Zhuzhou CRRC Times Electric Co. Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhuzhou CRRC Times Electric Co. Bundle

Zhuzhou CRRC Times Electric Co. excels by strategically aligning its advanced product offerings, competitive pricing, expansive global distribution, and targeted promotional campaigns. This synergy drives their dominance in the rail transit and electric vehicle sectors.

Want to understand the intricate details of their product innovation, pricing models, distribution networks, and promotional strategies? Get the full, editable 4Ps Marketing Mix Analysis for Zhuzhou CRRC Times Electric Co. today and unlock actionable insights for your own business.

Product

Zhuzhou CRRC Times Electric Co., Ltd.'s rail transit electrical systems, encompassing traction converters and sophisticated control systems, are the vital components powering modern rail. These systems are indispensable for the efficient and reliable operation of high-speed trains, locomotives, and urban metro systems, effectively serving as the trains' core power and intelligence. In 2023, the company's revenue reached RMB 34.3 billion, with its rail transit segment being a significant contributor, underscoring its market dominance.

The company's product portfolio is central to the advancement of rail technology, enabling enhanced performance and energy efficiency. CRRC Times Electric's commitment extends to shaping international standards, reflecting its influential position in the global rail industry. This focus on innovation and quality has solidified its leading domestic market share, a position it continues to strengthen through ongoing research and development.

Zhuzhou CRRC Times Electric's renewable energy equipment, particularly their wind power converters, is a cornerstone of their product strategy. This segment is crucial, with the company reporting significant growth in its new energy business, which includes wind power, contributing substantially to overall revenue. For instance, in 2023, their new energy sector saw robust performance, reflecting strong demand for these essential components in the expanding renewable energy infrastructure.

Their product portfolio goes beyond wind to encompass integrated clean energy solutions, covering solar, energy storage, and even emerging hydrogen production systems. This broad offering positions them as a comprehensive provider in the green energy transition. The company's commitment to these areas is underscored by substantial investments in research and development, aiming to enhance efficiency and expand their market reach in these critical low-carbon technologies.

This strategic focus directly supports China's national 'dual carbon' goals and the global imperative for decarbonization. The market for renewable energy equipment is projected for continued expansion, with global investment in clean energy expected to reach trillions of dollars in the coming years. Zhuzhou CRRC Times Electric is well-positioned to capitalize on this trend, leveraging its technological expertise and manufacturing capabilities to supply vital components for this global energy shift.

Zhuzhou CRRC Times Electric's Industrial Power Solutions segment offers advanced converter technology and robust power solutions tailored for diverse industrial applications. This strategic diversification allows the company to tap into sectors beyond its traditional rail transit and renewable energy focus, effectively leveraging its deep expertise in complex electrical systems.

The company's commitment to industrial power solutions is underscored by its significant investments in research and development. For example, in 2023, CRRC Times Electric reported R&D expenses of approximately 2.8 billion RMB, a portion of which directly fuels innovation in this growing segment, aiming to provide efficient and reliable power for manufacturing, mining, and other heavy industries.

Marine Power Solutions

Zhuzhou CRRC Times Electric's Marine Power Solutions extend their expertise beyond terrestrial applications, offering specialized power systems for the maritime sector. This strategic diversification taps into a growing market for advanced marine technologies.

The company is actively involved in developing cutting-edge deep-sea robot technology, a critical component for underwater exploration and resource management. This focus underscores their commitment to innovation in challenging environments.

Furthermore, CRRC Times Electric is bolstering its independent support capabilities for marine equipment. This ensures robust operational readiness and long-term reliability for their clients in the marine industry.

Key aspects of their marine offering include:

- Advanced Power Systems: Tailored electrical solutions for vessels and marine operations.

- Deep-Sea Robotics: Power and control systems for autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs).

- Marine Equipment Support: Enhancing the lifecycle and performance of marine machinery through dedicated service and upgrades.

Emerging Equipment and Technologies

Zhuzhou CRRC Times Electric is aggressively pursuing innovation in emerging equipment, focusing on areas like advanced power semiconductor devices, sophisticated electric drive systems for new energy vehicles, and cutting-edge sensor technologies. This forward-looking approach is crucial for staying competitive.

The company's commitment to research and development is substantial, with significant investments aimed at securing a technological advantage and penetrating key growth sectors. For instance, in 2023, CRRC Times Electric reported R&D expenditure of approximately RMB 3.07 billion (around $420 million USD), a key indicator of their dedication to future technologies.

- Power Semiconductor Devices: Development of high-performance silicon carbide (SiC) and insulated-gate bipolar transistor (IGBT) modules for enhanced efficiency in power conversion.

- New Energy Vehicle Electric Drive Systems: Continued enhancement of integrated powertrain solutions, aiming for higher power density and improved thermal management.

- Sensor Technologies: Expansion of intelligent sensor portfolios, including advanced optical and magnetic sensors for various industrial applications.

CRRC Times Electric's product strategy centers on its core rail transit electrical systems, which are essential for modern rail infrastructure, and its expanding renewable energy equipment, particularly wind power converters. The company also diversifies into industrial power solutions and marine power systems, including deep-sea robotics. A significant portion of their 2023 R&D spending, approximately RMB 3.07 billion, fuels innovation across these product lines, especially in advanced power semiconductor devices and new energy vehicle electric drive systems.

| Product Segment | Key Offerings | 2023 Revenue Contribution (Approximate) | Strategic Focus |

|---|---|---|---|

| Rail Transit Electrical Systems | Traction converters, control systems | Significant contributor to RMB 34.3 billion total revenue | Dominance in high-speed rail, urban metro |

| Renewable Energy Equipment | Wind power converters, solar, energy storage, hydrogen systems | Robust growth in new energy business | Green energy transition, decarbonization goals |

| Industrial Power Solutions | Advanced converter technology, power solutions | Diversification into manufacturing, mining | Leveraging expertise in complex electrical systems |

| Marine Power Solutions | Specialized power systems, deep-sea robotics | Emerging market for advanced marine tech | Innovation in challenging marine environments |

What is included in the product

This analysis offers a comprehensive examination of Zhuzhou CRRC Times Electric Co.'s marketing mix, detailing its product innovation, pricing strategies, distribution channels, and promotional efforts.

It provides actionable insights into how the company leverages its 4Ps to maintain a competitive edge in the global transportation and industrial equipment market.

This analysis condenses CRRC Times Electric's 4Ps marketing mix into a clear, actionable framework, directly addressing customer pain points by highlighting how their product innovation, strategic pricing, accessible distribution, and promotional efforts solve key industry challenges.

It serves as a high-level, easily digestible overview for leadership, simplifying complex marketing strategies into tangible pain point relievers for rapid internal alignment and decision-making.

Place

Zhuzhou CRRC Times Electric's distribution strategy heavily leans on direct sales and project-based engagements, reflecting the highly specialized nature of its products. This approach is essential for large-scale infrastructure components like traction systems for high-speed rail and significant energy conversion equipment, where bespoke solutions are paramount.

The company directly interfaces with key clients such as national railway operators and major energy conglomerates. This direct channel allows for in-depth understanding of client needs, facilitating the development of customized proposals and complex project agreements. For instance, securing contracts for new metro lines or upgrades to national power grids necessitates this direct, consultative sales process.

In 2023, CRRC Corporation Limited, the parent company, reported significant revenue from its rolling stock and related businesses, which directly correlates with the demand for Times Electric's core products. Their order book growth, often driven by large infrastructure projects, underscores the effectiveness of this project-based distribution model in securing substantial, long-term contracts.

Zhuzhou CRRC Times Electric enjoys a commanding presence in China's domestic market, especially within the rail transit sector. For more than ten years, they have consistently held the top market share for urban rail traction converter systems, a testament to their deep-rooted relationships and efficient distribution channels across the nation.

Zhuzhou CRRC Times Electric is actively expanding its international footprint, currently operating in over 20 countries and regions globally. This broad reach underscores their commitment to becoming a significant player in the worldwide rail transport sector.

The company has set a clear objective to boost its global market share, a strategy that involves forging international joint ventures. Particular emphasis is being placed on opportunities within Europe and North America, key markets for rail infrastructure development.

In 2023, CRRC Corporation Limited, the parent company, reported significant international sales, with overseas revenue contributing substantially to its overall financial performance, reflecting the success of its global expansion efforts.

Strategic Partnerships and Collaborations

Zhuzhou CRRC Times Electric leverages strategic partnerships and collaborations to bolster its distribution network, particularly within the burgeoning urban rail sector. These alliances, often structured as joint ventures, are designed to unlock market synergies and expand reach.

By engaging in these collaborations, the company effectively taps into local expertise and gains crucial market access, which is vital for navigating diverse regulatory landscapes and customer preferences. This approach was evident in their reported involvement in numerous urban rail projects across China and internationally.

For instance, their participation in the development of smart metro systems, often in partnership with local transit authorities and engineering firms, exemplifies this strategy. These ventures allow CRRC Times Electric to share risks and rewards while accelerating the adoption of their advanced electrical systems.

- Joint Ventures: CRRC Times Electric actively participates in joint ventures to share technological development and market penetration, especially in overseas markets.

- Urban Rail Synergies: Collaborations focus on enhancing system integration and operational efficiency within urban rail transit projects, aiming for comprehensive solutions.

- Market Access: Partnerships provide a critical pathway to new geographical markets and customer segments, overcoming entry barriers through shared resources and local knowledge.

Integrated Supply Chain and Service Network

Zhuzhou CRRC Times Electric has built a robust, integrated network that spans supply chain, manufacturing, marketing, and after-sales service. This comprehensive system operates both within China and on a global scale, ensuring their products are readily available to customers worldwide.

This integrated approach is a cornerstone of their international competitive strategy. It allows for efficient production and timely delivery, directly impacting customer satisfaction and market penetration. For instance, CRRC Times Electric's commitment to a strong service network was evident in their support for the Jakarta-Bandung High-Speed Railway project, providing critical maintenance and operational assistance.

The company's extensive network facilitates:

- Global Product Availability: Ensuring timely access to their advanced electrical systems and components across diverse markets.

- Efficient Operations: Streamlining the flow from raw materials to finished products and delivery.

- Enhanced Customer Support: Providing reliable after-sales service and technical assistance, crucial for complex industrial equipment.

- Competitive Advantage: Leveraging their integrated infrastructure to outmaneuver competitors in terms of logistics and service quality.

Zhuzhou CRRC Times Electric's place strategy centers on its strong domestic dominance in China's rail transit sector, holding over 10 years of top market share for urban rail traction converters. This is complemented by an aggressive global expansion, targeting over 20 countries and regions, with a strategic focus on Europe and North America through international joint ventures.

Their integrated network, encompassing supply chain, manufacturing, marketing, and after-sales service, ensures product availability and efficient operations worldwide, exemplified by their support for projects like the Jakarta-Bandung High-Speed Railway.

The company's direct sales and project-based engagements are crucial for large, customized infrastructure components, fostering deep client relationships with national operators and energy conglomerates.

In 2023, CRRC Corporation Limited, the parent, reported substantial international sales, validating Times Electric's global market penetration efforts.

| Market Focus | Key Strategy | 2023 Parent Revenue Contribution (Illustrative) |

|---|---|---|

| Domestic China (Rail Transit) | Dominant market share, deep-rooted relationships | Significant portion of CRRC Corp's rolling stock revenue |

| International Expansion | Joint ventures, targeting Europe & North America | Substantial overseas revenue reported by CRRC Corp |

| Distribution Channels | Direct sales, project-based engagements, strategic partnerships | Supports large-scale infrastructure contracts |

Preview the Actual Deliverable

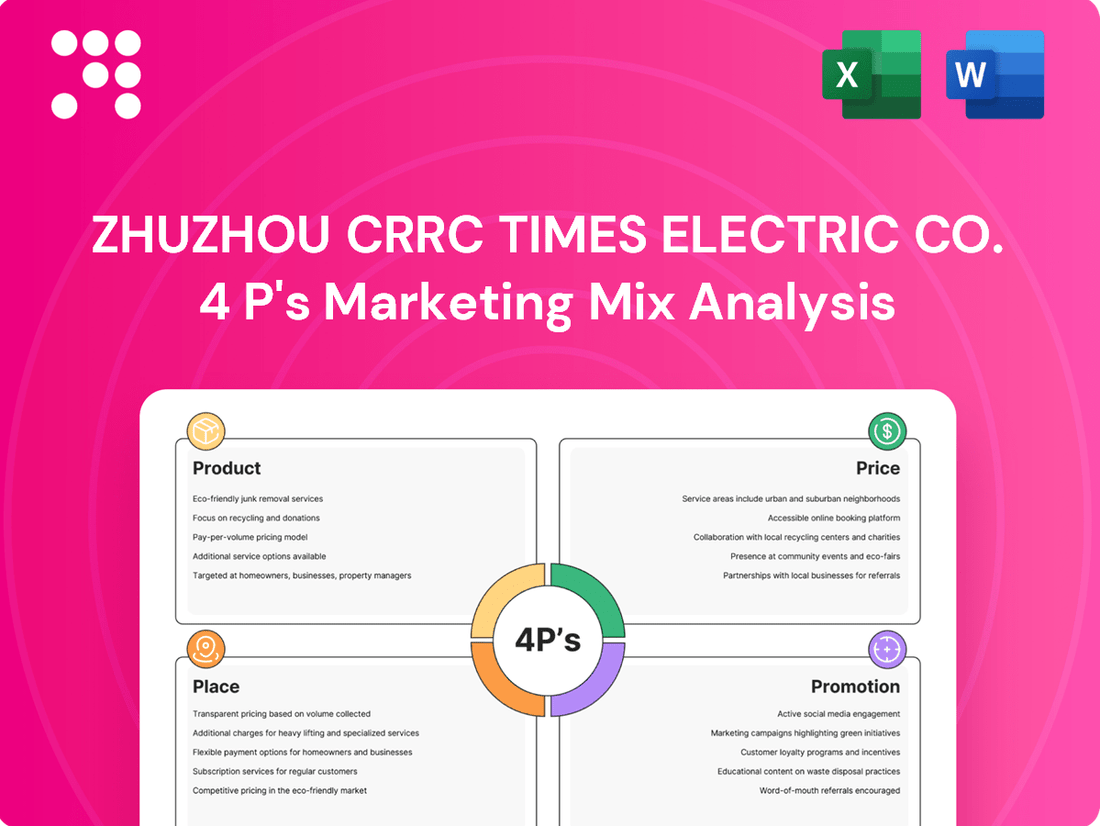

Zhuzhou CRRC Times Electric Co. 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Zhuzhou CRRC Times Electric Co.'s 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Zhuzhou CRRC Times Electric leverages industry exhibitions and conferences as a key promotional tool. They actively participate in major international events like Intersolar Europe and WindEnergy Hamburg, showcasing their cutting-edge technologies and comprehensive solutions in areas such as power electronics and rail transit. In 2023, for instance, their presence at these events facilitated direct interaction with a significant number of potential clients and strategic partners from across the globe, driving lead generation and brand visibility.

Zhuzhou CRRC Times Electric Co. actively showcases its technical leadership through a strong emphasis on innovation, evidenced by its extensive portfolio of patented technologies. In 2023, the company reported investing RMB 4.5 billion in research and development, a significant increase from previous years, underscoring its commitment to technological advancement and industry standards.

Their marketing strategies focus on demonstrating this technical superiority, highlighting R&D achievements that contribute to setting new industry benchmarks. This approach aims to solidify their position as an innovator in the electric vehicle and rail transit sectors, attracting clients and partners who value cutting-edge solutions.

Zhuzhou CRRC Times Electric actively manages its public image through robust corporate communications. This includes the timely release of annual reports and detailed financial results, ensuring stakeholders, particularly investors, are well-informed about the company's performance and future strategies. For instance, their 2023 annual report detailed significant revenue growth and strategic investments in new energy sectors.

The company prioritizes maintaining open and transparent communication channels with its investor base. This commitment fosters trust and provides a clear understanding of the company's operational efficiency and market positioning. In 2024, they hosted several investor relations events, including virtual roadshows, to discuss their progress in expanding their high-speed rail signaling systems and electric vehicle components businesses.

Alignment with National Strategies

Zhuzhou CRRC Times Electric's promotional efforts strongly resonate with China's overarching national development blueprints. Their messaging frequently highlights contributions to initiatives like the Outline for the Construction of a Transportation Power, emphasizing advancements in high-speed rail and intelligent transportation systems. This strategic alignment positions the company not just as a manufacturer but as a vital enabler of national progress and modernization.

Furthermore, the company actively promotes its role in achieving the 'Double Carbon' goals, focusing on the environmental benefits of its electric vehicle technologies and smart grid solutions. This commitment to sustainability is a core tenet of their promotional narrative, underscoring their dedication to green development and a low-carbon future. For instance, their electric traction systems are crucial for reducing emissions in the rail sector, a key component of China's carbon reduction targets.

- National Strategy Alignment: Promotions often echo the 'Outline for the Construction of a Transportation Power'.

- Sustainability Focus: Messaging highlights contributions to 'Double Carbon' goals through green technologies.

- Market Positioning: The company is presented as a key player in achieving national sustainable development objectives.

- Industry Impact: CRRC Times Electric's products, like advanced electric traction systems, directly support emission reduction targets in transportation.

Brand Building and Reputation Management

Zhuzhou CRRC Times Electric actively cultivates its brand as a pioneer and leader in China's electrified railway sector. This involves consistently delivering high-quality, innovative solutions that underscore their technological prowess and commitment to industry advancement. Their efforts in brand building are directly linked to their strong reputation.

The company's focus on customer satisfaction is a cornerstone of its reputation management strategy. By ensuring reliable products and responsive service, they foster trust and loyalty among clients. This dedication to client relationships strengthens their market standing and reinforces their brand image as a dependable partner.

Zhuzhou CRRC Times Electric's brand strength is evident in its market position. For instance, in 2023, the company secured significant orders, contributing to its robust financial performance and reinforcing its leadership narrative. Their brand is synonymous with advanced electric traction systems and intelligent manufacturing.

- Pioneering Role: Recognized as a leader in China's electrified railway equipment sector.

- Quality Focus: Emphasis on high-quality solutions drives brand perception.

- Customer Satisfaction: Commitment to customer needs enhances reputation and trust.

- Market Recognition: Strong brand image supports continued market share and order acquisition.

Zhuzhou CRRC Times Electric's promotional strategy is deeply intertwined with national development goals, particularly in transportation and sustainability. Their messaging consistently highlights contributions to China's ambitious infrastructure projects and environmental targets, positioning them as a key enabler of national progress.

The company actively participates in industry events and leverages its strong R&D investments, which reached RMB 4.5 billion in 2023, to showcase technological leadership. This focus on innovation and tangible achievements, such as securing major orders in 2023, reinforces their brand as a reliable and forward-thinking industry leader.

CRRC Times Electric also prioritizes transparent corporate communications, including detailed annual reports and investor events, to build trust and clearly articulate their market position. Their brand is synonymous with advanced electric traction systems and intelligent manufacturing, supported by a commitment to customer satisfaction and product quality.

| Promotional Focus | Key Activities/Evidence | 2023/2024 Data/Impact |

|---|---|---|

| Industry Events & Tech Showcase | Participation in Intersolar Europe, WindEnergy Hamburg | Direct interaction with global clients; lead generation |

| R&D and Innovation | Investment of RMB 4.5 billion in R&D (2023) | Extensive patent portfolio, setting industry benchmarks |

| National Strategy Alignment | Messaging on 'Transportation Power' and 'Double Carbon' goals | Enabling national modernization and green development |

| Brand Building & Reputation | Focus on quality, customer satisfaction, and market leadership | Secured significant orders in 2023; robust financial performance |

Price

Zhuzhou CRRC Times Electric likely employs a value-based pricing strategy for its high-tech solutions, such as advanced electric drive systems and converters. This approach aligns with the significant benefits customers receive, including enhanced performance, unwavering reliability, and crucial safety features for critical infrastructure like high-speed rail.

The pricing reflects the substantial long-term operational efficiencies and reduced lifecycle costs that their sophisticated technology provides. For instance, the company's traction systems contribute to energy savings and reduced maintenance needs for rail operators, justifying a premium price point based on these economic advantages.

For major endeavors like rail transit systems and renewable energy installations, Zhuzhou CRRC Times Electric often engages in competitive bidding. This means pricing isn't fixed but is carefully crafted to meet the unique demands of each project, considering its scale, specific technical needs, and the prevailing market environment.

In 2024, for instance, bids for large infrastructure projects in China’s rail sector saw intense competition, with pricing strategies needing to balance cost efficiency with advanced technological offerings. This approach ensures that Zhuzhou CRRC Times Electric remains competitive while delivering tailored solutions for government contracts.

Zhuzhou CRRC Times Electric's acquisition strategy is a key component of its growth. For instance, the planned acquisition of Hunan CRRC Commercial Vehicle Power Technology Co., Ltd. for RMB 106.925 million highlights this. The pricing for such deals is typically determined by the assessed net assets of the target company, ensuring a valuation grounded in tangible worth.

Shareholder Return and Dividend Policy

Zhuzhou CRRC Times Electric's pricing strategy is intertwined with its commitment to shareholder value. The company's dividend policy reflects this focus, aiming to distribute profits directly to investors. This approach can influence pricing by ensuring profitability targets are met to support consistent dividend payouts.

For the 2024 fiscal year, the company approved a profit distribution plan that includes a cash dividend of RMB 10 for every 10 shares. This demonstrates a clear intention to return capital to shareholders.

The company has also established a three-year dividend distribution plan, signaling a forward-looking strategy to provide predictable returns. This long-term commitment can provide a stable anchor for pricing decisions, as future dividend obligations are factored into financial planning.

- Dividend Payout for 2024: RMB 10 cash dividend per 10 shares.

- Strategic Focus: Commitment to distributing cash dividends to shareholders.

- Long-Term Planning: Implementation of a three-year dividend distribution plan.

Cost-Efficiency and Profitability Focus

Zhuzhou CRRC Times Electric Co. prioritizes cost-efficiency and profitability, evident in their strategic pricing. The company actively seeks to enhance product quality and operational efficiency, directly impacting their ability to offer competitive pricing while ensuring healthy returns. This commitment to optimization allows them to maintain a strong market position.

Their ongoing review of internal processes is geared towards maximizing reliability and efficiency. These improvements can translate into lower production costs, enabling more attractive pricing for their customers. For instance, in 2023, the company reported a gross profit margin of 25.8%, reflecting their success in managing costs effectively.

The focus on cost optimization and profitability influences their entire pricing strategy. They aim to strike a balance that reflects the high quality and reliability of their products while remaining competitive. This approach is crucial for sustained growth and market share.

Key aspects of their cost-efficiency and profitability focus include:

- Continuous process improvement to reduce manufacturing costs.

- Emphasis on product reliability to minimize after-sales service expenses.

- Strategic pricing that balances market competitiveness with profit margins.

- Investment in R&D aimed at developing more efficient and cost-effective technologies.

Zhuzhou CRRC Times Electric's pricing is a dynamic interplay of value, project specifics, and market conditions. Their value-based approach, especially for advanced electric drive systems, reflects the significant performance and efficiency gains customers realize, justifying premium pricing. This is underscored by their traction systems contributing to energy savings, a key selling point.

For large-scale projects, competitive bidding is standard, meaning prices are tailored to each tender's unique technical requirements and scale. This was evident in China's rail sector in 2024, where pricing strategies balanced cost-effectiveness with technological advancement to win contracts.

The company's commitment to shareholder value, demonstrated by a RMB 10 per 10 shares cash dividend for 2024 and a three-year dividend plan, also indirectly influences pricing by ensuring profitability targets are met to support these payouts.

Cost efficiency is a cornerstone, with a 2023 gross profit margin of 25.8% highlighting effective cost management. This allows for competitive pricing while maintaining healthy returns.

| Metric | Value (2023/2024) | Significance |

|---|---|---|

| Gross Profit Margin | 25.8% (2023) | Indicates strong cost management supporting competitive pricing. |

| Dividend Payout (2024) | RMB 10 per 10 shares | Reflects profitability targets influencing pricing strategy. |

| Acquisition Value | RMB 106.925 million (Hunan CRRC Commercial Vehicle Power Technology) | Pricing in M&A reflects net asset valuation, impacting overall financial strategy. |

4P's Marketing Mix Analysis Data Sources

Our Zhuzhou CRRC Times Electric Co. 4P's Marketing Mix Analysis is built upon a foundation of official company disclosures, including annual reports and investor presentations, alongside credible industry research and news articles. This ensures a comprehensive understanding of their product portfolio, pricing strategies, distribution networks, and promotional activities.