Suntory Beverage & Food PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Suntory Beverage & Food Bundle

Suntory Beverage & Food operates within a dynamic global landscape shaped by political stability, economic fluctuations, and evolving social preferences. Understanding these external forces is crucial for strategic planning and sustained growth. Our comprehensive PESTLE analysis delves into these critical factors, offering actionable intelligence to navigate the complexities of the beverage and food industry.

Gain a competitive edge by understanding how regulatory changes, economic downturns, and technological advancements are impacting Suntory Beverage & Food. This expertly crafted PESTLE analysis provides the deep-dive insights you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now and empower your strategic decisions.

Political factors

Governments worldwide are actively using excise taxes on sugar-sweetened beverages (SSBs) as a public health tool, targeting issues like obesity and diabetes. This trend directly impacts companies such as Suntory Beverage & Food, compelling them to adjust their product portfolios and pricing. For instance, the UAE's planned tiered excise tax from 2026, based on sugar content, encourages manufacturers to reformulate products with less sugar.

Governments worldwide are tightening rules around packaging, especially plastics. For instance, the EU's Single-Use Plastics Directive and the upcoming Packaging and Packaging Waste Regulation are pushing companies like Suntory to use more recycled materials and design for better recyclability. These changes directly affect how much Suntory spends on materials and how they source them.

These regulations often include Extended Producer Responsibility (EPR) schemes. This means Suntory will be more accountable for managing the waste generated by their packaging. Suntory's own goals align with this trend, as they are targeting 100% recyclable packaging by 2025 and aim to use 50% recycled plastic in their bottles by the same year.

Changes in international trade policies and tariffs directly influence Suntory Beverage & Food's global operations. For instance, the imposition of new tariffs on imported ingredients or finished goods, such as those seen in trade disputes between major economies in 2023-2024, could increase Suntory's cost of goods sold and reduce profit margins in affected markets. The company's extensive presence across Japan, Europe, Asia, and Oceania means it's exposed to a complex web of trade agreements and potential disruptions.

Geopolitical instability, a significant factor impacting trade, can also lead to volatility in raw material prices. For a company reliant on agricultural commodities like sugar, fruits, and grains, shifts in global supply chains due to conflicts or political tensions, as observed in various regions in 2024, can drive up input costs. This directly affects Suntory's ability to maintain competitive pricing for its diverse beverage portfolio.

Food Safety and Labeling Laws

Suntory Beverage & Food operates within a complex web of global food safety and labeling regulations. For instance, the European Union's General Food Law (Regulation (EC) No 178/2002) mandates strict traceability throughout the food chain, impacting how Suntory sources ingredients and manages its supply chain. Failure to comply can result in significant fines and reputational damage, as seen when companies face recalls due to undeclared allergens or contamination issues.

Navigating these requirements is critical for maintaining consumer trust and market access. Suntory must adhere to diverse labeling standards, which include detailed nutritional information, ingredient lists, and allergen warnings, varying significantly by country. As of 2024, many regions are also implementing enhanced traceability requirements for packaging materials, adding another layer of complexity to compliance efforts.

- Global Regulatory Landscape: Suntory must comply with varying food safety standards, such as the EU's General Food Law and national regulations in markets like Japan and the United States.

- Labeling Transparency: Adherence to detailed ingredient, nutritional, and allergen labeling is paramount for consumer confidence and legal compliance.

- Traceability Mandates: New traceability rules for packaging, increasingly enforced globally, require robust supply chain management and data tracking.

- Compliance Costs: Investing in quality control, updated labeling systems, and supply chain technology is essential to meet these evolving political mandates.

Political Stability and Consumer Confidence

Political stability in Suntory's key markets is a significant driver of consumer confidence and spending. When political environments are stable, consumers tend to feel more secure about their economic future, leading to increased discretionary spending on items like beverages. Conversely, political uncertainty or unrest can dampen consumer sentiment, potentially reducing purchasing power and impacting demand for Suntory's products.

Economic uncertainty, often linked to political factors, can directly affect Suntory Beverage & Food's sales volumes and overall revenue. For instance, periods of political instability might coincide with inflation or job insecurity, causing consumers to cut back on non-essential purchases. This directly translates to challenges for beverage companies like Suntory.

Despite potential economic headwinds influenced by political factors, Suntory Beverage & Food demonstrated resilience. The company reported revenue growth in 2024, suggesting effective strategies to navigate and mitigate the impact of these broader economic conditions on consumer behavior.

- Political Stability: A stable political climate fosters consumer confidence, encouraging spending on discretionary goods like beverages.

- Economic Impact: Political instability can lead to economic uncertainty, reducing consumer purchasing power and affecting Suntory's sales.

- Consumer Confidence: Fluctuations in consumer confidence, often tied to political events, directly influence demand for Suntory's beverage portfolio.

- Suntory's Resilience: Suntory Beverage & Food achieved revenue growth in 2024, indicating its ability to perform even amidst challenging political and economic landscapes.

Governments globally are increasingly implementing sugar taxes on beverages, a trend that directly impacts Suntory Beverage & Food's pricing strategies and product development. For example, the UK's Soft Drinks Industry Levy, introduced in 2018 and revised in 2023, has prompted many manufacturers, including Suntory, to reformulate products to reduce sugar content and avoid higher tax brackets. This public health initiative continues to shape the beverage market landscape as of 2024.

Trade policies and tariffs significantly influence Suntory's global operations and costs. For instance, in 2023-2024, ongoing trade tensions between major economic blocs led to fluctuating import duties on raw materials and finished goods, impacting Suntory's supply chain and profitability in various regions. The company's diversified international presence means it must continually adapt to evolving trade agreements and potential disruptions.

Regulatory frameworks concerning packaging, particularly single-use plastics, are becoming more stringent. The EU's ambitious targets for recycled content in packaging, aiming for 30% recycled PET in bottles by 2030, are pushing companies like Suntory to invest in sustainable sourcing and innovative packaging solutions. Suntory's own commitment to using 50% recycled plastic in bottles by 2025 underscores the industry-wide shift driven by political mandates.

| Political Factor | Impact on Suntory Beverage & Food | 2024/2025 Data/Trend |

| Sugar Taxes | Increased operational costs, product reformulation pressure | Continued implementation and potential expansion of tiered excise taxes based on sugar content in various countries. |

| Trade Policies & Tariffs | Supply chain disruptions, increased cost of goods sold | Ongoing volatility in import/export duties and trade agreement reviews impacting global sourcing and market access. |

| Packaging Regulations | Investment in sustainable materials, R&D for recyclability | Stricter mandates for recycled content and Extended Producer Responsibility (EPR) schemes driving innovation in packaging. |

What is included in the product

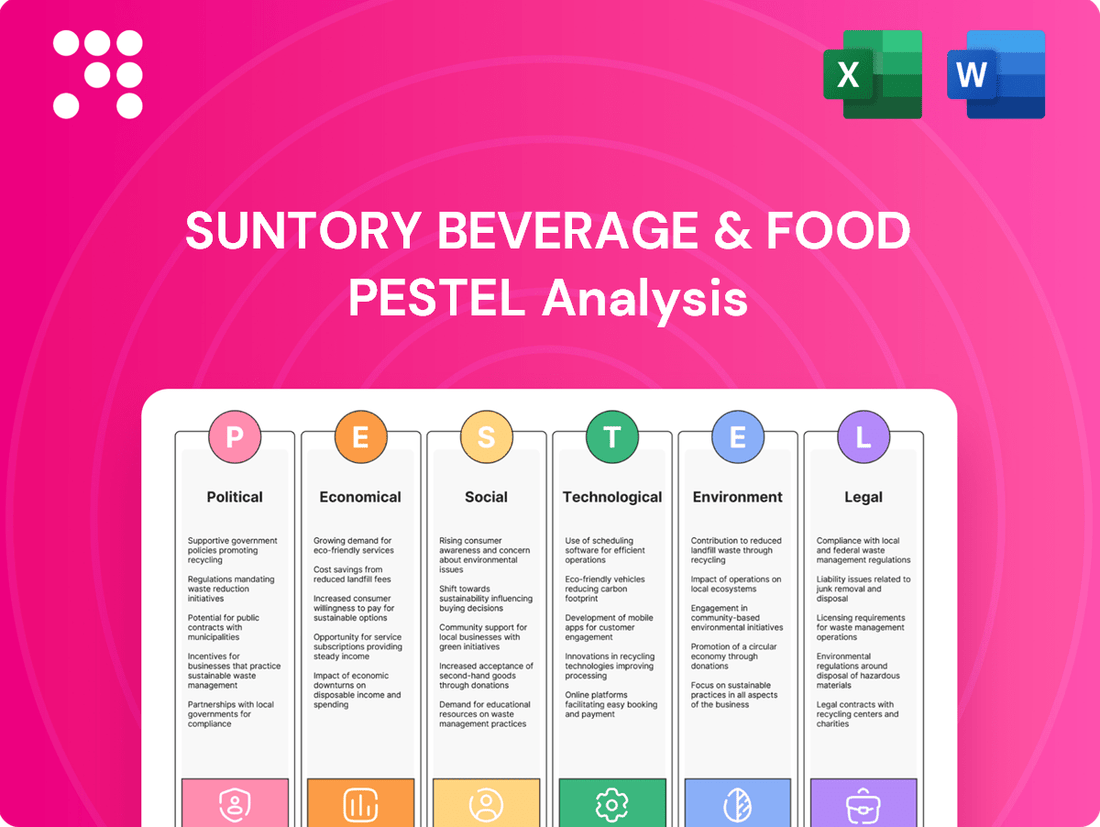

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing Suntory Beverage & Food, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats within the global beverage and food market.

Provides a clear, actionable framework for understanding the external forces impacting Suntory Beverage & Food, enabling proactive strategy development and mitigating potential disruptions.

Economic factors

Rising inflation and volatile raw material prices present a significant challenge for Suntory Beverage & Food. For instance, global sugar prices saw an increase of approximately 10% in early 2024 compared to the previous year, directly impacting the cost of many of Suntory's core products. Similarly, fluctuations in coffee bean and tea leaf markets, driven by weather patterns and geopolitical events, add to procurement uncertainties.

Packaging costs are also a critical factor, with PET plastic prices experiencing an upward trend as demand for sustainable packaging solutions grows. By Q1 2025, analysts predict a further 5-7% increase in PET resin costs. Suntory's ability to navigate these rising expenses hinges on effective procurement strategies, including hedging and exploring alternative sourcing, alongside judicious price adjustments to maintain healthy profit margins.

Consumer purchasing power is a key economic driver for Suntory Beverage & Food. In 2024, global economic growth, while showing resilience, faces varied regional performance. For instance, the IMF projected global growth around 3.2% for 2024, but this masks differences. In developed markets, sustained inflation can erode disposable income, potentially favoring value-oriented beverage choices.

Conversely, emerging economies with stronger income growth often see increased demand for premium and varied beverage offerings, a segment Suntory actively targets. The company's strategy hinges on its ability to cater to a broad spectrum of consumers, from those seeking everyday value to those desiring specialized or higher-priced options, reflecting the diverse economic realities faced by its customer base worldwide.

Suntory Beverage & Food's global operations, spanning Japan, Europe, Asia, and Oceania, expose it to significant exchange rate fluctuations. For instance, the Japanese Yen's strength against other currencies can increase the cost of raw materials sourced internationally, directly impacting Suntory's cost of goods sold.

Conversely, a weaker Yen could make Suntory's exports more competitive in global markets, potentially boosting sales volume. However, the translation of foreign earnings back into Yen can be volatile; for example, if the Euro weakens against the Yen, European profits would translate to fewer Yen, affecting reported financial performance.

In 2024, currency volatility remained a key concern for multinational corporations. For example, the Bank of Japan's monetary policy continued to influence the Yen's trajectory, with significant movements observed throughout the year impacting import costs and export competitiveness for companies like Suntory.

Global Non-Alcoholic Beverage Market Growth

The global non-alcoholic beverage market is experiencing robust expansion, presenting a fertile ground for Suntory Beverage & Food. This sector is anticipated to reach a substantial USD 1.41 trillion by 2025, underscoring its significant economic impact and growth potential.

Several key drivers are fueling this upward trend. Growing consumer awareness regarding health and wellness is leading to increased demand for beverages with functional benefits, such as those fortified with vitamins or probiotics.

- Increasing Health Consciousness: Consumers are actively seeking healthier alternatives to traditional sugary drinks.

- Demand for Functional Beverages: Products offering added health benefits, like improved hydration or cognitive function, are gaining popularity.

- Market Expansion: The overall non-alcoholic beverage market is projected for continued strong growth.

Suntory is well-positioned to capitalize on these market dynamics through its extensive and varied product range, allowing it to cater to diverse consumer preferences and evolving health trends.

Competitive Landscape and Pricing Strategies

The beverage market is fiercely competitive, with giants like Coca-Cola and PepsiCo constantly vying for market share against Suntory Beverage & Food. This intense rivalry demands astute pricing strategies and a relentless focus on product innovation to stand out.

Suntory must navigate the challenge of offering competitive prices while ensuring healthy profit margins. The growing consumer preference for functional and plant-based drinks adds another layer of complexity, requiring agile product development and marketing to meet evolving demands.

- Intense Competition: Suntory operates in a crowded beverage space, facing off against global powerhouses and nimble startups.

- Pricing Dilemma: Balancing market competitiveness with profit preservation is a core strategic challenge.

- Market Trends: Adapting to the surge in demand for functional beverages and plant-based alternatives is crucial for continued growth.

- Key Players: Major competitors include Coca-Cola and PepsiCo, setting a high bar for market performance.

Rising inflation and volatile raw material prices present a significant challenge for Suntory Beverage & Food. For instance, global sugar prices saw an increase of approximately 10% in early 2024 compared to the previous year, directly impacting the cost of many of Suntory's core products. Similarly, fluctuations in coffee bean and tea leaf markets, driven by weather patterns and geopolitical events, add to procurement uncertainties.

Packaging costs are also a critical factor, with PET plastic prices experiencing an upward trend as demand for sustainable packaging solutions grows. By Q1 2025, analysts predict a further 5-7% increase in PET resin costs. Suntory's ability to navigate these rising expenses hinges on effective procurement strategies, including hedging and exploring alternative sourcing, alongside judicious price adjustments to maintain healthy profit margins.

Consumer purchasing power is a key economic driver for Suntory Beverage & Food. In 2024, global economic growth, while showing resilience, faces varied regional performance. For instance, the IMF projected global growth around 3.2% for 2024, but this masks differences. In developed markets, sustained inflation can erode disposable income, potentially favoring value-oriented beverage choices.

Conversely, emerging economies with stronger income growth often see increased demand for premium and varied beverage offerings, a segment Suntory actively targets. The company's strategy hinges on its ability to cater to a broad spectrum of consumers, from those seeking everyday value to those desiring specialized or higher-priced options, reflecting the diverse economic realities faced by its customer base worldwide.

Suntory Beverage & Food's global operations, spanning Japan, Europe, Asia, and Oceania, expose it to significant exchange rate fluctuations. For instance, the Japanese Yen's strength against other currencies can increase the cost of raw materials sourced internationally, directly impacting Suntory's cost of goods sold.

Conversely, a weaker Yen could make Suntory's exports more competitive in global markets, potentially boosting sales volume. However, the translation of foreign earnings back into Yen can be volatile; for example, if the Euro weakens against the Yen, European profits would translate to fewer Yen, affecting reported financial performance.

In 2024, currency volatility remained a key concern for multinational corporations. For example, the Bank of Japan's monetary policy continued to influence the Yen's trajectory, with significant movements observed throughout the year impacting import costs and export competitiveness for companies like Suntory.

The global non-alcoholic beverage market is experiencing robust expansion, presenting a fertile ground for Suntory Beverage & Food. This sector is anticipated to reach a substantial USD 1.41 trillion by 2025, underscoring its significant economic impact and growth potential.

Several key drivers are fueling this upward trend. Growing consumer awareness regarding health and wellness is leading to increased demand for beverages with functional benefits, such as those fortified with vitamins or probiotics.

- Increasing Health Consciousness: Consumers are actively seeking healthier alternatives to traditional sugary drinks.

- Demand for Functional Beverages: Products offering added health benefits, like improved hydration or cognitive function, are gaining popularity.

- Market Expansion: The overall non-alcoholic beverage market is projected for continued strong growth.

Suntory is well-positioned to capitalize on these market dynamics through its extensive and varied product range, allowing it to cater to diverse consumer preferences and evolving health trends.

The beverage market is fiercely competitive, with giants like Coca-Cola and PepsiCo constantly vying for market share against Suntory Beverage & Food. This intense rivalry demands astute pricing strategies and a relentless focus on product innovation to stand out.

Suntory must navigate the challenge of offering competitive prices while ensuring healthy profit margins. The growing consumer preference for functional and plant-based drinks adds another layer of complexity, requiring agile product development and marketing to meet evolving demands.

- Intense Competition: Suntory operates in a crowded beverage space, facing off against global powerhouses and nimble startups.

- Pricing Dilemma: Balancing market competitiveness with profit preservation is a core strategic challenge.

- Market Trends: Adapting to the surge in demand for functional beverages and plant-based alternatives is crucial for continued growth.

- Key Players: Major competitors include Coca-Cola and PepsiCo, setting a high bar for market performance.

Economic factors significantly influence Suntory Beverage & Food's performance, primarily through raw material costs and consumer spending power. Inflationary pressures, such as the 10% rise in global sugar prices in early 2024, directly impact production expenses. Simultaneously, varying regional economic growth rates, with a projected global growth of 3.2% for 2024, affect disposable incomes and demand for Suntory's diverse product portfolio, from value options to premium offerings.

Currency exchange rate volatility also poses a substantial economic risk, as seen with the Japanese Yen's movements in 2024 impacting import costs and export competitiveness. The expanding global non-alcoholic beverage market, projected to reach USD 1.41 trillion by 2025, presents a significant opportunity, driven by increasing health consciousness and demand for functional beverages.

However, intense market competition from giants like Coca-Cola and PepsiCo necessitates strategic pricing and innovation to maintain market share. Suntory must adeptly balance competitive pricing with profit margins, while also responding to evolving consumer preferences for healthier and plant-based alternatives.

| Economic Factor | Impact on Suntory Beverage & Food | Data Point/Trend (2024-2025) |

|---|---|---|

| Inflation & Raw Material Costs | Increased production costs, pressure on profit margins | Global sugar prices up ~10% (early 2024); PET resin costs predicted to rise 5-7% (Q1 2025) |

| Consumer Purchasing Power | Varies by region; impacts demand for different product tiers | IMF projected global growth ~3.2% (2024), with varied regional performance |

| Currency Exchange Rates | Affects cost of goods sold and export competitiveness | Yen volatility influenced by Bank of Japan policy (2024) |

| Market Growth | Opportunity for increased sales volume | Global non-alcoholic beverage market to reach USD 1.41 trillion by 2025 |

| Competitive Landscape | Requires strategic pricing and innovation | Intense rivalry with Coca-Cola and PepsiCo |

Full Version Awaits

Suntory Beverage & Food PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Suntory Beverage & Food PESTLE analysis provides an in-depth look at the external factors influencing the company's operations and strategic decisions.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental considerations for Suntory Beverage & Food.

Sociological factors

Consumers are increasingly prioritizing health and wellness, driving a robust demand for beverages that are low-sugar, zero-sugar, functional, or plant-based. This shift necessitates continuous innovation for Suntory, requiring product reformulation to meet the preferences of a health-conscious market seeking perceived health benefits.

Suntory Beverage & Food Europe's 2024 Sustainability Report indicates significant strides in sugar reduction initiatives, demonstrating the company's commitment to aligning its portfolio with evolving consumer health expectations.

Modern consumers, particularly in urban centers, are embracing faster-paced lifestyles. This shift, coupled with busier work schedules, naturally leads to a greater demand for convenient beverage solutions. For instance, the global ready-to-drink (RTD) tea market, a key segment for Suntory, was projected to reach approximately $140 billion by 2024, highlighting this consumer trend.

This evolving consumer behavior directly translates into a preference for products that fit seamlessly into an on-the-go routine. Think about smaller, portable pack sizes and beverages that require minimal preparation. Suntory's strategic focus on expanding its RTD portfolio, including brands like BOSS coffee, directly addresses this need for convenience and immediate consumption.

Suntory Beverage & Food’s global presence necessitates a deep dive into cultural and regional tastes. For instance, while Japan favors subtle, often green tea-based flavors, markets in Southeast Asia might lean towards sweeter, fruitier profiles, and Europe often shows a preference for more traditional, less intensely flavored beverages. This adaptation is crucial; in 2023, Suntory’s international sales, excluding Japan, represented a significant portion of its overall revenue, underscoring the importance of localized product development.

Sustainability and Ethical Consumption

Consumers are increasingly prioritizing sustainability and ethical practices, influencing purchasing decisions. This trend fuels demand for products with ethically sourced ingredients, eco-friendly packaging, and transparent supply chains. For instance, in 2024, a significant majority of global consumers indicated they would pay more for sustainable products, demonstrating a clear market shift.

Suntory's proactive engagement in sustainability, including ambitious targets for carbon emission reduction and water conservation, resonates with this growing consumer consciousness. Their investment in recycled materials for packaging further solidifies this appeal. By 2025, Suntory aims to increase the use of recycled PET bottles across its portfolio, a move that directly addresses consumer concerns about plastic waste.

- Growing Consumer Demand: Reports from 2024 indicate that over 70% of consumers consider sustainability when making purchasing decisions.

- Suntory's Sustainability Goals: The company has committed to reducing greenhouse gas emissions by 50% by 2030 compared to 2007 levels.

- Packaging Innovation: Suntory is targeting a 100% use of sustainable materials for its main plastic containers by 2030, with a focus on recycled and plant-based options.

Demographic Shifts (e.g., Gen Z and Millennials)

Younger demographics, particularly Gen Z and Millennials, are significantly shaping beverage consumption patterns. These groups show a strong preference for global flavors, novel taste profiles, and a growing interest in low or no-alcohol beverages. Suntory Beverage & Food must align its product development and marketing strategies with these evolving consumer demands to maintain relevance and foster future market expansion.

For instance, by early 2024, reports indicated that the global low/no-alcohol market was projected to reach over $10 billion, with Gen Z and Millennials being key drivers of this growth. This highlights a tangible shift in consumer priorities, moving towards healthier and more mindful consumption choices.

- Gen Z and Millennial Preferences: These generations are actively seeking out diverse flavor profiles and unique beverage experiences, moving beyond traditional offerings.

- Low/No-Alcohol Trend: A significant portion of these demographics are opting for beverages with reduced or no alcohol content, reflecting a broader wellness movement.

- Market Responsiveness: Suntory's ability to innovate and cater to these specific tastes and lifestyle choices will be crucial for sustained market share and growth in the coming years.

- Global Flavor Appeal: The demand for international tastes, from Asian-inspired drinks to Latin American infusions, is a direct reflection of these younger consumers' global outlook.

Sociological factors significantly influence Suntory Beverage & Food's market approach. A growing emphasis on health and wellness, particularly among younger demographics like Gen Z and Millennials, is driving demand for low-sugar, functional, and plant-based options. For example, by early 2024, the global low/no-alcohol market was projected to exceed $10 billion, with these age groups being primary drivers of this trend.

Consumers are increasingly prioritizing convenience, leading to a surge in the ready-to-drink (RTD) market, which was expected to reach around $140 billion globally by 2024. Suntory's strategic expansion in RTD products, such as BOSS coffee, directly addresses this need for on-the-go solutions.

Sustainability and ethical sourcing are also paramount, with a majority of consumers in 2024 indicating a willingness to pay more for eco-friendly products. Suntory's commitment to using recycled materials, aiming for 100% sustainable packaging by 2030, aligns with these consumer values.

| Sociological Factor | Impact on Suntory | Supporting Data (2024/2025) |

|---|---|---|

| Health & Wellness Consciousness | Increased demand for low-sugar, functional, plant-based beverages. | Global low/no-alcohol market projected over $10 billion by early 2024. |

| Demand for Convenience | Growth in ready-to-drink (RTD) product segment. | Global RTD tea market projected to reach ~$140 billion by 2024. |

| Sustainability & Ethical Consumption | Preference for eco-friendly packaging and transparent sourcing. | Over 70% of consumers consider sustainability in purchasing decisions (2024). |

| Demographic Shifts (Gen Z/Millennials) | Preference for global flavors, novel tastes, and reduced alcohol options. | Key drivers of growth in the low/no-alcohol beverage market. |

Technological factors

Technological advancements in manufacturing, particularly in automation, are significantly boosting efficiency and cutting costs for companies like Suntory. For instance, the global industrial automation market was projected to reach over $300 billion by 2024, highlighting the widespread adoption of these technologies. This trend allows for improved product consistency, a critical factor in the competitive beverage sector.

Suntory's investment in smart factories and automated systems is paramount for optimizing its operations and scaling production effectively to meet growing consumer demand. The food and beverage industry, in particular, has seen a substantial rise in automation adoption, with reports indicating that the sector's automation spending is expected to grow by over 10% annually in the coming years. This strategic focus ensures Suntory can maintain a competitive edge.

Technological advancements are a significant driver for Suntory Beverage & Food. New technologies are enabling the creation of innovative beverage formulations, incorporating functional ingredients, natural sweeteners, and a growing range of plant-based alternatives. This allows Suntory to tap into consumer demand for healthier and more specialized drinks.

Suntory can harness cutting-edge tools like biotechnology, artificial intelligence (AI), and advanced food science to develop novel products. These technologies are crucial for meeting evolving consumer preferences, particularly in the health and wellness sector. For instance, AI is increasingly being employed in product development, aiding in everything from flavor profiling to predicting consumer acceptance of new formulations.

The food and beverage sector's digital transformation is accelerating, with e-commerce, digital marketing, and data analytics becoming paramount for consumer engagement and trend identification. Suntory needs to bolster its digital infrastructure to strengthen its online footprint, tailor customer interactions, and streamline operations.

By 2025, digital capabilities are non-negotiable for companies aiming to stay competitive. For instance, global e-commerce sales in the food and grocery sector were projected to reach over $1.5 trillion by the end of 2024, highlighting the massive shift towards online purchasing channels.

Sustainable Packaging Technologies

Suntory is actively investing in sustainable packaging technologies to align with its ambitious environmental goals. This includes exploring and implementing advanced recycled plastics and novel plant-based materials. By 2030, Suntory has committed to using 100% sustainable plastic bottles, a significant undertaking driven by technological innovation in the sector.

These advancements are crucial for meeting evolving regulatory landscapes and increasing consumer demand for environmentally responsible products. Beyond sustainability, smart packaging solutions are also being integrated, offering potential benefits in product traceability and enhanced consumer interaction.

- Innovation Focus: Development of plant-based plastics and advanced recycled plastics.

- Sustainability Target: Suntory aims for 100% sustainable plastic bottles by 2030.

- Consumer & Regulatory Drivers: Meeting eco-friendly expectations and compliance.

- Added Value: Potential for improved traceability and consumer engagement through smart packaging.

Water Management and Treatment Technologies

Water management and treatment technologies are becoming increasingly vital for beverage companies like Suntory, especially with growing concerns about global water scarcity. These advanced systems are key to minimizing the significant water footprint inherent in beverage production.

Suntory is actively investing in smart water technologies, which include real-time monitoring systems and sophisticated recycling solutions. These innovations allow for more efficient water use and help ensure that operations are sustainable and environmentally responsible.

The company has set ambitious targets, aiming for a 35% reduction in water usage across its global operations by the year 2030. This commitment underscores the strategic importance of technological advancements in water management for Suntory's long-term business strategy and environmental stewardship.

- Smart Water Monitoring: Implementing IoT sensors for real-time tracking of water consumption and quality across all production facilities.

- Advanced Recycling Systems: Utilizing membrane filtration and UV treatment to enable high-quality water reuse within manufacturing processes.

- Wastewater Treatment: Employing biological and chemical treatment methods to ensure discharged water meets or exceeds environmental regulations, potentially for re-use in non-potable applications.

- Water Footprint Reduction: Targeting a 35% decrease in global water usage by 2030, a critical goal for sustainability.

Technological advancements are critical for Suntory's product innovation, enabling the development of novel formulations with functional ingredients and plant-based alternatives to meet evolving consumer health trends. The integration of AI in product development aids in flavor profiling and predicting market acceptance, ensuring Suntory stays ahead of consumer preferences.

The company's commitment to digital transformation, including e-commerce and data analytics, is vital for enhancing consumer engagement and operational efficiency. Global e-commerce sales in the food and grocery sector are projected to exceed $1.5 trillion by the end of 2024, underscoring the necessity of a robust online presence.

Suntory's investment in sustainable packaging technologies, such as advanced recycled plastics, is driven by environmental goals and consumer demand. The company aims to use 100% sustainable plastic bottles by 2030, a target supported by technological innovations in material science.

Furthermore, smart water management technologies are crucial for Suntory to address water scarcity concerns and reduce its operational footprint. By 2030, Suntory targets a 35% reduction in global water usage, supported by real-time monitoring and advanced recycling systems.

| Technology Area | Suntory's Focus/Investment | Market Trend/Data (2024/2025 Projections) | Impact on Suntory |

|---|---|---|---|

| Manufacturing Automation | Smart factories, automated systems | Global industrial automation market projected over $300 billion by 2024 | Increased efficiency, cost reduction, product consistency |

| Product Development | Biotechnology, AI, advanced food science | Growing demand for functional ingredients, plant-based alternatives | Novel product creation, meeting health and wellness trends |

| Digital Transformation | E-commerce, digital marketing, data analytics | Food & grocery e-commerce sales projected over $1.5 trillion by end of 2024 | Enhanced consumer engagement, strengthened online footprint |

| Sustainable Packaging | Advanced recycled plastics, plant-based materials | Commitment to 100% sustainable plastic bottles by 2030 | Meeting environmental goals, consumer demand for eco-friendly products |

| Water Management | Smart water monitoring, advanced recycling | Targeting 35% reduction in global water usage by 2030 | Sustainable operations, addressing water scarcity concerns |

Legal factors

Suntory Beverage & Food operates under a complex web of food and beverage safety regulations globally. These rules, enforced by bodies like the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA), cover everything from ingredient sourcing and permissible additives to contaminant limits and hygienic manufacturing practices. For instance, the FDA's Food Safety Modernization Act (FSMA) emphasizes preventive controls, a significant shift that requires rigorous oversight throughout the supply chain.

Compliance is not optional; failure to meet these standards can result in severe consequences. In 2023, the FDA issued numerous warning letters and recalls for products violating safety regulations, highlighting the constant vigilance required. For Suntory, this means meticulous tracking of raw materials, robust quality control at every production stage, and adherence to labeling requirements that can differ significantly between markets, impacting product formulation and marketing strategies.

Advertising and marketing laws significantly shape how Suntory Beverage & Food promotes its products. Regulations around health claims and sugar content, for instance, directly influence messaging for brands like Lucozade and Ribena, especially in markets like the UK where the sugar tax has been in effect since 2018. The company must meticulously ensure all campaigns adhere to consumer protection laws, avoiding any misleading statements about product benefits or ingredients to maintain trust and avoid penalties.

Suntory Beverage & Food must navigate a complex web of labor laws globally, encompassing minimum wage, overtime, and workplace safety standards. For instance, in 2024, many developed nations continued to see adjustments to minimum wage rates, impacting Suntory's operational costs in regions like Europe and North America.

Compliance with regulations regarding employee benefits, such as health insurance and paid leave, is also critical. Suntory's commitment to diversity and inclusion, as highlighted by Suntory Global Spirits, necessitates adherence to non-discrimination policies, ensuring fair treatment across its diverse workforce.

Failure to comply can lead to significant fines and reputational damage. For example, in 2023, several multinational corporations faced substantial penalties for labor law violations, underscoring the importance of robust internal compliance mechanisms for companies like Suntory.

Intellectual Property Rights

Suntory Beverage & Food heavily relies on robust intellectual property (IP) protection to safeguard its valuable brands, unique product formulations, and advanced technologies. This includes securing patents for novel beverage production methods and ingredients, registering trademarks for iconic brand names like Suntory, and utilizing copyrights for marketing materials and packaging designs.

The legal landscape surrounding IP rights is critical for Suntory to maintain its market differentiation and prevent competitors from unfairly benefiting from its innovations. For instance, in 2023, the global legal spend on IP protection for major beverage companies often ran into tens of millions of dollars, reflecting the significant investment in this area.

- Patents: Suntory actively patents new flavor combinations, processing techniques, and functional ingredient applications to create barriers to entry.

- Trademarks: Protecting its diverse portfolio of beverage brands through trademark registration is essential for consumer recognition and brand loyalty.

- Copyrights: Copyright law safeguards Suntory's creative assets, including unique advertising campaigns and product packaging artwork.

- Trade Secrets: Certain proprietary recipes and manufacturing processes are maintained as trade secrets, offering another layer of competitive protection.

Environmental Protection Laws

Environmental protection laws extend beyond packaging, creating legal obligations for Suntory regarding waste disposal, emissions, and resource management, such as water usage. These regulations are continually tightening, making compliance crucial to avoid penalties and showcase corporate responsibility. The EU Deforestation Regulation, for instance, directly impacts the sourcing and use of paper and cardboard in packaging.

Failure to comply can result in significant fines and reputational damage. For example, in 2023, companies faced penalties for non-compliance with Extended Producer Responsibility (EPR) schemes, which often include waste management and recycling targets.

- Waste Management: Suntory must adhere to national and international waste disposal regulations, including those related to recycling and landfill diversion.

- Emissions Control: Legal requirements for controlling air and water emissions from manufacturing facilities are in place, necessitating investment in pollution abatement technologies.

- Resource Management: Laws governing water usage and conservation, particularly in water-scarce regions, impact operational planning and efficiency.

- Packaging Regulations: Increasingly stringent rules on packaging materials, recyclability, and recycled content, such as the EU's Circular Economy Action Plan, directly affect Suntory's product presentation and supply chain.

Suntory Beverage & Food must navigate evolving food safety regulations globally, with bodies like the FDA and EFSA setting strict standards for ingredients and manufacturing. For example, the FDA's FSMA emphasizes preventive controls throughout the supply chain, requiring rigorous oversight to avoid recalls and penalties, as seen with numerous warning letters issued in 2023.

Advertising laws, particularly concerning health claims and sugar content, significantly influence marketing strategies. The UK's sugar tax, in effect since 2018, demonstrates how such legislation impacts product formulation and promotional messaging for brands like Ribena. Suntory must ensure all campaigns are transparent and compliant with consumer protection laws to maintain brand trust.

Labor laws, including minimum wage and workplace safety, affect operational costs, with adjustments to minimum wages occurring in many developed nations in 2024. Suntory also adheres to non-discrimination policies, reflecting a commitment to diversity and inclusion across its global workforce, crucial for avoiding legal repercussions and reputational damage.

Intellectual property (IP) protection is vital, with global legal spend on IP for major beverage companies reaching tens of millions of dollars in 2023. Suntory actively patents new processes and trademarks brands like Suntory to maintain market differentiation and prevent infringement.

Environmental factors

Water scarcity and quality are critical environmental factors for Suntory Beverage & Food. As a core ingredient, access to clean water is paramount, and increasing global shortages and contamination risks present a significant operational challenge. Suntory is actively addressing this by implementing comprehensive water stewardship programs, focusing on reduction and recycling, particularly in areas facing water stress. Their ambitious target is a 35% reduction in global water usage by 2030, underscoring their commitment to sustainable water management.

Climate change poses significant risks to Suntory Beverage & Food by disrupting agricultural supply chains for key ingredients like coffee and tea, and increasing operational energy costs due to extreme weather events. For instance, droughts in coffee-growing regions can lead to reduced yields and price volatility, directly impacting Suntory's sourcing stability and profitability.

The company faces increasing pressure from consumers, investors, and regulators to demonstrably reduce its carbon footprint across its entire value chain, from raw material sourcing to final product distribution. This includes addressing emissions from agriculture, manufacturing processes, packaging, and transportation.

Setting and achieving ambitious, science-based targets for greenhouse gas (GHG) emission reduction is paramount for Suntory's long-term sustainability and brand reputation. As of 2024, Suntory is committed to a 50% reduction in CO2 emissions from its production facilities by 2030 and aims to achieve net-zero emissions across its entire value chain by 2050.

The escalating global problem of plastic pollution and the increasing concern over packaging waste directly affect the beverage sector. Suntory is under pressure from both government bodies and consumers to implement more environmentally friendly packaging options, boost the use of recycled materials, and guarantee that its product containers can be recycled or composted.

Suntory has set ambitious targets, aiming for all its packaging to be recyclable by 2025. Furthermore, the company is striving to incorporate 50% recycled plastic into its containers by the same year, reflecting a commitment to circular economy principles in its operations.

Biodiversity and Sustainable Sourcing

Suntory Beverage & Food's reliance on natural ingredients for its diverse product portfolio, ranging from teas to juices, directly links its operations to biodiversity. The company must prioritize sustainable and ethical sourcing to safeguard ecosystems and promote responsible land management. This commitment is crucial for minimizing its environmental footprint across the entire supply chain, particularly concerning raw materials used in packaging, such as paper and pulp, which can contribute to deforestation if not managed responsibly.

Ensuring biodiversity protection involves a multi-faceted approach to sourcing. For instance, in 2023, the company continued its efforts to promote sustainable agriculture for key ingredients. Their initiatives often involve working with farmers to adopt practices that reduce pesticide use and protect natural habitats. This focus is increasingly important as global consumer awareness of environmental impact grows, pushing companies to demonstrate tangible progress in their sustainability commitments.

Key aspects of Suntory's approach to biodiversity and sustainable sourcing include:

- Promoting Biodiversity in Agriculture: Implementing agricultural practices that support local ecosystems and reduce reliance on harmful chemicals.

- Sustainable Packaging Materials: Sourcing paper and pulp from certified sustainable forests to combat deforestation and protect forest biodiversity.

- Water Stewardship: Recognizing water as a vital natural resource, Suntory focuses on responsible water management in its sourcing regions, which directly impacts aquatic biodiversity.

- Supply Chain Transparency: Enhancing visibility into its supply chain to identify and mitigate risks related to biodiversity loss and ensure ethical sourcing standards are met.

Waste Management and Circular Economy Principles

Suntory Beverage & Food is increasingly focusing on integrating circular economy principles, which means prioritizing waste reduction, material reuse, and enhanced recycling across its operations. This strategic shift is vital for environmental stewardship and achieving long-term sustainability targets.

The company's commitment to minimizing operational waste, with an ambition for zero waste to landfill, directly impacts its environmental footprint. For instance, by 2022, Suntory Group achieved a 98.7% recycling rate for packaging materials in Japan, demonstrating tangible progress in waste management.

- Waste Reduction Targets: Suntory aims for zero waste to landfill from its manufacturing sites globally.

- Circular Economy Initiatives: Focus on reducing plastic usage, increasing recycled content in packaging, and exploring innovative reuse models.

- Recycling Rates: In 2022, Suntory Beverage & Food achieved a 98.7% recycling rate for packaging materials in Japan.

- Sustainable Packaging: Continued investment in developing and implementing more sustainable packaging solutions, including plant-based plastics and lightweighting.

Suntory Beverage & Food's environmental strategy is heavily influenced by water availability and quality, with a goal to reduce global water usage by 35% by 2030, highlighting the critical nature of water stewardship for their operations.

Climate change impacts their supply chain, especially for ingredients like coffee, and increases operational costs through extreme weather, necessitating adaptation and mitigation strategies to ensure sourcing stability.

The company is actively working to reduce its carbon footprint, aiming for a 50% reduction in CO2 emissions from production by 2030 and net-zero across its value chain by 2050, reflecting a strong commitment to climate action.

Addressing plastic pollution is a priority, with Suntory targeting 100% recyclable packaging by 2025 and aiming to use 50% recycled plastic in containers by the same year, demonstrating a push towards a circular economy.

| Environmental Factor | Suntory's Commitment/Target | Year | Progress/Data Point |

|---|---|---|---|

| Water Usage Reduction | 35% reduction in global water usage | 2030 | |

| CO2 Emission Reduction | 50% reduction from production facilities | 2030 | |

| Net-Zero Emissions | Across entire value chain | 2050 | |

| Packaging Recyclability | 100% recyclable packaging | 2025 | |

| Recycled Plastic in Packaging | 50% recycled plastic in containers | 2025 | |

| Packaging Recycling Rate (Japan) | 2022 | 98.7% |

PESTLE Analysis Data Sources

Our Suntory Beverage & Food PESTLE Analysis is grounded in data from reputable sources including the World Health Organization, national food safety agencies, and leading market research firms. We incorporate economic indicators from the IMF and World Bank, alongside reports on environmental sustainability and technological advancements.