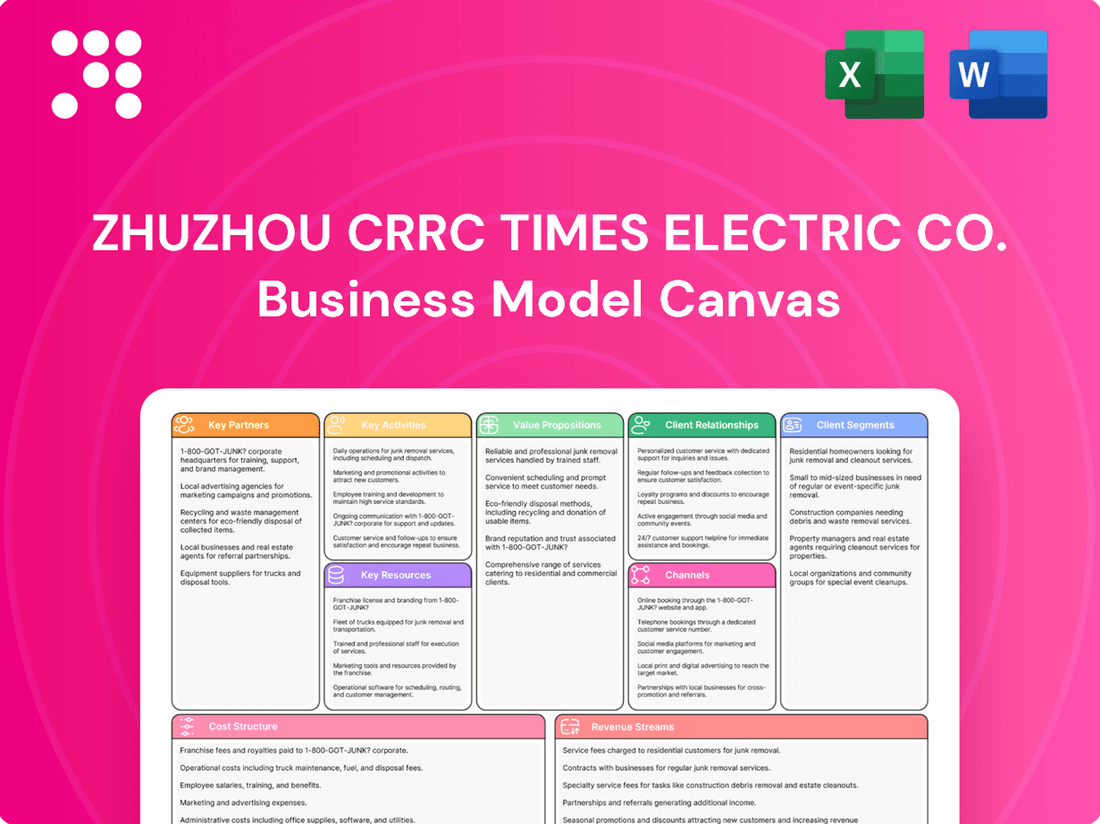

Zhuzhou CRRC Times Electric Co. Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhuzhou CRRC Times Electric Co. Bundle

Discover the strategic engine behind Zhuzhou CRRC Times Electric Co.'s dominance with our comprehensive Business Model Canvas. This detailed analysis unveils how they leverage key resources and partnerships to deliver innovative solutions and maintain market leadership.

Unlock the secrets to Zhuzhou CRRC Times Electric Co.'s success with their complete Business Model Canvas. Understand their customer relationships, revenue streams, and cost structure to gain actionable insights for your own ventures.

See how Zhuzhou CRRC Times Electric Co. orchestrates its operations and value creation by downloading their full Business Model Canvas. This essential tool is perfect for anyone seeking to understand and replicate their strategic brilliance.

Partnerships

Zhuzhou CRRC Times Electric Co., Ltd. benefits significantly from its position within the CRRC Group, fostering key partnerships with numerous subsidiaries. This internal network grants access to a vast ecosystem within the global rail transport sector, enabling synergistic collaborations and shared technological advancements. For example, CRRC Times Electric actively collaborates with CRRC Zhuzhou Institute on research and development initiatives, and with CRRC Commercial Vehicle Power Technology for integrated powertrain solutions.

Zhuzhou CRRC Times Electric Co. actively pursues technology and R&D collaborations to bolster its innovation pipeline. These partnerships are vital for driving progress in key sectors such as smart mobility, advanced magnetic technologies, and the burgeoning renewable energy market.

A prime example of this strategy is CRRC's memorandum of understanding with Thyssenkrupp, highlighting a commitment to shared technological advancement. Such collaborations are instrumental in Zhuzhou CRRC Times Electric's ability to stay at the forefront of industry innovation and develop cutting-edge solutions.

Zhuzhou CRRC Times Electric's manufacturing prowess hinges on robust relationships with suppliers of core components, particularly power semiconductors and advanced materials. These partnerships are critical for maintaining production continuity and ensuring the high quality demanded by their specialized railway and industrial applications.

In 2023, the global semiconductor market experienced fluctuations, yet CRRC Times Electric continued to secure essential components, a testament to its supplier network's resilience. The company's strategic sourcing aims to mitigate risks associated with supply chain disruptions, which have been a concern across various high-tech industries in recent years.

Financial Institutions and Investment Partners

Zhuzhou CRRC Times Electric actively cultivates relationships with financial institutions and investment partners to bolster its financial strategy. A prime example is the CRRC Financial Services Framework Agreement, which facilitates efficient capital deployment, robust risk management, and reliable funding streams for ongoing operations and future growth initiatives.

These crucial alliances include collaborations with entities such as CRRC Finance Co., Ltd. These partnerships are vital for securing the necessary capital to fund large-scale projects and technological advancements, ensuring the company remains competitive in the global market.

- CRRC Financial Services Framework Agreement: This agreement underpins Zhuzhou CRRC Times Electric's access to financial resources and operational efficiencies.

- CRRC Finance Co., Ltd.: A key partner providing financial support and services essential for the company's expansion and investment in research and development.

- Optimizing Capital Use: These collaborations enable the company to manage its financial resources effectively, ensuring optimal allocation for strategic objectives.

- Risk Management and Funding: Partnerships are instrumental in mitigating financial risks and securing stable funding for both current operations and ambitious expansion plans.

International Sales and Distribution Networks

Zhuzhou CRRC Times Electric Co. actively cultivates key partnerships to bolster its international reach. They collaborate with local distributors, agents, and engineering firms across various regions. This strategy is crucial for effectively navigating diverse regulatory landscapes and understanding specific market needs.

These alliances are instrumental in providing localized support and technical expertise for their advanced rail transportation and renewable energy solutions. By leveraging these local networks, CRRC Times Electric ensures their products are well-integrated and supported in overseas markets.

- Global Reach: Partnerships enable access to over 100 countries and regions, facilitating the export of their advanced electrical systems.

- Market Adaptation: Local partners help tailor product offerings and services to meet specific regional demands and compliance standards.

- Technical Support: Collaborations ensure robust after-sales service and technical assistance for complex systems like high-speed rail components.

- Risk Mitigation: Working with established local entities helps mitigate risks associated with entering new and unfamiliar international markets.

Zhuzhou CRRC Times Electric's key partnerships are foundational to its operational success and innovation strategy. These alliances span internal group synergies, technological collaborations, supply chain robustness, financial backing, and international market penetration.

The company leverages its position within the CRRC Group, partnering with subsidiaries like CRRC Zhuzhou Institute for R&D and CRRC Commercial Vehicle Power Technology for integrated solutions. Externally, collaborations like the memorandum of understanding with Thyssenkrupp drive advancements in areas such as smart mobility and renewable energy.

Securing critical components, especially power semiconductors, relies on strong supplier relationships, which proved resilient even amidst 2023 market fluctuations. Financial partnerships, notably through the CRRC Financial Services Framework Agreement and CRRC Finance Co., Ltd., ensure capital availability for growth and R&D.

Internationally, partnerships with local distributors and engineering firms are vital for market adaptation and technical support across the over 100 countries and regions where CRRC Times Electric operates.

| Partnership Type | Key Partners | Strategic Importance | 2024 Focus/Benefit |

|---|---|---|---|

| Internal Group Synergies | CRRC Zhuzhou Institute, CRRC Commercial Vehicle Power Technology | R&D, integrated solutions, technological advancement | Accelerated development of next-gen rail and electric vehicle technologies. |

| Technology & R&D | Thyssenkrupp (MOU) | Innovation in smart mobility, magnetic tech, renewables | Joint projects targeting advanced energy efficiency and intelligent transport systems. |

| Supply Chain | Power semiconductor & advanced material suppliers | Production continuity, quality assurance | Diversification of sourcing to mitigate geopolitical supply risks. |

| Financial | CRRC Finance Co., Ltd. | Capital access, risk management, funding | Facilitating investment in expanding manufacturing capacity and R&D infrastructure. |

| International Market | Local distributors, agents, engineering firms | Market access, localized support, regulatory navigation | Expanding presence in emerging markets with tailored solutions. |

What is included in the product

This Business Model Canvas provides a comprehensive overview of Zhuzhou CRRC Times Electric Co.'s strategy, detailing its customer segments, value propositions, and channels for its electric traction and control systems. It reflects the company's real-world operations and plans, making it ideal for presentations and funding discussions.

Zhuzhou CRRC Times Electric Co.'s Business Model Canvas acts as a pain point reliever by offering a high-level, one-page snapshot of their complex operations, simplifying understanding for stakeholders.

This concise format condenses their strategy, making it a perfect tool for brainstorming and internal use, effectively addressing the pain of deciphering intricate business structures.

Activities

Zhuzhou CRRC Times Electric dedicates substantial resources to Research and Development, focusing on pioneering technologies for electric drive systems, traction converters, and advanced control systems. This commitment ensures they remain at the forefront of innovation in rail transit and strategically expand their reach into emerging new energy markets.

The company's R&D strategy prioritizes fundamental, urgent, cutting-edge, and disruptive technologies. For instance, in 2023, CRRC Times Electric reported R&D expenditure of approximately RMB 3.3 billion, a significant portion of which fuels the development of next-generation high-speed train components and solutions for electric vehicles and renewable energy integration.

Zhuzhou CRRC Times Electric's core manufacturing activities revolve around producing advanced high-tech equipment. This includes critical components like traction converters essential for powering various rail vehicles, as well as converters for wind power generation and sophisticated industrial and marine power solutions. The company's operational structure is built on a 'device + system + machine' framework, highlighting its commitment to precision engineering and smart manufacturing.

This focus on advanced manufacturing is supported by significant investment. For instance, in 2023, CRRC Times Electric reported revenue of 37.6 billion RMB, with a substantial portion derived from its high-tech equipment manufacturing. The company consistently invests in research and development to maintain its edge in areas like power electronics and intelligent control systems, crucial for its product advancements.

Zhuzhou CRRC Times Electric excels in delivering comprehensive, integrated solutions for rail transit and new energy sectors, moving beyond mere component supply. This strategic focus allows them to bundle diverse technologies into unified systems.

A prime example is their work in new energy, where they offer advanced wind-solar-hydrogen-storage integration solutions. This highlights their capability to combine multiple energy generation and storage technologies into a single, functional system.

In 2023, CRRC Times Electric reported significant revenue growth, with their rail transit segment playing a crucial role, demonstrating the market's demand for their integrated electrical system solutions.

Sales and Marketing (Domestic and International)

Zhuzhou CRRC Times Electric Co. actively pursues sales and marketing across its domestic and international arenas. The company employs a multi-pronged approach, including participation in public tenders, engaging in competitive negotiations, and utilizing direct sales channels to connect with clients.

These efforts are strategically designed to bolster global market penetration and expand its international footprint. In 2024, CRRC Times Electric reported significant revenue growth, with its international sales contributing a notable portion, reflecting the success of its global outreach. The company's commitment to increasing its worldwide market share remains a core objective, supported by these robust sales and marketing initiatives.

- Domestic Market Focus: Leveraging established relationships and participating in key infrastructure projects within China.

- International Expansion: Targeting emerging markets and established economies for traction power systems and related solutions.

- Sales Channels: Employing public bidding, direct sales, and strategic partnerships to secure contracts.

- Marketing Strategy: Highlighting technological innovation and reliability to differentiate in competitive global landscapes.

After-Sales Service and Technical Support

Zhuzhou CRRC Times Electric Co. prioritizes comprehensive after-sales service and technical support as a core business activity. This commitment ensures the long-term reliability and performance of their sophisticated electrical systems, particularly within the demanding rail sector. Their support framework is designed to foster enduring customer relationships and uphold product integrity.

- Rail Maintenance Services: Offering specialized maintenance programs for railway infrastructure and rolling stock, ensuring operational continuity and safety.

- Technical Assistance: Providing expert troubleshooting and ongoing technical support for complex electrical control and power systems.

- Spare Parts Management: Ensuring timely availability of genuine spare parts to minimize downtime and support efficient repairs.

- Customer Training: Equipping client maintenance teams with the necessary skills to effectively operate and maintain CRRC Times Electric products.

Zhuzhou CRRC Times Electric Co.'s key activities encompass advanced research and development, focusing on next-generation electric drive systems and intelligent control for rail transit and new energy applications. Their manufacturing prowess lies in producing high-tech equipment like traction converters and power solutions, built on a sophisticated 'device + system + machine' framework. The company also excels in delivering integrated solutions, bundling diverse technologies for rail and new energy sectors, such as wind-solar-hydrogen-storage systems.

Furthermore, CRRC Times Electric actively engages in domestic and international sales and marketing, utilizing public tenders, direct sales, and strategic partnerships to secure contracts and expand its global footprint. Crucially, they provide comprehensive after-sales service and technical support, including specialized maintenance, expert assistance, spare parts management, and customer training, ensuring product reliability and fostering long-term client relationships.

| Key Activity | Description | 2023 Data/Impact |

|---|---|---|

| Research & Development | Pioneering technologies for electric drive systems, traction converters, and advanced control systems. | R&D expenditure of approx. RMB 3.3 billion. |

| Manufacturing | Producing advanced high-tech equipment like traction converters and power solutions. | Revenue of 37.6 billion RMB, with significant contribution from high-tech equipment. |

| Integrated Solutions | Bundling diverse technologies for rail transit and new energy sectors. | Offering advanced wind-solar-hydrogen-storage integration solutions. |

| Sales & Marketing | Domestic and international outreach via tenders, direct sales, and partnerships. | International sales contributed a notable portion to revenue growth in 2024. |

| After-Sales Service | Providing maintenance, technical support, spare parts, and training. | Ensuring long-term reliability and performance of sophisticated electrical systems. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas for Zhuzhou CRRC Times Electric Co. that you are previewing is the exact document you will receive upon purchase. This comprehensive overview provides a direct snapshot of the company's strategic framework, including key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You'll gain full access to this professionally structured and ready-to-use document, allowing you to analyze and understand CRRC Times Electric's operational blueprint without any alterations or missing sections.

Resources

Zhuzhou CRRC Times Electric's competitive edge is significantly bolstered by its extensive intellectual property portfolio, particularly in core areas such as electrical systems, converter technology, and power semiconductors. This strong foundation of patents safeguards its innovative advancements and solidifies its standing in the market.

As of June 30, 2024, the company reported an impressive 3,540 valid domestic and foreign registered patents. This substantial number underscores Zhuzhou CRRC Times Electric's commitment to research and development and its success in creating proprietary technologies.

Zhuzhou CRRC Times Electric's advanced manufacturing facilities are the backbone of its operations, housing state-of-the-art production lines. These facilities are engineered for the intricate assembly of high-precision electrical and mechanical equipment, crucial for their diverse product portfolio.

The company boasts dedicated production bases specifically designed for new energy vehicle electric drive systems and power devices. This specialization allows for optimized manufacturing processes and a focus on innovation within these rapidly growing sectors.

In 2023, CRRC Times Electric reported significant investments in upgrading its manufacturing capabilities. For instance, their commitment to enhancing production efficiency for electric drive systems contributed to a substantial portion of their revenue growth in the new energy vehicle segment.

Zhuzhou CRRC Times Electric Co. boasts a highly skilled R&D and engineering talent pool, a cornerstone of its business model. This team, comprising top-tier engineers and technical specialists, is instrumental in driving the company's relentless pursuit of innovation and the consistent delivery of high-quality products. Their expertise ensures CRRC Times Electric remains at the forefront of technological advancements in its sectors.

The company actively cultivates this high-end technical talent, recognizing its critical role in maintaining a competitive edge. This investment in human capital directly translates into the development of cutting-edge solutions and the refinement of manufacturing processes, underpinning CRRC Times Electric's reputation for excellence. For instance, in 2023, the company highlighted its significant investment in R&D personnel, contributing to its robust patent portfolio.

Financial Capital

Zhuzhou CRRC Times Electric Co. requires substantial financial capital to fuel its ambitious growth strategies. This includes significant investments in research and development to stay at the forefront of rail transit technology, maintaining and upgrading its extensive manufacturing facilities, and funding its expansion into new domestic and international markets.

The company demonstrated strong financial resilience and growth throughout 2024. Key financial highlights for the year include:

- Revenue Growth: Reported a notable increase in revenue, reflecting strong demand for its products and services.

- Net Profitability: Achieved a healthy rise in net profit, underscoring efficient operations and effective cost management.

- Investment Capacity: The robust financial performance provides ample capacity to fund ongoing R&D projects and strategic market penetration efforts.

Brand Reputation and Industry Leadership

Zhuzhou CRRC Times Electric boasts a formidable brand reputation, firmly established as a premier supplier within China's expansive rail transit sector. This leadership, cultivated over more than six decades in electrified railway equipment, translates into significant trust and recognition.

Their industry leadership extends beyond rail, with a notable and expanding footprint in renewable energy and diversified industrial solutions. This dual focus enhances their market standing and resilience.

- Established Rail Dominance: Over 60 years of experience in electrified railway equipment solidifies their position.

- Growing Diversification: Significant presence in renewable energy and industrial solutions broadens their market appeal.

- Intangible Asset Value: The strong brand reputation and leadership are critical intangible assets driving customer loyalty and market share.

Zhuzhou CRRC Times Electric's key resources include a robust intellectual property portfolio, advanced manufacturing facilities, and a highly skilled R&D and engineering talent pool. These elements are critical for innovation and production. The company also relies on substantial financial capital for growth and maintains a strong brand reputation built over decades of industry leadership.

| Key Resource | Description | Supporting Data/Facts |

| Intellectual Property | Extensive patents in core technologies. | 3,540 valid domestic and foreign registered patents as of June 30, 2024. |

| Manufacturing Facilities | State-of-the-art production lines for high-precision equipment. | Dedicated bases for new energy vehicle electric drive systems and power devices. Significant investment in capability upgrades in 2023. |

| Talent Pool | Highly skilled R&D and engineering professionals. | Significant investment in R&D personnel in 2023 contributing to patent portfolio. |

| Financial Capital | Sufficient capital for R&D, manufacturing, and market expansion. | Notable revenue and net profit growth reported for 2024, providing strong investment capacity. |

| Brand Reputation | Premier supplier in rail transit with growing diversification. | Over 60 years of experience in electrified railway equipment. Expanding presence in renewable energy and industrial solutions. |

Value Propositions

Zhuzhou CRRC Times Electric provides electric drive and control systems essential for the smooth and secure operation of high-speed trains, locomotives, and urban transit. These systems are engineered for exceptional safety, unwavering reliability, and a strong commitment to sustainability. In 2024, the company continued to be a key supplier, with its electric drive systems powering a significant portion of China's extensive high-speed rail network, contributing to its reputation for efficiency and punctuality.

Zhuzhou CRRC Times Electric's value proposition centers on its advanced technology and innovation, offering cutting-edge solutions fueled by substantial investment in research and development. This focus has resulted in a robust portfolio of independent intellectual property rights across critical sectors like power semiconductors and smart railway systems.

The company's dedication to innovation directly translates into superior product performance and enhanced energy efficiency for its customers. For instance, in 2023, CRRC Times Electric reported R&D expenses of approximately 3.5 billion RMB, underscoring its commitment to staying at the forefront of technological advancements.

Zhuzhou CRRC Times Electric Co. offers customers in the rail sector a complete suite of products, encompassing traction converters, advanced control systems, and crucial communication signal systems. This allows them to provide truly integrated solutions tailored to the diverse requirements of modern rail transit, from high-speed trains to urban subways.

For instance, in 2023, the company secured significant contracts for signaling systems for new metro lines, demonstrating the demand for their comprehensive approach. Their ability to deliver a full spectrum of rail transportation solutions, rather than isolated components, streamlines procurement and integration for rail operators worldwide.

Contributions to Renewable Energy Transition

Zhuzhou CRRC Times Electric Co. is a key player in the renewable energy transition, supplying essential equipment like wind power converters. These products directly support the shift towards low-carbon energy sources and sustainable development goals.

Their comprehensive solutions cater to critical segments within the renewable energy market.

- Wind Power: Providing converters and related equipment to harness wind energy efficiently.

- Photovoltaic Power: Supporting the integration and operation of solar energy systems.

- Energy Storage: Offering technologies that enable reliable storage of renewable energy.

- Hydrogen Power: Contributing to the development of hydrogen as a clean fuel source.

In 2023, the global renewable energy sector saw significant investment, with wind power capacity additions reaching new heights, underscoring the demand for CRRC Times Electric's offerings.

Customized Industrial and Marine Power Solutions

Zhuzhou CRRC Times Electric excels in crafting bespoke power systems for demanding industrial and marine environments. These solutions are engineered to enhance operational efficiency and boost performance, addressing the unique challenges faced by each sector.

The company's commitment to customization ensures that clients receive power solutions precisely matched to their specific needs. This focus on tailored engineering translates into tangible benefits, such as reduced energy consumption and improved equipment longevity.

- Tailored Power Systems: Offering specialized solutions for industrial machinery and marine vessels.

- Efficiency Focus: Designing systems that optimize energy usage and reduce operational costs.

- Performance Enhancement: Improving the reliability and output of critical industrial and marine equipment.

- Industry-Specific Expertise: Leveraging deep knowledge to meet the unique demands of diverse sectors.

Zhuzhou CRRC Times Electric's value proposition is built on delivering integrated, high-performance electric drive and control systems for rail transit, ensuring safety and efficiency. They offer comprehensive solutions, from traction converters to signaling systems, streamlining operations for rail operators.

The company is a significant contributor to the renewable energy sector, providing essential components like wind power converters that support global decarbonization efforts. Their commitment to innovation is backed by substantial R&D investment, evidenced by 3.5 billion RMB in R&D expenses in 2023, securing a strong intellectual property portfolio.

CRRC Times Electric also specializes in customized power systems for industrial and marine applications, focusing on enhancing operational efficiency and reducing energy consumption for clients.

| Value Proposition Area | Key Offerings | Customer Benefit | 2023/2024 Data Point |

|---|---|---|---|

| Rail Transit Solutions | Electric drive and control systems, signaling systems | Enhanced safety, reliability, efficiency | Powered a significant portion of China's high-speed rail network in 2024 |

| Renewable Energy Support | Wind power converters, photovoltaic integration, energy storage | Facilitates low-carbon energy transition | Global renewable energy investment surged in 2023 |

| Industrial & Marine Power | Tailored power systems for machinery and vessels | Improved operational efficiency, reduced energy costs | R&D expenses of ~3.5 billion RMB in 2023 |

Customer Relationships

Zhuzhou CRRC Times Electric Co. primarily utilizes a direct sales approach, engaging clients through public bidding, competitive negotiations, and direct procurement processes. This strategy is key to establishing robust relationships.

These direct interactions frequently result in the formation of long-term contracts, particularly with significant players in the rail transportation and energy industries. For instance, in 2024, the company secured several multi-year agreements for advanced traction systems and power electronics, underscoring the stability derived from these direct, long-term engagements.

Zhuzhou CRRC Times Electric prioritizes robust customer relationships by offering dedicated after-sales support and maintenance. This includes readily available technical assistance and efficient complaint resolution mechanisms.

The company actively solicits quality feedback, which is crucial for continuous improvement. In 2023, CRRC Times Electric reported a significant portion of its revenue derived from after-sales services, underscoring its commitment to customer retention and satisfaction.

For key strategic clients, Zhuzhou CRRC Times Electric often engages in deep technical collaboration, extending to the co-development of entirely new solutions. This is particularly evident in complex, bespoke projects where standard offerings aren't sufficient.

This collaborative approach ensures that products are not just delivered, but are precisely tailored to meet the dynamic and evolving needs of these crucial customers, fostering long-term partnerships and innovation.

Key Account Management

Zhuzhou CRRC Times Electric Co. likely implements robust key account management for its major clients. This involves dedicated teams focused on nurturing relationships with significant rail operators, energy firms, and large industrial groups, ensuring their specific needs are met and fostering long-term partnerships. For instance, the company’s substantial contracts, such as the 2023 order for traction systems for 120 metro vehicles in a major Asian city, highlight the importance of these high-value relationships.

- Dedicated Relationship Managers: Assigning specialized personnel to manage and deepen relationships with strategic partners.

- Proactive Engagement: Regularly consulting with key clients to understand evolving needs and anticipate future requirements.

- Customized Solutions: Tailoring product development and service offerings to align with the operational goals of major accounts.

- Performance Reviews: Conducting periodic reviews with key accounts to assess satisfaction and identify areas for improvement, reinforcing commitment and trust.

Global Presence and Localized Support

Zhuzhou CRRC Times Electric Co. prioritizes global reach with localized customer engagement. For international clients, this means accessible sales, dedicated service teams, and readily available technical assistance, fostering strong relationships across varied markets.

This approach is crucial for building trust and ensuring seamless operations for their diverse clientele. For instance, in 2023, CRRC Times Electric reported a significant portion of its revenue from international markets, underscoring the importance of this localized support strategy.

- Global Network: Establishing a robust international presence through subsidiaries and partnerships.

- Localized Service: Offering sales, after-sales service, and technical support tailored to regional needs.

- Relationship Building: Fostering trust and long-term partnerships with international customers through consistent engagement.

Zhuzhou CRRC Times Electric Co. cultivates deep customer relationships through direct engagement, long-term contracts, and extensive after-sales support, ensuring client satisfaction and retention.

The company emphasizes collaborative development and key account management for strategic clients, tailoring solutions to meet specific operational needs and fostering enduring partnerships.

A global network with localized service and proactive engagement strategies underpins their approach to building trust and ensuring seamless operations for a diverse international clientele.

| Customer Relationship Aspect | Description | 2023/2024 Impact/Data |

|---|---|---|

| Direct Sales & Long-Term Contracts | Engaging clients via public bidding, negotiations, and direct procurement, leading to multi-year agreements. | Secured multiple multi-year agreements for traction systems and power electronics in 2024. |

| After-Sales Support & Feedback | Providing dedicated technical assistance, complaint resolution, and actively soliciting quality feedback. | Significant portion of revenue derived from after-sales services in 2023. |

| Technical Collaboration & Co-development | Engaging in deep technical collaboration and co-development for bespoke projects with key clients. | Focus on tailored solutions for complex projects, strengthening strategic partnerships. |

| Key Account Management | Dedicated teams nurturing relationships with major rail operators, energy firms, and industrial groups. | Substantial contracts, like a 2023 order for 120 metro vehicle traction systems, highlight relationship value. |

| Global Reach with Localized Engagement | Establishing international presence with localized sales, service teams, and technical assistance. | Significant revenue from international markets in 2023, driven by localized support. |

Channels

Zhuzhou CRRC Times Electric heavily relies on its dedicated direct sales force and business development teams. These teams are crucial for fostering relationships and securing major B2B contracts, especially in sectors like rail infrastructure and energy.

In 2024, CRRC Times Electric's focus on direct engagement proved effective, contributing to its significant market presence. For instance, the company secured substantial orders for electric multiple units (EMUs) and traction systems, underscoring the importance of these sales channels.

Zhuzhou CRRC Times Electric Co. leverages public bidding and specialized procurement platforms as key channels, particularly for securing contracts in government-led rail and infrastructure development. These platforms are crucial for accessing large-scale projects, a significant revenue driver for the company. In 2023, CRRC Corporation Limited (parent company) secured a substantial portion of China's railway construction tenders, highlighting the importance of these public channels.

Zhuzhou CRRC Times Electric Co. actively participates in major industry exhibitions and conferences, showcasing its advanced electric traction systems and power electronics. These events are crucial for generating leads, fostering strategic partnerships, and demonstrating their latest technological innovations to a global audience.

In 2024, CRRC Times Electric likely leveraged these platforms to highlight its contributions to high-speed rail and urban transit, areas where it holds significant market share. For instance, participation in events like the InnoTrans trade fair in Berlin provides direct access to key decision-makers in the global rail industry.

Online Presence and Corporate Website

Zhuzhou CRRC Times Electric Co.'s official website and other online platforms are crucial for disseminating information. These digital channels provide stakeholders with details on their extensive product lines, service offerings, and vital financial reports, ensuring broad accessibility and transparency.

These online presences are key to investor relations, offering a direct line of communication and access to critical corporate updates. For instance, in 2024, the company actively updated its investor relations section with quarterly earnings reports and management commentary, facilitating informed decision-making for a global audience.

- Website Functionality: The corporate website serves as a central hub for product catalogs, technical specifications, and company news, reaching potential customers and partners worldwide.

- Investor Communication: Online platforms facilitate the distribution of financial statements, annual reports, and webcast presentations, enhancing engagement with shareholders.

- Digital Reach: In 2024, the company reported increased traffic to its official website, indicating a growing interest in its technological advancements and market position.

- Information Dissemination: Key announcements, such as new product launches or strategic partnerships, are often first communicated through these digital channels.

Strategic Partnerships and Joint Ventures

Zhuzhou CRRC Times Electric Co. leverages strategic partnerships and joint ventures as key channels to expand its reach. These collaborations, particularly with other CRRC subsidiaries and international firms, are crucial for entering new geographic markets and tapping into previously inaccessible customer bases. For instance, in 2024, CRRC Times Electric continued to deepen its ties with global industry leaders to co-develop advanced rail transit technologies, aiming to secure a larger share of the international market.

These alliances facilitate the sharing of expertise, technology, and resources, enabling the company to offer more comprehensive solutions. By working with partners, CRRC Times Electric can more effectively navigate diverse regulatory environments and market demands. This approach was evident in their 2024 initiatives, where joint ventures were established to localize manufacturing and service operations in emerging economies, thereby reducing logistical costs and improving customer responsiveness.

- Market Access: Partnerships provide direct entry into new regions and customer segments that might otherwise be difficult or costly to penetrate independently.

- Technology Sharing: Collaborations enable the co-development and adoption of cutting-edge technologies, enhancing product offerings and competitive advantage.

- Risk Mitigation: Joint ventures allow for the sharing of financial and operational risks associated with entering new markets or undertaking large-scale projects.

- Enhanced Capabilities: By pooling resources and expertise, CRRC Times Electric can offer more integrated and sophisticated solutions to its clients.

Zhuzhou CRRC Times Electric Co. utilizes a multi-faceted channel strategy, blending direct sales with indirect approaches. Their direct sales force is paramount for high-value B2B relationships in sectors like rail and energy, while public bidding platforms are critical for securing large government infrastructure projects. Industry exhibitions and their robust online presence further amplify their market reach, showcasing innovation and facilitating investor communication.

Strategic partnerships and joint ventures are also vital, enabling market expansion and technological co-development. In 2024, CRRC Times Electric's diverse channel engagement supported its continued growth. For example, their direct sales efforts were instrumental in securing orders for new subway systems in 2024, while participation in global trade fairs solidified international partnerships.

| Channel | Key Activities | 2024 Focus/Impact |

|---|---|---|

| Direct Sales Force | B2B relationship building, securing large contracts | Secured significant orders for electric multiple units (EMUs) |

| Public Bidding Platforms | Accessing government-led infrastructure projects | Crucial for large-scale rail development contracts |

| Industry Exhibitions & Conferences | Lead generation, strategic partnerships, product showcasing | Highlighting contributions to high-speed rail and urban transit |

| Official Website & Online Platforms | Information dissemination, investor relations | Increased website traffic, facilitating access to financial reports |

| Strategic Partnerships & Joint Ventures | Market expansion, technology co-development | Deepening ties with global leaders for advanced rail transit technologies |

Customer Segments

Rail transit operators and authorities, including national railway companies like China Railway and municipal transit bodies such as the Shanghai Metro, are key customers. These entities procure advanced electric drive systems, traction converters, and sophisticated control solutions for their high-speed rail, freight locomotives, and extensive urban metro networks. In 2023, global investment in rail infrastructure was projected to reach hundreds of billions of dollars, highlighting the significant demand for such specialized equipment.

Renewable energy developers and utilities are key customers for Zhuzhou CRRC Times Electric. This segment includes companies building and operating wind farms and solar power plants. They are actively looking for advanced wind power converters and comprehensive energy storage solutions to enhance clean energy generation and ensure seamless grid integration.

In 2024, global investment in renewable energy is projected to reach significant levels, with wind and solar power leading the charge. For instance, the International Energy Agency (IEA) reported that renewable capacity additions are expected to grow by nearly 50% by 2026 compared to the previous five years, highlighting the strong demand for the types of equipment CRRC Times Electric provides.

Industrial Enterprises represent a core customer base for Zhuzhou CRRC Times Electric, seeking advanced industrial converters, robust power solutions, and sophisticated electrical control systems. These clients operate across various manufacturing sectors, from heavy industry to specialized production lines, all of which demand reliable and efficient electrical equipment to optimize their operations and output.

In 2023, Zhuzhou CRRC Times Electric reported that its industrial sector revenue, which includes sales to these enterprises, showed strong performance, contributing significantly to the company's overall financial health. The company's ability to tailor solutions for complex industrial needs, such as high-power traction converters for automated factories or specialized control systems for continuous manufacturing processes, positions it as a key partner for these demanding clients.

Marine and Offshore Industry Clients

Zhuzhou CRRC Times Electric Co. caters to the demanding marine and offshore industries by delivering robust power solutions and specialized equipment. Their offerings are crucial for marine engineering, encompassing vital systems like ship propulsion and essential offshore equipment.

In 2024, the global marine propulsion market was valued at approximately $25 billion, with a projected compound annual growth rate (CAGR) of over 4% through 2030, highlighting the significant demand for advanced systems like those provided by CRRC Times Electric.

- Ship Propulsion Systems: Providing integrated electric propulsion solutions for enhanced efficiency and reduced emissions in vessels.

- Offshore Equipment: Supplying specialized power and control systems for offshore platforms, drilling rigs, and subsea applications.

- Marine Engineering Solutions: Offering tailored electrical and automation systems for complex marine projects and infrastructure.

New Energy Vehicle Manufacturers

Zhuzhou CRRC Times Electric Co. serves new energy vehicle (NEV) manufacturers, encompassing both commercial and passenger electric vehicle makers. This segment is crucial as the company expands its electric drive systems offerings.

The company holds a significant position within China's NEV market, particularly as a leading supplier of power modules for passenger cars. In 2023, China's NEV sales reached approximately 9.5 million units, a substantial increase from previous years, highlighting the growth potential for CRRC Times Electric's products.

- Key Customers: Manufacturers of electric buses, trucks, and passenger cars.

- Market Position: Among the top suppliers of power modules for passenger vehicles in China.

- Growth Driver: Expansion of electric drive systems and increasing demand for NEV components.

- Market Data: China's NEV market saw robust growth in 2023, with sales exceeding 9 million units.

Zhuzhou CRRC Times Electric Co. serves a diverse customer base, with rail transit operators and authorities being a primary focus. These clients, including national railway companies and municipal transit bodies, require advanced electric drive systems and control solutions for various rail applications. The company also targets renewable energy developers and utilities seeking efficient wind power converters and energy storage solutions to support the growing clean energy sector.

Industrial enterprises are another significant customer segment, requiring robust power solutions and sophisticated electrical control systems for optimized operations. Furthermore, the company caters to the marine and offshore industries with specialized power and control systems for propulsion and offshore equipment. Finally, Zhuzhou CRRC Times Electric is a key supplier to new energy vehicle manufacturers, particularly in China, providing essential power modules and electric drive systems.

| Customer Segment | Key Needs | 2023/2024 Relevance |

|---|---|---|

| Rail Transit Operators | Electric drive systems, traction converters | Global rail infrastructure investment in hundreds of billions (2023) |

| Renewable Energy Developers | Wind power converters, energy storage | Renewable capacity additions up ~50% by 2026 (IEA) |

| Industrial Enterprises | Industrial converters, power solutions | Strong performance in industrial sector revenue (2023) |

| Marine & Offshore | Marine propulsion, offshore power systems | Marine propulsion market valued at ~$25 billion (2024) |

| NEV Manufacturers | Electric drive systems, power modules | China NEV sales ~9.5 million units (2023) |

Cost Structure

Zhuzhou CRRC Times Electric Co. dedicates significant resources to Research and Development, recognizing it as a core driver of innovation and future growth. This investment encompasses personnel salaries for their research teams, the acquisition and maintenance of advanced laboratory equipment, the creation of prototypes for testing and refinement, and the crucial development and protection of intellectual property.

In 2023, the company's commitment to R&D was evident with an expenditure of RMB 2.145 billion. This figure represents a substantial investment, translating to a research and development investment intensity of 9.84% of their revenue, underscoring the strategic importance of innovation within their business model.

Manufacturing and production costs are a significant component for Zhuzhou CRRC Times Electric, driven by their 'device + system + machine' industrial structure. These expenses encompass the procurement of essential raw materials like semiconductors and various metals, which are critical for their advanced electrical systems.

Labor wages for the skilled production workforce and the substantial energy consumption required to operate their manufacturing facilities also factor heavily into this cost category. Furthermore, ongoing maintenance and upkeep of sophisticated manufacturing equipment are necessary to ensure operational efficiency and product quality, adding to the overall production expenditure.

For instance, in 2023, CRRC Times Electric reported significant investments in manufacturing capacity and technological upgrades, reflecting the capital-intensive nature of their operations. While specific breakdowns for 2024 are still emerging, the trend indicates continued substantial spending on these core production elements to support their product development and market demand.

Zhuzhou CRRC Times Electric's sales, marketing, and distribution costs are significant, encompassing salaries for their sales force, extensive marketing campaigns, and participation in crucial industry events. These expenditures are vital for reaching both domestic and international markets.

In 2024, the company's sales and marketing expenses were a substantial part of their operational budget, reflecting a strategic emphasis on market penetration and brand building. For instance, their commitment to global expansion necessitates robust logistics and distribution networks, adding to this cost center.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for Zhuzhou CRRC Times Electric Co. encompass the essential overheads that keep the company running smoothly. These include compensation for administrative personnel, the cost of maintaining office spaces, utility payments, and professional services like legal and accounting support. Corporate governance costs, ensuring compliance and ethical operations, also fall under this umbrella.

For 2024, CRRC Times Electric’s G&A expenses are a critical component of its operational budget. While specific figures fluctuate, these costs are managed to ensure efficiency. For instance, in 2023, the company reported G&A expenses that represented a portion of its overall operating costs, reflecting investments in management and support functions.

- Administrative Staff Salaries: Costs associated with human resources, finance, and executive management teams.

- Office Rent and Utilities: Expenses for corporate headquarters and administrative office spaces.

- Professional Fees: Payments for legal counsel, auditing services, and consulting.

- Corporate Governance: Costs related to board of directors, compliance, and shareholder relations.

Capital Expenditures (CapEx) for New Facilities and Equipment

Zhuzhou CRRC Times Electric's cost structure heavily features capital expenditures for expanding and upgrading its manufacturing capabilities. In 2023, the company reported significant investments in new facilities and advanced machinery to support its growth, particularly in emerging sectors.

These substantial CapEx outlays are crucial for maintaining a competitive edge and scaling production. For instance, investments in new energy passenger vehicle electric drive systems highlight a strategic focus on future market demands.

- Facility Expansion and Upgrades: Significant capital was allocated to enhance existing manufacturing plants and construct new production bases.

- Machinery Acquisition: Investments were made in state-of-the-art machinery to improve production efficiency and product quality.

- New Energy Vehicle Systems: A notable portion of CapEx was directed towards developing and producing electric drive systems for new energy passenger vehicles.

Zhuzhou CRRC Times Electric's cost structure is characterized by significant investments in research and development, manufacturing, sales and marketing, and administrative functions. Capital expenditures are also a major component, reflecting the company's commitment to expanding and modernizing its production capabilities. These costs are essential for maintaining technological leadership and meeting market demand.

| Cost Category | 2023 Data (RMB billions) | % of Revenue (2023) |

|---|---|---|

| Research & Development | 2.145 | 9.84% |

| Manufacturing & Production | N/A (Significant component) | N/A |

| Sales, Marketing & Distribution | N/A (Substantial part of budget) | N/A |

| General & Administrative | N/A (Portion of operating costs) | N/A |

| Capital Expenditures | N/A (Significant investments) | N/A |

Revenue Streams

Sales of rail transit electrical equipment represent a foundational revenue source for Zhuzhou CRRC Times Electric. This segment brings in income from delivering essential components like traction converters, sophisticated control systems, and vital signaling apparatus. These products are crucial for a wide array of rail vehicles, from high-speed passenger trains to heavy-duty locomotives and the ever-expanding urban metro systems.

In 2023, the company reported significant contributions from this area, with sales of electrical equipment for rail transit forming a substantial portion of its overall revenue. For instance, the demand for upgraded and new rail infrastructure globally, especially in emerging markets, continues to drive sales. The company's ability to supply integrated electrical solutions positions it favorably in this competitive landscape.

Zhuzhou CRRC Times Electric's revenue from equipment sales is primarily driven by its wind power converters and energy storage systems. In 2023, the company reported significant growth in its new energy segment, contributing substantially to its overall financial performance.

The company's offerings cater to the burgeoning renewable energy market, supplying critical components for both wind and solar power installations. This focus positions them to capitalize on global efforts towards decarbonization and sustainable energy infrastructure development.

Zhuzhou CRRC Times Electric generates income by supplying advanced electric drive systems and power conversion solutions tailored for diverse industrial sectors. This includes equipment for manufacturing, mining, and transportation infrastructure, ensuring efficient and reliable power management.

The company also profits from its expertise in marine engineering, providing specialized power solutions for ships and offshore platforms. These systems are crucial for propulsion, onboard power generation, and auxiliary systems, meeting the demanding requirements of the maritime industry.

In 2023, Zhuzhou CRRC Times Electric reported significant revenue from its industrial and marine segments, reflecting strong demand for its high-performance power solutions. The company's commitment to innovation and quality continues to drive growth in these critical markets.

Sales of New Energy Vehicle Electric Drive Systems

A significant and expanding revenue source for Zhuzhou CRRC Times Electric is the sale of electric drive systems and power modules to new energy vehicle (NEV) manufacturers. This segment is crucial as the global automotive industry continues its rapid transition towards electrification.

The company's expertise in rail transit electrification has translated effectively into the automotive sector. In 2024, the demand for advanced NEV components remains robust, driven by government incentives and increasing consumer adoption of electric cars, buses, and trucks.

CRRC Times Electric's electric drive systems are designed for high efficiency and reliability, catering to the evolving needs of NEV makers. This strategic focus allows them to capture a growing share of the burgeoning NEV supply chain.

- Growing NEV Market Penetration: CRRC Times Electric is a key supplier to numerous domestic and international NEV manufacturers, benefiting from the overall expansion of the electric vehicle market.

- Technological Advancement: The company continuously invests in R&D to enhance the performance and cost-effectiveness of its electric drive systems and power modules, maintaining a competitive edge.

- Sales Growth in NEV Components: While specific 2024 figures are still emerging, the company has consistently reported strong growth in its NEV-related business segments in preceding years, indicating continued upward momentum.

After-Sales Services and Maintenance Contracts

Zhuzhou CRRC Times Electric generates revenue through after-sales services and maintenance contracts, ensuring the longevity and optimal performance of its installed equipment. This includes providing essential repair services, ongoing technical support, and supplying necessary spare parts across all its business segments.

In 2024, the company continued to leverage its extensive installed base, which includes critical components for rail transit, electric vehicles, and industrial power systems. This recurring revenue stream is vital for stable financial performance.

- Maintenance Contracts: Recurring revenue from long-term agreements for scheduled upkeep and preventative maintenance.

- Repair Services: Income generated from fixing and restoring equipment to operational status.

- Technical Support: Fees for expert assistance and troubleshooting provided to customers.

- Spare Parts Sales: Revenue from selling replacement components to maintain equipment functionality.

Zhuzhou CRRC Times Electric's revenue streams are diverse, spanning rail transit electrical equipment, new energy sectors, industrial applications, marine engineering, and after-sales services. The company's strength lies in its ability to leverage its technological expertise across these varied markets, ensuring consistent income generation.

In 2023, the company saw substantial revenue from its core rail transit business, complemented by significant growth in its new energy segment, particularly wind power converters and energy storage systems. The industrial and marine sectors also contributed robustly, highlighting demand for their specialized power solutions.

Looking ahead, the burgeoning electric vehicle market presents a key growth area, with CRRC Times Electric supplying critical electric drive systems and power modules. The company's recurring revenue from after-sales services and maintenance contracts further solidifies its financial stability.

| Revenue Stream | Key Products/Services | 2023 Contribution (Illustrative) | Growth Drivers |

|---|---|---|---|

| Rail Transit Electrical Equipment | Traction converters, control systems, signaling | Significant portion of total revenue | New infrastructure, upgrades, metro expansion |

| New Energy | Wind power converters, energy storage | Substantial growth reported | Renewable energy demand, decarbonization |

| Industrial & Marine Power Solutions | Electric drive systems, marine power systems | Strong demand, high-performance solutions | Industrial efficiency, maritime needs |

| New Energy Vehicles (NEV) Components | Electric drive systems, power modules | Rapidly expanding segment | EV market growth, technological advancements |

| After-Sales Services & Maintenance | Repair, technical support, spare parts | Recurring and stable revenue | Extensive installed base, equipment longevity |

Business Model Canvas Data Sources

The Zhuzhou CRRC Times Electric Co. Business Model Canvas is informed by a blend of internal financial reports, public company filings, and extensive market research on the rail transit and electric vehicle sectors. These data sources provide a comprehensive view of the company's operational performance, strategic direction, and competitive landscape.