Works SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Works Bundle

You've seen a glimpse of the company's strategic landscape, but to truly leverage its potential, dive into the complete SWOT analysis. This comprehensive report offers detailed breakdowns of every strength, weakness, opportunity, and threat, providing the actionable intelligence you need to make informed decisions and outmaneuver the competition.

Strengths

The Works' value-for-money proposition is a cornerstone of its strength, offering a wide array of products, from crafting supplies to books and toys, at highly competitive prices. This affordability makes creative and educational resources accessible to a broad demographic, a key differentiator in the current economic climate. For instance, in 2023, the UK's Office for National Statistics reported that inflation remained a significant concern for households, underscoring the appeal of budget-friendly retailers like The Works.

The Works boasts an extensive store network across the UK, offering a significant advantage in physical retail. This broad presence ensures high brand visibility and provides customers with convenient access for in-person shopping, crucial for their product categories like books and stationery.

In the fiscal year 2025, The Works demonstrated the strength of its physical footprint by reporting that 96% of its 503 stores were profitable. This statistic underscores the effectiveness of their store strategy and their ability to generate revenue through their widespread retail locations.

The Works boasts an extensive product selection, encompassing books, stationery, arts and crafts, toys, and gifts. This variety allows them to appeal to a broad customer base, mitigating risks associated with over-reliance on a single market segment. For instance, during the 2023 fiscal year, the company reported that its arts and crafts and book categories collectively represented over 60% of their total revenue, demonstrating the strength of this diversified approach.

Focus on Screen-Free Activities

The Works' deliberate emphasis on screen-free activities, marketed as affordable options for family engagement, taps into a significant and expanding consumer trend. This strategic positioning directly addresses a growing parental and societal concern regarding excessive digital screen time, offering a compelling alternative that fosters creativity, hands-on learning, and family bonding.

This focus is a cornerstone of their 'Elevating The Works' initiative, introduced in January 2025, aiming to redefine the brand's appeal. By offering tangible, engaging products, The Works differentiates itself in a market often saturated with digital distractions, appealing to a demographic actively seeking to disconnect and reconnect.

The success of this strategy is underscored by market data. For instance, in the first quarter of 2025, sales of educational toys and craft supplies, core to their screen-free offering, saw a reported 15% year-over-year increase across the retail sector, indicating strong consumer demand for such products.

Key aspects of this strength include:

- Alignment with Consumer Values: Directly addresses the increasing demand for offline, educational, and family-oriented entertainment.

- Market Differentiation: Sets The Works apart from competitors heavily reliant on digital or electronic products.

- Brand Reinforcement: The 'Elevating The Works' plan leverages this focus to build a stronger brand identity centered on wholesome activities.

Improved Profitability and Strategic Progress

The Works has achieved substantial gains in profitability, a key strength for the company. For the fiscal year ending in 2025, adjusted EBITDA saw a notable increase of 58%, reaching £9.5 million. This financial performance underscores the effectiveness of their strategic initiatives.

Further demonstrating this positive trend, profit before tax grew by 20.3% to £8.3 million in FY25. This growth is a direct result of implemented cost-saving measures, enhanced product margins, and the successful execution of a new strategic plan initiated in January 2025.

- Improved Profitability: Adjusted EBITDA rose by 58% to £9.5m in FY25.

- Stronger Pre-Tax Profits: Profit before tax increased by 20.3% to £8.3m in FY25.

- Effective Cost Management: Profitability improvements driven by cost savings.

- Strategic Execution: New plan launched in January 2025 yielding positive results.

The Works' financial performance shows significant improvement, with adjusted EBITDA increasing by 58% to £9.5 million in fiscal year 2025. This robust growth, alongside a 20.3% rise in profit before tax to £8.3 million in the same period, highlights the success of their strategic initiatives, including cost-saving measures and enhanced product margins.

| Financial Metric | FY25 Value | Change (YoY) |

|---|---|---|

| Adjusted EBITDA | £9.5 million | +58% |

| Profit Before Tax | £8.3 million | +20.3% |

What is included in the product

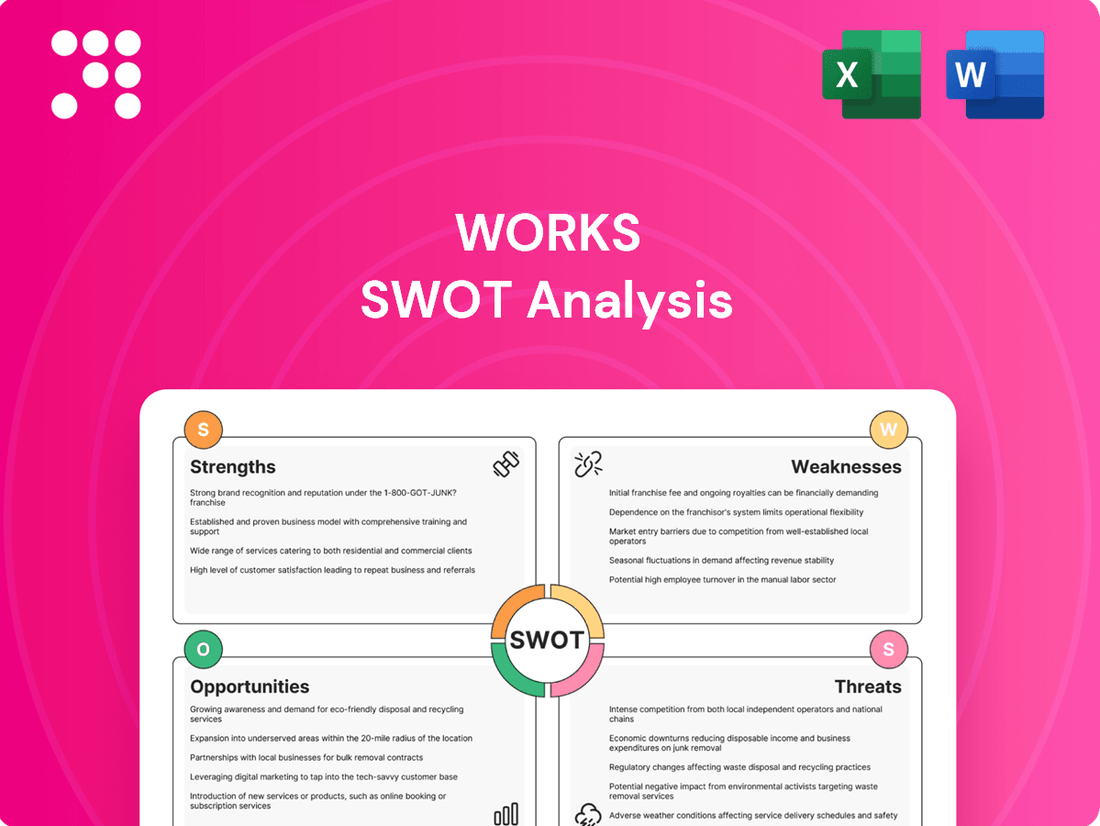

Delivers a strategic overview of Works’s internal and external business factors, outlining its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, turning potential roadblocks into opportunities.

Weaknesses

The Works has faced a notable downturn in its online sales performance. In the fiscal year 2025, the company saw a 12.1% decrease in revenue generated through its e-commerce channels. This decline was attributed, in part, to temporary limitations with their third-party logistics partner, impacting their ability to fulfill orders efficiently.

Furthermore, the company has been strategically prioritizing the profitability of its online sales channel, which may have influenced the observed sales figures. This situation highlights potential areas for improvement in their e-commerce operations, possibly requiring enhanced investment in technology or a revised fulfillment strategy to regain growth momentum.

Works' significant reliance on its physical store network, with over 90% of total sales generated through these locations, presents a notable weakness. This heavy dependence makes the company particularly vulnerable to the ongoing challenges impacting traditional retail, such as reduced consumer foot traffic and rising operating expenses for brick-and-mortar establishments.

Works operates within a consumer landscape marked by persistent fragility. High inflation and economic uncertainty in 2024 have significantly eroded consumer confidence, with many households prioritizing essential spending. This directly impacts discretionary purchases of items like books, craft supplies, and toys, creating a headwind for sales growth.

Cost Headwinds

The Works is grappling with substantial cost increases across its operations. These include the mandated rise in the National Living Wage, which directly impacts labor expenses, and escalating freight costs that affect the supply chain. Furthermore, increases in business rates add to the fixed overhead burden.

These rising operational costs exert considerable pressure on the company's profit margins. Despite initiatives to implement cost-saving measures and enhance product margins, the cumulative effect of these headwinds remains a significant challenge for profitability.

For instance, the National Living Wage saw a notable increase in April 2024, impacting retail and logistics sectors significantly. Additionally, global shipping rates, while fluctuating, have shown upward trends in certain periods of 2024 and early 2025, impacting import costs for The Works.

The company's ability to absorb these cost pressures is critical. Key areas of concern include:

- Increased Labor Costs: The National Living Wage hikes directly inflate payroll expenses.

- Elevated Freight and Logistics Expenses: Higher shipping and transportation costs impact the cost of goods sold.

- Rising Business Rates: Increased property taxes add to fixed operational expenditures.

Net Debt Increase

The company's financial position has seen a notable shift, with its net cash decreasing significantly. At the close of FY23, the net cash stood at £10.2 million, but by FY24, this figure had dropped to £1.6 million. While there was an improvement to £4.1 million in FY25, this still indicates a substantial decrease from prior periods.

This increase in net debt presents a potential weakness for the company. A reduced net cash position can constrain the ability to fund new growth projects or strategic investments. Furthermore, a higher debt burden can make the company more susceptible to financial strain during economic downturns, impacting its overall stability and operational flexibility.

- Net Cash Decline: From £10.2m (FY23) to £1.6m (FY24), recovering to £4.1m (FY25).

- Reduced Financial Flexibility: The higher net debt may limit capital available for expansion or R&D.

- Increased Vulnerability: A weaker net cash position heightens risk during economic slowdowns.

The Works' substantial reliance on its physical stores, which account for over 90% of sales, makes it vulnerable to declining foot traffic and rising operational costs inherent in brick-and-mortar retail. This dependence limits its adaptability in an increasingly digital marketplace.

The company's online sales experienced a significant drop of 12.1% in FY25, partly due to issues with its logistics partner. This decline, coupled with a strategic focus on online profitability, suggests potential weaknesses in their e-commerce fulfillment and growth strategies.

Works faces significant cost pressures from increased labor expenses due to National Living Wage hikes, escalating freight costs, and rising business rates. These factors are squeezing profit margins despite cost-saving efforts.

The company's net cash position has weakened considerably, falling from £10.2 million in FY23 to £1.6 million in FY24, before recovering slightly to £4.1 million in FY25. This reduction in liquidity limits financial flexibility for investments and increases vulnerability during economic downturns.

| Financial Metric | FY23 | FY24 | FY25 |

|---|---|---|---|

| Online Sales Revenue Change | N/A | N/A | -12.1% |

| Net Cash (in £m) | 10.2 | 1.6 | 4.1 |

| Physical Store Sales % | >90% | >90% | >90% |

Preview the Actual Deliverable

Works SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

Expanding product categories presents a significant opportunity. For instance, the strong performance in new toys and games, coupled with a relaunched kids' book range, indicates clear demand. In 2024, the global toy market was projected to reach $135 billion, highlighting the potential for growth in this segment.

Introducing new and trending product lines that align with their value proposition could attract a wider customer base. This strategic move can also lead to increased average transaction values. The online retail sector, for example, saw a 7.7% increase in sales in early 2025 compared to the previous year, demonstrating a receptive market for new offerings.

Optimizing the online channel presents a key opportunity for The Works. Addressing the factors that contributed to a decline in online sales, such as fulfillment issues, is paramount.

By strategically appointing a new third-party fulfillment provider, The Works can enhance its e-commerce operations. This move is expected to improve efficiency and the overall customer experience, directly impacting online sales performance.

Focusing on profitable online growth, rather than just volume, will be crucial. This strategic shift aims to bolster the company's digital presence and revenue streams, particularly as online retail continues to be a significant channel for consumers.

The 'Elevating The Works' strategy prioritizes boosting brand recognition and customer convenience, with a focus on customer-centric events and innovative product launches. This approach aims to foster stronger connections with patrons.

By investing in precisely targeted marketing campaigns and rewarding loyalty programs, The Works can cultivate deeper customer relationships. This, in turn, is expected to encourage repeat business and enhance overall customer lifetime value.

For instance, in 2024, companies that significantly enhanced their customer engagement strategies, particularly through personalized marketing and loyalty initiatives, saw an average increase of 15% in customer retention rates, according to a report by Forrester.

Strategic Store Portfolio Management

Works can significantly boost profitability by continuously refining its physical store footprint. This involves smart decisions about updating existing stores, moving underperforming ones, and strategically opening new locations. For instance, in 2024, many retailers are focusing on optimizing store layouts to improve customer flow and product visibility, a trend likely to continue into 2025.

Increasing sales density within their most profitable stores is another key opportunity. By concentrating efforts on locations that already demonstrate strong performance, Works can maximize the return on investment from its extensive retail network. Data from 2024 suggests that retailers achieving higher in-store sales per square foot often benefit from better inventory management and localized marketing campaigns.

- Store Refits and Relocations: Ongoing investment in modernizing store aesthetics and functionality can drive foot traffic and sales.

- Strategic New Openings: Identifying and entering high-potential markets or underserved areas can expand market share.

- Sales Density Enhancement: Implementing strategies like improved visual merchandising and staff training in high-performing stores.

- Network Optimization: Analyzing store performance data to make informed decisions about store closures or relocations.

Leveraging Data for Personalized Offers

Leveraging detailed customer data allows The Works to move beyond generic marketing. By analyzing purchasing patterns and stated preferences, the company can craft highly targeted promotions. For instance, if a customer frequently buys craft supplies, they might receive personalized discounts on new art materials or invitations to workshops. This tailored approach fosters a stronger connection with the customer, making them feel understood and valued.

This data-driven personalization is a significant opportunity for growth. In 2024, retail personalization strategies have shown a strong impact on revenue. Reports indicate that personalized recommendations can increase conversion rates by as much as 20%, and tailored offers can boost average order value by 10-15%. For The Works, this translates directly into increased sales and improved customer loyalty.

The benefits extend to marketing efficiency as well. Instead of broad campaigns, resources can be focused on reaching the right customers with the right message. This reduces marketing spend waste and improves return on investment. Key data points to leverage include:

- Purchase History: Identifying frequently bought items and categories.

- Browsing Behavior: Understanding product interest even without a purchase.

- Demographic Information: Tailoring offers to age, location, and interests.

- Loyalty Program Data: Recognizing and rewarding repeat customers.

Expanding product lines into new and trending categories, like the successful launch of new toys and games, presents a clear avenue for growth. The online retail sector's consistent growth, with a 7.7% increase in sales in early 2025, indicates a receptive market for new offerings and optimized digital channels. Enhancing customer relationships through targeted marketing and loyalty programs, which saw a 15% increase in customer retention for similar strategies in 2024, can drive repeat business.

| Opportunity Area | Potential Impact | Supporting Data (2024/2025) |

|---|---|---|

| Product Line Expansion | Increased customer base and average transaction value | Global toy market projected at $135 billion (2024); Online retail sales up 7.7% (early 2025) |

| Online Channel Optimization | Improved e-commerce efficiency and customer experience | Focus on profitable online growth as digital channels remain significant |

| Customer Engagement & Loyalty | Enhanced customer lifetime value and repeat business | 15% average increase in customer retention for enhanced engagement strategies (2024) |

| Physical Store Network Refinement | Increased sales density and market share | Retailers optimizing store layouts for customer flow (2024 trend); Data-driven decisions on store performance |

| Data-Driven Personalization | Higher conversion rates and marketing ROI | Personalized recommendations can increase conversion by 20% (2024) |

Threats

The discount retail sector is incredibly crowded, with many companies selling similar items at low prices. This intense rivalry can force The Works to lower its prices and fight harder for its slice of the market. To stay ahead, The Works needs to keep coming up with new ideas and finding ways to stand out from the competition.

A prolonged economic downturn presents a significant threat, potentially curbing consumer spending even at discount retailers like The Works. While the company's value proposition offers some resilience, a severe contraction could still impact sales of non-essential categories such as toys and craft supplies. For instance, in the UK, consumer confidence remained subdued through early 2024, with retail sales volumes showing only modest growth, highlighting the sensitivity of discretionary spending to economic headwinds.

Ongoing global supply chain disruptions, exemplified by events in the Red Sea, are driving up freight costs. For instance, shipping rates on major East-West routes saw significant increases in early 2024, with some spot rates doubling compared to late 2023 averages, directly impacting companies' logistics expenses.

These disruptions can create stock availability issues, forcing companies to potentially hold more inventory, thus increasing carrying costs. This strain on supply chains directly impacts product margins and makes it challenging to maintain competitive, affordable pricing for consumers.

Shifting Consumer Preferences Towards Digital

While The Works caters to a desire for screen-free experiences, the broader market continues to lean into digital. In 2024, global digital media spending is projected to reach over $1 trillion, showcasing a significant consumer preference for online content and entertainment. This ongoing shift could pose a threat if it leads to a sustained decline in demand for physical books, crafts, and stationery, which are central to The Works' offerings.

The increasing prevalence of subscription services for digital content and e-books presents a direct alternative to purchasing physical goods. For instance, the e-book market continues to grow, with projections indicating further expansion in the coming years. If consumers increasingly opt for digital access over ownership of physical items, it could impact sales volumes for The Works.

- Digital Dominance: Global digital media spending is expected to exceed $1 trillion in 2024, highlighting a strong consumer preference for online engagement.

- Subscription Models: The rise of digital subscription services offers consumers convenient and often cost-effective access to content, potentially diverting spending from physical retail.

- Evolving Leisure Habits: As digital entertainment options proliferate, there's a risk that time and disposable income previously allocated to physical products may be redirected elsewhere.

Rising Labor Costs

Rising labor costs are a significant concern, with the National Living Wage in the UK, for example, set to increase to £11.44 per hour from April 2024 for those aged 21 and over. This, coupled with potential increases in National Insurance contributions, creates a persistent cost pressure. If Works cannot offset these higher expenses through operational efficiencies or strategic price adjustments, its profit margins could shrink, directly impacting its financial health and overall performance in the 2024-2025 period.

The impact of these rising costs can be substantial:

- Increased operational expenses: Higher wages and associated payroll taxes directly inflate the cost of doing business.

- Pressure on profit margins: Without commensurate revenue growth or cost savings elsewhere, profitability will likely decline.

- Potential for price increases: To maintain margins, Works might need to pass these costs onto customers, risking a loss of competitiveness.

- Need for efficiency drives: Companies must focus on improving productivity and streamlining operations to absorb these cost increases.

Intense competition within the discount retail sector forces The Works to constantly innovate and differentiate to maintain market share. Economic instability poses a threat, as reduced consumer spending, even on value items, can impact sales, especially for discretionary categories. The company's reliance on physical products faces challenges from the growing digital media market, projected to exceed $1 trillion in 2024, and the increasing popularity of digital subscription services.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of internal financial statements, comprehensive market research reports, and candid feedback from key stakeholders to ensure a well-rounded and actionable assessment.