Supreme Industries PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Supreme Industries Bundle

Navigate the complex external forces shaping Supreme Industries 's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental regulations, and social trends are impacting its operations and market position. Gain a critical edge by downloading the full analysis to unlock actionable intelligence for your strategic planning and investment decisions.

Political factors

India's government is heavily investing in infrastructure, with initiatives like the Jal Jeevan Mission aiming to provide tap water to every household and the Swachh Bharat Abhiyan focusing on sanitation. These programs, along with a significant push for affordable housing, directly boost demand for plastic piping solutions. For instance, the Jal Jeevan Mission alone has seen substantial budget allocations, driving the need for extensive piping networks across rural India.

Increased government spending on rural development and urban infrastructure projects creates a larger market for plastic manufacturers. This expansion translates into more opportunities for companies like Supreme Industries, particularly within its piping division, which benefits from the construction boom these initiatives foster.

Supreme Industries is well-positioned to capitalize on this government-driven infrastructure expansion. The company's piping segment is a direct beneficiary of these large-scale projects, with the increasing demand for water supply and sanitation infrastructure expected to fuel significant growth in this division through 2025.

The Indian government's 'Make in India' initiative, launched in 2014, continues to bolster the manufacturing sector. This program directly supports exporters like Supreme Industries by potentially lowering tariffs on essential raw materials for plastic production, thereby improving cost-competitiveness on the global stage. For example, India's merchandise exports reached an all-time high of $453 billion in FY23, a testament to the growing export ecosystem.

Government incentives, such as the Production Linked Incentive (PLI) schemes and various trade agreements, further amplify India's position in international markets. These policies are designed to make Indian-made goods more attractive abroad. Supreme Industries, a significant player in plastic product exports, is well-positioned to capitalize on these favorable policy shifts, enhancing its global reach and profitability.

India's commitment to tackling plastic pollution intensified with amendments to the Plastic Waste Management (PWM) Rules in 2024 and further refinements anticipated in 2025, placing a significant emphasis on Extended Producer Responsibility (EPR). These regulations now squarely place the onus on manufacturers like Supreme Industries to manage the entire lifecycle of their plastic products, from production to end-of-life collection and recycling.

The updated PWM framework mandates specific actions, including clear labeling requirements for plastic products to aid in segregation and comprehensive reporting on waste collection and recycling efforts. Supreme Industries will need to invest in robust systems to track and manage its plastic waste footprint, ensuring compliance with these evolving national standards.

Adherence to these EPR mandates is likely to impact Supreme Industries' operational costs, potentially necessitating investments in new recycling technologies or partnerships with waste management firms. Furthermore, the rules may influence product design, encouraging the use of more easily recyclable materials or the development of take-back programs to meet collection targets.

Policy on Biodegradable Plastics

The Indian government's updated Plastic Waste Management Rules (2024) are a significant development, placing greater emphasis on biodegradable plastics. These amendments mandate that manufacturers meticulously track and report the volume of biodegradable products they produce, along with any pre-consumer waste generated. This regulatory shift signals a strong governmental impetus towards encouraging the adoption of more environmentally friendly materials across industries.

For companies like Supreme Industries, this policy direction presents a dual opportunity and challenge. It encourages investment in research and development to innovate and enhance biodegradable plastic solutions, potentially opening new market segments.

- Stricter Standards: The 2024 amendments to the Plastic Waste Management Rules impose more rigorous requirements for biodegradable plastics.

- Reporting Mandates: Manufacturers must now report quantities of biodegradable products and associated pre-consumer waste.

- Government Push: This reflects a clear governmental drive to promote sustainable material alternatives.

- R&D Incentive: Such policies can spur innovation and development in biodegradable plastic technologies for companies like Supreme Industries.

Support for Plastic Recycling Industry

The 2024 Union Budget and ongoing government programs are actively fostering a robust plastic recycling sector. These initiatives focus on channeling investments and encouraging collaborative ventures, particularly in waste management projects. For instance, the government has allocated significant funds towards developing advanced waste-to-energy and recycling facilities across the nation.

These policy shifts are designed to attract private capital into recycling infrastructure, creating a more favorable ecosystem. Supreme Industries can capitalize on these supportive measures to advance its sustainability objectives. A key opportunity lies in integrating recycled plastic content into its product lines, aligning with circular economy principles and potentially reducing raw material costs.

- Government Focus: The 2024 Budget emphasizes waste management and recycling, signaling a strong political will to support the industry.

- Investment Incentives: Policies are in place to encourage private sector investment in recycling infrastructure and technology.

- Supreme Industries Opportunity: Leverage government support to integrate recycled plastics, enhancing sustainability and potentially improving cost-efficiency.

Government infrastructure spending, particularly on water and sanitation projects like the Jal Jeevan Mission, directly fuels demand for Supreme Industries' piping solutions. This focus on rural and urban development, supported by substantial budget allocations, creates a robust market for plastic pipes. The 'Make in India' initiative further enhances the competitiveness of Indian manufacturers like Supreme Industries in global markets.

The Indian government's push for sustainability is evident in the updated Plastic Waste Management Rules (2024), emphasizing Extended Producer Responsibility (EPR) and biodegradable plastics. These regulations require companies to manage product lifecycles and report on waste, potentially increasing operational costs but also driving innovation in eco-friendly materials. The government is also actively promoting the plastic recycling sector, offering opportunities for companies to integrate recycled content.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Supreme Industries, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into market dynamics and regulatory landscapes, empowering strategic decision-making for Supreme Industries.

The Supreme Industries PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliever by enabling quick referencing during strategic planning and decision-making.

Economic factors

Supreme Industries' profitability is heavily tied to the price swings of key raw materials, especially polymers such as PVC, PP, and PE. For instance, in early 2024, global polymer prices saw upward pressure influenced by factors like supply chain disruptions and recovering demand, directly impacting Supreme's cost of goods sold.

Crude oil price volatility and escalating logistics expenses, exacerbated by geopolitical events like the Red Sea shipping route challenges in late 2023 and early 2024, directly translate into higher plastic resin costs. This means Supreme Industries must continuously adapt its procurement and pricing strategies to navigate these unpredictable input cost environments.

India's consumer economy is experiencing significant expansion, fueled by increasing urbanization and a steady rise in disposable incomes. This trend directly translates to higher demand for plastic products across various sectors, including packaging, automotive, and construction, creating a robust market for companies like Supreme Industries.

The growth in consumer spending is a key driver for Supreme Industries, as a substantial portion of its revenue is linked to domestic consumption. For instance, in the fiscal year 2023-24, Supreme Industries reported strong sales, reflecting the positive impact of sustained domestic demand on its diverse product offerings.

Government focus on large-scale infrastructure projects, such as those for water supply, sanitation, and housing, is a significant driver for Supreme Industries. These initiatives directly translate into increased demand for plastic pipes and related construction materials. For instance, India's National Infrastructure Pipeline (NIP) projects, with an estimated outlay of ₹111 lakh crore (approximately $1.3 trillion) for 2020-2025, are expected to boost sectors reliant on construction components.

Supreme Industries' plastic piping division stands to gain substantially from this heightened public and private sector investment. The company's product portfolio is well-aligned with the needs of these infrastructure developments. The ongoing urbanisation and the push for improved public utilities across various regions are further solidifying this demand, creating a robust market for Supreme Industries' offerings.

Export Opportunities and Global Demand

India's plastics sector is experiencing a surge in interest from overseas buyers, driven by cost-effective labor and readily available raw materials that enhance export competitiveness. Supreme Industries, already a global player exporting to over 55 nations, is well-positioned to leverage this expanding worldwide appetite for plastic goods, especially within developing markets.

The company's extensive export network can further benefit from the projected growth in global plastic consumption. For instance, the global plastic packaging market alone was valued at approximately USD 250 billion in 2023 and is anticipated to grow significantly in the coming years, presenting a substantial opportunity for companies like Supreme Industries to increase their international market share.

- Increasing Inquiries: International buyers are showing greater interest in Indian plastic products.

- Competitive Advantages: India's competitive labor costs and raw material access bolster export potential.

- Global Reach: Supreme Industries exports to over 55 countries, indicating a strong existing international presence.

- Market Growth: Emerging economies represent a key growth area for plastic product exports.

Company Financial Performance and Capex Plans

Supreme Industries' financial performance in fiscal year 2024-25 presented a mixed picture. While the company saw a slight uptick in revenue, its net profit experienced a downturn. This financial performance is a key indicator for investors and strategists assessing the company's current health.

Despite the profit dip, Supreme Industries is signaling confidence in its future growth trajectory. The company has outlined ambitious capital expenditure plans, earmarking approximately ₹1,100 to ₹1,500 crore. These funds are designated for critical areas such as expanding manufacturing capacity, pioneering new product development, and pursuing strategic acquisitions.

The substantial capital expenditure suggests a strong belief in the company's long-term prospects and its ability to generate robust internal accruals. This investment strategy aims to bolster its market position and drive future profitability, even in the face of short-term financial fluctuations.

- Revenue Growth: Marginal increase reported for FY 2024-25.

- Net Profit: Experienced a decline in FY 2024-25.

- Capex Plans: ₹1,100-1,500 crore allocated for expansion, new products, and acquisitions.

- Funding: Initiatives are expected to be supported by strong internal accruals.

Economic factors significantly influence Supreme Industries' operations. Fluctuations in raw material prices, particularly polymers like PVC, PP, and PE, directly impact the cost of goods sold. For instance, global polymer prices saw upward pressure in early 2024 due to supply chain issues and demand recovery.

The company's performance is also tied to consumer spending and government infrastructure initiatives. India's expanding consumer economy, driven by urbanization and rising disposable incomes, fuels demand for Supreme's products. Furthermore, government focus on large-scale infrastructure projects, like those under the National Infrastructure Pipeline (NIP) with an estimated outlay of ₹111 lakh crore for 2020-2025, boosts demand for plastic pipes and construction materials.

Supreme Industries' financial results for FY 2024-25 showed a slight revenue uptick but a dip in net profit. Despite this, the company has outlined substantial capital expenditure plans of ₹1,100-1,500 crore for expansion, new product development, and acquisitions, indicating confidence in future growth driven by internal accruals.

| Factor | Impact on Supreme Industries | Recent Data/Trend |

| Raw Material Prices | Affects cost of goods sold; higher prices reduce profitability. | Global polymer prices experienced upward pressure in early 2024. |

| Consumer Spending | Drives demand for plastic products across various sectors. | India's consumer economy shows steady expansion, boosting domestic sales. |

| Infrastructure Spending | Increases demand for plastic pipes and construction materials. | National Infrastructure Pipeline (NIP) projects estimated at ₹111 lakh crore (2020-2025). |

| Financial Performance (FY24-25) | Revenue slightly up, net profit down. | Capex plans of ₹1,100-1,500 crore indicate future growth focus. |

Preview Before You Purchase

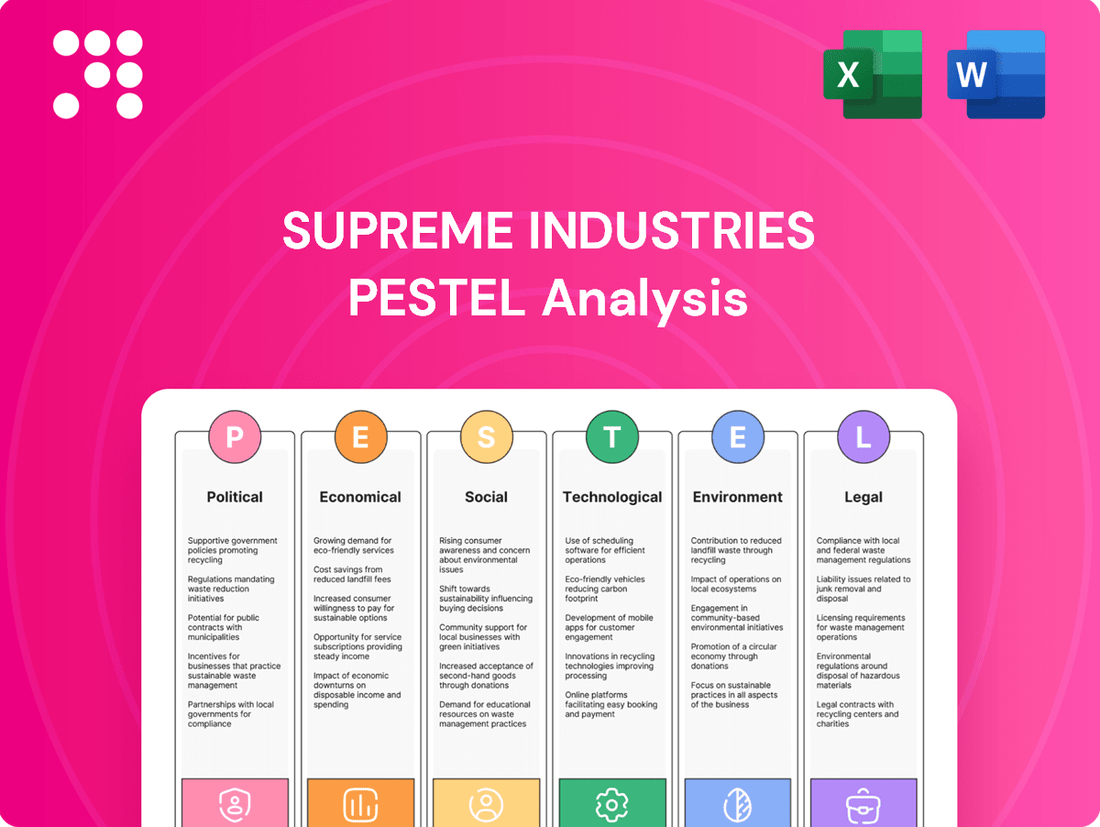

Supreme Industries PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of Supreme Industries provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping Supreme Industries' business landscape, enabling informed strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. It details key trends and potential challenges within each PESTLE category, offering a robust framework for understanding Supreme Industries' market position.

Sociological factors

India's urbanization is accelerating, with projections indicating that by 2030, 40% of the population will reside in urban areas. This demographic shift, coupled with a growing middle class and rising disposable incomes, is a significant tailwind for Supreme Industries. As more people move to cities and have more money to spend, the demand for packaged goods, home furnishings, and other plastic-based products that Supreme Industries manufactures is expected to surge.

The increasing purchasing power of Indian households is directly translating into higher consumption. For instance, the per capita income in India reached approximately $2,600 in 2024, a notable increase that allows consumers to spend more on non-essential items. This societal trend creates a larger addressable market for Supreme Industries' extensive product portfolio, from storage solutions to furniture and industrial components.

Consumers increasingly favor pre-packaged goods, a shift that directly boosts demand for Supreme Industries' plastic solutions. This preference, coupled with busier lifestyles, means more people are looking for convenient and sturdy plastic items for everyday use.

Supreme Industries' packaging and consumer products divisions are particularly affected by this trend. For example, the company's extensive range of storage containers and household items directly benefits from the move towards organized, ready-to-use products.

The company's 2023-2024 financial reports indicate a steady rise in sales for these segments, reflecting the growing consumer reliance on plastic for convenience. This necessitates continuous innovation in product design and material science to meet evolving consumer expectations for both functionality and sustainability.

Public awareness of environmental issues is surging, driving demand for sustainable and eco-friendly products. This trend directly impacts the plastics industry, pushing consumers and businesses alike to seek alternatives. For Supreme Industries, this translates to a growing market for biodegradable and recyclable plastic solutions, a shift that began gaining significant momentum in 2024 and is projected to accelerate through 2025.

This growing consciousness presents both a challenge and a substantial opportunity for Supreme Industries. The challenge lies in adapting existing product lines and manufacturing processes. However, the opportunity is significant: by investing in and developing innovative biodegradable and recyclable plastics, Supreme Industries can tap into a rapidly expanding market segment. For instance, the global bioplastics market was valued at approximately USD 11.5 billion in 2023 and is forecast to reach over USD 25 billion by 2030, indicating a strong growth trajectory that Supreme Industries can leverage.

Growth in Agriculture and Plumbing Sectors

The agriculture sector's expansion, supported by government programs like the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), is a significant driver for Supreme Industries. This growth necessitates efficient water management, directly increasing the demand for plastic pipes and fittings used in irrigation systems. In 2023-24, India's agricultural sector was projected to grow by 3.5%, highlighting the sustained need for these products.

Concurrently, ongoing advancements in plumbing and sanitation infrastructure across India are bolstering the demand for Supreme Industries' piping solutions. Government initiatives focused on improving urban and rural sanitation, such as the Swachh Bharat Mission, lead to increased construction and renovation activities. This trend is expected to continue, with the Indian plumbing market alone projected to reach $20 billion by 2025.

- Government Support for Agriculture: Initiatives like PMKSY are boosting irrigation, thus increasing demand for plastic pipes.

- Urbanization and Sanitation: Improvements in plumbing and sanitation infrastructure, driven by urban development, fuel sales of piping products.

- Market Growth Projections: The Indian plumbing market is anticipated to reach $20 billion by 2025, indicating strong future demand.

Employment Generation and Skill Development

The plastics industry in India is a substantial employer, providing livelihoods for a vast number of individuals, particularly within the micro, small, and medium-sized enterprises (MSMEs) that form the backbone of the sector. Supreme Industries, as a leading entity, plays a crucial role in this employment landscape.

As of recent data, the Indian plastics processing industry directly and indirectly employs over 4 million people. Supreme Industries, with its extensive operations, contributes significantly to this figure, creating numerous direct and indirect job opportunities across its manufacturing facilities and supply chain. The company's growth is intrinsically linked to its ability to foster a skilled workforce, aligning with national priorities for economic development.

Government initiatives focused on skill development within manufacturing sectors, including plastics, can directly benefit companies like Supreme Industries. These programs aim to enhance the capabilities of the workforce, leading to improved productivity and innovation. For example, programs under the Skill India Mission are designed to upskill and reskill individuals, ensuring the industry has access to trained personnel capable of operating advanced machinery and adopting new technologies.

- Employment Contribution: The plastics sector in India is a significant job creator, with MSMEs accounting for a large share of employment.

- Supreme Industries' Role: As a major player, Supreme Industries actively contributes to employment generation through its operations.

- Skill Development Synergy: Government skill development initiatives can enhance the workforce quality in the plastics industry, benefiting companies like Supreme Industries.

- Economic Impact: The company's employment generation and potential skill development alignment contribute to the broader economic growth of India.

The increasing focus on sustainability is a major sociological factor influencing Supreme Industries. Consumers are more aware of environmental impacts, driving demand for eco-friendly plastic alternatives. This trend, prominent in 2024 and expected to grow through 2025, presents both a challenge to adapt and a significant opportunity for companies that invest in biodegradable and recyclable materials.

The growing Indian middle class and rising disposable incomes, with per capita income reaching approximately $2,600 in 2024, are key drivers for Supreme Industries. This demographic shift fuels demand for consumer goods, home furnishings, and packaged products, expanding the market for the company's diverse plastic solutions.

Urbanization in India is accelerating, with projections of 40% of the population living in urban areas by 2030. This demographic change, combined with increased purchasing power, directly boosts demand for Supreme Industries' products, from storage solutions to furniture, as urban lifestyles often favor convenience and organized living.

The plastics processing industry is a substantial employer in India, supporting over 4 million jobs. Supreme Industries, as a major player, contributes significantly to this employment, aligning with national economic development goals and benefiting from government skill development initiatives aimed at enhancing the workforce.

Technological factors

Innovations in plastic manufacturing, like advanced blow molding and injection molding, are significantly boosting the global competitiveness of Indian plastic products. Supreme Industries can capitalize on these technological leaps to improve how efficiently they produce goods, the overall quality of their offerings, and their cost structure.

For instance, the Indian plastics processing industry, a key sector for Supreme Industries, saw a substantial growth rate, with projections indicating continued expansion driven by these very manufacturing advancements. This means Supreme Industries is well-positioned to benefit from improved output and potentially lower per-unit production costs in the 2024-2025 period.

The push for environmental responsibility is accelerating the creation of plastics that can be recycled, broken down naturally, or made from renewable sources. This trend presents a significant opportunity for companies like Supreme Industries to innovate.

Investing in research and development for these advanced materials allows Supreme Industries to align with shifting consumer preferences and stricter environmental regulations, potentially opening new market segments.

For instance, the global bioplastics market was valued at approximately $12.7 billion in 2023 and is projected to reach $31.8 billion by 2030, indicating a substantial growth trajectory driven by sustainability demands.

Supreme Industries leverages its technological prowess to drive product innovation, evident in its advanced piping systems and contemporary molded furniture. The company's commitment to R&D is crucial for developing these cutting-edge offerings.

Technological advancements allow Supreme Industries to continually diversify its product range. For instance, recent introductions include new bathroom fittings and updated almirah designs, reflecting an ongoing effort to capture evolving consumer preferences and market demands.

Adoption of Digital Technologies in Manufacturing

The manufacturing sector is increasingly embracing digital technologies like automation and AI. For plastic manufacturers such as Supreme Industries, this means faster production cycles, increased output, and a noticeable boost in product quality. These advancements are crucial for staying competitive.

Supreme Industries can leverage these digital tools to streamline its manufacturing processes. For instance, AI-powered quality control systems can identify defects with greater accuracy than manual inspections, leading to fewer rejected products. Automation can also reduce labor costs and improve worker safety.

The global industrial automation market was valued at approximately USD 85.6 billion in 2023 and is projected to reach USD 150.7 billion by 2030, demonstrating a significant trend towards digital adoption. Supreme Industries' investment in these areas could yield substantial operational efficiencies and market advantages.

- Increased Efficiency: Automation can reduce cycle times by up to 30% in certain plastic molding processes.

- Enhanced Quality Control: AI-driven visual inspection systems can detect micro-defects invisible to the human eye, potentially reducing scrap rates by 10-15%.

- Cost Reduction: Optimized energy consumption through smart manufacturing can lead to savings of 5-10% on utility bills.

Focus on Green Energy and Carbon Emission Reduction

Technological advancements are significantly reshaping industries, with a strong emphasis on green energy and carbon emission reduction. Companies worldwide are channeling substantial investments into renewable energy sources and low-carbon fuels to minimize their environmental impact.

Supreme Industries is actively participating in this shift through its dedicated 'Energy and Environment' vertical. This division is focused on enhancing the company's reliance on renewable energy, primarily through solar power installations and other clean energy strategies.

For instance, by the end of fiscal year 2023, Supreme Industries had achieved a notable increase in its solar power generation capacity, contributing to a reduction in its overall carbon footprint. This strategic focus aligns with global sustainability goals and anticipates future regulatory landscapes.

- Renewable Energy Investment: Companies globally are increasing investments in solar, wind, and other renewable sources.

- Low-Carbon Fuels: There's a growing trend towards adopting cleaner fuels to reduce emissions.

- Supreme Industries' Initiatives: The company's 'Energy and Environment' vertical spearheads solar power adoption and other green energy projects.

- Fiscal Year 2023 Impact: Supreme Industries saw a tangible increase in solar energy generation, aiding its environmental targets.

The integration of advanced manufacturing techniques, such as automation and AI, is a significant technological driver for Supreme Industries. These technologies promise to enhance production efficiency, improve product quality, and reduce operational costs, crucial for maintaining competitiveness in the 2024-2025 period.

The company's strategic investments in R&D for sustainable and recyclable materials are also vital, aligning with global environmental trends and consumer demand for eco-friendly products. This focus on green innovation is expected to open new market avenues.

Supreme Industries' commitment to leveraging technology is evident in its product diversification, with new offerings like updated almirah designs and advanced bathroom fittings reflecting its adaptability to market shifts.

The company's proactive adoption of renewable energy, particularly solar power through its 'Energy and Environment' vertical, demonstrates a forward-thinking approach to sustainability and cost management, which is increasingly important in the current business climate.

| Technology Area | Impact on Supreme Industries | Industry Trend (2024-2025 Focus) | Example Data/Metric |

|---|---|---|---|

| Advanced Manufacturing (AI/Automation) | Increased efficiency, enhanced quality control, cost reduction | Global industrial automation market projected to reach USD 150.7 billion by 2030 | Potential 10-15% reduction in scrap rates via AI inspection |

| Sustainable Materials | Product innovation, market expansion, regulatory compliance | Global bioplastics market projected to reach USD 31.8 billion by 2030 | Alignment with growing consumer preference for eco-friendly products |

| Digitalization & Data Analytics | Streamlined operations, predictive maintenance, optimized supply chains | Increased adoption of IoT and big data in manufacturing for real-time insights | Improved inventory management and reduced lead times |

| Renewable Energy Integration | Reduced carbon footprint, lower energy costs, enhanced corporate image | Growing investment in solar and wind energy globally | Increased solar power generation capacity by end of FY23 |

Legal factors

India's Plastic Waste Management Rules, with significant amendments expected in 2024 and 2025, are tightening controls on plastic producers, importers, and brand owners. These regulations include bans on specific single-use plastics and mandate minimum thickness for carry bags, impacting companies like Supreme Industries.

Compliance with these evolving rules, which also emphasize mandatory waste segregation, is crucial for Supreme Industries. Failure to adhere could result in penalties, affecting operational efficiency and market access.

The Extended Producer Responsibility (EPR) framework, a cornerstone of India's Plastic Waste Management (PWM) Rules, mandates that manufacturers like Supreme Industries bear responsibility for the environmentally sound disposal of their plastic products post-consumer use. This includes meeting specific recycling and reuse targets, with mandatory annual reporting to regulatory bodies. For the fiscal year ending March 31, 2024, Supreme Industries reported a significant volume of plastic products, necessitating proactive strategies to manage its EPR obligations effectively.

New regulations are coming into effect that will require specific labeling and certification for plastics intended to be compostable or biodegradable. Beginning in July 2025, plastic packaging must also include barcodes, QR codes, or unique identification numbers to ensure traceability throughout the supply chain. Supreme Industries will need to adjust its packaging and labeling procedures to meet these evolving legal mandates.

Environmental Protection Act and Penalties

The Environmental Protection Act of 1986 in India forms the bedrock of environmental regulation, with subsequent amendments significantly bolstering waste management mandates and escalating penalties for non-compliance. Supreme Industries, as a major player in plastic manufacturing, must navigate these evolving legal landscapes.

Failure to adhere to plastic waste management rules, such as those under the Plastic Waste Management Rules, 2016 (and subsequent amendments), can result in substantial financial penalties. For instance, violations can incur fines ranging from ₹5,000 to ₹1 lakh, with repeated offenses potentially leading to more severe consequences, including imprisonment.

- Stricter Waste Management: Amendments to the Environmental Protection Act, 1986, have introduced more rigorous requirements for waste handling and disposal.

- Increased Penalties: Non-compliance with environmental regulations, particularly concerning plastic waste, can lead to significant fines and other legal sanctions.

- Plastic Waste Management Rules: Supreme Industries must comply with specific rules governing the management and recycling of plastic waste, with penalties for violations.

- Enforcement Actions: Authorities can impose fines, cease-and-desist orders, and even criminal charges for persistent environmental breaches.

Regulations on Use of Recycled Content

Extended Producer Responsibility (EPR) guidelines are increasingly pushing for reduced virgin plastic consumption, which directly encourages the incorporation of recycled content. This regulatory trend signals a potential for future mandates and incentives favoring the use of recycled materials in manufacturing processes. Supreme Industries will likely need to adapt its material sourcing strategies and production workflows to comply with these evolving environmental requirements.

For instance, India's Plastic Waste Management Rules, 2016, as amended, mandate specific percentages of recycled plastic usage in certain applications. By mid-2024, companies are expected to demonstrate progress in meeting these targets, with potential penalties for non-compliance. Supreme Industries, a major player in plastic products, must proactively integrate recycled content into its product lines to navigate these regulations effectively.

- EPR Mandates: Increasing pressure to use recycled plastics in manufacturing.

- Regulatory Landscape: Potential for future laws and incentives favoring recycled materials.

- Operational Adjustments: Need for Supreme Industries to modify sourcing and production.

- Compliance Costs: Anticipating potential increases in costs related to recycled material procurement and processing.

Supreme Industries faces an evolving legal framework in India, particularly concerning plastic waste management. Amendments to the Environmental Protection Act, 1986, and the Plastic Waste Management Rules, 2016, are introducing stricter controls, including bans on certain single-use plastics and mandates for minimum carry bag thickness, effective from 2024 and 2025. The company must also navigate Extended Producer Responsibility (EPR) obligations, requiring them to manage post-consumer plastic waste and meet recycling targets, with penalties for non-compliance. Furthermore, new labeling and traceability requirements, such as barcodes and QR codes on packaging from July 2025, necessitate operational adjustments.

| Regulation | Key Provisions | Impact on Supreme Industries | Compliance Deadline |

|---|---|---|---|

| Plastic Waste Management Rules Amendments | Bans on specific single-use plastics, minimum thickness for carry bags | Product redesign, sourcing adjustments | Ongoing, with key changes in 2024-2025 |

| Extended Producer Responsibility (EPR) | Responsibility for post-consumer waste, recycling targets | Investment in waste management infrastructure, material innovation | Annual reporting; targets to be met progressively |

| Packaging & Labeling Rules | Mandatory traceability (barcodes/QR codes), compostable/biodegradable certification | Packaging redesign, integration of tracking systems | July 2025 for traceability |

Environmental factors

India grapples with substantial plastic waste, ranking among the world's top generators. Estimates suggest India generates around 3.5 million metric tons of plastic waste annually, with a significant portion remaining uncollected. This situation demands robust waste management systems, encompassing source segregation, efficient collection networks, and advanced recycling technologies.

As a leading plastic processor, Supreme Industries is intrinsically linked to these environmental challenges. The company's operations are directly influenced by the availability of recycled plastic feedstock and the evolving regulatory landscape around plastic use and disposal. Supreme Industries can play a crucial role in promoting circular economy principles by investing in recycling infrastructure and developing products made from recycled materials, thereby contributing to a more sustainable plastic waste management ecosystem.

India's increasing focus on a circular economy for plastics, as evidenced by initiatives like the Plastic Waste Management Rules, 2022, directly impacts companies like Supreme Industries. These regulations encourage greater reuse and recycling, with targets for extended producer responsibility. Supreme Industries' commitment to integrating recycled content and exploring biodegradable alternatives will be crucial for navigating this evolving regulatory landscape and ensuring long-term operational viability.

The plastics industry, a core sector for Supreme Industries, is inherently linked to greenhouse gas emissions. In 2023, the global plastics industry's carbon footprint was estimated to be around 1.5 billion metric tons of CO2 equivalent, highlighting the environmental challenges. Supreme Industries is proactively addressing this by investing in sustainability initiatives.

Supreme Industries is making tangible efforts to shrink its carbon footprint. This includes a significant push towards renewable energy sources, with plans to increase their share in the energy mix. Furthermore, the company is upgrading its power infrastructure and transitioning away from high-carbon fuels to lower-emission alternatives, demonstrating a commitment to environmental responsibility in its operations.

Water Management and Conservation

Water scarcity presents a significant environmental challenge, impacting industries globally. Supreme Industries acknowledges this growing concern and is committed to optimizing its water usage across manufacturing operations. The company is actively exploring and implementing water conservation strategies, including the integration of rainwater harvesting systems.

These efforts are crucial as water availability becomes increasingly unpredictable. For instance, in 2023, India faced monsoon deficits in several key regions, highlighting the need for proactive water management. Supreme Industries' focus on efficient water use not only addresses environmental responsibility but also mitigates operational risks associated with water shortages.

- Water Scarcity Impact: Increasing global concern over water availability affects industrial operations.

- Supreme Industries' Strategy: Focus on optimizing water usage and implementing conservation measures.

- Key Initiative: Exploration and implementation of rainwater harvesting systems.

- Operational Resilience: Proactive water management reduces risks linked to water shortages.

Sustainable Raw Material Sourcing

The push for sustainability is significantly impacting raw material sourcing, with a growing emphasis on eco-friendly alternatives to traditional plastics. Supreme Industries will likely need to investigate and incorporate these materials to align with evolving market expectations and regulatory requirements. For instance, by 2025, the global bioplastics market is projected to reach over $11.5 billion, highlighting the increasing demand for sustainable options.

This shift necessitates a strategic evaluation of Supreme Industries' supply chain. The company might need to invest in research and development for bio-based or recycled polymers. Failure to adapt could lead to competitive disadvantages as more environmentally conscious consumers and businesses opt for greener products. Recent reports indicate that over 60% of consumers are willing to pay more for sustainable packaging, a trend that is expected to accelerate.

Supreme Industries' response to this trend could involve:

- Developing partnerships with suppliers of recycled or bio-based polymers.

- Investing in new manufacturing processes to handle alternative materials.

- Launching product lines featuring sustainable raw materials to capture market share.

- Engaging in life cycle assessments of its products to identify areas for material improvement.

India's substantial plastic waste, estimated at 3.5 million metric tons annually, necessitates robust waste management. Supreme Industries, as a major plastic processor, is directly impacted by this, needing to integrate recycled feedstock and comply with evolving regulations like the Plastic Waste Management Rules, 2022, which promote extended producer responsibility and recycling targets.

The company's carbon footprint is also a key environmental consideration. In 2023, the global plastics industry emitted approximately 1.5 billion metric tons of CO2 equivalent. Supreme Industries is addressing this by increasing its use of renewable energy and transitioning to lower-emission fuels, aiming to reduce its environmental impact.

Water scarcity is another critical factor, with India experiencing monsoon deficits in 2023. Supreme Industries is implementing water conservation strategies, including rainwater harvesting, to ensure operational resilience against water shortages.

The growing demand for eco-friendly alternatives, with the bioplastics market projected to exceed $11.5 billion by 2025, requires Supreme Industries to adapt its raw material sourcing. Over 60% of consumers are willing to pay more for sustainable packaging, a trend that necessitates strategic evaluation of supply chains and potential investment in bio-based or recycled polymers.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Supreme Industries is built on a foundation of diverse and credible data sources. We draw from government reports, economic indicators, industry-specific publications, and reputable market research firms to ensure a comprehensive understanding of the macro-environmental factors influencing the company.