Zhuzhou CRRC Times Electric Co. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhuzhou CRRC Times Electric Co. Bundle

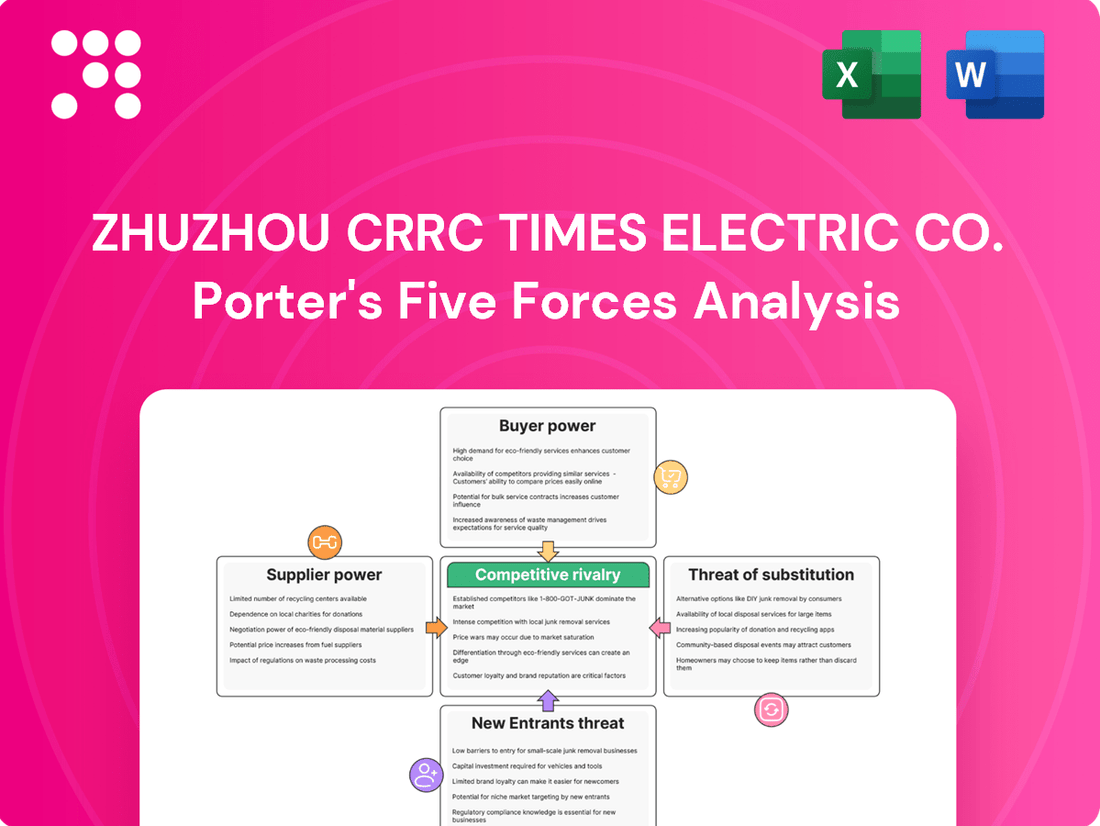

Zhuzhou CRRC Times Electric Co. faces significant competitive pressures, with moderate bargaining power from suppliers and buyers shaping its market landscape. The threat of new entrants is present, while the intensity of rivalry among existing players demands constant innovation and efficiency. Understanding these forces is crucial for strategic positioning.

Ready to move beyond the basics? Get a full strategic breakdown of Zhuzhou CRRC Times Electric Co.’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Zhuzhou CRRC Times Electric (TEC) depends on specialized suppliers for critical components like power semiconductors and advanced control systems. In 2024, the market for these high-tech inputs remained concentrated, with few manufacturers possessing the necessary expertise and production capacity.

This limited supplier base grants them significant leverage, particularly when dealing with proprietary technologies essential for TEC's electric drive systems. For instance, disruptions in the supply of advanced IGBT modules, a key component, could directly impact TEC's production schedules and product innovation.

Consequently, TEC's strategy in 2024 focused on fostering robust, long-term relationships with these key suppliers. This often involves securing stable supply chains through multi-year agreements and collaborative development initiatives to mitigate risks associated with this specialized component dependency.

Zhuzhou CRRC Times Electric Co. (TEC) actively engages in power semiconductor technology, a move that hints at a strategic effort towards vertical integration. This focus on controlling essential components like semiconductors can significantly reduce reliance on external suppliers, thereby lessening their bargaining power. For instance, in 2023, TEC’s investment in advanced power semiconductor manufacturing capabilities aimed to secure a more stable supply chain for its traction control systems and other high-tech products.

While TEC’s internal capabilities in power semiconductor technology offer a degree of insulation from supplier pressure, the company still depends on sourcing various raw materials and other specialized components. The overall impact of vertical integration on supplier bargaining power is therefore contingent on the breadth and depth of TEC's control over its entire value chain. For example, securing long-term contracts for critical rare earth materials, a key input for some of their advanced electronic components, remains a crucial factor in managing supplier leverage.

Zhuzhou CRRC Times Electric Co. (TEC) navigates a complex global supply chain where supplier power is a significant factor. Operating in both domestic Chinese and international markets exposes TEC to geopolitical shifts and evolving trade policies that can influence supplier leverage.

Disruptions, such as those seen in the semiconductor industry throughout 2021-2023, can dramatically increase supplier bargaining power. When key components become scarce or difficult to source, suppliers can command higher prices, impacting TEC's cost of goods sold. For instance, the global chip shortage led to significant price increases for electronic components across various industries.

TEC's strategy to mitigate this risk involves diversifying its supplier base across different geographic regions. This approach reduces reliance on any single supplier or region, thereby lessening the impact of localized supply chain disruptions or concentrated supplier power on its operations and profitability.

Innovation and R&D from Suppliers

Suppliers leading in crucial technological advancements, like novel materials or cutting-edge power electronics, hold considerable sway. Zhuzhou CRRC Times Electric Co. (TEC), with its substantial investment in research and development, may partner with these forward-thinking suppliers. However, such collaborations can empower suppliers if their innovations are distinctive and hard to duplicate.

The push for a 'dual carbon' economy is accelerating progress in related component sectors, which in turn can bolster the bargaining power of innovative suppliers. For instance, the demand for high-efficiency components in new energy vehicles and renewable energy infrastructure, areas where TEC is active, creates opportunities for specialized suppliers to gain leverage.

- Supplier Innovation as a Bargaining Chip: Suppliers at the vanguard of technological progress, particularly in areas like advanced materials or next-generation power electronics, can significantly influence TEC's operations and costs.

- TEC's R&D and Supplier Dependence: While TEC's own R&D efforts might involve collaboration with these innovative suppliers, this very collaboration can grant suppliers leverage, especially if their innovations are unique and difficult for TEC to replicate internally or source elsewhere.

- Impact of 'Dual Carbon' Policy: The national 'dual carbon' policy is a significant driver for rapid development in component industries relevant to TEC's business. This policy-driven growth can strengthen the position of innovative suppliers by increasing demand for their specialized products and technologies.

Switching Costs for TEC

Switching suppliers for highly integrated and specialized components in rail transit and power electronics presents significant challenges for Zhuzhou CRRC Times Electric Co. (TEC). These challenges translate directly into high switching costs.

The costs associated with changing suppliers for TEC are substantial. They encompass not only the financial outlay for redesigning and re-certifying new components but also the inherent risks of production disruptions. For instance, in the highly regulated rail industry, a change in a critical power electronics supplier could necessitate extensive re-testing and approval processes, potentially delaying product launches and impacting ongoing projects.

These high switching costs directly bolster the bargaining power of TEC's existing suppliers. Because TEC faces considerable hurdles and potential financial penalties in transitioning to a new supplier, incumbent suppliers can leverage this situation to negotiate more favorable terms, potentially impacting TEC's cost structure and profitability.

- High Redesign Costs: Specialized components often require extensive modifications to existing product designs, leading to significant engineering and development expenses for TEC.

- Re-certification Hurdles: For safety-critical applications in rail transit, new components must undergo rigorous testing and certification, a process that can be lengthy and costly.

- Production Disruption Risks: A sudden change in supplier could lead to temporary shutdowns or reduced output if new components are not immediately compatible or available in sufficient quantities, impacting delivery schedules and revenue.

- Supplier Dependence: In 2023, TEC's reliance on key suppliers for advanced traction systems and power converters meant that a disruption from even one major supplier could have a cascading effect on its production capacity.

Suppliers of specialized components for Zhuzhou CRRC Times Electric (TEC) possess considerable bargaining power due to limited alternatives and high switching costs. In 2024, the market for critical inputs like advanced power semiconductors remained concentrated, with a few key manufacturers dominating. This concentration means TEC faces significant challenges in finding comparable substitutes if a primary supplier fails to meet terms or availability. For example, disruptions in the supply of high-performance IGBT modules, essential for TEC's electric drive systems, directly impacted production timelines in early 2024, highlighting supplier leverage.

TEC's efforts towards vertical integration, such as investing in its own power semiconductor manufacturing capabilities in 2023, aim to reduce this dependency. However, the company still relies on external sources for many raw materials and other specialized parts. The bargaining power of these suppliers is further amplified by the high costs TEC would incur to switch, including redesign, re-certification, and potential production delays, particularly in the stringent rail transit sector. This dynamic allows incumbent suppliers to negotiate more favorable terms, impacting TEC's cost structure.

| Component Type | Supplier Concentration (2024) | Estimated Switching Costs for TEC | Impact on TEC |

|---|---|---|---|

| Power Semiconductors (e.g., IGBTs) | High (few dominant manufacturers) | Very High (redesign, re-certification, production ramp-up) | Significant cost pressure, potential production delays |

| Advanced Control Systems | Moderate to High (proprietary technology) | High (software integration, testing) | Limited flexibility in sourcing, potential price increases |

| Specialized Raw Materials (e.g., rare earths) | Variable (can be concentrated by region) | Moderate (long-term contracts, supply chain adjustments) | Price volatility, supply chain risk management |

What is included in the product

This analysis dissects the competitive forces shaping Zhuzhou CRRC Times Electric Co.'s market, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its strategic positioning.

Instantly grasp the competitive landscape for Zhuzhou CRRC Times Electric Co. with a clear, one-sheet summary of Porter's Five Forces, simplifying strategic analysis and decision-making.

Customers Bargaining Power

Zhuzhou CRRC Times Electric’s primary customers, including major railway operators and infrastructure developers, tend to procure in large volumes for significant projects. This concentrated demand grants them substantial bargaining power, especially given the strategic nature of their investments in rail and energy systems.

The prevalent market-oriented public bidding process is a key mechanism through which these customers exert pressure. By fostering competition among potential suppliers, they can negotiate more favorable terms, driving down prices and influencing product specifications.

For instance, in 2023, CRRC Corporation Limited, the parent company, secured contracts for a substantial portion of China’s high-speed rail expansion, demonstrating the scale of these procurement events and the leverage held by entities like China Railway.

Zhuzhou CRRC Times Electric Co. (TEC) faces significant bargaining power from its government and state-owned customers, particularly within the rail transit sector. These entities, often acting on national policy and strategic development plans, command large procurement budgets and possess considerable regulatory influence. For instance, China's ambitious high-speed rail expansion, a key market for TEC, is driven by state directives, giving the government substantial leverage in negotiations. This power is amplified by the long-term nature of infrastructure projects, allowing these customers to dictate terms and pricing over extended periods.

Customers in the rail transit and industrial solutions sectors often require highly customized products. These products must meet very specific technical specifications and rigorous safety standards, which can be a significant driver of customer power.

While this need for customization highlights Zhuzhou CRRC Times Electric Co. (TEC) expertise and creates a reliance on their capabilities, it also empowers customers. They can leverage this by demanding particular features and performance levels, which can, in turn, limit TEC's ability to set prices freely. For instance, in 2023, a significant portion of TEC's revenue came from large, bespoke projects where client specifications were paramount.

After-Sales Service and Long-Term Support

The extended operational lifecycles of rail equipment and power solutions mean that customers require significant after-sales service, maintenance, and ongoing technical support. This creates a situation where customers can leverage their power by insisting on comprehensive service agreements and favorable terms for this continuous support.

Zhuzhou CRRC Times Electric Co. (TEC) maintains a global after-sales service network, which is crucial for addressing these customer demands. However, this extensive network also represents a substantial commitment from TEC, providing customers with a point of leverage when negotiating service terms.

For instance, in 2023, TEC reported that its after-sales service and maintenance segment played a vital role in its revenue streams, underscoring the importance of this customer-facing aspect. Customers can use the need for reliable, long-term support to negotiate better pricing on initial equipment purchases or secure more advantageous service contract conditions.

- Customer Leverage: Long operational lifecycles of rail and power equipment necessitate robust after-sales support, giving customers bargaining power.

- Service Demands: Customers can influence terms by requiring comprehensive service agreements and favorable conditions for ongoing maintenance and technical assistance.

- TEC's Network: TEC's global after-sales service network, while a strength, also represents a commitment that customers can leverage.

- Financial Impact: After-sales services are a significant revenue component, making customer satisfaction and contract terms critical for TEC.

Limited Number of Direct Buyers

While the ultimate consumers of rail transit and wind energy are widespread, Zhuzhou CRRC Times Electric Co. (TEC) primarily deals with a limited number of large, direct buyers for its specialized equipment. This concentration of significant customers means that each individual buyer represents a substantial portion of TEC's revenue, giving them considerable leverage in negotiations. For instance, in 2023, major rail manufacturers and energy conglomerates often account for a significant percentage of sales for such specialized components.

The reduced number of potential buyers for TEC's high-tech rail and wind power components translates directly into increased bargaining power for these entities. Because these buyers are often large, established corporations with substantial purchasing power, they can more effectively demand favorable pricing, customized specifications, and flexible delivery terms. This dynamic can put pressure on TEC's profit margins and operational planning.

- Concentrated Buyer Base: TEC's market for specialized rail and wind power equipment is characterized by a small number of large, institutional buyers rather than a broad retail customer base.

- High Customer Value: Each significant buyer's contract is crucial to TEC's financial performance, amplifying their negotiation strength.

- Negotiating Leverage: This buyer concentration allows major clients to exert considerable influence over pricing, product features, and delivery timelines.

Zhuzhou CRRC Times Electric Co. (TEC) faces considerable bargaining power from its customer base, particularly due to the concentrated nature of its key clients in sectors like rail transit and renewable energy. These large-scale buyers, often state-owned enterprises or major infrastructure developers, procure in significant volumes, granting them substantial negotiation leverage. For example, in 2023, the demand for advanced rail signaling systems from national railway operators represented a substantial portion of TEC's order book, allowing these entities to influence pricing and specifications.

The public bidding processes common in these industries further empower customers. By fostering competition among suppliers, these mechanisms enable buyers to secure more favorable terms and pricing. This is evident in the competitive tenders for high-speed rail components, where price is a critical factor. Furthermore, the highly specialized and customized nature of TEC's products means customers can leverage specific technical requirements to their advantage, potentially limiting TEC's pricing flexibility.

The long operational lifecycles of rail and energy infrastructure also contribute to customer bargaining power through the demand for extensive after-sales services and maintenance. Customers can negotiate favorable terms for these ongoing support contracts, which are vital for maintaining the reliability of their investments. In 2023, TEC's after-sales service revenue highlighted the importance of these long-term relationships and the leverage customers hold in securing continuous, cost-effective support.

| Customer Segment | Key Bargaining Factors | Impact on TEC | Example (2023 Data) |

|---|---|---|---|

| Major Railway Operators | Large order volumes, public bidding, customization needs | Price pressure, specification influence | Procurement of signaling systems |

| Infrastructure Developers | Project scale, long-term service demands | Negotiation on service contracts, pricing | Supply of power electronics for rail projects |

| Wind Energy Companies | Customized component requirements, after-sales support | Leverage on technical specifications, service terms | Demand for specialized converters |

Preview Before You Purchase

Zhuzhou CRRC Times Electric Co. Porter's Five Forces Analysis

This preview shows the exact Porter's Five Forces Analysis of Zhuzhou CRRC Times Electric Co. you'll receive immediately after purchase, detailing the competitive landscape including intense rivalry from established and emerging players in the rail transit and electric vehicle sectors, and the significant bargaining power of large government-backed clients and suppliers. The analysis also thoroughly examines the threat of new entrants, which is moderately high due to substantial capital requirements and technological expertise, and the threat of substitutes, which is present but less impactful given the specialized nature of their core products.

Rivalry Among Competitors

Zhuzhou CRRC Times Electric (TEC) navigates a highly competitive global landscape, particularly within the rail transit sector. Established giants such as Siemens Mobility, Alstom, ABB, and Toshiba represent formidable rivals, commanding significant market share and technological expertise.

While TEC's parent company, CRRC Corporation Limited, stands as the world's largest rolling stock manufacturer, TEC itself encounters intense competition in its specialized areas, notably high-speed rail and urban transit solutions. This rivalry compels continuous innovation and operational efficiency to maintain its market position.

For instance, in 2023, the global rail signaling market was valued at approximately $10.5 billion, with these major players vying for contracts. Siemens Mobility, a key competitor, reported significant revenue growth in its mobility division, underscoring the competitive pressures TEC faces.

The competitive landscape for Zhuzhou CRRC Times Electric Co. (TEC) is intensely shaped by a relentless technology and innovation race. Companies are locked in a constant pursuit to develop more efficient, dependable, and intelligent solutions, making R&D a critical battleground.

TEC's strategic emphasis on building independent intellectual property and allocating substantial resources to research and development is paramount. This focus allows them to stay ahead of competitors who are also making significant investments in innovation, particularly in areas like energy-efficient traction motors and sophisticated converter systems.

The rail transit and renewable energy sectors are booming, especially in Asia-Pacific, fueled by urbanization and significant infrastructure spending. For instance, China's railway investment alone reached approximately 764.5 billion yuan in 2023, highlighting the scale of these opportunities.

This rapid expansion naturally intensifies competitive rivalry. As these markets grow, more players enter, all striving to capture a larger slice of the increasing demand, leading to price pressures and innovation races.

Zhuzhou CRRC Times Electric Co. (TEC) is actively pursuing a strategy of concentric diversification, aiming to leverage its expertise beyond its traditional rail transit base into these high-growth renewable energy markets.

High Fixed Costs and Exit Barriers

Zhuzhou CRRC Times Electric Co. (TEC) operates in sectors like rail equipment manufacturing and power electronics, where substantial investments in research and development, advanced manufacturing facilities, and skilled personnel lead to very high fixed costs. For instance, the rail industry alone demands massive capital outlays for specialized production lines and testing equipment.

These significant fixed costs, coupled with the highly specialized nature of assets and technology, create formidable exit barriers. Companies like TEC find it difficult to divest or repurpose these assets, making it economically imperative to continue operating and securing orders, even in challenging economic climates, to spread the overhead. This pressure intensifies competition among established players.

- High Fixed Costs: Industries such as rail equipment manufacturing require substantial upfront investment in R&D and specialized production facilities.

- Exit Barriers: The specialized nature of assets and technology makes it difficult and costly for companies to exit these markets, encouraging continued competition.

- Capacity Utilization: To cover high fixed costs, companies are incentivized to maintain high capacity utilization, leading to aggressive bidding for contracts.

Product Differentiation and Service Quality

Zhuzhou CRRC Times Electric Co. (TEC) differentiates itself through superior product performance, unwavering reliability, and stringent safety standards. This focus on quality is crucial for securing long-term contracts in demanding sectors.

The company actively promotes its commitment to high-quality operation and maintains an extensive global service network. This strategic emphasis on service quality helps TEC stand out from competitors.

- Product Performance & Reliability: TEC's products are engineered for demanding applications, ensuring consistent operation and minimizing downtime.

- Safety Standards: Adherence to rigorous safety protocols is a non-negotiable aspect of TEC's product development and manufacturing.

- Global Service Network: A comprehensive after-sales support system, including maintenance and technical assistance, is a key differentiator.

- Tailored Solutions: The ability to customize offerings and provide responsive support is vital for winning and retaining large, complex contracts.

The competitive rivalry within Zhuzhou CRRC Times Electric Co.'s (TEC) operating sectors is intense, driven by established global players like Siemens Mobility and Alstom. These companies compete fiercely on innovation, product performance, and reliability, particularly in the high-speed rail and urban transit markets. The significant capital investments required in these industries, coupled with high exit barriers due to specialized assets, mean that companies must continuously strive for efficiency and market share to cover their substantial fixed costs. This often leads to aggressive bidding and a constant push for technological advancement.

| Competitor | Key Strengths | 2023 Market Focus/Activity |

| Siemens Mobility | Technological leadership, broad product portfolio | Secured significant signaling and rolling stock contracts globally. Reported strong growth in its mobility division. |

| Alstom | Global presence, strong in rolling stock and signaling | Continued integration of Bombardier Transportation assets, expanding its European and North American footprint. |

| ABB | Power electronics expertise, automation solutions | Focus on electrification of transport and smart grid technologies, including rail. |

| Toshiba | Advanced electronics, signaling systems | Active in high-speed rail projects, particularly in Asia, and modernization of existing infrastructure. |

SSubstitutes Threaten

For Zhuzhou CRRC Times Electric Co., alternative transport modes pose a significant threat. Road transportation, including trucks, buses, and private cars, offers flexibility and door-to-door service that rail sometimes struggles to match, particularly for shorter or more localized journeys. In 2024, the global automotive industry continued its strong performance, with sales of new vehicles remaining robust, indicating sustained demand for personal and commercial road transport solutions.

Air travel also serves as a substitute, especially for long-distance passenger and high-value cargo transport where speed is paramount. While rail transit is generally more energy-efficient and environmentally friendly, the convenience and rapid delivery offered by air freight can make it a compelling alternative for certain market segments. Global air cargo volume saw a notable increase in early 2024 compared to previous years, reflecting its continued importance in international logistics.

The attractiveness of these substitutes is heavily influenced by cost, speed, and convenience. While rail transit excels in mass transit and efficiency, shifts in consumer preferences and logistical requirements can favor alternatives. The ongoing global emphasis on sustainability generally supports rail, but the competitive pricing and evolving capabilities of road and air transport keep them relevant threats to rail-based solutions.

Wind power converters, like those produced by Zhuzhou CRRC Times Electric Co. (TEC), face a significant threat from other renewable energy technologies. Solar photovoltaic systems, for instance, have seen dramatic cost reductions, with global solar capacity reaching over 1,300 GW by the end of 2023, making it a highly competitive alternative.

Hydropower and geothermal energy also present substitution risks, particularly in regions with favorable natural resources. For example, China's significant investment in hydropower, which accounted for roughly 17% of its total electricity generation in 2023, can divert capital and focus from wind energy projects.

Furthermore, evolving government energy policies and subsidies can rapidly shift the competitive landscape. If policies favor solar or battery storage development over wind, demand for TEC's wind power converter systems could be negatively impacted, as seen with fluctuating renewable energy incentives in various global markets.

For industrial and marine power solutions, the threat of substitutes is significant. Traditional diesel generators remain a prevalent alternative, offering established reliability and infrastructure. However, the push for decarbonization is accelerating the adoption of fuel cells, particularly in heavy-duty applications where emissions reduction is paramount.

Advancements in battery technology present another potent substitute. By 2024, the global energy storage market, largely driven by battery solutions, was projected to reach hundreds of billions of dollars, demonstrating rapid growth. These solutions can directly compete with electric drive and power systems, especially in sectors like shipping and heavy industry aiming to reduce their carbon footprint.

Hydrogen-based power systems are also emerging as a strong contender. While still in development for widespread industrial use, the potential for zero-emission operation makes them an attractive long-term substitute. Investments in hydrogen infrastructure and technology are steadily increasing, signaling a growing competitive landscape for existing power solutions.

Decentralized Power Solutions

The growing adoption of decentralized power solutions, like microgrids and on-site renewable energy generation, poses a threat to traditional, large-scale power equipment manufacturers. While CRRC Times Electric (TEC) benefits from its converter production for renewables, this shift could diminish demand for its utility-scale offerings.

This trend is driven by a desire for grid resilience and energy independence. For instance, by the end of 2023, global installed capacity for distributed solar PV reached over 300 GW. This growing segment represents a potential substitution for the centralized power infrastructure where TEC traditionally operates.

- Growing Microgrid Deployment: The global microgrid market is projected to reach USD 70 billion by 2030, indicating a significant shift towards localized power.

- On-Site Renewables Trend: Corporate PPA agreements for on-site solar and wind installations are increasing, reducing reliance on grid-supplied power.

- Impact on Utility-Scale Equipment: As more energy is generated and consumed locally, the need for large-scale transmission and distribution equipment, a segment TEC serves, may see slower growth.

Technological Obsolescence

Technological obsolescence is a significant threat for Zhuzhou CRRC Times Electric Co. (TEC). Rapid advancements in areas like power electronics and digital control systems mean that current products can quickly become outdated. For instance, the automotive sector, a key market for TEC, is seeing an accelerated shift towards electric vehicles and advanced driver-assistance systems, requiring constant innovation in related components. If TEC's offerings are surpassed in efficiency or cost-effectiveness by newer technologies, customers might switch, despite existing switching costs.

TEC's commitment to research and development is crucial in countering this threat. In 2023, the company's R&D expenditure was approximately RMB 3.2 billion, a testament to its focus on staying ahead of technological curves. This investment allows TEC to develop next-generation products that maintain a competitive edge.

- Rapid technological change in power electronics and digital control systems can render existing products obsolete.

- Emergence of superior substitutes offering better efficiency or lower costs poses a risk of customer defection.

- TEC's R&D investment, around RMB 3.2 billion in 2023, is a key strategy to mitigate obsolescence.

- Sector-specific trends, such as the EV transition in automotive, necessitate continuous technological adaptation.

The threat of substitutes for Zhuzhou CRRC Times Electric Co. (TEC) is multifaceted, spanning transportation, energy generation, and power solutions. For its rail transit components, road and air transport offer convenience and speed, particularly for shorter distances or time-sensitive cargo, with robust global automotive sales in 2024 underscoring road transport's continued appeal. Similarly, in renewable energy, solar power's declining costs, evidenced by over 1,300 GW of global solar capacity by end-2023, directly competes with TEC's wind power converters.

For industrial and marine power systems, traditional diesel generators remain a substitute, but the rapid growth in energy storage, with the global market projected to reach hundreds of billions by 2024, and the increasing investment in hydrogen technology present significant future challenges. Furthermore, the trend towards decentralized power and microgrids, with global microgrid market projected to reach USD 70 billion by 2030, could reduce demand for TEC's utility-scale offerings.

Technological obsolescence is another critical substitute threat, as rapid advancements in power electronics and digital control systems can quickly render current products outdated. TEC's substantial R&D investment, approximately RMB 3.2 billion in 2023, is a proactive measure to counter this by developing next-generation products that maintain a competitive edge against emerging technologies.

Entrants Threaten

Entering the rail transit equipment and high-power electronics manufacturing sectors requires immense capital. Companies need significant investments for research and development, specialized factories, and rigorous testing facilities. For instance, developing advanced traction systems alone can cost hundreds of millions of dollars.

These substantial upfront costs act as a major hurdle, discouraging many potential new competitors. Only those with deep pockets and long-term commitment can realistically consider entering this market, thereby limiting the threat of new entrants.

Zhuzhou CRRC Times Electric's (TEC) advanced technology and extensive R&D create a significant barrier for new entrants. The company holds a vast portfolio of intellectual property in crucial areas such as traction converters and power semiconductors, demanding substantial investment and specialized expertise to replicate.

New competitors would face immense challenges in matching TEC's technological depth, which has been built over years of dedicated research and development. For instance, the high cost and long gestation period for developing proprietary technologies in the electric propulsion sector, estimated to be in the hundreds of millions of dollars, deter many potential market entrants.

The rail transportation and high-voltage power equipment sectors are characterized by exceptionally stringent regulatory and certification processes. These requirements mandate strict adherence to safety standards, extensive testing protocols, and often lengthy approval timelines. For instance, obtaining certifications for new traction systems or power transmission equipment can take years and involve substantial investment in compliance and documentation.

Navigating these complex and evolving regulatory landscapes presents a formidable barrier to entry for potential new competitors. The significant time and financial resources required to meet these standards, including rigorous quality control and safety audits, can make market entry economically unfeasible for smaller or less established firms. This inherent cost and time commitment effectively deters many new entrants.

Established Customer Relationships and Brand Reputation

Zhuzhou CRRC Times Electric Co. benefits significantly from deeply entrenched customer relationships with major railway operators and industrial clients, both domestically and internationally. These relationships are built on a foundation of trust, reliability, and a track record of proven performance, making it difficult for new entrants to gain traction.

The strong brand loyalty and established procurement channels mean that customers, especially for critical infrastructure projects, are hesitant to switch from suppliers they know and trust. This creates a substantial barrier to entry.

Furthermore, as a subsidiary of CRRC, a prominent state-owned enterprise, Zhuzhou CRRC Times Electric enjoys an even more fortified position in key markets, leveraging the parent company's extensive network and influence.

- Established Trust: Long-standing relationships with railway operators and industrial clients foster deep trust.

- Brand Loyalty: Customers exhibit strong preference for proven suppliers, hindering new entrants.

- Procurement Channels: Existing, well-established channels are difficult for newcomers to penetrate.

- State-Owned Backing: Affiliation with CRRC provides significant market advantages and credibility.

Economies of Scale and Experience Curve

Existing players like Zhuzhou CRRC Times Electric Co. (TEC) benefit significantly from economies of scale in production, procurement, and distribution. These advantages translate into lower unit costs, making it challenging for new entrants to match TEC's pricing. For instance, in 2023, TEC's revenue reached RMB 37.85 billion, indicating a substantial operational footprint that new, smaller competitors cannot easily replicate.

The experience curve in manufacturing complex systems, such as rail transit equipment, further solidifies the position of incumbents. TEC has accumulated years of operational knowledge, leading to greater efficiency and refined processes. This accumulated expertise is difficult for newcomers to acquire rapidly, creating a barrier to entry based on operational proficiency and cost-effectiveness.

- Economies of Scale: TEC's large-scale operations in 2023, with RMB 37.85 billion in revenue, enable lower per-unit production costs compared to potential new entrants.

- Procurement Power: Bulk purchasing by established firms like TEC leads to better terms and lower input costs, a significant advantage over smaller, new competitors.

- Distribution Efficiency: Existing networks and logistics developed by TEC reduce delivery costs and improve market reach, posing a challenge for new market entrants.

- Experience Curve Advantage: TEC's long history in manufacturing complex electrical systems translates into process efficiencies and cost savings that are hard for new players to quickly match.

The threat of new entrants for Zhuzhou CRRC Times Electric Co. (TEC) is significantly mitigated by high capital requirements, estimated in the hundreds of millions of dollars for R&D and specialized facilities. Stringent regulatory and certification processes, often taking years and substantial investment, further deter new players. Established customer relationships, brand loyalty, and the backing of its parent company, CRRC, create formidable barriers.

Economies of scale, as evidenced by TEC's 2023 revenue of RMB 37.85 billion, allow for lower production costs that new entrants struggle to match. The company’s accumulated experience curve in manufacturing complex electrical systems also provides a distinct competitive advantage. These factors collectively limit the ease with which new companies can enter TEC's market.

| Barrier Type | Description | Impact on New Entrants | Example Data/Fact |

|---|---|---|---|

| Capital Requirements | High investment needed for R&D, facilities, and testing. | Deters new entrants due to significant upfront costs. | Developing advanced traction systems can cost hundreds of millions of dollars. |

| Regulatory & Certification | Strict safety standards, lengthy approval processes. | Increases time and financial burden for market entry. | Certification for new traction systems can take years. |

| Customer Relationships & Brand Loyalty | Established trust and procurement channels. | Makes it difficult for new players to gain market share. | Customers prefer proven suppliers for critical infrastructure. |

| Economies of Scale & Experience Curve | Lower unit costs and process efficiencies from large-scale operations. | New entrants struggle to compete on price and efficiency. | TEC's 2023 revenue of RMB 37.85 billion indicates significant scale. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Zhuzhou CRRC Times Electric Co. leverages data from annual reports, investor presentations, and industry-specific market research reports to understand competitive dynamics.

We incorporate information from regulatory filings, financial news outlets, and competitor websites to assess the bargaining power of buyers and suppliers, as well as the threat of new entrants and substitutes.