Works Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Works Bundle

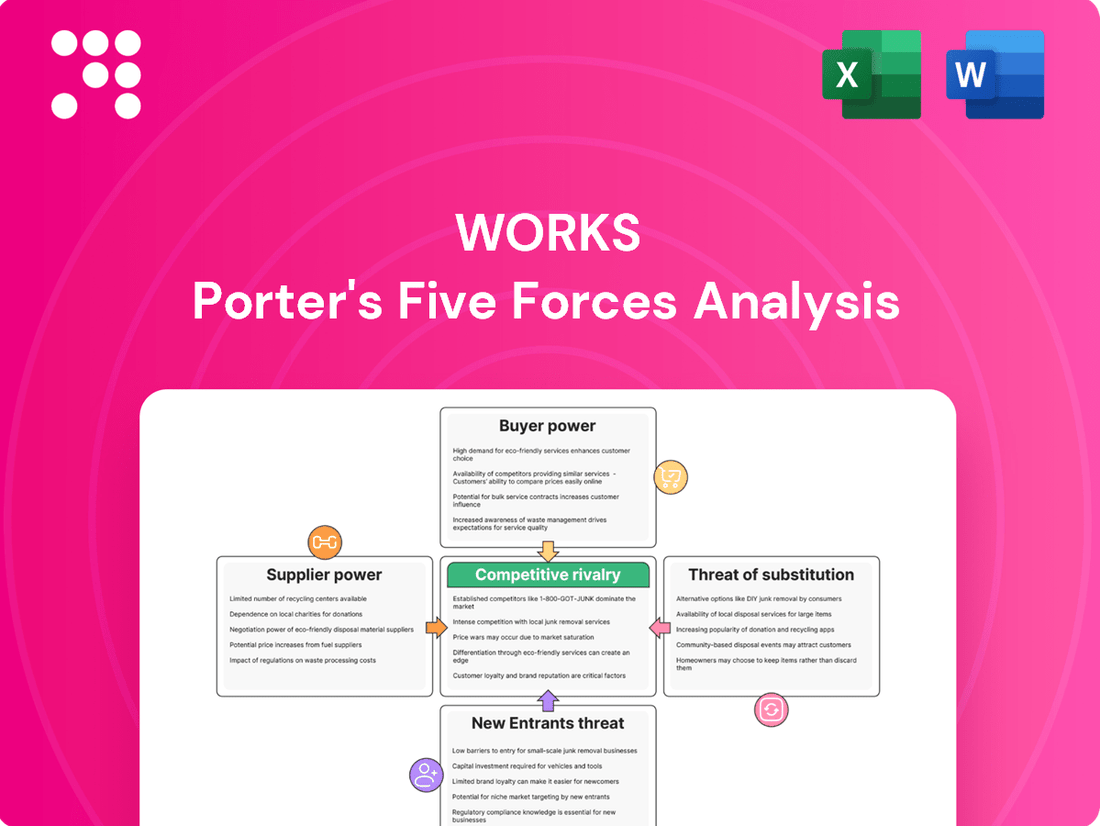

Porter's Five Forces Analysis for Works reveals the intricate competitive landscape, highlighting the bargaining power of buyers and the intensity of rivalry. Understanding these forces is crucial for navigating the market effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Works’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration is a key factor in assessing the bargaining power of suppliers for The Works. If a large percentage of their diverse product range, from books to toys, is sourced from a limited number of major suppliers, those suppliers gain significant leverage.

However, The Works' broad product categories suggest a more fragmented supplier base. Dealing with numerous smaller suppliers typically dilutes individual supplier power, making it harder for any single one to dictate terms.

For instance, in the UK retail sector in 2024, companies relying on specialized or niche suppliers often face higher input costs due to limited alternatives, whereas those with diversified sourcing can negotiate more favorable terms.

Switching costs for The Works, a discount retailer, are a critical factor in assessing supplier bargaining power. If it’s expensive for The Works to switch from one supplier to another, suppliers gain leverage. These costs can include redesigning products to fit new components, retooling manufacturing processes, or establishing entirely new logistical and distribution networks. For a business like The Works, where maintaining low prices is paramount to its value proposition, significant switching costs could severely impact its ability to offer competitive pricing.

If suppliers offer unique or highly differentiated products that are crucial to The Works' product mix and cannot be easily replicated, their bargaining power increases significantly. This is especially true for popular, in-demand book titles or exclusive branded toy lines that drive customer traffic. For instance, in 2024, the book industry saw continued demand for exclusive editions and author-signed copies, giving publishers of these items considerable leverage.

Threat of Forward Integration by Suppliers

Suppliers might leverage their position by integrating forward and selling directly to customers, effectively cutting out The Works. This action would transform them from mere suppliers into direct competitors, significantly enhancing their bargaining power. While this threat is more pronounced in specialized industries, it remains a factor to consider across various supply chains.

For instance, in the retail sector, a dominant supplier of a niche product could potentially launch its own online store or physical outlets. This would not only capture a larger share of the profit margin but also establish a direct relationship with the end consumer, bypassing the intermediary like The Works. Such a move would invariably shift the power dynamic, forcing The Works to compete on price or service with its own former supplier.

- Forward Integration Threat: Suppliers may enter the retail market, becoming direct competitors.

- Increased Bargaining Power: Direct sales by suppliers enhance their leverage over The Works.

- Industry Specificity: The likelihood of this threat varies by industry; it's less common for general product suppliers.

Importance of The Works to Suppliers

The Works' extensive retail footprint, encompassing over 500 stores as of early 2024, coupled with its growing e-commerce presence, offers suppliers a substantial and valuable distribution channel. This broad reach can be particularly attractive to smaller or niche suppliers looking to expand their market penetration.

For many suppliers, The Works can represent a significant portion of their overall sales volume. For instance, if a supplier’s product line is heavily featured and sells well through The Works, it creates a dependency. This reliance can diminish the supplier's leverage in negotiations, as they would likely prioritize maintaining a strong relationship with a key customer like The Works.

- Distribution Reach: The Works' network of over 500 physical stores provides a vast distribution platform for suppliers.

- Online Presence: A robust online sales channel further amplifies the distribution opportunities for suppliers.

- Supplier Dependence: If The Works accounts for a considerable percentage of a supplier's revenue, it can reduce the supplier's bargaining power.

- Relationship Value: Suppliers may be motivated to offer more favorable terms to secure or maintain their position with The Works.

Suppliers' bargaining power is influenced by their concentration and the uniqueness of their offerings. If The Works relies on a few key suppliers for essential products, those suppliers have more sway. Conversely, a broad supplier base for its diverse inventory, from books to toys, generally weakens individual supplier leverage.

High switching costs for The Works, such as retooling or redesigning products, empower suppliers. Similarly, if suppliers provide exclusive or highly differentiated items, like popular book titles or branded toys, their bargaining power increases, as seen in the 2024 market where exclusive editions commanded higher terms.

The threat of forward integration, where suppliers become direct competitors by selling to consumers, significantly boosts their power. The Works' extensive retail network of over 500 stores as of early 2024, alongside its online presence, offers suppliers significant distribution, potentially reducing their dependence on The Works and thus their bargaining power.

| Factor | Impact on Supplier Bargaining Power for The Works | Rationale |

|---|---|---|

| Supplier Concentration | Potentially Moderate to High | Reliance on a few key suppliers for specific product categories increases their leverage. |

| Switching Costs | Potentially Moderate to High | High costs to change suppliers empower existing ones, especially if product differentiation is high. |

| Product Differentiation | Potentially High | Exclusive or unique products, like popular book titles, give suppliers significant pricing power. |

| Forward Integration Threat | Potentially Moderate | Suppliers entering the retail space directly can increase their competitive power. |

| Distribution Channel Value | Potentially Low to Moderate | The Works' large distribution network can reduce supplier dependence, thus lowering their power. |

What is included in the product

This analysis unpacks the five competitive forces impacting Works, detailing industry rivalry, buyer and supplier power, threats of new entrants and substitutes, providing a strategic view of its market position.

Visualize competitive intensity with a dynamic five forces spider chart, instantly highlighting areas of strategic pressure.

Customers Bargaining Power

The Works' position as a discount retailer means its customers are highly attuned to price. This sensitivity grants them significant bargaining power, as they readily switch to competitors offering lower prices. For instance, in 2024, the average consumer spent roughly 15% more on essential goods compared to the previous year, making price a paramount consideration for shoppers at retailers like The Works.

The bargaining power of customers for The Works is significantly influenced by the availability of substitute products. Customers can easily find similar books, stationery, arts and crafts supplies, and toys from numerous other retailers, both online and in physical stores. This broad accessibility to alternatives empowers them to seek better prices or product features elsewhere, putting pressure on The Works to remain competitive.

The internet and readily available price comparison websites have dramatically increased customer information and transparency. For instance, in 2024, platforms like Google Shopping and Amazon's own price tracking tools allow consumers to instantly compare prices for millions of products, from electronics to groceries. This ease of access empowers buyers to identify the lowest prices and best value, directly amplifying their negotiation leverage.

Low Switching Costs for Customers

The bargaining power of customers is significantly influenced by low switching costs. For a retailer like The Works, this means customers can easily move to a competitor if they find better prices or product selections elsewhere. In 2024, the UK retail sector saw continued price sensitivity among consumers, with many actively seeking deals, which amplifies the impact of low switching costs.

This ease of switching empowers customers to demand better terms, such as lower prices or improved product quality. If The Works fails to meet these expectations, customers have readily available alternatives, putting pressure on the company's pricing and profitability.

- Low Switching Costs: Customers face minimal financial or effort barriers when changing from The Works to another retailer.

- Price Sensitivity: In 2024, UK consumers demonstrated a strong inclination towards price comparison and seeking value, a trend that benefits customers with low switching costs.

- Competitive Landscape: The presence of numerous alternative retailers offering similar products means customers can easily shift their loyalty.

- Impact on Profitability: High customer bargaining power due to low switching costs can constrain The Works' ability to maintain profit margins.

Customer Volume and Frequency of Purchase

While individual purchases at a discount retailer like The Works might be small, the sheer breadth of its customer base signifies a substantial collective purchase volume. This high volume, spread across many individuals, means that while no single customer can dictate terms, the aggregate demand is a significant factor.

The Works' strategy relies on attracting a large number of customers who make frequent, albeit often small, purchases. This broad appeal is crucial for maintaining sales momentum. For instance, in the UK, discount retailers often see millions of customer transactions annually, underscoring the importance of this collective buying power.

- High Customer Footfall: Discount retailers typically benefit from high traffic, indicating a large number of individual transactions that contribute to overall volume.

- Fragmented Demand: Individual customer purchasing power is diluted due to the vast number of buyers, preventing any single entity from exerting significant influence.

- Price Sensitivity: Customers at discount retailers are often highly price-sensitive, which indirectly limits their bargaining power as they are primarily seeking value.

- Low Switching Costs: For many products sold at The Works, customers can easily switch to other retailers if prices or offerings are not competitive, a common trait in the discount sector.

The bargaining power of customers for The Works is substantial due to low switching costs and high price sensitivity, particularly evident in 2024 UK retail trends. Customers can easily move to competitors offering better prices or product assortments, a factor amplified by the widespread availability of comparable goods. This dynamic pressures The Works to maintain competitive pricing to retain its broad customer base.

The collective purchasing volume of The Works' numerous customers represents significant aggregate demand. While individual buyers have limited power, their sheer numbers and frequent transactions mean their combined spending habits heavily influence the retailer's sales and operational strategies. This is a common characteristic of discount retailers, which often process millions of transactions annually.

| Factor | Description | Impact on The Works |

|---|---|---|

| Low Switching Costs | Minimal barriers for customers to choose alternative retailers. | Increases customer ability to seek better deals, potentially reducing loyalty. |

| Price Sensitivity (2024 UK Data) | Consumers actively comparing prices and seeking value. | Forces The Works to maintain competitive pricing, impacting profit margins. |

| Availability of Substitutes | Numerous retailers offer similar products (books, stationery, etc.). | Empowers customers to switch easily if The Works' offerings are not perceived as superior or cost-effective. |

| Aggregate Demand | High volume of transactions from a large customer base. | While individual power is low, collective demand influences overall sales but also highlights the importance of customer retention. |

Same Document Delivered

Works Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape for any business by analyzing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This detailed Porter's Five Forces analysis is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

The UK retail market, especially within The Works' core segments like discount, books, stationery, arts and crafts, and toys, is incredibly crowded. This means many businesses are vying for the same customers, from massive supermarket chains and dedicated online stores to smaller independent shops.

This sheer number and variety of competitors mean The Works faces intense pressure. For instance, in 2024, the UK retail sector continued to see significant online growth, with figures from the Office for National Statistics indicating a substantial portion of sales occurring digitally, directly challenging traditional brick-and-mortar models.

The UK's non-food retail sector is navigating a complex environment, with some areas like the book market showing promise, while the broader consumer landscape presents headwinds. This mixed outlook suggests that as overall market growth moderates, companies will likely intensify their efforts to capture market share, potentially leading to heightened competitive rivalry.

The Works competes in markets where product differentiation is often low. For instance, in the book and stationery sectors, many of the same titles and basic stationery items are available from numerous retailers, including supermarkets and online giants. This makes it difficult for The Works to stand out based on product uniqueness alone.

This limited product differentiation means customers often choose based on price or convenience. In 2024, the retail landscape continues to be dominated by aggressive pricing strategies, especially from online competitors who can leverage economies of scale. For The Works, this translates into a constant pressure to match or beat prices, impacting profit margins.

When products are similar, the rivalry intensifies. Competitors are more likely to engage in price wars or promotional activities to capture market share. This dynamic is evident in the stationery market, where sales events and discounts are commonplace across the industry, forcing The Works to remain highly competitive on price to attract and retain customers.

Exit Barriers

High exit barriers can keep less successful competitors in the market, leading to sustained aggressive competition even when conditions are tough. The Works, with its substantial investment in physical retail locations, likely faces some degree of these barriers.

These barriers can include significant sunk costs in store infrastructure and long-term lease commitments. For instance, if The Works has many stores with leases extending several years, exiting these agreements could incur substantial penalties or unrecouped costs, making continued operation, even at a loss, a more palatable option than immediate closure.

- Significant Fixed Assets: The physical store network represents a major investment that is difficult to liquidate without substantial loss.

- Long-Term Leases: Commitments to property leases can create ongoing financial obligations that are costly to break.

- Brand and Reputation: A company's established brand, even if struggling, might be difficult to divest or abandon, influencing decisions to stay operational.

Cost Structure of Competitors

Competitors with lower cost structures, potentially stemming from more advantageous sourcing or superior operational efficiencies, can indeed apply considerable price pressure on The Works. This is particularly relevant in the discount retail sector, where cost sensitivity is a paramount concern. For instance, a competitor like B&M European Value Retail S.A. in the UK, known for its aggressive pricing, often leverages bulk purchasing and a no-frills store format to achieve lower overheads compared to more traditional retailers.

- Cost Sensitivity: The discount retail market thrives on price competition, making cost structure a key differentiator.

- Operational Efficiencies: Competitors achieving lower operating costs through streamlined logistics or optimized inventory management can undercut pricing.

- Sourcing Strategies: Direct sourcing from manufacturers or negotiating better terms can significantly reduce a competitor's cost of goods sold.

- Price Pressure: A lower cost base allows rivals to offer similar products at lower prices, forcing The Works to either match these prices and reduce margins or risk losing market share.

The intense competition in the UK retail market, particularly in The Works' key segments, means many businesses are vying for the same customers. This crowded environment, amplified by online growth in 2024, puts significant pressure on The Works.

The similarity of products across many categories, such as books and stationery, forces retailers to compete heavily on price and convenience. This dynamic is exacerbated by aggressive pricing strategies from online competitors, impacting profit margins.

High exit barriers, like substantial investments in physical stores and long-term leases, can keep struggling competitors in the market, prolonging aggressive rivalry. Competitors with lower cost structures also exert significant price pressure.

| Competitor Type | Key Characteristics | Impact on The Works |

|---|---|---|

| Supermarkets | Broad product range, high footfall, price competitiveness | Direct competition on price for books, stationery, and toys |

| Online Retailers (e.g., Amazon) | Vast selection, convenience, aggressive pricing, efficient logistics | Significant price pressure, threat to physical store model |

| Discount Retailers (e.g., B&M) | Low overheads, bulk purchasing, no-frills approach | Intense price competition, particularly in value-oriented segments |

| Specialty Hobby Stores | Niche product focus, expert knowledge, community engagement | Competition in arts and crafts segments, potential for customer loyalty |

SSubstitutes Threaten

The increasing availability of digital alternatives presents a significant threat to traditional book and stationery retailers like The Works. E-books and audiobooks directly substitute physical books, offering consumers convenience and often lower price points. For instance, the global e-book market was valued at over $15 billion in 2023 and is projected to grow, indicating a sustained shift in consumer preference.

Similarly, digital note-taking apps and online productivity tools are replacing the need for physical stationery. Services like Evernote and Notion offer robust features for organization and collaboration, directly competing with traditional notebooks and planners. This trend is amplified by the growing adoption of cloud-based services, making digital solutions increasingly accessible and cost-effective for a broad user base.

The threat of substitutes intensifies when alternatives offer similar or superior performance at a more attractive price point. For example, the rise of free-to-play mobile games and accessible online learning platforms poses a significant challenge to traditional physical toys and premium educational materials, particularly for budget-conscious consumers.

In 2024, the global toy market, while resilient, faces pressure from digital entertainment. While specific substitute data is proprietary, the continued growth in mobile gaming revenue, projected to exceed $200 billion globally by the end of 2024, indicates a substantial portion of entertainment budgets being diverted from physical goods.

A significant shift in consumer preferences towards sustainable and ethically sourced products, as seen in the growing demand for eco-friendly fashion and plant-based foods, directly increases the threat of substitutes for many industries. For instance, by 2024, the global market for sustainable fashion was projected to reach over $10 billion, demonstrating this powerful trend. Companies that fail to adapt their product lines to meet these evolving demands risk losing market share to alternatives that better align with consumer values.

Ease of Switching to Substitutes

The ease with which customers can switch from The Works' products to substitutes is a significant factor in assessing this threat. For many of the value-oriented stationery, craft, and gift items The Works offers, the effort and cost involved in switching to an alternative are quite low.

This low switching barrier means the threat of substitutes is considerable. For instance, if a customer needs a specific type of pen or a basic craft supply, they can readily find similar or identical products at numerous other retailers, both online and in physical stores, often with comparable pricing. The Works reported a revenue of £229.5 million for the fiscal year ending March 2024, highlighting the scale of its operations and the potential impact of customer diversion.

Key considerations regarding the ease of switching include:

- Low Search Costs: Information about alternative products and their prices is readily available, making it easy for consumers to compare options.

- Minimal Switching Costs: There are typically no significant financial penalties or learning curves associated with moving to a competitor's offering for most of The Works' product range.

- Availability of Alternatives: A wide array of competitors, from large supermarkets to specialist online retailers and discount chains, offer similar product categories.

Innovation in Substitute Industries

Continuous innovation in industries offering substitute products, such as advancements in digital entertainment or e-learning platforms, can create new and more appealing alternatives. For example, the global e-learning market was valued at approximately $250 billion in 2023 and is projected to grow significantly, potentially impacting traditional educational providers.

The Works faces a rising threat from substitutes as new technologies and business models emerge. For instance, advancements in virtual reality (VR) and augmented reality (AR) offer immersive entertainment experiences that could draw consumers away from traditional physical entertainment venues or products. The VR market alone was estimated to be worth over $30 billion in 2023.

Sustainable product materials also represent a growing substitute threat. As consumer awareness and demand for eco-friendly options increase, companies offering sustainable alternatives in packaging, manufacturing, or consumer goods may gain market share. In 2024, the market for sustainable packaging is expected to exceed $1 trillion globally, indicating a substantial shift in consumer preference.

- Digital Entertainment Growth: The streaming services market, a key substitute for traditional media, saw revenues surpass $100 billion in 2023, demonstrating its increasing appeal.

- E-learning Expansion: Online learning platforms continue to expand, with projections suggesting the global market could reach over $400 billion by 2026, offering accessible alternatives to in-person education.

- Sustainable Material Adoption: A significant percentage of consumers, often cited between 60-70% in recent surveys, express a willingness to pay more for products made from sustainable materials, pressuring traditional material providers.

The threat of substitutes for The Works is substantial due to the low switching costs and the wide availability of alternatives. Consumers can easily find comparable products from numerous competitors, both online and in physical stores, often at similar price points. This ease of substitution is a key challenge for the company.

Digital alternatives, such as e-books and online learning platforms, directly compete with The Works' traditional offerings. For instance, the global e-learning market was valued at approximately $250 billion in 2023 and is projected to grow, indicating a significant shift in consumer spending towards digital educational resources.

The increasing consumer demand for sustainable products also presents a growing substitute threat. By 2024, the market for sustainable fashion was projected to reach over $10 billion, illustrating a powerful trend where eco-friendly alternatives are gaining traction over conventional options.

| Substitute Category | Example | 2023 Market Value (Approx.) | Growth Trend |

|---|---|---|---|

| Digital Entertainment | Streaming Services | $100 billion+ | Increasing |

| Digital Learning | E-learning Platforms | $250 billion | Significant Growth Projected |

| Sustainable Goods | Sustainable Fashion | $10 billion+ (Projected 2024) | Strong Growth |

Entrants Threaten

Establishing a retail chain similar to The Works, with its extensive physical store presence and a growing e-commerce operation, demands considerable upfront capital. This includes costs for inventory, store leases, staffing, and marketing, creating a significant hurdle for newcomers.

For instance, in 2024, the average cost to open a new retail store can range from $50,000 to over $200,000 depending on size and location, not including the significant investment needed for a functional online platform and initial stock. This high capital requirement effectively deters many potential entrants from challenging established players in the book and craft retail market.

Existing large retailers, like The Works, leverage significant economies of scale in their operations. This means they can buy in bulk, distribute products more cheaply, and market more effectively, leading to lower costs per unit. For instance, in 2023, major UK retailers often secured discounts of 5-10% on high-volume purchases compared to smaller players.

New entrants face a considerable hurdle in matching these cost advantages. They would need substantial initial investment to build comparable purchasing power and distribution networks. Without achieving similar scale, new businesses would find it difficult to compete on price with established players, impacting their ability to gain market share.

Even though The Works operates in the discount retail sector, it boasts a well-established brand and a loyal customer following. New competitors would need substantial marketing investment and compelling incentives to lure customers away from established players. Customers might also incur minor switching costs related to product familiarity or existing loyalty programs, which could deter immediate shifts.

Access to Distribution Channels

New entrants into the retail sector, particularly those aiming to compete with established players like The Works, face significant hurdles in gaining access to critical distribution channels. The Works benefits from a well-established network of physical stores strategically located across the UK, providing broad market reach and customer accessibility.

Building a comparable physical presence requires substantial capital investment and time, making it difficult for newcomers to replicate The Works' existing footprint. For instance, securing prime retail locations often involves high rental costs and competitive bidding, a barrier that can deter nascent businesses.

Furthermore, establishing efficient supply chains and robust online infrastructure is paramount for modern retail success. New entrants must invest heavily in logistics, warehousing, and e-commerce platforms to match the operational capabilities of established companies. In 2024, the cost of setting up and maintaining a nationwide logistics network can run into millions of pounds, a significant deterrent for startups.

- Limited Retail Space Availability: Prime high-street and shopping centre locations are often occupied by established retailers, making it difficult and expensive for new entrants to secure suitable physical stores.

- High Infrastructure Costs: Developing a competitive online platform and efficient national delivery network requires significant upfront investment in technology, logistics, and staffing.

- Brand Recognition and Loyalty: Existing players like The Works have built brand awareness and customer loyalty over time, which new entrants must overcome through substantial marketing efforts and superior value propositions.

- Supplier Relationships: Established retailers often have strong, long-standing relationships with suppliers, potentially securing better terms and product availability that new entrants struggle to match.

Government Policy and Regulations

Government policy and regulations can significantly impact the threat of new entrants in the retail sector. While not as heavily regulated as finance or healthcare, retailers still face a landscape of compliance. For instance, in 2024, businesses must adhere to evolving data privacy laws like GDPR and CCPA, which can necessitate substantial investment in cybersecurity and compliance infrastructure.

Navigating employment laws, including minimum wage requirements and worker protections, adds another layer of complexity and cost for newcomers. In 2024, the average minimum wage across US states varied, with some states seeing increases, directly affecting labor costs for new retail operations.

- Data Privacy Compliance: Retailers must invest in systems to protect customer data, with potential fines for non-compliance.

- Employment Law Adherence: Meeting minimum wage and worker safety standards increases operational costs for new entrants.

- Consumer Protection: Regulations around product safety, labeling, and advertising require careful attention and can deter new businesses if not properly managed.

- Licensing and Permits: Obtaining necessary business licenses and permits can be a time-consuming and costly hurdle, varying by local jurisdiction.

The threat of new entrants for a retailer like The Works is generally moderate. Significant capital investment is required for physical store setup, inventory, and e-commerce operations, acting as a primary barrier. For example, opening a single retail unit in 2024 could cost upwards of £75,000, excluding stock and marketing.

Established players benefit from economies of scale, securing better supplier terms and lower unit costs, a position difficult for newcomers to quickly replicate. In 2023, large UK retailers often achieved 5-10% better pricing on bulk purchases than smaller competitors.

Brand loyalty and recognition built by The Works also present a challenge, necessitating substantial marketing spend from new entrants to attract customers. Switching costs, though minor, can also deter immediate customer shifts.

Access to prime retail locations and the development of efficient supply chains are further deterrents, requiring significant investment and time to establish.

| Barrier to Entry | Impact on New Entrants | Example Data (2024) |

|---|---|---|

| Capital Requirements | High | Retail store setup: £50,000 - £200,000+ |

| Economies of Scale | Moderate | Supplier discounts for large retailers: 5-10% |

| Brand Loyalty | Moderate | Marketing investment needed to overcome established brands |

| Distribution Channels | High | Cost of nationwide logistics network: Millions of pounds |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, industry-specific market research from firms like Gartner and Forrester, and publicly available regulatory filings.