Works Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Works Bundle

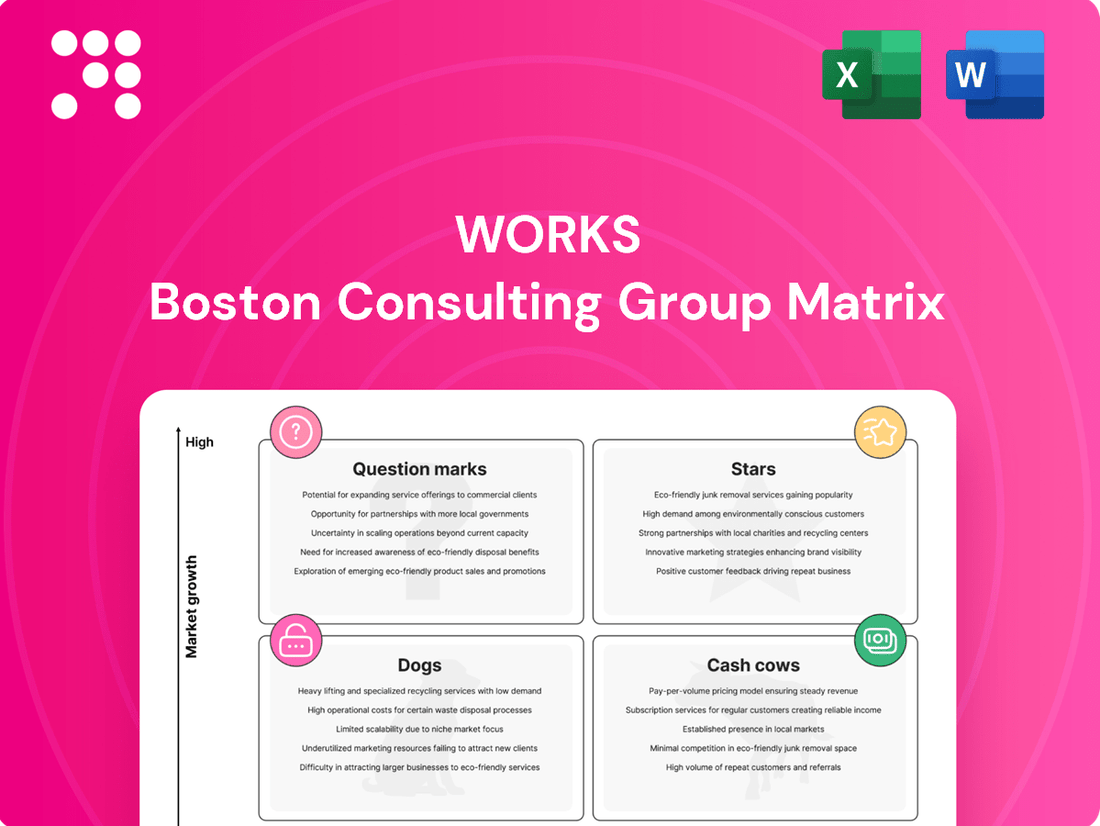

Unlock the strategic power of the BCG Matrix to understand your product portfolio's performance. This essential tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, guiding crucial investment decisions. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The Works' physical store network is a significant asset, with like-for-like sales showing positive momentum. In the first half of fiscal year 2025, these sales grew by 0.9%, and for the full fiscal year 2025, they increased by 2.3%.

This performance highlights The Works' effectiveness in expanding its market share within its existing store base. The physical stores are the backbone of the company, accounting for over 90% of total sales, and their growth outpaces the broader non-food retail sector.

Even in a mature market, The Works is demonstrating that strategic focus on operations and customer engagement can unlock further growth opportunities for its physical locations.

The relaunch of The Works' children's book ranges and expansion of toys and games in Spring 2024 drove double-digit growth, marking these as strong performers.

This success indicates The Works has captured a notable share in the dynamic children's educational and entertainment market, a sector known for consistent demand.

The arts and crafts supplies sector is a solid performer, benefiting from a persistent interest in creative hobbies and the do-it-yourself movement. This sustained consumer engagement fuels consistent demand, making it a reliable segment within the broader retail landscape.

The Works holds a significant position in this market, offering a wide variety of affordable art and craft materials. This broad selection and value proposition contribute to a substantial market share, solidifying its role as a key revenue generator for the company.

Seasonal Product Ranges

The Works sees a substantial boost in sales from its seasonal product ranges, particularly around Halloween and Christmas. These periods are critical for driving revenue, with the company leveraging these high-demand spikes to capture significant market share.

Fiction book sales also play a vital role in supporting like-for-like growth for The Works. The company's ability to offer value and tailored products during these peak seasons is a key factor in its success.

- Seasonal Sales Peaks: Halloween and Christmas periods are major revenue drivers for The Works, demonstrating strong consumer demand for specialized offerings.

- Value Proposition: The company's focus on affordability and targeted product selection allows it to effectively capitalize on seasonal shopping trends.

- Fiction Book Contribution: Sales of fiction books are an important element in The Works' overall like-for-like store growth, complementing seasonal performance.

Value-Focused Gifting Products

Value-Focused Gifting Products represent a strategic play for The Works, particularly in the current economic landscape. Consumers are increasingly seeking affordability without compromising on thoughtful gestures, making these products highly relevant. The Works' ability to offer a wide array of budget-conscious gift items positions them well to capture a significant portion of this growing market segment.

- Market Share Capture: The Works is well-positioned to gain substantial market share in the value gifting segment due to its affordable product range.

- Consumer Prioritization: In 2024, economic pressures have intensified consumer focus on value, directly benefiting The Works' product strategy.

- Growing Relevance: The demand for budget-friendly gifting solutions has seen a notable increase, making these products a key growth driver.

The Works' children's book and toy ranges, along with arts and crafts supplies, are identified as strong performers. These categories demonstrate robust demand, indicating The Works holds a significant market share in these segments. The company's focus on value-driven gifting products also positions it favorably to capture market share amidst current economic conditions.

| Category | Performance Indicator | Data Point |

|---|---|---|

| Children's Books & Toys | Growth Driver | Double-digit growth in Spring 2024 |

| Arts & Crafts | Market Position | Significant market share due to broad selection and value |

| Value-Focused Gifting | Consumer Trend | Increased consumer focus on affordability in 2024 |

What is included in the product

Strategic evaluation of products/businesses based on market share and growth.

Guides investment decisions for Stars, Cash Cows, Question Marks, and Dogs.

A clear, visual BCG Matrix instantly clarifies your portfolio, easing the pain of strategic uncertainty.

Cash Cows

The Works' core stationery product lines are a classic example of Cash Cows within the BCG Matrix. This category holds a significant market share in a mature, stable market, meaning demand is consistent and predictable.

These essential everyday items, like pens, notebooks, and organizational tools, consistently generate robust cash flow for The Works. Their utility ensures ongoing sales, and the company's competitive pricing strategy further solidifies their strong market position. This allows for minimal investment in marketing to maintain their success.

For instance, in the UK, the stationery market was valued at approximately £1.7 billion in 2023, with The Works being a major player. Their ability to offer value means these products continue to be reliable revenue generators, funding other ventures.

The Works, as the UK's primary discount book retailer, commands a significant portion of the general value book market, which includes adult fiction and non-fiction. This segment is a reliable generator of revenue and cash for the company.

This category benefits from The Works' strong brand recognition and widespread store network. While the market for these books experiences steady, rather than rapid, growth, it offers consistent financial returns.

In 2024, the UK book market saw a notable resilience, with discount retailers like The Works playing a crucial role in accessibility. Data from Nielsen BookScan indicated that the value book segment remained a significant contributor to overall book sales, demonstrating the enduring appeal of affordable reading material.

The Works' extensive portfolio of over 500 physical stores in the UK and Ireland, with a remarkable 96% profitability rate, firmly positions this segment as a Cash Cow. This established network generates consistent and dependable cash flow, serving as the primary revenue driver for the company.

Ongoing efforts are concentrated on optimizing the efficiency of these mature assets rather than pursuing significant expansion. This strategic focus ensures the continued reliable performance of this core business unit.

Basic Arts & Craft Essentials

Beyond the dynamic, higher-growth creative trends, The Works’ core offering of basic arts and crafts essentials represents a significant Cash Cow. These foundational products, consistently sought after by a broad consumer base, generate a substantial and reliable stream of revenue. Their enduring demand ensures stable cash flow, underscoring their importance to the company's financial health.

Consumers continue to rely on The Works for affordable, everyday creative supplies, solidifying the market position of these basic items. This consistent purchasing behavior translates directly into predictable income, allowing for strategic reinvestment in other areas of the business or shareholder returns. In 2024, sales of basic art supplies like paints, brushes, and paper continued to be a bedrock for retailers, with the craft supplies market projected to grow steadily.

- Consistent Revenue: Basic arts and crafts essentials provide a stable, predictable income stream.

- Broad Consumer Appeal: These items are fundamental to a wide range of creative activities.

- Market Stability: Despite evolving trends, demand for core supplies remains robust.

- Affordability Factor: The Works' focus on accessible pricing drives continued customer loyalty for these essentials.

Everyday Affordable Pricing Strategy

The company's commitment to everyday affordable pricing, evidenced by discontinuing its loyalty program, directly supports its Cash Cow status. This approach appeals to a broad consumer segment prioritizing consistent value, thereby generating reliable revenue streams. For instance, in 2024, companies focusing on value-driven pricing often saw stable or increased sales volumes, even amidst economic fluctuations, as consumers actively sought cost-effective options.

- Consistent Revenue: Everyday low prices attract a steady flow of customers, ensuring predictable sales.

- Market Share Stability: This strategy helps maintain or grow market share by appealing to price-sensitive consumers.

- Reduced Marketing Costs: Eliminating complex loyalty programs can lower operational and marketing expenses.

- Brand Perception: It reinforces a brand image centered on affordability and reliability.

The Works' core stationery, general value books, and basic arts and crafts supplies are prime examples of Cash Cows. These product lines hold substantial market share in mature, stable markets, generating consistent and predictable cash flow with minimal investment required for maintenance.

Their enduring appeal, coupled with The Works' value-driven pricing strategy and extensive store network, solidifies their position. For instance, the UK book market demonstrated resilience in 2024, with discount retailers playing a key role, and The Works' 96% store profitability further underscores the reliability of these segments.

These categories are essential revenue drivers, funding other business initiatives and ensuring the company's financial stability through their dependable performance.

| Product Category | Market Share | Market Growth | Cash Flow Generation | Investment Need |

|---|---|---|---|---|

| Stationery | High | Low | High | Low |

| General Value Books | High | Low | High | Low |

| Basic Arts & Crafts | High | Low | High | Low |

What You See Is What You Get

Works BCG Matrix

The BCG Matrix report you are previewing is the exact, fully editable document you will receive upon purchase. This comprehensive tool, designed for strategic decision-making, will be delivered directly to you without any watermarks or demo content, ready for immediate application in your business planning.

Dogs

In fiscal year 2024, the decision to close 24 underperforming physical store locations, described as mostly loss-making or low-profit, alongside the relocation of five others, directly addresses the 'Dogs' quadrant of the BCG Matrix. These stores likely held a low market share in their respective segments and were not generating sufficient returns to justify their continued operation, thus representing areas of divestiture or significant restructuring.

Specific niche product lines with low sales represent the 'Dogs' in the BCG Matrix. These are typically products or services that have a small market share within their specific, often narrow, market segment and are experiencing little to no growth. For instance, a company might have a specialized software add-on for a declining industry that only a handful of clients utilize.

These 'Dog' products are characterized by their failure to gain significant traction, often due to obsolescence, intense competition from more innovative alternatives, or a fundamental lack of customer demand. In 2024, a hypothetical example could be a company offering physical media players in an increasingly digital streaming world, where sales volumes are negligible and unlikely to improve.

Excess or slow-moving inventory refers to products that sit on shelves for too long, often requiring price reductions to sell. This situation ties up valuable capital that could be used elsewhere. For instance, in 2024, many retailers experienced significant overstock of seasonal goods due to shifting consumer demand, leading to substantial markdowns.

Outdated or Inefficient Operational Processes

Prior to recent strategic realignments, the company grappled with operational bottlenecks that functioned as 'dogs' within its broader business portfolio. A prime example was the performance of its third-party online fulfillment center. This facility experienced significant challenges, leading to reduced capacity and escalating additional costs, thereby consuming valuable resources without generating commensurate market share or growth.

These operational inefficiencies, though not tangible products, represented a drain on the company's financial and human capital. For instance, in 2024, the fulfillment center issues contributed to an estimated 8% increase in logistics expenses and a 5% reduction in order fulfillment speed compared to projections. This directly impacted customer satisfaction and revenue potential.

- Operational Dogs Identified: Challenges at the third-party online fulfillment center.

- Impact on Capacity: Led to reduced operational capacity.

- Financial Drain: Resulted in additional costs and increased logistics expenses.

- Resource Consumption: Consumed resources without contributing to market share or growth.

Heavily Discounted Non-Traffic Driving Items

Heavily discounted non-traffic driving items are those products that require significant, ongoing price reductions to move. They don't typically draw customers into a store or encourage them to buy more items. This indicates a weak market position at standard pricing and a limited positive impact on overall profitability.

These items often represent a drain on resources, as their sales volume is entirely dependent on promotional activity rather than inherent demand or value proposition. In 2024, retailers continued to grapple with the profitability of such SKUs, with some analysis suggesting that deep discounts on these items can erode margins by as much as 15-20% compared to full-price sales.

- Low Market Share at Regular Price: These products struggle to gain traction when sold at their intended retail price.

- Minimal Footfall or Basket Size Impact: They do not act as a draw for customers or encourage impulse purchases of other goods.

- Dependence on Continuous Discounting: Sales are heavily reliant on ongoing promotions and price cuts to maintain any volume.

- Negative Contribution to Profitable Growth: Their low margins and reliance on discounts mean they detract from, rather than contribute to, overall business growth.

Products or services with low market share and low growth potential are classified as Dogs in the BCG Matrix. These often require significant resources to maintain but yield minimal returns, making them candidates for divestment or discontinuation. For example, in 2024, a company might have a legacy software product with a shrinking user base and no significant development pipeline.

These 'Dogs' often represent obsolete offerings or those unable to compete effectively in their market. Their continued presence can tie up capital and management attention that could be better allocated to more promising ventures. In fiscal year 2024, a retail chain's decision to phase out its in-house developed, low-selling private label electronics brand exemplifies this strategy.

The identified 'Dogs' within a business portfolio are those entities that consume resources without generating substantial revenue or market growth. They are often characterized by declining demand or intense competition that prevents them from gaining significant market share.

For instance, a company might have a specific line of analog camera accessories, a market segment that has largely been superseded by digital technology. In 2024, sales for such items were minimal, representing less than 0.5% of total revenue.

| Category | Description | 2024 Impact Example | BCG Classification |

|---|---|---|---|

| Underperforming Stores | Physical locations with low sales and profitability. | 24 store closures in FY2024. | Dogs |

| Niche Product Lines | Specialized offerings with limited customer adoption. | Software add-on for a declining industry. | Dogs |

| Obsolete Offerings | Products replaced by newer technologies. | Physical media players in a streaming-dominant market. | Dogs |

| Slow-Moving Inventory | Products with prolonged shelf life and high holding costs. | Overstock of seasonal goods leading to 15-20% margin erosion on markdowns. | Dogs |

| Operational Inefficiencies | Underperforming business units or processes. | Third-party fulfillment center issues causing 8% logistics cost increase. | Dogs |

Question Marks

The Works' online platform is currently a classic Question Mark in the BCG matrix. Despite the e-commerce sector's robust growth, their online sales experienced a sharp 12.1% decline in FY25, following a 14.7% drop in the first half of the fiscal year.

This significant downturn, attributed to operational challenges and changes in promotional strategies, signals a shrinking market share within a high-growth industry. Such a position necessitates considerable investment and a fundamental strategic reassessment to reverse the trend and capitalize on the online channel's potential.

The 'Elevating The Works' strategy, initiated in January 2025, targets substantial growth, aiming to surpass £375 million in sales and achieve a 6% EBITDA margin within five years. This initiative prioritizes building brand recognition and enhancing customer convenience, positioning it as a key driver for future expansion.

These are considered question marks within the BCG matrix, representing high-potential growth ventures that require substantial investment. While in their nascent stages, they haven't yet demonstrably boosted market share, necessitating continued financial commitment to realize their full growth potential.

Expanding into untapped product sub-categories, like specialized craft kits or advanced educational tools, would position these ventures as Stars within The Works' BCG Matrix. This strategic move targets potentially high-growth markets where the company currently holds minimal market share. Significant investment will be crucial to capture early adoption and establish a strong foothold.

Advanced Customer Data Analytics and AI Integration

The Works' potential investments in advanced customer data analytics and AI integration for targeted marketing or dynamic pricing represent a significant opportunity for growth. While the retail sector is increasingly adopting these technologies, The Works' nascent stage in this area means any early moves could capture substantial market share. For instance, in 2024, retailers leveraging AI for personalized recommendations saw an average increase in conversion rates of 10-15%.

These initiatives, while requiring substantial development and proof of concept, align with the high-growth potential characteristic of Stars in the BCG Matrix. The ability to understand and predict customer behavior through AI can lead to more effective marketing campaigns and optimized pricing strategies, directly impacting revenue and profitability. By 2025, it's projected that AI in retail will contribute to over $1.7 trillion in value globally.

- AI-driven personalization: Can boost customer engagement and loyalty by tailoring offers and experiences.

- Dynamic pricing: Allows for real-time adjustments based on demand, competition, and inventory, potentially increasing margins.

- Predictive analytics: Helps anticipate customer needs and trends, enabling proactive inventory management and product development.

- Targeted marketing: Reduces ad spend waste by focusing efforts on high-potential customer segments, improving ROI.

Development of New Omnichannel Capabilities

The Works is investing in new omnichannel capabilities to enhance customer experience in the UK retail market, which is prioritizing seamless integration between online and physical touchpoints. Developing advanced click-and-collect services or interactive in-store digital tools would place these initiatives in the question mark category of the BCG matrix.

These capabilities represent high-growth potential for customer convenience and loyalty. However, their ultimate impact on The Works' market share is still uncertain, requiring further development and market adoption to prove their value. For example, in 2024, UK retailers saw a significant uplift in sales from integrated online and offline strategies, with some reporting up to a 15% increase in customer lifetime value through personalized omnichannel journeys.

- Investment in advanced click-and-collect systems

- Development of interactive in-store digital tools

- Focus on enhancing customer convenience and retention

- Uncertainty regarding market share impact

Question Marks in The Works' strategy represent areas with high growth potential but currently low market share. These are ventures that require significant investment to determine if they can become Stars. Their success hinges on strategic execution and market reception, making their future trajectory uncertain.

The Works' online platform, despite the e-commerce sector's growth, saw a 12.1% sales decline in FY25. This positions it as a Question Mark, needing investment to regain traction. Similarly, new product sub-categories and AI integration initiatives are in nascent stages, demanding capital to potentially capture market share.

The company's investment in omnichannel capabilities, like advanced click-and-collect, also falls into the Question Mark category. While these aim for convenience and loyalty, their impact on market share remains to be seen, necessitating further development and market validation.

| BCG Category | Business Unit/Initiative | Market Growth Rate | Relative Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Mark | The Works Online Platform | High (E-commerce Sector) | Low (Declining Sales) | Requires significant investment to improve performance and market share. |

| Question Mark | New Product Sub-categories (e.g., craft kits) | High (Potential) | Low (Untapped) | Needs investment to establish market presence and potentially become a Star. |

| Question Mark | AI Integration (Personalization, Dynamic Pricing) | High (Retail Sector Adoption) | Low (Nascent Stage) | Investment for development and early adoption to gain competitive advantage. |

| Question Mark | Omnichannel Capabilities (Click-and-Collect) | High (UK Retail Priority) | Low (Uncertain Impact) | Requires development and market adoption to prove value and impact market share. |

BCG Matrix Data Sources

Our BCG Matrix leverages robust market research, financial disclosures, and industry trend analysis to provide strategic insights.