Symrise PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Symrise Bundle

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping Symrise's trajectory. Our expertly crafted PESTLE analysis provides the actionable intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now to gain a decisive advantage.

Political factors

Ongoing geopolitical conflicts, including the protracted war in Ukraine and escalating tensions in the Middle East, create significant headwinds for global supply chains. This instability directly impacts Symrise's ability to reliably source critical raw materials and efficiently distribute its finished products, potentially leading to increased costs and delivery delays.

Changes in international trade policies, such as tariffs or import/export restrictions, can significantly impact Symrise's supply chain. For instance, a shift towards protectionist measures in key markets could increase the cost of sourcing essential fragrance and cosmetic ingredients or hinder the export of finished goods, potentially affecting profit margins and market competitiveness.

Trade disruptions, like those experienced with global shipping backlogs in 2021-2022 which saw container shipping rates surge by over 100%, can also create logistical challenges. This congestion can lead to delays in raw material delivery and finished product distribution, increasing operational expenses and potentially impacting Symrise's ability to meet customer demand in a timely manner.

The German Act on Corporate Due Diligence Obligations in Supply Chains (LkSG), effective since January 1, 2023, places significant responsibility on companies like Symrise. This legislation requires Symrise to conduct thorough sustainability risk assessments for all its suppliers, ensuring compliance with human rights and environmental standards throughout its extensive value chain. Failure to comply can result in substantial fines, impacting profitability and brand reputation.

Antitrust and Competition Scrutiny

Antitrust and competition scrutiny remains a significant political factor impacting the fragrance industry. Regulatory bodies globally are increasingly focused on market concentration and potential anti-competitive practices. While Symrise's specific investigation by the UK's Competition and Markets Authority (CMA) was closed in May 2025, this signals the ongoing vigilance of authorities.

This heightened regulatory attention can influence market dynamics and strategic decisions for companies like Symrise. It underscores the importance of transparent operations and adherence to fair competition principles. The potential for investigations, even if ultimately closed, creates an environment where companies must proactively manage compliance.

- Regulatory Oversight: Fragrance market players face ongoing scrutiny from antitrust regulators worldwide.

- CMA Case Closure: Symrise's investigation by the UK's CMA concluded in May 2025, indicating a resolution for that specific instance.

- Market Impact: Such investigations can affect market access, pricing strategies, and merger and acquisition activities.

- Compliance Focus: Companies must prioritize robust compliance programs to navigate the complex regulatory landscape.

Governmental Support for Sustainability

Governments worldwide are actively pushing for sustainable development, a trend that directly benefits Symrise. This global push translates into potential advantages like tax breaks, grants, and preferential treatment for companies demonstrating strong environmental, social, and governance (ESG) credentials. For instance, the European Union's Green Deal, aiming for climate neutrality by 2050, offers significant opportunities for companies like Symrise that invest in sustainable ingredients and processes. Symrise reported that its sustainability initiatives contributed to €1.2 billion in sales in 2023, highlighting the financial impact of this governmental support.

This increasing governmental focus on sustainability creates a more favorable operating environment for Symrise, aligning its business strategy with public policy objectives. Such alignment can lead to reduced regulatory burdens and enhanced brand reputation. For example, many nations are implementing carbon pricing mechanisms, which can disproportionately affect less sustainable industries while rewarding those, like Symrise, that prioritize eco-friendly operations. The company's commitment to reducing its greenhouse gas emissions by 30% by 2030 compared to 2019 levels is a prime example of proactively addressing these policy shifts.

Key aspects of this governmental support include:

- Incentives for Green Innovation: Financial aid and tax credits for research and development in sustainable technologies and products.

- Support for Circular Economy Models: Policies encouraging waste reduction, recycling, and the use of renewable resources.

- Stricter Environmental Regulations: While seemingly a challenge, these regulations often drive innovation and create a competitive advantage for companies already adhering to high sustainability standards.

- International Agreements: Global accords like the Paris Agreement set targets that encourage national policies supporting sustainable business practices.

Governmental support for sustainable practices presents a significant advantage for Symrise, with initiatives like the EU Green Deal driving demand for eco-friendly solutions. Symrise leveraged sustainability to achieve €1.2 billion in sales in 2023, demonstrating the financial benefits of aligning with policy objectives. This trend is further reinforced by national policies, such as carbon pricing, which reward companies like Symrise that prioritize environmental responsibility and have set ambitious targets like reducing greenhouse gas emissions by 30% by 2030.

| Governmental Support Area | Symrise's Alignment/Benefit | Example Data/Initiative |

|---|---|---|

| Sustainable Development Push | Increased demand for eco-friendly ingredients and processes | €1.2 billion in sales from sustainability initiatives (2023) |

| Climate Neutrality Goals | Favorable operating environment and potential incentives | EU Green Deal |

| Carbon Pricing Mechanisms | Competitive advantage for eco-conscious operations | Company target: 30% GHG emission reduction by 2030 (vs. 2019) |

| Supply Chain Due Diligence | Mandatory compliance and risk management | German Act on Corporate Due Diligence (LkSG) effective Jan 2023 |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Symrise, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid in strategic decision-making and identify potential opportunities and threats for Symrise.

Provides a concise Symrise PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, streamlining discussions on external factors impacting the business.

Economic factors

Symrise has been navigating persistent inflationary pressures, which have notably increased its operational expenses. For instance, the company's cost of goods sold saw an upward trend in recent reporting periods due to these economic conditions.

To combat these rising costs, Symrise is actively implementing global efficiency programs. These initiatives are designed to streamline operations and enhance profitability despite the challenging inflationary environment.

The company's strategic focus on cost management is crucial for maintaining its competitive edge and ensuring sustained financial performance in the face of economic headwinds.

Symrise reported robust sales and profitability growth throughout 2024, underscoring its resilience. The company saw its net sales climb by 8.2% to €4.8 billion for the first nine months of 2024, with earnings before interest, taxes, and amortization (EBITDA) increasing by 13.5% to €831 million. This performance highlights Symrise's capacity to expand its market share and maintain strong margins even amidst fluctuating global economic landscapes.

Symrise has boosted its 2024 financial outlook, now anticipating organic sales growth to surpass 7%. This upward revision reflects strong performance and positive market reception.

The company also expects its EBITDA margin to remain above 20% for 2024, demonstrating continued operational efficiency and profitability. This is a key indicator of their ability to manage costs effectively.

Furthermore, Symrise is reaffirming its ambitious long-term financial targets, aiming to achieve significant growth and profitability through 2028. These goals underscore their strategic vision and commitment to sustained value creation.

Growth in Key Market Segments

The global cosmetic ingredients market, a crucial area for Symrise, was valued at an estimated USD 35.58 billion in 2024. This segment is expected to see robust expansion, with projections indicating it will reach USD 61.94 billion by 2034, presenting substantial growth prospects.

This upward trend is driven by several factors, including increasing consumer demand for natural and sustainable ingredients. Symrise is well-positioned to capitalize on this by leveraging its expertise in developing innovative solutions for the beauty and personal care industries.

- Market Value: USD 35.58 billion in 2024.

- Projected Growth: Expected to reach USD 61.94 billion by 2034.

- Growth Drivers: Rising demand for natural and sustainable cosmetic ingredients.

- Symrise's Position: Well-placed to benefit from these market trends.

Consumer Demand for Value and Indulgence

Consumers are increasingly navigating a landscape of rising living costs by seeking out products that offer both perceived value and opportunities for premium indulgence. This dual focus means that while budget-consciousness remains paramount, there's a simultaneous desire for small luxuries or experiences that provide emotional benefits and a sense of elevated quality.

This trend is evident in several key consumer markets. For instance, in the food and beverage sector, while bulk buying and private label options are popular, there's also significant growth in artisanal products and premium ready-to-eat meals. Similarly, in personal care, consumers might opt for more affordable core products but still invest in higher-end skincare or fragrances for a touch of self-care.

- Value-Seeking: Consumers are actively comparing prices and seeking promotions, with a significant portion of shoppers prioritizing brands that offer good value for money.

- Premium Indulgence: Despite economic pressures, spending on experiences and premium goods that offer emotional satisfaction or a sense of escape remains resilient.

- Dual Purchasing Behavior: Many consumers exhibit a split purchasing pattern, opting for value in everyday essentials while still allocating discretionary income for occasional indulgences.

- Brand Loyalty Shifts: While value drives many decisions, brands that can effectively communicate both quality and affordability, or offer unique indulgent experiences, can foster strong loyalty.

Symrise is demonstrating strong financial resilience, with net sales up 8.2% to €4.8 billion in the first nine months of 2024, and EBITDA rising 13.5% to €831 million. The company has also raised its 2024 organic sales growth forecast to over 7% and expects its EBITDA margin to stay above 20%, reflecting effective cost management amidst inflationary pressures.

The global cosmetic ingredients market, vital for Symrise, was valued at USD 35.58 billion in 2024 and is projected to reach USD 61.94 billion by 2034, driven by consumer demand for natural and sustainable products.

Consumers are balancing rising living costs with a desire for value and premium indulgence, creating a dual purchasing behavior where budget-consciousness for essentials coexists with spending on occasional luxuries.

| Metric | 2024 (First Nine Months) | Outlook 2024 |

|---|---|---|

| Net Sales Growth | 8.2% | Over 7% (Organic) |

| EBITDA | €831 million (up 13.5%) | Above 20% margin |

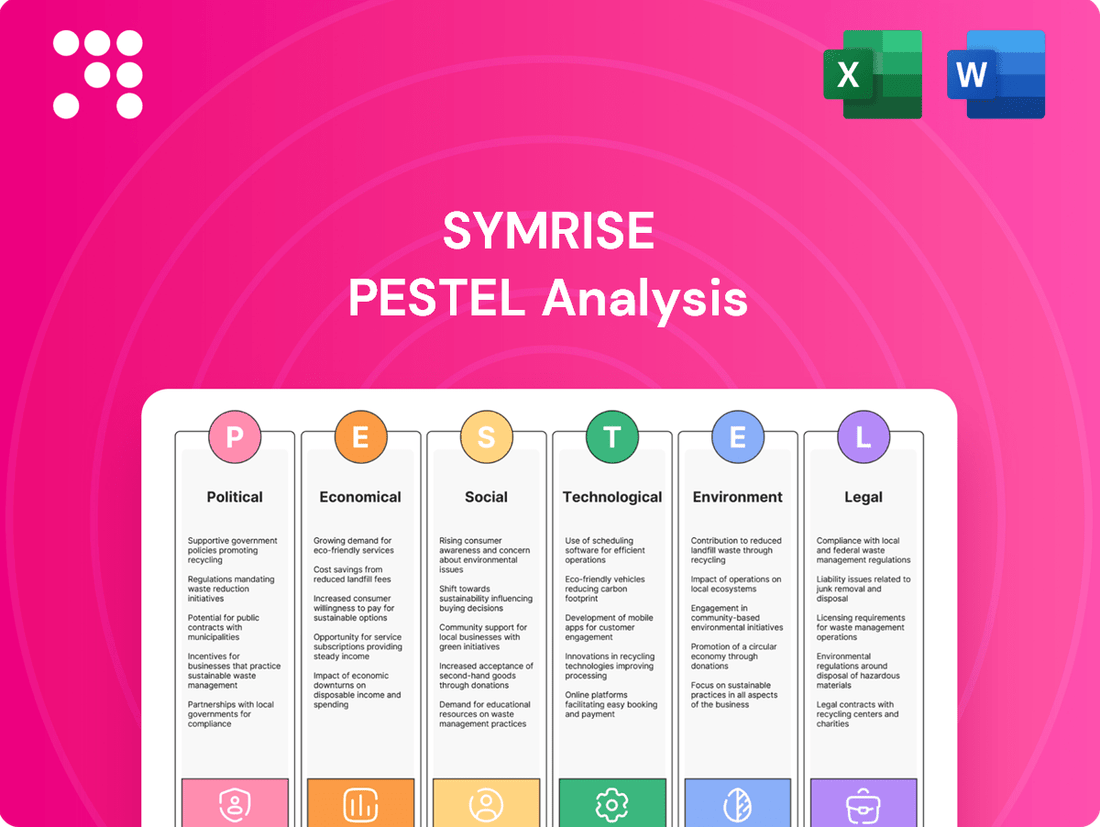

Preview Before You Purchase

Symrise PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive Symrise PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Symrise.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into Symrise's strategic landscape.

Sociological factors

Consumers are showing a growing preference for products made with natural, organic, and ethically sourced ingredients. This trend is significantly impacting the food, beverage, and cosmetics industries, with an estimated 60% of consumers globally stating they are willing to pay more for sustainable brands in 2024.

This heightened eco-consciousness translates directly into demand for ingredients that are perceived as healthier and better for the environment. For instance, the global market for natural and organic personal care products was valued at over $20 billion in 2023 and is projected to grow substantially in the coming years.

Consumers are increasingly prioritizing their health and wellness, driving demand for products that offer functional benefits. This trend is particularly evident in the food and beverage sector, where Symrise's health-oriented taste solutions are gaining traction. For instance, the global wellness market was valued at over $5.6 trillion in 2022 and is projected to continue its upward trajectory, fueled by this heightened consumer focus.

The beauty industry is also experiencing a similar shift, with a growing emphasis on natural, sustainable, and ethically sourced ingredients. Consumers are seeking products that not only enhance their appearance but also contribute to their overall well-being. Symrise's portfolio of cosmetic ingredients, which includes active ingredients derived from natural sources, aligns perfectly with these evolving consumer preferences.

Consumers are increasingly prioritizing health, environmental impact, and ethical considerations when making food choices. This shift has fueled a substantial rise in demand for plant-based and alternative protein products. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162.5 billion by 2030, demonstrating a compound annual growth rate of over 27%.

Symrise is well-positioned to capitalize on this trend by offering innovative taste solutions that enhance the palatability of plant-based alternatives. Their expertise in flavor creation helps manufacturers overcome challenges like off-notes and texture, making these products more appealing to a wider consumer base. This focus on taste is crucial for sustained growth in the alternative protein sector.

Personalization and Customization Trends

The traditional one-size-fits-all model is rapidly losing ground as consumers increasingly demand products that cater to their specific needs and preferences. This shift is particularly evident in the beauty and fragrance sectors, where a growing appetite for personalized and customizable solutions is directly fueling demand.

This trend is supported by market data showing significant growth in personalized products. For instance, the global personalized beauty market was valued at approximately $27.7 billion in 2023 and is projected to reach $60.1 billion by 2030, growing at a compound annual growth rate (CAGR) of 11.7% during this period. This indicates a strong consumer willingness to invest in tailored experiences.

- Growing Demand for Bespoke Products Consumers are actively seeking out brands that offer customization options, from ingredient selection to scent profiles.

- Digitalization Enabling Personalization Technology, including AI-driven recommendations and online customization tools, plays a crucial role in delivering these tailored experiences.

- Impact on Brand Loyalty Brands that successfully implement personalization strategies often see increased customer engagement and stronger loyalty.

Influence of Digitalization and Social Media

Digitalization profoundly reshapes consumer behavior, with social media platforms acting as powerful trendsetters, especially for younger generations. For instance, by early 2024, platforms like TikTok and Instagram saw a significant surge in user-generated content focused on beauty routines and product reviews, directly influencing purchasing decisions.

This digital shift means brands must actively engage online to stay relevant. Symrise, like its competitors, needs to monitor online conversations and influencer marketing to understand evolving beauty standards and consumer preferences. A 2023 report indicated that over 60% of Gen Z consumers discover new beauty products through social media channels.

The influence extends to ingredient transparency and ethical sourcing, as consumers increasingly research these aspects online before buying. This necessitates robust digital communication strategies from companies like Symrise to address these growing concerns. For example, searches for 'clean beauty ingredients' saw a 40% increase on Google Trends in the past year.

Consumers are increasingly prioritizing health and wellness, driving demand for products perceived as natural and ethically sourced. This trend is a significant driver for Symrise, particularly in the food, beverage, and cosmetics sectors, where demand for ingredients supporting these values continues to rise. The global wellness market, valued at over $5.6 trillion in 2022, underscores this consumer focus.

The rise of plant-based diets and alternative proteins is another key sociological factor. Consumers are actively seeking these options, with the global plant-based food market projected to reach $162.5 billion by 2030. Symrise's expertise in flavor creation is crucial for enhancing the palatability of these products, making them more appealing to a broader audience.

Personalization is also a major trend, with consumers expecting tailored products and experiences. The global personalized beauty market, valued at approximately $27.7 billion in 2023, highlights this demand. Digital platforms are key enablers of this personalization, allowing brands to connect with consumers on a more individual level.

Digitalization, especially social media, profoundly influences consumer behavior and trend adoption, particularly among younger demographics. Over 60% of Gen Z consumers discover new beauty products through social media, making online engagement vital for brands like Symrise to stay relevant and understand evolving preferences.

Technological factors

Symrise is heavily investing in AI to refine its product development, aiming to predict flavor trends with greater accuracy and understand consumer preferences more deeply. This AI integration is crucial for maintaining a competitive edge in a rapidly evolving market.

By leveraging AI for tasks like trend forecasting, Symrise can anticipate shifts in consumer tastes, allowing for more targeted and efficient product innovation. This proactive approach is key to meeting dynamic market demands and optimizing resource allocation in research and development.

In 2024, Symrise reported that its digital transformation initiatives, including AI adoption, are contributing to improved operational efficiency. For instance, AI-powered analytics in consumer research are providing richer insights, enabling faster decision-making and potentially reducing time-to-market for new products.

Symrise's technological edge in taste balancing is a significant factor. Their proprietary Symlife technology is specifically designed to tackle the inherent challenges in alternative protein bases, such as masking undesirable off-notes and enhancing the overall sensory experience. This innovation is crucial for improving mouthfeel and optimizing flavor release in plant-based products, a rapidly growing market segment.

Technological advancements are significantly reshaping ingredient production for companies like Symrise. Innovations in clean-label modulators and fermentation-based methods are gaining traction, offering ways to create natural flavors and fragrances with a reduced environmental footprint and enhanced consistency. This shift is driven by consumer demand for transparency and sustainability.

For instance, Symrise has been investing in biotechnological processes. While specific 2024/2025 figures are still emerging, the trend indicates a growing reliance on these technologies. The company’s commitment to sustainable sourcing and production aligns with these technological advancements, aiming to deliver high-quality ingredients with greater predictability and a lower ecological impact.

Enhancements in Fragrance Formulation and Delivery

Technological advancements are significantly reshaping the fragrance industry, with innovations like encapsulated fragrances and time-release formulations enhancing product longevity and consumer experience. These technologies allow scents to be released gradually, offering a more sustained and pleasant aroma. For instance, Symrise, a major player, is actively investing in such technologies to improve the performance and appeal of its fragrance ingredients.

Biodegradable scent carriers are also gaining traction, aligning with growing consumer demand for sustainable products. This shift reflects a broader trend in ingredient development, where environmental impact is a key consideration. The market for encapsulation technologies in the fragrance sector is projected for robust growth, driven by the desire for more sophisticated and eco-friendly scent delivery systems.

- Encapsulation: Innovations like microencapsulation allow for controlled release of fragrance compounds, extending scent life and improving stability.

- Time-Release Formulations: These technologies enable fragrances to unfold in stages, providing a dynamic and evolving scent profile throughout the day.

- Biodegradable Carriers: The development of eco-friendly carriers addresses sustainability concerns, meeting consumer preferences for environmentally conscious products.

- Digitalization in Formulation: AI and advanced analytics are increasingly used to predict scent combinations and optimize formulation processes, speeding up innovation cycles.

Digital Transformation for Operational Efficiency

Symrise is actively pursuing digital transformation across its entire value chain to boost operational efficiency. This includes optimizing procurement processes through advanced analytics and implementing smart manufacturing techniques in production. These efforts are crucial for enhancing transparency and streamlining operations, directly supporting the company's strategic growth objectives.

The company's focus on digitalization is evident in its investments in data-driven decision-making and automated workflows. For instance, Symrise reported that its digital initiatives contributed to a more agile supply chain, enabling faster response times to market demands. This digital push is a key enabler for maintaining a competitive edge in the dynamic flavor and fragrance industry.

- Digitalization in Procurement: Symrise leverages digital platforms for supplier management and raw material sourcing, aiming for greater cost-efficiency and reliability.

- Smart Manufacturing: Implementation of IoT sensors and AI in production facilities allows for real-time monitoring and predictive maintenance, minimizing downtime.

- Data Analytics: The company utilizes advanced analytics to gain insights into consumer trends and optimize product development cycles.

- Operational Transparency: Digital tools provide end-to-end visibility of the value chain, from sourcing to delivery, improving accountability and performance tracking.

Symrise is significantly investing in artificial intelligence and digitalization to enhance its product development and operational efficiency. The company aims to predict flavor trends more accurately and deepen its understanding of consumer preferences through AI-driven insights. These digital transformation initiatives, including AI adoption, are reported to be contributing to improved operational efficiency as of 2024.

Technological advancements are crucial for Symrise's innovation in taste balancing, particularly with its Symlife technology designed for alternative protein bases. This technology addresses challenges like masking off-notes and improving mouthfeel, which is vital for the growing plant-based market. Furthermore, innovations in clean-label modulators and fermentation-based methods are being adopted to produce natural flavors and fragrances with a reduced environmental impact and increased consistency.

The fragrance sector is also being reshaped by technologies such as encapsulated fragrances and time-release formulations, which extend scent longevity and improve consumer experience. Symrise is actively investing in these areas, alongside the development of biodegradable scent carriers, to meet consumer demand for sustainable and sophisticated scent delivery systems. The market for encapsulation technologies in fragrances is expected to see robust growth.

Symrise's commitment to digitalization extends across its value chain, optimizing procurement and implementing smart manufacturing techniques. As of 2024, the company reported that its digital initiatives are supporting a more agile supply chain, enabling quicker responses to market demands and enhancing overall operational transparency.

Legal factors

Symrise demonstrates strong adherence to evolving supply chain due diligence laws, notably the German Supply Chain Due Diligence Act (LkSG). This legislation requires companies to identify, prevent, and mitigate human rights and environmental risks within their supply chains. Symrise's commitment means conducting rigorous sustainability risk assessments for its suppliers, ensuring compliance with international standards.

In 2023, Symrise reported that it had conducted initial risk assessments for 98% of its direct suppliers, a significant step towards full compliance with the LkSG's requirements. The company actively engages with suppliers to address identified risks, fostering a more responsible and sustainable global supply network.

The flavor and fragrance sector, including companies like Symrise, is navigating a landscape of tightening regulations focused on product safety and ingredient transparency. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation continues to influence chemical safety assessments, impacting ingredient sourcing and formulation. Companies must invest in robust compliance systems to meet these evolving standards, which often demand greater disclosure about product composition and potential health impacts.

Symrise navigates a complex web of evolving environmental regulations across its global operations. These rules, covering everything from manufacturing emissions to the responsible sourcing of raw materials, necessitate significant investment in compliance technologies and processes. For instance, the European Union's Green Deal, with its ambitious targets for carbon neutrality by 2050, directly impacts how Symrise operates, requiring adaptations in energy use and supply chain management.

These regulatory demands translate into tangible costs, including capital expenditures for pollution control equipment and ongoing operational expenses for monitoring and reporting. Failure to comply can result in substantial fines, reputational damage, and even operational shutdowns, underscoring the critical importance of proactive environmental stewardship for Symrise's long-term viability and profitability.

Antitrust Compliance and Investigations

While Symrise's specific antitrust investigation concluded in 2025, the broader fragrance and flavor industry continues to face regulatory attention. This ongoing scrutiny highlights the critical need for robust compliance programs to ensure adherence to competition laws across global markets.

The European Commission, for instance, has been actively monitoring various sectors for potential anti-competitive practices. Though Symrise's case was resolved, the general environment suggests that companies must maintain vigilance regarding pricing, market allocation, and information sharing to avoid future legal entanglements.

- Continued Regulatory Scrutiny: The global fragrance market, valued at approximately $50 billion in 2024, remains an area of interest for competition authorities.

- Importance of Compliance: Strict adherence to antitrust regulations is paramount to prevent investigations and potential penalties, which can significantly impact financial performance.

- Proactive Risk Management: Companies like Symrise must proactively implement and update compliance frameworks to address evolving regulatory landscapes and potential market conduct issues.

Financial Disclosure Regulations

Symrise operates within a landscape of evolving financial disclosure regulations, notably the Sustainable Financial Disclosure Regulation (SFDR). This means the company must provide detailed data to financial institutions, ensuring compliance with increasingly stringent requirements for transparency concerning sustainability factors. For instance, as of early 2024, the EU's SFDR mandates extensive reporting on how financial products integrate sustainability risks and consider adverse sustainability impacts.

These legal frameworks are driving a greater demand for quantifiable sustainability metrics. Symrise's ability to accurately report on its environmental, social, and governance (ESG) performance is crucial not only for regulatory compliance but also for maintaining investor confidence and market access. The company's commitment to providing this data supports the financial sector's own obligations under similar global regulations.

- SFDR Compliance: Symrise provides data to financial institutions to meet disclosure obligations under regulations like the SFDR.

- Increased Transparency: The company highlights the growing legal requirements for transparency in sustainability factors.

- Investor Confidence: Accurate ESG reporting is vital for maintaining investor trust and market access in 2024/2025.

- Data Provision: Symrise's data supports the financial sector's adherence to global sustainability reporting standards.

Symrise is actively navigating stringent supply chain due diligence laws, such as the German Supply Chain Due Diligence Act (LkSG), which mandates risk assessments and mitigation strategies for human rights and environmental impacts. The company reported in 2023 that initial risk assessments had been completed for 98% of its direct suppliers, demonstrating a proactive approach to compliance. Furthermore, Symrise must adhere to evolving chemical safety regulations like REACH, requiring thorough ingredient transparency and safety evaluations.

The company's operations are also shaped by global environmental regulations, including the EU's Green Deal aiming for carbon neutrality by 2050, necessitating investments in cleaner technologies and sustainable sourcing. Symrise faces ongoing regulatory attention regarding antitrust practices, underscoring the need for robust compliance programs to manage market conduct and avoid potential penalties. In 2024, the global fragrance market, valued at approximately $50 billion, continues to be monitored by competition authorities.

Symrise is also committed to transparency in sustainability reporting, complying with regulations like the EU's Sustainable Financial Disclosure Regulation (SFDR) as of early 2024. This involves providing detailed ESG data to financial institutions, which is crucial for maintaining investor confidence and market access in the current financial landscape.

Environmental factors

Symrise is aggressively pursuing climate neutrality, aiming for net-zero Scope 1 and 2 greenhouse gas emissions by 2030. This ambitious target demonstrates a significant commitment to environmental stewardship and aligns with global efforts to combat climate change.

The company's vision extends to achieving company-wide net-zero emissions by 2045, encompassing all operational scopes. This long-term goal reflects a comprehensive strategy to integrate sustainability across its entire value chain, anticipating stricter regulations and evolving stakeholder expectations.

Symrise is actively tackling its supply chain's environmental impact, aiming for a substantial 15% reduction in Scope 3 greenhouse gas emissions by 2025 and a further target of 30% by 2030. This ambitious goal involves engaging a vast network of over 5,000 partner suppliers to establish and meet their own climate targets.

Symrise is actively pursuing sustainable sourcing for its raw materials, aiming for 100% of its strategic biological raw materials to be sourced sustainably by 2025. This commitment involves close monitoring and strong partnerships with suppliers to ensure responsible practices throughout the supply chain.

Water Conservation Efforts

Symrise is actively engaged in water conservation, with a strategic goal to cut water usage by 15% across its operations between 2018 and 2025. This initiative is particularly focused on production facilities located in areas facing water scarcity, ensuring responsible resource management.

The company's commitment is reflected in tangible achievements, with significant progress reported towards its reduction targets. For instance, by the end of 2023, Symrise had already achieved a notable reduction in water consumption, demonstrating a proactive approach to environmental stewardship.

Key aspects of their water conservation strategy include:

- Implementing advanced water treatment and recycling technologies at production sites.

- Optimizing production processes to minimize water input and wastewater generation.

- Engaging local communities and stakeholders in water management initiatives.

- Monitoring water usage rigorously to track progress and identify further improvement areas.

Promotion of Regenerative Agriculture

Symrise is making significant strides in promoting regenerative agriculture, a key environmental factor influencing its operations. This approach focuses on improving soil health, biodiversity, and water cycles, directly impacting the quality and availability of natural raw materials. For instance, Symrise's commitment to sustainable sourcing in 2023 saw a notable increase in the proportion of raw materials derived from certified regenerative farming projects, contributing to a more resilient supply chain.

The company's efforts extend to resource-saving manufacturing processes, aiming to minimize its environmental footprint. This includes optimizing water usage and reducing energy consumption across its production facilities. In 2024, Symrise reported a further reduction in its Scope 1 and Scope 2 greenhouse gas emissions, demonstrating tangible progress in its sustainability targets.

Key aspects of Symrise's environmental strategy include:

- Focus on Sustainable Cultivation: Prioritizing farming methods that enhance ecological balance and long-term land productivity.

- Yield Optimization: Implementing techniques to maximize the output of natural raw materials while minimizing resource input.

- Reduced Environmental Footprint: Actively working to lower emissions, water consumption, and waste generation in both agriculture and manufacturing.

- Supply Chain Resilience: Building a more robust and sustainable supply of raw materials through regenerative practices.

Symrise is deeply committed to environmental sustainability, setting ambitious targets for emissions reduction and resource management. The company aims for climate neutrality in its own operations (Scope 1 and 2) by 2030 and company-wide net-zero by 2045, demonstrating a forward-thinking approach to climate change mitigation.

A significant focus is placed on the supply chain, with plans to reduce Scope 3 greenhouse gas emissions by 15% by 2025 and 30% by 2030, involving over 5,000 suppliers. This aligns with their goal of sourcing 100% of strategic biological raw materials sustainably by 2025.

Water conservation is another key environmental priority, targeting a 15% reduction in water usage by 2025, with notable progress already achieved by the end of 2023. Symrise actively promotes regenerative agriculture, enhancing soil health and biodiversity, and reported further reductions in Scope 1 and 2 emissions in 2024.

| Environmental Target | 2025 Target | Progress/Status | 2030 Target | 2045 Target |

|---|---|---|---|---|

| Scope 1 & 2 GHG Emissions | Net-zero by 2030 | On track | Net-zero by 2030 | Company-wide net-zero |

| Scope 3 GHG Emissions | 15% reduction | Ongoing engagement with suppliers | 30% reduction | |

| Sustainable Biological Raw Materials | 100% sustainable sourcing | Increasing proportion sourced sustainably | ||

| Water Usage Reduction | 15% reduction (vs. 2018) | Achieved notable reduction by end of 2023 |

PESTLE Analysis Data Sources

Our Symrise PESTLE Analysis is built on a robust foundation of data from reputable sources, including official government publications, leading economic institutions like the IMF and World Bank, and comprehensive industry-specific market research reports. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in current, verifiable information.