Zhuzhou CRRC Times Electric Co. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhuzhou CRRC Times Electric Co. Bundle

Navigate the complex external landscape impacting Zhuzhou CRRC Times Electric Co. with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping opportunities and challenges in the rail and electric vehicle sectors. Gain a strategic advantage by uncovering social trends and environmental regulations that influence operational decisions. Download the full PESTLE analysis now to arm yourself with actionable intelligence for informed strategic planning and investment decisions.

Political factors

The Chinese government's commitment to expanding its rail network, particularly high-speed and urban transit systems, is a significant tailwind for Zhuzhou CRRC Times Electric. For instance, China's railway investment exceeded 700 billion yuan (approximately $97 billion USD) in 2023, with continued strong allocations expected through 2025, directly boosting demand for the company's electric drive systems and related technologies.

These government-led infrastructure initiatives are typically supported by substantial state funding and long-term strategic planning. This creates a stable and predictable market environment for Zhuzhou CRRC Times Electric, reducing exposure to market fluctuations and fostering consistent revenue streams from these large-scale projects.

Such robust governmental backing not only stabilizes the market but also actively encourages sustained expansion within the rail transportation sector. This proactive support translates into ongoing opportunities for Zhuzhou CRRC Times Electric to supply its advanced electric propulsion solutions, underpinning its growth trajectory.

China's national industrial policies, notably 'Made in China 2025,' are a significant political factor for Zhuzhou CRRC Times Electric. These policies champion indigenous innovation and increased domestic content within strategic industries, directly impacting advanced rail equipment and new energy vehicles, sectors where CRRC Times Electric is a major player.

As a result, CRRC Times Electric is positioned to benefit from preferential treatment, including research and development subsidies and market protection. For instance, government support for high-speed rail development has been a consistent theme, with significant state investment driving domestic manufacturers. In 2023, China's railway investment reached approximately 760 billion RMB, underscoring the scale of this policy-driven growth.

These government initiatives are designed to bolster the competitiveness of domestic firms like CRRC Times Electric against international competitors. By fostering technological advancement through these policies, the company is better equipped to lead in its specialized fields.

Rising geopolitical tensions, particularly between China and Western nations, create significant headwinds for Zhuzhou CRRC Times Electric. Increased trade protectionism, including tariffs and export controls, directly threatens the company's ability to access key international markets and maintain stable supply chains. For instance, in 2023, the US continued to implement tariffs on various goods, impacting global trade flows and potentially increasing costs for imported components or finished products.

Belt and Road Initiative opportunities

The Belt and Road Initiative (BRI) offers Zhuzhou CRRC Times Electric substantial avenues for global expansion, driven by extensive infrastructure projects in participating nations. The significant need for enhanced rail and energy infrastructure along BRI corridors directly translates into new market opportunities for the company's specialized electric drive systems, traction converters, and renewable energy technologies. This strategic initiative not only opens doors to emerging markets but also cultivates enduring partnerships for large-scale, long-term projects.

The BRI's focus on connectivity and development is particularly beneficial for companies like Zhuzhou CRRC Times Electric, which specialize in the very infrastructure components essential for these projects. For instance, the initiative aims to connect Asia with Europe and Africa, requiring massive investments in transportation networks. By 2023, over 150 countries had signed BRI cooperation agreements, highlighting the sheer scale of potential projects. Zhuzhou CRRC Times Electric's expertise in high-speed rail components and power systems positions it as a key player in supplying these critical technologies.

- Increased demand for rail infrastructure: The BRI is driving significant investment in new and upgraded railway lines across Asia, Africa, and Europe, creating direct demand for CRRC Times Electric's traction systems and related equipment.

- Energy infrastructure development: Beyond rail, the initiative includes substantial projects in power grids and renewable energy, areas where CRRC Times Electric offers advanced solutions, including electric drive systems for power generation and grid integration.

- Market access and partnerships: The BRI framework facilitates easier market entry and fosters collaborative opportunities with local entities and governments, enabling CRRC Times Electric to secure long-term contracts and build a stronger international presence.

Regulatory stability in key markets

Zhuzhou CRRC Times Electric's operational landscape is significantly shaped by regulatory stability in its primary markets, particularly China and countries involved in the Belt and Road Initiative. Predictable and consistent regulations concerning rail safety, emissions, and product certification are vital for the company's ability to forecast demand and invest in R&D. For instance, China's ongoing commitment to high-speed rail development, supported by stable regulatory frameworks, has been a key driver for CRRC's domestic growth. In 2023, China's railway network continued its expansion, with new lines and upgrades requiring advanced signaling and power systems, areas where CRRC Times Electric is a major player.

Sudden regulatory changes pose a considerable risk, potentially impacting product compliance and market access. For example, a shift in environmental standards for traction systems in a major export market could necessitate costly re-engineering. The company's ability to adapt to evolving international standards, such as those for interoperability and cybersecurity in railway systems, directly influences its global competitiveness. As of early 2025, discussions around stricter cybersecurity mandates for critical infrastructure, including rail networks, are ongoing in several European nations, which could affect future product specifications.

- Regulatory Predictability: Stable policies in China and BRI countries support CRRC Times Electric's long-term strategic planning and investment in new technologies.

- Compliance Costs: Unforeseen regulatory shifts, especially concerning environmental or safety standards, can lead to increased product development and certification expenses.

- Market Access: Adherence to consistent international standards is crucial for maintaining and expanding market share in global railway projects.

- Cybersecurity Focus: Emerging cybersecurity regulations in key international markets may require proactive adjustments to the company's product design and service offerings.

China's national industrial policies, like Made in China 2025, significantly benefit Zhuzhou CRRC Times Electric by promoting domestic innovation in strategic sectors such as advanced rail equipment. This policy environment offers preferential treatment, including R&D subsidies, which helped the company secure its leading position. For instance, government support for high-speed rail development in 2023, backed by substantial state investment, continues to fuel demand for CRRC's specialized electric propulsion solutions.

Geopolitical tensions present challenges, with potential trade protectionism and tariffs impacting global supply chains and market access for CRRC Times Electric. For example, the ongoing trade dynamics in 2023 between major economies have highlighted the risks associated with international market reliance. The company must navigate these complexities to maintain its competitive edge and operational stability.

The Belt and Road Initiative (BRI) provides significant global expansion opportunities for CRRC Times Electric, driven by infrastructure development in over 150 participating countries as of 2023. The demand for enhanced rail and energy infrastructure along BRI corridors directly translates into new markets for the company's electric drive systems and related technologies, fostering long-term partnerships.

| Political Factor | Impact on CRRC Times Electric | Supporting Data (2023-2025 Projections) |

|---|---|---|

| Government Infrastructure Spending (China) | Increased demand for rail systems and components. | China's railway investment exceeded 700 billion yuan (~$97 billion USD) in 2023, with continued strong allocations expected through 2025. |

| National Industrial Policies (e.g., Made in China 2025) | Preferential treatment, R&D subsidies, and market protection for domestic firms. | Policies aim to boost indigenous innovation in sectors like advanced rail, directly benefiting CRRC's core business. |

| Geopolitical Tensions & Trade Protectionism | Threatens market access and supply chain stability; potential cost increases. | Ongoing trade disputes in 2023 led to increased tariffs and export controls impacting global trade flows. |

| Belt and Road Initiative (BRI) | Opens new markets and fosters partnerships for global expansion. | Over 150 countries signed BRI agreements by 2023, driving demand for rail and energy infrastructure CRRC supplies. |

What is included in the product

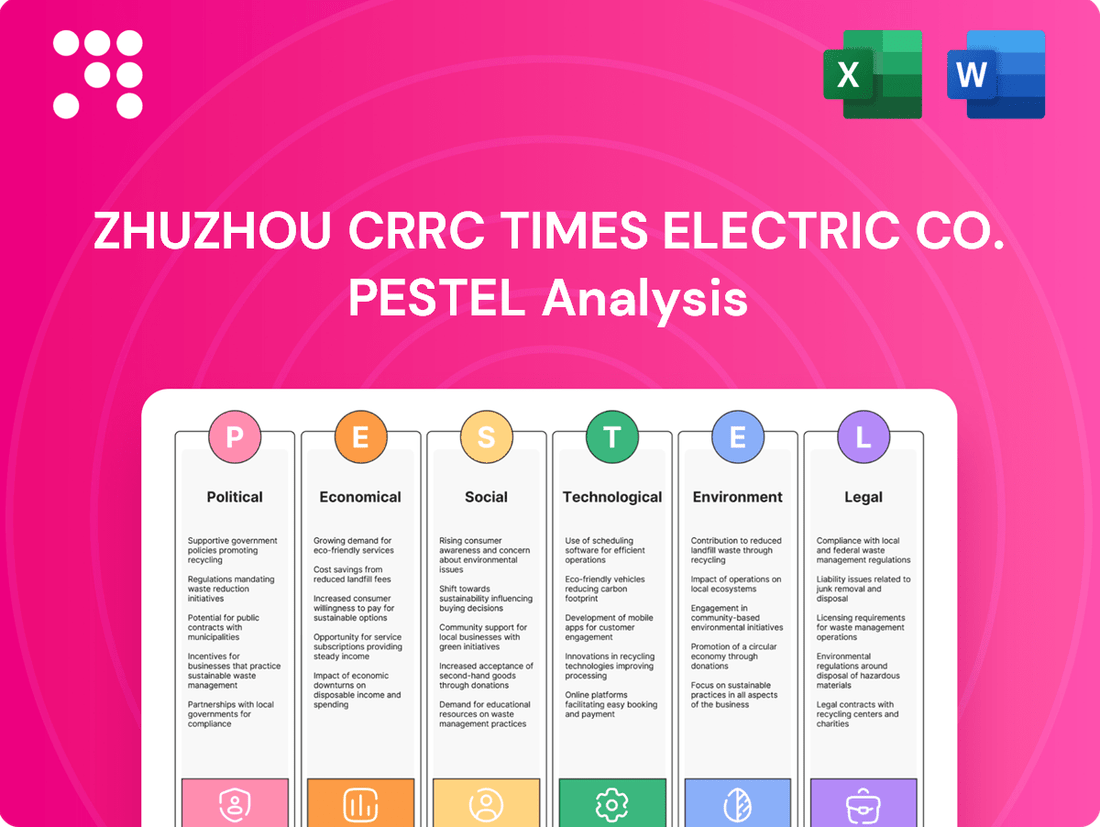

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Zhuzhou CRRC Times Electric Co., covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into market opportunities and potential threats, enabling strategic decision-making and proactive adaptation for the company.

This PESTLE analysis for Zhuzhou CRRC Times Electric Co. provides a clear, summarized version of external factors, acting as a pain point reliever by offering easy referencing for strategic discussions and decision-making.

Economic factors

Global economic growth is a significant driver for Zhuzhou CRRC Times Electric. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, indicating a generally favorable environment for infrastructure investment. Nations prioritizing modernization and sustainability are more likely to fund large-scale rail and energy projects, directly boosting demand for CRRC Times Electric's advanced electrical systems and components.

Infrastructure spending is particularly crucial. In 2024, many countries continued to allocate substantial funds towards upgrading transportation networks and expanding renewable energy capacity. The US Infrastructure Investment and Jobs Act, for example, earmarks billions for transportation improvements, creating opportunities for companies like CRRC Times Electric that supply critical technologies for these sectors.

Conversely, economic slowdowns or recessions can temper this spending. A projected slowdown in global growth, or increased geopolitical instability, could lead to delayed or scaled-back infrastructure initiatives. This would directly impact CRRC Times Electric's order pipeline and revenue, as major projects often represent multi-year contracts.

Fluctuations in raw material costs pose a significant economic challenge for Zhuzhou CRRC Times Electric. The prices of essential inputs like copper, steel, rare earth elements, and semiconductor components, critical for their electric drive systems and converters, directly affect profit margins. For instance, in early 2024, copper prices saw considerable volatility, trading around $8,000-$9,000 per metric ton, impacting manufacturing expenses.

Global commodity market volatility and supply chain disruptions, as seen with semiconductor shortages in recent years, can cause unpredictable spikes in production costs. These events necessitate robust supply chain management and hedging strategies to cushion the economic impact and maintain competitive pricing.

Exchange rate volatility presents a significant economic factor for Zhuzhou CRRC Times Electric. As a company with substantial international sales, fluctuations between the Chinese Yuan (CNY) and major currencies like the US Dollar (USD) and Euro directly influence its export competitiveness and the translation of foreign earnings. For instance, during periods of Yuan appreciation, CRRC Times Electric's products become more expensive for overseas buyers, potentially dampening international demand.

Conversely, a weaker Yuan can enhance export pricing power, making its offerings more attractive globally. However, this scenario also raises the cost of imported components necessary for production. In 2024, the CNY experienced periods of weakness against the USD, which could have provided a tailwind for exports, but also increased the Yuan cost of imported raw materials and advanced components, impacting overall profitability.

Access to capital and financing for large projects

Access to capital is a significant driver for large infrastructure projects, directly impacting demand for Zhuzhou CRRC Times Electric's products. Favorable financing terms, such as lower interest rates or government incentives, encourage investment in rail and renewable energy sectors. For instance, in 2024, global infrastructure investment is projected to reach trillions, with a substantial portion reliant on accessible and affordable financing. Tight credit markets or elevated interest rates, as seen in some periods of 2023 and early 2024, can significantly slow down the initiation of these capital-intensive projects.

Government-backed loan programs and project financing schemes play a crucial role in de-risking investments for clients undertaking massive undertakings. These mechanisms can unlock projects that might otherwise be financially unviable. The availability of such support directly translates into a more robust pipeline of opportunities for companies like Zhuzhou CRRC Times Electric. For example, many countries are actively promoting green finance initiatives in 2024 to accelerate renewable energy deployment, creating a more conducive environment for related equipment suppliers.

The cost and availability of capital directly influence the economic feasibility of new rail lines, high-speed train upgrades, and large-scale renewable energy installations. When credit is readily available and affordable, clients are more likely to commit to these long-term investments. Conversely, periods of high interest rates, such as those experienced through 2023, can make financing prohibitively expensive, leading to project delays or cancellations. This directly impacts the order books and revenue streams for companies supplying essential components and systems.

Key factors influencing access to capital for large projects include:

- Interest Rate Environment: Fluctuations in benchmark interest rates directly affect the cost of borrowing for project developers.

- Government Support Mechanisms: The presence and accessibility of government guarantees, subsidies, or direct lending programs are critical enablers.

- Investor Confidence: The overall economic outlook and perceived project risk influence the willingness of private investors and financial institutions to provide funding.

- Availability of Project Finance: Specialized financing structures tailored for large, long-term projects are essential for their successful execution.

Inflationary pressures affecting operational costs

Inflationary pressures are a significant concern for Zhuzhou CRRC Times Electric, directly impacting its operational costs. Rising general inflation, as seen in recent global trends, can drive up expenses for essential inputs like labor, energy, and logistics. For instance, China's Consumer Price Index (CPI) saw a notable increase in early 2024, indicating broader cost pressures across industries.

These increased operational costs can affect Zhuzhou CRRC Times Electric's profitability. While the company might attempt to pass some of these higher expenses onto its customers through price adjustments, sustained high inflation can still squeeze profit margins if cost increases outpace revenue growth. The ability to manage these cost escalations effectively is crucial for maintaining financial health.

To navigate these challenges, Zhuzhou CRRC Times Electric must closely monitor inflation rates and implement robust cost-control strategies. This includes exploring more efficient production methods, optimizing supply chain logistics, and potentially hedging against volatile commodity prices. Proactive management of these inflationary impacts is key to ensuring continued financial performance and competitiveness.

- Increased Input Costs: Global inflation trends in 2024 have led to higher raw material prices and elevated energy costs, directly impacting manufacturing expenses for companies like Zhuzhou CRRC Times Electric.

- Wage Inflation: Growing labor markets and demands for higher wages in China contribute to increased personnel expenses, a key operational cost for the company.

- Transportation and Logistics: Rising fuel prices and global shipping costs, exacerbated by geopolitical factors in 2024, add to the expense of moving components and finished products.

Global economic growth directly influences demand for Zhuzhou CRRC Times Electric's infrastructure solutions. With projected global growth around 3.2% for 2024 by the IMF, there's a generally positive outlook for infrastructure investment, especially in nations focused on modernization and sustainability. This translates to increased opportunities for the company's advanced electrical systems in rail and energy projects.

Infrastructure spending remains a critical economic driver. Many countries continued significant investments in transportation and renewable energy in 2024. For example, the US Infrastructure Investment and Jobs Act, allocating billions to transportation, creates a direct market for CRRC Times Electric's technological contributions.

However, economic downturns pose a risk, potentially leading to scaled-back infrastructure initiatives and impacting CRRC Times Electric's order pipeline. Fluctuations in raw material costs, such as copper prices trading around $8,000-$9,000 per metric ton in early 2024, also directly affect profit margins.

Exchange rate volatility is another key factor; a stronger Yuan in 2024 could make exports pricier for international buyers, potentially dampening demand. Conversely, access to capital is vital, with affordable financing in 2024 crucial for the multi-trillion dollar global infrastructure investment market.

Full Version Awaits

Zhuzhou CRRC Times Electric Co. PESTLE Analysis

The preview you see here is the exact Zhuzhou CRRC Times Electric Co. PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

Rapid urbanization continues to be a major global trend, particularly in developing nations. This surge in city populations, with an estimated 68% of the world's population projected to live in urban areas by 2050 according to UN data, intensifies the need for effective public transit. Zhuzhou CRRC Times Electric, a key player in this sector, directly benefits as cities invest in expanding and modernizing their rail networks to manage this growth.

The increasing density within urban centers creates a clear demand for sustainable transportation options like metros and light rail. These systems are the backbone of modern urban mobility, and their development and maintenance rely heavily on the advanced electric drive and control technologies supplied by companies like Zhuzhou CRRC Times Electric. The company's solutions are integral to building and upgrading these vital transit infrastructures.

A significant societal trend is the increasing public demand for green transportation options, fueled by heightened awareness of climate change and air pollution. This shift directly benefits companies like Zhuzhou CRRC Times Electric, whose expertise in electric rail and sustainable energy systems aligns perfectly with these evolving consumer preferences. For instance, in 2024, global investment in sustainable transportation infrastructure saw a notable uptick, with electric vehicle sales alone projected to reach over 15 million units worldwide, indicating a strong market appetite for eco-friendly solutions.

The specialized nature of electric drive systems, rail transportation technology, and renewable energy equipment demands a highly skilled workforce. This includes engineers, researchers, and technical specialists with expertise in these complex fields.

Zhuzhou CRRC Times Electric's innovation, production, and service capabilities are significantly dependent on accessing a large and well-trained talent pool. For instance, in 2023, China's manufacturing sector faced a growing demand for skilled technicians, with reports indicating a shortage of around 30 million skilled workers across various industries, a trend that directly impacts companies like CRRC Times Electric.

Shortages in skilled labor can indeed impede growth and lead to increased operational costs. If CRRC Times Electric struggles to find enough qualified personnel, it could slow down new product development and affect the efficiency of its manufacturing processes, potentially impacting its competitive edge.

Workforce demographics and labor costs

Demographic shifts in China, such as a gradually aging population and evolving labor market participation, directly influence the availability and cost of skilled workers for Zhuzhou CRRC Times Electric. While China's vast labor pool remains a strength, upward pressure on wages, with average manufacturing wages in China increasing by approximately 7-8% annually in recent years, could impact the company's production expenses. This necessitates a strategic focus on automation and potentially localized manufacturing to mitigate rising labor costs.

Understanding these workforce dynamics is crucial for Zhuzhou CRRC Times Electric's long-term human resource planning and operational efficiency. For instance, the dependency ratio in China, which measures the number of dependents (children and elderly) per working-age person, has been on the rise, potentially impacting the future supply of younger workers. The company's investment in advanced manufacturing technologies and R&D talent acquisition strategies will be key to navigating these demographic trends and maintaining a competitive edge.

- Aging Workforce: China's median age has been steadily increasing, posing challenges for labor-intensive manufacturing.

- Rising Labor Costs: Wage inflation in China's manufacturing sector continues to outpace many other global regions.

- Automation Imperative: Companies like Zhuzhou CRRC Times Electric are increasingly investing in automation to offset labor cost increases.

- Talent Acquisition: Securing and retaining skilled engineers and technicians is paramount amidst demographic shifts.

Corporate social responsibility expectations

Societal expectations for corporate social responsibility (CSR) are increasingly influencing business operations. Customers, investors, and the general public now demand that companies exhibit ethical labor practices, actively engage with their communities, and prioritize environmental stewardship. This trend is evident globally, with a growing emphasis on ESG (Environmental, Social, and Governance) factors in investment decisions. For example, in 2024, the global sustainable investment market reached an estimated $37.4 trillion, indicating a significant shift towards socially conscious capital allocation.

Zhuzhou CRRC Times Electric's proactive approach to sustainable manufacturing, robust employee welfare programs, and a commitment to responsible business conduct are crucial for bolstering its brand reputation. By aligning with these societal demands, the company can attract a growing segment of socially conscious investors and forge stronger partnerships. A recent survey in late 2024 found that over 70% of consumers are more likely to purchase from brands that demonstrate strong CSR commitments.

Conversely, failure to meet these rising CSR expectations can result in substantial reputational damage and financial repercussions. Companies perceived as neglecting their social or environmental responsibilities may face boycotts, divestment from investors, and increased regulatory scrutiny. In 2024, several high-profile companies experienced significant stock price declines following public outcry over their labor or environmental practices.

- Growing Demand for Ethical Practices: Over 70% of consumers in late 2024 indicated a preference for brands with strong CSR.

- Investor Influence: The global sustainable investment market reached $37.4 trillion in 2024, highlighting the financial impact of ESG.

- Reputational Risk: Companies ignoring CSR face potential boycotts and investor divestment, as seen in stock declines of some firms in 2024.

Societal shifts toward sustainability and green initiatives directly benefit Zhuzhou CRRC Times Electric, as evidenced by the 2024 global sustainable investment market reaching $37.4 trillion. This increasing consumer and investor preference for eco-friendly solutions aligns perfectly with the company's focus on electric rail technology. Furthermore, a growing demand for ethical corporate behavior, with over 70% of consumers in late 2024 favoring brands with strong CSR, underscores the importance of the company's commitment to responsible practices.

Technological factors

Zhuzhou CRRC Times Electric is significantly influenced by ongoing leaps in high-speed rail technology. Innovations like increased speeds, better energy conservation, and upgraded safety measures directly shape the company's product evolution. For instance, the development of new high-speed rail lines in China, such as the Beijing-Shanghai High-Speed Railway which reached operational speeds of 350 km/h, necessitates advanced components from companies like CRRC Times Electric.

To maintain its competitive edge, CRRC Times Electric must pour resources into research and development, ensuring its traction converters and control systems are not only current but also ready for the next generation of rail engineering. This commitment to technological advancement is vital for holding a leading position in the global rail market, especially as countries worldwide continue to invest in high-speed rail infrastructure, with global high-speed rail network length projected to exceed 70,000 km by 2030.

Zhuzhou CRRC Times Electric is poised to benefit from significant advancements in electric drive systems and energy storage. Breakthroughs in electric motor design, power electronics, and energy storage solutions, such as next-generation batteries and supercapacitors, present a clear opportunity to boost the performance, dependability, and energy efficiency of their offerings. For instance, the global electric vehicle battery market was valued at approximately $74.5 billion in 2023 and is projected to reach $300 billion by 2030, indicating substantial growth in the underlying technology.

By integrating these cutting-edge innovations, Zhuzhou CRRC Times Electric can develop lighter, more potent, and environmentally friendly drive systems, particularly for the rail and marine sectors. The company's commitment to research and development is crucial for capitalizing on these technological leaps. In 2023, CRRC Corporation Limited, the parent company, invested over 10% of its revenue in R&D, a significant portion of which supports the development of electrified transportation solutions.

Zhuzhou CRRC Times Electric is well-positioned to leverage the integration of smart grid and IoT technologies within the rail sector. This convergence allows for the creation of intelligent systems for predictive maintenance, real-time performance tracking of rolling stock, and sophisticated energy management for both rail infrastructure and renewable energy sources like wind farms. For instance, smart grid advancements in 2024 are enabling more granular data collection, which CRRC Times Electric can use to refine its IoT-based monitoring solutions, potentially reducing downtime by an estimated 15-20% for key rail components.

The company's expertise in electrical systems, combined with the growing adoption of IoT in industrial applications, opens avenues for developing advanced digital services. These services can go beyond traditional equipment supply, offering enhanced operational efficiency and new revenue streams through data analytics and optimized network management. By 2025, the global market for rail IoT solutions is projected to reach over $10 billion, a significant growth area where CRRC Times Electric can expand its market share by offering integrated smart grid capabilities.

Cybersecurity threats to critical infrastructure

As rail and energy systems become more digitized and interconnected, the risk of cybersecurity threats to critical infrastructure escalates significantly. Zhuzhou CRRC Times Electric, a key player in providing essential control systems for these sectors, faces the imperative to allocate substantial resources towards developing and implementing advanced cybersecurity defenses. This investment is crucial to safeguard its own products and the infrastructure of its clients from sophisticated cyberattacks.

The increasing reliance on digital networks for operational control means that vulnerabilities can be exploited to disrupt services, cause widespread damage, or steal sensitive data. For Zhuzhou CRRC Times Electric, ensuring the security of its software and hardware components is not merely a technical requirement but a foundational element for maintaining client trust and the overall operational integrity of the systems it provides.

In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial and operational risks involved. Sectors like transportation and energy are increasingly targeted. For instance, reports from 2023 indicated a rise in ransomware attacks specifically targeting operational technology (OT) within critical infrastructure, underscoring the urgency for companies like Zhuzhou CRRC Times Electric to fortify their defenses.

- Increased Vulnerability: The digital transformation of rail and energy systems creates new attack vectors for cyber threats.

- Investment Imperative: Zhuzhou CRRC Times Electric must prioritize significant investment in robust cybersecurity measures to protect its control systems and client infrastructure.

- Trust and Integrity: Ensuring the security of software and hardware is paramount for maintaining customer confidence and operational reliability.

- Economic Impact: Global cybercrime costs are projected to skyrocket, emphasizing the financial stakes for critical infrastructure providers.

R&D investment and intellectual property protection

Zhuzhou CRRC Times Electric's commitment to research and development is crucial for staying ahead in the rapidly evolving rail transit and advanced manufacturing sectors. In 2023, the company reported R&D expenses of 2.6 billion RMB, a significant increase from previous years, reflecting its focus on innovation. This sustained investment is key to developing cutting-edge technologies like intelligent train control systems and advanced power electronics.

Protecting its intellectual property is paramount for Zhuzhou CRRC Times Electric to maintain its competitive advantage. The company holds over 10,000 patents as of late 2024, covering critical areas such as high-speed train propulsion and smart grid technologies. A robust IP portfolio not only shields its innovations from infringement but also enables it to differentiate its offerings and solidify its market leadership.

- R&D Investment: Zhuzhou CRRC Times Electric invested 2.6 billion RMB in R&D in 2023, highlighting a strong commitment to technological advancement.

- Intellectual Property: The company possesses over 10,000 patents, safeguarding its innovations in areas like train control and power electronics.

- Market Differentiation: A strong IP portfolio allows the company to offer unique solutions and maintain a leading position in its target markets.

Advancements in artificial intelligence (AI) and machine learning (ML) are set to revolutionize rail operations, offering Zhuzhou CRRC Times Electric opportunities in predictive maintenance and operational efficiency. By 2025, the global AI in transportation market is expected to reach $10.8 billion, with rail being a significant contributor. These technologies can optimize train scheduling, improve energy consumption, and enhance passenger experience.

The integration of AI and ML into CRRC Times Electric's product portfolio, such as their advanced signaling and control systems, can lead to smarter, more autonomous rail networks. For instance, AI-powered systems can analyze vast amounts of data from sensors to predict component failures before they occur, reducing costly downtime. The company's investment in R&D, which saw CRRC Corporation Limited invest over 10% of its revenue in 2023, is crucial for developing these sophisticated AI applications.

| Technology Area | 2023/2024 Data/Projections | Impact on CRRC Times Electric |

|---|---|---|

| AI in Transportation Market | Projected to reach $10.8 billion by 2025 | Opportunities for smarter rail operations, predictive maintenance, and optimized energy usage. |

| High-Speed Rail Network Growth | Projected to exceed 70,000 km by 2030 | Increased demand for advanced components like traction converters and control systems. |

| Electric Vehicle Battery Market | Valued at ~$74.5 billion in 2023, projected to reach $300 billion by 2030 | Drives innovation in electric drive systems and energy storage solutions for rail. |

| Rail IoT Solutions Market | Projected to exceed $10 billion by 2025 | Growth potential for integrated smart grid capabilities and data analytics services. |

| Global Cybercrime Costs | Projected to reach $10.5 trillion annually by 2025 | Necessitates significant investment in cybersecurity for critical rail infrastructure control systems. |

Legal factors

Zhuzhou CRRC Times Electric must navigate a complex web of rail safety standards, including those set by bodies like the International Union of Railways (UIC) and national regulators such as the Federal Railroad Administration (FRA) in the US. Obtaining certifications for its electric drive systems and control equipment is a critical, non-negotiable step for market access. For instance, in 2024, the European Union continued to emphasize interoperability and safety through updated Technical Specifications for Interoperability (TSIs).

Compliance with these evolving regulations, which differ significantly across jurisdictions, directly impacts Zhuzhou CRRC Times Electric's ability to participate in global tenders and secure contracts. A failure to meet these stringent requirements, such as those related to electromagnetic compatibility or functional safety, can lead to costly product recalls, substantial fines, and outright exclusion from lucrative projects, as seen in past instances where non-compliant suppliers were disqualified from major infrastructure bids.

Zhuzhou CRRC Times Electric faces growing pressure from stricter environmental laws, especially those targeting manufacturing emissions and the energy efficiency of its electric products. For instance, China's national emissions standards for industrial pollution continue to tighten, impacting the company's production facilities and requiring ongoing investment in cleaner technologies.

Compliance with regulations on pollutants, waste management, and energy usage is non-negotiable for maintaining operational licenses and market access. Furthermore, Zhuzhou CRRC Times Electric's transit solutions, like high-speed rail components, must meet evolving environmental performance benchmarks set by international bodies and national governments, influencing product design and material selection.

Zhuzhou CRRC Times Electric's global operations are significantly shaped by international trade laws. These encompass import and export regulations, customs duties, and potential anti-dumping actions, all of which directly influence the cost of goods and market access. For instance, the World Trade Organization (WTO) reported that global trade growth slowed to an estimated 0.9% in 2023, reflecting a more complex regulatory environment.

Fluctuations in trade policies and the imposition of tariffs can directly impact Zhuzhou CRRC Times Electric's supply chain efficiency and the competitiveness of its exported products. The ongoing trade tensions between major economies, for example, have led to increased uncertainty and costs for many multinational corporations. Navigating this intricate legal landscape is therefore crucial for maintaining profitability and market position.

Intellectual property rights and patent enforcement

The strength and consistency of intellectual property rights (IPR) protection, particularly patent enforcement, across the various markets Zhuzhou CRRC Times Electric operates in are paramount. Strong legal frameworks are essential to safeguard their advanced technologies from imitation and unauthorized replication, thereby protecting their significant R&D investments. For instance, China's commitment to strengthening IP protection has seen a notable increase in patent filings and enforcement actions in recent years, with the Supreme People's Court reporting a 23.6% rise in IP case filings in 2023 compared to the previous year. This environment is crucial for CRRC Times Electric to maintain its competitive edge and prevent the dilution of its technological innovations.

The company's strategy must include vigilant monitoring and proactive enforcement of its intellectual property on a global scale. This proactive stance is vital for securing its market share and ensuring that its technological advancements translate into sustained commercial success. In 2024, global IP litigation spending is projected to continue its upward trend, reflecting the increasing importance of IP as a strategic asset. CRRC Times Electric's ability to navigate and leverage these legal landscapes directly impacts its long-term profitability and market leadership.

Key considerations for Zhuzhou CRRC Times Electric regarding legal factors include:

- Global Patent Portfolio Management: Ensuring comprehensive patent coverage in key operational and manufacturing regions, with a focus on emerging markets demonstrating increased IP enforcement.

- Enforcement Strategy: Developing robust legal strategies to combat infringement, including litigation, cease-and-desist orders, and customs recordation in jurisdictions with varying IP protection levels.

- Regulatory Compliance: Adhering to evolving national and international regulations concerning technology transfer, data privacy, and product safety, which can impact the deployment of their innovations.

- Trade Secret Protection: Implementing strong internal policies and contractual agreements to safeguard proprietary information and trade secrets, especially in collaborative ventures.

Government procurement regulations and bidding processes

Zhuzhou CRRC Times Electric, as a key supplier for state-owned enterprises and major government infrastructure initiatives, navigates a landscape shaped by stringent government procurement regulations. These regulations are designed to ensure fairness, transparency, and value for taxpayer money in how contracts are awarded. For instance, in 2023, China's central government continued to emphasize centralized procurement platforms for major projects, aiming to streamline processes and enhance oversight.

The company must meticulously adhere to these often complex bidding processes, which can involve detailed technical specifications, rigorous qualification criteria, and strict timelines. Successfully winning contracts, particularly for large-scale projects like high-speed rail or urban transit systems, hinges on a deep understanding and compliance with these legal frameworks. In 2024, the focus on domestic sourcing and technological self-reliance within China's procurement policies remains a significant factor for companies like CRRC Times Electric.

- Compliance with China's Public Procurement Law: This law governs all government purchases, setting standards for bidding, negotiation, and contract execution.

- Adherence to Specific Industry Regulations: For rail and transportation projects, additional regulations from bodies like the China Railway Corporation (now China State Railway Group) dictate technical and safety standards.

- International Procurement Standards: For projects funded by international financial institutions, CRRC Times Electric must also meet their specific procurement guidelines, which often include stringent anti-corruption clauses.

- Impact of Trade Policies: Government trade policies and tariffs can influence the cost of imported components used in projects, affecting bidding competitiveness.

Zhuzhou CRRC Times Electric operates within a framework of evolving safety and interoperability standards, crucial for global market access. For instance, the European Union's updated Technical Specifications for Interoperability (TSIs) in 2024 continue to emphasize these aspects, directly impacting CRRC Times Electric's ability to secure international contracts by meeting stringent requirements.

The company must also contend with increasingly strict environmental regulations, such as China's tightening emissions standards for industrial pollution, necessitating ongoing investment in cleaner production technologies. Compliance with these laws, covering waste management and energy usage, is vital for maintaining operational licenses and market participation, influencing product design and material choices.

Navigating international trade laws, including import/export rules and potential anti-dumping actions, is critical for managing costs and market access, especially given the 0.9% global trade growth forecast for 2023. Fluctuations in trade policies and tariffs directly affect supply chain efficiency and product competitiveness, making legal compliance a key factor for profitability.

Protecting its intellectual property is paramount, with China's strengthening IP protection, evidenced by a 23.6% rise in IP case filings in 2023, offering a more robust legal environment. CRRC Times Electric's strategy must include vigilant monitoring and proactive enforcement of its patents globally, as global IP litigation spending is projected to increase in 2024.

Environmental factors

The global drive towards decarbonization and net-zero emissions by 2050 is a powerful tailwind for Zhuzhou CRRC Times Electric. This international commitment directly fuels demand for their electric rail systems and wind power converters, key areas of their business. For instance, the International Energy Agency (IEA) reported in 2024 that renewable energy sources accounted for over 80% of new electricity capacity globally in 2023, highlighting the market expansion for wind power components.

CRRC Times Electric's product portfolio is intrinsically linked to this environmental shift. Their advanced traction systems for high-speed rail and metro lines offer a cleaner alternative to traditional transport, while their power electronics for wind turbines are crucial for harnessing renewable energy. By providing these solutions, the company actively supports the reduction of carbon emissions across the transportation and energy sectors, aligning its growth with sustainability goals.

Growing environmental awareness and supportive government policies are significantly driving the global demand for renewable energy, with wind power at the forefront. This surge directly benefits Zhuzhou CRRC Times Electric by increasing the market for its wind power converters and associated electrical equipment.

The company is well-positioned to capitalize on substantial investments being channeled into new wind farm developments and the broader transition away from fossil fuels in electricity generation. For instance, global investment in renewable energy reached an estimated $1.7 trillion in 2023, with wind power accounting for a significant portion of this growth, according to BNEF data.

Zhuzhou CRRC Times Electric faces growing pressure to improve resource efficiency and waste management, a trend amplified by global sustainability initiatives. For instance, China's commitment to reducing carbon emissions by 2030, with a peak before then, directly impacts heavy industries like manufacturing. This necessitates optimizing material usage, cutting energy consumption, and enhancing recycling programs to align with national environmental goals.

The company's operational sustainability is increasingly linked to its environmental footprint. By investing in cleaner production technologies and robust waste management systems, Zhuzhou CRRC Times Electric can not only comply with stricter regulations but also bolster its corporate image. A positive environmental record, particularly in resource efficiency, can attract environmentally conscious investors and customers, contributing to long-term business resilience.

Climate change resilience in infrastructure

The escalating frequency and intensity of extreme weather events, a direct consequence of climate change, are driving a significant need for more resilient rail and energy infrastructure. This trend translates into a growing demand for robust and dependable electrical systems capable of enduring challenging environmental conditions. Zhuzhou CRRC Times Electric is positioned to meet this demand by focusing on product development and testing that ensures reliable performance in a dynamic climate, thereby offering solutions that bolster infrastructure resilience.

The company's commitment to climate resilience is crucial, as global infrastructure investment is increasingly prioritizing adaptation. For instance, the World Economic Forum highlighted in its 2024 Global Risks Report that extreme weather events are among the top long-term threats. This underscores the market opportunity for Zhuzhou CRRC Times Electric's advanced electrical systems.

- Increased demand for climate-resilient electrical components

- Focus on product durability against extreme weather

- Opportunity to provide solutions for infrastructure adaptation

- Alignment with global infrastructure resilience goals

Compliance with environmental reporting standards

Zhuzhou CRRC Times Electric faces increasing pressure to adhere to evolving environmental reporting standards, a critical aspect of its PESTLE analysis. This includes detailed disclosure of carbon emissions, energy usage, and overall environmental footprint, reflecting a global trend towards greater corporate accountability.

Meeting these regulatory mandates and investor expectations requires robust systems for tracking and reporting environmental performance. For instance, companies globally are investing in advanced data analytics to ensure accuracy in their sustainability disclosures, a trend likely impacting CRRC Times Electric.

- Regulatory Scrutiny: Environmental regulations are tightening globally, demanding more comprehensive and transparent reporting from industrial companies.

- Investor Demand: Investors increasingly prioritize Environmental, Social, and Governance (ESG) performance, using detailed environmental data to inform investment decisions.

- Reputational Impact: Accurate and transparent environmental reporting can enhance stakeholder trust and signal a commitment to sustainable practices, potentially improving CRRC Times Electric's brand image.

The global push for sustainability is a significant driver for Zhuzhou CRRC Times Electric, particularly in its rail and wind power sectors. The company's electric traction systems and wind power converters directly benefit from the worldwide commitment to decarbonization, with renewable energy capacity seeing substantial growth. For example, the International Energy Agency reported in early 2024 that renewable sources provided over 80% of new global electricity capacity in 2023.

CRRC Times Electric's product line is inherently aligned with environmental progress, offering cleaner transportation alternatives and essential components for renewable energy generation. This positions the company to capitalize on substantial investments in green infrastructure, with global renewable energy investments estimated at $1.7 trillion in 2023, according to BNEF data.

The company also faces increasing scrutiny regarding its own environmental footprint, necessitating greater resource efficiency and waste management improvements. China's commitment to peak carbon emissions before 2030 directly influences manufacturing sectors, requiring CRRC Times Electric to optimize material use and energy consumption.

Furthermore, the escalating impacts of climate change, such as extreme weather, are creating a demand for more resilient infrastructure, including robust electrical systems. This presents an opportunity for CRRC Times Electric to provide solutions that enhance infrastructure adaptation and withstand challenging environmental conditions.

| Environmental Factor | Impact on CRRC Times Electric | Supporting Data/Trend (2023-2024) |

|---|---|---|

| Decarbonization & Net-Zero Goals | Increased demand for electric rail and wind power components. | Renewable energy accounted for over 80% of new global electricity capacity in 2023 (IEA). |

| Renewable Energy Investment | Growth in market for wind power converters. | Global renewable energy investment reached approx. $1.7 trillion in 2023 (BNEF). |

| Climate Change & Extreme Weather | Demand for resilient electrical systems and infrastructure adaptation solutions. | Extreme weather events are top long-term global risks (World Economic Forum, 2024). |

| Environmental Reporting Standards | Pressure for greater transparency in carbon emissions and energy usage. | Global trend towards increased corporate environmental accountability and ESG focus. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Zhuzhou CRRC Times Electric Co. is grounded in data from official Chinese government publications, reports from international financial institutions, and leading industry analysis firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.