Supreme Industries Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Supreme Industries Bundle

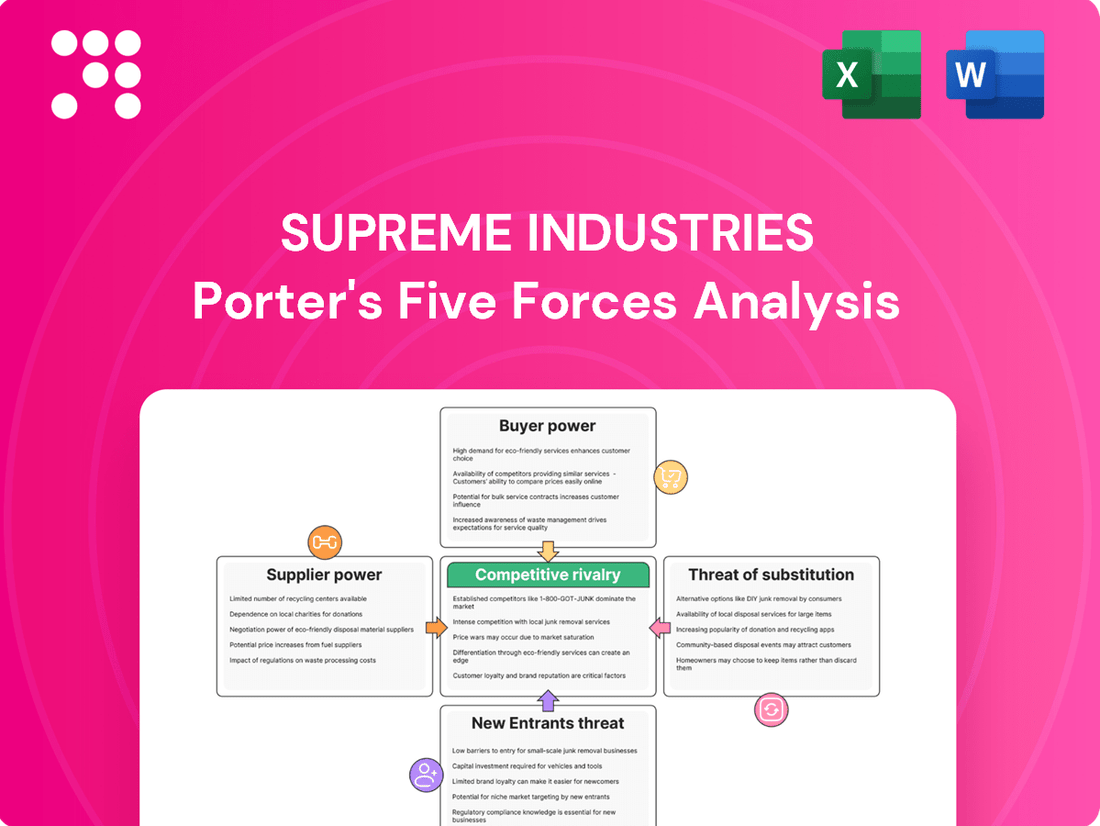

Supreme Industries navigates a competitive landscape shaped by moderate buyer power and the persistent threat of substitutes. Understanding the intensity of rivalry and the influence of suppliers is crucial for strategic positioning.

The complete report reveals the real forces shaping Supreme Industries ’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The Indian plastic manufacturing sector, which includes Supreme Industries, faces significant challenges due to the fluctuating costs of key raw materials like PVC, polyethylene, and polypropylene. These polymers are directly linked to crude oil prices, meaning any surge in oil costs immediately escalates manufacturing expenses.

This inherent volatility in raw material pricing, driven by global energy markets, empowers suppliers of these essential inputs. For instance, in 2024, global crude oil prices experienced notable swings, impacting the procurement costs for plastic manufacturers. This dependency allows raw material providers to exert considerable influence on pricing and supply terms.

Supreme Industries, like many Indian manufacturers, faces significant import dependence for key plastic raw materials. For instance, India imports a substantial amount of polymers such as PVC, LLDPE, HDPE, and polypropylene. These are often sourced from major petrochemical producing nations like the UAE, Russia, Iran, and Saudi Arabia.

This reliance on foreign suppliers inherently strengthens their bargaining power. Fluctuations in global commodity prices, currency exchange rates, and geopolitical events can directly impact Supreme Industries' input costs. For example, a strengthening US dollar against the Indian Rupee would make imported raw materials more expensive, directly affecting profitability.

Furthermore, trade policies and logistical challenges, such as shipping delays or increased freight costs, can also empower these international suppliers. Any disruptions in these supply chains can force Supreme Industries to accept less favorable terms or face production halts, underscoring the considerable leverage held by overseas raw material providers.

Limited domestic production of polymers in India, concentrated among a few major players, means Supreme Industries faces fewer supplier choices. This scarcity can empower these domestic suppliers, allowing them to potentially dictate terms and pricing more effectively. For instance, in 2023, India's polymer production, while growing, still relies on imports for certain specialized grades, further concentrating power among the few domestic manufacturers capable of supplying these.

Switching Costs for Supreme Industries

Switching suppliers for Supreme Industries, particularly for specialized plastic raw materials or established supply chains, could incur significant costs. These might include expenses for new quality assurance protocols, obtaining necessary certifications for alternative materials, and reconfiguring logistical operations. Such potential disruptions and associated expenses inherently grant suppliers a degree of bargaining power.

Supreme Industries actively works to reduce its reliance on a limited number of suppliers. By cultivating long-term contractual relationships, the company aims to secure more favorable terms and mitigate the risks associated with supplier dependency. This strategic approach helps to level the playing field and diminish the bargaining power of individual suppliers.

For instance, in 2024, Supreme Industries reported that its raw material costs, predominantly plastics, represented a substantial portion of its overall manufacturing expenses. While specific figures on switching costs aren't publicly detailed, the company's stated strategy of building robust supplier relationships underscores the importance of managing this aspect of its supply chain. This proactive stance is crucial for maintaining cost competitiveness and operational stability.

- Potential Switching Costs: Includes expenses for new certifications, quality assurance adjustments, and logistical reconfigurations when changing suppliers for specialized plastic raw materials.

- Supplier Power Mitigation: Supreme Industries aims to decrease dependency on a few suppliers by fostering long-term contractual relationships.

- Strategic Importance: Managing supplier relationships is critical for Supreme Industries to maintain cost competitiveness and operational stability in its manufacturing processes.

Supplier Concentration

Supplier concentration significantly impacts Supreme Industries' bargaining power. If a few dominant suppliers control key raw materials, such as specialized polymers or metal components, they can dictate terms and prices. This is especially potent if these suppliers are geographically clustered, limiting Supreme's options for sourcing.

For instance, in the plastics industry, which is crucial for Supreme Industries' diverse product portfolio, the availability and pricing of specific grades of polymers can be influenced by a handful of global manufacturers. Supreme Industries, like many in its sector, relies on these suppliers for consistent quality and volume. If these suppliers were to consolidate further, their leverage over Supreme would undoubtedly grow, potentially leading to increased input costs.

- Supplier Concentration: A limited number of suppliers for critical raw materials grants them greater leverage over Supreme Industries.

- Geographic Concentration: Suppliers clustered in specific regions can exert more control due to reduced accessibility for Supreme.

- Impact on Costs: Increased supplier power can translate to higher raw material prices for Supreme Industries, affecting profitability.

- Supply Chain Vulnerability: High concentration can make Supreme's supply chain more susceptible to disruptions or price shocks.

The bargaining power of suppliers for Supreme Industries is considerable, primarily due to the industry's reliance on a few key polymer raw materials. Fluctuations in global crude oil prices, the feedstock for these polymers, directly impact input costs. For example, in 2024, volatility in oil markets meant that Supreme Industries faced unpredictable procurement expenses for materials like PVC and polyethylene.

Supreme Industries' dependence on imported polymers from regions like the Middle East and Russia further amplifies supplier leverage. Geopolitical events and currency exchange rates, such as the USD/INR movement in 2024, can significantly alter the cost of these essential inputs. Limited domestic production of certain polymer grades also concentrates power among a few domestic players, forcing Supreme to contend with fewer sourcing options.

The potential costs associated with switching suppliers, including new certifications and logistical adjustments, create a barrier that strengthens existing supplier relationships. Supreme Industries actively mitigates this by fostering long-term contracts, aiming to secure stable pricing and supply, thereby managing the inherent power of its raw material providers.

| Factor | Impact on Supreme Industries | 2024 Relevance |

|---|---|---|

| Raw Material Price Volatility | Increases manufacturing costs | Linked to crude oil price swings |

| Import Dependence | Strengthens foreign supplier power | Currency fluctuations (USD/INR) impact costs |

| Supplier Concentration | Limits sourcing options, increases leverage | Few domestic producers for specialized grades |

| Switching Costs | Creates inertia, favors existing suppliers | Certifications, logistics adjustments |

What is included in the product

This analysis dissects Supreme Industries' competitive environment, examining the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes, and their impact on profitability.

Instantly understand strategic pressure with a powerful spider/radar chart for Supreme Industries' Porter's Five Forces.

Customers Bargaining Power

Supreme Industries serves a broad spectrum of industries, from industrial and infrastructure to consumer goods and packaging. This wide reach means no single customer segment dominates, diluting the collective bargaining power of buyers. For instance, while a large infrastructure project might involve substantial orders, these are offset by numerous smaller transactions across other sectors.

For highly standardized plastic products, such as basic pipes and fittings, customers often wield significant bargaining power. This is primarily because switching costs are low, and they can readily compare prices from various manufacturers. For instance, in 2024, the competitive landscape for commodity plastic pipes saw numerous players offering similar specifications, intensifying price sensitivity among buyers.

However, Supreme Industries actively mitigates this by emphasizing value-added products and maintaining a vast and diverse product catalog. With over 14,000 Stock Keeping Units (SKUs) specifically within its plastic piping segment alone, the company offers a breadth of specialized solutions that are not easily replicated. This extensive portfolio allows Supreme to cater to niche requirements and build customer loyalty beyond mere price considerations.

In segments where Supreme Industries' plastic products are viewed as commodities, customers tend to be highly price-sensitive. This sensitivity directly translates into increased bargaining power for these buyers, as they can more readily switch to competitors if prices rise. For instance, in 2023, the company’s operating profit margin stood at 14.1%, indicating a degree of pricing power, yet the inherent nature of commodity markets means this sensitivity is always a consideration.

Customer Loyalty and Brand Recognition

Supreme Industries, as India's largest plastic processor, benefits from significant brand recognition. This household name status fosters customer loyalty, making it harder for customers to switch to competitors without a perceived loss in quality or trust. For instance, in FY23, Supreme Industries reported a revenue of ₹23,162 crore, showcasing its substantial market presence and the ingrained trust customers place in its products.

This established brand equity effectively raises switching costs for consumers. When customers are loyal to Supreme Industries due to consistent product quality and ongoing innovation, they are less likely to explore alternative brands, even if those alternatives offer slightly lower prices. This loyalty directly diminishes the bargaining power of individual customers.

- Brand Strength: Supreme Industries' position as a market leader in India's plastic processing sector translates into high brand recognition and customer trust.

- Switching Costs: Building loyalty through quality and innovation increases the perceived cost for customers to switch to competitors, thereby reducing their bargaining power.

- Market Presence: With revenues reaching ₹23,162 crore in FY23, Supreme Industries demonstrates a commanding market presence that reinforces customer loyalty and reduces customer price sensitivity.

'Nal Se Jal' Scheme and Government Demand

The government's 'Nal Se Jal' scheme, aimed at providing tap water connections to every household, is a significant driver of demand for plastic piping solutions. This initiative, with substantial budgetary allocations, positions the government as a key customer for manufacturers like Supreme Industries. For instance, the scheme has projected an outlay of ₹3.60 lakh crore, creating a robust market for piping materials.

This large-scale government procurement grants the government considerable bargaining power. As a dominant buyer, it can leverage its volume to negotiate favorable pricing and terms, potentially impacting the profit margins of suppliers. This dynamic is particularly relevant for 2024, as the scheme continues to roll out its ambitious targets.

- Government as a major customer: The 'Nal Se Jal' scheme creates a concentrated demand for plastic pipes.

- Price negotiation leverage: The government's significant purchase volume allows for strong price negotiations.

- Impact on suppliers: This can lead to pressure on profit margins for companies like Supreme Industries.

- 2024 market dynamics: The ongoing implementation of the scheme in 2024 highlights this customer power.

While Supreme Industries benefits from broad market reach, certain customer segments, particularly those purchasing commodity plastic products, exhibit significant bargaining power. This is driven by low switching costs and easy price comparison, a dynamic amplified in 2024 by a competitive market for standardized pipes.

However, Supreme Industries' extensive product portfolio, boasting over 14,000 SKUs in its piping segment alone, allows it to cater to specialized needs, thereby reducing customer reliance on price alone. Furthermore, its strong brand equity, evidenced by FY23 revenues of ₹23,162 crore, fosters customer loyalty and raises perceived switching costs, diminishing individual buyer power.

| Customer Segment | Bargaining Power Factors | Supreme Industries' Mitigation Strategy |

|---|---|---|

| General Consumers/Small Businesses (Commodity Products) | Low switching costs, high price sensitivity | Emphasis on value-added products, broad SKU portfolio, brand loyalty |

| Large Infrastructure Projects (e.g., 'Nal Se Jal' Scheme) | High volume procurement, potential for price negotiation | Focus on quality and reliability, long-term partnerships |

Preview Before You Purchase

Supreme Industries Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the Supreme Industries' Porter's Five Forces analysis, thoroughly examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its competitive landscape.

The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This comprehensive analysis provides actionable insights into the market dynamics affecting Supreme Industries, equipping you with a deep understanding of its strategic positioning and potential challenges.

Rivalry Among Competitors

The Indian plastic manufacturing market, where Supreme Industries operates, is incredibly fragmented. This means there are many players, from big companies to small local workshops, all vying for business. This intense competition often puts pressure on prices, leading to thinner profit margins for everyone involved.

This highly competitive landscape means customer expectations are naturally high. With so many choices available, buyers expect quality products at competitive prices, and excellent service. Supreme Industries, like its peers, must constantly innovate and optimize to meet these demands in 2024.

Supreme Industries holds a strong position as a market leader in the plastic piping sector, estimated to command around 12% of the market share in FY2024. This leadership is further solidified by its volume growth, which has surpassed the overall industry's expansion rate.

However, the competitive intensity is notable, with players like Finolex Industries also maintaining a significant presence. This indicates a dynamic market where multiple established companies vie for market dominance.

Supreme Industries is notably expanding its production capabilities through both brownfield projects and new greenfield investments. For instance, the company has outlined plans to significantly boost its piping system capacities, a key segment for growth. This proactive expansion strategy signals a strong intent to capture a larger market share.

This aggressive capacity enhancement, including the potential acquisition of other businesses, directly fuels competitive rivalry. As Supreme Industries aims for market dominance, other players in the industry are compelled to respond with their own growth initiatives to avoid losing ground. This dynamic creates an environment where increased production capacity can lead to heightened competition.

For example, in the fiscal year 2023-24, Supreme Industries continued its strategic investments in capacity expansion across various product lines. While specific figures for Greenfield investments are often phased, the company's consistent capital expenditure in expanding its manufacturing footprint, particularly in the piping and packaging sectors, underscores this competitive drive.

Product Diversification and Value-Added Offerings

Supreme Industries boasts a highly diversified product range, serving sectors from construction to consumer goods, with a strategic emphasis on value-added offerings. This differentiation strategy, however, intensifies rivalry as competitors also pursue innovation in product development and feature enhancements. For instance, in 2023, the plastics industry saw significant R&D spending, with major players allocating substantial budgets to develop next-generation materials and smart solutions, directly impacting Supreme Industries' competitive landscape.

The drive for product diversification means that Supreme Industries faces intense competition not just on price but also on innovation and the ability to offer unique, value-added features. Competitors are actively investing in research and development to capture market share through superior product design and functionality. This necessitates continuous investment by Supreme Industries to maintain its edge.

- Diversified Portfolio: Supreme Industries' broad product range across multiple sectors provides a competitive advantage.

- Value-Added Focus: Emphasis on value-added products helps in differentiation.

- Innovation Rivalry: Competitors' investments in similar strategies fuel rivalry in innovation and product development.

- R&D Investment: Increased R&D spending in the plastics sector by competitors in 2023 highlights the competitive pressure on innovation.

Price Volatility of Raw Materials

Fluctuations in raw material prices, particularly for PVC, significantly impact the profitability of companies like Supreme Industries. These price swings can create substantial inventory gains or losses, directly affecting operating profit margins across the plastics industry. For instance, in early 2024, PVC prices experienced notable volatility, prompting adjustments in industry-wide strategies.

This inherent volatility often fuels aggressive pricing strategies as competitors battle for market share. Supreme Industries, for example, adjusted its volume guidance in response to PVC price volatility, highlighting the direct link between raw material costs and competitive maneuvering. The ability to manage these price fluctuations is a key determinant of sustained profitability.

- PVC Price Volatility: In the first half of 2024, PVC prices saw swings of up to 15% due to global supply chain disruptions and demand shifts.

- Impact on Margins: For Supreme Industries, a 10% increase in PVC costs can reduce EBITDA margins by approximately 2-3% if not passed on to customers.

- Competitive Response: Competitors often engage in price wars during periods of high raw material costs, forcing players like Supreme Industries to balance market share with profitability.

- Inventory Management: Effective inventory management strategies are crucial to mitigate losses from falling raw material prices, a challenge faced by all major plastic product manufacturers.

The competitive rivalry within India's plastic manufacturing sector is intense, driven by a fragmented market and significant players like Supreme Industries and Finolex Industries. Supreme Industries, holding approximately 12% market share in piping in FY2024, actively expands capacity, prompting rivals to respond with their own growth initiatives.

This capacity expansion, coupled with a focus on diversified, value-added products, intensifies competition not just on price but also on innovation. Competitors' R&D investments, like those seen in 2023, force Supreme Industries to continuously innovate to maintain its market position.

Raw material price volatility, particularly for PVC, further fuels aggressive pricing strategies as companies vie for market share. Supreme Industries' response to PVC price swings in early 2024, including volume guidance adjustments, highlights the direct link between cost management and competitive maneuvering.

| Competitor | Market Share (Piping, FY2024 est.) | Key Strategy |

|---|---|---|

| Supreme Industries | ~12% | Capacity expansion, product diversification, value-added focus |

| Finolex Industries | Significant presence | Maintaining market position, likely responding to competitive moves |

| Other Players | Fragmented | Price competition, regional focus, niche product development |

SSubstitutes Threaten

While plastics offer compelling benefits like superior corrosion resistance and simpler installation, traditional materials such as concrete, steel, and clay remain viable substitutes for plastic pipes and construction components. For instance, in 2024, the global concrete market was valued significantly, demonstrating its continued widespread use and acceptance in infrastructure projects.

These established materials can compete effectively, especially where their inherent strengths, like high compressive strength in concrete or structural integrity in steel, are paramount. Any advancements in the durability or cost-effectiveness of these traditional substitutes, or shifts in regulatory frameworks like updated building codes favoring them, could potentially diminish the market share of plastic alternatives.

The threat of substitutes for Supreme Industries' packaging products is a significant consideration. Alternatives like glass, metal, paper, and increasingly, biodegradable materials, offer different advantages. For instance, paper-based packaging is often perceived as more eco-friendly, and its market share has seen steady growth.

Environmental concerns are a key driver pushing consumers and businesses towards these substitutes. In 2023, the global market for sustainable packaging materials was valued at approximately $270 billion, with projections indicating continued expansion. This trend could directly impact Supreme Industries' market share in its packaging segment if it doesn't adapt to evolving consumer preferences for greener options.

Moulded furniture, a significant segment for Supreme Industries, faces potential substitution from traditional materials like wood and metal, as well as newer composite materials. For instance, while plastic furniture is often lauded for its cost-effectiveness and resilience, a growing consumer preference for natural aesthetics or a perceived higher quality associated with wood could drive demand towards timber-based options. This is particularly relevant as the global furniture market continues to evolve, with wood furniture sales projected to reach approximately USD 270 billion by 2025, indicating a substantial existing market for alternative materials.

Technological Advancements in Substitutes

Technological advancements are continuously fueling the development of substitute materials that could challenge Supreme Industries' existing product lines. For instance, ongoing research into bioplastics and advanced composites is creating alternatives with potentially superior performance characteristics or a reduced environmental footprint. This persistent innovation in material science represents a significant long-term threat, as these novel substitutes could offer compelling value propositions to customers, potentially eroding market share.

The threat of substitutes is amplified by the increasing accessibility and affordability of these emerging technologies. As R&D efforts mature, these advanced materials are becoming more viable for widespread adoption across various industries. Supreme Industries must remain vigilant and adaptable to these evolving material landscapes.

- Emerging Materials: Bioplastics and advanced composites are key areas of development, offering potential performance enhancements and sustainability benefits.

- Competitive Pressure: These substitutes could provide customers with more attractive options, impacting Supreme Industries' pricing power and market share.

- R&D Investment: Companies investing heavily in material science innovation are likely to bring disruptive substitutes to market, requiring proactive responses from established players.

Cost-Benefit Analysis of Substitutes

Customers weigh the cost-benefit of switching to substitutes, factoring in initial outlay, lifespan, upkeep, and specific needs. Supreme Industries' focus on providing affordable, long-lasting plastic products helps to lessen this risk.

For instance, in the furniture sector, while metal or wood might be alternatives, Supreme's plastic furniture often presents a lower price point and easier maintenance, appealing to budget-conscious consumers. In 2023, the global furniture market was valued at over $700 billion, with plastic furniture holding a significant, growing segment due to its versatility and cost-effectiveness.

- Cost Savings: Plastic alternatives often require less labor and fewer raw materials, leading to lower production costs passed on to consumers.

- Durability and Maintenance: Supreme's products are engineered for resilience, often outperforming traditional materials in terms of resistance to moisture and corrosion, and requiring minimal upkeep.

- Performance Characteristics: Specific applications might favor plastic's lightweight nature, electrical insulation properties, or moldability, making it the superior choice over substitutes.

The threat of substitutes for Supreme Industries is multifaceted, spanning pipes, packaging, and furniture. While plastic offers advantages, traditional materials like concrete and steel remain competitive in infrastructure, with the global concrete market valued significantly in 2024. In packaging, paper and biodegradable materials are gaining traction due to environmental concerns, with the sustainable packaging market valued at approximately $270 billion in 2023. For furniture, wood and metal are key substitutes, with wood furniture sales projected to reach USD 270 billion by 2025.

Technological advancements are also introducing new substitutes, such as bioplastics and advanced composites, which could offer superior performance or sustainability. These emerging materials are becoming more accessible, posing a long-term challenge. Supreme Industries mitigates this threat by focusing on cost-effectiveness and durability, as seen in its furniture segment where plastic options often present a lower price point and easier maintenance compared to wood or metal alternatives.

| Product Segment | Key Substitutes | Market Data Point (2023-2025) | Supreme's Competitive Advantage |

| Pipes & Construction | Concrete, Steel, Clay | Global concrete market valued significantly (2024) | Corrosion resistance, simpler installation |

| Packaging | Paper, Glass, Metal, Biodegradable | Sustainable packaging market ~$270 billion (2023) | Cost-effectiveness, durability |

| Furniture | Wood, Metal, Composites | Wood furniture sales projected ~$270 billion (by 2025) | Lower price point, easier maintenance |

Entrants Threaten

Entering the plastics processing industry, especially at the scale of Supreme Industries, necessitates a significant capital outlay. This includes substantial investments in advanced manufacturing machinery, robust infrastructure, and cutting-edge technology to compete effectively. For instance, establishing a plant comparable to Supreme's broad operational footprint could easily run into hundreds of crores of rupees, creating a formidable financial hurdle for potential newcomers.

Supreme Industries' significant advantage lies in its substantial economies of scale, driven by its extensive network of 30 manufacturing plants and high production volumes. This scale allows the company to spread fixed costs over a larger output, resulting in lower per-unit production costs. For instance, in fiscal year 2024, Supreme Industries reported a revenue of INR 22,500 crore, underscoring its massive operational footprint and the cost efficiencies derived from it.

New entrants face a considerable hurdle in matching Supreme Industries' cost structure. To achieve comparable per-unit costs, they would need to invest heavily in establishing a similarly large-scale manufacturing and distribution infrastructure. This capital requirement makes it challenging for smaller, less established players to compete effectively on price, thereby reducing the immediate threat of new entrants in the market.

Supreme Industries benefits from an established distribution network, boasting over 5,000 distributors across India. This extensive reach, coupled with its strong brand recognition as the nation's largest plastic manufacturer, presents a significant barrier for new entrants. Replicating this infrastructure and building equivalent customer trust would require substantial investment and time, making direct competition challenging.

Raw Material Sourcing and Supply Chain Expertise

The threat of new entrants regarding raw material sourcing for Supreme Industries is moderate. Establishing reliable and cost-effective raw material procurement, especially for polymers where India has import dependence, necessitates robust relationships with global suppliers and sophisticated supply chain management. New players would struggle to replicate Supreme Industries' established network and procurement expertise, potentially facing higher costs and supply uncertainties.

- Established Supplier Relationships: Supreme Industries benefits from long-standing ties with key global polymer suppliers, ensuring preferential pricing and consistent availability.

- Supply Chain Efficiency: Their advanced logistics and inventory management systems minimize raw material costs and lead times, a significant barrier for newcomers.

- Import Dependency Challenges: India's reliance on imported polymers means new entrants would face currency fluctuations and potential trade policy shifts impacting raw material costs, unlike Supreme Industries which has likely hedged or secured long-term contracts.

- Economies of Scale in Procurement: Supreme Industries' large-scale purchasing power allows for better negotiation leverage, a benefit not readily available to smaller, emerging competitors.

Regulatory and Environmental Hurdles

The plastics industry faces significant regulatory and environmental hurdles, acting as a formidable barrier to new entrants. Companies must navigate a complex web of national and international environmental standards, such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe, which dictates the safe use of chemicals and can impose substantial compliance costs. For instance, in 2024, the European Union continued to strengthen its regulations on plastic waste, including extended producer responsibility schemes, requiring new players to factor in significant upfront investment for waste management and recycling infrastructure.

New entrants would need to secure numerous permits and licenses, a process that can be lengthy and costly, especially when dealing with environmental impact assessments. Supreme Industries, like other established players, has invested heavily in ensuring compliance with evolving environmental laws, including those related to emissions and waste disposal. The need for substantial capital expenditure to meet these stringent requirements, often including investments in advanced, eco-friendly production technologies, deters many potential competitors from entering the market.

Furthermore, the increasing global focus on sustainability and the circular economy necessitates that new entrants build environmentally responsible practices into their core operations from day one. This includes designing products for recyclability and potentially investing in bio-based or recycled plastic feedstocks. By 2024, many markets saw a growing consumer preference for sustainable products, pushing companies to adopt greener manufacturing processes, a requirement that adds another layer of complexity and cost for those looking to enter the plastics sector.

- Environmental Regulations: Compliance with standards like REACH and evolving plastic waste directives (e.g., EU's focus on extended producer responsibility in 2024) increases operational costs for new entrants.

- Permitting and Licensing: Obtaining necessary environmental permits is a time-consuming and capital-intensive process, posing a significant entry barrier.

- Sustainability Investments: The demand for eco-friendly practices and materials necessitates upfront investment in sustainable technologies and supply chains, raising the cost of market entry.

The threat of new entrants for Supreme Industries is generally low due to significant capital requirements and established economies of scale. New players would need substantial investment to match Supreme's 30 manufacturing plants and INR 22,500 crore revenue in fiscal year 2024. This high cost of entry, coupled with Supreme's efficient, large-scale operations, makes it difficult for newcomers to compete on price.

Supreme Industries' extensive distribution network of over 5,000 distributors and strong brand recognition further acts as a barrier. Replicating this reach and customer trust demands considerable time and investment, effectively deterring many potential competitors from entering the market.

Regulatory and environmental compliance also presents a substantial challenge. New entrants must navigate complex regulations and invest in sustainable practices, adding significant upfront costs. For instance, by 2024, stricter environmental standards, like those concerning plastic waste, require new players to invest in specialized infrastructure, further raising the barrier to entry.

Porter's Five Forces Analysis Data Sources

Our Supreme Industries Porter's Five Forces analysis is built upon a robust foundation of data, including the company's annual reports, investor presentations, and filings with regulatory bodies like the Securities and Exchange Commission (SEC).

We supplement this internal data with insights from reputable industry research firms, market intelligence platforms, and macroeconomic databases to provide a comprehensive view of the competitive landscape.