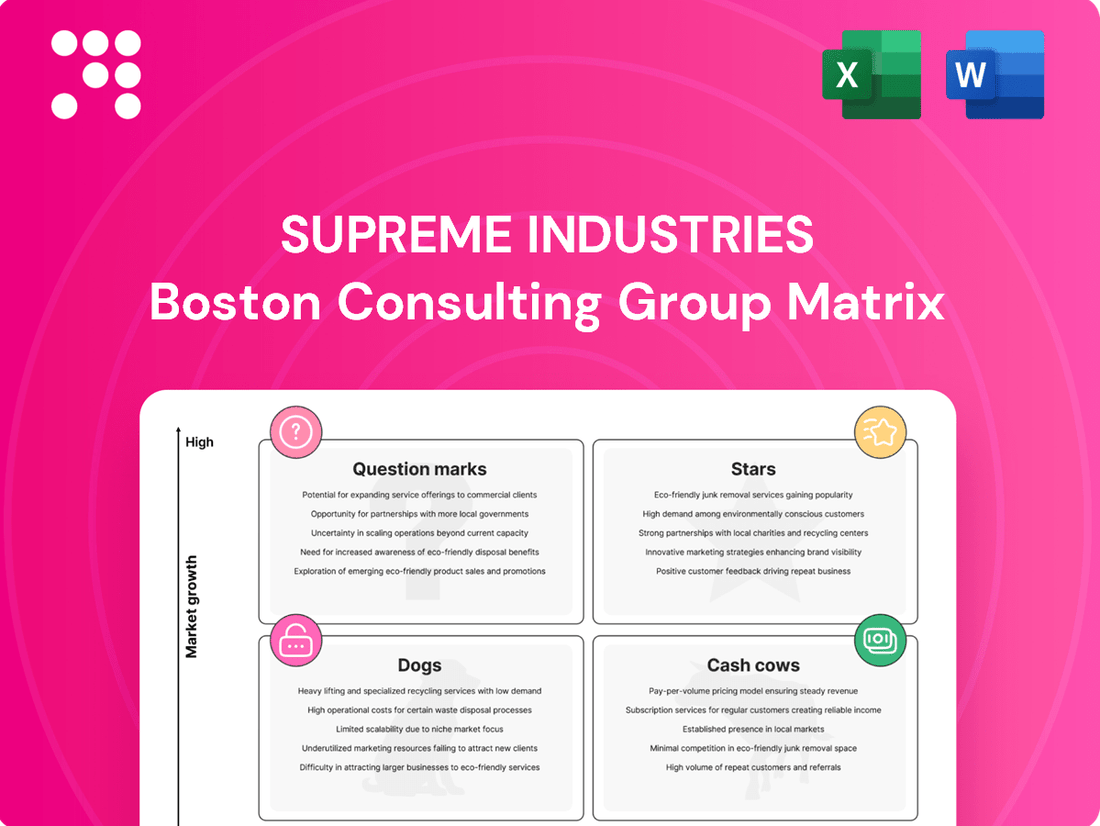

Supreme Industries Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Supreme Industries Bundle

Uncover the strategic positioning of Supreme Industries with our comprehensive BCG Matrix analysis. See which products are fueling growth, which are generating steady profits, and which require careful consideration. This preview is just the beginning; purchase the full report for detailed quadrant placements and actionable insights to optimize your investment strategy.

Stars

Supreme Industries' Plastic Piping Systems division is a shining star in its BCG matrix, boasting both a high market share and operating within a rapidly expanding market. As India's foremost producer of plastic piping, the company held an estimated 11-15% of the plastic piping market in fiscal year 2024, a position poised for further growth.

The Indian plastic pipes market itself is set for substantial expansion, with forecasts indicating a compound annual growth rate of 6.56% between 2025 and 2033. This growth is fueled by crucial government programs such as the Nal Se Jal initiative and the Smart Cities Mission, alongside increasing investments in infrastructure and housing projects.

Demonstrating its strong market position, Supreme Industries anticipates a 25% volume growth in its plastic piping systems business for fiscal year 2025, significantly outperforming the industry's projected 12% growth. This aggressive expansion is supported by substantial investments in both brownfield and greenfield projects, with plans to increase plastic piping system capacity to one million metric tons by the end of fiscal year 2025-26, up from 870,000 metric tons in fiscal year 2025.

Supreme Industries' focus on value-added products within its plastic piping segment clearly positions these offerings as Stars in its BCG Matrix. The company reported a robust 13% increase in the turnover of these specialized products, reaching INR 3,737 crores in FY24.

These higher-margin products, including specialized pipes and fittings for plumbing, water tanks, and fire protection, are meeting growing market demands. Supreme Industries is significantly expanding its product portfolio, planning to increase its SKU count for bath fittings and sanitary products from 421 to over 1,000 by FY25-26.

The planned launch of five new plastic piping systems and the expansion of bath fittings and sanitary SKUs to over 1,000 in FY25 strongly positions these offerings as Stars for Supreme Industries. This aggressive product development strategy targets emerging market opportunities and aims to solidify the company's presence in a rapidly expanding sector.

Supreme Industries' dedicated new product development team at the Pune Supreme Design Centre is actively innovating for Indian toilets and kitchens. This focus on continuous improvement and market capture, especially within a growing segment like plumbing and sanitaryware, is characteristic of a Star business. The company's investment in these new product lines, anticipating increased market adoption, underscores their Star potential.

Cross-Laminated Film Products

The cross-laminated film and products division of Supreme Industries is exhibiting strong growth, characteristic of a star in the BCG matrix. This segment saw a notable 11% increase in volume and 12% in value during FY25. This surge is largely attributed to the re-establishment of significant government business, marking a return after a five-year hiatus.

The division's strategic focus includes developing tailored solutions and expanding fabrication capabilities. These efforts are aimed at catering to escalating demand across different regions. The company is also advancing its product pipeline, with trials underway for a new Cross Plastic Film anticipated to have strong export potential.

- Strong Growth: FY25 saw an 11% volume and 12% value increase for cross-laminated films.

- Government Contracts: A significant driver of growth is the return of government business after a five-year gap.

- Product Development: Trials for a new Cross Plastic Film with export potential are ongoing, with a December 2024 commercial launch planned.

- Capacity Expansion: The division is increasing fabrication capacities to meet rising demand and focusing on customized solutions.

Industrial and Ball Valves (New Greenfield Unit)

The recent launch of Supreme Industries' new greenfield unit for industrial and ball valves at Malanpur, Madhya Pradesh, commencing production in September 2024, marks a significant entry into a potentially high-growth market. This strategic expansion into a new manufacturing facility underscores the company's ambition to broaden its product offerings and meet rising industrial demand.

This new venture is positioned as a burgeoning star within the BCG matrix, reflecting its potential for substantial market share capture in the expanding industrial applications sector. The company's investment in this new capacity demonstrates a clear commitment to capitalizing on future growth opportunities.

- Market Entry: The September 2024 operational start at Malanpur signifies Supreme Industries' direct engagement in the industrial and ball valve market.

- Growth Potential: This segment is characterized by increasing demand from various industrial sectors, offering a strong growth trajectory for the new unit.

- Strategic Investment: The establishment of a new greenfield unit highlights a deliberate strategy to enhance manufacturing capabilities and product diversity.

- Market Share Ambition: The venture is poised to compete effectively and gain significant market share, leveraging its new capacity and focused market approach.

Supreme Industries' Plastic Piping Systems division is a clear star, holding a significant market share in a rapidly expanding sector. The company's foresight in increasing capacity to one million metric tons by FY25-26, up from 870,000 metric tons in FY25, and its focus on value-added products, like specialized pipes and fittings, further solidify its star status.

The cross-laminated film and products division is also performing as a star, driven by an 11% volume and 12% value increase in FY25, largely due to renewed government business. Ongoing trials for a new Cross Plastic Film with export potential, slated for a December 2024 commercial launch, highlight its bright future.

The new greenfield unit for industrial and ball valves, operational since September 2024, represents a strategic move into a high-growth market, positioning it as a burgeoning star with significant market share potential.

| Business Segment | Market Share (FY24 Est.) | Market Growth Rate | Key Growth Drivers | FY25 Outlook |

|---|---|---|---|---|

| Plastic Piping Systems | 11-15% | 6.56% (2025-2033) | Nal Se Jal, Smart Cities Mission, Infrastructure | 25% volume growth |

| Cross-Laminated Film & Products | N/A | Strong | Government contracts, product development | 11% volume, 12% value growth (FY25) |

| Industrial & Ball Valves | N/A | Expanding | Industrial demand | New market entry, capacity expansion |

What is included in the product

Highlights which of Supreme Industries' product lines to invest in, hold, or divest based on market growth and share.

A clear Supreme Industries BCG Matrix visually clarifies which business units need investment and which can be divested, alleviating the pain of resource allocation uncertainty.

Cash Cows

Supreme Industries' molded furniture segment is a classic cash cow. Even though the plastic furniture market isn't growing much, this part of Supreme's business still brings in steady money. They've kept sales going by refreshing their offerings, launching 20 new models in the fiscal year 2024-2025 and planning another eight in the first quarter of fiscal year 2025-2026.

This segment's strength lies in its established position and the fact that it doesn't need huge marketing budgets to maintain sales in a mature market. By expanding their retail footprint, with 40 new showrooms opened in fiscal year 2025 and 60 more planned for fiscal year 2025-2026, Supreme ensures continued visibility and sales without excessive spending. This consistent cash generation is vital for funding other business ventures or returning value to shareholders.

Supreme Industries' established packaging products, especially those with consistent demand and strong market share in mature areas, are its cash cows. In fiscal year 2024, this division saw a solid 8% growth in volume and 7% in value.

While the overall Indian plastic packaging market is expanding, certain established products like general packaging films and protective packaging are in mature stages. These benefit from existing distribution and customer ties, needing minimal investment to hold their ground and reliably generate cash.

The protective packaging segment, for example, is focusing on increasing capacity utilization and offering tailored solutions. This strategic move points to a stable, cash-generating operation within Supreme Industries' portfolio.

Supreme Industries' material handling products, encompassing essential items like crates and pallets, are likely positioned as cash cows. Their fundamental role in industrial and commercial logistics points to a stable, consistent demand, a hallmark of this BCG matrix category.

The company's strategic expansion, with plans to boost pallet manufacturing capacity starting March 2025, underscores the expectation of sustained, low-growth revenue from these established product lines. This investment signals confidence in their ongoing cash-generating ability.

These products benefit from long lifecycles and recurring orders, ensuring predictable cash flow without requiring substantial investment in marketing or innovation. This reliable performance solidifies their cash cow status within Supreme Industries' portfolio.

Industrial Moulded Components (Recurring Revenue)

The Industrial Moulded Components division at Supreme Industries functions as a cash cow, primarily driven by its recurring revenue stream. This segment demonstrated robust recurring revenue growth of approximately 14% in FY25, a notable figure especially when contrasted with the overall segment revenue growth of around 5% for the same period.

These components, often specialized and custom-made for industrial clients, benefit from stable, long-term contracts and consistent repeat business. The mature market indicated by lower overall growth doesn't diminish the division's strength; instead, its reliable recurring revenue highlights a well-established market position that consistently generates cash flow with minimal need for aggressive marketing efforts.

- Recurring Revenue Dominance: The industrial moulded components segment's recurring revenue is its key cash cow.

- FY25 Performance: Recurring revenue grew by nearly 14%, while overall segment revenue grew by about 5% in FY25.

- Customer Relationships: Custom-made and specialized parts for industrial clients ensure stable, long-term contracts and repeat business.

- Market Position: A mature market with consistent recurring revenue signifies a strong, established position generating reliable cash flow.

Older, Standard Pipe Offerings

Within Supreme Industries' portfolio, older, standard pipe offerings like PVC and uPVC for basic water supply and drainage represent classic cash cows. These products have long dominated the market, enjoying widespread adoption and requiring little in the way of marketing support to maintain their strong positions. Their maturity means they generate consistent, reliable profits, forming a stable financial bedrock for the company.

The overall piping segment might be a star, fueled by innovation, but these foundational products are the dependable earners. For instance, in fiscal year 2023-24, Supreme Industries reported robust growth in its piping division, with these standard offerings continuing to be significant contributors to overall sales volume, even as newer, specialty pipes gain traction.

- Mature Market Dominance: Standard PVC and uPVC pipes have achieved high market penetration, making them reliable revenue generators.

- Low Investment Needs: Minimal promotional expenditure is required to sustain their established market share.

- Stable Profitability: These products provide a consistent and predictable stream of income for Supreme Industries.

- Financial Bedrock: They underpin the company's financial stability, supporting investments in newer, growth-oriented segments.

Supreme Industries' molded furniture segment, a prime example of a cash cow, continues to generate steady income despite a mature market. The company's strategy to refresh its product line, with 20 new models launched in FY24-25 and eight more planned for Q1 FY25-26, ensures sustained sales. This segment thrives on its established market presence and minimal need for extensive marketing, further bolstered by an expanding retail footprint with 40 new showrooms in FY25 and 60 planned for FY25-26.

The packaging products division, particularly general packaging films and protective packaging, also functions as a cash cow. These products benefit from existing distribution networks and customer relationships, requiring low investment to maintain market share. In FY24, this segment saw a solid 8% volume growth and 7% value growth, demonstrating its consistent cash-generating ability.

Material handling products like crates and pallets are key cash cows for Supreme Industries due to their essential role in logistics, ensuring stable demand. The company's planned capacity expansion for pallets starting March 2025 reinforces the expectation of sustained revenue from these low-growth, reliable product lines. Their long lifecycles and recurring orders contribute to predictable cash flow without significant marketing or innovation investment.

The Industrial Moulded Components division is another strong cash cow, characterized by its significant recurring revenue, which grew by nearly 14% in FY25 against an overall segment growth of about 5%. This stability stems from custom-made parts for industrial clients, secured through long-term contracts and repeat business, highlighting a robust, established market position that consistently generates cash.

| Segment | BCG Category | FY24-25 Key Performance Indicators | Strategic Focus | Cash Generation Outlook |

| Molded Furniture | Cash Cow | 20 new models launched; 40 new showrooms opened | Product refresh, retail expansion | Steady and reliable |

| Packaging Products | Cash Cow | 8% volume growth, 7% value growth (FY24) | Leveraging existing distribution and customer ties | Consistent and predictable |

| Material Handling Products | Cash Cow | Capacity expansion planned for pallets (from March 2025) | Sustaining demand in essential logistics | Recurring orders, long lifecycles |

| Industrial Moulded Components | Cash Cow | 14% recurring revenue growth (FY25) | Long-term contracts, repeat business | Stable, high-margin cash flow |

What You’re Viewing Is Included

Supreme Industries BCG Matrix

The preview you are currently viewing is the identical, fully-prepared Supreme Industries BCG Matrix report you will receive upon purchase. This ensures absolute transparency, meaning you'll get the exact strategic analysis, complete with all data and formatting, ready for immediate application in your business planning.

Rest assured, the Supreme Industries BCG Matrix document you see here is precisely the file you will download after completing your purchase; there are no hidden surprises or altered content. This comprehensive report is designed to provide actionable insights, allowing you to confidently assess Supreme Industries' product portfolio and make informed strategic decisions.

Dogs

Within Supreme Industries' broad product range, certain general consumer products are classified as dogs. In fiscal year 2024, this segment saw no volume growth and a slight 1% decrease in value.

These products likely exist in markets with minimal expansion potential and hold a small share, thus not contributing substantially to cash flow. They might also represent older product lines or appeal to shrinking consumer bases.

The strategy for these dog products would typically involve reducing capital expenditure and potentially exploring divestment if they consistently drain resources without offering future prospects.

Segments within Supreme Industries' industrial products that lack recurring revenue and have experienced substantial value erosion or stagnant growth are classified as dogs. The industrial products division, despite some recurring revenue growth, witnessed a 30% overall value decrease in FY24.

This downturn indicates that specific non-recurring or project-based industrial product lines are likely struggling in sluggish industrial sectors or are hampered by fierce competition, resulting in low market share and minimal cash flow.

These underperforming product lines are potentially immobilizing capital without delivering commensurate returns, impacting the company's overall financial health.

Products highly sensitive to PVC price swings and lacking unique features are prime candidates for the dog category within Supreme Industries' BCG matrix. These items, often commoditized, struggle to maintain profitability when raw material costs fluctuate significantly.

While Supreme Industries holds a strong position in plastic pipes, certain less differentiated plastic products, particularly those where PVC price volatility directly impacts margins and can lead to inventory write-downs, might be underperforming. For example, if the company's gross profit margin on certain basic plastic sheets or molded items, which are heavily reliant on PVC, dips below industry averages due to price pressures, these could be considered dogs.

If these low-differentiation, PVC-sensitive products also command a minimal market share within their specific product lines, they become particularly problematic. This is because the eroded margins from raw material costs are not offset by sufficient sales volume, turning them into cash traps that drain resources without generating substantial returns.

Older, Less Efficient Manufacturing Lines/Plants

Older, less efficient manufacturing lines or plants within Supreme Industries could be classified as 'dogs' if they operate in low-growth markets and incur high operational costs. These legacy assets might not be contributing significantly to the company's profitability, especially as Supreme Industries actively invests in modernizing and expanding its production capabilities. Such units often possess a low market share in terms of production efficiency and are situated in segments experiencing minimal growth, potentially hindering overall company performance.

The company's strategic focus on greenfield and brownfield expansions signals a deliberate effort to phase out or re-evaluate these less efficient older assets. For instance, while specific figures for 'dog' assets are not publicly itemized, Supreme Industries reported a capital expenditure of ₹1,100 crore in FY23 for capacity expansion and modernization, indicating a clear direction towards upgrading its operational base.

- Low Market Share in Production Efficiency: Older lines often lag behind newer technologies in output per unit of time and resource.

- Declining or Low-Growth Market Segments: Products manufactured on these lines may serve markets with limited future expansion potential.

- High Operating Costs: Inefficient machinery and processes typically lead to higher energy consumption, maintenance, and labor costs.

- Strategic Divestment/Modernization: Companies like Supreme Industries often plan to either upgrade these assets or divest them to focus on more profitable and efficient operations.

Products with Limited Export Potential in Stagnant Markets

Products with limited export potential in stagnant domestic markets, where Supreme Industries holds a low market share, would be classified as Dogs. For instance, if the company offers specific industrial components primarily to a local manufacturing sector that is not growing, and Supreme Industries doesn't possess a unique technological edge or cost advantage in these offerings, they would likely fall into this category. These items would face challenges in increasing sales volume and profitability, potentially becoming candidates for discontinuation.

Consider a hypothetical scenario where Supreme Industries has a line of specialized fasteners catering exclusively to the domestic automotive repair market. If this market segment has seen negligible growth, perhaps only 0.5% annually, and Supreme Industries' market share within it is a mere 3%, these fasteners would fit the Dog profile. Such products would likely yield low margins and require significant investment to gain traction, making them less attractive compared to the company's other business units.

- Limited Export Capability: Products designed solely for a specific domestic market with no international demand.

- Stagnant Market Conditions: The target market experiences minimal to no growth, hindering sales expansion.

- Low Market Share: The company holds an insignificant position within the domestic market, indicating weak competitive standing.

- Minimal Profitability: These products generate low returns and offer little potential for future profit enhancement.

Products in the 'Dogs' category for Supreme Industries are those with low market share and low growth potential, often facing intense competition or market saturation. These could include older, less differentiated plastic products or specific industrial components serving stagnant sectors.

In fiscal year 2024, certain general consumer products within Supreme Industries experienced a 1% value decrease, indicating they are likely in the dog quadrant. Similarly, specific industrial product lines saw a significant 30% overall value erosion, further highlighting underperforming segments.

The strategy for these dog products typically involves minimizing investment, focusing on cost control, and potentially exploring divestment to free up resources for more promising business units.

These underperforming assets or product lines can immobilize capital, demanding attention without generating substantial returns, thereby impacting the company's overall financial health and strategic focus.

Question Marks

Supreme Industries' composite LPG cylinders are currently positioned as a question mark in its BCG matrix. While the market for these cylinders shows potential for growth, the company's market share and profitability within this segment are not yet dominant, leading to uncertainty about its future performance.

The company is actively engaged with overseas clients and exploring new export opportunities, which suggests some positive market dynamics. However, the lack of a clear leadership position in the domestic market, coupled with ongoing investment in operations and export development, means this segment consumes cash without guaranteed substantial returns.

For instance, in the fiscal year 2023-24, Supreme Industries reported a revenue of ₹8,563 crore. While specific segment data for composite LPG cylinders isn't broken out in detail for this period, the company's overall growth trajectory in related polymer products indicates the potential, but also the investment required to capture market share in newer segments like composite cylinders.

The strategic decision for Supreme Industries regarding its composite LPG cylinders would involve either investing further to transform it into a star performer or considering divestment if the growth and market share objectives are not met. This requires careful analysis of competitive landscape and future demand trends, especially with the increasing global focus on lighter and safer LPG cylinder alternatives.

Supreme Industries' new PVC profile manufacturing facility is currently a question mark in its BCG matrix. While the company aims to supply windows in the first half of FY25-26, this represents a new venture with an uncertain market share for Supreme Industries.

This segment demands substantial upfront investment and marketing to gain traction. It holds the potential to become a star if successful, but currently risks remaining a low market share product in a market that is either new or growing for the company.

Supreme Industries' products being introduced into nascent geographic markets, particularly overseas where brand familiarity and established distribution channels are limited, are prime candidates for the question mark category. The company's strategy involves expanding its reach beyond its core domestic operations, necessitating considerable investment in market entry and brand building.

These international ventures represent high-growth opportunities, but they also come with the inherent risk of slow initial revenue generation and demand substantial capital to gain traction. For instance, in 2024, Supreme Industries continued its focus on expanding its presence in Southeast Asia, a region with significant growth potential but also intense competition from local and international players. This expansion requires ongoing investment in marketing and logistics to establish a strong market position.

Newly Developed Cross Plastic Film for Export

The newly developed Cross Plastic Film for export by Supreme Industries is positioned as a question mark in the BCG Matrix. This signifies a new product with high growth potential but currently a low market share in its target international markets, which are themselves experiencing rapid expansion. The company has initiated trials for this product, with commercial launch anticipated by December 2024.

This product requires substantial investment to build brand awareness and establish distribution networks abroad. Its future success depends on effectively capturing a significant portion of the export market, which is a key challenge for any new entrant. If Supreme Industries can achieve rapid adoption and aggressive market penetration, this product could potentially transition into a star performer.

- Product Stage: Nascent, with commercial launch planned for December 2024.

- Market Potential: High growth in international markets, but currently low or non-existent market share for Supreme Industries.

- Investment Needs: Significant capital required for market development, marketing, and establishing export distribution channels.

- Strategic Goal: Aggressive market penetration and rapid adoption to move from question mark to star.

Bath Fittings and Sanitary Ware Expansion

Supreme Industries' significant expansion in bath fittings and sanitary ware, increasing SKUs from 421 to over 1,000 for FY25-26, clearly places it in the question mark quadrant of the BCG matrix.

This strategic move, supported by a new product development team focused on Indian toilets and kitchens, aims to capitalize on the existing piping network. However, it enters a highly competitive consumer market where establishing a strong brand and market share against entrenched players is crucial.

- SKU Expansion: From 421 to over 1,000 SKUs planned for FY25-26.

- Market Entry: Deepens involvement in a competitive consumer segment for toilets and kitchens.

- Investment Needs: Requires substantial marketing and distribution investment for growth.

- Potential Outcome: Risks remaining a low-share product if market penetration goals aren't met.

Supreme Industries' composite LPG cylinders and new PVC profile manufacturing facility are currently question marks. While these segments offer growth potential, Supreme Industries has yet to establish a dominant market share, necessitating significant investment to capture market position.

The company's expansion into nascent geographic markets overseas and the introduction of new export products like Cross Plastic Film also fall into the question mark category. These ventures require substantial capital for market development and brand building, with success hinging on aggressive market penetration.

Supreme Industries' expanded bath fittings and sanitary ware line, with over 1,000 SKUs planned for FY25-26, represents another question mark. This move into a competitive consumer market demands considerable marketing and distribution investment to achieve significant market share against established brands.

| Segment | Market Growth | Supreme Industries Market Share | Cash Flow | Strategic Consideration |

| Composite LPG Cylinders | High | Low | Negative | Invest or Divest |

| PVC Profiles | High | Low (New) | Negative | Invest for Growth |

| New Export Markets | High | Low | Negative | Market Development |

| Cross Plastic Film (Export) | High | Low (New) | Negative | Aggressive Penetration |

| Bath Fittings/Sanitary Ware | Moderate to High | Low | Negative | Brand Building & Distribution |

BCG Matrix Data Sources

Our Supreme Industries BCG Matrix leverages financial reports, market share data, and industry growth rates to accurately position each business unit.