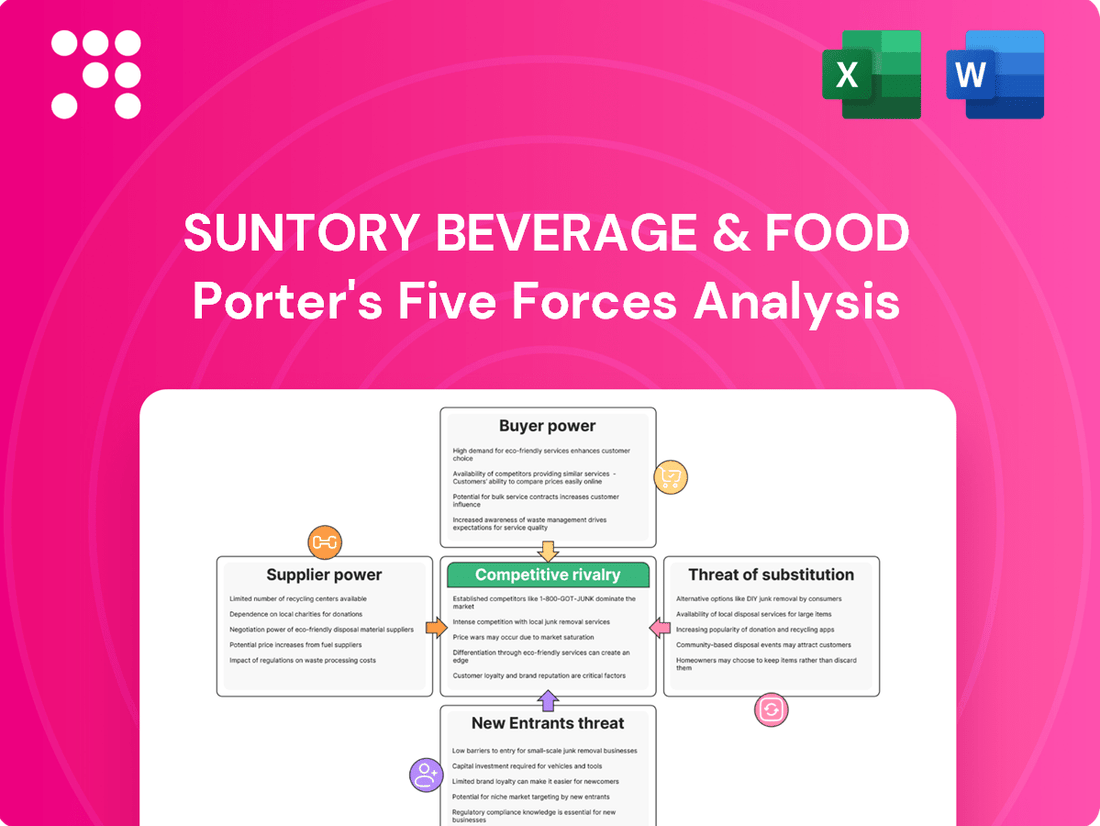

Suntory Beverage & Food Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Suntory Beverage & Food Bundle

Suntory Beverage & Food navigates a dynamic beverage landscape, facing moderate threats from new entrants and intense rivalry among established players. Buyer power is significant, especially for large retailers, while supplier power remains relatively low due to the commoditized nature of many ingredients.

The complete report reveals the real forces shaping Suntory Beverage & Food’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suntory Beverage & Food, like many in its industry, navigates the challenge of fluctuating raw material costs. Key ingredients such as sugar, coffee beans, and tea leaves are subject to global market volatility. For instance, in 2024, global inflation and ongoing supply chain issues have demonstrably driven up the cost of agricultural commodities, directly impacting input expenses for beverage producers.

The bargaining power of suppliers is amplified when these cost increases can be readily passed on to companies like Suntory. Without robust long-term supply contracts or diversified sourcing strategies, Suntory's profit margins are vulnerable to these supplier-driven price hikes, a risk that became particularly apparent throughout 2024.

The availability and pricing of essential packaging materials like PET plastic and glass bottles significantly impact Suntory Beverage & Food due to their widespread use. Suntory's commitment to increasing recycled content, reaching 47% in 2024 with a goal of 50% by the end of 2025, could empower specialized sustainable material suppliers.

Water is a critical input for Suntory Beverage & Food, directly impacting production and product quality. The availability of high-quality, sustainable water sources is paramount, and any disruption can significantly affect operations.

Global water scarcity and growing environmental awareness can increase the bargaining power of water suppliers, whether they are utility companies or landowners, particularly in areas where Suntory has a significant manufacturing presence. For instance, in 2023, several regions faced heightened water stress, impacting industrial water availability.

Suntory's proactive approach includes a commitment to reducing its global water usage by 35% by 2030, a strategy designed to lessen its reliance on external water sources and mitigate the associated risks from powerful suppliers.

Specialized Ingredient Providers

Suntory Beverage & Food might face significant bargaining power from specialized ingredient providers, especially for its innovative and health-focused product lines. For instance, functional beverages incorporating adaptogens, probiotics, or novel flavors often depend on a select group of suppliers who possess unique intellectual property or a dominant market share, making direct substitutions difficult.

The increasing consumer demand for functional beverages, a trend projected to continue strongly through 2024 and into 2025, amplifies this dependency. This reliance means these specialized suppliers can command higher prices or more favorable terms.

- Limited Substitutability: Suppliers of unique functional ingredients, like specific strains of probiotics or patented adaptogenic compounds, offer little room for Suntory to switch providers without compromising product efficacy or innovation.

- Intellectual Property: Suppliers holding patents or proprietary production methods for key ingredients gain leverage, as Suntory cannot easily replicate these components.

- Market Trends: The booming functional beverage market, with global sales expected to reach over $200 billion by 2025, increases the strategic importance of these specialized suppliers, enhancing their negotiating position.

- Concentration of Supply: If only a few companies globally produce a critical ingredient, Suntory's options are severely restricted, granting those suppliers considerable bargaining power.

Logistics and Distribution Services

The bargaining power of suppliers in logistics and distribution is a critical factor for Suntory Beverage & Food. Efficient and reliable services are essential across its global footprint, including Japan, Europe, Asia, and Oceania. Suppliers of transportation, warehousing, and specialized cold chain services wield significant influence, especially in areas with developing infrastructure or robust demand.

In 2024, the global logistics landscape faced ongoing volatility. For instance, shipping costs saw fluctuations, with the Drewry World Container Index experiencing periods of increase due to factors like port congestion and demand shifts. This volatility directly impacts Suntory’s operational costs and supply chain reliability, giving logistics providers more leverage.

- Increased Shipping Costs: Global container shipping rates, a key indicator of logistics expenses, remained a concern throughout 2024. For example, some routes saw year-on-year increases in freight rates, impacting Suntory's cost of goods sold.

- Supply Chain Disruptions: Geopolitical events and weather patterns in 2024 continued to pose risks to global supply chains, potentially limiting the number of available logistics partners and strengthening the position of those who could guarantee consistent service.

- Demand for Cold Chain: The growing demand for temperature-sensitive beverage products necessitates specialized cold chain logistics, a segment where suppliers with advanced capabilities can command higher prices and terms.

- Fuel Price Volatility: Fluctuations in global fuel prices in 2024 directly affect transportation costs, providing suppliers with a basis to negotiate higher rates with clients like Suntory.

The bargaining power of suppliers for Suntory Beverage & Food is influenced by the concentration of key ingredient providers and the demand for specialized components. For instance, the functional beverage market's growth, projected to exceed $200 billion by 2025, elevates the importance of suppliers offering unique adaptogens or probiotics, giving them significant leverage.

This leverage is further amplified by limited substitutability and intellectual property held by these specialized suppliers. If only a few entities can produce a critical ingredient, Suntory's options are restricted, strengthening those suppliers' negotiating positions.

Logistics providers also hold considerable power, especially with ongoing supply chain volatility and increased shipping costs observed throughout 2024. Factors like port congestion and demand shifts can lead to rate increases, impacting Suntory's operational expenses and supply chain reliability.

| Supplier Category | Factors Influencing Bargaining Power | Impact on Suntory | Example Data/Trend (2024-2025) |

|---|---|---|---|

| Specialized Ingredients | Limited Substitutability, Intellectual Property, Market Trends | Higher input costs, potential product innovation constraints | Functional beverage market growth: >$200 billion by 2025 |

| Logistics & Distribution | Supply Chain Disruptions, Fuel Price Volatility, Demand for Cold Chain | Increased transportation costs, potential service reliability issues | Drewry World Container Index: Periods of increase due to port congestion |

| Raw Materials (e.g., Sugar, Coffee) | Global Market Volatility, Inflation, Supply Chain Issues | Fluctuating input expenses, pressure on profit margins | Global inflation driving up agricultural commodity costs |

What is included in the product

This analysis of Suntory Beverage & Food examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the presence of substitute products to understand the company's competitive environment.

Effortlessly identify key competitive pressures impacting Suntory Beverage & Food, allowing for targeted strategies to mitigate threats and capitalize on opportunities.

Customers Bargaining Power

Major retail chains and distributors, particularly those with substantial market share, wield significant bargaining power over Suntory Beverage & Food. Their ability to purchase in large volumes allows them to negotiate for lower prices, more favorable trade terms, and increased promotional support, directly impacting Suntory's margins and market access.

In 2024, the consolidation of retail power continues, with large supermarket chains often accounting for over 50% of grocery sales in key markets. This concentration means a few powerful buyers can dictate terms, making it challenging for beverage companies like Suntory to resist demands for price reductions or preferential placement, especially in saturated markets where shelf space is a critical battleground.

Consumers in the non-alcoholic beverage market often exhibit significant price sensitivity, particularly for everyday items such as bottled water and standard carbonated beverages. This means that even small price increases can lead to substantial shifts in purchasing behavior.

In 2024, heightened economic pressures and persistent inflation have amplified consumer cost-consciousness. This trend encourages shoppers to gravitate towards more budget-friendly options, including local brands and private label products, thereby constraining Suntory's ability to freely adjust its pricing strategies.

The sheer volume of non-alcoholic beverage choices, from juices and teas to energy drinks and sparkling waters, significantly empowers consumers. This abundance means customers aren't tied to a single brand like Suntory Beverage & Food. For instance, in 2024, the global non-alcoholic beverage market was valued at over $1.2 trillion, showcasing the vast competitive landscape.

The accessibility of alternatives, such as tap water or home-prepared beverages, further amplifies customer bargaining power. If Suntory were to increase prices, consumers could readily opt for these lower-cost or free alternatives, diminishing the company's pricing leverage. This ease of switching means consumers can easily shift their spending based on price or evolving tastes.

Health and Wellness Trends

The growing health and wellness movement significantly amplifies customer bargaining power within the beverage sector. Consumers are actively seeking healthier options, prioritizing low-sugar, natural ingredients, and functional benefits in their drinks. This shift means Suntory Beverage & Food must be highly responsive to these evolving preferences.

Suntory's commitment to reducing added sugar by 30% by 2025 directly addresses this trend. Failure to adapt and innovate in line with these consumer demands could lead to a loss of market share as customers gravitate towards competitors offering products that better align with their wellness objectives.

- Health-Conscious Demand: Consumers increasingly scrutinize ingredient lists, favoring beverages with fewer artificial additives and lower sugar content.

- Functional Beverage Growth: The market for beverages offering specific health benefits, such as improved hydration or added vitamins, is expanding rapidly.

- Suntory's Sugar Reduction Target: The company's goal to achieve a 30% reduction in added sugar by 2025 demonstrates an awareness of this critical consumer driver.

- Competitive Pressure: Competitors that successfully innovate with healthier formulations can capture market share from less adaptable players.

Brand Loyalty vs. Private Labels

Suntory's strong brand equity faces a challenge from the growing appeal of private labels and local alternatives. Between 2019 and 2024, consumer surveys consistently showed an increasing willingness to opt for lower-priced store brands, particularly in everyday beverage categories. This trend directly impacts Suntory's bargaining power by diminishing customer loyalty.

- Shifting Consumer Preferences: Data from market research firms indicates a steady rise in private label market share in key beverage segments, growing from approximately 15% in 2019 to over 20% by early 2024 in several major markets.

- Price Sensitivity: This shift suggests increased price sensitivity among consumers, empowering them to switch to more affordable options if Suntory's pricing is perceived as too high.

- Competitive Pressure: Consequently, Suntory may need to invest more in value-added propositions or price adjustments to retain market share against these cost-effective alternatives.

The bargaining power of customers is substantial for Suntory Beverage & Food due to market concentration and price sensitivity. In 2024, large retail chains, often controlling over half of grocery sales, can negotiate favorable terms, squeezing Suntory's margins. Consumers, facing economic pressures and inflation, are increasingly opting for budget-friendly private labels and local brands, limiting Suntory's pricing flexibility.

| Factor | Impact on Suntory | 2024 Data/Trend |

|---|---|---|

| Retailer Concentration | High bargaining power due to large purchase volumes | Major supermarket chains account for >50% of grocery sales in key markets. |

| Consumer Price Sensitivity | Limits pricing power, encourages switching to alternatives | Heightened economic pressures amplify cost-consciousness; private label market share grew to >20% by early 2024. |

| Product Availability | Abundance of choices empowers consumers | Global non-alcoholic beverage market valued at >$1.2 trillion, offering vast alternatives. |

| Health & Wellness Trend | Demand for healthier options constrains traditional offerings | Suntory aims for 30% added sugar reduction by 2025; functional beverage market expanding rapidly. |

Full Version Awaits

Suntory Beverage & Food Porter's Five Forces Analysis

This preview showcases the complete Suntory Beverage & Food Porter's Five Forces Analysis, offering a detailed examination of competitive rivalry, buyer and supplier power, threat of new entrants, and the threat of substitutes within the industry. The document you see here is precisely what you will receive, fully formatted and ready for immediate use upon purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

The non-alcoholic beverage sector is incredibly fragmented, boasting a vast array of global, regional, and local competitors. Giants like Coca-Cola and PepsiCo are major players, but Suntory also contends with countless smaller brands in each market it enters.

Suntory's operations span diverse product categories worldwide, including teas, bottled water, carbonated beverages, and coffee. This broad reach means it faces intense rivalry across all these segments, from established international brands to niche local producers.

This high degree of fragmentation, coupled with the sheer number of formidable competitors, fuels aggressive competition for market share. Companies constantly engage in price wars, heavy marketing campaigns, and product innovation to capture consumer attention and loyalty.

Competitive rivalry in the beverage sector is fierce, fueled by a relentless pursuit of product differentiation and innovation. Companies are continuously introducing novel flavors, functional benefits, and healthier alternatives to capture consumer attention. This dynamic environment demands constant adaptation and creativity from market players.

Suntory Beverage & Food's success hinges on its ability to tailor products to local preferences and roll out innovative offerings. For instance, the company is expected to launch new energy drinks and ready-to-drink (RTD) beverages in 2024 and 2025, reflecting a strategic effort to stay ahead in this rapidly evolving market. This focus on new product development is a key differentiator.

Competitors in the beverage industry aggressively pursue market share through intense marketing and brand-building campaigns. This often involves substantial spending on advertising, sponsorships, and promotional activities to capture consumer attention and loyalty. For instance, in 2024, major beverage companies continued to invest billions globally in marketing efforts to differentiate their products in a crowded marketplace.

Securing prime shelf space in retail outlets and optimizing distribution channels are critical battlegrounds. Suntory must continually invest in its distribution networks, encompassing traditional retail, convenience stores, and its significant vending machine operations, alongside expanding its e-commerce presence to ensure product availability and accessibility to consumers.

This intense rivalry necessitates significant financial commitment from Suntory to maintain visibility and market penetration. The need to constantly innovate and promote new products, while also defending existing market share, drives up operational costs in marketing and distribution.

Price Wars and Margin Pressure

The beverage industry, particularly in segments with less distinct products, often experiences intense competition, leading to price wars. This dynamic significantly squeezes profit margins for all players. The widespread availability of substitute beverages further exacerbates this pressure.

Despite these industry-wide challenges, Suntory Beverage & Food demonstrated resilience. In 2024, the company reported record revenue and operating income. This success was attributed to strategic initiatives and effective revenue growth management, showcasing their ability to navigate and mitigate the impact of price wars and margin pressure.

- Intense Competition: The presence of numerous competitors and readily available substitutes drives price wars in less differentiated beverage segments.

- Margin Squeeze: These price wars directly lead to reduced profit margins across the entire industry.

- Suntory's 2024 Performance: Suntory Beverage & Food achieved record revenue and operating income in 2024, a testament to their strategic navigation of these market pressures.

- Key Success Factors: Focused activities and effective revenue growth management were crucial in overcoming the challenges of price wars and margin pressure.

Global and Regional Market Dynamics

Suntory navigates a complex competitive environment across its key operating regions, including Japan, Europe, Asia, and Oceania. Each area presents unique challenges and opportunities shaped by local market conditions and consumer preferences.

The Asia Pacific region, in particular, is a significant growth engine for non-alcoholic beverages. However, this dynamism is matched by fierce competition from both global giants and strong local players with deep-rooted brand loyalty.

- Regional Variations: Suntory's competitive intensity varies significantly by geography, from mature markets in Japan to rapidly expanding ones in Asia.

- Asia Pacific Growth: This region is a key focus, offering substantial growth but also demanding strategies to overcome established local brands.

- Global Market Size: The global soft drinks market was valued at an impressive USD 1.1 trillion in 2024, underscoring the immense scale and intense competition within the industry.

Competitive rivalry within the beverage sector is exceptionally intense due to the industry's fragmentation and the presence of numerous global and local players. This dynamic environment is characterized by aggressive marketing, continuous product innovation, and strategic efforts to secure prime distribution channels. The global soft drinks market's substantial size, valued at approximately USD 1.1 trillion in 2024, highlights the scale of this competition.

Suntory Beverage & Food navigates this rivalry by focusing on tailored products for local preferences and introducing new offerings, such as energy drinks and RTD beverages slated for 2024 and 2025. Despite facing price wars and margin pressures, the company achieved record revenue and operating income in 2024, underscoring its effective revenue growth management and strategic resilience.

The company's success is also tied to its ability to manage competition across diverse regions, with the Asia Pacific being a key growth area facing strong local brands. This regional variation requires adaptive strategies to maintain market penetration and capture consumer loyalty.

| Key Competitor Actions | Impact on Suntory | 2024 Market Data/Trends |

| Aggressive marketing and brand building | Requires significant marketing investment for visibility | Billions invested globally in beverage marketing |

| Product innovation and differentiation | Necessitates continuous R&D and new product launches | Focus on functional benefits and healthier alternatives |

| Price wars in less differentiated segments | Squeezes profit margins | Industry-wide margin pressure |

| Securing shelf space and distribution | Demands investment in distribution networks and e-commerce | Expansion of omni-channel retail presence |

SSubstitutes Threaten

Tap water stands as the most basic and potent substitute for bottled non-alcoholic beverages. Its near-zero cost and widespread availability in most developed regions make it an economically compelling choice for consumers. In 2024, the global average cost of municipal tap water remained remarkably low, often fractions of a cent per liter, directly contrasting with the price of bottled water.

Consumers also increasingly opt for home-prepared beverages as a substitute. This includes everything from brewing coffee and tea to making infused water. These DIY options offer cost savings and greater control over ingredients, aligning with growing consumer interest in health and wellness. For instance, the #watertok trend on social media, which gained significant traction in 2023 and continued into 2024, highlights a growing preference for personalized, homemade hydration solutions.

Consumers often choose solid food snacks or light meals to quench their thirst or satisfy hunger, bypassing the need for a beverage purchase. This wide array of food items directly competes for consumer attention and spending, particularly during informal eating or drinking occasions. For instance, in 2024, the global snack market was projected to reach over $200 billion, indicating a substantial portion of consumer discretionary spending that could otherwise go to beverages.

While Suntory Beverage & Food primarily operates in the non-alcoholic sector, alcoholic beverages can indeed act as substitutes for consumers seeking to mark social occasions. However, this threat is being reshaped by evolving consumer preferences. The 'sober curious' movement, gaining considerable traction between 2022 and 2024, has fueled a notable rise in demand for no- and low-alcohol options.

This shift is not only mitigating the direct threat of traditional alcoholic drinks but is also opening up new avenues for innovation within the non-alcoholic beverage market itself. For instance, the global market for non-alcoholic beverages was projected to reach over $1.7 trillion by 2027, indicating a strong growth trajectory for these alternatives.

Powder Concentrates and Syrups

Powder concentrates, liquid enhancers, and syrups present a significant threat to Suntory Beverage & Food. These products allow consumers to create their own beverages by simply adding water, offering a more economical and personalized option compared to ready-to-drink (RTD) beverages. Their appeal is growing, driven by lower price points, adaptability to various tastes, and the inclusion of functional benefits such as enhanced hydration or energy boosts.

The market for these DIY beverage solutions is expanding, particularly among budget-conscious consumers and those seeking greater control over their drink ingredients and flavors. For instance, the global powdered beverage mixes market was valued at approximately USD 30 billion in 2023 and is projected to grow steadily. This trend directly challenges the sales volume and market share of pre-packaged RTD drinks offered by companies like Suntory.

- Cost-Effectiveness: Consumers can often produce multiple servings from a single concentrate or syrup package at a lower per-serving cost than buying individual RTD beverages.

- Customization: Users can adjust flavor intensity, sweetness, and even mix different concentrates, catering to individual preferences.

- Growing Functional Benefits: Many new entrants are incorporating vitamins, electrolytes, and natural energy enhancers, appealing to health-conscious consumers.

- Environmental Impact: Reduced packaging and transportation needs compared to RTD products can also be an attractive factor for some consumers.

Dairy and Plant-Based Milk Alternatives

The threat of substitutes for Suntory Beverage & Food's dairy products is significant, particularly from the burgeoning plant-based milk alternatives market. For beverages like coffee and tea, these alternatives are direct substitutes, offering consumers choices driven by dietary needs, health consciousness, and evolving taste preferences.

The plant-based milk sector is experiencing robust growth. Projections indicate a compound annual growth rate (CAGR) of 6.25% through 2030, highlighting its increasing market share and influence. This expansion directly challenges traditional dairy consumption patterns.

- Plant-based milk alternatives offer diverse options catering to lactose intolerance, veganism, and perceived health benefits.

- Market growth projections for plant-based milk suggest a sustained shift in consumer preference away from traditional dairy.

- Innovation in plant-based formulations, including oat, almond, soy, and coconut milk, continues to broaden consumer appeal and product variety.

The threat of substitutes remains a critical factor for Suntory Beverage & Food, with tap water and home-prepared beverages presenting strong, low-cost alternatives. Consumers are increasingly embracing DIY hydration, fueled by social media trends and a desire for customization and cost savings. This trend directly impacts the demand for pre-packaged drinks.

The broader market for beverages also sees competition from snacks and light meals, diverting consumer spending. Furthermore, the rise of the 'sober curious' movement is reshaping the landscape of alcoholic beverage substitutes, creating opportunities for innovative non-alcoholic options. Powder concentrates and liquid enhancers also offer a compelling, cost-effective alternative for consumers seeking personalized beverage experiences.

Plant-based milk alternatives pose a significant threat to Suntory's dairy offerings, driven by growing consumer interest in health, dietary needs, and sustainability. This market segment is experiencing substantial growth, indicating a sustained shift in consumer preferences.

| Substitute Category | Key Characteristics | Impact on Suntory | 2024 Market Relevance |

|---|---|---|---|

| Tap Water | Near-zero cost, ubiquitous availability | High, as a direct low-cost alternative | Continues to be the most economical hydration choice |

| Home-Prepared Beverages | Cost-effective, customizable, health-focused | Growing, driven by DIY trends | Social media trends like #watertok highlight consumer engagement |

| Snacks/Light Meals | Satisfy hunger and thirst | Moderate, competes for discretionary spending | Global snack market projected over $200 billion in 2024 |

| Alcoholic Beverages (incl. N/A options) | Social occasions, evolving preferences | Moderate, influenced by sober curious movement | Growth in no/low-alcohol options |

| Powder Concentrates/Syrups | Economical, customizable, functional benefits | Significant, offers DIY beverage creation | Global powdered beverage mixes market valued around $30 billion in 2023 |

| Plant-Based Milk Alternatives | Dietary needs, health, sustainability | High for dairy products, growing market share | Projected CAGR of 6.25% through 2030 |

Entrants Threaten

Building a beverage business comparable to Suntory's, with its extensive global manufacturing and distribution capabilities, demands immense upfront capital. This includes setting up state-of-the-art production facilities, acquiring sophisticated machinery, and establishing a robust logistics network. For instance, in 2024, major beverage companies continued to invest billions in upgrading and expanding their production lines and supply chains to meet growing demand and maintain efficiency.

This significant financial hurdle effectively discourages many smaller players or new companies from entering the market. The sheer scale of investment needed to compete on production volume and distribution reach acts as a powerful deterrent. Suntory's consistent capital expenditures, such as their reported investments in expanding bottling capacity in key Asian markets throughout 2024, further solidify this barrier by demonstrating their commitment to maintaining a competitive edge through scale.

The non-alcoholic beverage sector is a battlefield of giants, where brands like Suntory have cultivated deep consumer loyalty. For any newcomer, breaking through this ingrained preference is a monumental task, requiring substantial investment just to get noticed.

In 2024, the sheer scale of marketing expenditure by major players is staggering. For instance, global beverage giants often allocate billions annually to advertising and promotions, a figure that new entrants would struggle to match, let alone surpass, to carve out even a small market share.

Furthermore, the evolving landscape of consumer engagement, particularly through sophisticated digital marketing strategies and personalized offerings, adds another layer of complexity. New companies must not only compete on product but also on their ability to connect with consumers in increasingly nuanced ways, a costly and intricate endeavor.

New beverage companies face a formidable challenge in securing shelf space and distribution. Suntory, for instance, benefits from deeply entrenched relationships with major retailers across Japan and globally, making it difficult for newcomers to gain comparable access to supermarkets, convenience stores, and vending machines. In 2024, the beverage market continues to be dominated by established brands with extensive distribution footprints, a barrier that requires substantial investment and time to overcome.

Regulatory Hurdles and Quality Standards

The beverage sector faces significant regulatory challenges. New companies must comply with strict health, safety, and labeling laws that vary globally. For instance, in 2024, the European Union continued to enforce its comprehensive food safety regulations, requiring extensive documentation and testing for new products entering the market.

Meeting these demanding quality standards is a major barrier. It often involves substantial investment in research, development, and manufacturing processes to ensure products are safe and meet consumer expectations. Suntory Beverage & Food, for example, emphasizes its dedication to quality assurance and sustainable sourcing, reflecting the high bar set for established players and potential entrants alike.

- Stringent Health and Safety Regulations: Compliance with evolving food safety laws, such as those overseen by the FDA in the United States, requires significant upfront investment and ongoing monitoring.

- Complex Labeling Requirements: Accurate nutritional information and ingredient disclosure are mandated, adding to product development costs and complexity, especially for international markets.

- High-Quality Standards: Adherence to quality benchmarks, including those for ingredient sourcing and production hygiene, necessitates robust operational controls and certifications.

- Cost and Time Investment: Navigating these regulatory landscapes and quality demands can deter new entrants due to the considerable financial and temporal resources required.

Access to Raw Materials and Sustainable Sourcing

Newcomers face significant hurdles in securing consistent access to high-quality raw materials, especially those requiring sustainable and ethical sourcing. Established players like Suntory often leverage existing preferred supplier relationships and long-term contracts, creating a supply chain advantage that is difficult for new entrants to replicate. This can translate into higher input costs and less reliable supply for challengers.

Suntory's proactive approach to sustainable procurement and regenerative agriculture further solidifies its competitive standing. For instance, in 2024, Suntory announced its commitment to sourcing 100% of its key raw materials sustainably by 2030, a goal that requires significant upfront investment and established partnerships. This long-term vision makes it exceptionally challenging for new beverage companies to enter the market and compete on both quality and cost of goods sold.

- Supply Chain Barriers: New entrants struggle to match the established supplier networks and favorable contract terms of incumbents like Suntory.

- Cost Disadvantage: Difficulty in securing raw materials at competitive prices puts new companies at a cost disadvantage.

- Sustainability as a Differentiator: Suntory's investment in sustainable sourcing, a trend gaining momentum in 2024 consumer preferences, creates an additional barrier for less-resourced new entrants.

- Market Entry Costs: The capital expenditure required to build equivalent supply chain capabilities and secure sustainable material sources is substantial.

The threat of new entrants for Suntory Beverage & Food is relatively low, primarily due to the substantial capital requirements for production and distribution. For example, in 2024, major beverage companies continued to invest billions in upgrading and expanding their production lines and supply chains, a cost prohibitive for most newcomers. The sheer scale of investment needed to compete on volume and reach acts as a powerful deterrent, as demonstrated by Suntory's ongoing capital expenditures in expanding bottling capacity in key Asian markets throughout 2024.

Furthermore, established brand loyalty and the high cost of marketing present significant barriers. In 2024, global beverage giants allocated billions annually to advertising and promotions, a sum that new entrants would struggle to match to gain market visibility. Securing prime shelf space and distribution channels, where Suntory benefits from deeply entrenched retailer relationships, also requires substantial investment and time, making it difficult for challengers to gain comparable access in 2024.

Porter's Five Forces Analysis Data Sources

Our Suntory Beverage & Food Porter's Five Forces analysis is built upon a foundation of robust data, including Suntory's annual reports, industry-specific market research from firms like Euromonitor, and regulatory filings from relevant authorities.