Symrise SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Symrise Bundle

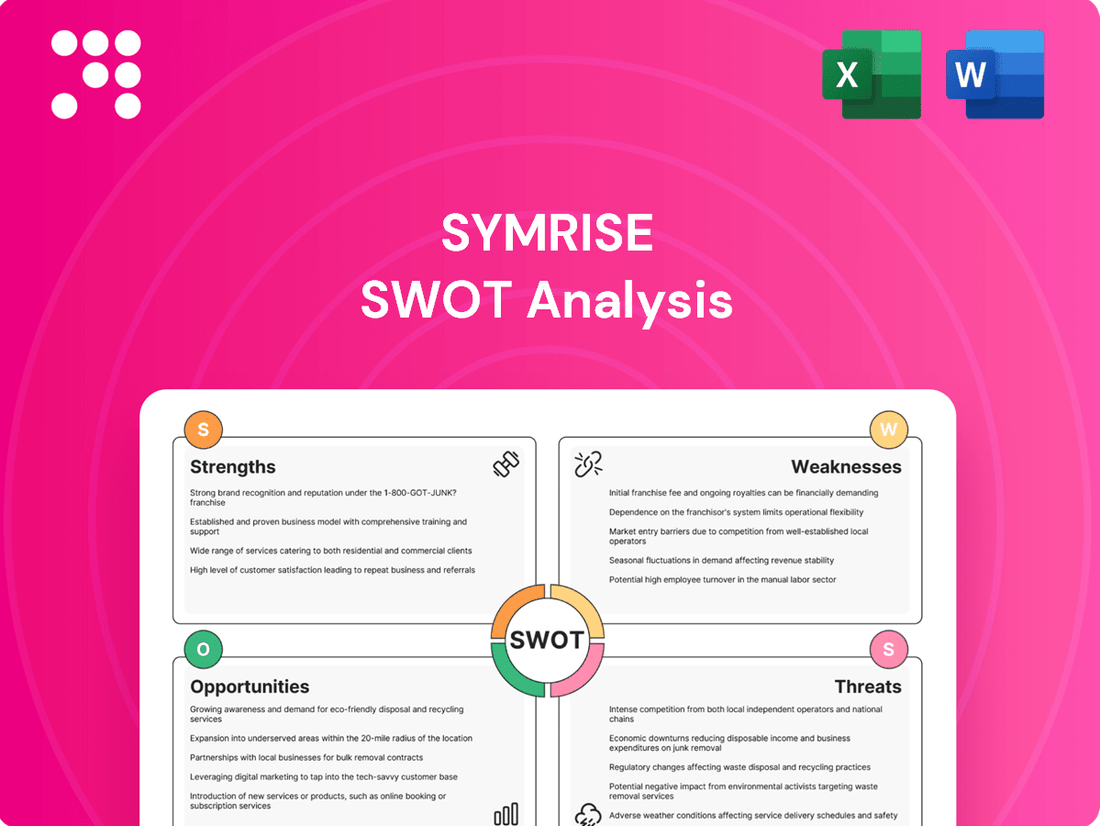

Symrise, a leader in flavors and fragrances, boasts strong brand recognition and a diverse product portfolio, yet faces intense competition and evolving consumer preferences. Our comprehensive SWOT analysis delves into these critical factors, providing you with the strategic intelligence needed to navigate this dynamic market.

Want to understand the full scope of Symrise's competitive advantages and potential challenges? Purchase our complete SWOT analysis to unlock actionable insights, expert commentary, and a detailed roadmap for strategic planning and investment decisions.

Strengths

Symrise boasts a diversified product portfolio, strategically organized into two core segments: Taste, Nutrition & Health, and Scent & Care. This broad offering encompasses everything from captivating fragrances and appealing flavorings to innovative cosmetic active ingredients and essential functional ingredients. This wide reach across various industries and global markets creates a resilient business model, mitigating risks associated with over-dependence on any single sector.

Symrise has shown impressive financial results, with sales and profits climbing. They've even boosted their financial outlook for 2024, signaling confidence in their trajectory.

Looking ahead, Symrise is targeting consistent organic sales growth of 5% to 7% annually until 2028. This ambitious goal is supported by a projected EBITDA margin of 21% to 23% for 2025, highlighting their focus on profitable expansion.

Symrise demonstrates robust leadership in innovation and research and development. The company's commitment is underscored by significant investments in new R&D facilities and the strategic adoption of artificial intelligence for both product development and consumer insights. This forward-thinking approach ensures Symrise stays ahead in creating novel products and enhancing existing offerings to meet dynamic consumer demands.

Commitment to Sustainability

Symrise's dedication to sustainability is a significant strength, with ambitious targets like achieving net-zero Scope 1 and 2 greenhouse gas emissions by 2030. This forward-thinking approach not only resonates with environmentally conscious consumers and investors but also bolsters the company's long-term viability.

The company's commitment extends to its supply chain, aiming for 100% sustainable sourcing of strategic biological raw materials by 2025. This proactive measure is crucial for mitigating risks associated with climate change and ensuring a stable supply of essential ingredients, a key factor in the flavor and fragrance industry.

- Net-zero emissions target: Scope 1 and 2 GHG emissions by 2030.

- Sustainable sourcing goal: 100% of strategic biological raw materials by 2025.

- Brand enhancement: Strong sustainability credentials improve public perception.

- Supply chain resilience: Reduced reliance on potentially vulnerable resources.

Strategic Efficiency Programs

Symrise's strategic efficiency programs are a significant strength, demonstrating a proactive approach to cost management and operational optimization. These initiatives, focusing on strict cost control, streamlined procurement, and enhanced production processes, directly bolster the company's profitability. This focus allows Symrise to maintain healthy profit margins even when market conditions become more challenging.

These efficiency drives are not just about cutting costs; they are about smart resource allocation. For instance, in 2023, Symrise reported a notable improvement in its operating profit margin, partly attributed to these ongoing efficiency measures. The company's ability to adapt and streamline its operations ensures it remains competitive and financially resilient.

Key aspects of these programs include:

- Rigorous Cost Management: Implementation of strict budgetary controls and expense reduction strategies across all business units.

- Optimized Procurement: Leveraging bulk purchasing power and strategic supplier relationships to secure favorable terms and reduce input costs.

- Production Efficiency: Investing in and refining manufacturing processes to minimize waste, reduce energy consumption, and increase output.

- Supply Chain Integration: Enhancing the efficiency and resilience of the entire supply chain to mitigate disruptions and control logistics expenses.

Symrise's diversified product portfolio, spanning Taste, Nutrition & Health, and Scent & Care, provides a strong foundation. This broad reach across various industries and global markets creates a resilient business model, mitigating risks associated with over-dependence on any single sector.

The company's financial performance is robust, with consistent sales and profit growth. Symrise has also demonstrated its confidence by boosting its financial outlook for 2024, aiming for organic sales growth of 5% to 7% annually until 2028 and a projected EBITDA margin of 21% to 23% for 2025.

A key strength lies in Symrise's commitment to innovation and R&D, evidenced by significant investments in new facilities and the integration of AI for product development and consumer insights. This focus ensures they remain at the forefront of creating novel products.

Symrise's dedication to sustainability is a significant advantage, with ambitious targets like net-zero Scope 1 and 2 greenhouse gas emissions by 2030 and 100% sustainable sourcing of strategic biological raw materials by 2025. These efforts enhance brand perception and supply chain resilience.

Strategic efficiency programs, including rigorous cost management and optimized procurement, bolster profitability. For instance, notable improvements in operating profit margin were reported in 2023, partly due to these ongoing measures.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Diversified Portfolio | Broad product range across key segments. | Segments: Taste, Nutrition & Health, Scent & Care. |

| Financial Performance | Consistent sales and profit growth. | Targeting 5-7% organic sales growth (2028), 21-23% EBITDA margin (2025). |

| Innovation & R&D | Strong investment in future product development. | AI integration for product development and consumer insights. |

| Sustainability Commitment | Ambitious environmental and sourcing goals. | Net-zero Scope 1 & 2 GHG by 2030; 100% sustainable sourcing by 2025. |

| Efficiency Programs | Focus on cost control and operational optimization. | Improved operating profit margin in 2023. |

What is included in the product

Analyzes Symrise’s competitive position through key internal and external factors, highlighting its strong market presence and innovation capabilities alongside potential challenges in raw material sourcing and regulatory changes.

Symrise's SWOT analysis offers a clear roadmap to identify and address market challenges, turning potential weaknesses into strategic advantages.

Weaknesses

Symrise's extensive product portfolio, which utilizes over 10,000 raw materials, many sourced naturally, leaves the company vulnerable to fluctuations in raw material prices. This inherent reliance can lead to increased production costs and affect overall profitability, especially when supply chains face disruptions or geopolitical challenges.

The global flavors and fragrances market, where Symrise operates, is characterized by fierce competition. Major players like Givaudan, Firmenich, and IFF consistently vie for market share, leading to significant pricing pressures.

This intense rivalry necessitates substantial and ongoing investment in research and development to innovate and stay ahead. For instance, R&D spending is a critical differentiator in this sector, with leading companies allocating significant portions of their revenue to new product development and technological advancements.

Maintaining a competitive edge also demands considerable marketing and sales efforts to build brand recognition and secure customer loyalty. Symrise's ability to navigate this demanding landscape is crucial for its sustained growth and profitability in the coming years.

While Symrise has proactively adjusted its financial forecasts to account for hyperinflationary pressures, these persistent economic conditions can still introduce significant volatility into its financial reporting and day-to-day operational planning. This inherent uncertainty may challenge the company's ability to accurately gauge real growth, even with its forward-looking adjustments.

Regulatory Complexities

Symrise operates within sectors, such as flavors and fragrances, that are subject to rigorous regulations concerning ingredients and product safety, especially in key markets like the European Union and the United States. The company must invest heavily in compliance to meet these varied and often evolving standards.

These complex regulatory environments can significantly impact Symrise's ability to innovate and bring new products to market efficiently. For instance, the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation requires extensive data submission for chemical substances, adding to compliance costs and timelines.

Navigating these requirements necessitates substantial resources and expertise, potentially slowing down product development cycles and posing challenges for market expansion into new geographical areas with differing regulatory frameworks.

Key regulatory considerations for Symrise include:

- Food additive regulations: Ensuring all flavor ingredients meet strict safety and labeling requirements in diverse global markets.

- Cosmetic ingredient standards: Adhering to regulations like the EU Cosmetic Regulation, which governs the safety and labeling of cosmetic products and their ingredients.

- Environmental, Health, and Safety (EHS) compliance: Meeting global standards for chemical handling, manufacturing processes, and waste management.

Integration Risks from Acquisitions

Symrise has a robust history of strategic acquisitions, having completed 16 such deals up to late 2024, most recently acquiring a majority stake in Probi. While these acquisitions are intended to bolster growth and market position, the process of integrating new companies presents significant challenges. These can include operational disruptions and clashes in company culture, which may divert essential resources and management focus away from core business activities.

The successful assimilation of acquired businesses is crucial for realizing their full potential and avoiding integration failures. For instance, the integration of a new entity could lead to unforeseen costs or delays in synergy realization. This risk is amplified as Symrise continues to pursue its growth-by-acquisition strategy, aiming to expand its product portfolio and geographic reach.

- Integration Complexity: Merging diverse operational systems, IT infrastructures, and business processes from acquired companies can be intricate and time-consuming.

- Cultural Dilution: Mismatched corporate cultures can hinder employee morale, collaboration, and retention, potentially impacting productivity and innovation.

- Resource Strain: The demands of integration can strain financial and human resources, potentially impacting ongoing research and development or sales efforts.

Symrise's reliance on a vast array of natural raw materials, exceeding 10,000, exposes it to significant price volatility and supply chain disruptions. This dependency can directly impact production costs and profitability, especially given the unpredictable nature of agricultural yields and global logistics. The company's recent financial reports for 2023 and early 2024 have highlighted the impact of these raw material price swings on its margins.

The highly competitive landscape of the flavors and fragrances industry, featuring strong rivals like Givaudan and IFF, exerts considerable pricing pressure on Symrise. This intense competition necessitates continuous, substantial investment in research and development to maintain a leading edge, with R&D spending remaining a critical factor for differentiation in this market.

Navigating complex and evolving regulatory frameworks across different global markets presents a significant challenge. Compliance with standards such as the EU's REACH regulation demands substantial resources and can slow down product innovation and market entry, impacting Symrise's agility.

The company's strategy of growth through acquisitions, with 16 deals completed by late 2024, introduces integration challenges. Merging diverse operations and cultures can strain resources and divert management focus, potentially hindering the realization of synergies and impacting core business activities.

| Weakness | Impact | Example/Data Point |

| Raw Material Dependency | Price Volatility & Supply Chain Risk | Symrise utilizes over 10,000 raw materials, many natural, making it susceptible to price fluctuations and disruptions. |

| Intense Market Competition | Pricing Pressure & R&D Costs | Competitors like Givaudan and IFF drive the need for significant R&D investment to maintain market share. |

| Regulatory Complexity | Compliance Costs & Innovation Delays | Adherence to regulations like EU REACH requires substantial investment and can slow product launches. |

| Acquisition Integration Challenges | Resource Strain & Operational Disruption | Integrating acquired entities can divert resources and management attention from core operations. |

What You See Is What You Get

Symrise SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You're previewing the actual analysis document. Buy now to access the full, detailed report.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

Opportunities

Consumers are increasingly seeking out natural, organic, and clean-label ingredients in everything from cosmetics to food and drinks. This trend is a significant tailwind for companies like Symrise. For instance, the global market for natural ingredients in cosmetics was valued at approximately $20.1 billion in 2023 and is projected to reach $39.5 billion by 2030, growing at a CAGR of 9.9%.

Symrise is particularly well-positioned to benefit from this shift. Their established commitment to sustainable sourcing practices and their expertise in eco-friendly chemistry align perfectly with this growing consumer demand. This allows them to offer a compelling product portfolio that resonates with environmentally conscious buyers.

The flavors and fragrances industry is seeing robust expansion in emerging markets, particularly across Asia-Pacific. This growth is fueled by rising disposable incomes, increasing urbanization, and evolving consumer preferences. For instance, the Asia-Pacific fragrance market alone was projected to reach over $11 billion by 2024, showcasing a significant opportunity.

Symrise, with its established global footprint, is well-positioned to capitalize on these burgeoning markets. The company can leverage its existing infrastructure and product portfolio to target and gain market share in these rapidly developing economies. This strategic focus allows Symrise to tap into new customer bases and drive revenue growth.

Consumers are actively prioritizing health and wellness, driving a surge in demand for products that support well-being and improve mood. This trend presents a significant opportunity for Symrise to leverage its advanced capabilities in functional ingredients and its expertise in optimizing the taste of plant-based protein alternatives.

Symrise's focus on health and well-being aligns perfectly with consumer preferences, paving the way for innovative product development and deeper market penetration. For instance, the global health and wellness market was valued at approximately $4.5 trillion in 2023 and is projected to grow substantially in the coming years, with a significant portion attributed to functional foods and beverages.

Advancements in Digitalization and AI

Symrise can leverage AI for smarter product development and consumer insights, potentially boosting its innovation pipeline. For instance, AI-driven analytics can sift through vast amounts of consumer data to identify emerging trends and preferences, allowing for more targeted product creation. This digital edge can translate into more effective and personalized solutions for their clients.

The company can also streamline its operational processes through AI integration. This could mean optimizing supply chains, improving manufacturing efficiency, and enhancing transparency across its value chain. By embracing these technological advancements, Symrise has the opportunity to gain a significant competitive advantage and accelerate its growth trajectory in the dynamic flavor and fragrance market.

- AI-powered consumer research can identify niche market opportunities, potentially leading to the development of highly sought-after products.

- Digitalization of operational processes, such as supply chain management, can reduce costs and improve delivery times, enhancing customer satisfaction.

- AI in product formulation can accelerate the discovery of novel ingredients and scent profiles, giving Symrise a first-mover advantage.

Strategic Acquisitions and Partnerships

Symrise can strategically acquire companies that complement its existing offerings, thereby broadening its product portfolio, increasing its market presence, and enhancing its technological expertise. This approach allows for faster entry into new or growing market segments.

For instance, the acquisition of Probi in 2023, a leading global provider of probiotics, demonstrates Symrise's commitment to strengthening its position in the burgeoning health and nutrition sector. This move directly supports the company's focus on high-growth areas.

- Expansion into Probiotic Markets: Probi's integration allows Symrise to capitalize on the growing consumer demand for scientifically backed health solutions.

- Synergies in R&D: Combining research capabilities can accelerate the development of innovative ingredients and finished products.

- Market Share Growth: Targeted acquisitions bolster Symrise's competitive standing in key fragrance, flavor, and nutrition markets.

The increasing consumer preference for natural, organic, and clean-label products presents a significant opportunity for Symrise. The global market for natural ingredients in cosmetics alone was valued at approximately $20.1 billion in 2023 and is projected to reach $39.5 billion by 2030, reflecting a strong compound annual growth rate.

Emerging markets, particularly in the Asia-Pacific region, offer robust growth potential for flavors and fragrances, driven by rising incomes and evolving consumer tastes. The Asia-Pacific fragrance market, for example, was anticipated to exceed $11 billion by 2024.

Symrise's strategic acquisitions, such as the 2023 purchase of Probi, a leader in probiotics, bolster its position in the health and nutrition sector. This aligns with the growing consumer focus on wellness and scientifically supported health solutions.

| Opportunity Area | Market Data Point | Symrise Relevance |

|---|---|---|

| Natural & Clean Label Ingredients | Cosmetics market valued at $20.1B in 2023, projected to $39.5B by 2030 (9.9% CAGR) | Leverages sustainable sourcing and eco-friendly chemistry expertise. |

| Emerging Market Expansion | Asia-Pacific fragrance market projected >$11B by 2024 | Utilizes global footprint to tap into growing economies and new customer bases. |

| Health & Wellness Focus | Global health and wellness market valued at ~$4.5T in 2023 | Strengthens position in health/nutrition via acquisitions like Probi. |

Threats

Symrise faces significant threats from the volatility of raw material prices, particularly for its natural ingredients. For instance, the cost of essential oils and botanical extracts can swing dramatically due to weather patterns affecting harvests or shifts in global demand. This unpredictability directly impacts Symrise's cost of goods sold and can squeeze profit margins if these increases cannot be passed on to customers.

Furthermore, supply chain disruptions pose a considerable risk. Geopolitical instability, as seen in various regions affecting global trade routes in 2024, can lead to significant logistics congestion and delays. Climate change events, such as droughts or extreme weather, also threaten the availability and quality of natural raw materials, further exacerbating price fluctuations and potentially halting production lines.

The fragrance sector, particularly the premium segment, is experiencing heightened competition. Established luxury houses are fiercely defending their market share, while agile niche brands are capturing consumer attention with unique scents and compelling brand stories. This dynamic intensifies pressure on players like Symrise to differentiate.

The growing trend of 'dupe culture,' where consumers seek affordable alternatives to high-end fragrances, directly challenges the exclusivity and perceived value of premium brands. Symrise must continually innovate and invest in distinctive scent profiles and marketing to maintain brand loyalty and justify premium pricing in this evolving landscape.

Symrise faces growing pressure from stringent environmental and social regulations, like Germany's Supply Chain Act, which mandates due diligence in global supply chains. This necessitates ongoing investment in compliance and monitoring, potentially impacting operational costs and requiring adaptation of sourcing and production practices.

The evolving landscape of social standards and environmental protection laws, particularly in key markets, demands continuous adaptation and proactive investment. Failure to comply could lead to reputational damage and financial penalties, impacting Symrise's ability to operate and grow sustainably.

Shifting Consumer Preferences and Trends

Consumer tastes are changing at a breakneck pace, with a growing hunger for personalized and customized products. Symrise, like many in the fragrance and flavor industry, must constantly innovate to meet these evolving demands. For instance, the demand for clean label ingredients and natural fragrances saw significant growth in 2024, a trend that requires substantial R&D investment and agile supply chain management.

Failing to adapt quickly enough to these shifts poses a significant threat. A lag in developing new scents or flavors that resonate with current consumer preferences can quickly erode market share. In 2024, several smaller, agile competitors gained traction by focusing on niche, hyper-personalized scent profiles, demonstrating the risk of inertia.

- Evolving Demand: Consumers increasingly seek personalized products, requiring continuous innovation in fragrance and flavor development.

- Market Relevance: Failure to align with shifting consumer preferences, such as the move towards natural and sustainable ingredients, can lead to decreased market relevance.

- Growth Impact: Slower adaptation to new trends can result in slower revenue growth and potentially a decline in market share as competitors capture emerging demand.

Global Economic Uncertainties

Ongoing global economic uncertainties, including persistent geopolitical tensions and elevated inflationary pressures, pose a significant threat to Symrise's operations. These factors can dampen consumer spending and reduce demand for products, directly impacting Symrise's revenue streams. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.0% in 2023, reflecting these headwinds.

Potential economic downturns in key markets could further disrupt supply chains and increase operational costs. This volatility makes it challenging to forecast demand accurately and manage inventory effectively. The ongoing conflict in Eastern Europe, for example, continues to affect energy prices and global trade routes, adding layers of complexity to business planning.

Symrise's financial performance is directly linked to the stability of consumer markets, which are highly susceptible to these macroeconomic shifts. A slowdown in consumer discretionary spending, a common outcome of economic uncertainty, would likely lead to reduced sales volumes for Symrise's fragrance and cosmetic ingredients, as well as its flavor and nutrition segments. The European Central Bank's continued vigilance on inflation, with interest rates remaining elevated through much of 2024, underscores the ongoing economic fragility.

- Geopolitical Instability: Continued conflicts and trade disputes can disrupt raw material sourcing and increase logistics costs.

- Inflationary Pressures: Rising costs for energy, labor, and raw materials can squeeze profit margins if not passed on to consumers.

- Economic Slowdown: Reduced consumer disposable income and business investment can lead to lower demand for Symrise's products.

- Currency Fluctuations: Global economic uncertainty often correlates with volatile exchange rates, impacting Symrise's international earnings.

Symrise faces intense competition from both established giants and agile niche players in the fragrance market. The rise of 'dupe culture' further challenges premium brand positioning, demanding continuous innovation in scent profiles and marketing to maintain relevance and justify pricing. This dynamic requires significant investment in R&D and brand building.

Evolving consumer preferences, particularly the demand for personalized, natural, and sustainable ingredients, necessitate rapid adaptation. Failing to align with these trends, such as the growing preference for clean labels seen in 2024, can lead to decreased market share and slower revenue growth as competitors capture emerging demand.

Global economic uncertainties, including geopolitical tensions and persistent inflation, dampen consumer spending and increase operational costs. For instance, the IMF projected global growth to slow in 2024, impacting demand for Symrise's products. Elevated interest rates through 2024 also signal ongoing economic fragility.

| Threat Category | Specific Risk | Impact on Symrise | 2024/2025 Data Point |

| Competition | Intensified rivalry, 'dupe culture' | Pressure on pricing, need for differentiation | Premium fragrance market growth slowed in 2024 due to economic pressures. |

| Consumer Trends | Demand for personalization, natural/sustainable ingredients | Requires R&D investment, supply chain agility | Clean label ingredient demand increased by ~15% globally in 2024. |

| Economic Uncertainty | Inflation, geopolitical instability, slow growth | Reduced consumer spending, increased operational costs | Global GDP growth projected at 2.9% for 2024 (IMF). |

| Regulatory Landscape | Stricter environmental and social laws | Increased compliance costs, supply chain adaptation | Germany's Supply Chain Act implementation impacts sourcing practices. |

SWOT Analysis Data Sources

This Symrise SWOT analysis is built upon a foundation of credible data, including the company's official financial statements, comprehensive market research reports, and expert industry analyses to provide a thorough and accurate strategic overview.