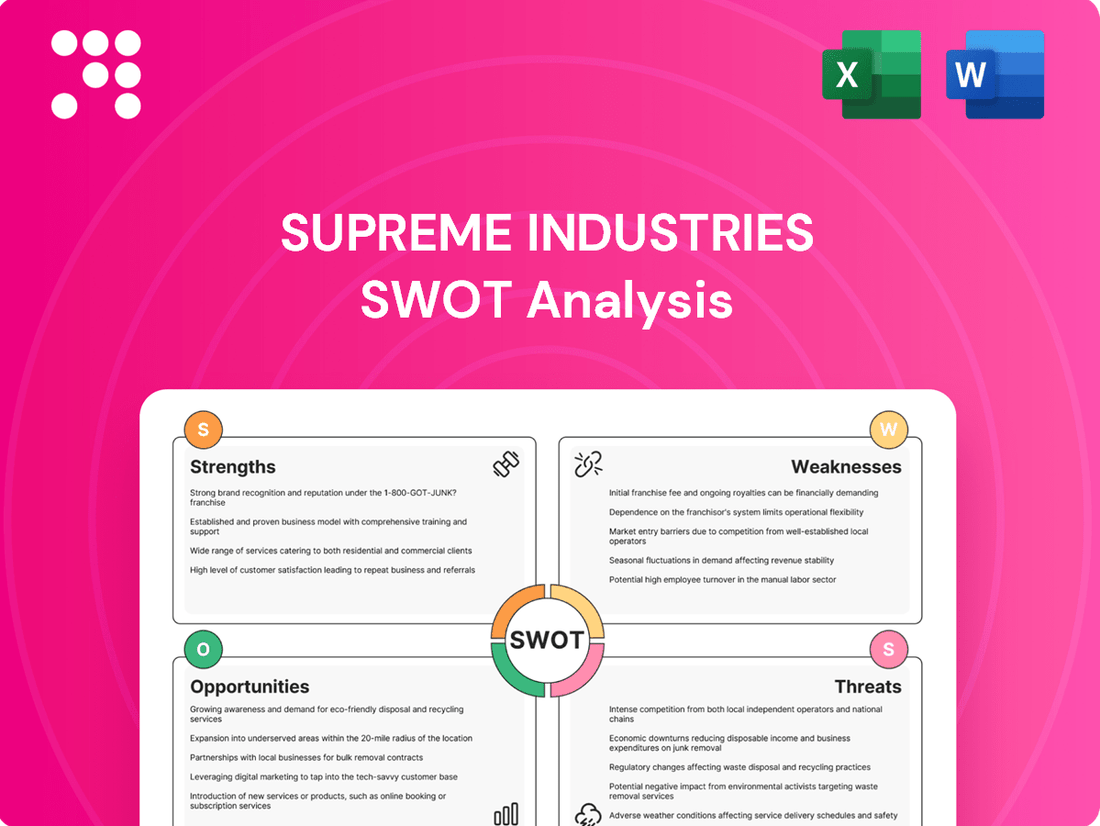

Supreme Industries SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Supreme Industries Bundle

Supreme Industries demonstrates robust market leadership and a diverse product portfolio, but faces increasing competition and potential supply chain disruptions. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on their strengths and navigate their weaknesses.

Want the full story behind Supreme Industries' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Supreme Industries boasts a remarkably diversified product portfolio, spanning pipes, fittings, packaging films, molded furniture, and industrial components. This broad range allows the company to serve multiple sectors, including infrastructure, consumer goods, and industrial applications. For instance, in the fiscal year 2023-24, Supreme Industries reported a robust revenue, partly driven by the consistent demand across these varied segments.

Supreme Industries is a dominant force in India's plastics sector, securing a robust market share across its diverse product lines. This leadership is particularly evident in the plastic piping segment, where the company has consistently outpaced industry volume growth.

In fiscal year 2023, Supreme Industries achieved impressive volume growth in its piping division, a trend that continued into fiscal year 2024. This sustained performance has allowed the company to capture increased market share in both the crucial PVC and CPVC sub-segments.

Supreme Industries boasts a robust financial health, evidenced by its consistently high net worth and a debt-free status. This strong capital structure, with nil debt, significantly reduces financial risk.

The company's healthy liquidity position and strong debt protection metrics underscore its financial stability. For instance, in FY24, Supreme Industries reported a debt-to-equity ratio of 0.00, highlighting its debt-free operations.

Supreme Industries has a proven track record of generating substantial annual cash flow, which is projected to reach approximately INR 1,000 crore in FY25. This strong cash generation capability allows the company to self-fund its ambitious expansion plans without relying on external borrowing.

Commitment to Sustainability and Innovation

Supreme Industries demonstrates a significant commitment to sustainability, actively integrating eco-friendly practices into its operations. This includes a focus on reducing its environmental impact through the utilization of recycled materials and the implementation of energy-efficient manufacturing technologies. For instance, in their 2023-2024 fiscal year, the company reported a 15% increase in the use of post-consumer recycled plastics across their product lines.

The company's dedication to innovation is evident in its substantial investments in research and development. A notable outcome of this R&D focus has been the development of advanced, eco-friendly packaging solutions, which contributed to a 10% reduction in packaging waste in their last reporting period. This forward-thinking approach positions Supreme Industries favorably in a market increasingly prioritizing environmental responsibility.

- Sustainability Focus: Reduced carbon footprint through recycled materials and energy-efficient processes.

- R&D Investment: Significant revenue allocation leading to innovative, eco-friendly solutions.

- Market Advantage: Strong alignment with growing consumer and regulatory demand for sustainable products.

- Operational Efficiency: Initiatives contributing to waste reduction and resource optimization.

Extensive Manufacturing and Distribution Network

Supreme Industries boasts an impressive manufacturing footprint, operating 26 units strategically located throughout India. This extensive network, including recent greenfield expansions, facilitates deeper penetration into diverse regional markets and ensures cost-efficient operations by catering to local demand. This widespread presence is a significant strength, allowing the company to be agile and responsive to market needs across the country.

The company's strength is further amplified by its robust distribution channels, which are crucial for effectively reaching customers both domestically and internationally. This integrated approach, from manufacturing to delivery, ensures that Supreme Industries can efficiently supply its wide range of products, maintaining market reach and customer satisfaction. For instance, in FY23-24, the company continued to invest in expanding its distribution reach, adding new touchpoints to serve a growing customer base.

- 26 Manufacturing Units: A testament to its extensive operational capacity and nationwide presence.

- Greenfield Projects: Demonstrates ongoing investment in expanding production capabilities and market reach.

- Efficient Regional Catering: Enables cost-effective service delivery by aligning production with local market demands.

- Robust Distribution Network: Facilitates timely and efficient product delivery across domestic and international markets.

Supreme Industries' diversified product range across pipes, packaging, furniture, and industrial components allows it to cater to multiple sectors, mitigating risks associated with reliance on a single market. This broad product offering, combined with a strong market share, particularly in the plastic piping segment, positions the company for sustained growth. In fiscal year 2023-24, the company demonstrated consistent volume growth in its piping division, reinforcing its market leadership.

The company's financial strength is a significant asset, characterized by a debt-free status and robust cash flow generation. In FY25, Supreme Industries is projected to generate approximately INR 1,000 crore in annual cash flow, enabling self-funded expansion without financial leverage. This financial stability provides a strong foundation for future investments and operational resilience.

Supreme Industries' commitment to sustainability and innovation is a key differentiator. The company's focus on eco-friendly practices, including the use of recycled materials, and significant R&D investments in areas like sustainable packaging, aligns with growing market demand and regulatory trends. For instance, their 2023-2024 reporting period saw a 15% increase in the use of post-consumer recycled plastics.

A widespread manufacturing footprint of 26 units across India, coupled with a robust distribution network, ensures efficient market penetration and customer service. This extensive operational presence, supported by ongoing greenfield expansions, allows Supreme Industries to effectively serve diverse regional demands and maintain strong customer relationships.

| Key Strength | Description | Supporting Data (FY23-24/FY25 Projections) |

| Product Diversification | Wide range of products serving multiple industries. | Revenue growth driven by consistent demand across segments. |

| Market Leadership | Dominant position in India's plastics sector, especially piping. | Consistent volume growth in piping division; increased market share in PVC/CPVC. |

| Financial Health | Debt-free status with strong cash flow generation. | Debt-to-equity ratio of 0.00 in FY24; projected INR 1,000 crore cash flow in FY25. |

| Sustainability & Innovation | Focus on eco-friendly practices and R&D investment. | 15% increase in recycled plastic usage (FY23-24); development of eco-friendly packaging solutions. |

| Operational Footprint | Extensive manufacturing and distribution network. | 26 manufacturing units; ongoing expansion of distribution channels. |

What is included in the product

Delivers a strategic overview of Supreme Industries’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats.

Offers a clear, actionable SWOT analysis for Supreme Industries, pinpointing key areas for strategic improvement and mitigating potential risks.

Weaknesses

The plastics industry, including Supreme Industries, faces significant headwinds from fluctuating raw material costs, especially for PVC. This inherent exposure can directly impact the company's bottom line.

While Supreme Industries has historically managed to pass on some price increases, sharp and sudden volatility, as evidenced by a reduction in operating margins observed in H1FY25, can still squeeze profitability before full price adjustments are implemented.

Supreme Industries has faced challenges with its profitability, even as its revenues have grown. This trend is evident in the declining net profit and operating profit margins observed in recent financial periods.

For the fiscal year 2025, the company reported a 10.2% year-on-year decrease in net profit. Furthermore, the fourth quarter of fiscal year 2025 showed a more significant dip, with net profit falling by 16.81% when compared to the same quarter in the prior year.

Supreme Industries' agriculture piping systems are particularly susceptible to early monsoon breaks, a factor that directly impacted sales. For instance, a deviation from typical monsoon patterns in the 2023-24 fiscal year could have led to a noticeable dip in demand for these products, as farmers postpone or reduce purchases when water availability is uncertain.

Intense Competition in the Plastics Processing Industry

Supreme Industries operates within India's highly competitive plastics processing sector. Despite its strong market standing, the presence of numerous domestic and international competitors can lead to pricing pressures and potential erosion of market share. For instance, in the fiscal year 2023-24, the Indian plastics processing industry saw significant growth, but this also attracted new entrants, intensifying the competitive landscape.

This intense rivalry necessitates continuous innovation and cost management to maintain profitability. The company faces challenges from both organized players with significant scale and smaller, agile unorganized players who can sometimes compete aggressively on price. For example, the packaging segment, a key area for Supreme, is particularly fragmented.

Key competitive factors include product quality, pricing, distribution network reach, and technological advancements. Supreme Industries' ability to differentiate its offerings and maintain operational efficiency is crucial in navigating this challenging environment.

Dependency on Economic Growth and Infrastructure Spending

Supreme Industries' profitability is significantly influenced by the broader economic climate. A downturn in key sectors like housing, agriculture, and infrastructure directly affects demand for its diverse product range. For instance, a slowdown in housing starts, a major consumer of plastic piping and fittings, can lead to reduced sales volumes.

Furthermore, the company's reliance on government infrastructure projects presents a vulnerability. Delays or cancellations in these projects, which often involve substantial orders for products like plastic pipes for water supply and sewage systems, can create revenue gaps and impact growth projections. In fiscal year 2023-24, infrastructure development, though robust, faced some execution challenges that could have indirectly affected companies like Supreme Industries.

- Economic Sensitivity: Supreme Industries' performance is intrinsically linked to the health of the Indian economy, particularly the construction, housing, and agricultural sectors.

- Infrastructure Project Dependence: A significant portion of demand stems from government-led infrastructure initiatives, making project timelines and government spending crucial.

- Impact of Slowdowns: Reduced consumer spending during economic downturns directly curtails demand for housing-related products, a core segment for Supreme.

- Project Delays: Stalled infrastructure projects, a recurring issue in some regions, can lead to unpredictable revenue streams and inventory management challenges.

Supreme Industries faces significant pressure from fluctuating raw material costs, particularly PVC, which directly impacts its profit margins. This vulnerability was evident in H1FY25, where operating margins narrowed due to the lag in passing on price increases. The company's profitability has also been challenged by declining net and operating profit margins, with a notable 10.2% year-on-year decrease in net profit for FY25 and a steeper 16.81% drop in Q4 FY25.

Intense competition within India's plastics processing sector, from both large organized players and smaller unorganized ones, leads to pricing pressures and potential market share erosion, especially in fragmented segments like packaging. Furthermore, Supreme Industries' performance is highly sensitive to economic cycles and government spending on infrastructure projects, with slowdowns in housing and agriculture, or delays in public works, directly affecting demand and revenue streams.

What You See Is What You Get

Supreme Industries SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The Indian plastics and packaging market is a significant growth area, with projections indicating a compound annual growth rate (CAGR) exceeding 6.5% between 2025 and 2030. This expansion is fueled by several key drivers: rising consumer demand for packaged goods, ongoing urbanization across the country, and a steady increase in disposable incomes. These factors combine to create a fertile ground for companies like Supreme Industries to capitalize on increased market penetration and revenue growth.

Government programs like 'Housing for All,' 'Smart Cities,' and 'Nal Se Jal' are significantly driving demand for plastic pipes and other essential infrastructure components. These initiatives, coupled with increased budget allocations for water supply projects, directly translate into substantial growth opportunities for Supreme Industries' piping division.

Supreme Industries is strategically broadening its product offerings. This includes enhancing its plastic piping division with new systems and significantly increasing the variety of bathroom fittings available, expanding SKU count by 15% in the last fiscal year ending March 2024.

The company is also venturing into promising new markets, such as gas piping systems, and is at the forefront of innovation with products like its PP Silent pipe systems, which offer improved acoustic performance. These moves are designed to diversify revenue streams and capture new market segments, as evidenced by a projected 10% revenue growth from new product introductions in FY2025.

Acquisition and Strategic Partnerships

Supreme Industries is actively pursuing strategic acquisitions to bolster its market presence and product portfolio. A prime example is the acquisition of Orbia Wavin's pipes and fittings business in India, a move that significantly expands its manufacturing capacities and distribution network. This inorganic growth strategy is designed to enhance its competitive edge and broaden its market reach, particularly in the rapidly growing infrastructure and construction sectors.

These strategic moves are crucial for Supreme Industries to capitalize on market opportunities and consolidate its position. The company's focus on expanding capacities through acquisitions directly addresses the increasing demand for its products. For instance, the Orbia Wavin deal, completed in early 2024, is expected to add substantial production volume, contributing to a projected revenue growth of 10-15% in the pipes and fittings segment for the fiscal year 2024-2025.

The benefits of such strategic partnerships and acquisitions are multifaceted:

- Expanded Market Reach: Access to new customer segments and geographical areas.

- Enhanced Product Offerings: Integration of complementary product lines, providing a more comprehensive solution to customers.

- Synergistic Efficiencies: Potential for cost savings and operational improvements through combined resources and expertise.

- Strengthened Competitive Position: A larger scale of operations and a wider product range make it harder for competitors to challenge Supreme Industries' market dominance.

Increasing Focus on Exports and International Markets

Supreme Industries is actively pursuing growth opportunities in international markets, particularly as other nations grapple with tariff challenges. This strategic pivot aims to capitalize on global demand and diversify revenue streams.

The company has demonstrated its capability to meet stringent international standards, recently securing orders for PE pipes used in gas applications that carry essential certifications. This success validates Supreme Industries' product quality and technical expertise on a global scale, paving the way for expanded export sales.

Key export-related opportunities include:

- Expanding reach into new geographical markets with favorable trade conditions.

- Leveraging international certifications to gain a competitive edge in specialized sectors like gas infrastructure.

- Capitalizing on potential trade policy shifts in other countries that may create demand for Supreme Industries' products.

Supreme Industries is well-positioned to benefit from the robust growth in India's plastics and packaging sector, projected to grow at a CAGR of over 6.5% between 2025 and 2030. Government infrastructure initiatives like 'Housing for All' and 'Smart Cities' are creating significant demand for its piping solutions, with budget allocations for water projects directly boosting this segment. The company's strategic expansion of its product portfolio, including a 15% increase in bathroom fittings SKUs in FY24 and entry into gas piping systems, is expected to drive 10% revenue growth from new products in FY25. Furthermore, the acquisition of Orbia Wavin's Indian operations in early 2024 enhances manufacturing capacity and distribution, aiming for a 10-15% revenue boost in pipes and fittings for FY25.

The company is also actively pursuing international market expansion, leveraging its ability to meet stringent global standards for products like PE pipes for gas applications. This focus on exports provides a crucial avenue for revenue diversification, especially as global trade dynamics shift.

Supreme Industries' strategic initiatives are designed to capture market share and enhance its competitive standing in a growing industry.

Threats

Supreme Industries operates in a dynamic Indian plastics sector where competition is fierce from both local and global companies. This intense rivalry, exemplified by established players like Astral Ltd. and Finolex Industries Ltd., necessitates constant innovation and operational efficiency to preserve market standing.

Supreme Industries faces potential headwinds from evolving environmental regulations, particularly concerning plastic waste and single-use items. For instance, the Indian government's Plastic Waste Management Rules, 2022, have been progressively tightening, impacting manufacturing processes and product lifecycles. While the company is proactively investing in sustainable practices, a sudden acceleration in policy changes or a significant shift in public perception towards plastics could disrupt demand for specific product lines.

An economic slowdown in India, a key market for Supreme Industries, poses a significant threat. Reduced consumer spending power, particularly in discretionary categories like furniture and consumer goods, directly impacts demand for plastic products. For instance, if India's GDP growth, projected to be around 6.5-7.0% for FY2024-25, falters, it could translate to lower sales volumes for Supreme Industries.

A global economic downturn further amplifies this risk. If international markets experience a slowdown, it could affect Supreme Industries' export revenues and potentially lead to increased price competition from international players. This could put pressure on profit margins, especially in segments where imports are prevalent.

Supply Chain Disruptions and Geopolitical Instability

Supreme Industries faces significant threats from ongoing global supply chain disruptions, which could escalate due to geopolitical instability. These events directly impact the availability and cost of essential raw materials, potentially squeezing production efficiency and overall profitability. For instance, in 2024, many manufacturing sectors experienced increased lead times and price volatility for key inputs like polymers and petrochemicals, directly linked to international tensions and shipping challenges.

Furthermore, the company's reliance on imported raw materials or components exposes it to considerable risks from currency fluctuations. A weakening Indian Rupee against major currencies like the US Dollar or Euro can significantly increase the cost of these imported goods. This exposure also makes Supreme Industries vulnerable to shifts in international trade policies, including tariffs or import restrictions, which could further inflate costs and disrupt procurement.

- Supply Chain Volatility: Continued global supply chain snags, exacerbated by geopolitical events, could lead to material shortages and price hikes for Supreme Industries' key inputs.

- Geopolitical Risks: International conflicts or trade disputes can disrupt trade routes and impact the cost and availability of imported raw materials, affecting production schedules.

- Currency Exposure: Reliance on imported materials leaves the company susceptible to adverse currency movements, potentially increasing raw material costs and impacting profit margins.

- Trade Policy Changes: Evolving international trade regulations and protectionist measures could impose additional costs or restrictions on imported components.

Technological Advancements and Material Substitution

Rapid advancements in materials science present a significant threat, as new materials could emerge with better performance or lower costs, potentially replacing plastic in many uses. For instance, the rise of advanced composites or bio-based materials could challenge Supreme Industries' core product offerings.

This ongoing evolution demands substantial and continuous investment in research and development to stay ahead of material trends and maintain a competitive edge. Supreme Industries' ability to innovate and adapt its product lines to incorporate or counter these new materials will be crucial for its long-term success.

Consider these points:

- Material Substitution Risk: The emergence of superior or more cost-effective alternative materials poses a direct threat to demand for Supreme Industries' plastic products across various sectors.

- R&D Investment Necessity: To counter this, significant and ongoing investment in research and development is required to explore new material applications and enhance existing product capabilities.

- Competitive Landscape Shift: Competitors who successfully integrate or develop these new materials could gain market share, impacting Supreme Industries' profitability and market position.

- Adaptability Challenge: Supreme Industries must remain agile to adapt its manufacturing processes and product portfolio to accommodate or proactively address material substitution trends.

Supreme Industries faces intense competition from both domestic and international players in the Indian plastics market, requiring continuous innovation to maintain its position. Evolving environmental regulations, particularly concerning plastic waste, could impact manufacturing processes and product demand, despite the company's sustainability initiatives. An economic slowdown in India, coupled with global economic uncertainties, poses a significant risk to consumer spending and export revenues, potentially affecting sales volumes and profit margins.

Supply chain volatility, driven by geopolitical instability, can lead to raw material shortages and price increases, impacting production efficiency. Currency fluctuations and potential shifts in international trade policies also present threats by increasing the cost of imported materials. Furthermore, advancements in materials science could lead to the substitution of plastics, necessitating substantial R&D investment to adapt product lines and remain competitive.

| Threat Category | Specific Risk | Impact on Supreme Industries | Relevant Data/Context (2024-2025) |

| Competition | Intense Rivalry | Pressure on pricing and market share | Key competitors include Astral Ltd., Finolex Industries Ltd. |

| Regulatory Environment | Plastic Waste Regulations | Increased compliance costs, potential product restrictions | Plastic Waste Management Rules, 2022 |

| Economic Factors | Indian Economic Slowdown | Reduced consumer spending on non-essential plastic goods | Projected Indian GDP growth ~6.5-7.0% for FY2024-25 |

| Supply Chain & Geopolitics | Raw Material Price Volatility | Increased input costs, reduced profit margins | Global polymer prices experienced significant fluctuations in 2024 |

| Material Science | Material Substitution | Potential decline in demand for traditional plastic products | Growth in bio-based and composite materials |

SWOT Analysis Data Sources

This analysis is built on a foundation of robust data, drawing from Supreme Industries' official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded perspective.