Thai Beverage Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Thai Beverage Bundle

Thai Beverage faces intense rivalry from numerous domestic and international players, significantly impacting pricing power and profitability. Understanding the nuances of buyer bargaining power, particularly with large distributors and retailers, is crucial for navigating this competitive landscape.

The full analysis reveals the real forces shaping Thai Beverage’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for essential inputs like malt, hops, sugar, water, and packaging materials is a key factor influencing Thai Beverage's (ThaiBev) bargaining power with its suppliers. If only a small number of companies supply a critical raw material, those suppliers gain leverage, potentially driving up costs for ThaiBev.

For instance, if the global hop market, crucial for beer production, is dominated by a few large producers, ThaiBev faces a higher risk of price increases. Similarly, a concentrated supply chain for specialized glass bottles or aluminum cans can empower those suppliers. ThaiBev's substantial purchasing volume and its ability to enter into long-term supply agreements are critical strategies to offset this supplier concentration and secure favorable pricing.

Switching suppliers for essential ingredients or packaging presents significant hurdles for ThaiBev. These can include costly re-tooling of production lines, rigorous quality control for new materials, and the renegotiation of complex logistics. For instance, a change in a key ingredient's supplier might necessitate extensive testing to ensure product consistency, a process that consumes both time and financial resources. These substantial switching costs inherently bolster the bargaining power of ThaiBev's existing suppliers.

The bargaining power of suppliers for Thai Beverage is significantly influenced by the availability of substitutes for their inputs. If ThaiBev can easily source alternative materials or if it possesses the capability for backward integration, such as producing its own packaging or securing diverse raw material suppliers, the leverage of existing suppliers diminishes considerably. This strategic flexibility is crucial in managing input costs and ensuring supply chain stability.

ThaiBev's proactive approach to sustainable packaging initiatives is a prime example of how it can reduce supplier dependence. By exploring and adopting new, environmentally friendly packaging solutions, the company can diversify its supplier base and potentially lessen its reliance on traditional, single-source providers. This not only aligns with corporate social responsibility goals but also strengthens its negotiating position.

For example, in 2024, the global beverage industry saw increased investment in alternative packaging materials like plant-based plastics and recycled aluminum. Companies that successfully integrated these alternatives reported an average reduction of 5-7% in packaging material costs. This trend suggests that ThaiBev's focus on sustainability can directly translate into enhanced bargaining power by creating a wider array of viable supplier options.

Importance of ThaiBev to Suppliers

ThaiBev's position as a dominant beverage player in Southeast Asia makes it a crucial client for numerous suppliers. In 2023, for instance, the company's revenue reached approximately THB 200 billion (roughly USD 5.5 billion), highlighting the sheer scale of its procurement operations.

This substantial purchasing power means that many suppliers rely heavily on ThaiBev for a significant portion of their sales. The potential loss of ThaiBev's business could represent a substantial financial setback for these suppliers, thereby granting ThaiBev considerable bargaining leverage.

This situation creates a dynamic where suppliers are motivated to offer competitive pricing and favorable terms to retain ThaiBev's patronage. Consequently, the bargaining power of suppliers is somewhat mitigated by the significant dependence many of them have on ThaiBev.

- Significant Customer Base: ThaiBev's extensive operations across multiple beverage categories translate to high-volume orders for raw materials, packaging, and logistics services.

- Revenue Impact: With 2023 revenues around THB 200 billion, ThaiBev's purchasing volume directly influences the financial health of its suppliers.

- Supplier Dependence: For many specialized suppliers, ThaiBev accounts for a substantial percentage of their total revenue, limiting their ability to dictate terms.

- Balanced Power Dynamic: While suppliers offer essential inputs, ThaiBev's market dominance and purchasing scale create a more balanced, or even supplier-leaning, power dynamic in negotiations.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into beverage production is a significant factor influencing their bargaining power. If suppliers, such as those providing key ingredients or packaging, could credibly enter ThaiBev's market, they would gain considerable leverage.

However, the beverage industry is characterized by high capital intensity and requires extensive, established distribution networks. These are substantial barriers to entry for most raw material suppliers, effectively limiting the likelihood of this particular threat materializing against ThaiBev.

ThaiBev's own robust and comprehensive distribution network, spanning Thailand and the broader ASEAN region, further strengthens its position. This established infrastructure acts as a deterrent, making it difficult for potential supplier entrants to compete effectively.

For instance, in 2024, ThaiBev's extensive network reached an estimated 90% of retail outlets in Thailand, a testament to its market penetration and a significant hurdle for any supplier considering forward integration.

- Supplier Forward Integration Threat: Suppliers can increase bargaining power by threatening to enter the beverage production market themselves.

- Industry Barriers: High capital costs and the need for established distribution networks make forward integration difficult for most suppliers in the beverage sector.

- ThaiBev's Advantage: ThaiBev's extensive distribution network across Thailand and ASEAN acts as a strong defense against this threat.

- Market Penetration: In 2024, ThaiBev's reach into approximately 90% of Thai retail outlets highlights the significant challenge for potential supplier entrants.

ThaiBev's bargaining power with suppliers is significantly influenced by the concentration of suppliers for critical inputs. A concentrated supply market, where few companies provide essential materials like malt or packaging, grants these suppliers greater leverage, potentially leading to higher costs for ThaiBev. For example, in 2024, the global hop market, vital for beer, was dominated by a few major producers, increasing price pressure.

The ability of ThaiBev to switch suppliers is hindered by substantial switching costs, including re-tooling production lines and ensuring new material quality, which strengthens existing suppliers' positions. However, ThaiBev's considerable purchasing volume, evidenced by its 2023 revenue of approximately THB 200 billion, means many suppliers are heavily reliant on its business, thus mitigating supplier leverage.

The threat of suppliers integrating forward into beverage production is low due to the high capital intensity and established distribution networks required, which act as significant barriers to entry for raw material providers. ThaiBev's extensive distribution network, reaching about 90% of Thai retail outlets in 2024, further solidifies its competitive advantage against potential supplier encroachment.

| Factor | Impact on ThaiBev's Bargaining Power | Supporting Data/Example (2023-2024) |

|---|---|---|

| Supplier Concentration | Reduces ThaiBev's power; increases supplier leverage. | Domination of global hop market by few producers. |

| Switching Costs | Reduces ThaiBev's power; strengthens existing suppliers. | Costly re-tooling and quality control for new materials. |

| ThaiBev's Purchasing Volume | Increases ThaiBev's power; reduces supplier leverage. | 2023 Revenue: THB 200 billion (approx. USD 5.5 billion). |

| Supplier Forward Integration Threat | Low threat; strengthens ThaiBev's position. | High industry capital costs and distribution network barriers. |

| ThaiBev's Distribution Network | Strengthens ThaiBev's position against integration. | 2024 reach: ~90% of Thai retail outlets. |

What is included in the product

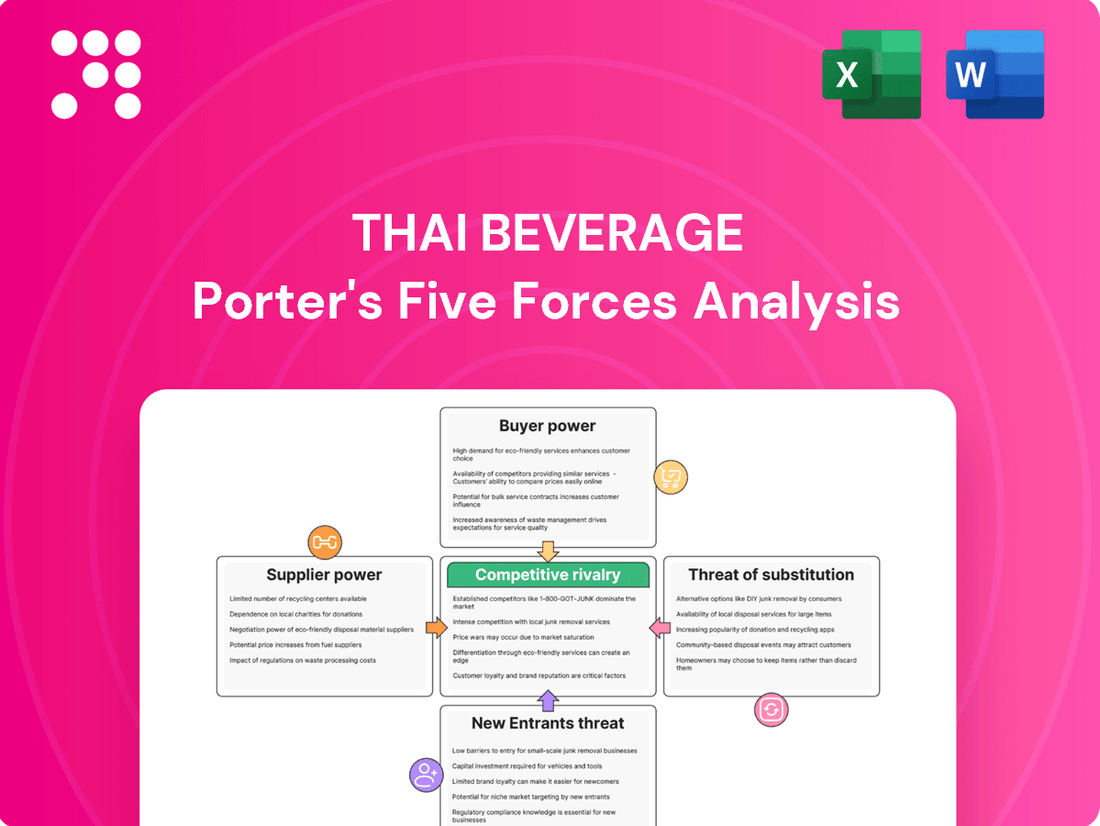

This analysis dissects the competitive landscape for Thai Beverage, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the beverage industry.

Instantly visualize competitive pressures on Thai Beverage with a dynamic Porter's Five Forces dashboard, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Thai Beverage navigates varying customer price sensitivity across its diverse product portfolio. In the non-alcoholic segment, particularly for staple items like bottled water and standard soft drinks, consumers are generally more responsive to price changes. This is a common trend where basic necessities often see higher price sensitivity.

Conversely, within the alcoholic beverage sector, especially for premium and craft products, customer price sensitivity tends to be lower. Consumers in this category may prioritize brand, quality, and experience over minor price fluctuations. For instance, while a 3% price increase on a mass-market beer might deter some buyers, a similar increase on a high-end whiskey is less likely to significantly impact demand.

Economic conditions play a crucial role in shaping this sensitivity. In 2024, with fluctuating global and regional economic indicators, disposable incomes in Thailand and the broader ASEAN market directly influence how much consumers are willing to spend on beverages. A downturn in economic growth or rising inflation can push even premium consumers towards more price-conscious choices, thereby increasing overall price sensitivity.

Thai Beverage's customer base is incredibly diverse, ranging from individual consumers to large retail chains and the hospitality industry. While individual buyers have minimal impact, major retailers and distributors, due to their substantial purchasing volumes, can indeed wield considerable influence over ThaiBev. This power is amplified by their control over shelf space and their ability to negotiate pricing, impacting ThaiBev's sales strategies.

Customers in Thailand's beverage market face a vast array of choices, impacting Thai Beverage's (THBEV) ability to dictate terms. From established competitors like Carabao Tawandang to emerging craft beverage makers and even readily available homemade options, the sheer volume of alternatives empowers consumers. This ease of switching, especially in the highly competitive non-alcoholic segment, significantly amplifies their bargaining power.

Customer Information and Transparency

Customer information and transparency significantly impact Thai Beverage's bargaining power of customers. Increased consumer awareness regarding health, ingredients, and sustainability empowers buyers to make more informed choices. For instance, in 2024, global consumer surveys indicated a growing preference for products with clear ingredient lists and sustainable sourcing, directly influencing purchasing decisions within the beverage sector.

The widespread availability of product information and comparative pricing online enhances transparency. This allows customers to easily compare offerings from various companies, including ThaiBev, and exert pressure on them to maintain competitive pricing and high product quality. In 2023, e-commerce platforms reported a substantial increase in price comparison tool usage among consumers, highlighting this trend.

- Informed Choices: Consumers are increasingly scrutinizing product labels for health benefits and ethical sourcing, driving demand for transparency.

- Online Price Comparison: Digital platforms facilitate easy comparison of beverage prices and features, intensifying competitive pressures on companies like ThaiBev.

- Sustainability Focus: A growing segment of consumers prioritizes environmentally friendly practices, empowering them to choose brands aligning with their values.

- Brand Loyalty Impact: Enhanced transparency can either foster loyalty through perceived value or erode it if pricing or quality is deemed uncompetitive.

Threat of Backward Integration by Customers

The threat of customers backward integrating into beverage production is generally low for ThaiBev, particularly in the complex alcoholic beverage sector. However, for simpler non-alcoholic drinks, large restaurant chains might consider private-label brands or in-house production, which could marginally enhance their bargaining power.

ThaiBev's broad product range, encompassing spirits, beer, and non-alcoholic beverages, acts as a significant buffer against this threat. This diversification means that a customer's ability to replicate any single product line is limited, thus preserving ThaiBev's overall market position.

- Low Threat in Alcohol: The intricate production processes and brand loyalty associated with alcoholic beverages make backward integration by customers highly improbable.

- Moderate Threat in Non-Alcoholic: For high-volume, simpler non-alcoholic drinks, major retail chains or food service providers could potentially develop their own private-label products, exerting some pressure.

- Diversification as a Mitigant: ThaiBev's extensive portfolio across various beverage categories reduces the likelihood of any single customer segment being able to effectively replace a significant portion of their offerings through backward integration.

Thai Beverage's customers, particularly large retailers and distributors, possess significant bargaining power due to their substantial purchasing volumes and control over shelf space. This power is amplified by the wide array of beverage choices available in the market, making it easier for consumers and businesses to switch suppliers. Furthermore, increased consumer awareness and online transparency empower buyers to demand competitive pricing and high product quality, directly influencing ThaiBev's strategies.

| Factor | Impact on ThaiBev | 2024 Relevance |

|---|---|---|

| Customer Price Sensitivity | Varies by product segment; higher for non-alcoholic staples. | Economic conditions in 2024 directly affect disposable income and thus sensitivity. |

| Availability of Substitutes | High due to numerous competitors and product variety. | Intensifies pressure on ThaiBev to maintain competitive offerings. |

| Buyer Concentration | Low for individual consumers, high for major retailers/distributors. | Large buyers can negotiate favorable terms, impacting margins. |

| Switching Costs | Generally low for consumers, moderate for large distributors. | Facilitates easier shifts in purchasing patterns. |

| Information Transparency | High due to online platforms and consumer awareness. | Drives demand for clear labeling, ethical sourcing, and competitive pricing. |

What You See Is What You Get

Thai Beverage Porter's Five Forces Analysis

This preview showcases the complete Thai Beverage Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning within the beverage industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file. This comprehensive analysis will equip you with critical insights for informed decision-making and strategic planning.

Rivalry Among Competitors

The Thai and Southeast Asian beverage markets are quite crowded, featuring a mix of local favorites and big international names. This means ThaiBev faces stiff competition from many different kinds of companies.

Within Thailand, strong domestic players like Boon Rawd Brewery, known for its Singha and Leo beer brands, and Carabao Group, famous for its energy drinks, are significant rivals. These companies have deep roots and loyal customer bases, making it tough for ThaiBev to gain market share.

The competition isn't just in beer; it spans across both alcoholic and non-alcoholic beverage categories. This broad competition across different product types and market segments significantly intensifies the rivalry for ThaiBev.

The Thai beverage market is expected to see continued growth, with particular strength anticipated in non-alcoholic drinks and healthier options. However, this positive outlook doesn't eliminate the challenge of fierce competition, which can temper individual company growth trajectories.

Moderate industry growth rates often fuel aggressive competition for market share. This is especially true in established segments like beer, where ThaiBev's Chang brand enjoys a strong position but must contend with emerging competitors.

Thai Beverage (ThaiBev) cultivates significant competitive rivalry through its strong brand loyalty, particularly with flagship products like Chang beer and its extensive spirits portfolio. This loyalty acts as a substantial barrier to new entrants and a competitive advantage against rivals.

However, in product categories where differentiation is less pronounced, such as bottled water or standard soft drinks, the competitive landscape often intensifies into price-driven battles. For instance, the Thai beverage market for non-alcoholic drinks is highly fragmented, with numerous local and international players vying for market share, frequently leading to promotional pricing strategies.

To counter this, ThaiBev invests heavily in continuous product innovation and robust marketing campaigns. These efforts are vital for maintaining brand distinctiveness and securing customer preference in an increasingly crowded market, ensuring its brands remain top-of-mind for consumers.

Exit Barriers

The beverage industry, including Thai Beverage's operating environment, is characterized by substantial exit barriers. High fixed costs tied to production facilities, extensive distribution networks, and significant marketing investments mean that exiting the market is a costly endeavor. This financial commitment can trap less profitable players, forcing them to continue operations and maintain competitive pressure, thereby intensifying rivalry.

ThaiBev's own substantial infrastructure, built over years of expansion, exemplifies these high exit barriers. For instance, the capital expenditure on bottling plants and nationwide distribution channels represents a sunk cost that is difficult to recoup. This makes it challenging for companies to simply shut down operations without incurring significant losses, a factor that contributes to the persistent nature of competition.

These exit barriers can lead to:

- Continued market presence of underperforming firms, maintaining competitive intensity.

- Difficulty for new entrants to acquire established assets, as the cost of exit for incumbents is high.

- Pressure on ThaiBev to manage its operational efficiency to avoid becoming one of the firms trapped by these barriers.

Strategic Stakes

The Southeast Asian beverage market is a hotbed of activity, drawing significant investment due to its robust growth prospects and extensive consumer base. This makes it a strategically vital arena for both established regional giants and international corporations aiming for market share. Companies are channeling substantial resources into marketing campaigns, innovative product launches, and expanding their distribution networks to secure or fortify their leading positions. This intense competition fuels a dynamic environment where strategic maneuvering is paramount for survival and success.

For Thai Beverage, the competitive rivalry is particularly fierce. Consider the beer segment, where Chang beer, a flagship brand, faces intense pressure. In 2024, the beer market in Thailand alone is projected to see continued growth, driven by increased tourism and domestic consumption, though market share battles remain aggressive. For instance, Heineken and Carlsberg are significant global players with strong local presences, constantly vying for consumer preference through differentiated product offerings and extensive promotional activities.

- Strategic Importance: Southeast Asia's beverage market is highly attractive due to its growth potential and large consumer base, making it a key region for both local and global players.

- Intense Investment: Companies are investing heavily in marketing, product development, and distribution to gain or maintain market leadership.

- Competitive Landscape: Brands like Chang beer face significant rivalry from global giants such as Heineken and Carlsberg in markets like Thailand.

- Market Dynamics: The beer market in Thailand, for example, is expected to grow in 2024, but market share remains a fiercely contested battleground.

Competitive rivalry is a significant force for Thai Beverage (ThaiBev), driven by a crowded market with both local and international players. Strong domestic competitors like Boon Rawd Brewery and Carabao Group, along with global giants such as Heineken and Carlsberg, create an intensely competitive environment across alcoholic and non-alcoholic segments. This rivalry is further fueled by substantial exit barriers, including high fixed costs and established distribution networks, which keep even underperforming firms in the market, thereby maintaining competitive pressure.

| Competitor | Key Brands | Market Segment |

|---|---|---|

| Boon Rawd Brewery | Singha, Leo | Beer |

| Carabao Group | Carabao Energy Drink | Energy Drinks |

| Heineken | Heineken, Tiger | Beer |

| Carlsberg | Carlsberg, San Miguel | Beer |

SSubstitutes Threaten

Thai Beverage (ThaiBev) contends with a substantial threat from direct substitutes, encompassing a wide array of beverages and even non-beverage alternatives that satisfy similar consumer desires. For its alcoholic portfolio, consumers might opt for non-alcoholic beers, sophisticated mocktails, or even find their entertainment needs met through activities that don't involve drinking.

In the non-alcoholic beverage segment, the threat is equally pronounced. Readily available and often more economical options like tap water, homemade concoctions, and fresh fruit juices present strong competition. For instance, in 2024, the market for bottled water in Thailand continued its steady growth, indicating a sustained preference for simple hydration alternatives over packaged beverages for many consumers.

The attractiveness of substitutes for Thai Beverage's products, particularly in the beer and spirits segments, is heavily influenced by the price-performance trade-off. Consumers are increasingly scrutinizing the value they receive for their money. For example, while premium craft beers might offer superior taste, their higher price point can make them less appealing compared to more affordable mass-market options or even certain imported brands that have become more accessible.

Furthermore, the rise of healthier beverage alternatives presents a significant threat. In 2024, the global market for functional beverages, which includes options like enhanced waters and low-sugar drinks, continued its upward trajectory, with projections indicating sustained growth. This trend directly impacts ThaiBev's traditional beverage portfolio, as consumers, driven by health consciousness and often finding these alternatives competitively priced, may reduce their consumption of alcoholic and sugary drinks.

ThaiBev's strategy must therefore focus on continuous product innovation and portfolio adaptation. This includes developing and promoting healthier or lower-calorie options that can compete on both price and perceived value. For instance, the company could explore expanding its non-alcoholic beverage lines or introducing lighter versions of its existing alcoholic products to capture market share from consumers shifting away from traditional offerings due to health concerns or a desire for better value.

For consumers, the cost of switching to a substitute beverage is typically very low, often involving no more than a different purchase decision at the point of sale. This ease of switching significantly amplifies the threat of substitution, allowing consumers to effortlessly shift their preferences based on evolving health trends, price fluctuations, or changing tastes. For example, the ready-to-drink tea market, a key segment for Thai Beverage, faces constant pressure from alternatives like flavored waters and functional beverages, where brand loyalty is often less entrenched.

Changing Consumer Preferences and Lifestyle Trends

The increasing global focus on health and wellness significantly elevates the threat of substitutes for traditional beverages. Consumers are actively choosing options that align with healthier lifestyles, such as low-sugar, natural, functional, and plant-based drinks. This shift directly challenges established beverage categories.

Thai Beverage Public Company Limited (ThaiBev) is actively addressing this by diversifying its product offerings and strategically investing in its non-alcoholic segments. For instance, in 2024, the company continued to expand its portfolio of functional beverages and water products, aiming to capture this growing consumer demand.

- Health and Wellness Trend: Consumers worldwide, including in Thailand, are increasingly prioritizing beverages with perceived health benefits, leading to a decline in demand for high-sugar, traditional options.

- Plant-Based Alternatives: The rise of plant-based diets has fueled demand for beverages derived from sources like soy, almond, oat, and coconut, directly competing with dairy-based and other traditional drinks.

- Functional Beverages: Drinks fortified with vitamins, minerals, probiotics, or other beneficial ingredients are gaining traction as consumers seek added value beyond basic hydration.

- ThaiBev's Response: ThaiBev's strategic investments in its non-alcoholic portfolio, including water and functional drinks, demonstrate its commitment to adapting to these evolving consumer preferences and mitigating the threat of substitutes.

Regulatory and Social Pressures

Government initiatives, such as the sugar tax introduced in Thailand in 2017, directly impact the beverage industry. This tax, initially applied to sugary drinks with high sugar content, has since been adjusted, reflecting ongoing efforts to curb sugar consumption. For instance, by 2023, the tax structure continued to incentivize lower-sugar formulations.

Societal pressure for healthier lifestyles is a significant driver for consumers to seek alternatives to traditional sugary beverages. This trend is evident globally and in Thailand, with increasing demand for water, unsweetened teas, and functional beverages. This shift compels companies like Thai Beverage to invest in product innovation and reformulation to meet evolving consumer preferences.

The accelerating shift towards healthier substitutes creates a tangible threat. Companies must adapt by either reformulating existing products to reduce sugar or introducing entirely new, healthier beverage lines. This strategic imperative directly influences the competitive landscape, as companies that fail to innovate risk losing market share to those offering more health-conscious options.

- Sugar Tax Impact: Thailand's sugar tax, implemented in 2017 and evolving through 2023, directly increases the cost of high-sugar beverages, making substitutes more attractive.

- Health Consciousness: Growing consumer demand for healthier options, including water and low-sugar drinks, is a key factor driving the threat of substitutes.

- Product Reformulation: Beverage companies face pressure to reformulate existing products or launch new healthier alternatives to remain competitive against substitute offerings.

The threat of substitutes for Thai Beverage is significant, driven by a broad range of alternatives that cater to similar consumer needs, from non-alcoholic options to healthier choices. The ease with which consumers can switch, coupled with evolving health consciousness and government policies like sugar taxes, intensifies this challenge.

For instance, the market for bottled water in Thailand saw continued growth in 2024, highlighting a preference for simple hydration. Similarly, the global functional beverage market, including low-sugar options, continued its upward trend in 2024, directly impacting traditional beverage consumption.

ThaiBev's strategic response involves expanding its non-alcoholic and functional beverage lines, aiming to align with consumer preferences for healthier and value-driven alternatives. This diversification is crucial for maintaining market share against readily available and often more affordable substitutes.

| Beverage Category | Key Substitutes | Consumer Driver for Substitution | ThaiBev's Relevant Segment | Market Trend (2024 Data/Projections) |

|---|---|---|---|---|

| Alcoholic Beverages (Beer, Spirits) | Non-alcoholic beers, mocktails, other leisure activities | Health consciousness, price sensitivity, changing entertainment preferences | Beer, Spirits | Growth in non-alcoholic beer segment, increased consumer price scrutiny |

| Non-Alcoholic Beverages (Soft Drinks, Juices) | Tap water, homemade drinks, fresh juices, functional beverages | Health consciousness, cost savings, demand for natural ingredients | Water, Functional Beverages | Continued growth in bottled water market, strong expansion of functional beverages |

| Overall Beverage Consumption | Water, healthy alternatives | Societal pressure for healthy lifestyles, government health initiatives (sugar tax) | All segments | Increased demand for low-sugar and natural drinks; sugar tax continues to influence formulation choices |

Entrants Threaten

The beverage industry, especially for large-scale operations, demands significant capital for manufacturing facilities, bottling equipment, and widespread distribution channels. This substantial financial commitment forms a formidable barrier for newcomers. ThaiBev's extensive operational footprint underscores the high entry costs involved.

Established players like ThaiBev leverage substantial economies of scale across production, procurement, marketing, and distribution. For instance, ThaiBev’s 2023 revenue reached approximately THB 295 billion, reflecting its vast operational footprint.

New entrants would find it challenging to match these cost efficiencies, hindering their ability to compete on price or fund aggressive market penetration and branding efforts. Achieving comparable scale requires immense capital investment, creating a significant barrier.

Thai Beverage Public Company Limited (ThaiBev) benefits from significant brand loyalty, particularly with flagship products like Chang beer. This established consumer preference acts as a substantial hurdle for potential new entrants. For instance, in 2023, ThaiBev reported revenue of approximately THB 290 billion, demonstrating the scale of its operations and market penetration, which is largely driven by its strong brand equity.

New companies entering the Thai beverage market would require considerable investment in marketing and product development to challenge ThaiBev's entrenched position. Building brand recognition and convincing consumers to switch from familiar, trusted brands demands substantial resources and time, making the threat of new entrants relatively moderate in this segment.

Access to Distribution Channels

Gaining access to established distribution channels is a significant hurdle for newcomers in the beverage sector. ThaiBev benefits from an extensive and deeply entrenched distribution network that spans supermarkets, convenience stores, and the crucial food service sector, including restaurants and bars, across Thailand and the broader ASEAN region. This robust infrastructure, built over years, makes it exceptionally challenging for new entrants to secure comparable shelf space and market penetration.

For instance, ThaiBev's market presence is evident in its vast portfolio reaching millions of consumers daily. In 2023, the company reported significant sales volumes across its beverage categories, underscoring the effectiveness of its distribution reach. New companies often struggle to replicate this scale, facing higher costs and longer lead times to establish similar logistical capabilities. This disparity in distribution power creates a substantial barrier to entry.

- Distribution Network Reach: ThaiBev's established network provides access to over 500,000 retail outlets across Thailand alone.

- Logistical Costs: New entrants face significantly higher logistical costs to match ThaiBev's existing infrastructure and reach.

- Market Penetration: Securing prime shelf space in key retail and hospitality channels is a major challenge for emerging beverage brands.

Government Policy and Regulations

Government policy and regulations present a substantial barrier to entry in Thailand's beverage sector, particularly for alcoholic products. New companies must contend with stringent licensing requirements, which can be a lengthy and costly process. For instance, obtaining an alcohol manufacturing license in Thailand involves multiple steps and approvals from various government agencies.

Advertising restrictions and specific product standards also add complexity. Companies must adhere to rules on how and where they can promote their beverages, and meet quality and safety benchmarks. In 2024, the Thai government continued to enforce strict excise tax policies on alcoholic beverages, with rates varying based on alcohol content and type, directly impacting the cost structure for any new player attempting to gain market share.

Furthermore, the implementation of taxes like the sugar tax on sweetened beverages, even in non-alcoholic segments, creates an additional layer of financial consideration for new entrants. Navigating this intricate and evolving regulatory environment requires significant investment in compliance and legal expertise, acting as a deterrent for smaller or less capitalized new businesses.

- Licensing: Obtaining necessary permits for production and distribution can be a complex and time-consuming hurdle.

- Taxation: Excise duties on alcoholic beverages and sugar taxes on certain non-alcoholic drinks significantly impact pricing and profitability.

- Advertising Restrictions: Strict rules limit promotional activities, making brand building more challenging for newcomers.

- Product Standards: Compliance with quality and safety regulations requires investment in manufacturing processes and quality control.

The threat of new entrants into Thailand's beverage market is generally considered moderate, primarily due to substantial capital requirements, strong brand loyalty, and extensive distribution networks controlled by incumbents like ThaiBev. New players face significant hurdles in matching the economies of scale, marketing prowess, and regulatory navigation that established companies have mastered.

However, specific segments might present varying levels of threat. For instance, the continued enforcement of excise taxes on alcoholic beverages in 2024, alongside sugar taxes on sweetened drinks, impacts overall profitability and pricing strategies, potentially creating opportunities for niche players with different cost structures or product offerings.

ThaiBev’s 2023 revenue of approximately THB 295 billion highlights its market dominance, making it difficult for newcomers to achieve comparable scale and cost efficiencies quickly. Furthermore, securing shelf space in over 500,000 retail outlets across Thailand requires substantial investment and established relationships, a barrier that remains significant for any emerging brand.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for manufacturing, bottling, and distribution. | Significant financial barrier, requiring substantial upfront investment. |

| Brand Loyalty | Established consumer preference for brands like Chang beer. | Challenging to gain market share without significant marketing investment. |

| Distribution Channels | ThaiBev's extensive network reaching over 500,000 retail outlets. | Difficult for new entrants to secure comparable shelf space and reach. |

| Government Regulations | Strict licensing, advertising restrictions, and excise/sugar taxes. | Increases compliance costs and complexity, particularly for alcoholic beverages and sweetened drinks. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Thai Beverage is built upon a robust foundation of data, drawing from the company's annual reports, investor presentations, and public financial filings. We supplement this with insights from reputable industry research firms and market intelligence platforms to capture the competitive landscape and key industry trends.