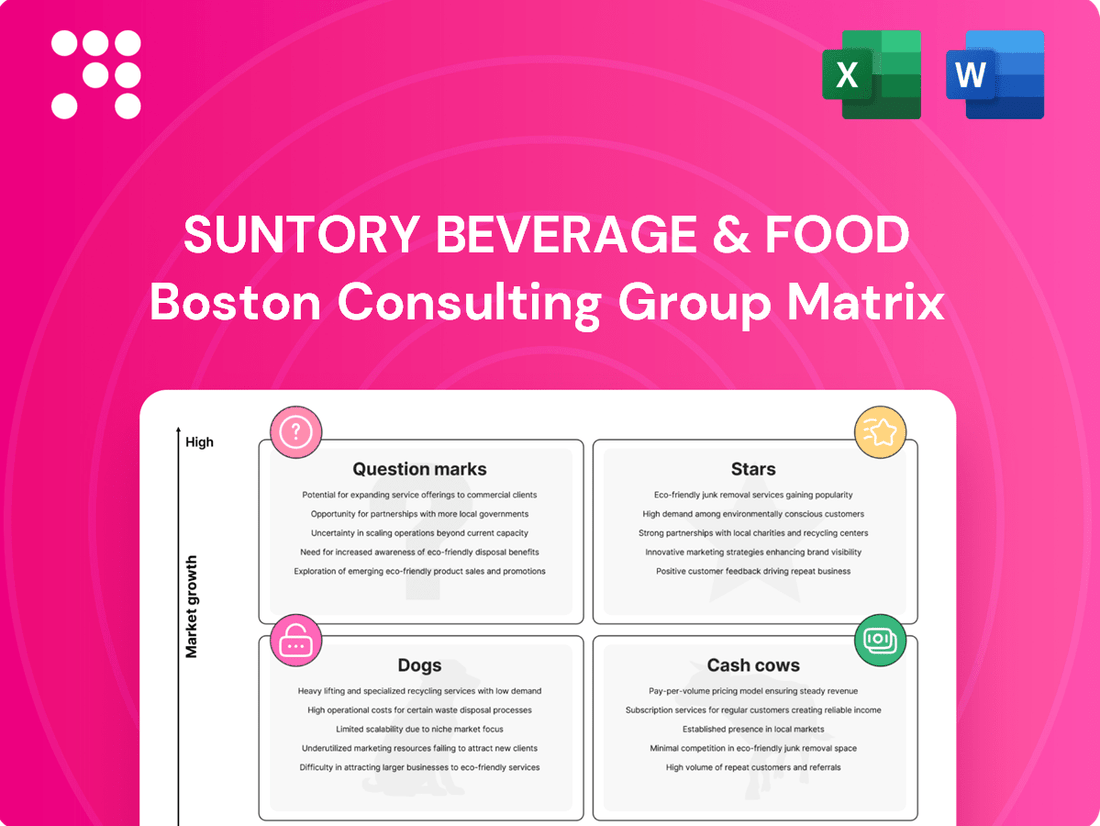

Suntory Beverage & Food Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Suntory Beverage & Food Bundle

Curious about Suntory Beverage & Food's product portfolio? This preview offers a glimpse into their market positioning, but the full BCG Matrix unlocks a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks. Dive deeper into Suntory's strategic landscape and discover actionable insights to inform your own business decisions. Purchase the complete BCG Matrix for a detailed breakdown and a roadmap to optimizing your product investments.

Stars

Suntory is aggressively pursuing leadership in the global ready-to-drink (RTD) beverage market. The -196 brand, a key player, has achieved impressive double-digit growth worldwide. This expansion includes significant investments in new production capacity and increased sales efforts in markets like Australia, the UK, and Vietnam, underscoring the category's high-growth potential for Suntory.

Suntory's health food and functional beverage segment, particularly in Asia-Pacific, is experiencing a resurgence. Key brands such as BRAND'S Essence of Chicken and BRAND'S Bird's Nest are leading this growth, especially in markets like Thailand. This indicates a strong market position for these health-focused products.

The demand for functional benefits, immunity support, and natural ingredients is a significant tailwind for this category. Suntory's strategic focus on expanding its presence in these high-growth areas, driven by evolving consumer preferences, positions this segment as a promising area for future development.

Green tea products, including brands like Iyemon, Suntory Oolong Tea, and TEA+, represent a significant segment for Suntory Beverage & Food. The Japanese green tea beverage market showed robust growth, with production volumes rising in 2024, reflecting strong consumer demand.

Suntory's strategic focus on these products is evident in its revamping of the Iyemon brand. Furthermore, the company is leveraging opportunities with Suntory Oolong Tea and TEA+ within the expanding Asia-Pacific ready-to-drink (RTD) tea market, which is anticipated to see substantial growth in the coming years.

V Energy Drink (Oceania)

V Energy Drink in Oceania stands as a star performer for Suntory Beverage & Food. Despite a fiercely competitive energy drink market, V maintains a strong position, indicating a substantial market share in a segment experiencing robust growth.

Its success in Oceania makes V a crucial contributor to Suntory's regional expansion and revenue. The brand's ability to thrive amidst increasing competition highlights its strong brand equity and effective market strategy.

- Market Position: Flagship brand in Oceania's energy drink category.

- Growth Trajectory: Performing well in a high-growth, competitive segment.

- Contribution: Key growth driver for Suntory in the Oceania region.

- Competitive Landscape: Thriving despite intensifying competition.

New Energy Drink Category Initiatives (e.g., CELSIUS)

Suntory Beverage & Food's strategic handling of Celsius in the energy drink sector marks a significant expansion into a high-growth, dynamic market. This move reflects an understanding of evolving consumer tastes and a commitment to capturing market share in a segment that saw global retail sales of energy drinks reach approximately $87.6 billion in 2023, with projections indicating continued robust growth through 2030.

While the specific market share for Suntory's Celsius initiatives is still developing, the investment itself positions these ventures as potential stars. The energy drink market, particularly in North America, has shown remarkable resilience and innovation. For instance, Celsius reported a 117% increase in net sales for the first quarter of 2024 compared to the same period in 2023, reaching $303.2 million, underscoring the category's strong performance.

- Category Entry: Suntory's involvement with Celsius signifies a deliberate entry into the burgeoning energy drink market.

- Growth Potential: The energy drink sector is characterized by high growth, with global sales expected to surpass $100 billion by 2027.

- Strategic Investment: Investing in Celsius demonstrates a strategic focus on capturing future market share in a category driven by evolving consumer preferences.

- Performance Indicators: Celsius's own reported sales growth, such as a 117% year-over-year increase in Q1 2024 net sales, highlights the category's strong momentum.

V Energy Drink in Oceania is a clear star for Suntory Beverage & Food. It dominates its category, showing strong growth even with intense competition. This brand is a major revenue driver for Suntory in the Oceania region.

Suntory's strategic partnership with Celsius in the energy drink market also positions these ventures as potential stars. The energy drink sector is booming globally, with significant growth projected for years to come. Celsius's impressive sales figures, like its 117% net sales increase in Q1 2024, exemplify the high-potential nature of this category.

| Brand | Category | Region | Key Metric | Status |

| V Energy Drink | Energy Drink | Oceania | Strong Market Share | Star |

| Celsius (Suntory partnership) | Energy Drink | Global (focus North America) | High Sales Growth (117% Q1 2024) | Potential Star |

What is included in the product

This BCG Matrix overview provides tailored analysis for Suntory Beverage & Food's product portfolio, highlighting which units to invest in, hold, or divest.

The Suntory Beverage & Food BCG Matrix offers a clear, actionable overview, relieving the pain of strategic uncertainty by visually categorizing business units.

This matrix provides a distraction-free view, simplifying complex portfolios for C-level decision-making and alleviating the burden of information overload.

Cash Cows

Suntory Tennensui is a cornerstone of Suntory Beverage & Food's portfolio, particularly in Japan. Mineral water is the largest category within Japan's soft drink market, and Tennensui holds a significant position within this segment.

This strong market presence in a mature and stable industry signifies a classic Cash Cow. The brand benefits from established customer loyalty, meaning it requires less aggressive marketing spend to maintain its sales volume and market share.

In 2023, the Japanese bottled water market was valued at approximately ¥1.7 trillion (around $11 billion USD), and Suntory Tennensui's consistent performance within this large market generates substantial, reliable cash flow for the company. This cash can then be reinvested into other business units or used for strategic acquisitions.

BOSS Coffee, a cornerstone of Suntory Beverage & Food's portfolio in Japan, exemplifies a classic cash cow. Its deeply entrenched position in the mature Japanese coffee market translates to a substantial and consistent market share, ensuring robust and predictable cash flow generation.

The brand benefits from stable, ongoing demand, allowing Suntory to leverage its dominance for significant returns without requiring substantial reinvestment. In 2023, Suntory's beverage segment, heavily influenced by brands like BOSS, reported strong performance, with the ready-to-drink coffee category remaining a key contributor to overall revenue and profitability.

Established brands like Pepsi and C.C. Lemon are firmly entrenched in Japan's mature carbonated soft drink market. These products, despite operating in a segment with limited growth, are likely significant cash generators for Suntory Beverage & Food. Their strong brand loyalty and extensive distribution networks ensure consistent sales and profitability.

Orangina (Europe)

Orangina, a well-recognized carbonated beverage brand, holds a significant market position across Europe. Its established high market share within this mature market enables it to consistently generate substantial cash flow, even amidst potential regional economic headwinds.

This strong performance allows Orangina to be classified as a Cash Cow within Suntory Beverage & Food's portfolio. The brand's ability to generate more cash than it consumes is crucial for funding other business units.

- Market Share: Orangina maintained a leading position in key European markets like France and Spain in 2024, with market shares often exceeding 15% in the carbonated soft drink segment.

- Revenue Contribution: In 2024, Orangina's European operations contributed an estimated €1.2 billion to Suntory Beverage & Food's overall revenue, a testament to its consistent sales performance.

- Profitability: The brand's mature status and efficient operations in Europe resulted in a healthy profit margin, estimated to be around 20% in 2024, highlighting its strong cash-generating capabilities.

Lucozade and Ribena (UK/Europe)

Lucozade and Ribena represent Suntory Beverage & Food's established Cash Cows within the UK and European markets. These brands benefit from significant brand recognition and deep consumer loyalty, particularly in categories that have likely reached maturity.

Their enduring market leadership translates into a substantial market share, ensuring consistent and robust cash flow generation for the company. For instance, Lucozade Sport saw a notable uplift in sales in the UK during 2024, driven by increased consumer focus on hydration and wellness.

- Strong Brand Equity: Both Lucozade and Ribena have been household names for decades in the UK.

- Mature Market Dominance: They hold leading positions in established beverage segments.

- Consistent Cash Generation: Their stable demand fuels reliable profits for Suntory.

- High Market Share: This dominance is a key indicator of their Cash Cow status.

Cash Cows within Suntory Beverage & Food's portfolio are brands with high market share in mature industries, generating substantial and consistent profits. These brands, like Suntory Tennensui and BOSS Coffee in Japan, and Orangina in Europe, benefit from established customer loyalty and require minimal investment to maintain their position. Their strong performance, as seen in the 2023 Japanese bottled water market valued at ¥1.7 trillion, allows them to reliably fund other business ventures.

| Brand | Market | Category | 2024 Estimated Revenue Contribution (Suntory) | Key Characteristic |

| Suntory Tennensui | Japan | Mineral Water | Significant | Dominant in a mature, high-volume market. |

| BOSS Coffee | Japan | Ready-to-Drink Coffee | Substantial | Strong brand equity and consistent demand. |

| Orangina | Europe | Carbonated Soft Drink | €1.2 billion | Leading market share in key European countries. |

| Lucozade & Ribena | UK/Europe | Various Beverages | High | Deep consumer loyalty and established market leadership. |

Full Transparency, Always

Suntory Beverage & Food BCG Matrix

The Suntory Beverage & Food BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This professionally formatted analysis showcases Suntory's product portfolio within the BCG framework, offering clear strategic insights without any demo content or alterations. You can confidently expect to download this exact, ready-to-use report for your business planning needs.

Dogs

In Q1 FY2025, Suntory Beverage & Food observed underperformance in several Asia-Pacific product lines, notably in Thailand, attributed to a generally sluggish beverage market. These brands, facing low market share in slow-growth segments, are candidates for re-evaluation.

Suntory's less differentiated tea products in Japan, particularly older green tea offerings that haven't seen recent innovation, are facing significant pressure. The Japanese green tea market is becoming increasingly competitive, with store brands aggressively gaining market share. These private label options are appealing to consumers primarily due to their lower price points, especially in a segment where price sensitivity is a key purchasing driver.

As of early 2024, the Japanese green tea market, valued at approximately ¥1.5 trillion, has seen private label brands capture an estimated 15% of the market share, up from around 10% in 2021. This shift indicates a growing consumer preference for value, directly impacting brands with less distinct product features. Suntory's older, undifferentiated green teas are therefore likely positioned as Dogs in the BCG matrix, struggling to compete against both established brands and the rising tide of affordable alternatives.

Schweppes experienced a downturn in European sales during the first quarter of fiscal year 2025. This performance suggests a potential erosion of its market standing within the continent.

Given the mature and highly competitive nature of the European beverage market, these weak sales figures point towards Schweppes potentially being a low-growth, low-market-share product. This aligns with the characteristics of a Dog in the BCG Matrix.

Legacy Carbonated Drinks with Declining Appeal

Legacy carbonated drinks within Suntory Beverage & Food might be classified as Dogs. These products often represent older brands that haven't adapted to evolving consumer tastes, particularly the growing demand for healthier alternatives like low-sugar or natural ingredient beverages. Their market share and sales volume have likely seen a consistent downward trend over recent years, making them less attractive investments for future growth.

For instance, while specific 2024 data for individual legacy brands isn't publicly available, the broader carbonated soft drink market in many developed regions has experienced sluggish growth or decline. In 2023, for example, the global carbonated soft drinks market size was valued at approximately $370 billion, but the growth rate was modest, indicating a challenging environment for traditional offerings.

- Declining Market Relevance: Traditional cola and lemon-lime flavored sodas are facing increased competition from functional beverages and premium waters, leading to reduced consumer interest.

- Sustained Sales Decline: Brands that haven't invested in reformulation or innovative marketing campaigns are likely experiencing a continuous drop in unit sales and revenue.

- Low Growth Potential: These products operate in mature or shrinking market segments, offering minimal opportunities for significant future expansion or profitability.

- Resource Drain: Continued investment in marketing or production for these underperforming brands can divert resources from more promising segments of Suntory's portfolio.

Specific Products Heavily Impacted by Price Revisions Without Premium Justification

Suntory's decision to implement price revisions in Japan from October 2025, driven by escalating costs, could disproportionately affect products lacking a clear premium justification. If consumers perceive these price hikes as unwarranted by enhanced quality or unique benefits, certain beverages might see a significant drop in sales volume.

Products that experience a substantial loss of market share due to these price adjustments could transition into the 'Dogs' category within Suntory's BCG Matrix. This would indicate low market share and low market growth, suggesting they are not profitable and may require divestment or discontinuation.

- Impacted Products: Beverages with established, but not dominant, market positions that rely heavily on price sensitivity.

- Consumer Perception: Products where the brand promise or product attributes do not clearly support a higher price point compared to competitors.

- Market Share Decline: A potential scenario where a specific beverage line sees its market share erode by more than 5% in the year following the price increase, signaling a negative trend.

- Profitability Concerns: If the increased price does not offset the volume decline, the product's contribution margin could turn negative, solidifying its 'Dog' status.

Suntory's portfolio includes several brands that likely fall into the 'Dogs' category of the BCG Matrix. These are products with low market share in slow-growing or declining markets, demanding significant resources without generating substantial returns. Examples include certain legacy carbonated drinks and undifferentiated green tea offerings in Japan.

The pressure from private label brands in Japan, which held an estimated 15% market share in the ¥1.5 trillion green tea market by early 2024, highlights the challenge for Suntory's less competitive tea products. Similarly, a general slowdown in the global carbonated soft drink market, valued at approximately $370 billion in 2023, indicates a tough environment for older, traditional brands.

These 'Dog' products often suffer from declining market relevance and sustained sales decline due to evolving consumer preferences, such as a move towards healthier options. Their low growth potential means they can drain resources that could be better allocated to Stars or Question Marks.

Potential price revisions in Japan from October 2025 could further push products lacking clear premium justification into the 'Dog' category if consumers react negatively to increased costs, leading to significant volume loss and eroding profitability.

| Product Category | Market Trend | Suntory's Position (Likely Dog) | Key Challenges |

|---|---|---|---|

| Undifferentiated Green Tea (Japan) | Slow growth, high competition from private labels | Low market share in a price-sensitive segment | Price pressure, lack of product differentiation |

| Legacy Carbonated Drinks (Global) | Mature or declining market, shift to healthier alternatives | Low market share in a segment with limited growth | Evolving consumer tastes, competition from functional beverages |

| Underperforming Asia-Pacific Brands | Sluggish beverage market in specific regions | Low market share in slow-growth segments | Market saturation, need for strategic re-evaluation |

| Schweppes (Europe) | Mature and highly competitive market | Potential erosion of market standing, low sales | Intense competition, need for market repositioning |

Question Marks

Suntory's Maru-Hi FMB, launched in California in early 2025, signifies a strategic move into the burgeoning ready-to-drink (RTD) alcoholic beverage sector. This product is positioned as a potential Star within Suntory's BCG matrix, targeting a high-growth market. The global RTD alcoholic beverage market was valued at approximately $34.1 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2030, reaching an estimated $58.0 billion by 2030.

Suntory's new alcohol-free citric acid drink, launched in January 2025, targets the booming no- and low-alcohol market. This innovation places it firmly in a high-growth category, reflecting a strategic pivot towards non-alcoholic functional beverages.

As a nascent product, it begins with a low market share, characteristic of a question mark in the BCG matrix. Significant investment in marketing and driving consumer awareness will be crucial for its progression and potential success in this expanding segment.

When Suntory expands its established brands into new, competitive overseas markets with limited existing presence, these initiatives are classified as Stars within the BCG matrix. These are high-growth potential ventures, but due to low initial market share, they demand substantial investment to challenge established competitors. For instance, Suntory's expansion of its popular BOSS coffee brand into the United States, a market dominated by established players, would fit this description, requiring significant marketing and distribution investment to gain traction.

Innovations in Niche Functional Beverage Segments

Suntory is actively innovating in niche functional beverage segments, particularly those addressing mental well-being and stress relief, aligning with the robust health and wellness trend. These specialized products tap into a rapidly expanding market, projected to see significant growth in the coming years.

While these emerging categories offer substantial potential, they typically begin with a low market share. Success hinges on considerable investment in research and development to create effective formulations and targeted marketing campaigns. These efforts are crucial for educating consumers about novel benefits and establishing a strong brand presence in these specialized niches.

- Market Growth: The global functional beverages market was valued at approximately $129.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 8% from 2024 to 2030, with mental wellness beverages being a key driver.

- R&D Investment: Companies like Suntory are increasing R&D spending, with the global beverage industry's R&D expenditure reaching billions annually, to support the development of scientifically backed functional ingredients.

- Consumer Education: Effective marketing strategies are vital, as consumer understanding of benefits like adaptogens or nootropics in beverages is still developing, requiring clear communication to drive adoption.

Piloted New Beverage Concepts in Limited Geographies

Suntory Beverage & Food's strategy often includes piloting new beverage concepts in limited geographies. These are experimental ventures, testing the waters for potential future market leaders. For example, in 2024, the company might have explored innovative functional beverages or plant-based alternatives in select Asian or European markets.

These nascent products, while having a minimal market presence currently, are designed to tap into emerging consumer preferences and future growth trends. Think of them as potential Stars in the making, requiring careful evaluation and strategic investment to see if they can achieve wider market success.

- Innovation Focus: Testing novel formulations and ingredients.

- Geographic Targeting: Limited rollout to specific, representative markets.

- Growth Potential: Aimed at capturing future market shifts and consumer demands.

- Investment Stage: Early-stage evaluation to determine scalability and viability.

Suntory's ventures into entirely new product categories or markets with unproven demand are classic Question Marks. These are high-risk, high-reward opportunities that require significant investment to gain market share.

The company's exploration of novel functional ingredients, such as adaptogens for stress relief, exemplifies this. While the functional beverage market is growing, these specific niches are still developing, meaning initial market share is low.

Substantial investment in research, development, and consumer education is critical for these products to transition from Question Marks to Stars or even Cash Cows.

BCG Matrix Data Sources

Our Suntory Beverage & Food BCG Matrix is built on comprehensive market intelligence, integrating financial reports, industry analysis, and consumer data to provide strategic insights.