Symrise Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Symrise Bundle

Symrise, a global leader in flavors and fragrances, navigates a complex competitive landscape shaped by powerful market forces. Understanding these dynamics is crucial for any stakeholder looking to grasp Symrise's strategic positioning and future potential.

The complete report reveals the real forces shaping Symrise’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Symrise sources over 10,000 raw materials globally, with many being natural and specialized. For certain unique or high-quality natural ingredients, the pool of qualified suppliers is significantly smaller, granting these suppliers greater leverage.

This concentration is especially pronounced for exotic botanicals or specific natural extracts where specialized cultivation or processing knowledge is scarce. For example, a particular rare vanilla bean or a unique floral extract might only be available from a handful of producers worldwide, giving them considerable pricing power.

The quality and origin of raw materials are paramount for Symrise to craft distinctive and high-performing fragrances, flavors, and cosmetic ingredients. If a supplier offers a unique or superior raw material that substantially elevates Symrise's final products, their bargaining power strengthens, as Symrise would struggle to find a comparable substitute without impacting product quality or market standing.

Switching suppliers for specialized ingredients can be a costly endeavor for Symrise. These costs can include substantial research and development for reformulating products, rigorous re-testing to ensure quality and performance, obtaining necessary regulatory approvals, and the potential for significant disruptions to ongoing production schedules. For instance, in the flavor and fragrance industry, developing and validating a new ingredient can take years and millions in investment, making a sudden switch prohibitive.

Forward Integration by Suppliers

Forward integration by suppliers, while less frequent, presents a significant potential threat to Symrise. If a supplier were to move into producing flavors, fragrances, or cosmetic ingredients, they would directly compete with Symrise, altering the market dynamic.

This possibility grants suppliers enhanced bargaining power. Symrise would naturally seek to avoid nurturing a future competitor, making them more amenable to supplier demands during negotiations. For instance, if a key raw material supplier for a high-demand fragrance ingredient decided to develop their own finished fragrance line, Symrise would face increased pressure to secure favorable terms for that ingredient.

- Potential for Direct Competition: Suppliers moving into Symrise's core business areas.

- Increased Bargaining Leverage: Symrise's desire to avoid creating future rivals.

- Strategic Implications: Suppliers could control critical inputs and finished products.

- Market Disruption: New entrants from the supplier side could reshape the industry landscape.

Symrise's Sustainable Sourcing and Long-Term Partnerships

Symrise actively addresses the bargaining power of its suppliers by cultivating long-term partnerships and championing sustainable sourcing. A key objective is to achieve 100% sustainable procurement for strategic agro- and aquaculture raw materials by 2025. This commitment extends to a robust supplier code of conduct and initiatives focused on enhancing transparency and traceability throughout the supply chain.

These strategic efforts are designed to foster collaborative relationships and promote responsible practices, thereby mitigating the leverage individual suppliers might otherwise hold. By ensuring a stable and ethically sourced supply of essential raw materials, Symrise aims to create a more resilient and predictable operational environment.

- Sustainable Procurement Target: 100% by 2025 for strategic agro- and aquaculture raw materials.

- Supplier Engagement: Emphasis on long-term partnerships and a strict supplier code of conduct.

- Transparency Initiatives: Focus on traceability to build trust and accountability within the supply chain.

- Impact on Bargaining Power: Collaborative relationships and responsible practices aim to reduce individual supplier leverage.

The bargaining power of suppliers is a significant factor for Symrise, particularly concerning specialized natural ingredients where fewer suppliers exist. This limited supplier base allows them to command higher prices and exert more influence over terms. The high cost and time involved in switching suppliers for these critical inputs further solidify their leverage.

| Factor | Impact on Symrise | Example/Data Point |

|---|---|---|

| Supplier Concentration | High for specialized natural ingredients | Sourcing of rare botanicals or unique natural extracts from a limited number of producers. |

| Switching Costs | Substantial for reformulated products | Years and millions in R&D, validation, and regulatory approvals for new ingredients. |

| Supplier Differentiation | Strong for unique/superior raw materials | Ingredients that significantly enhance Symrise's final product quality and market standing. |

| Potential Forward Integration | Threat of direct competition | Suppliers developing their own finished fragrance or flavor lines, increasing their leverage. |

What is included in the product

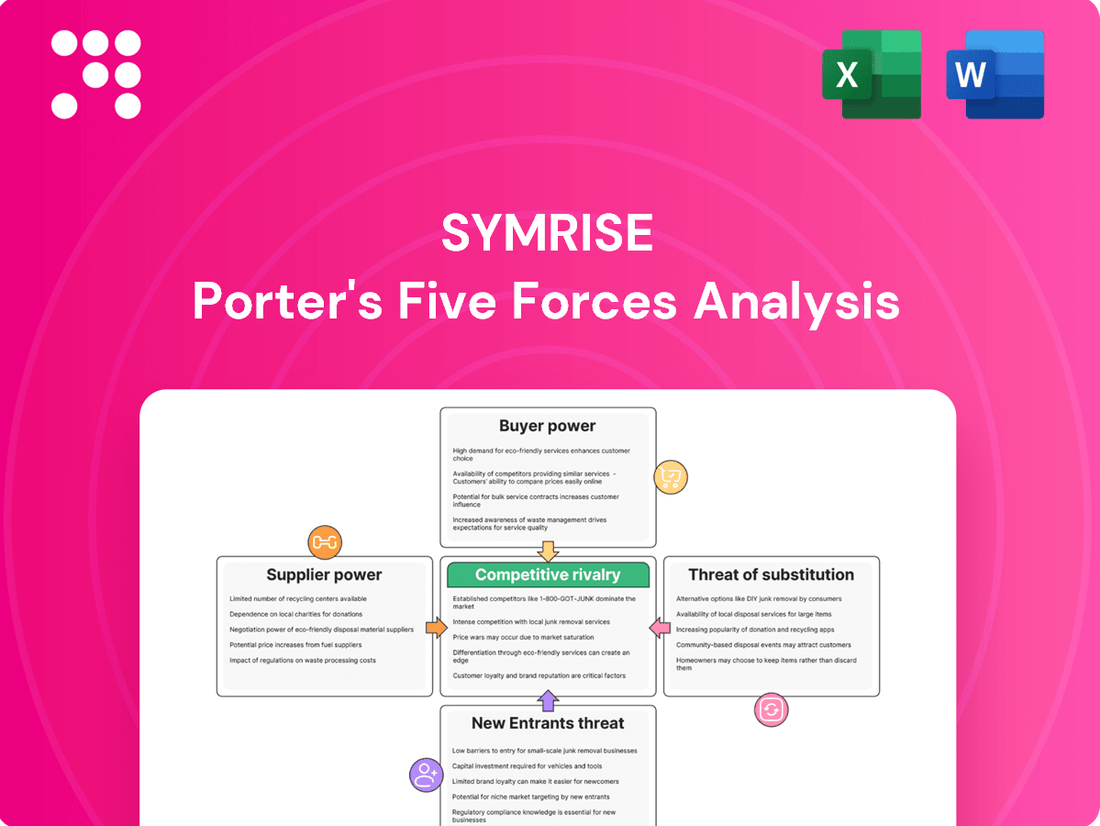

This analysis meticulously examines the five competitive forces impacting Symrise, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes.

Quickly identify and address competitive pressures by visualizing Symrise's industry landscape, allowing for proactive strategic adjustments.

Customers Bargaining Power

Symrise caters to a wide array of global customers across the perfume, cosmetic, food, and beverage sectors. While this broad customer base generally dilutes individual customer power, the presence of large multinational clients, who often account for substantial purchasing volumes, presents a concentration of influence. The potential loss of even one of these key accounts could significantly impact Symrise's revenue streams.

Flavors and fragrances, while a small cost component for Symrise's customers, often ranging from 1% to 5% of the total product cost, are critical for consumer appeal. This significance allows Symrise to command a premium for its specialized ingredients, as customers prioritize differentiation and consumer preference over minor cost savings.

Symrise's strength in product differentiation and customization significantly curbs customer bargaining power. By offering specialized ingredients, often developed through extensive research and development, and tailored to unique regional or client specifications, Symrise creates proprietary formulations.

This deep customization, coupled with the embedded intellectual property, makes it difficult and costly for customers to switch to alternative suppliers. For instance, Symrise's success in the fragrance sector, where unique scent profiles are paramount, demonstrates this. In 2023, Symrise reported a substantial portion of its sales stemming from its Specialty Ingredients segment, highlighting the value placed on these differentiated offerings.

Customer Switching Costs and 'Core List' Systems

Customers integrating Symrise's specialized ingredients into their product lines often face significant switching costs. These costs stem from the need for extensive reformulation, rigorous re-testing of new formulations, and the potential risk to brand reputation if a change negatively impacts product quality or consumer perception. For instance, a food manufacturer relying on a specific Symrise flavor enhancer might incur substantial expenses and time delays to validate a replacement ingredient.

The prevalence of 'core list' systems within large customer organizations further solidifies these supplier relationships. These systems, which essentially pre-approve a set of trusted suppliers and their products, create high barriers for new entrants and make it challenging for existing suppliers to be displaced. This entrenched loyalty means customers have limited flexibility in easily switching to alternative suppliers, thereby strengthening Symrise's position.

In 2024, the trend of customers seeking long-term, stable supply chains for critical ingredients, especially in the food and beverage sector, has intensified. This focus on reliability, coupled with the inherent complexities of ingredient integration, means that switching costs remain a potent factor in maintaining customer loyalty for companies like Symrise. The average time to reformulate and re-launch a consumer packaged good can range from six months to over a year, depending on the product's complexity and regulatory requirements.

- High Reformulation Costs: Changing a key ingredient can necessitate significant R&D investment and product development cycles.

- Re-testing and Validation: Ensuring the new ingredient meets all quality, safety, and performance standards requires extensive testing.

- Brand Reputation Risk: A failed ingredient switch can damage consumer trust and brand image.

- 'Core List' Entrenchment: Established supplier relationships within customer procurement systems create inertia against switching.

Customer Demand for Natural and Sustainable Solutions

Customers are increasingly prioritizing natural, clean-label, and sustainably sourced ingredients, a trend that significantly impacts ingredient suppliers like Symrise. This growing demand means that companies offering solutions aligned with these values can command stronger customer loyalty.

Symrise's strategic emphasis on natural and sustainable solutions, including investments in regenerative agriculture and innovative technologies for extracting natural ingredients, directly addresses these evolving consumer preferences. For instance, their commitment to sourcing natural raw materials responsibly resonates with a market segment willing to pay a premium for ethical and environmentally sound products.

- Growing Consumer Preference: Reports indicate a significant rise in consumer demand for natural and sustainable products across various sectors, influencing purchasing decisions.

- Symrise's Alignment: Symrise's portfolio, heavily weighted towards naturally derived ingredients and sustainable sourcing practices, positions them favorably to meet this demand.

- Reduced Price Sensitivity: By offering solutions that align with key market trends, Symrise can mitigate customer power to demand lower prices, as customers value the unique selling propositions of natural and sustainable offerings.

Symrise's customers, particularly large multinational corporations, wield moderate bargaining power. While Symrise's specialized and differentiated products, often protected by intellectual property, reduce customer price sensitivity, the sheer volume purchased by key clients means their satisfaction is crucial. The significant switching costs associated with reformulating products with new ingredients further anchor customer relationships, limiting their ability to easily shift suppliers.

| Factor | Impact on Symrise | Supporting Data/Trend |

|---|---|---|

| Customer Concentration | Moderate Power | Key clients represent substantial purchasing volumes, but Symrise's broad base dilutes individual power. |

| Switching Costs | Lowers Customer Power | Reformulation, re-testing, and brand risk can take 6-12+ months and significant investment. |

| Product Differentiation | Lowers Customer Power | Proprietary formulations and customization create high perceived value, reducing price focus. |

| Ingredient Cost as % of Customer Product | Lowers Customer Power | Flavors/fragrances are typically 1-5% of final product cost, making differentiation more important than minor price variations. |

Preview Before You Purchase

Symrise Porter's Five Forces Analysis

This preview showcases the complete Symrise Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the flavor and fragrance industry. You are viewing the exact, professionally formatted document that will be delivered instantly upon purchase, ensuring you receive a comprehensive and ready-to-use strategic assessment. This analysis meticulously covers the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

The flavors and fragrances industry is dominated by a handful of global giants like Givaudan, IFF, Firmenich, and Symrise. These key players collectively control a substantial portion of the market, creating a landscape of intense rivalry.

This concentration means that competition is fierce as these established companies vie for market share through innovation and strategic partnerships. For instance, in 2023, Givaudan reported net sales of CHF 6.9 billion, highlighting the scale of operations for these leading firms.

The global flavors and fragrances market is experiencing robust growth, with projections indicating a steady upward trend. This expansion is fueled by several key factors: the burgeoning food and beverage sector, a heightened consumer focus on personal care and grooming, evolving taste preferences, and a significant shift towards natural and organic ingredients. For instance, the market was valued at approximately $27.6 billion in 2023 and is expected to reach over $40 billion by 2030, demonstrating a compound annual growth rate of around 6.0%.

This favorable market outlook naturally encourages intense competition and drives innovation among industry players. Companies are actively investing in research and development to create novel scent profiles and taste experiences that cater to diverse consumer demands. The pursuit of market share in this expanding landscape necessitates continuous strategic maneuvering, including product differentiation, strategic partnerships, and efficient supply chain management.

The flavor and fragrance industry, where Symrise operates, is characterized by substantial investments in research and development, advanced production facilities, and specialized scientific talent. These high fixed costs create a strong incentive for companies to operate at peak capacity.

To cover these significant upfront investments and ongoing operational expenses, companies like Symrise often engage in aggressive pricing strategies. The pursuit of high capacity utilization can intensify competitive rivalry as firms strive to maximize sales volume, potentially leading to price wars.

For instance, Symrise's substantial capital expenditures, which are crucial for maintaining its competitive edge in innovation and production scale, underscore the importance of capacity utilization. In 2023, Symrise reported capital expenditures of €348 million, reflecting ongoing investment in its global manufacturing and R&D infrastructure, a clear indicator of the high fixed cost environment.

Product Differentiation and Specialization

Symrise actively differentiates itself by offering integrated solutions that span research, development, and the production of specialized ingredients. This approach covers a broad spectrum, including fragrances, flavorings, cosmetic active ingredients, and functional ingredients, allowing them to cater to diverse market needs with unique, high-value offerings.

This strategic focus on innovation and customization helps Symrise sidestep intense price-based competition. Instead, the rivalry within its operating segments often centers on the ability to develop novel products and maintain superior quality, fostering a competitive landscape driven by technological advancement and customer-specific solutions.

- Product Portfolio Breadth: Symrise's extensive range of specialized ingredients across multiple categories provides a significant competitive advantage.

- R&D Investment: The company's commitment to research and development fuels its ability to create differentiated, high-value products.

- Customization Capabilities: Offering tailored solutions to clients mitigates direct price comparisons and strengthens customer loyalty.

- Innovation as a Differentiator: Symrise's success is largely built on its capacity for continuous innovation, setting it apart from competitors focused on commodity products.

Strategic Acquisitions and Portfolio Optimization

Major players in the flavor and fragrance industry, including Symrise, frequently pursue strategic acquisitions and portfolio optimization. This strategy aims to bolster capabilities, broaden market access, and enhance product portfolios. For instance, Symrise's ongoing 'ONE Symrise' initiative and its systematic review of chemical production operations underscore a drive to capitalize on growth opportunities and internal synergies. This active pursuit of strategic advantages intensifies rivalry among competitors.

This competitive dynamic is evident in market activities. In 2023, the global flavors and fragrances market was valued at approximately $30 billion, with major players consistently investing in M&A to gain market share and technological advancements. For example, Givaudan, a key competitor, completed several acquisitions in 2023 to strengthen its position in specific segments.

- Strategic Acquisitions: Companies like Symrise, Givaudan, and Firmenich (now part of DSM-Firmenich) regularly engage in mergers and acquisitions to expand their product lines and geographic reach.

- Portfolio Optimization: Continuous evaluation and streamlining of business units and production facilities, such as Symrise's review of its chemical operations, are common to enhance efficiency and focus on high-growth areas.

- Synergy Realization: The pursuit of operational and financial synergies through acquisitions is a key driver, leading to increased consolidation and a more intense competitive landscape as firms seek scale advantages.

- Market Share Competition: These strategic moves directly impact market share, forcing rivals to respond with their own consolidation or innovation strategies to maintain or improve their competitive standing.

Competitive rivalry in the flavors and fragrances sector is intense, driven by a few dominant global players like Givaudan, IFF, and Symrise. These companies compete fiercely for market share through continuous innovation and strategic acquisitions. For instance, the global flavors and fragrances market was valued at around $30 billion in 2023, with significant M&A activity shaping the competitive landscape.

Symrise differentiates itself through a broad product portfolio and substantial R&D investment, focusing on innovation and customization rather than price wars. This strategy allows them to offer unique, high-value solutions across fragrances, flavors, and cosmetic ingredients. Their commitment to innovation is reflected in their capital expenditures, with Symrise investing €348 million in 2023 for infrastructure and R&D.

The industry's high fixed costs encourage companies to maximize capacity utilization, sometimes leading to aggressive pricing tactics. However, Symrise's focus on integrated solutions and specialized ingredients helps it maintain a competitive edge. Strategic moves, such as acquisitions and portfolio optimization by major players, further intensify this rivalry, forcing companies to constantly adapt and innovate to maintain their market position.

| Key Competitor | 2023 Net Sales (approx.) | Key Competitive Strategy |

| Givaudan | CHF 6.9 billion | Innovation, Acquisitions |

| IFF | USD 12.4 billion (2023 total) | Portfolio Diversification, R&D |

| Symrise | EUR 4.7 billion (2023) | Integrated Solutions, Customization |

SSubstitutes Threaten

For less specialized applications, customers can often find generic or commodity flavor, fragrance, or cosmetic ingredients from numerous suppliers, including smaller, regional businesses. This broad availability of alternatives means Symrise faces competition from a wider pool of providers, especially in segments where its offerings are not highly differentiated.

These alternative suppliers may compete on price, potentially offering lower costs to customers. This cost advantage for generic ingredients can pose a threat to Symrise's market share in less specialized product categories, as customers may opt for more budget-friendly options when the unique value proposition of Symrise's ingredients is less critical.

Large players in sectors like food and beverage, or personal care, may possess the resources and technical know-how to develop and manufacture certain fundamental flavors and fragrances internally. This capability, while demanding substantial capital and specialized skills, could lessen their dependence on external providers such as Symrise.

For instance, a major beverage company might invest in its own flavor development labs, potentially replicating some of Symrise's offerings for cost savings or greater control over their product's unique taste profile. This in-house production represents a direct threat, as it bypasses the need for external sourcing for specific components.

Changes in consumer preferences, like a growing demand for 'fragrance-free' or 'unflavored' products, could significantly impact Symrise's core business. This shift in taste could directly reduce the overall market for many of its flavor and fragrance creations.

While Symrise is well-positioned with its focus on natural and health-conscious ingredients, very extreme or rapid changes in consumer lifestyles, such as a widespread move away from scented personal care items, could still present a substantial threat by diminishing the appeal of its existing product portfolio.

Technological Advancements in Alternative Solutions

Emerging technologies are creating new ways to deliver sensory experiences, potentially bypassing traditional flavors and fragrances. For instance, advancements in digital scent technology or highly effective natural alternatives that simplify ingredient sourcing could disrupt the market. These innovations represent a long-term threat by offering substitutes that might be more efficient or appealing to certain consumer segments.

Symrise is actively addressing this threat through strategic investments. The company is channeling resources into artificial intelligence and biotechnology for flavor and fragrance development. This proactive approach aims to not only adapt to these technological shifts but also to position Symrise as a leader in innovation, developing its own advanced solutions.

- Technological Disruption: Innovations in digital scent creation and advanced natural ingredient extraction offer alternatives to conventional flavor and fragrance compounds.

- Supply Chain Simplification: Highly effective natural alternatives can reduce reliance on complex and potentially volatile traditional ingredient supply chains.

- Symrise's Response: Investments in AI and biotechnology are key to developing proprietary technologies and staying ahead of substitute threats.

- Market Adaptation: Symrise's focus on innovation allows it to potentially lead the market in creating next-generation sensory experiences.

Regulatory Changes and Health Concerns

Stricter regulations on certain artificial ingredients or growing consumer concerns about the health implications of synthetic chemicals could lead to a preference for natural or simpler formulations. This shift presents a threat of substitution, as consumers might opt for products with fewer or more easily understood ingredients.

Symrise's strong emphasis on natural, clean-label, and sustainable ingredients positions it well to mitigate this threat. By offering compliant and preferred alternatives, Symrise can capture market share from competitors less prepared for these evolving consumer demands and regulatory landscapes.

- Regulatory Scrutiny: Increased governmental oversight on food additives and cosmetic ingredients, such as potential bans on certain artificial colors or preservatives, directly impacts product formulations.

- Consumer Health Awareness: Surveys in 2024 continue to show a strong consumer preference for natural ingredients, with over 60% of shoppers actively seeking products labeled as ‘natural’ or ‘organic’.

- Symrise's Portfolio: Symrise reported a significant increase in sales from its naturals portfolio, demonstrating market acceptance and a strategic advantage in responding to these substitution threats.

The threat of substitutes for Symrise stems from readily available generic ingredients and the potential for large customers to develop their own solutions. For example, in 2024, the demand for simple, unflavored products continues to grow, impacting the core business of flavor and fragrance creators. Innovations in digital scent technology also present a long-term risk by offering alternative sensory experiences.

Symrise is proactively investing in AI and biotechnology to develop its own advanced solutions, aiming to stay ahead of these evolving market dynamics. The company's focus on natural and sustainable ingredients also positions it favorably against substitutes driven by regulatory changes and increasing consumer health awareness, as evidenced by strong sales growth in its naturals portfolio in early 2024.

Entrants Threaten

The flavors, fragrances, and specialty ingredients sector demands significant upfront capital for robust research and development, state-of-the-art manufacturing plants, and intricate supply chain networks. For instance, Symrise's investment in innovation, as seen in their consistent R&D spending, highlights the substantial financial commitment needed. This high barrier to entry deters many potential competitors from establishing a foothold.

The significant investment required in research and development, coupled with specialized technical knowledge in chemistry, biology, and sensory science, creates a substantial barrier for potential new entrants. Symrise's decades of experience have cultivated extensive industry expertise and technical know-how in developing complex flavors, fragrances, and cosmetic active ingredients.

The threat of new entrants for Symrise, particularly concerning regulatory hurdles, is substantial. The flavor and fragrance industry operates under a complex web of global regulations governing product safety, ingredient sourcing, labeling accuracy, and environmental impact. For instance, compliance with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe, or similar frameworks in North America and Asia, requires extensive data generation and submission, often costing millions of dollars.

These stringent requirements act as a formidable barrier. New companies must invest heavily in research and development to ensure their products meet diverse international standards, a process that can take years and significant capital. Obtaining necessary certifications and approvals for new ingredients or formulations is not only expensive but also time-consuming, delaying market entry and profitability.

Established Customer Relationships and 'Core List' Systems

Symrise benefits from deeply entrenched relationships with major global manufacturers across diverse sectors. These long-standing partnerships create significant barriers for potential new competitors.

Many of Symrise's clients operate with stringent 'core list' systems, where they maintain a curated selection of approved suppliers. This practice makes it exceptionally challenging for new entrants to penetrate the market and displace established players like Symrise, who are already on these critical lists.

- Supplier Loyalty: Customers often prioritize continuity and reliability, making switching suppliers a complex and often costly process.

- Core List Exclusivity: Inclusion on a client's core list is a prerequisite for significant business, and gaining this initial approval is a major hurdle for newcomers.

- Switching Costs: The effort and potential disruption involved in qualifying new suppliers deter many businesses from exploring alternatives to their current, trusted partners.

Brand Reputation and Trust

The threat of new entrants into the flavors and fragrances market, particularly for Symrise, is significantly mitigated by the crucial role of brand reputation and trust. In sectors like food, beverages, and cosmetics, where consumer perception is key, establishing a strong, reliable brand is a lengthy and costly endeavor. New players must overcome considerable hurdles to gain the confidence of major clients who prioritize consistent quality and safety. For instance, Symrise's long-standing commitment to innovation and sustainability, as highlighted in their 2023 annual report which noted a 10% increase in sales from sustainable products, builds a powerful moat against newcomers attempting to replicate this level of market acceptance.

- Brand Reputation as a Barrier: Symrise's established name in the industry signifies quality and reliability, making it difficult for new entrants to gain immediate customer trust.

- Trust in Sensitive Applications: For flavors and fragrances used in food, beverages, and cosmetics, consumer and client trust is non-negotiable, favoring established, reputable suppliers.

- Innovation and Sustainability Credentials: Symrise's proven track record in developing innovative and sustainable solutions, like their 2024 focus on biodegradable fragrance ingredients, presents a high barrier for new entrants seeking to match these credentials.

- Market Acceptance Challenges: New companies face significant challenges in achieving the same level of market acceptance and long-term partnerships that Symrise has cultivated over years of consistent performance.

The threat of new entrants for Symrise is generally low due to the substantial capital required for R&D, advanced manufacturing, and complex supply chains, coupled with deep industry expertise. For example, Symrise's 2024 investment in expanding its biotechnology capabilities underscores the ongoing need for significant financial commitment to remain competitive.

Regulatory compliance, including stringent safety and environmental standards across various global markets, presents a formidable barrier. Newcomers must navigate lengthy and costly approval processes, often requiring millions in investment for data generation and certification. Symrise's established compliance infrastructure and experience in managing these requirements provide a significant advantage.

Entrenched customer relationships and supplier loyalty further deter new entrants. Many clients maintain strict approved supplier lists, making it difficult for new companies to gain access. Symrise's long-standing partnerships, built on trust and consistent performance, create high switching costs for customers, reinforcing Symrise's market position.

| Barrier | Description | Impact on New Entrants | Symrise Advantage |

|---|---|---|---|

| Capital Requirements | High costs for R&D, manufacturing, and supply chains. | Deters new players due to financial burden. | Established infrastructure and ongoing investment capacity. |

| Technical Expertise | Specialized knowledge in chemistry, biology, and sensory science. | Difficult for newcomers to replicate decades of accumulated know-how. | Extensive R&D teams and proprietary technologies. |

| Regulatory Hurdles | Complex global regulations on product safety and ingredients. | Requires significant investment and time for compliance and approvals. | Proven track record and established compliance processes. |

| Customer Relationships | Loyalty to existing suppliers and core list systems. | Challenging to penetrate the market and displace established players. | Long-standing, trusted partnerships with major clients. |

| Brand Reputation | Trust and perception in sensitive consumer applications. | New entrants struggle to build credibility and market acceptance. | Strong brand recognition signifying quality and reliability. |

Porter's Five Forces Analysis Data Sources

Our Symrise Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Symrise's annual reports, investor presentations, and competitor financial filings. We also incorporate insights from leading industry research firms and market intelligence platforms to capture the dynamics of the flavors and fragrances sector.