Thai Beverage Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Thai Beverage Bundle

Thai Beverage masterfully crafts its product portfolio, from iconic beers to diverse spirits, ensuring broad appeal. Their pricing strategies are finely tuned to market segments, offering value across various consumer levels. Discover how their extensive distribution network ensures widespread availability and how their promotional campaigns resonate with cultural nuances.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Thai Beverage's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Thai Beverage boasts an extensive product range, encompassing both alcoholic and non-alcoholic drinks. Their alcoholic offerings include well-known beer brands like Chang, along with a variety of spirits. In the non-alcoholic sector, they provide popular ready-to-drink teas, coffees, and water, effectively catering to a wide spectrum of consumer tastes and consumption occasions.

The company's strategic focus for 2025 involves a deliberate expansion into the mass premium market segment. This initiative includes the introduction of new products designed to align with shifting consumer preferences and market trends. Key additions to their portfolio in this category are expected to be Chang Cold Brew, Federbräu, and Chang Unpasteurized, signaling a move towards more sophisticated and differentiated offerings.

ThaiBev is strategically expanding its product offerings by targeting the mass premium segment within its beer portfolio. New introductions like Chang Cold Brew and Chang Unpasteurized are designed to capture the burgeoning mainstream plus market, a segment anticipated to experience significant double-digit growth in the coming years.

In parallel, the company is making a concerted push into the non-alcoholic beverage sector with a focus on health-conscious consumers. By introducing health-focused products under the F&N Nutriwell brand in 2025, ThaiBev aims to capitalize on the increasing consumer demand for healthier alternatives and functional beverages.

Thai Beverage’s strategic expansion into the food sector, notably with quick-service restaurants like KFC and Oishi, diversifies its revenue streams beyond beverages. This integration is a key element of their growth strategy, allowing them to capture a broader market share.

The company is set to invest heavily in 2025, planning to launch 69 new restaurant outlets. This aggressive expansion targets primarily their established brands, KFC and Oishi, with a clear objective of reaching a total of 1,200 branches by the year 2030.

This expansion into food services facilitates powerful cross-promotional opportunities, leveraging Thai Beverage’s established brand recognition and distribution networks. It also allows for synergistic benefits, such as bundled offers between beverage and food products, enhancing customer value and driving sales.

Innovation and Quality Assurance

Thai Beverage places a strong emphasis on innovation to enhance product accessibility and consumer experience. A prime example is the introduction of Chang Unpasteurized beer in a convenient screw-top aluminum bottle, making it easier for consumers to enjoy. This innovation is supported by a robust cold-chain network, ensuring the beer's quality from production to consumption.

Quality assurance is paramount for ThaiBev, reflected in its stringent certifications. Their non-alcoholic beverage and dairy plants have achieved halal certification, catering to a significant consumer segment. Furthermore, all drinking water products meet the high standards of the National Sanitation Foundation (NSF), underscoring a commitment to safety and quality across their diverse product portfolio.

- Chang Unpasteurized Beer: Launched in a new screw-top aluminum bottle for enhanced accessibility.

- Cold-Chain Network: Implemented to maintain product quality, particularly for the unpasteurized beer.

- Halal Certification: Awarded to non-alcoholic beverage and dairy plants, broadening market reach.

- NSF Certification: Achieved for all drinking water products, guaranteeing high safety and quality standards.

Strategic Dairy ion Investment

Thai Beverage's strategic dairy investment, particularly the 8-billion-baht Agri Valley Farm project in Malaysia, is a pivotal move within its product strategy. This initiative is designed to tap into the burgeoning demand for milk across the ASEAN region, a market projected for significant expansion in the coming years. The company is positioning itself to capture a substantial share of this growth.

This venture is more than just an expansion; it's a diversification play aimed at bolstering the non-alcoholic beverage segment. ThaiBev anticipates this dairy focus will drive double-digit annual growth, leveraging the inherently higher profit margins found in dairy products compared to other beverage categories. This financial foresight underpins the strategic importance of this investment.

Key aspects of this strategic dairy initiative include:

- Agri Valley Farm Project: An 8-billion-baht investment in Malaysia for large-scale dairy production.

- Market Focus: Targeting the increasing demand for milk products throughout the ASEAN region.

- Growth Objective: Aiming for double-digit annual growth in the non-alcoholic beverage segment.

- Profitability Strategy: Capitalizing on the strong profit margins characteristic of the regional dairy market.

Thai Beverage's product strategy for 2024-2025 centers on expanding its reach into the mass premium segment, notably with new beer offerings like Chang Cold Brew and Chang Unpasteurized. They are also strengthening their non-alcoholic portfolio by focusing on health-conscious options under the F&N Nutriwell brand and investing in dairy production through the Agri Valley Farm project in Malaysia to capitalize on ASEAN's growing milk demand.

| Product Category | Key Brands/Initiatives | 2025 Strategic Focus | Key Differentiators/Facts |

|---|---|---|---|

| Alcoholic Beverages | Chang, Federbräu, Mekhong | Mass premium expansion (Chang Cold Brew, Federbräu, Chang Unpasteurized) | Chang Unpasteurized in screw-top aluminum bottles; cold-chain network for quality. |

| Non-Alcoholic Beverages | Oishi, est Cola, F&N Nutriwell | Health-conscious products (F&N Nutriwell), dairy expansion | Agri Valley Farm project (MYR 8 billion investment); targeting double-digit growth in non-alcoholic segment. |

| Food Services | KFC, Oishi | Aggressive outlet expansion | Plan to launch 69 new outlets in 2025, aiming for 1,200 branches by 2030. |

What is included in the product

This analysis delves into Thai Beverage's robust 4Ps marketing mix, examining their diverse product portfolio, strategic pricing across segments, extensive distribution network, and impactful promotional campaigns to understand their market dominance.

Simplifies complex Thai Beverage marketing strategies into actionable 4P insights, alleviating the pain of understanding their market approach.

Provides a clear, concise overview of Thai Beverage's 4Ps, easing the burden of deciphering their competitive positioning.

Place

Thai Beverage boasts an extensive domestic distribution network, reaching every province in Thailand through its dedicated sales offices. This robust infrastructure ensures their wide array of products are readily available to consumers nationwide.

The company's direct sales force cultivates strong relationships with retailers, actively supporting product placement and pricing strategies. This hands-on approach is crucial for maintaining shelf presence and driving sales for their diverse beverage portfolio, from beer to spirits and non-alcoholic options.

In 2023, Thai Beverage's sales volume reached approximately 3.5 billion liters, a testament to the effectiveness of its broad distribution reach and in-store execution. This extensive network is a cornerstone of their market leadership.

ThaiBev is actively expanding its footprint across the ASEAN region, identifying Malaysia, Vietnam, and Myanmar as key growth areas for its non-alcoholic beverage portfolio. This strategic focus aims to leverage the increasing consumer demand in these dynamic markets.

Further demonstrating its commitment to regional expansion, ThaiBev is investing approximately 3 billion baht to construct a new beer manufacturing facility in Cambodia. This investment is designed to bolster the company's production capacity and enhance its distribution network throughout Southeast Asia.

ThaiBev is strategically enhancing its reach through modern trade and convenience channels, a key element of its marketing strategy. This includes collaborations with major supermarket chains such as Tesco and Asda, broadening product availability. For instance, the successful nationwide rollout of Chang Unpasteurized beer in 7-Eleven stores, facilitated by an advanced cold-chain network, highlights this commitment to accessible distribution.

Digital Transformation for Enhanced Reach

ThaiBev's 'Passion 2030' strategy heavily emphasizes 'Digital for Growth,' aiming to boost efficiency, effectiveness, and consumer insights. This digital push is crucial for strengthening connections with both consumers and business partners.

A key initiative is the expansion of online B2C channels, exemplified by Sermsuk Click for non-alcoholic beverages. This platform's presence across multiple online marketplaces has yielded significant results.

In 2024, Sermsuk Click experienced a remarkable 380% growth, underscoring the success of ThaiBev's digital transformation in reaching a wider audience and driving sales.

- Digital for Growth: Central to 'Passion 2030' for efficiency and consumer engagement.

- Sermsuk Click: Launched B2C online channel for non-alcoholic beverages.

- Marketplace Presence: Active on multiple online platforms to maximize reach.

- 2024 Performance: Achieved 380% growth, demonstrating strong digital adoption and sales.

Strategic Acquisitions for Distribution Synergy

ThaiBev's strategic acquisitions, such as its investment in BevFood Holdings in Cambodia, are crucial for enhancing its distribution capabilities. This move allows ThaiBev to leverage and broaden its existing sales and distribution channels, reaching more consumers in important growth markets.

These acquisitions are designed to create significant distribution synergies, enabling ThaiBev to more effectively place its diverse product portfolio within these expanding economies. By integrating these operations, ThaiBev solidifies its regional presence and market penetration.

- Acquisition of BevFood Holdings: This Cambodian venture provides a robust platform for ThaiBev's products.

- Distribution Network Expansion: The move aims to utilize and grow the sales and distribution infrastructure in key Southeast Asian markets.

- Market Foothold: Such strategic moves strengthen ThaiBev's competitive position and market share in the region.

- Synergy Realization: Focus is on creating operational efficiencies and increased market access through complementary businesses.

ThaiBev's Place strategy is built on a pervasive domestic distribution network reaching every Thai province, supported by a direct sales force that actively manages retail relationships and product placement. This extensive reach is further amplified by strategic regional expansion, notably with a new beer facility in Cambodia, and a strong push into modern trade and digital channels.

The company's digital transformation, embodied by 'Digital for Growth' and the success of Sermsuk Click, which saw 380% growth in 2024, is crucial for enhancing consumer and partner engagement. Strategic acquisitions, like BevFood Holdings in Cambodia, bolster distribution synergies and market penetration across Southeast Asia.

| Distribution Channel | Key Initiatives/Examples | 2023/2024 Impact |

| Domestic Network | Sales offices nationwide, direct sales force | 3.5 billion liters sales volume (2023) |

| Modern Trade/Convenience | 7-Eleven rollout (Chang Unpasteurized), Tesco/Asda collaborations | Enhanced product accessibility |

| Digital Channels | Sermsuk Click (B2C), online marketplaces | 380% growth for Sermsuk Click (2024) |

| Regional Expansion | Investment in Cambodia facility, focus on ASEAN markets | Strengthening regional production and distribution |

What You See Is What You Get

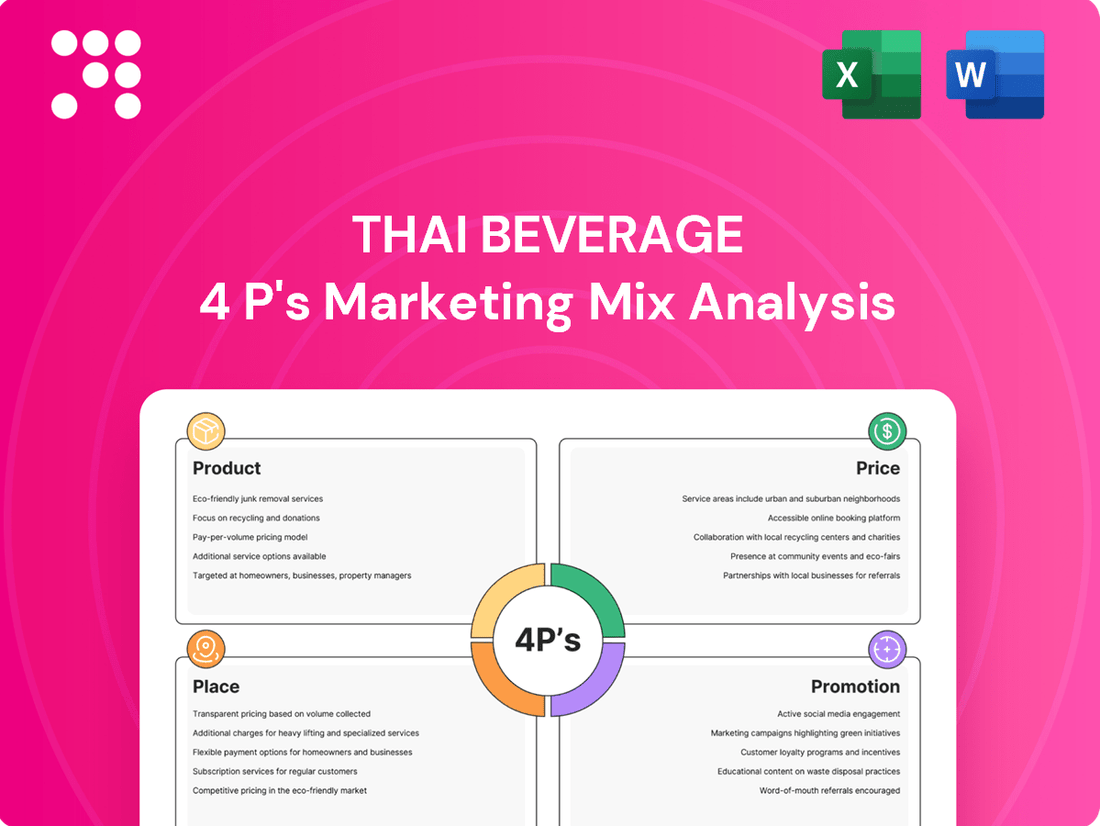

Thai Beverage 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Thai Beverage 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail, offering a complete picture of their strategy.

You're viewing the exact version of the analysis you'll receive—fully complete, ready to use. This includes in-depth insights into Thai Beverage's product portfolio, pricing strategies, distribution channels, and promotional activities.

This isn’t a teaser or a sample—it’s the actual content you’ll receive when you complete your order. Gain immediate access to the full Thai Beverage 4P's Marketing Mix Analysis to understand their market approach.

Promotion

Thai Beverage is actively pursuing aggressive marketing to solidify its brand leadership, especially within its beer segment. A prime example is Chang Beer's ambition to capture the top spot in the Thai market, driven by significant investment in innovative promotional activities and technology.

Thai Beverage effectively utilizes event-led campaigns and sponsorships to boost brand visibility. Chang Beer's involvement in events like ARTBOX Singapore 2025 and Sentosa GrillFest 2024, alongside its ongoing partnership with Everton FC, demonstrates a strategic approach to reaching diverse consumer segments.

Thai Beverage is significantly boosting its digital and social media presence. The company is increasing its digital advertising spend, recognizing that non-alcoholic beverages are a top-five industry for digital ad spending in Thailand, with a projected 10% growth in 2025.

The company actively uses platforms like TikTok, evidenced by its Hong Thong brand's success, which secured a 'Best Branding Campaign' award for its viral marketing efforts. This demonstrates ThaiBev's commitment to leveraging social media for brand building and customer connection.

Furthermore, ThaiBev employs LINE Official Account 'Chang Family' as a crucial tool for direct engagement with both consumers and business partners, facilitating communication and relationship management.

Public Relations and Sustainability Communications

Thai Beverage prioritizes public relations and sustainability communications to enhance its brand image. A key strategy involves participating in significant industry events, such as the FTI EXPO 2025, to demonstrate its commitment to environmental, social, and governance (ESG) principles. This proactive engagement highlights initiatives like advanced water management systems and the development of healthier beverage options, directly addressing consumer interest in responsible corporate practices.

These public relations efforts are crucial for building trust and loyalty. For instance, ThaiBev's focus on ESG performance, including its 2024 sustainability report which detailed a 15% reduction in water intensity across its operations compared to 2020, directly appeals to a growing segment of consumers who prioritize ethical and environmentally sound brands. This transparent communication fosters a positive perception and reinforces the company's dedication to long-term value creation.

The company's communication strategy also emphasizes innovation, particularly in health and wellness. By showcasing its progress in developing beverages that cater to evolving consumer health preferences, ThaiBev positions itself as a forward-thinking organization. This aligns with broader market trends and strengthens its competitive advantage by meeting demand for healthier product alternatives.

Key aspects of ThaiBev's Public Relations and Sustainability Communications include:

- Showcasing ESG performance: Actively communicating progress on environmental, social, and governance goals.

- Participation in industry events: Engaging in expos like FTI EXPO 2025 to highlight initiatives.

- Focus on water management: Demonstrating commitment to responsible resource utilization, with a reported 15% reduction in water intensity by 2024.

- Health-focused innovation: Promoting the development of healthier beverage options to meet consumer demand.

On-Pack s and Trade Marketing

Thai Beverage goes beyond general advertising by implementing specific sales promotions. Global on-pack promotions are a key strategy, often tied to major sponsorships, to encourage consumers to buy their products. For instance, in 2024, their Chang beer brand continued its strong association with Thai sports, including football, which often features on-pack elements.

The company also actively supports trade marketing efforts. This includes providing point-of-sale (POS) tools and programs for retailers. These initiatives aim to enhance how products are displayed in stores and improve inventory management, ultimately boosting sales and profitability for store owners. In 2024, ThaiBev reported significant growth in its sales channels, partly attributed to these trade marketing enhancements.

- On-Pack Promotions: Global campaigns leveraging sponsorships to drive immediate purchase decisions.

- Trade Marketing Support: Providing POS tools and programs to retailers for better merchandising and stock management.

- Sales Profitability: Initiatives designed to increase sales volume and improve profit margins for retail partners.

Thai Beverage's promotional strategy is multifaceted, aiming to build brand equity and drive sales across its diverse portfolio. Their approach integrates digital engagement, event sponsorships, and direct consumer interaction to create a strong brand presence. For example, the company's increased digital ad spend, targeting a projected 10% growth in non-alcoholic beverage digital ad spending in Thailand for 2025, underscores their commitment to online visibility.

The company leverages sponsorships and event participation to connect with consumers, as seen with Chang Beer's involvement in events like ARTBOX Singapore 2025 and its ongoing partnership with Everton FC. This multi-channel approach ensures broad reach and reinforces brand recall.

Furthermore, ThaiBev emphasizes public relations and sustainability communications, with a reported 15% reduction in water intensity by 2024, to build trust and appeal to socially conscious consumers. Their focus on ESG performance and healthier product innovation positions them as a responsible and forward-thinking company.

Thai Beverage also employs targeted sales promotions, including on-pack offers tied to sponsorships and robust trade marketing support for retailers, aiming to boost sales volume and partner profitability.

| Promotional Activity | Key Initiatives | Impact/Goal |

|---|---|---|

| Digital Marketing | Increased digital ad spend, TikTok campaigns | Enhanced brand visibility, customer connection |

| Event Sponsorships | ARTBOX Singapore 2025, Everton FC partnership | Brand awareness, diverse consumer reach |

| Public Relations & Sustainability | ESG reporting, water intensity reduction (15% by 2024) | Brand image enhancement, consumer trust |

| Sales Promotions | On-pack offers, trade marketing support | Sales volume increase, retailer profitability |

Price

Thai Beverage utilizes a dynamic pricing approach, segmenting its offerings to capture different consumer bases. Chang Beer, for example, is strategically moving into the mass premium category while keeping its mainstream pricing highly competitive. This allows them to appeal to a broader range of consumers.

In Vietnam, ThaiBev's subsidiary SABECO leverages its Saigon brand with aggressive pricing, often 20% to 30% lower than competitors. This tactic capitalizes on economic shifts and consumer preferences for value, particularly during periods of downtrading, boosting market share.

Thai Beverage, through its subsidiary SABECO in Vietnam, is actively adjusting its pricing strategy. In anticipation of upcoming excise tax changes, SABECO is planning a modest 2% price increase. This move is designed to gradually transfer the majority of the new tax burden to consumers, a common tactic to maintain profitability amidst evolving regulatory landscapes.

Thai Beverage's pricing strategy is a direct reflection of how consumers perceive the value and quality of its diverse product portfolio. For instance, premium products such as Chang Cold Brew and unpasteurized Chang command higher price tags. This premium pricing is supported by superior ingredients, specialized brewing techniques, and distinctive packaging, all designed to cater to consumers desiring a more refined and exclusive beverage experience.

Cost Management and Margin Preservation

Thai Beverage prioritizes stringent cost management, particularly within its robust spirits segment, to safeguard profit margins. A key driver for this is the anticipated decrease in molasses procurement costs, projected to positively impact profitability starting from fiscal year 2026. This focus on operational efficiency is crucial for maintaining pricing flexibility and a strong competitive stance amidst prevailing economic headwinds.

The company's commitment to cost control is evident in its strategic sourcing and production optimization efforts. These initiatives are designed to absorb potential cost increases and allow for more competitive pricing strategies, ensuring ThaiBev remains attractive to consumers. For instance, the spirits business, a significant contributor to revenue, benefits directly from favorable raw material cost movements.

ThaiBev's proactive approach to cost management directly supports its margin preservation goals, especially when facing inflationary pressures or shifts in consumer spending. The expected improvement in molasses prices from FY2026, for example, is a tangible benefit that bolsters the financial health of its core spirits operations.

- FY2026 Molasses Cost Reduction: Expected to enhance spirits segment profitability.

- Operational Efficiency: Enables greater flexibility in pricing strategies.

- Competitive Positioning: Crucial for navigating challenging economic conditions.

- Margin Preservation: A core objective supported by cost control measures.

Impact of Taxes and Economic Conditions

Pricing strategies for Thai Beverage are heavily shaped by external forces, including excise taxes and the broader economic climate. For instance, a phased excise tax increase in Vietnam aims to ease consumer adaptation, while in Thailand, the spirits market has experienced a downturn. This decline is partly attributed to factors like subdued farmer incomes and political uncertainty, which directly impact pricing flexibility and promotional effectiveness.

ThaiBev actively tracks these economic indicators to maintain its competitive edge. In 2023, Thailand's GDP growth was projected around 2.8%, a figure that influences consumer spending power and, consequently, pricing decisions. The company's ability to adjust pricing and promotions in response to these dynamic conditions is crucial for sustained market presence.

- Excise Tax Impact: Vietnam's phased beer tax hike necessitates careful pricing adjustments to manage consumer response.

- Economic Sensitivity: Thailand's spirits segment sales decline, linked to weak farmer incomes and political instability, highlights the sensitivity of pricing to macroeconomic factors.

- Competitive Pricing: ThaiBev's continuous monitoring of these external conditions allows for adaptive pricing and promotional strategies to remain competitive.

- GDP Influence: Economic growth rates, such as Thailand's projected 2.8% GDP in 2023, directly affect consumer purchasing power and pricing power.

Thai Beverage employs a multi-tiered pricing strategy, aligning product value with consumer perception. Premium offerings like Chang Cold Brew and unpasteurized Chang command higher prices, justified by superior ingredients and brewing methods. Conversely, Chang Beer targets the mass premium segment with competitive mainstream pricing, while SABECO in Vietnam uses aggressive pricing, often 20-30% lower than rivals, to capture market share, especially during economic downturns.

The company's pricing is also influenced by external factors like excise taxes and economic conditions. For instance, a planned 2% price increase by SABECO in Vietnam is designed to pass on anticipated excise tax hikes to consumers. In Thailand, a downturn in the spirits market, linked to factors like reduced farmer incomes, necessitates careful pricing and promotional adjustments.

| Product Segment | Pricing Strategy | Key Rationale |

|---|---|---|

| Chang Beer | Mass Premium / Competitive Mainstream | Broad consumer appeal, market share defense |

| Chang Cold Brew / Unpasteurized Chang | Premium | Superior ingredients, brewing, packaging |

| SABECO (Vietnam) | Aggressive / Value-driven | Market share capture, economic sensitivity |

4P's Marketing Mix Analysis Data Sources

Our Thai Beverage 4P's analysis is grounded in comprehensive data, including official company reports, investor relations materials, and publicly available market research. We leverage insights from product portfolios, pricing strategies, distribution networks, and promotional activities to provide an accurate portrayal of their market approach.