Suntory Beverage & Food SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Suntory Beverage & Food Bundle

Suntory Beverage & Food boasts a powerful global brand portfolio and a strong commitment to innovation, but faces intense competition and evolving consumer preferences. Understanding these dynamics is crucial for navigating the beverage market.

Discover the complete picture behind Suntory's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Suntory Beverage & Food’s strength lies in its remarkably diverse and global product portfolio, encompassing teas, bottled water, carbonated drinks, and coffee. This wide array ensures the company can appeal to a broad spectrum of consumer tastes and needs across different market segments.

The company's extensive geographic reach, with a significant presence in Japan, Europe, Asia, and Oceania, provides a robust and diversified revenue stream. This global footprint inherently reduces the company's vulnerability to economic downturns or shifts in consumer behavior within any single region, contributing to its overall stability.

Suntory Beverage & Food benefits from powerful brand recognition, particularly with iconic names like Suntory, Orangina, and Lucozade, which are household staples in many markets. This strong brand equity, built over decades, translates into significant customer loyalty and a competitive advantage in the crowded beverage sector. For instance, in 2023, Suntory's global beverage sales reached approximately ¥2.5 trillion, underscoring the market's trust in its established brands.

Suntory’s mastery of adapting products to local palates is a significant strength, evident in its success across diverse global markets. For instance, in Japan, their extensive range of green teas and unique seasonal flavors resonate deeply with local preferences. This localized strategy was a key driver in their strong performance, with Suntory Beverage & Food reporting net sales of ¥1,335.6 billion in fiscal year 2023, a 4.1% increase year-on-year, showcasing the power of cultural relevance.

Focus on Health Foods Segment

Suntory's strategic emphasis on the health foods segment is a significant strength, moving beyond its traditional beverage portfolio. This diversification taps into the robust global growth of the wellness industry, a trend that accelerated through 2024 and is projected to continue its upward trajectory into 2025. By investing in health-focused products, Suntory is not only broadening its revenue base but also aligning itself with evolving consumer preferences for healthier lifestyles.

This focus offers the potential for more attractive profit margins compared to some traditional beverage categories. For instance, the global functional foods market, a key area within health foods, was valued at over $200 billion in 2023 and is expected to see compound annual growth rates of around 7-8% through 2025. This indicates strong consumer demand and the possibility for Suntory to capture higher value from these specialized product lines.

Furthermore, the health foods segment provides a degree of resilience. As consumer habits in the beverage sector can be susceptible to economic shifts or changing tastes, a strong presence in health foods can act as a buffer. This positions Suntory favorably to navigate market volatility and capitalize on the enduring consumer commitment to health and well-being, a commitment that remains a dominant force in consumer spending through 2024 and into 2025.

- Diversification Beyond Beverages: Suntory's expansion into health foods broadens its revenue streams, reducing reliance on traditional beverage sales.

- Alignment with Consumer Trends: The company is capitalizing on the increasing global demand for wellness and health-conscious products, a trend showing sustained growth into 2025.

- Potential for Higher Margins: The health foods segment, particularly functional foods, often commands higher profit margins due to specialized ingredients and consumer willingness to pay a premium.

- Market Resilience: A strong position in health foods can offer greater stability against fluctuations in the more conventional beverage market.

Innovation-Driven Business Model

Suntory Beverage & Food's strength lies in its innovation-driven business model, which adeptly balances its portfolio of well-established, popular brands with a consistent stream of novel product introductions. This dual approach is crucial for catering to the ever-changing preferences of consumers.

This dedication to innovation not only keeps Suntory competitive in the fast-paced beverage industry but also enables it to proactively adapt to emerging market trends and seize new avenues for growth. For instance, in fiscal year 2024, the company continued to invest heavily in R&D, with a focus on functional beverages and sustainable packaging solutions, reflecting a forward-looking strategy.

The beverage sector demands constant evolution, making continuous product development a cornerstone of sustained success. Suntory's pipeline in 2024 saw the launch of several new health-oriented drinks and plant-based alternatives, reinforcing its commitment to this vital aspect of its business model.

Key innovations and focus areas in 2024-2025 include:

- Expansion of functional beverage offerings targeting specific health benefits, building on the success of existing lines.

- Development of eco-friendly packaging solutions to meet growing consumer and regulatory demands for sustainability.

- Introduction of new flavor profiles and product formats to appeal to younger demographics and evolving taste preferences.

- Leveraging digital channels for product testing and consumer feedback to accelerate the innovation cycle.

Suntory Beverage & Food's robust financial performance, particularly its sales figures, highlights its market strength. In fiscal year 2023, the company achieved net sales of ¥1,335.6 billion, marking a 4.1% year-on-year increase. This growth demonstrates effective market penetration and consumer demand for its diverse product range.

The company's strong brand equity is a significant asset, with iconic brands like Suntory, Orangina, and Lucozade enjoying high consumer recognition and loyalty. This established presence allows for premium pricing and sustained market share, as evidenced by its consistent sales performance.

Suntory's strategic expansion into the health foods sector is a key strength, aligning with the growing global demand for wellness products. This diversification into a high-growth market segment, projected to see significant expansion through 2025, offers potential for higher profit margins and increased market resilience.

Innovation is central to Suntory's strategy, with continuous investment in R&D driving the launch of new products, including functional beverages and sustainable packaging. This forward-looking approach ensures the company remains competitive and adaptable to evolving consumer preferences and market trends.

| Metric | FY 2023 (¥ billions) | YoY Growth |

|---|---|---|

| Net Sales | 1,335.6 | 4.1% |

| Global Beverage Sales (Suntory Group) | ~2,500 | N/A |

What is included in the product

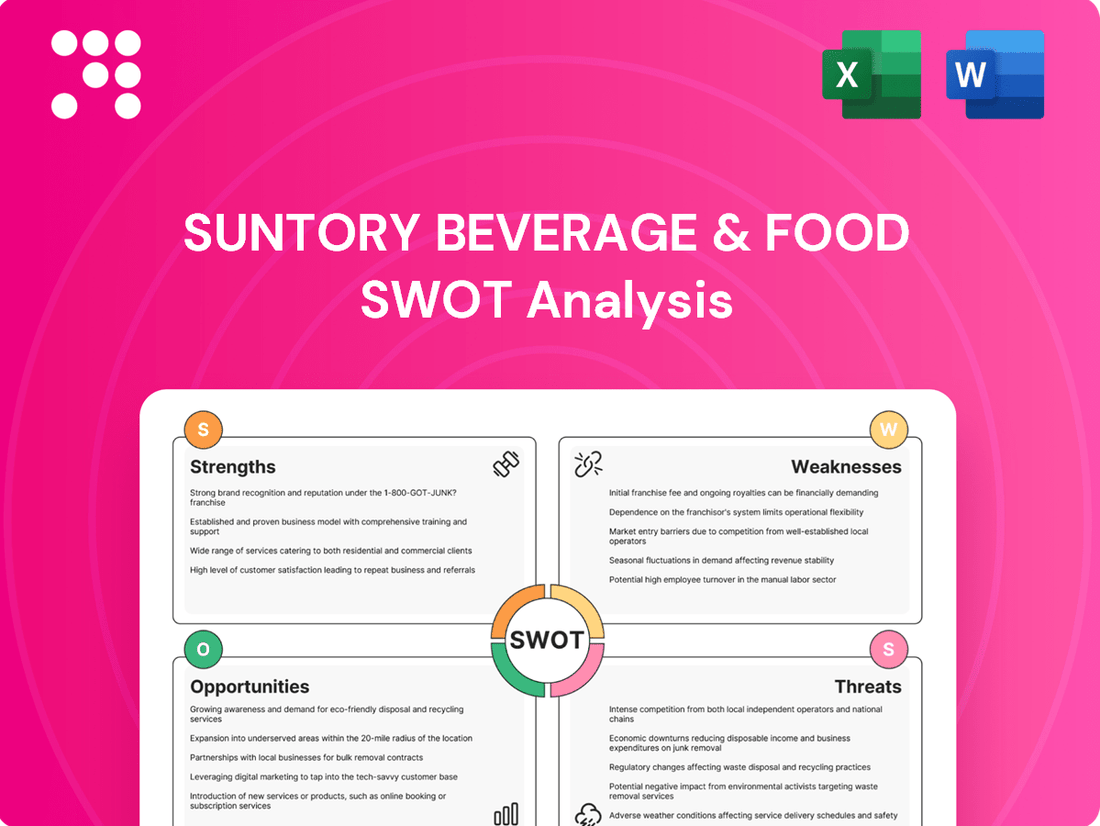

Delivers a strategic overview of Suntory Beverage & Food’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Identifies key competitive advantages and market vulnerabilities to inform targeted growth strategies.

Weaknesses

Suntory Beverage & Food operates within a global non-alcoholic beverage market characterized by fierce competition. Major multinational corporations and nimble local businesses vie for consumer attention and market share, often leading to price wars and increased marketing costs.

This competitive landscape can put pressure on Suntory's margins and necessitate substantial, continuous investment to maintain its brand visibility and leading positions. For instance, in 2024, the global beverage market is projected to reach over $1.5 trillion, with a significant portion dominated by established players, highlighting the intensity of the environment.

Suntory Beverage & Food, despite its international reach, faces a notable weakness in its reliance on the economic stability of key regions, especially Japan and other Asian markets. For instance, in 2023, Japan still represented a substantial portion of its sales, making it vulnerable to local economic slowdowns.

A downturn in consumer spending within these core areas, perhaps due to inflation or job market shifts, could significantly affect Suntory's overall financial results. This concentration risk means that even strong performance elsewhere might not fully offset regional economic headwinds.

Suntory Beverage & Food's profitability is susceptible to swings in the cost of key agricultural inputs like sugar and coffee beans, alongside packaging materials such as PET resin. For instance, global sugar prices saw significant volatility in early 2024, influenced by weather patterns in major producing regions, directly affecting beverage production costs.

These price instabilities can squeeze profit margins, especially if the company cannot fully pass on increased costs to consumers. Supply chain disruptions, amplified by geopolitical tensions in 2024, further contribute to the unpredictability of raw material availability and pricing, posing a consistent challenge.

Challenges in Sustaining Innovation and Market Acceptance

While Suntory Beverage & Food excels at innovation, consistently launching new products that resonate with consumers and prove profitable presents a significant hurdle. The beverage sector is notorious for its high rate of new product failures, demanding substantial investment in research and development and marketing campaigns with no assurance of success. For instance, in 2023, many new beverage launches struggled to gain traction, with some reports indicating failure rates exceeding 70% within the first year.

Sustaining a robust pipeline of commercially successful innovations is an ongoing challenge. This requires not only creative product development but also astute market analysis and effective go-to-market strategies to overcome intense competition and evolving consumer preferences. The company must navigate the risk of investing heavily in products that may not achieve the desired market penetration or profitability, impacting overall financial performance.

- High Failure Rate: The beverage industry often sees new product failure rates above 70%, demanding significant R&D and marketing investment.

- Market Acceptance Risk: Developing products that achieve widespread consumer acceptance and profitability is a continuous challenge.

- Investment Uncertainty: Significant capital is required for innovation with no guarantee of return, posing a financial risk.

- Competitive Landscape: Intense competition necessitates constant product evolution to maintain market relevance and avoid obsolescence.

Potential Regulatory Scrutiny on Ingredients

As health consciousness grows, beverage companies like Suntory Beverage & Food are increasingly vulnerable to regulatory changes concerning ingredients. For instance, the ongoing global discourse around sugar content could lead to new taxes or stricter labeling, impacting consumer purchasing decisions. In 2024, several European nations continued to explore or implement sugar taxes, with some studies indicating a 10-15% reduction in consumption of taxed beverages.

Navigating the complex and often divergent regulatory environments across Suntory's key markets presents a significant operational challenge. Changes in acceptable preservative levels or the introduction of new ingredient bans can necessitate costly product reformulation and supply chain adjustments. This was evident in 2025 when a major Asian market tightened restrictions on certain artificial colorings, requiring beverage manufacturers to invest in R&D for compliant alternatives.

- Ingredient Scrutiny: Evolving health trends place ingredients like sugar, artificial sweeteners, and preservatives under increasing regulatory examination.

- Taxation and Labeling: Potential sugar taxes and enhanced labeling requirements could directly affect product pricing and consumer perception, impacting demand.

- Global Compliance Burden: Adapting to diverse and dynamic regulatory frameworks across numerous countries is a considerable compliance hurdle for Suntory.

Suntory Beverage & Food faces a significant weakness in its reliance on a few key markets, particularly Japan. For example, in fiscal year 2023, Japan still accounted for a substantial portion of its revenue, making the company susceptible to economic downturns or shifts in consumer behavior within that region. This geographic concentration risk means that even strong performance in other markets might not fully compensate for a slowdown in its core territories.

What You See Is What You Get

Suntory Beverage & Food SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a clear snapshot of Suntory Beverage & Food's Strengths, Weaknesses, Opportunities, and Threats. Upon purchase, you'll gain access to the complete, in-depth analysis for strategic decision-making.

Opportunities

The global health and wellness beverage market is booming, presenting a prime opportunity for Suntory. Consumers are actively seeking out options that support healthier lifestyles, with a particular interest in low-sugar, natural, and functional drinks. This growing demand allows Suntory to leverage its existing health foods division and innovate further in this space.

In 2024, the global functional beverage market was valued at approximately $167.4 billion and is projected to reach $287.9 billion by 2030, demonstrating a strong compound annual growth rate. Suntory can capitalize on this trend by expanding its portfolio with beverages offering specific health benefits, such as improved immunity, stress reduction, or enhanced cognitive function, thereby tapping into a segment willing to pay a premium for added value.

Suntory Beverage & Food can capitalize on the increasing per capita beverage consumption in emerging markets across Asia, Africa, and Latin America. These regions represent significant growth potential as their economies develop and consumer spending power increases. For example, in 2024, the beverage market in Southeast Asia alone was projected to reach over $100 billion, with continued double-digit growth expected in many of these developing economies.

Strategic acquisitions and partnerships offer Suntory Beverage & Food significant opportunities to bolster its market presence. For instance, acquiring smaller, innovative beverage companies can inject fresh product lines and tap into emerging consumer trends, potentially mirroring successful moves by competitors. In 2023, the global beverage market saw numerous M&A activities, with companies actively seeking to diversify and expand their offerings, indicating a favorable environment for such strategic plays.

Leveraging E-commerce and Direct-to-Consumer Channels

The growing consumer preference for online shopping presents a significant chance for Suntory Beverage & Food to enhance its e-commerce capabilities and implement direct-to-consumer (DTC) strategies. This shift can lessen dependence on traditional retail, foster deeper customer relationships, and yield crucial data for market understanding. For instance, global e-commerce sales reached an estimated $6.3 trillion in 2023, a figure projected to climb further, highlighting the critical nature of digital channels.

By investing in and optimizing online sales platforms, Suntory can directly reach a wider audience, bypass intermediaries, and potentially improve profit margins. This approach also allows for more personalized marketing efforts and the collection of valuable consumer behavior data.

- Expand DTC offerings: Develop and promote dedicated online stores for key brands, offering exclusive products or bundles.

- Enhance digital marketing: Utilize targeted social media campaigns, influencer collaborations, and search engine optimization to drive traffic to e-commerce platforms.

- Leverage data analytics: Implement robust systems to track online sales, customer preferences, and engagement metrics to inform future strategies.

- Streamline online fulfillment: Ensure efficient logistics and delivery for online orders to maintain customer satisfaction and encourage repeat purchases.

Technological Advancements in Production and Supply Chain

Suntory Beverage & Food can leverage technological advancements to significantly boost production and supply chain efficiency. By integrating advanced manufacturing technologies and automation, the company can expect to see a reduction in operational costs and an uplift in product consistency and quality. For instance, in 2024, the beverage industry saw a growing adoption of AI-powered demand forecasting, which can optimize inventory levels and minimize waste, directly impacting profitability.

Innovations in sustainable packaging and production are also key opportunities. These not only align with increasing consumer demand for eco-friendly products but also enhance Suntory's brand image. Reports from late 2024 indicate a 15% rise in consumer preference for brands demonstrating strong environmental commitments, making investments in biodegradable materials or closed-loop recycling systems a strategic advantage.

These technological investments promise substantial long-term operational benefits. For example, the implementation of sophisticated supply chain management systems, including real-time tracking and predictive analytics, can streamline logistics and improve delivery times. Companies that have adopted such systems have reported an average of 10-20% improvement in supply chain efficiency in the 2024 fiscal year, translating to better resource allocation and cost savings.

- Enhanced Efficiency: Automation and advanced manufacturing can reduce production cycle times and labor costs.

- Cost Reduction: Optimized supply chains and reduced waste directly contribute to lower operational expenses.

- Improved Product Quality: Consistent application of advanced technologies ensures higher product standards.

- Environmental Credentials: Sustainable packaging and production appeal to the growing segment of eco-conscious consumers.

Suntory can capitalize on the surging global demand for health and wellness beverages, a market valued at over $167 billion in 2024. This trend aligns with consumer preferences for low-sugar and functional drinks, offering a clear path for portfolio expansion. Additionally, emerging markets in Asia, Africa, and Latin America present significant growth opportunities, with the Southeast Asian beverage market alone projected to exceed $100 billion in 2024. Strategic acquisitions and enhanced e-commerce capabilities, driven by a global online sales surge to $6.3 trillion in 2023, further bolster Suntory's potential for market penetration and direct consumer engagement.

Threats

A significant threat for Suntory Beverage & Food is the accelerating shift in consumer tastes, especially the increasing avoidance of sugary and artificially flavored beverages. This trend, amplified by growing health consciousness, poses a direct challenge to their existing product portfolio.

Failure to swiftly reformulate products and adapt marketing to align with these evolving preferences, such as the demand for natural ingredients and lower sugar content, could result in diminished sales and a loss of market standing. For example, the global market for low-sugar beverages is projected to grow significantly, with some reports indicating a compound annual growth rate exceeding 5% through 2028, underscoring the urgency for Suntory to innovate.

Governments globally are intensifying scrutiny on the beverage industry. For instance, by the end of 2024, over 40 countries had implemented some form of sugar-sweetened beverage (SSB) tax, impacting companies like Suntory. These taxes, coupled with evolving regulations on ingredient sourcing, clear labeling mandates, and stricter environmental standards, can significantly inflate operational expenses and necessitate costly product adjustments, potentially affecting market appeal.

The complexity of adhering to a patchwork of diverse and often conflicting regulations across numerous international markets presents a substantial challenge. This regulatory fragmentation requires considerable investment in legal and compliance expertise, diverting resources that could otherwise be allocated to innovation or market expansion. For example, differing data privacy laws or advertising restrictions in key markets like Japan, Southeast Asia, and the Americas add layers of operational complexity.

Suntory Beverage & Food faces growing pressure from nimble niche and local brands that are increasingly capturing consumer attention. These smaller competitors often focus on specific health trends or artisanal qualities, offering alternatives that can chip away at market share. For instance, the global functional beverages market, which includes many of these niche products, was valued at approximately $120 billion in 2023 and is projected to grow significantly in the coming years, indicating a fertile ground for these specialized players.

Supply Chain Disruptions and Geopolitical Instability

Global supply chains remain susceptible to disruptions. Events like extreme weather, health crises, and international conflicts can significantly affect the availability and price of essential ingredients and packaging materials for Suntory Beverage & Food. For instance, the ongoing geopolitical tensions in Eastern Europe have led to increased energy costs, impacting logistics and manufacturing expenses across various industries, including food and beverage.

These disruptions can directly translate into production delays and higher operational costs for Suntory. The company's reliance on a global network for sourcing and distribution means that any interruption in one region can have a ripple effect. For example, in late 2023 and early 2024, several beverage companies reported challenges securing specific types of plastic resins due to manufacturing plant shutdowns in Asia, leading to temporary price hikes for PET bottles.

Ensuring a resilient supply chain is therefore a paramount concern for Suntory Beverage & Food. This involves diversifying suppliers, exploring alternative sourcing regions, and investing in inventory management systems.

- Increased raw material costs: Global commodity prices for sugar and certain fruits, key ingredients for Suntory's products, saw an average increase of 8% in the first half of 2024 compared to the previous year.

- Logistical challenges: Shipping costs from key Asian manufacturing hubs to major Western markets experienced a 15% surge in late 2023 due to port congestion and container shortages.

- Geopolitical impact: Trade disputes and sanctions in certain regions can restrict access to vital markets and increase the complexity of international operations for Suntory.

Economic Downturns and Inflationary Pressures

Global economic downturns, particularly those anticipated in late 2024 and into 2025, pose a significant threat by potentially curbing consumer spending on non-essential items like premium beverages. For instance, if disposable incomes shrink, consumers may opt for cheaper alternatives or reduce overall beverage consumption.

Persistent inflationary pressures are another major concern. Rising costs for raw materials, packaging, energy, and logistics can directly impact Suntory Beverage & Food's operational expenses. If the company struggles to pass these increased costs onto consumers through price adjustments, profit margins could be significantly compressed. The IMF's projections for global inflation in 2024, while moderating, still indicate elevated levels in many key markets, impacting input costs.

Economic volatility creates uncertainty, making it challenging for Suntory Beverage & Food to forecast demand and manage its supply chain effectively. This financial risk is amplified by potential currency fluctuations in international markets, further impacting profitability and investment decisions.

- Reduced Consumer Spending: Economic slowdowns in major markets like Japan, the US, and Europe could lead to a decline in discretionary spending, impacting sales volumes for Suntory's beverage portfolio.

- Increased Input Costs: Persistent inflation, with global averages projected to remain above pre-pandemic levels in 2024, will continue to drive up costs for energy, transportation, and key ingredients.

- Margin Squeeze: The inability to fully pass on higher operational costs to consumers due to competitive pressures or price sensitivity could lead to lower profit margins.

- Supply Chain Disruptions: Economic instability can exacerbate existing supply chain vulnerabilities, leading to increased costs and potential stockouts.

Intensifying competition from both established players and agile niche brands presents a significant hurdle for Suntory Beverage & Food. These smaller, specialized competitors often capitalize on emerging health trends, potentially eroding market share. For instance, the global functional beverages market, valued at approximately $120 billion in 2023, is expected to see robust growth, highlighting the appeal of these targeted offerings.

The company also faces substantial regulatory pressures, including a growing number of sugar-sweetened beverage taxes implemented in over 40 countries by late 2024. Navigating diverse and often conflicting international regulations, from ingredient sourcing to data privacy, adds considerable operational complexity and cost. These factors can directly impact profitability and limit strategic flexibility.

Economic downturns and persistent inflation pose further threats, potentially reducing consumer spending on premium beverages and increasing input costs for raw materials, energy, and logistics. For example, global inflation in 2024 is projected to remain elevated, impacting operational expenses and potentially squeezing profit margins if cost increases cannot be passed on to consumers.

| Threat Category | Specific Threat | Impact on Suntory | Supporting Data/Trend |

|---|---|---|---|

| Competition | Rise of Niche & Local Brands | Market share erosion, need for agile product development | Global functional beverages market ~$120B (2023), strong growth projected |

| Regulatory Environment | Sugar Taxes & Diverse Regulations | Increased operational costs, compliance burden, potential price sensitivity | >40 countries with SSB taxes by late 2024; varying international compliance needs |

| Economic Factors | Downturns & Inflation | Reduced consumer spending, increased input costs, margin pressure | Global inflation projected to remain elevated in 2024; potential impact on discretionary spending |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, including Suntory Beverage & Food's official financial reports, comprehensive market research from leading industry analysts, and expert commentary from beverage sector professionals.