Symrise Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Symrise Bundle

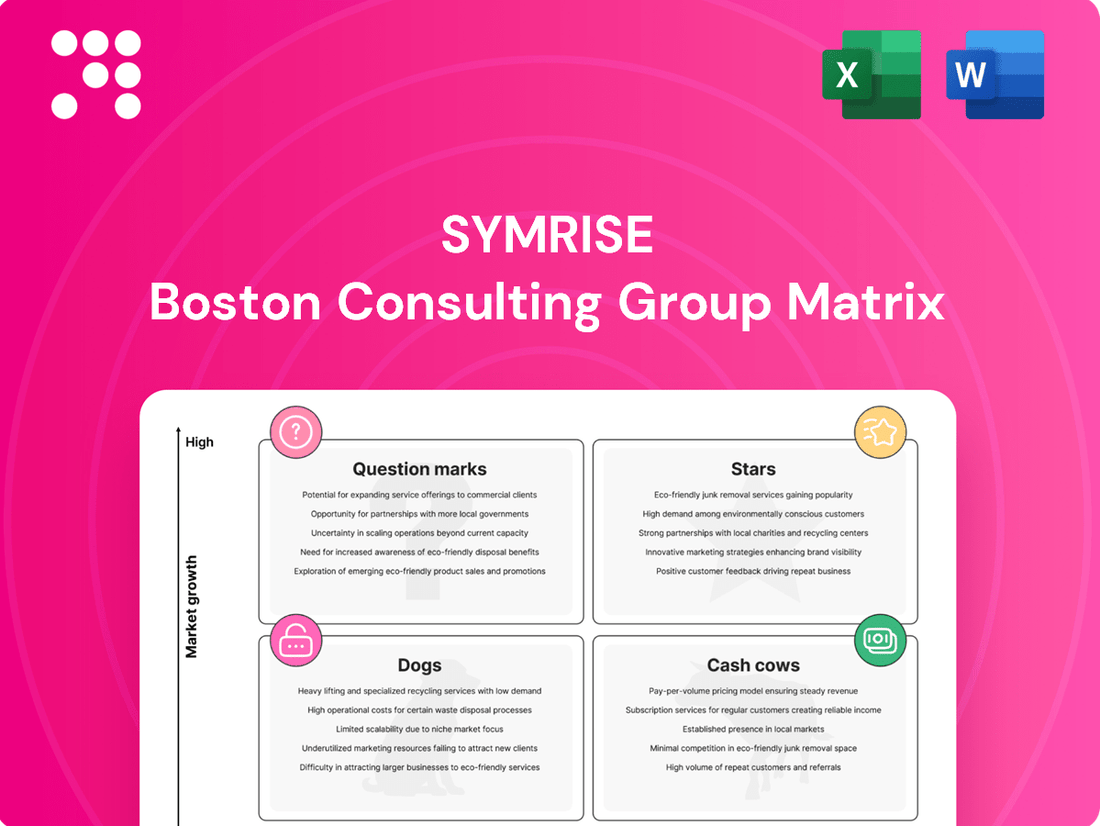

Unlock the strategic potential of Symrise's product portfolio with our comprehensive BCG Matrix analysis. Discover which ingredients are driving growth (Stars), which are generating consistent revenue (Cash Cows), and which require careful consideration for the future (Dogs and Question Marks).

This insightful preview offers a glimpse into Symrise's market positioning, but the full BCG Matrix report provides the granular data and strategic recommendations you need to make informed decisions. Gain a clear roadmap for resource allocation and product development to ensure Symrise's continued success.

Don't miss out on the complete picture. Purchase the full Symrise BCG Matrix today to receive a detailed breakdown, actionable insights, and a powerful tool for competitive advantage.

Stars

Symrise holds a robust position in the functional food ingredients market, further solidified by its November 2024 acquisition of a majority stake in Probi. This strategic move targets a high-growth sector, with projections indicating market expansion at compound annual growth rates (CAGRs) between 6.7% and 10.4% starting in 2025. This investment underscores Symrise's dedication to leading in this expanding segment.

Within Symrise's Taste, Nutrition & Health segment, savory products and beverage applications were standout performers in 2024, achieving impressive double-digit organic growth. This robust expansion is fueled by persistent strong consumer demand across key regions, notably EAME and Asia/Pacific, within the ever-expanding global food and beverage market. Symrise's market leadership and consistent success in these categories firmly establish them as Stars in the BCG matrix.

Fine Fragrances, a key player in Symrise's Scent & Care division, has been a standout performer, achieving impressive high double-digit organic growth. This success is largely fueled by its strong presence and dynamic engagement within the luxury fragrance market, a sector known for its resilience and premium appeal.

The global flavors and fragrances market is anticipated to maintain a healthy compound annual growth rate, providing a favorable backdrop for Symrise's Fine Fragrances unit. This sustained market expansion underscores the ongoing demand for sophisticated scent experiences.

Symrise's commitment to innovation and a deep understanding of customer needs are central to its leadership in the Fine Fragrances space. This strategic focus allows the company to consistently deliver sought-after products and maintain its competitive edge in a discerning market.

Cosmetic Active Ingredients (Micro-Protection, Actives & Botanicals)

Symrise's Micro-Protection and Active & Botanicals segments are shining stars within its Cosmetic Ingredients division, demonstrating exceptional growth in 2024. These areas are capitalizing on a surging consumer appetite for scientifically proven and naturally derived skincare solutions.

The broader active cosmetic ingredients market is booming, with projections indicating continued strong expansion fueled by innovation and a consumer push towards efficacy and sustainability. Symrise's strategic focus and established market share in these high-growth niches position it favorably for sustained success.

- High Growth Niches: Micro-Protection and Active & Botanicals are key drivers for Symrise's cosmetic division.

- Market Demand: Consumer preference for effective, natural ingredients fuels growth in these segments.

- Symrise's Position: The company holds a significant market share in these expanding product categories.

- 2024 Performance: These segments recorded very strong growth rates, contributing to overall division strength.

Natural and Plant-Based Solutions

Symrise is strategically leveraging the strong consumer preference for natural and plant-based ingredients across its flavor, fragrance, and functional food segments. This aligns perfectly with a major market trend, boosting growth in areas where Symrise already has a significant presence.

The company's commitment to sustainable and clean-label products solidifies its leading position in these rapidly expanding markets. For instance, in 2023, the demand for plant-based alternatives in the food industry continued its upward trajectory, with the global market projected to reach over $200 billion by 2030, according to various industry reports.

Symrise's investments in natural sourcing and innovative processing technologies are key differentiators. This focus allows them to cater to evolving consumer desires for transparency and health-conscious options.

- Growing Demand: Consumer interest in natural and plant-based ingredients is a primary growth engine for Symrise.

- Market Position: Symrise holds strong market positions in key segments driven by this trend.

- Sustainability Focus: The company's emphasis on sustainable and clean-label solutions reinforces its leadership.

- Innovation: Investments in natural sourcing and processing technologies are critical to meeting consumer needs.

Symrise's savory products and beverage applications within the Taste, Nutrition & Health segment are clear Stars. These areas achieved double-digit organic growth in 2024, driven by consistent strong consumer demand, particularly in EAME and Asia/Pacific. The company's leadership in these expanding global food and beverage markets solidifies their Star status.

Fine Fragrances within the Scent & Care division also shines as a Star. It delivered high double-digit organic growth in 2024, propelled by its robust presence in the resilient luxury fragrance market. The overall global flavors and fragrances market's healthy projected CAGR further supports this segment's Star positioning.

The Micro-Protection and Active & Botanicals segments of Symrise's Cosmetic Ingredients division are also Stars. These segments demonstrated exceptional growth in 2024, capitalizing on the increasing consumer demand for effective, natural skincare. Symrise's strong market share in these high-growth niches, within a booming active cosmetic ingredients market, confirms their Star classification.

| Segment | Performance Indicator | 2024 Growth | Market Trend | Star Status Rationale |

| Savory & Beverage Applications | Organic Growth | Double-digit | Strong global food & beverage demand | Market leadership in expanding categories |

| Fine Fragrances | Organic Growth | High double-digit | Resilient luxury fragrance market | Strong presence in premium segment |

| Micro-Protection & Active Botanicals | Growth | Exceptional | Demand for natural, effective skincare | Strong share in booming cosmetic ingredients market |

What is included in the product

Highlights which units to invest in, hold, or divest based on market growth and share.

Simplifies complex portfolio decisions by visually categorizing Symrise's business units, easing strategic planning.

Cash Cows

Symrise's extensive flavor portfolio, especially for processed and convenience foods, acts as a strong cash cow. This segment benefits from Symrise's dominant global market position, built on deep customer ties and a wide array of offerings. The market itself is mature, seeing only modest growth, but Symrise's established presence ensures consistent and significant cash generation.

Symrise's established consumer fragrance applications, covering personal care and household products, represent a classic Cash Cow. This segment thrives in a mature, stable market where Symrise holds a significant share, ensuring a predictable and substantial revenue stream.

Despite not seeing rapid expansion, these fragrances are a reliable profit generator due to their deep market penetration and loyal customer base. For instance, in 2024, Symrise reported strong performance in its Scent & Care segment, which largely encompasses these established applications, contributing significantly to the company's overall profitability and providing ample cash to fund other strategic initiatives.

Symrise's traditional oral care ingredients represent a strong cash cow. Their long-standing expertise in supplying components for toothpaste and mouthwash has secured a significant market share in a mature but consistently demanded segment. This stability means the business requires less aggressive marketing, allowing it to reliably generate profits.

Classic Aroma Chemicals

Classic aroma chemicals represent a significant Cash Cow for Symrise, holding a strong position in a mature market. These foundational ingredients are crucial for numerous fragrance and flavor creations, ensuring consistent demand across various consumer goods sectors.

The segment's stability allows Symrise to generate substantial profits and cash flow with minimal need for further capital expenditure. This reliable performance underpins the company's overall financial health.

- High Market Share: Symrise commands a leading share in the established classic aroma chemicals market.

- Stable Demand: These products benefit from consistent and predictable demand from diverse industries like personal care, home care, and food.

- Profitability Driver: The segment contributes significantly to Symrise's earnings and cash generation.

- Low Investment Needs: Mature products require limited investment in research and development or capacity expansion, maximizing returns.

Mature Pet Food Palatability Solutions

Symrise's mature pet food palatability solutions represent a classic cash cow within their pet nutrition segment. These products hold a significant and stable market share in a well-established, albeit not rapidly expanding, sector. This strong position ensures consistent revenue generation, effectively subsidizing areas of the business that may be experiencing slower growth or require more investment.

The reliability of these palatability enhancers is a key characteristic. They are a dependable source of earnings for Symrise, contributing significantly to the company's overall financial stability. This mature offering is crucial for funding research and development in newer, potentially high-growth areas of the pet food market.

- Market Position: Strong, established share in the pet food palatability sector.

- Revenue Generation: Consistently provides reliable and steady income.

- Strategic Role: Funds growth initiatives in other business segments.

- Growth Outlook: Mature market, characterized by stable demand rather than rapid expansion.

Symrise's established portfolio of cosmetic ingredients, particularly those used in skin and hair care, functions as a robust cash cow. These products benefit from a mature market with consistent demand, where Symrise has cultivated a significant and stable market share through years of innovation and customer relationships.

This segment requires relatively low investment for maintenance and growth, allowing it to generate substantial and predictable profits. For example, Symrise's Beauty Care segment, which includes many of these mature ingredient offerings, consistently contributes to the company's profitability, providing essential cash flow. In 2024, the company continued to see steady demand for its established cosmetic ingredients, underscoring their cash cow status.

| Category | Market Position | Growth Rate | Cash Flow Generation |

| Cosmetic Ingredients (Skin & Hair Care) | High Market Share | Mature / Low | High / Stable |

| Classic Aroma Chemicals | High Market Share | Mature / Low | High / Stable |

| Oral Care Ingredients | Significant Market Share | Mature / Low | High / Stable |

What You See Is What You Get

Symrise BCG Matrix

The Symrise BCG Matrix preview you are viewing is the identical, fully-formatted document you will receive immediately after purchase. This comprehensive analysis, meticulously prepared by industry experts, provides actionable insights into Symrise's product portfolio, categorizing each business unit into Stars, Cash Cows, Question Marks, and Dogs. You can confidently expect the same level of detail and strategic clarity in the purchased version, ready for immediate integration into your business planning and decision-making processes.

Dogs

Symrise has categorized its Aqua Feed business unit as a 'Dog' within its BCG Matrix, signaling a period of declining organic growth for this segment. This strategic classification highlights the business's low market share within a slow or contracting market.

Reflecting its commitment to portfolio optimization and a sharpened focus on lucrative growth sectors, Symrise plans to divest the Aqua Feed business. This move is consistent with the 'Dog' quadrant's typical strategy of divestment to reallocate resources to more promising ventures.

Symrise's divestment of its UK beverage trading business in 2024 clearly places this segment within the 'Dog' category of the BCG Matrix. This move signals that the business likely exhibited low market share and low growth, making it a candidate for divestment rather than further investment.

The sale of this operation in 2024 underscores Symrise's strategic focus on optimizing its portfolio. By shedding underperforming assets like the UK beverage trading unit, the company frees up capital and management attention to concentrate on its core, high-growth segments.

Symrise's decision to divest its operations in Costa Rica and Ecuador signals a strategic move to optimize its business portfolio. These ventures are likely categorized as 'Dogs' in the BCG matrix, indicating low growth potential and a small market share in their respective regions.

In 2023, Symrise's overall revenue reached approximately €4.4 billion, with a notable focus on its core segments like Flavor & Nutrition and Scent & Care. The divestment of smaller, less profitable regional units aligns with the company's strategy to concentrate resources on high-growth, high-market-share areas, a common practice for businesses aiming to improve overall profitability and efficiency.

Underperforming Legacy Chemical Production

Symrise's underperforming legacy chemical production, particularly its terpene business, falls into the Dogs category of the BCG Matrix. This classification indicates low market share and low market growth potential for these specific operations. The company is actively reviewing strategic options, which could include divestment or significant restructuring to address these challenges.

The rationale behind this assessment stems from potentially lower profitability and a less favorable alignment with Symrise's future growth ambitions. For instance, while the broader fragrance and cosmetics ingredients market continues to expand, certain legacy chemical processes might face competitive pressures or declining demand.

- Terpene Business Review: Symrise is actively evaluating its terpene production, a segment often associated with legacy chemical processes.

- Low Growth & Profitability: These operations likely exhibit characteristics of low market growth and reduced profitability, fitting the 'Dog' profile.

- Strategic Options: Potential outcomes include divestment or substantial restructuring to improve financial performance or reallocate resources.

- Market Context: While the overall Symrise portfolio shows strength, specific legacy chemical segments may not align with current high-growth market trends.

Niche or Outdated Synthetic Ingredients

Within Symrise's portfolio, niche or outdated synthetic ingredients often find themselves in the 'Dogs' quadrant of the BCG matrix. These are typically products that struggle to keep pace with evolving consumer demands for natural, clean-label, and high-performance alternatives. Their market share is likely minimal, existing within sub-segments that are either stagnant or experiencing a decline.

These ingredients may represent legacy formulations or chemicals that are no longer cost-effective or competitive. For instance, a synthetic fragrance compound developed decades ago, which doesn't align with current trends for natural extracts or sophisticated scent profiles, could be a prime example. Such products offer low returns and often tie up valuable resources in production and inventory without significant upside potential.

- Low Market Share: These ingredients typically hold less than 5% of their respective market segments.

- Stagnant or Declining Markets: The sub-segments they operate in are often characterized by minimal or negative growth, with industry reports from 2023-2024 indicating a shift away from older synthetic chemistries in many regions.

- Minimal Profitability: The profit margins on these products are often razor-thin, sometimes barely covering production costs.

- Consideration for Divestment: Companies like Symrise often evaluate 'Dogs' for potential discontinuation or sale to streamline their product offerings and focus on growth areas.

Symrise's strategic review of its legacy chemical production, specifically its terpene business, places it firmly in the 'Dog' category of the BCG Matrix. This classification highlights its low market share within a slow-growing or declining market segment.

The company is actively exploring strategic options for these operations, which could include divestment or significant restructuring. This approach aims to improve financial performance and reallocate valuable resources towards more promising, high-growth areas of Symrise's business.

In 2024, Symrise continued its portfolio optimization efforts, including the divestment of its UK beverage trading business, a move consistent with managing 'Dog' assets. This strategy allows Symrise to concentrate its investments and management focus on core, high-potential segments.

Symrise's overall revenue in 2023 was approximately €4.4 billion, underscoring the importance of divesting underperforming units like certain legacy chemical segments to enhance overall profitability and efficiency.

| Business Segment | BCG Category | Strategic Action | Rationale |

|---|---|---|---|

| Aqua Feed | Dog | Divestment | Declining organic growth, low market share in a slow market. |

| UK Beverage Trading | Dog | Divestment (completed 2024) | Low market share and low growth, aligning with portfolio optimization. |

| Costa Rica & Ecuador Operations | Dog | Divestment | Low growth potential and small market share in respective regions. |

| Legacy Chemical Production (Terpenes) | Dog | Reviewing strategic options (divestment/restructuring) | Low market share, low market growth potential, potentially lower profitability. |

| Niche/Outdated Synthetic Ingredients | Dog | Potential discontinuation or sale | Struggling against natural alternatives, minimal market share in stagnant segments. |

Question Marks

Symrise's novel probiotic and postbiotic solutions are strategically positioned as Question Marks within the BCG matrix. While the overall probiotics market is a Star, these specific innovations, targeting high-growth segments like gut health and personalized nutrition, are in their nascent stages.

These advanced formulations represent Symrise's push into cutting-edge areas, potentially capturing significant future market share. However, their current market penetration is likely low, necessitating substantial investment in research, development, and market penetration to achieve leadership and transition into Stars.

Personalized nutrition ingredients for Symrise would likely fall into the question marks category of the BCG matrix. This segment represents high-growth potential, fueled by a global surge in health consciousness and demand for tailored dietary solutions. For instance, the global personalized nutrition market was valued at approximately USD 11.4 billion in 2023 and is projected to reach USD 33.1 billion by 2030, exhibiting a CAGR of 16.4%.

These ingredients are in the early stages of market development, requiring significant investment in research and development to create novel formulations and build consumer adoption. Symrise's focus on highly customized or innovative components for this sector positions them to capture future market share, but also necessitates substantial upfront capital for marketing and distribution to establish a strong foothold.

Symrise's commitment to research and development fuels the creation of advanced biotechnology-derived ingredients. These innovative products are designed for high-growth markets, but often begin with a small market share. This positioning requires substantial investment and careful strategy to evolve into market leaders.

Ingredients for Emerging Health & Wellness Applications

The functional food market is experiencing a surge in demand for solutions addressing mental well-being and sleep enhancement. Symrise is actively developing innovative ingredients tailored for these burgeoning health and wellness applications.

These segments represent high-growth opportunities, but Symrise is focused on building substantial market share within these relatively nascent categories.

- Mental Well-being: Ingredients supporting mood enhancement and stress reduction are key.

- Sleep Support: Formulations aiding natural sleep cycles and improved sleep quality are in demand.

- Cognitive Function: Ingredients that boost focus and memory are gaining traction.

- Gut Health & Immunity: A growing awareness links gut health to overall well-being and immune response.

Sustainable Sourcing and Circular Economy Innovations

Symrise's dedication to sustainable sourcing and circular economy principles fuels innovation, positioning these efforts as potential stars in their portfolio. The company is actively investing in new processes and materials that embody these values, seeking to create a more resource-efficient future.

Innovations like novel upcycled ingredients and fully circular solutions are emerging from these initiatives. For instance, Symrise has been exploring the use of by-products from the food industry to create valuable cosmetic ingredients, a prime example of circularity in action. These advancements represent high-potential growth areas, tapping into a growing consumer demand for environmentally conscious products.

- Circular Economy Investment: Symrise is channeling significant investment into developing and scaling circular economy solutions, aiming to reduce waste and enhance resource utilization.

- Upcycled Ingredients: The company is actively developing and marketing ingredients derived from upcycled raw materials, tapping into a growing market segment.

- Market Adoption: While these innovative solutions show promise, they may currently hold a low market share as they navigate scaling and broader industry adoption, necessitating strategic financial backing.

Symrise's novel probiotic and postbiotic solutions, while targeting high-growth areas like personalized nutrition, are positioned as Question Marks due to their early market stage. These innovations, requiring substantial investment for market penetration, aim to capture future market share in a sector projected for significant expansion.

The personalized nutrition market, valued at approximately USD 11.4 billion in 2023, is expected to reach USD 33.1 billion by 2030, growing at a CAGR of 16.4%. Symrise's tailored ingredients for this market, though promising, necessitate significant R&D and marketing investment to establish a strong presence.

Symrise's focus on ingredients for mental well-being and sleep enhancement also falls into the Question Mark category. These nascent but high-growth segments require strategic investment to build market share and capitalize on increasing consumer demand for functional foods addressing these needs.

Innovations in circular economy solutions, such as upcycled ingredients, represent Symrise's investment in sustainable growth. While these environmentally conscious products tap into growing consumer demand, their current market share may be low, requiring strategic financial backing for scaling and broader adoption.

| Category | Symrise's Position | Market Growth | Investment Need |

|---|---|---|---|

| Probiotic & Postbiotic Solutions | Question Mark | High (Personalized Nutrition) | High (R&D, Market Penetration) |

| Personalized Nutrition Ingredients | Question Mark | High (16.4% CAGR projected) | High (R&D, Marketing, Distribution) |

| Mental Well-being & Sleep Ingredients | Question Mark | High (Functional Food Market) | High (Market Share Development) |

| Circular Economy & Upcycled Ingredients | Question Mark | High (Consumer Demand for Sustainability) | High (Scaling, Industry Adoption) |

BCG Matrix Data Sources

Our Symrise BCG Matrix leverages a robust blend of internal financial disclosures, comprehensive market research reports, and competitor performance data to accurately map product portfolios.