Thai Beverage Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Thai Beverage Bundle

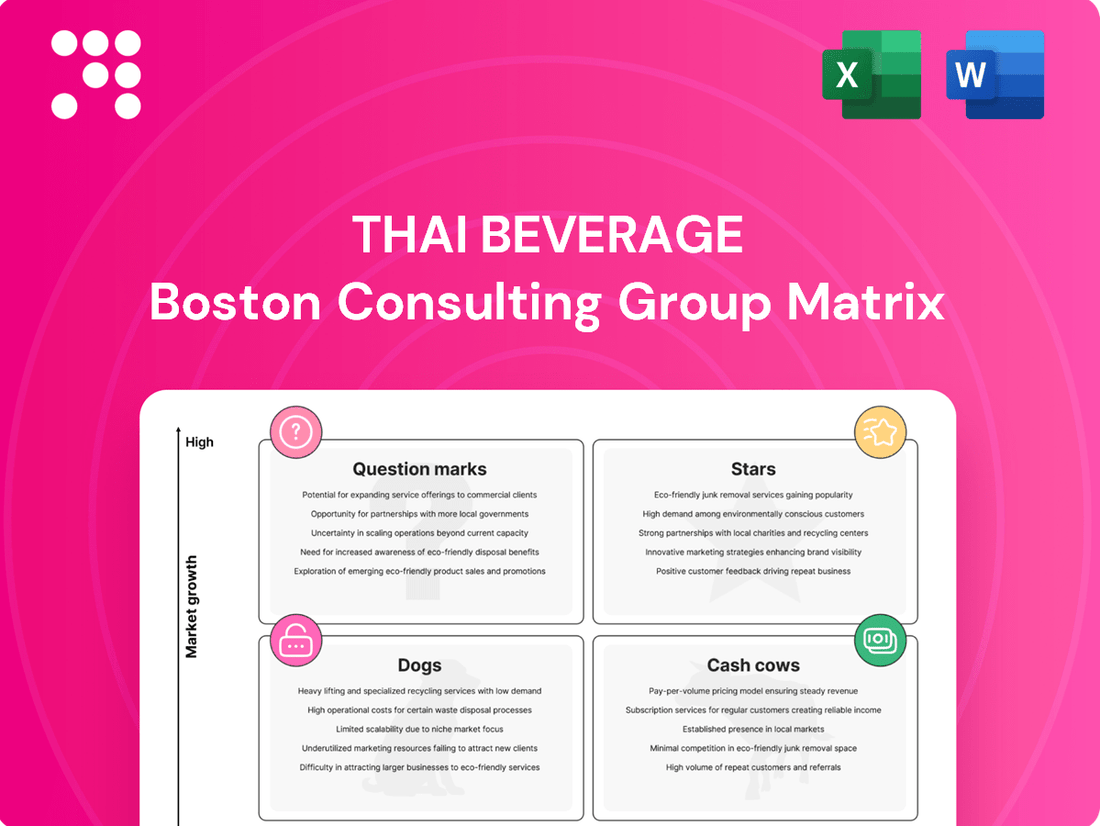

Thai Beverage's BCG Matrix offers a strategic snapshot of its diverse product portfolio, highlighting opportunities for growth and areas requiring careful management. Understanding these dynamics is crucial for navigating the competitive beverage market.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements for Thai Beverage's brands, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Chang Beer is a standout Star in Thai Beverage's portfolio within Myanmar. Its market share has seen dramatic growth, climbing from a mere 1% in 2020 to an impressive 16% by 2024. This surge is particularly noteworthy given Myanmar's beer market has been one of the fastest-growing in the ASEAN region since 2023.

This rapid expansion in a high-growth market signifies Chang Beer's strong competitive position and its potential for further development. The strategic advantage of local production at Emerald Brewery underpins this success, facilitating deeper market penetration and reinforcing its promising future outlook.

ThaiBev's premium beer segment, featuring brands like Chang Cold Brew, Federbräu, and Chang Unpasteurized, firmly positions these products within the Star category of the BCG Matrix. The company is strategically broadening this premium portfolio to appeal to a mass premium consumer base.

This expansion is designed to solidify ThaiBev's leadership in the Thai beer market, which analysts project will rebound to its pre-pandemic sales volumes by 2025, largely driven by a resurgent tourism sector. For instance, Thailand's tourism revenue reached approximately THB 1.5 trillion in the first half of 2024, indicating a strong recovery trajectory.

Significant investment in these premium brands is essential for ThaiBev to effectively capture higher-value market segments. This focus is critical for sustaining and enhancing future profitability, especially as consumer spending power and preferences evolve.

Thai Beverage's dairy products, notably under the F&N brand and enhanced by the Agri Valley Farm project in Malaysia, represent a strategic growth pillar. This segment is projected to deliver double-digit annual growth within ThaiBev's non-alcoholic beverage portfolio.

The dairy business benefits from robust profit margins, particularly within Thailand and surrounding regional markets. This strong performance is underpinned by ThaiBev's significant investment of 8 billion baht dedicated to expanding its dairy production capabilities, signaling confidence in this high-potential sector.

Functional Non-Alcoholic Beverages (e.g., F&N Nutriwell)

Functional non-alcoholic beverages, such as the anticipated F&N Nutriwell health products slated for a 2025 debut, represent a significant growth area for Thai Beverage. This segment directly taps into the escalating consumer demand for healthier beverage choices, including those fortified with vitamins and formulated with reduced sugar content within the broader non-alcoholic market. ThaiBev's strategic investment in developing and launching these types of products places them advantageously within a high-demand, expanding market. For instance, the global functional beverage market was valued at approximately USD 125 billion in 2023 and is projected to grow substantially, indicating a strong tailwind for these offerings.

- Category Growth: The functional non-alcoholic beverage market is experiencing robust expansion, driven by health-conscious consumers.

- Product Innovation: ThaiBev's F&N Nutriwell line, launching in 2025, exemplifies this trend with vitamin-enriched and low-sugar options.

- Market Positioning: This focus allows ThaiBev to capitalize on increasing consumer preferences for healthier lifestyle choices.

- Global Market Value: The global functional beverage market reached around USD 125 billion in 2023, highlighting the segment's economic significance.

Oishi Green Tea and Tea Pot Milk brands in Cambodia

The expansion of Oishi Green Tea and Tea Pot Milk into Cambodia in 2025 positions them as key growth drivers for Thai Beverage's diversified portfolio within the ASEAN region.

This strategic entry into Cambodia, a developing market with a growing demand for non-alcoholic beverages, is projected to tap into significant revenue potential for ThaiBev.

- Market Opportunity: Cambodia's beverage market is experiencing robust growth, with non-alcoholic segments showing particular promise.

- Brand Strength: Oishi Green Tea and Tea Pot Milk are established brands with strong recognition, facilitating easier market penetration.

- Revenue Growth: ThaiBev anticipates these brands will contribute substantially to its overall revenue by capturing new consumer bases.

- ASEAN Strategy: This expansion aligns with ThaiBev's broader strategy to increase its footprint and market share across high-potential ASEAN economies.

Chang Beer's remarkable ascent in Myanmar, from 1% market share in 2020 to 16% by 2024, highlights its Star status. This growth, fueled by local production, aligns with Myanmar's booming beer market, which expanded significantly post-2023.

ThaiBev's premium beer brands, including Chang Cold Brew, Federbräu, and Chang Unpasteurized, are also Stars. Their expansion targets the mass premium segment, capitalizing on Thailand's projected market recovery to pre-pandemic volumes by 2025, driven by a tourism rebound that saw THB 1.5 trillion in revenue in H1 2024.

The company's dairy products, particularly under the F&N brand, are positioned as Stars, expected to achieve double-digit annual growth. This segment benefits from strong regional margins and a 8 billion baht investment in production capacity, underscoring its high-potential outlook.

Functional non-alcoholic beverages, like the upcoming F&N Nutriwell line, represent another Star category. Tapping into the global functional beverage market, valued at approximately USD 125 billion in 2023, ThaiBev's focus on healthier options like vitamin-enriched and low-sugar products is strategically sound.

| Brand/Category | Market | 2024 Market Share (Est.) | Growth Driver | Outlook |

|---|---|---|---|---|

| Chang Beer | Myanmar | 16% | Local production, high-growth market | Continued expansion |

| Premium Beer (Chang Cold Brew, Federbräu, Unpasteurized) | Thailand | N/A (segment focus) | Premiumization, tourism recovery | Market leadership consolidation |

| Dairy (F&N) | Thailand, Regional | N/A (segment focus) | Investment in capacity, strong margins | Double-digit annual growth |

| Functional Non-Alcoholic (F&N Nutriwell) | Global/Regional | N/A (new launch) | Health trends, market demand | Significant growth potential |

What is included in the product

Thai Beverage's BCG Matrix offers a tailored analysis of its diverse product portfolio, identifying units for investment, divestment, or holding.

This BCG Matrix visualizes Thai Beverage's portfolio, clarifying strategic focus to alleviate decision-making paralysis.

Cash Cows

Chang Beer stands as a robust Cash Cow for Thai Beverage, commanding an impressive 32% of the Thai beer market. This dominance translates directly into its financial performance, as Chang contributes the largest portion of ThaiBev's overall revenue, accounting for 37.3%.

Despite the Thai beer market being mature, it's currently experiencing a recovery, which is crucial for Chang's Cash Cow status. This environment ensures a stable and substantial inflow of cash for ThaiBev.

The brand's entrenched market leadership means ThaiBev can effectively leverage Chang to generate consistent profits. This is achieved by requiring relatively lower investment in promotions and marketing compared to products in the growth or question mark categories.

ThaiBev's core mass-market spirits, including brands like Ruang Khao, Hong Thong, and Blend 285, are classic cash cows. These brands have long held a commanding presence in Thailand's spirits market, boasting a 71.2% share in 2022 and contributing a significant 36.3% to ThaiBev's revenue in the first half of fiscal year 2025. Even with recent cost pressures impacting profits, their entrenched market position guarantees steady cash flow from a mature and predictable market.

Bottled drinking water, exemplified by Chang Drinking Water, is a quintessential Cash Cow within the Thai Beverage BCG Matrix.

This segment dominates Thailand's non-alcoholic beverage market by volume, demonstrating a steady 3.9% volume increase in the first half of fiscal year 2025.

Its status as an essential commodity ensures consistent demand, generating predictable cash flow with limited need for substantial marketing expenditure.

Fraser & Neave (F&N) Established Beverage Lines

Fraser & Neave's (F&N) established beverage lines, now under Thai Beverage's majority ownership, function as cash cows within the BCG framework. These lines, encompassing popular soft drinks and dairy products, are primarily found in mature markets such as Malaysia and Thailand. They consistently generate substantial revenue and provide stable, predictable earnings for the company.

The enduring strength of F&N's brands and its loyal consumer base in these established markets underscore its role as a reliable cash-generating segment. This resilience translates into consistent cash flow, supporting the company's overall financial health and enabling investments in other business areas.

- Market Position: F&N holds significant market share in Malaysia and Thailand for its core beverage categories.

- Revenue Stability: In 2023, F&N's beverage segment demonstrated robust revenue streams, reflecting consistent consumer demand.

- Profitability: The established nature of these product lines allows for efficient operations and stable profit margins.

- Cash Generation: These mature brands are key contributors to ThaiBev's overall cash flow, funding growth initiatives.

Oishi Group's Established Quick-Service Restaurants

Oishi Group's established quick-service restaurants, including Oishi Buffet and Kakashi, function as the cash cows within Thai Beverage's BCG Matrix. These brands benefit from a strong market presence and a dedicated customer following, ensuring a steady flow of income for the company.

Despite facing some profit challenges in the wider food sector during 2024, these particular brands continue to deliver consistent revenue. Their strategic importance is further highlighted by their inclusion in Thai Beverage's long-term growth initiatives, underscoring their role as reliable cash generators.

- Established Market Position: Oishi Buffet and Kakashi have a significant and recognized presence in the quick-service restaurant market.

- Loyal Customer Base: Both brands command a strong and consistent customer loyalty, driving repeat business.

- Consistent Revenue Generation: They act as stable income sources, contributing reliably to Thai Beverage's overall financial performance.

- Strategic Importance for Expansion: These cash cows are integral to the company's future expansion plans, demonstrating their ongoing value.

Chang Beer remains a dominant force, holding a significant portion of the Thai beer market and contributing substantially to ThaiBev's revenue. Its established position in a recovering but mature market ensures a stable and predictable cash inflow, allowing ThaiBev to invest in other areas without extensive promotional spending.

ThaiBev's core mass-market spirits, including brands like Ruang Khao and Hong Thong, are prime examples of cash cows. These brands have long dominated the Thai spirits market, consistently generating significant revenue and providing predictable cash flow, even amidst recent cost pressures.

Bottled drinking water, such as Chang Drinking Water, exemplifies a cash cow due to its essential commodity status and consistent demand in Thailand's non-alcoholic beverage market. This segment generates predictable cash flow with minimal marketing investment, solidifying its role as a reliable income source.

Fraser & Neave's (F&N) established beverage lines, particularly in mature markets like Malaysia and Thailand, function as cash cows for ThaiBev. These brands, including popular soft drinks and dairy products, consistently deliver substantial revenue and stable earnings, supported by a loyal consumer base.

Oishi Group's quick-service restaurants, like Oishi Buffet and Kakashi, are cash cows within ThaiBev's portfolio. Despite broader sector challenges in 2024, these brands maintain consistent revenue and a strong customer following, making them vital for the company's ongoing financial health and expansion plans.

| Brand/Segment | Category | Market Position | Revenue Contribution (H1 FY25) | Cash Flow Generation |

|---|---|---|---|---|

| Chang Beer | Beer | 32% Thai Market Share | 37.3% of ThaiBev Revenue | High, Stable |

| Mass-Market Spirits (Ruang Khao, Hong Thong) | Spirits | 71.2% Thai Market Share (2022) | 36.3% of ThaiBev Revenue | High, Stable |

| Bottled Drinking Water (Chang Drinking Water) | Non-Alcoholic Beverage | Dominant in Thailand | Consistent Growth | High, Predictable |

| F&N Beverages (Malaysia & Thailand) | Beverages (Soft Drinks, Dairy) | Significant Market Share | Substantial Revenue Stream | Stable, Reliable |

| Oishi QSR (Oishi Buffet, Kakashi) | Quick-Service Restaurants | Strong Market Presence | Consistent Revenue | Stable, Integral to Growth |

What You’re Viewing Is Included

Thai Beverage BCG Matrix

The preview you are currently viewing is the identical, fully-formatted Thai Beverage BCG Matrix report you will receive immediately after purchase. This ensures you know exactly what you're getting—a comprehensive strategic analysis ready for immediate application, with no hidden surprises or watermarks.

Rest assured, the Thai Beverage BCG Matrix document you see here is the exact final version you will download upon completing your purchase. It's a professionally designed, analysis-ready report, providing clear strategic insights into Thai Beverage's product portfolio without any demo content.

This preview accurately represents the Thai Beverage BCG Matrix report you will acquire after your purchase. You'll receive the complete, unwatermarked document, allowing you to directly leverage its strategic insights for your business planning and decision-making processes.

Dogs

Certain niche spirits and specific whiskey brands within Thai Beverage's portfolio are likely candidates for the "cash cows" or "dogs" quadrant of the BCG matrix. The broader whiskey category in Thailand has been grappling with a continuous decline in its buyer base, suggesting a shrinking market share and negative growth for some of these products.

These underperforming brands may struggle to break even, potentially consuming more resources than they generate in revenue. For instance, while ThaiBev's overall revenue saw a robust increase in fiscal year 2023, reaching THB 297.2 billion, specific segments like spirits can experience internal variations in performance.

ThaiBev's publishing and printing segment, categorized under its 'Other' business, is currently positioned as a Dog in the BCG matrix. This classification stems from its poor financial performance, highlighting a challenging market position.

In the first quarter of fiscal year 2025, this segment saw its revenue decrease by 6.6% compared to the previous year. More alarmingly, its EBITDA experienced a substantial drop of 55.1%, signaling significant operational difficulties and a shrinking profit margin.

Such a performance indicates that the segment likely holds a low market share within a market that is either stagnant or shrinking. This makes it an unattractive investment, tying up valuable capital without generating commensurate returns, and suggests a strategy of minimization or divestiture might be appropriate.

Certain older, less popular non-alcoholic beverage SKUs, particularly those with higher sugar content, could be classified as Dogs within Thai Beverage's BCG Matrix. While the overall non-alcoholic beverage market in Thailand saw growth, these specific products may be experiencing declining market share due to evolving consumer preferences for healthier, low-sugar options.

For instance, the Thai market for sugary drinks faced increased scrutiny and potential regulatory changes in 2024, impacting sales of such items. These Dog products might require disproportionate marketing investment for relatively low returns, making them candidates for divestment or strategic repositioning to avoid draining resources.

Underperforming Quick-Service Restaurant Outlets

Within Thai Beverage's broader portfolio, specific underperforming quick-service restaurant (QSR) outlets can be classified as Dogs. Despite expansion efforts, the food segment experienced a significant 61% drop in net profit during the first half of fiscal year 2025, largely attributed to escalating operational costs. This downturn indicates that certain existing QSR locations are facing considerable challenges.

These struggling outlets likely exhibit low profit margins and a diminished effective market share, particularly when profitability is the key metric. Their contribution to the overall profitability of ThaiBev's food business is minimal, and they may require strategic intervention to improve performance or consider divestment.

- Low Profitability: These outlets generate minimal profit, often barely covering their operating expenses.

- Declining Sales: Customer traffic and sales volume at these specific QSR locations may be stagnant or decreasing.

- High Operating Costs: Increased input costs, such as ingredients and labor, disproportionately impact the margins of these already weak performers.

- Limited Market Share: In their respective local markets, these outlets command a very small and often shrinking share of the quick-service restaurant business.

International Beer/Spirits Exports to non-strategic, low-penetration markets

International beer and spirits exports to non-strategic, low-penetration markets are a weak point for ThaiBev. These ventures are struggling to gain traction, leading to declining sales volumes.

The overall alcoholic drinks export market is expected to contract. Specifically, beer and spirits exports are projected to decrease by 4.0-6.0% annually, highlighting challenges in these specific international segments.

- Low Market Share: Ventures in these markets exhibit minimal market share.

- Negative Growth: Sales volumes are declining, indicating a lack of market penetration and customer adoption.

- Strategic Re-evaluation Needed: The current performance suggests these markets may not be strategically viable for significant investment.

- Resource Allocation: ThaiBev may need to re-evaluate resource allocation away from these underperforming international markets.

Thai Beverage's "Dogs" represent products or segments with low market share in slow-growing or declining industries. These often require significant investment to maintain but yield minimal returns. The publishing and printing segment, for instance, saw a 6.6% revenue drop and a 55.1% EBITDA decrease in Q1 FY2025, clearly marking it as a Dog.

Certain older, high-sugar non-alcoholic beverages also fall into this category, facing declining demand due to health trends, especially with increased scrutiny on sugary drinks in Thailand during 2024. Similarly, underperforming quick-service restaurant outlets, burdened by rising operational costs, contribute minimally to profitability, with the food segment's net profit dropping 61% in H1 FY2025.

International export ventures in low-penetration markets for beer and spirits are also struggling, with declining sales volumes in a contracting global market. These segments are candidates for divestment or strategic repositioning to optimize resource allocation.

| Segment | Market Share | Market Growth | Performance Indicator | Status |

| Publishing & Printing | Low | Declining | -55.1% EBITDA (Q1 FY2025) | Dog |

| Sugary Non-Alcoholic Beverages | Declining | Stagnant/Declining | Increased regulatory scrutiny (2024) | Dog |

| Underperforming QSRs | Low | Stagnant | -61% Net Profit (H1 FY2025) | Dog |

| International Exports (Low Penetration) | Low | Declining | Decreasing sales volumes | Dog |

Question Marks

Thai Beverage's new beer factory in Cambodia, a 3 billion baht investment, fits the Question Mark category within the BCG matrix. This strategic move targets a promising geographic market with anticipated growth in beer consumption, reflecting an opportunity for expansion.

Despite the growth potential, ThaiBev faces a significant challenge in Cambodia, currently holding a low market share. This necessitates substantial investment to build brand recognition and achieve profitability in a competitive landscape, characteristic of a Question Mark's high risk and high reward profile.

Thai Beverage's aggressive plan to open 45 new KFC restaurants in fiscal year 2025 firmly places this venture in the Question Mark category of the BCG Matrix. This expansion represents a significant investment in a highly competitive food service landscape.

While KFC is a globally recognized and strong brand, its growth trajectory under ThaiBev's stewardship is still developing. The success of these new outlets in capturing market share and generating substantial profits remains to be seen.

The substantial capital expenditure required for this expansion, coupled with the inherent risks of market penetration and operational execution in the fast-food sector, underscores its Question Mark status. ThaiBev's strategic objective is to transform these investments into future Stars.

Thai Beverage's foray into the ready-to-eat (RTE) food market within ASEAN is classified as a Question Mark. This move taps into a rapidly expanding sector, fueled by evolving consumer preferences for convenience and healthier options across Southeast Asia.

The RTE food market in ASEAN is projected to reach USD 12.5 billion by 2027, growing at a CAGR of 7.2%, according to Mordor Intelligence. ThaiBev's current presence in this segment is minimal, necessitating significant investment in product development, distribution networks, and marketing to capture market share.

New Premium Spirits (e.g., PRAKAAN Tribura Series)

New premium spirits, exemplified by the PRAKAAN Tribura Series, represent Thai Beverage's strategic foray into a high-growth segment driven by increasing consumer demand for premium offerings. This segment is characterized by its potential for substantial revenue generation as consumers trade up for perceived quality and exclusivity. The company is investing in these lines to capture a share of this expanding market.

These premium spirits are positioned to capitalize on the global trend of premiumization, a key driver in the spirits industry. For instance, the global premium spirits market was valued at approximately USD 250 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 6% through 2030. This growth trajectory underscores the strategic importance of new premium product introductions like the PRAKAAN Tribura Series.

While the growth potential is significant, these new premium spirits currently hold a nascent market share. This necessitates substantial investment in marketing, distribution, and brand development to build awareness and consumer loyalty. The challenge lies in converting this initial interest into sustained market leadership within the competitive premium spirits landscape.

- Market Entry: PRAKAAN Tribura Series represents a strategic move into the premium spirits category.

- Growth Driver: Capitalizes on the global premiumization trend, a key factor in the spirits market's expansion.

- Investment Focus: Requires significant marketing and brand-building efforts due to its current niche status.

- Potential: Aims to establish market leadership in a segment offering high growth and revenue potential.

Digital Platform for Consumer Reach/Engagement

Thai Beverage's investment in a digital platform for consumer reach and engagement falls under the Question Mark category of the BCG Matrix. This strategic move, part of their 'Passion 2030' plan, focuses on utilizing digital channels to better understand and cater to evolving consumer demands in a rapidly expanding digital market.

The initiative is critical for securing future growth and maintaining a competitive edge. However, its direct contribution to revenue and its market share within digital channels are still in nascent stages, necessitating ongoing financial commitment and strategic refinement.

- Digital Investment: ThaiBev is actively investing in digital infrastructure to enhance consumer interaction and data acquisition.

- Market Potential: The digital space presents a high-growth opportunity, with increasing consumer reliance on online platforms for product discovery and purchasing.

- Developing Revenue Streams: While the platform aims to improve engagement, direct revenue generation and measurable market share in digital spaces are still being established.

- Strategic Importance: This digital push is vital for long-term competitive positioning and adapting to changing consumer behaviors.

Thai Beverage's expansion into new geographic markets with new products, such as its Cambodian beer factory, exemplifies a Question Mark. These ventures represent significant investment in areas with high growth potential but currently low market share.

The company's aggressive expansion of its KFC franchise, with plans for 45 new outlets in fiscal year 2025, also fits the Question Mark profile. While KFC is a strong brand, the success of these new locations in capturing market share and achieving profitability requires substantial investment and strategic execution.

New premium spirits, like the PRAKAAN Tribura Series, are another example of ThaiBev's Question Mark investments. These products target the growing premiumization trend, demanding significant marketing and brand development to establish a foothold in a competitive market.

Similarly, ThaiBev's investment in a digital platform for consumer engagement is a Question Mark. This initiative aims to tap into the expanding digital market but requires ongoing financial commitment to build direct revenue streams and measurable market share.

| Venture | Category | Key Characteristic | Investment/Growth Factor | Challenge |

|---|---|---|---|---|

| Cambodian Beer Factory | Question Mark | High market growth potential | 3 billion baht | Low current market share |

| KFC Expansion (FY25) | Question Mark | Strong brand recognition | 45 new outlets | Market penetration risk |

| Premium Spirits (PRAKAAN) | Question Mark | Premiumization trend | Marketing & distribution investment | Nascent market share |

| Digital Platform | Question Mark | Growing digital market | Consumer engagement focus | Developing revenue streams |

BCG Matrix Data Sources

Our Thai Beverage BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.