Thai Beverage SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Thai Beverage Bundle

Thai Beverage, a dominant force in Southeast Asia's beverage market, boasts significant strengths in its brand portfolio and extensive distribution network, yet faces potential threats from evolving consumer preferences and intense competition. Understanding these dynamics is crucial for navigating its future growth.

Want the full story behind Thai Beverage's market position, including its key opportunities and potential weaknesses? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Thai Beverage commands a formidable market presence across Southeast Asia. In Thailand, it holds an impressive 80-90% share of the spirits market, underscoring its dominance. This leadership extends to Vietnam, where it is the leading beer producer through its stake in SABECO.

This strong market position across spirits, beer, non-alcoholic beverages, and food segments creates a resilient business model. It significantly reduces the company's dependence on any single product category, offering stability and diversified revenue streams.

Thai Beverage operates an extensive distribution network within Thailand, reaching over 500,000 points of sale. This robust infrastructure is a significant asset, ensuring widespread product availability and strong market penetration across the country.

Beyond Thailand, the company has successfully expanded its distribution capabilities throughout the ASEAN region, including key markets like Vietnam and Myanmar. Its international presence also extends to countries such as Scotland, France, New Zealand, and China, demonstrating a broad geographical footprint and established logistics for global reach.

Thai Beverage is strategically investing in growth, allocating THB18 billion for fiscal year 2025 to bolster all its product categories. This substantial investment underscores a commitment to expanding its market presence and operational capabilities.

Key initiatives include the development of the AgriValley dairy farm in Malaysia, a move designed to secure a stable supply of high-quality raw materials. Simultaneously, a new beer factory is being established in Cambodia, signaling a clear intent to tap into the growing consumer demand in this region.

These projects are indicative of Thai Beverage's proactive approach to identifying and capitalizing on emerging market opportunities. By investing in infrastructure and supply chain enhancements, the company is positioning itself for sustained growth and increased competitiveness in the beverage industry.

Commitment to Sustainability and Innovation

ThaiBev's dedication to sustainability is a significant strength, with a clear target of achieving net-zero greenhouse gas emissions by 2040. This commitment is backed by a strategic push to increase renewable energy usage across its operations, aiming for 50% by 2030, demonstrating a proactive approach to environmental stewardship.

Furthermore, the company is actively investing in product innovation, particularly in categories that cater to growing consumer demand for healthier options. This includes a focus on beverages with reduced sugar content and those that promote well-being, positioning ThaiBev to capitalize on evolving market trends and ensure sustained growth.

- Net-Zero Target: Aiming for net-zero emissions by 2040.

- Renewable Energy Goal: Targeting 50% renewable energy usage by 2030.

- Product Innovation Focus: Developing health-conscious and low/no-sugar beverages.

Strong Brand Equity and Vertical Integration

ThaiBev's portfolio boasts highly recognizable brands such as Chang beer, Ruang Khao spirits, and Oishi ready-to-drink beverages, fostering significant consumer loyalty and market penetration. This strong brand equity is a cornerstone of its competitive strength.

The company's commitment to vertical integration, encompassing everything from raw material sourcing to sophisticated packaging solutions, significantly bolsters operational efficiency. This integration also extends to its substantial investment in F&N, a diversified regional player, further solidifying its market position and cost control capabilities.

ThaiBev's strategic advantage is amplified by its control over key aspects of the value chain. For instance, its ownership of packaging facilities directly impacts production costs and supply chain reliability, contributing to a healthier profit margin and a more resilient business model.

In 2023, ThaiBev reported impressive revenue figures, with its spirits segment alone generating approximately THB 108 billion, underscoring the power of its established brands and integrated operations.

Thai Beverage's market dominance is a key strength, holding an 80-90% share in Thailand's spirits market and leading beer production in Vietnam via SABECO. This broad market penetration across spirits, beer, and non-alcoholic beverages creates a stable, diversified revenue base. Its extensive distribution network, reaching over 500,000 points of sale in Thailand and expanding across ASEAN, ensures strong product availability and market access.

The company's robust brand portfolio, featuring names like Chang beer and Oishi, fosters significant consumer loyalty and market penetration. Vertical integration, from raw material sourcing to packaging, enhances operational efficiency and cost control, as evidenced by its spirits segment generating approximately THB 108 billion in 2023.

ThaiBev's strategic investments, including THB18 billion allocated for fiscal year 2025, signal a commitment to growth and market expansion. Initiatives like the AgriValley dairy farm and a new beer factory in Cambodia demonstrate a proactive approach to capitalizing on emerging opportunities and securing supply chains.

What is included in the product

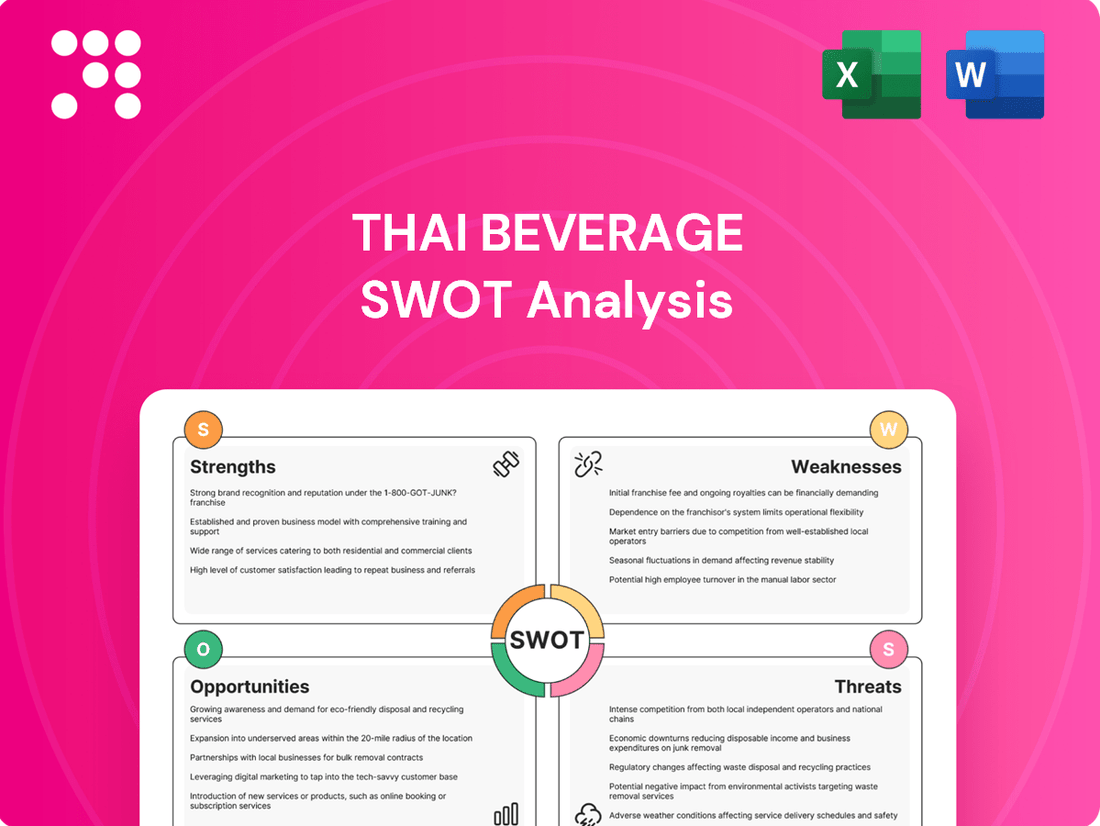

This SWOT analysis highlights Thai Beverage's strong brand portfolio and market leadership in Southeast Asia, while also identifying challenges such as intense competition and evolving consumer preferences.

Offers a clear breakdown of Thai Beverage's Strengths, Weaknesses, Opportunities, and Threats, simplifying complex strategic challenges for focused action.

Weaknesses

Thai Beverage's spirits and food segments are facing profitability headwinds. In the first half of fiscal year 2025, the spirits business saw its net profit drop by 10.3%, while the food segment experienced a more significant decline of 61%. This suggests that rising costs for raw materials and labor, coupled with increased marketing investments, are impacting the bottom line in these crucial areas.

Thai Beverage operates under the shadow of increasing regulatory scrutiny, notably concerning excise taxes. Thailand is progressively raising its excise tax on alcoholic beverages, aiming for a rate that could approach 90% by 2031. Similarly, Vietnam is on a path to increase its excise tax on alcohol to 100% by 2030.

These escalating tax burdens directly threaten Thai Beverage's profitability and sales volumes, especially within its core alcoholic beverage divisions. Furthermore, the implementation of stricter drink-driving laws across key markets adds another layer of regulatory risk, potentially dampening consumer demand for alcoholic products.

ThaiBev faces intense competition across its key segments, with both new entrants and established players employing aggressive promotional strategies. This dynamic is putting significant pressure on profit margins, particularly within the spirits and beer categories. For instance, in 2024, the beverage market saw a notable increase in promotional activities, with companies offering discounts and bundle deals to capture market share, directly impacting ThaiBev's ability to maintain strong margins.

The need to constantly invest in marketing campaigns and develop new products to stay ahead of rivals adds another layer of challenge. This continuous expenditure, while necessary for brand relevance and growth, can strain profitability, especially when faced with price wars initiated by competitors. In 2025, projections indicate that marketing spend in the Southeast Asian beverage sector is expected to rise by an average of 7-10% year-on-year, a trend that ThaiBev must navigate carefully.

Market Maturity in Core Alcohol Segments

Thai Beverage faces a significant hurdle in its core alcohol segments due to market maturity. Per capita alcohol consumption in key markets like Thailand and Vietnam is already quite high, reaching approximately 9.2 liters per person annually in Thailand and around 7.8 liters in Vietnam as of recent estimates. This saturation limits the potential for substantial organic volume expansion within these established territories.

Consequently, ThaiBev's ability to achieve significant growth from its existing alcohol businesses in Thailand and Vietnam is constrained. The company's reliance on these mature markets means that future volume increases are likely to be incremental rather than transformative. This situation necessitates a strategic focus on other avenues for growth to drive overall company performance.

- Market Saturation: High per capita alcohol consumption in Thailand and Vietnam restricts organic volume growth.

- Limited Upside: Established markets offer minimal room for significant expansion in core alcohol segments.

- Strategic Imperative: ThaiBev must explore new markets or product categories to overcome growth limitations.

Vulnerability to Macroeconomic Headwinds and Input Costs

Thai Beverage's profitability is significantly influenced by broader economic conditions. For instance, a downturn in agricultural sectors, which impacts farmer incomes, can lead to reduced consumer spending on discretionary items like beverages. This sensitivity to macroeconomic softness directly affects sales volumes.

Furthermore, the company faces challenges from fluctuating input costs. The prices of key raw materials such as molasses and packaging materials can increase unexpectedly. In 2024, for example, global supply chain disruptions and geopolitical events have put upward pressure on commodity prices, including those relevant to beverage production, directly impacting Thai Beverage's cost of goods sold.

These rising input costs, coupled with potential softening consumer demand due to economic headwinds, create a dual challenge for Thai Beverage. They can squeeze profit margins by increasing production expenses while simultaneously limiting the company's ability to pass these costs onto consumers through higher prices, thereby affecting overall financial performance.

- Macroeconomic Sensitivity: Weak farmer incomes in 2024, a significant demographic for consumer spending, directly dampened demand for Thai Beverage's products.

- Rising Input Costs: Molasses prices saw an approximate 15% increase in early 2024 compared to the previous year, impacting production costs.

- Packaging Expenses: The cost of key packaging materials, like aluminum cans, rose by an estimated 8% in the first half of 2024 due to global supply chain pressures.

Thai Beverage's profitability faces pressure from rising operational expenses. In the first half of fiscal year 2025, the spirits segment's net profit declined by 10.3%, and the food segment saw a substantial 61% drop, indicating that increased costs for raw materials, labor, and marketing are impacting these key areas.

The company is also subject to significant regulatory risks, particularly concerning excise taxes. Thailand plans to increase its excise tax on alcoholic beverages to nearly 90% by 2031, and Vietnam aims for a 100% tax by 2030. These hikes directly threaten profitability and sales volumes, compounded by stricter drink-driving laws that could curb consumer demand.

Intense competition across its beverage segments, driven by aggressive promotional strategies from both new and established players, is squeezing profit margins. For example, increased discounting in 2024 has put pressure on ThaiBev's ability to maintain strong margins, necessitating higher marketing investments, projected to rise 7-10% year-on-year in Southeast Asia for 2025.

Market saturation in core alcohol segments, with high per capita consumption in Thailand (9.2 liters annually) and Vietnam (7.8 liters annually), limits organic volume growth potential. This necessitates a strategic pivot towards new markets or product categories to drive future expansion.

ThaiBev's financial performance is highly sensitive to macroeconomic shifts, with reduced farmer incomes impacting discretionary spending on beverages. Fluctuations in input costs, such as a 15% rise in molasses prices in early 2024 and an 8% increase in aluminum can costs due to supply chain issues, further challenge profit margins by increasing production expenses without the ability to fully pass these on to consumers.

Preview Before You Purchase

Thai Beverage SWOT Analysis

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Thai Beverage SWOT Analysis, offering a comprehensive view of its Strengths, Weaknesses, Opportunities, and Threats.

You’re viewing a live preview of the actual SWOT analysis file for Thai Beverage. The complete version, detailing key strategic factors, becomes available after checkout, providing actionable insights.

The file shown below is not a sample—it’s the real Thai Beverage SWOT analysis you'll download post-purchase, in full detail, ready for your strategic planning needs.

Opportunities

ThaiBev's 'Passion 2030' strategy is a clear roadmap for expanding its reach beyond Thailand, with a keen eye on high-growth markets in the ASEAN region and beyond. Indonesia, for instance, is flagged as a particularly attractive opportunity for future business development.

To capitalize on this, ThaiBev is making strategic investments in new facilities. For example, a new beer factory is being established in Cambodia, and the company has also invested in the AgriValley dairy farm in Malaysia. These moves are designed to tap into the increasing consumer demand for beverages and dairy products across these burgeoning regional economies.

The non-alcoholic beverage market is a strong growth area for ThaiBev. In 2025, the company plans to launch new health-focused products under its F&N Nutriwell brand, tapping into increasing consumer demand for wellness options.

This strategic move aligns with global trends showing a significant shift towards healthier lifestyles. For instance, the global functional beverages market was valued at over $120 billion in 2023 and is projected to grow substantially in the coming years, presenting a prime opportunity for ThaiBev to expand its market share in this lucrative segment.

ThaiBev sees digital transformation as a key growth avenue, aiming to boost its digital platforms to better serve customers and strengthen ties with its supply chain. This focus on e-commerce and digital marketing is expected to broaden its customer base and streamline operations.

The company's commitment to digital solutions is evident in its ongoing investments. For instance, in 2023, ThaiBev continued to expand its online presence, with a significant portion of its sales now originating from digital channels, reflecting a growing consumer shift towards online purchasing for beverages.

Potential Value Unlocking Through IPOs

The planned initial public offerings (IPOs) for BeerCo and F&B Co are poised to be major drivers for unlocking Thai Beverage's hidden value. These strategic spin-offs are designed to allow ThaiBev to reduce its debt burden and sharpen its focus on core business areas.

These upcoming IPOs are expected to draw in new pools of capital, providing much-needed funding for future expansion and development projects. For instance, BeerCo's IPO was anticipated to raise approximately $1 billion, according to reports in early 2024, which would significantly bolster ThaiBev's financial flexibility.

- IPO Catalysts: BeerCo and F&B Co IPOs are key to unlocking shareholder value.

- Deleveraging and Focus: Spin-offs will help ThaiBev reduce debt and concentrate on strategic priorities.

- Capital Infusion: New investments attracted by the IPOs will fuel growth initiatives.

- Market Expectations: BeerCo's IPO alone was projected to raise around $1 billion in early 2024, demonstrating significant potential.

Premiumization and Product Innovation

ThaiBev is strategically focusing on premiumization within its beverage offerings, evidenced by the introduction of products like Chang Cold Brew and a growing range of upscale spirits. This move aims to capture evolving consumer preferences for higher-quality and differentiated alcoholic drinks.

This premiumization strategy is crucial for enhancing profitability. For instance, in the first half of fiscal year 2024, ThaiBev reported a 5.3% year-on-year increase in net profit to THB 13.8 billion, partly driven by a stronger performance in its non-beer segments which often include premium spirits.

- Targeting Premium Segments: ThaiBev is actively developing and marketing higher-priced alcoholic beverages to appeal to a more discerning customer base.

- Product Innovation: The company is launching new and improved products, such as Chang Cold Brew, to meet changing consumer demands for variety and quality.

- Margin Improvement: By shifting focus towards premium products, ThaiBev aims to achieve better profit margins compared to its standard offerings.

- Market Responsiveness: This strategy allows ThaiBev to adapt to market trends and capitalize on the growing demand for craft and premium alcoholic beverages.

ThaiBev's strategic expansion into high-growth ASEAN markets, particularly Indonesia, presents a significant opportunity for increased market penetration and revenue generation.

The company's focus on the non-alcoholic beverage sector, with planned launches of health-focused products under the F&N Nutriwell brand in 2025, aligns with the global trend towards wellness, a market valued at over $120 billion in 2023.

Digital transformation initiatives, including enhanced e-commerce platforms, are expected to broaden ThaiBev's customer base and improve operational efficiency, with digital channels contributing significantly to sales in 2023.

The planned IPOs for BeerCo and F&B Co are anticipated to unlock substantial shareholder value, with BeerCo's IPO alone projected to raise approximately $1 billion in early 2024, providing crucial capital for future growth.

Threats

ThaiBev faces a significant threat from the ongoing increases in excise taxes on alcoholic beverages, particularly in its major markets of Thailand and Vietnam. For instance, Thailand's excise tax structure has seen adjustments that can impact pricing and consumer affordability.

Furthermore, the tightening of regulations surrounding alcohol sales, including restrictions on operating hours and more stringent drink-driving laws, directly curtails opportunities for consumption and can increase compliance costs for ThaiBev's operations.

These policy shifts can lead to reduced sales volumes and a direct impact on the profitability of ThaiBev's core alcoholic beverage business, as higher taxes and operational constraints squeeze margins.

The increasing global focus on health and wellness, especially among millennials and Gen Z, presents a significant threat to ThaiBev. This demographic shift, favoring healthier lifestyles and reduced alcohol intake, directly challenges the demand for traditional alcoholic beverages, which form a core part of ThaiBev's offerings.

Adapting its extensive product portfolio to align with these evolving consumer preferences is a complex undertaking for ThaiBev, given its deeply rooted legacy in the alcoholic beverage sector. For instance, while the global non-alcoholic beverage market is projected to reach USD 1.7 trillion by 2027, a substantial portion of ThaiBev's 2023 revenue still stemmed from its beer and spirits segments.

ThaiBev operates in a highly competitive landscape, facing pressure from global beverage titans and nimble local competitors in every product category. This intense rivalry, exacerbated by new market entrants and aggressive promotional activities, can trigger price wars, erode market share, and escalate marketing costs, ultimately impacting profitability. For instance, in the beer segment, ThaiBev competes directly with global brands like Heineken and Carlsberg, alongside strong local players, forcing continuous investment in brand building and distribution to maintain its leading position.

Economic Downturns and Impact on Consumer Spending

Macroeconomic softness, including challenges like weak farmer incomes and a tough restaurant sector, directly curtails consumer purchasing power. This economic pressure can lead to reduced discretionary spending on non-essential items like beverages and food, impacting ThaiBev's sales volumes and overall revenue.

For instance, Thailand's economic growth forecast for 2024 has been revised by some institutions, highlighting potential headwinds. A slowdown in consumer spending, particularly in the food and beverage sector, poses a significant threat to ThaiBev's top-line performance.

- Reduced Discretionary Spending: Consumers may cut back on purchases of beverages and food products as their disposable income shrinks due to economic pressures.

- Lower Sales Volumes: A decline in consumer spending directly translates to fewer units sold for ThaiBev's diverse product portfolio.

- Impact on Profitability: Reduced sales volumes, coupled with potentially higher input costs, can squeeze profit margins for the company.

Supply Chain Disruptions and Volatility in Raw Material Costs

Thai Beverage faces significant risks from disruptions within its supply chain and fluctuating costs for essential raw materials. This vulnerability impacts everything from molasses, a key ingredient, to packaging and labor expenses. For instance, global shipping delays and geopolitical events can directly impede the flow of necessary inputs, as seen with various industries experiencing port congestion in late 2024.

The volatility in raw material prices directly squeezes profit margins. When the cost of molasses or aluminum for cans rises sharply, as it has periodically in 2024 due to energy prices and demand surges, Thai Beverage's production expenses increase. This can force the company to absorb higher costs, potentially reducing profitability, or pass them onto consumers, risking sales volume.

- Molasses Price Fluctuations: Global sugar production yields and international trade policies directly influence molasses prices, a critical input for spirits production. For example, a poor sugar harvest in a major producing region during 2024 could lead to a significant price increase for molasses.

- Packaging Cost Increases: The cost of aluminum for beverage cans and PET for bottles is tied to global commodity markets. Rising energy costs and increased demand for packaging materials in 2024 have put upward pressure on these prices.

- Labor Cost Pressures: Minimum wage adjustments and competition for skilled labor in Southeast Asia can lead to higher operational costs for Thai Beverage.

- Logistics and Shipping Volatility: Disruptions in global shipping routes, port congestion, and fluctuating freight rates, which were a persistent issue through 2024, can delay the delivery of raw materials and finished goods, impacting inventory management and product availability.

ThaiBev faces significant headwinds from evolving consumer preferences towards health and wellness, particularly among younger demographics who are reducing alcohol consumption. This trend directly challenges ThaiBev's core alcoholic beverage business, even as the non-alcoholic market expands. Intense competition from global and local players further pressures market share and necessitates increased marketing expenditure, impacting profitability.

SWOT Analysis Data Sources

This Thai Beverage SWOT analysis is built upon a robust foundation of publicly available financial statements, comprehensive market research reports, and expert industry analyses to ensure a well-informed and accurate strategic assessment.