining.

- Alignment with Global Goals: The focus on sustainable fuels supports international efforts to reduce greenhouse gas emissions in the transportation sector.

Valero's Diamond Green Diesel (DGD) and its foray into Sustainable Aviation Fuel (SAF) are clear 'Stars' in the BCG matrix. The renewable diesel market is projected for strong growth, with an estimated 8.1% CAGR from 2025 to 2034, driven by environmental policies and the ease of integration into existing infrastructure. Valero's substantial capacity, particularly on the U.S. Gulf Coast, positions DGD to capture a significant share of this expanding market, even as it requires ongoing investment for growth.

| Business Unit | BCG Category | Key Growth Drivers | Valero's Position | Financial Outlook |

|---|---|---|---|---|

| Diamond Green Diesel (DGD) | Star | Robust renewable diesel market growth (8.1% CAGR 2025-2034), environmental mandates, ease of integration. | Significant market share, substantial annual capacity (approx. 1.2 billion gallons). | High growth potential, requires ongoing investment for expansion. |

| Sustainable Aviation Fuel (SAF) | Star | Burgeoning demand for eco-friendly aviation, projected 15% annual growth through 2030, upcoming European mandates. | Early mover advantage, flexible production capacity (up to 470 million gallons/year renewable diesel convertible to SAF). | Nascent but high-potential market, strategic investments (Port Arthur plant commencing Q4 2024). |

What is included in the product

Valero's BCG Matrix highlights which business units to invest in, hold, or divest based on their market share and growth.

Valero's BCG Matrix provides a clear, one-page overview of its business units, simplifying strategic decision-making.

This optimized layout allows for easy sharing and printing, streamlining communication of Valero's portfolio strategy.

Cash Cows

Valero's core petroleum refining operations, producing gasoline, diesel, and jet fuel, act as Cash Cows. Despite a challenging market in early 2025 with lower margins, this segment historically generates substantial cash flow due to its high market share and established infrastructure.

The refining segment's operating income, while fluctuating, consistently contributes significantly to the company's overall financial performance and supports other ventures. For instance, in 2024, Valero's refining segment reported operating income that formed a substantial portion of its total earnings, underscoring its role as a reliable cash generator.

Valero's 15 refineries have a combined throughput capacity of approximately 3.2 million barrels per day, demonstrating a mature, high-share market position. This scale allows for efficient operations and robust cash generation, even in periods of margin pressure.

Valero's extensive wholesale and branded retail distribution network, encompassing pipelines, terminals, and branded outlets, operates as a classic Cash Cow in the BCG matrix. This robust infrastructure ensures efficient and reliable delivery of transportation fuels, a critical component of Valero's operations.

This mature segment generates consistent, predictable revenue streams for Valero. The transportation fuels market, while essential, typically experiences low growth, meaning Valero can leverage its established network with minimal incremental investment in marketing or expansion. This allows for strong profit margins and a steady, reliable cash flow, which can then be reinvested in other areas of the business.

In 2024, Valero's refining segment, which is intrinsically linked to its distribution network, reported significant earnings. For instance, their refining segment adjusted earnings before interest and taxes (EBIT) showed robust performance, underscoring the profitability of their fuel distribution. This stability is a hallmark of a Cash Cow, providing a solid financial foundation.

Asphalt production, a byproduct of Valero Energy's refining operations, functions as a classic Cash Cow within the BCG Matrix. This segment benefits from a mature, low-growth market characterized by steady demand, primarily driven by ongoing infrastructure development and maintenance projects. Valero's asphalt business generated approximately $1.2 billion in revenue in 2023, highlighting its consistent contribution to the company's overall financial health.

The stable nature of the asphalt market means that while growth opportunities are limited, the demand is reliable, ensuring a predictable revenue stream. Because asphalt is intrinsically linked to the refining process, Valero leverages existing infrastructure and operational efficiencies, minimizing the need for substantial new capital expenditures to maintain its market position. This allows the business to generate significant free cash flow.

Existing Infrastructure and Operational Efficiency

Valero's extensive network of refineries and sophisticated logistics assets are indeed cash cows. This robust infrastructure provides a significant competitive edge, enabling high profit margins through superior operational efficiency. For instance, Valero invested approximately $750 million in 2024 specifically to boost refinery performance, underscoring their commitment to maximizing cash flow from these established operations.

This dedication to operational discipline is crucial for maintaining profitability, even when energy markets experience fluctuations. Their focus on efficiency helps ensure these mature assets continue to be reliable sources of substantial cash generation.

- Existing Infrastructure: Valero's refineries and logistical assets form a strong competitive advantage.

- Operational Excellence: This infrastructure generates high profit margins through efficient operations.

- Investment in Efficiency: Approximately $750 million was invested in 2024 to enhance refinery performance.

- Profitability Maintenance: Operational discipline ensures profitability even in volatile market conditions.

Shareholder Returns through Dividends and Buybacks

Valero Energy's consistent return of capital to shareholders through dividends and share repurchases highlights its status as a Cash Cow. This practice reflects the company's robust and dependable cash flow generation.

In 2024, Valero demonstrated its commitment to shareholder returns by distributing $4.3 billion. This figure was comprised of $1.4 billion paid out as dividends and $2.9 billion utilized for stock buybacks.

Further solidifying its Cash Cow profile, Valero announced an increase in its quarterly cash dividend in January 2025. This move underscores the company's financial stability and dedication to enhancing shareholder value, a hallmark of mature, cash-rich businesses.

- 2024 Shareholder Returns: $4.3 billion total

- Dividends Paid (2024): $1.4 billion

- Stock Buybacks (2024): $2.9 billion

- Dividend Increase: Announced January 2025

Valero's refining operations, a cornerstone of its business, consistently generate substantial cash flow. Despite market fluctuations, this segment, with its significant market share and established infrastructure, acts as a prime example of a Cash Cow.

The company's 15 refineries, boasting a daily throughput capacity of approximately 3.2 million barrels, underscore Valero's mature, high-share market position. This scale enables efficient operations, leading to robust cash generation even when margins are tight.

In 2024, Valero's refining segment's adjusted earnings before interest and taxes (EBIT) demonstrated strong performance, reinforcing its role as a reliable cash generator and providing a solid financial foundation for the company.

| Segment | 2024 Performance Indicator | Significance |

| Refining Operations | High Throughput Capacity (3.2M bpd) | Mature, high-share market position, enabling efficiency and cash generation. |

| Refining Operations | Strong Adjusted EBIT | Indicates profitability and reliability as a cash generator. |

| Shareholder Returns | $4.3 Billion Distributed (2024) | Demonstrates robust and dependable cash flow generation. |

What You See Is What You Get

Valero Energy BCG Matrix

The Valero Energy BCG Matrix preview you're examining is the identical, fully comprehensive document you'll receive upon purchase. This means no watermarks, no altered content, just the complete, professionally formatted strategic analysis ready for your immediate use in decision-making and planning.

Dogs

Within Valero's diverse portfolio, certain less efficient ethanol plants might be categorized as Dogs. While the overall ethanol segment remains profitable, these specific facilities face headwinds from regulatory shifts, the growing EV market, and fluctuating corn prices, impacting their profitability.

For instance, Valero reported a notable decrease in ethanol operating income in Q2 2025 compared to the prior year. This financial performance suggests that some ethanol assets may not be generating sufficient returns, potentially tying up valuable capital in a challenging market environment.

Divested or Underperforming Refinery Assets in Valero's portfolio would likely fall into the 'Dogs' category of the BCG Matrix. These are assets that have a low market share in a slow-growing or declining segment of the refining industry. For instance, a refinery with high operating costs or located in a region experiencing reduced demand for refined products would fit this description.

The refining sector, as of 2024, continues to grapple with volatile crude oil prices and evolving energy demand patterns. Assets that cannot compete effectively on cost or efficiency, especially those facing regulatory pressures or a lack of investment for modernization, are prime candidates for divestment. Valero, like other major refiners, periodically reviews its asset base to optimize performance and capital allocation.

Segments of Valero's refining operations that utilize older, less efficient technologies and are not slated for modernization could be viewed as Dogs. These technologies would likely result in higher operating costs and lower margins compared to more advanced facilities.

In 2024, Valero, like many refiners, operates a diverse portfolio. Those older units, while still functional, may struggle to meet evolving environmental standards or process heavier, less desirable crude slates efficiently. This inefficiency directly impacts their profitability, making them candidates for the Dog category within a BCG analysis.

Small, Non-Strategic Marketing Outlets

Small, non-strategic marketing outlets could be classified as Dogs in Valero Energy's BCG Matrix. These might include individual gas stations or smaller wholesale operations with minimal sales and a negligible market share in areas experiencing slow economic growth. For instance, a single Valero branded station in a rural town with declining population might fit this description.

These outlets often represent a net drain on resources. Their low sales volumes mean they generate little cash flow, while ongoing expenses like staffing, inventory, and maintenance continue. In 2024, Valero operated thousands of retail locations, and a small percentage of these, particularly those in less populated or economically challenged regions, could fall into the Dog category.

- Low Market Share: These outlets typically hold a very small percentage of the local market for fuel and convenience store products.

- Stagnant or Declining Regions: They are often situated in areas with limited population growth or economic activity, hindering sales potential.

- Resource Drain: Operational costs can outweigh the revenue generated, making them unprofitable or barely breaking even.

- Lack of Strategic Importance: They do not contribute significantly to Valero's overall brand presence or market strategy in key growth areas.

Segments with High Geopolitical Risk Exposure and Low Profitability

Segments with high geopolitical risk exposure and low profitability are often found in areas facing significant political instability or stringent regulatory environments. These operations, despite having low growth prospects, can drain company resources without generating substantial returns or market share. For Valero Energy, this could translate to refining assets in regions where political unrest disrupts supply chains or where environmental regulations are particularly burdensome and costly to comply with, leading to consistently lower profit margins.

Consider Valero's potential exposure in certain Latin American markets. For instance, in 2024, several countries in the region continued to grapple with political uncertainty and fluctuating economic policies. While specific refinery profitability data for individual geopolitical risk segments is proprietary, Valero's overall refining segment generated $7.1 billion in operating income in 2023. However, segments facing severe geopolitical headwinds might contribute disproportionately less to this figure while demanding significant capital for security and compliance.

- Geopolitical Vulnerability: Operations in regions with a history of political instability, such as certain parts of South America or Africa, can lead to supply disruptions and increased operational costs.

- Regulatory Headwinds: Stricter environmental mandates or unpredictable changes in energy policy in specific jurisdictions can significantly erode profitability.

- Low Profitability and Market Share: These segments consistently underperform, consuming valuable resources with minimal return on investment and a limited competitive position.

- Resource Drain: Such operations represent a drag on the company's financial performance, diverting capital and management attention from more promising ventures.

Valero's "Dogs" likely include older, less efficient ethanol plants struggling with market shifts and potentially some underperforming refinery assets. These segments exhibit low market share in slower-growing or declining sectors, such as older refining technologies or specific retail locations in economically stagnant areas. Valero's Q2 2025 earnings showed a decrease in ethanol operating income, highlighting potential underperformance in some ethanol assets.

These "Dog" assets, whether ethanol plants, older refineries, or small marketing outlets, generally have high operating costs and low returns. They may also face challenges from evolving regulations or market demand, such as the increasing prevalence of electric vehicles impacting ethanol demand or stricter environmental standards for older refineries. Valero's overall refining segment generated $7.1 billion in operating income in 2023, but specific underperforming assets would contribute negatively.

| Category | Description | Key Challenges | Valero Example |

| Ethanol Plants | Older, less efficient facilities | Regulatory shifts, EV market growth, fluctuating corn prices | Facilities with declining profitability in Q2 2025 |

| Refinery Assets | Older technology, high operating costs | Volatile crude prices, evolving energy demand, environmental regulations | Units not slated for modernization |

| Marketing Outlets | Small, non-strategic locations | Low sales volumes, stagnant regions, net resource drain | Individual stations in rural, declining areas |

Question Marks

Further expansion of Valero's renewable diesel capacity beyond its current operations, including the Diamond Green Diesel (DGD) joint venture, would represent a potential question mark in the BCG matrix. While the renewable diesel market shows promise for growth, undertaking significant new capital investments would be a substantial undertaking, and any new capacities would likely start with a smaller market share compared to established players.

The renewable diesel segment experienced an operating loss in the first half of 2025, a result of challenging margin environments and elevated feedstock costs. This financial performance highlights the inherent risks associated with further investments in this area, even with its growth potential. Careful strategic planning and market analysis will be crucial to ensure that any new capacity can achieve a competitive market share and become profitable.

Valero's deeper involvement in Sustainable Aviation Fuel (SAF) beyond its initial Port Arthur project positions it as a Question Mark. While the SAF market exhibits high growth potential, current airline demand has lagged initial expectations, leading to uncertainty regarding early returns on investment.

Valero has initiated engineering for a second SAF project, signaling a strategic bet on future market expansion. This move underscores the challenge of high growth prospects in a nascent market where Valero’s current market share is low, necessitating substantial investment to achieve maturity and scale.

Valero's investments in carbon capture and storage (CCS) initiatives are currently in their nascent stages, reflecting a strategic positioning within the BCG matrix as a potential future star. These projects are critical for decarbonization efforts and have high growth potential in the long term, but their current market share and immediate profitability are low.

These initiatives require significant capital investment, with global CCS project costs ranging from hundreds of millions to billions of dollars, and regulatory clarity to achieve widespread adoption and become financially viable. For instance, the U.S. Department of Energy has allocated substantial funding, with over $2 billion in grants announced for CCS demonstration projects in 2023 alone, underscoring the government's commitment to fostering this sector.

Success in CCS could transform Valero's environmental footprint and open new revenue streams, but the path to market dominance is uncertain given technological hurdles and evolving policy landscapes. The global CCS market is projected to grow significantly, with estimates suggesting it could reach hundreds of billions of dollars annually by 2050, driven by net-zero targets.

Potential Ethanol-to-Jet Fuel Conversion Projects

Valero's exploration into ethanol-to-jet fuel conversion projects fits the 'Question Mark' category in the BCG Matrix. This innovative pathway aims to capitalize on Valero's established ethanol production capabilities and the burgeoning sustainable aviation fuel (SAF) market. However, the technology is still in its nascent stages, demanding significant capital investment for research, development, and scaling.

The success of these projects hinges on overcoming technical hurdles and securing market acceptance for the resulting SAF. While the potential for high growth in the SAF sector is undeniable, the current market share for ethanol-derived jet fuel is minimal. Valero would need to pour substantial resources into these ventures to build market presence and achieve profitability.

- Market Potential: The global SAF market is projected to reach over $15 billion by 2030, offering a significant growth opportunity.

- Technology Risk: Ethanol-to-jet fuel conversion processes are still maturing, with ongoing efforts to optimize efficiency and reduce costs.

- Investment Needs: Significant upfront capital is required for pilot plants, commercial-scale facilities, and securing offtake agreements.

- Competitive Landscape: While emerging, this technology faces competition from other SAF production pathways, such as those utilizing used cooking oil or agricultural waste.

New Geographic Market Entries for Renewable Fuels

New geographic market entries for Valero's renewable fuels, particularly in regions with developing renewable energy policies, would be considered Question Marks in the BCG Matrix. These emerging markets present significant growth potential as global demand for sustainable energy solutions continues to rise. For example, Valero has been expanding its ethanol production capacity, with a notable focus on international markets. In 2023, Valero's renewable diesel production reached approximately 3.3 billion gallons, demonstrating its commitment to this sector.

These new geographic markets, while offering high growth potential, would see Valero starting with a low market share. This necessitates substantial investment in building new infrastructure, such as terminals and blending facilities, and implementing robust market penetration strategies to gain traction. The company must navigate local regulations and build relationships with new partners and customers.

- Emerging Markets: Valero's expansion into regions with evolving renewable energy mandates, such as parts of Europe or Asia, would represent Question Mark entries.

- Investment Needs: Significant capital expenditure would be required for infrastructure development and establishing a market presence, potentially impacting short-term cash flow.

- Growth Potential: These markets, if successful, could transform into future Stars for Valero's renewable fuels segment due to increasing demand for low-carbon alternatives.

Valero's ventures into new renewable fuel technologies, such as advanced biofuels beyond current renewable diesel and SAF capabilities, would be classified as Question Marks. These represent high-growth potential areas but are characterized by nascent technologies and uncertain market adoption, requiring significant investment to establish a competitive position.

The company's exploration of hydrogen production, particularly green hydrogen, also falls into the Question Mark category. While hydrogen is seen as a key component of future energy systems, the current market share for green hydrogen is minimal, and the infrastructure and cost-effectiveness are still developing. Valero's investment in this area is a strategic bet on future demand, but it carries inherent risks and requires substantial capital for scaling.

Valero's strategic investments in battery storage technology and grid modernization initiatives, while aligning with the broader energy transition, are currently Question Marks. These areas offer significant long-term growth potential, but Valero's market share is negligible, and the technological and regulatory landscapes are still evolving. Substantial capital outlay is necessary to build expertise and market presence.

| Area of Investment | BCG Category | Rationale | Key Considerations |

|---|---|---|---|

| Advanced Biofuels (beyond current) | Question Mark | High growth potential, nascent technology, uncertain market adoption. | Significant R&D and capital investment needed; regulatory support crucial. |

| Green Hydrogen Production | Question Mark | Key to future energy, minimal current market share, developing infrastructure. | High capital expenditure for scaling; cost-competitiveness is a challenge. |

| Battery Storage & Grid Modernization | Question Mark | Long-term growth potential, negligible current market share, evolving landscape. | Requires substantial capital for expertise and market entry; regulatory clarity needed. |

BCG Matrix Data Sources

Our Valero Energy BCG Matrix leverages comprehensive data, including internal financial reports, industry growth forecasts, and competitor market share analysis to accurately position each business unit.