Works PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Works Bundle

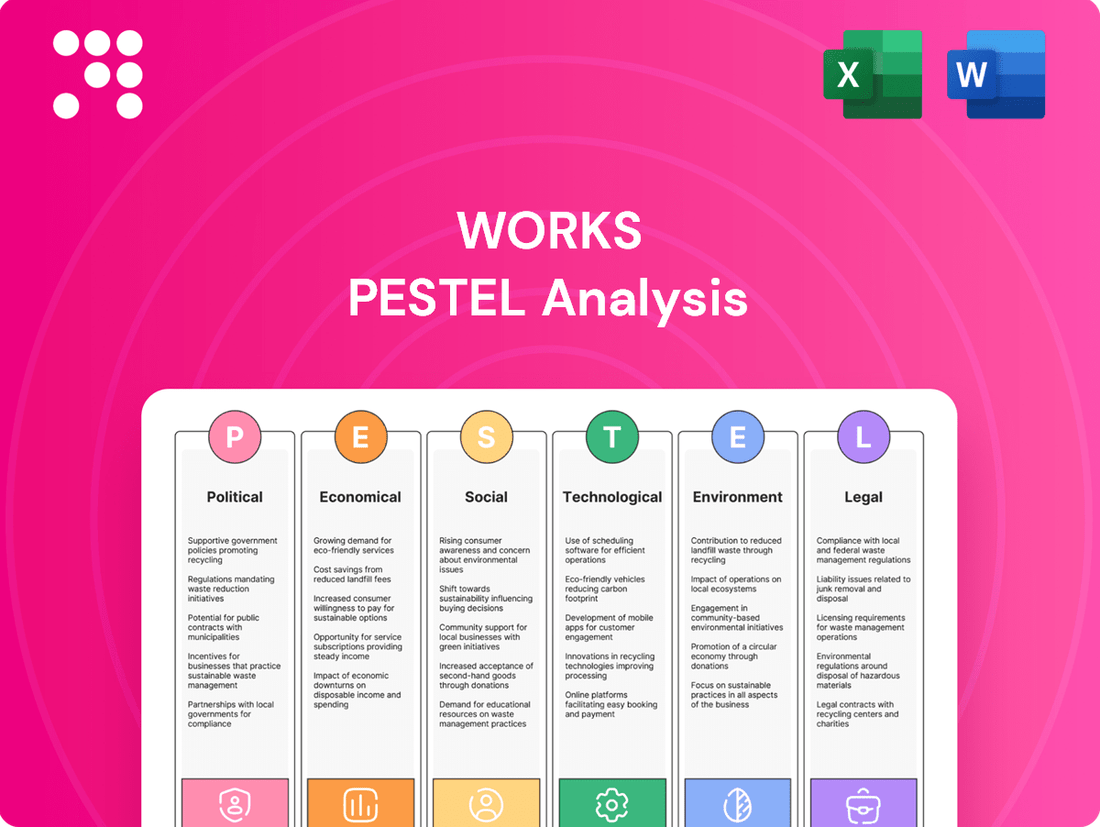

Uncover the critical external factors shaping Works's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your strategy and stay ahead of the curve. Download the full analysis now for a strategic advantage.

Political factors

Government retail policies, particularly those impacting business rates, directly affect The Works' bottom line. For instance, the UK government's announcement in the 2024 Autumn Statement indicated a freeze on the small business multiplier for business rates, providing some relief for eligible retailers. This policy aims to support high street businesses, potentially reducing operational costs for The Works' physical stores.

Changes in government support for the retail sector, such as grants or tax incentives for regenerating high street areas, could also influence The Works' expansion strategies. For example, if local authorities offer incentives for new store openings in specific town centers, The Works might consider these opportunities. The effectiveness of such policies in boosting footfall and sales remains a key consideration.

Fluctuations in Value Added Tax (VAT) rates and other corporate taxation policies directly influence The Works' pricing strategies and overall financial performance. For instance, a potential increase in the UK's standard VAT rate, which currently stands at 20%, could necessitate price adjustments for The Works' diverse product range.

As a discount retailer, even minor shifts in tax burdens can significantly impact The Works' core strategy of offering affordable products while striving to maintain healthy profit margins. A 1% change in VAT, for example, could translate to a noticeable difference in the final price for consumers on many items.

Understanding potential future tax reforms is vital for accurate financial forecasting. For example, any proposed changes to corporation tax rates, which saw a rise to 25% for companies with profits over £250,000 in April 2023, could affect The Works' bottom line and investment capacity.

The Works' reliance on international sourcing makes trade agreements and import regulations a critical political factor. For instance, post-Brexit trade deals significantly impact the cost and ease of importing goods into the UK. Changes in tariffs or customs duties directly affect procurement expenses, as seen in potential fluctuations in the cost of goods imported from the EU.

Consumer protection laws

The UK's robust consumer protection laws, encompassing product safety, returns, and fair trading, significantly shape The Works' operational framework. Compliance is essential for preserving customer confidence and sidestepping legal repercussions. For instance, the Consumer Rights Act 2015 mandates that goods must be of satisfactory quality, fit for purpose, and as described, impacting The Works' product sourcing and quality control processes.

These regulations necessitate continuous adaptation of The Works' sales strategies and customer service protocols. Staying abreast of evolving legislation, such as potential changes to online selling regulations or data privacy requirements under GDPR, is crucial. Failure to comply can lead to substantial fines; the Competition and Markets Authority (CMA) actively enforces these rules, with penalties potentially impacting profitability.

- Product Safety: The Works must ensure all products, especially those for children, meet stringent UK safety standards, like those outlined by the Office for Product Safety and Standards (OPSS).

- Returns and Refunds: Consumers have rights regarding faulty goods, requiring The Works to have clear and fair return and refund policies in line with the Consumer Rights Act 2015.

- Fair Trading: Advertising and sales practices must be transparent and not misleading, as enforced by bodies like the Advertising Standards Authority (ASA).

- Data Protection: Adherence to GDPR principles is vital for handling customer data, with significant fines for breaches, as demonstrated by GDPR enforcement actions across various sectors.

Employment laws and minimum wage

Changes in employment laws, such as minimum wage hikes and updated working hour regulations, directly impact The Works' operational expenses and how they manage their staff. For instance, a significant minimum wage increase in the UK, where The Works operates, could necessitate adjustments to their payroll budget.

Compliance with these evolving labor laws is essential for The Works to maintain smooth operations and ensure their employees are content. Failure to adapt to new legislation, like revised rules on paid leave or statutory benefits, can lead to penalties and affect staff morale.

- Minimum Wage Impact: The UK's National Living Wage is set to increase to £11.44 per hour for those aged 21 and over from April 2024, affecting businesses like The Works.

- Working Hours Regulations: Adherence to the Working Time Regulations, which limit average weekly working hours, is crucial for workforce planning.

- Employee Benefits: Statutory sick pay and pension auto-enrolment requirements add to the overall cost of employing staff.

- Compliance Costs: Investing in HR systems and training to ensure ongoing compliance with employment legislation represents a significant operational consideration.

Government fiscal policies, such as changes to Value Added Tax (VAT) or corporation tax, directly influence The Works' pricing and profitability. For example, the UK's standard VAT rate of 20% impacts the final price of goods, and any alteration could necessitate strategic adjustments. Furthermore, government incentives or business rate freezes, like the one announced for small businesses in the 2024 Autumn Statement, can offer cost relief for The Works' physical store operations.

Trade agreements and import regulations are critical due to The Works' reliance on international sourcing. Post-Brexit trade deals, for instance, affect the cost and logistics of importing goods into the UK, with tariffs and customs duties directly impacting procurement expenses. Consumer protection laws, such as the Consumer Rights Act 2015, mandate product quality and transparency, requiring The Works to maintain robust quality control and fair trading practices.

Employment legislation, including minimum wage increases, directly impacts The Works' operational costs and staff management. The UK's National Living Wage increase to £11.44 per hour from April 2024 for those aged 21 and over is a key factor. Compliance with regulations like the Working Time Regulations and statutory benefits such as sick pay and pension auto-enrolment also contributes to overall employment costs.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting The Works, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

The persistent inflationary pressures observed through 2024 and into early 2025 significantly erode consumer purchasing power. For instance, the US Consumer Price Index (CPI) showed a 3.3% increase year-over-year in May 2024, impacting the affordability of discretionary goods. This directly curtails disposable income, making consumers more cautious about spending on items like books and craft supplies.

While The Works, as a value-focused retailer, might attract budget-conscious shoppers, prolonged high inflation, which saw UK RPI at 6.8% in April 2024, can still lead to a general slowdown in consumer spending. Even discount retailers are not immune when the cost of essentials consumes a larger portion of household budgets.

Therefore, closely tracking shifts in consumer behavior and spending priorities is critical for The Works. This allows for agile adjustments to inventory levels and the development of targeted promotions that resonate with consumers navigating the cost of living crisis.

Changes in interest rates directly affect The Works' borrowing costs for crucial activities like capital expenditure, financing inventory, and any future expansion. For instance, if the Bank of England's base rate, which influences many commercial lending rates, were to increase significantly in 2024 or 2025, The Works would likely face higher interest payments on any outstanding loans or new debt taken on for store upgrades or e-commerce development.

Higher interest rates can lead to increased financial overheads, potentially making investments in new store openings or enhancing digital infrastructure less attractive due to the greater cost of borrowing. This economic reality necessitates that The Works' management carefully forecasts these shifts to maintain healthy profit margins and strategic investment capacity.

Disposable income levels are a critical economic factor for The Works. Higher disposable incomes generally translate to increased consumer spending, which directly benefits retailers like The Works that offer a range of discretionary items. For example, in Q1 2024, UK household disposable income saw a slight increase, potentially supporting demand for The Works' affordable products.

Conversely, economic slowdowns or periods of high inflation that erode real wages can significantly dampen consumer confidence and spending power. If households have less discretionary income, they are likely to cut back on non-essential purchases, impacting The Works' sales volumes. The Office for Budget Responsibility (OBR) forecasts for real household disposable income in 2024 and 2025 will be key indicators of future consumer behaviour.

Exchange rates

Fluctuations in exchange rates, especially the British Pound (GBP) against currencies like the US Dollar and Euro, directly impact The Works' cost of goods sold. For instance, if the GBP weakens, importing materials or finished goods becomes more expensive, potentially reducing profit margins or forcing price increases for consumers.

As of early 2024, the GBP experienced volatility, trading around 1.25 USD and 0.85 EUR. This means that for every dollar or euro worth of goods The Works sources internationally, a weaker pound translates to a higher sterling cost.

- Impact on Cost of Goods Sold: A 10% depreciation in GBP against USD could increase the cost of USD-denominated imports by roughly 10% before any other factors.

- Margin Squeeze: If The Works cannot pass on these increased costs to customers, profit margins will be directly compressed.

- Sourcing Diversification: To mitigate currency risk, companies like The Works often explore sourcing from countries with more stable or favorable exchange rates, or those where they can invoice in GBP.

- Hedging Strategies: Financial instruments like forward contracts can be used to lock in exchange rates for future transactions, providing greater cost certainty for international purchases.

Economic growth and recession outlook

The UK's economic growth trajectory significantly shapes consumer confidence and discretionary spending, directly impacting retailers like The Works. A slowing economy or recessionary pressures typically lead consumers to reduce spending on non-essential items, which can suppress sales volumes. For instance, the Office for Budget Responsibility (OBR) forecast for UK GDP growth was revised down to 0.7% for 2024 in their March 2024 Economic and Fiscal Outlook, indicating a more cautious consumer environment.

Conversely, a healthy and expanding economy generally boosts consumer sentiment and purchasing power across all product segments. This increased confidence can translate into higher sales for The Works, particularly for its range of books, arts, crafts, and stationery. The OBR projects UK GDP growth to accelerate to 1.9% in 2025, suggesting a potential uplift in consumer spending as economic conditions improve.

- Economic Growth Forecast: OBR projects UK GDP growth of 0.7% in 2024, rising to 1.9% in 2025.

- Consumer Confidence Impact: Economic downturns lead to reduced non-essential spending, affecting retailers like The Works.

- Recessionary Effects: Periods of contraction typically see consumers prioritize essential goods over discretionary purchases.

- Positive Economic Environment: A robust economy stimulates sales across all product categories, benefiting The Works.

Consumer spending power remains a key economic driver for The Works, directly influenced by inflation and disposable income trends. As of May 2024, US CPI stood at 3.3% year-over-year, while UK RPI was 6.8% in April 2024, indicating continued pressure on household budgets. These figures suggest consumers may prioritize essential spending, potentially impacting discretionary purchases at The Works.

Interest rate changes, such as the Bank of England's base rate, directly affect The Works' borrowing costs for investments and operations. For instance, a significant rate hike in 2024 or 2025 would increase the expense of financing inventory or store upgrades, potentially squeezing profit margins.

The UK's economic growth forecast, with the OBR projecting 0.7% GDP growth in 2024 and 1.9% in 2025, signals a potentially improving consumer environment. This economic recovery could bolster consumer confidence and increase demand for The Works' affordable product range.

| Economic Factor | Key Data Point (2024/2025) | Implication for The Works |

| Inflation (US CPI) | 3.3% (May 2024) | Erodes consumer purchasing power, potentially reducing discretionary spending. |

| Inflation (UK RPI) | 6.8% (April 2024) | Increases cost of living, making consumers more budget-conscious. |

| UK GDP Growth Forecast | 0.7% (2024), 1.9% (2025) | Suggests a gradual economic recovery, potentially boosting consumer confidence and spending. |

| Interest Rates | Influenced by Bank of England base rate | Higher rates increase borrowing costs for inventory, expansion, and operations. |

| Exchange Rates (GBP/USD) | ~1.25 USD (Early 2024) | Weakening GBP increases the cost of imported goods, impacting margins. |

Full Version Awaits

Works PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Works PESTLE Analysis covers all key external factors impacting your business. You'll gain valuable insights into Political, Economic, Social, Technological, Legal, and Environmental influences.

Sociological factors

Consumers increasingly favor online shopping, with e-commerce sales in the UK expected to reach £173 billion in 2024, a 7% increase from 2023. This trend necessitates that The Works strengthens its digital presence and integrates it with its physical stores for a true omnichannel experience, meeting the demand for convenience and accessibility.

The UK's population is aging, with the proportion of those aged 65 and over projected to reach 25% by 2035, impacting demand for products. This demographic shift means fewer young families buying children's books and educational toys, but potentially more older individuals interested in crafting supplies or hobby-related items. For The Works, adapting its inventory and marketing to cater to these evolving consumer needs is vital for sustained sales growth.

The enduring popularity of reading, educational pursuits, and creative hobbies such as arts and crafts directly fuels The Works' primary product lines. This sustained societal interest, often amplified by parental emphasis on early childhood development or a growing trend in adult wellness activities, ensures a consistent and reliable market for the company's offerings.

For instance, in the UK, the book market saw a 4% growth in 2023, reaching £1.9 billion, with children's books and fiction remaining strong performers. This indicates a robust demand for the very products The Works specializes in, suggesting that marketing strategies focusing on these societal values will likely resonate well with consumers.

Sustainability and ethical consumerism

Consumers are increasingly prioritizing sustainability and ethical sourcing, directly impacting their buying habits. For The Works, this means a growing demand to showcase responsible operations across its supply chain, from material sourcing to waste reduction initiatives. For instance, a 2024 Nielsen report indicated that 73% of global consumers would change their consumption habits to reduce their impact on the environment.

This shift puts pressure on The Works to be transparent about its environmental and social impact. Communicating these efforts effectively can significantly boost brand reputation and attract a larger segment of environmentally conscious shoppers. In 2025, companies that can clearly demonstrate their commitment to sustainability are expected to see a competitive advantage.

- Growing Consumer Demand: A significant majority of consumers, projected to be over 75% by late 2024, actively seek out brands with strong sustainability credentials.

- Supply Chain Scrutiny: The Works must demonstrate ethical sourcing and responsible manufacturing processes to meet evolving consumer expectations.

- Brand Reputation Enhancement: Proactive communication about sustainability efforts can build trust and loyalty among an increasingly values-driven customer base.

- Waste Management Focus: Consumers expect businesses to implement robust waste reduction and recycling programs, influencing purchasing decisions.

Community engagement and local store importance

Even with the surge in online shopping, local physical stores continue to be vital community centers for many shoppers. The Works' significant presence across the UK, with over 300 stores as of early 2024, leverages this by providing a physical shopping environment that builds local relationships.

This community focus acts as a key differentiator against online-only retailers, offering customers a tangible connection and a place to browse and discover products. For instance, in 2023, The Works reported a strong performance, with like-for-like sales showing positive growth in many of its locations, underscoring the continued relevance of its physical footprint.

- Community Hubs: Local stores serve as gathering places, fostering social interaction and a sense of belonging.

- Tangible Experience: Physical stores allow customers to see, touch, and experience products before purchasing, a key advantage over online retail.

- Local Economic Impact: Stores contribute to local economies through employment and by supporting local suppliers, strengthening community ties.

- Brand Loyalty: A strong community presence can cultivate deeper customer loyalty and brand advocacy.

Societal values significantly shape consumer behaviour, influencing purchasing decisions towards brands that align with personal beliefs. The Works benefits from a society that increasingly values literacy, education, and creative hobbies, directly supporting its core product offerings.

The UK book market alone demonstrated resilience, with sales reaching £1.9 billion in 2023, a 4% increase, highlighting sustained consumer interest in reading. This trend, coupled with a growing emphasis on early childhood development and adult wellness through crafts, provides a stable demand for The Works' product range.

Societal shifts towards sustainability are also paramount, with a 2024 report indicating 73% of global consumers would alter habits to reduce environmental impact. For The Works, demonstrating ethical sourcing and waste reduction is crucial for attracting and retaining this growing segment of environmentally conscious shoppers, with companies showing commitment expected to gain a competitive edge in 2025.

| Societal Trend | Impact on The Works | Supporting Data (2023-2024) |

|---|---|---|

| Value of Literacy & Hobbies | Drives demand for books, educational items, and craft supplies. | UK book market grew 4% to £1.9 billion in 2023. |

| Sustainability Focus | Requires transparent ethical sourcing and waste reduction. | 73% of global consumers would change habits for environmental impact (2024). |

| Digital Adoption | Necessitates strong omnichannel integration. | UK e-commerce sales projected to reach £173 billion in 2024 (+7% from 2023). |

Technological factors

The Works' e-commerce platform development and user experience are paramount in today's digital-first retail environment. Enhancing website navigation, ensuring robust mobile responsiveness, and integrating secure, streamlined payment gateways are essential for converting online interest into sales. In 2024, the average e-commerce conversion rate across the UK hovered around 2%, highlighting the significant impact of a smooth user journey on revenue.

A superior online user experience directly translates to customer loyalty and competitive advantage. For instance, a study by Statista in early 2025 indicated that 60% of online shoppers abandon their carts due to a complex checkout process. Therefore, The Works' investment in optimizing its digital storefront, including a seamless checkout, is a key technological factor for success.

The Works' ability to maintain its low-price strategy hinges on leveraging technology for supply chain automation. This includes advanced warehouse management systems and efficient logistics networks, which are critical for ensuring products are available when customers want them.

Optimizing inventory management and speeding up order fulfillment directly reduces operational costs. For instance, companies investing in automated guided vehicles (AGVs) in warehouses have reported up to a 20% reduction in labor costs for picking and put-away tasks. This efficiency translates to better customer satisfaction through quicker delivery times.

Strategic investments in these technological areas are not just about cost savings; they are about building significant competitive advantages. In 2024, the global supply chain management market was valued at over $25 billion, with automation being a key growth driver, indicating a strong trend towards technological integration for operational excellence.

Data analytics is becoming a cornerstone for retailers like The Works. By leveraging customer data, they can tailor marketing efforts, sending promotions that resonate with individual preferences, which can significantly boost engagement. For instance, a 2024 report indicated that personalized marketing campaigns can increase conversion rates by up to 10% compared to generic ones.

Furthermore, sophisticated analytics help optimize inventory. Understanding sales patterns allows The Works to forecast demand more accurately, ensuring popular items are in stock while reducing overstock of slower-moving products. This data-driven approach to inventory management can lead to a reduction in waste and improved capital efficiency, with many retailers aiming for a 5-15% decrease in stockouts and overstock situations by implementing robust analytics in 2025.

In-store technology and omnichannel integration

Integrating advanced technology into physical retail spaces is crucial for a smooth omnichannel experience. Think of upgraded Point-of-Sale (POS) systems, self-checkout kiosks, and efficient 'click and collect' services. These advancements bridge the gap between online browsing and in-store purchasing, making shopping more convenient and operations more streamlined.

This technological integration fosters a consistent customer journey across all touchpoints. For instance, by mid-2024, retailers were investing heavily in unified commerce platforms, with projections indicating the global unified commerce market could reach over $30 billion by 2027, highlighting the demand for seamless online-offline integration.

Key technological factors driving this include:

- Enhanced POS Systems: Enabling faster transactions and better inventory management.

- Self-Checkout Options: Reducing wait times and empowering customer autonomy.

- Click and Collect Facilities: Offering convenient pickup points for online orders, boosting foot traffic.

- Inventory Visibility: Real-time tracking across channels ensures product availability and reduces stockouts, a common pain point for 40% of consumers when shopping omnichannel.

Cybersecurity and data protection measures

For The Works, with its significant online presence and reliance on customer data, robust cybersecurity is absolutely critical. Protecting sensitive customer information from breaches is paramount, especially with increasing cyber threats. Failure to do so can result in loss of customer trust and substantial financial penalties.

Compliance with data protection regulations, such as the General Data Protection Regulation (GDPR), is non-negotiable. In 2024, the global cost of data breaches averaged $4.45 million, a significant increase from previous years. This underscores the financial imperative for The Works to maintain stringent data protection measures to avoid such costs and reputational damage.

Ongoing investment in cybersecurity infrastructure is therefore essential. This includes advanced threat detection systems, regular security audits, and employee training. For instance, many businesses are now allocating 5-10% of their IT budget specifically to cybersecurity to stay ahead of evolving threats.

- Cybersecurity investment is crucial to protect customer data and maintain trust.

- GDPR and similar regulations mandate strong data protection, with significant penalties for non-compliance.

- The average cost of a data breach in 2024 reached $4.45 million globally.

- Businesses are increasingly dedicating 5-10% of their IT budgets to cybersecurity.

Technological advancements are reshaping retail operations, from e-commerce platforms to supply chain efficiency. The Works must prioritize a seamless online user experience, as studies in early 2025 indicated 60% of shoppers abandon carts due to complex checkout processes. Investing in automation for warehouses and logistics is key to maintaining a low-price strategy, with companies reporting up to a 20% reduction in labor costs through automation in 2024.

Data analytics offers significant opportunities for personalized marketing and optimized inventory management, with personalized campaigns potentially boosting conversion rates by 10% in 2024. Furthermore, integrating technology into physical stores, such as advanced POS systems and click-and-collect services, enhances the omnichannel experience. The global unified commerce market is projected to exceed $30 billion by 2027, reflecting this trend.

Cybersecurity is paramount, with the average cost of a data breach in 2024 reaching $4.45 million globally. Businesses are increasingly allocating 5-10% of their IT budgets to cybersecurity to protect sensitive data and comply with regulations like GDPR, avoiding substantial financial penalties and reputational damage.

| Technological Factor | Impact on The Works | Relevant Data/Trend (2024-2025) |

|---|---|---|

| E-commerce User Experience | Drives online sales and customer loyalty. | 60% of online shoppers abandon carts due to complex checkout (early 2025). |

| Supply Chain Automation | Enables low-price strategy and operational efficiency. | Up to 20% labor cost reduction in warehouses via automation (2024). |

| Data Analytics | Enhances marketing personalization and inventory forecasting. | Personalized marketing can increase conversion rates by up to 10% (2024). |

| Omnichannel Integration | Creates a seamless customer journey across channels. | Global unified commerce market projected to exceed $30 billion by 2027. |

| Cybersecurity | Protects customer data, maintains trust, and ensures regulatory compliance. | Average cost of a data breach in 2024 was $4.45 million globally. |

Legal factors

The Works must meticulously adhere to the Consumer Rights Act 2015, which mandates that goods sold are of satisfactory quality, fit for their intended purpose, and match their description. This legal framework underpins consumer trust and dictates product standards, particularly for items like children's toys and craft supplies, which are subject to stringent safety regulations. Failure to comply can lead to significant legal repercussions.

In 2023, the UK's Competition and Markets Authority (CMA) continued to emphasize robust product safety enforcement, with specific attention on online marketplaces and the supply chains of retailers like The Works. Product liability claims can arise from defects that cause harm, and for a retailer, this means ensuring all products, especially those with potential hazards, meet or exceed all relevant safety standards. For instance, the General Product Safety Regulation 2005, and its subsequent updates, are critical for items sold by The Works.

The financial implications of non-compliance are substantial. Beyond potential fines, which can run into thousands of pounds per infraction, legal disputes and product recalls can severely damage a company's reputation and lead to a loss of consumer confidence. In 2024, regulatory bodies are expected to maintain a keen focus on consumer protection, making adherence to the Consumer Rights Act and product liability laws a non-negotiable aspect of The Works' operational strategy.

The Works must meticulously comply with the UK's Data Protection Act, which embeds GDPR principles, governing all customer and employee data handling. This includes how data is collected, stored, and processed, ensuring it aligns with robust privacy standards.

Failure to adhere to these stringent data privacy regulations can severely damage customer trust and lead to substantial financial penalties. For instance, under GDPR, fines can reach up to €20 million or 4% of global annual turnover, whichever is higher, underscoring the financial risk of non-compliance.

To maintain compliance and mitigate risks, The Works needs to implement regular data protection audits and provide ongoing staff training. This proactive approach ensures all personnel understand their responsibilities in safeguarding sensitive information, a critical aspect for business continuity and reputation management in the current regulatory landscape.

The Works, as a retailer of toys and consumer goods, must adhere to strict product safety standards. This includes compliance with regulations like the UKCA marking, which replaced CE marking for goods placed on the market in Great Britain from January 1, 2023. This ensures toys and other items meet safety requirements, including chemical restrictions and age-appropriateness.

Failure to comply can result in significant penalties. For instance, in 2024, the UK government continued to emphasize enforcement of product safety legislation, with Trading Standards bodies actively investigating non-compliant products. The Works must ensure all its merchandise, particularly children's items, meets these evolving legal benchmarks to avoid recalls and reputational damage.

Employment law and workforce regulations

Employment law is a critical factor for businesses, dictating everything from minimum wage to workplace safety. In 2024, the U.S. federal minimum wage remains at $7.25 per hour, though many states and cities have enacted higher rates, creating a patchwork of compliance requirements. For instance, California's minimum wage reached $16.00 per hour in 2024 for all employers.

Ensuring compliance with these evolving regulations, including those related to working hours, overtime pay, and non-discrimination, is paramount. Failure to adhere can lead to significant penalties, labor disputes, and damage to a company's reputation. For example, the Equal Employment Opportunity Commission (EEOC) reported over 60,000 private sector discrimination charges in fiscal year 2023, highlighting the ongoing importance of robust HR practices.

Businesses must proactively update their HR policies to reflect changes in employment law. This includes staying informed about new legislation and court rulings that impact hiring, compensation, benefits, and termination processes. For instance, the proposed Worker Protection Act of 2024, if passed, could introduce further requirements for employers regarding paid sick leave and collective bargaining rights.

Key areas of employment law requiring constant attention include:

- Minimum Wage Compliance: Adhering to federal, state, and local minimum wage laws, which vary significantly.

- Working Hours and Overtime: Properly tracking hours worked and ensuring correct overtime pay, especially for non-exempt employees.

- Health and Safety Standards: Maintaining safe working conditions as mandated by bodies like the Occupational Safety and Health Administration (OSHA).

- Non-Discrimination and Equal Opportunity: Implementing policies and practices that prevent discrimination based on protected characteristics.

Advertising standards and marketing regulations

The Works must navigate a landscape of stringent UK advertising standards and marketing regulations. This means all promotional content, from social media posts to in-store displays, must be truthful, substantiated, and avoid misleading consumers, particularly concerning product categories like books and toys where specific rules often apply. For instance, the Advertising Standards Authority (ASA) actively monitors and enforces these regulations, issuing rulings against brands that fall short. In 2023, the ASA upheld numerous complaints against various sectors for misleading advertising, underscoring the importance of meticulous campaign planning.

Failure to comply with these advertising and marketing laws can result in significant penalties. These can include substantial fines, mandatory corrective advertising campaigns to rectify any misinformation, and severe reputational damage, which can erode consumer trust and impact sales. The legal framework mandates that ethical marketing practices are not just a recommendation but a requirement for businesses operating in the UK.

- Truthful Advertising: All marketing claims made by The Works must be accurate and verifiable.

- No Misleading Content: Campaigns must avoid any ambiguity or deception that could lead consumers to make purchasing decisions based on false pretences.

- Regulatory Compliance: Adherence to specific regulations governing product promotions, such as those for children's toys or educational materials, is crucial.

- Consequences of Non-Compliance: Potential penalties include fines, reputational damage, and mandated corrective advertising.

The Works must navigate a complex web of consumer protection laws, ensuring all products meet stringent safety and quality standards. This includes adhering to regulations like the UKCA marking, which became mandatory for goods in Great Britain from January 1, 2023, replacing CE marking for many product categories, including toys. Non-compliance can lead to significant penalties, product recalls, and severe reputational damage, as enforcement by bodies like Trading Standards remains a key focus in 2024.

Environmental factors

The Works faces growing pressure from consumers and regulators to ensure its products, especially paper for books and stationery and plastics for toys and crafts, are sourced sustainably. This means partnering with suppliers who champion responsible forestry practices, utilize recycled content, and actively minimize their environmental footprint.

For instance, the UK government's 2024 Plastic Packaging Tax, which increased to £200 per tonne for plastic packaging that does not contain at least 30% recycled material, directly impacts the cost and sourcing strategy for The Works' toy and craft supplies. Similarly, the continued focus on Forest Stewardship Council (FSC) certification for paper products highlights a market trend where over 70% of consumers in the UK state they are more likely to buy from brands demonstrating strong environmental credentials.

The Works needs a strong strategy for handling operational waste, from packaging to unsold stock. This involves robust recycling programs and initiatives to cut down on waste generation. For instance, in 2023, the UK generated approximately 11.4 million tonnes of local authority collected waste, with a recycling rate of 43.2%, highlighting the ongoing challenge and opportunity in waste reduction.

Adhering to waste disposal regulations is crucial, but going further by actively minimizing landfill contribution can offer significant benefits. Companies that embrace circular economy principles, like reusing materials or designing products for longevity, can see reduced operational costs and a better environmental footprint. This approach aligns with increasing consumer and regulatory pressure for sustainable business practices.

The Works is increasingly focused on shrinking its carbon footprint across logistics and store operations. This involves optimizing delivery routes to cut down on fuel consumption and exploring more eco-friendly transportation methods. For instance, many companies in the retail sector are investing in electric vehicles for last-mile delivery, a trend The Works may also adopt.

Energy efficiency in stores is another critical area. Upgrading to LED lighting can significantly reduce electricity usage, a move that aligns with broader sustainability goals and offers tangible cost benefits. By setting and actively working towards emission reduction targets, The Works demonstrates a commitment to environmental stewardship, which is becoming a key differentiator for consumers.

Packaging regulations and plastic reduction

The Works faces increasing pressure from evolving packaging regulations, especially those targeting single-use plastics and promoting recyclable materials. For instance, the UK's Plastic Packaging Tax, introduced in April 2022, levies a charge of £200 per tonne on plastic packaging manufactured or imported into the UK that contains less than 30% recycled plastic. This directly affects The Works' operational costs and necessitates a strategic review of its packaging choices to comply with these environmental mandates.

Adapting packaging strategies is crucial for The Works to meet these new requirements, significantly reduce its plastic waste footprint, and actively explore more sustainable packaging alternatives. This proactive approach not only ensures regulatory compliance but also aligns with growing consumer demand for environmentally conscious business practices. Companies that fail to adapt risk reputational damage and potential market share loss.

Consumer preference for minimal and eco-friendly packaging is a powerful driver behind this industry-wide shift. Studies in 2024 indicate that over 60% of consumers are willing to pay more for products with sustainable packaging. This trend compels The Works to innovate its packaging solutions, moving towards materials that are biodegradable, compostable, or made from recycled content to resonate with this environmentally aware customer base.

- Regulatory Impact: The UK Plastic Packaging Tax imposes a £200/tonne charge on packaging with under 30% recycled content, impacting The Works' supply chain costs.

- Consumer Demand: Over 60% of consumers in 2024 showed a willingness to pay a premium for products featuring sustainable packaging.

- Strategic Adaptation: The Works must integrate recyclable, biodegradable, or recycled materials into its packaging to meet environmental standards and consumer expectations.

Consumer demand for eco-friendly products

Consumer demand for eco-friendly products presents a significant shift for The Works. This trend is not just a niche interest; by 2024, global sales of sustainable goods were projected to reach over $150 billion, indicating a substantial market. The Works can capitalize on this by expanding its offerings of items made from recycled content or those with reduced environmental footprints, such as paper products sourced from sustainably managed forests.

This growing preference translates into a clear opportunity for The Works to differentiate itself. For instance, a survey in early 2025 revealed that over 65% of consumers are willing to pay a premium for products with clear sustainability credentials. The company could highlight its commitment through clear labeling on its product lines, informing customers about the eco-friendly attributes of their purchases, from craft supplies to stationery.

- Growing Market Share: The global market for sustainable products is expanding rapidly, with projections indicating continued strong growth through 2025 and beyond.

- Consumer Willingness to Pay: A significant portion of consumers are demonstrating a willingness to pay more for products that align with their environmental values.

- Opportunity for Differentiation: The Works can leverage eco-friendly product lines to attract environmentally conscious customers and build brand loyalty.

- Transparency is Key: Clear and honest labeling regarding sustainability features is crucial for resonating with this consumer segment.

The environmental factors significantly influence The Works' operations, from sourcing raw materials to managing waste and energy consumption. Increasingly stringent regulations, like the UK's Plastic Packaging Tax, directly impact costs and necessitate strategic shifts towards sustainable materials. Simultaneously, a growing consumer demand for eco-friendly products presents both challenges and opportunities for the company to enhance its brand image and market position.

| Environmental Factor | Impact on The Works | Relevant Data (2024/2025) |

|---|---|---|

| Sustainable Sourcing | Pressure to use recycled content and responsibly sourced materials for paper and plastics. | Over 70% of UK consumers prefer brands with strong environmental credentials. |

| Waste Management | Need for robust recycling programs and reduction of operational waste. | UK recycling rate was 43.2% in 2023, indicating room for improvement. |

| Carbon Footprint | Focus on optimizing logistics and energy efficiency in stores. | Investment in electric vehicles for last-mile delivery is a growing trend in retail. |

| Packaging Regulations | Compliance with taxes on non-recycled plastic packaging. | UK Plastic Packaging Tax: £200/tonne for packaging with <30% recycled content. |

| Consumer Demand | Growing preference for eco-friendly products and packaging. | Over 65% of consumers in early 2025 were willing to pay a premium for sustainable products. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using a blend of official government publications, reputable market research firms, and international economic databases. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting your business.