Sumitomo Metal Mining PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sumitomo Metal Mining Bundle

Gain a strategic advantage by understanding the complex external forces impacting Sumitomo Metal Mining. Our PESTLE analysis delves into political stability, economic fluctuations, technological advancements, environmental regulations, and social shifts that shape the company's operational landscape. Unlock actionable intelligence to refine your investment strategy and anticipate market dynamics. Download the full PESTLE analysis now for a comprehensive understanding.

Political factors

Government policies are a major influence on Sumitomo Metal Mining's operations, especially in countries where it extracts resources. For instance, in 2024, several nations are reviewing their mining royalty structures, with some proposing increases to capture more value from their natural resources. This directly affects Sumitomo Metal Mining's profitability and the overall cost of doing business.

Regulations concerning mining permits and environmental standards are also critical. In 2025, stricter environmental compliance measures are expected to be implemented in key mining regions, potentially increasing operational expenses for Sumitomo Metal Mining. Resource nationalism, where governments prioritize domestic control and benefit from resource extraction, can also lead to unpredictable policy shifts, impacting supply chain stability.

Global trade policies and bilateral agreements significantly influence the movement of raw materials and refined metals, directly impacting Sumitomo Metal Mining. For instance, in 2024, ongoing negotiations around trade frameworks, such as potential revisions to existing agreements or the formation of new ones, could reshape market access and cost structures for key commodities like copper and nickel.

Tariffs imposed on imported or exported metals can directly alter the competitiveness of Sumitomo Metal Mining's products on the international stage. A hypothetical tariff increase on refined copper entering a major manufacturing hub in 2025 could make Sumitomo's offerings less attractive compared to domestic producers or those from countries with more favorable trade terms.

Geopolitical tensions and trade disputes, such as those observed between major economic blocs in recent years, pose a substantial risk to supply chains and demand patterns. For example, escalating trade friction in 2024 could lead to disruptions in the availability of essential raw materials or create uncertainty in the demand for Sumitomo's high-purity metals used in advanced manufacturing.

The political stability of nations where Sumitomo Metal Mining operates, particularly the Philippines for nickel and Chile for copper, is a significant factor. For instance, the Philippines' political landscape, while generally stable, can experience localized unrest that might affect supply chains or mining permits. In 2023, the country's mining sector continued to navigate regulatory changes and environmental concerns, underscoring the need for constant political risk assessment.

Instability, such as civil conflicts or abrupt government policy changes, poses direct threats to Sumitomo Metal Mining's operations. These events can disrupt production, escalate security costs, and even raise the specter of asset nationalization, directly impacting profitability and investment security. Chile, a major copper producer, has seen shifts in its political discourse regarding resource management, which could influence future mining regulations and investment climates.

Government support for green technologies

Government support for green technologies is a significant tailwind for Sumitomo Metal Mining. Initiatives and subsidies promoting electric vehicles (EVs) and renewable energy directly bolster the company's advanced materials segment, especially its battery materials business. For instance, Japan's government has set ambitious targets for EV adoption, aiming for 100% of new vehicle sales to be electrified by 2035, which translates to increased demand for the nickel and cobalt compounds Sumitomo produces.

These policies create a predictable and expanding market for critical minerals and specialized components essential for these green technologies. The global push for decarbonization, reinforced by government policies, is expected to drive substantial growth in the battery market. Analysts project the global EV battery market to reach over $300 billion by 2027, a significant increase from the $50 billion market in 2020, underscoring the impact of government support on companies like Sumitomo.

- Government incentives for EV adoption: Many countries, including Japan and those in Europe, offer tax credits and subsidies for purchasing EVs, directly boosting demand for battery components.

- Renewable energy targets: Ambitious renewable energy goals necessitate grid-scale battery storage, increasing demand for materials used in these systems.

- Investment in battery research and development: Government funding supports innovation in battery technology, benefiting companies like Sumitomo that are at the forefront of material science.

- Critical mineral supply chain support: Governments are increasingly focused on securing stable supply chains for critical minerals, which can lead to favorable policies for domestic or allied producers.

Regulatory environment for environmental standards

Sumitomo Metal Mining faces increasing global pressure to adhere to stricter environmental regulations. For instance, in 2024, the European Union's Carbon Border Adjustment Mechanism (CBAM) began its transitional phase, impacting carbon-intensive imports and potentially affecting supply chains for materials like metals. This necessitates substantial investment in cleaner technologies and sustainable mining practices to ensure compliance and maintain market access.

These evolving environmental standards, while adding to operational expenses, also serve as a catalyst for innovation. Companies like Sumitomo Metal Mining are driven to develop more efficient and less polluting production methods. For example, advancements in tailings management and water recycling are becoming critical, with many jurisdictions now mandating specific water usage reduction targets, pushing companies towards more circular economy principles in their operations.

- Stricter Regulations: Governments worldwide are implementing tougher environmental rules, requiring significant capital outlay for compliance.

- Innovation Driver: These regulations incentivize the development of cleaner production technologies and sustainable resource management.

- Operational Costs: Compliance measures, such as advanced pollution control systems, can increase overall operating expenses.

- Sustainability Alignment: Adherence to environmental standards supports the company's commitment to global sustainability goals and corporate social responsibility.

Government policies significantly shape Sumitomo Metal Mining's operational landscape, influencing everything from royalty structures to environmental compliance. In 2024, many nations are re-evaluating mining royalties, potentially increasing costs for companies like Sumitomo. Stricter environmental regulations are also on the horizon for 2025, demanding greater investment in sustainable practices and potentially impacting profitability.

Resource nationalism and geopolitical shifts add layers of complexity, affecting supply chain stability and market access for key commodities like copper and nickel. Trade policies and tariffs can alter the competitiveness of Sumitomo's refined metals, while government support for green technologies, such as electric vehicles, presents a significant growth opportunity for its advanced materials segment. For example, Japan's push for electrification by 2035 directly benefits Sumitomo's battery materials business.

The political stability of operating regions, such as the Philippines and Chile, remains a crucial consideration for Sumitomo Metal Mining. While generally stable, localized unrest or shifts in resource management policies can introduce operational risks and impact investment climates. Companies must remain agile, continuously assessing political risks to navigate these dynamic environments effectively.

What is included in the product

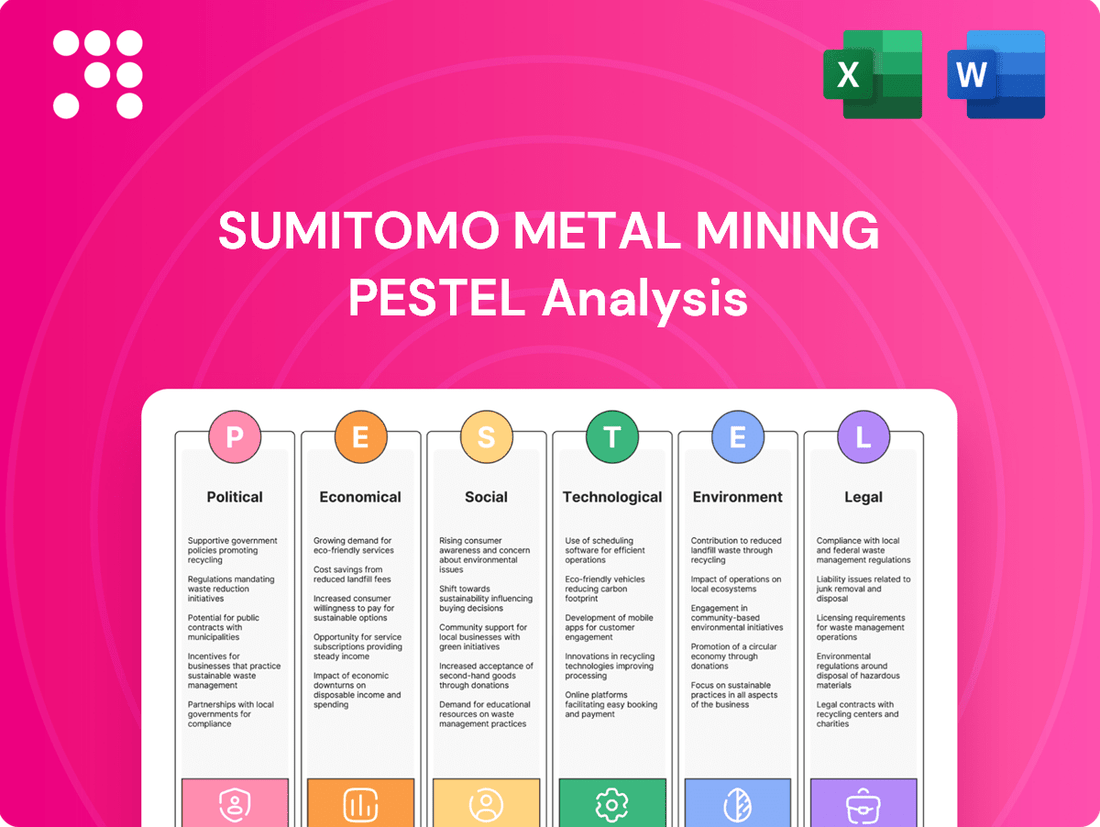

This PESTLE analysis examines the external macro-environmental factors influencing Sumitomo Metal Mining, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive overview of how global and regional trends create both challenges and opportunities for the company's strategic planning and operations.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex PESTLE data into actionable insights for Sumitomo Metal Mining's strategic discussions.

Economic factors

Sumitomo Metal Mining's financial performance is heavily tied to the volatile prices of base metals like copper and nickel, and precious metals such as gold and silver. For instance, copper prices, a key revenue driver, saw significant fluctuations in 2024, influenced by global manufacturing demand and supply chain disruptions, impacting Sumitomo's top-line results.

Global supply and demand shifts, coupled with speculative trading and macroeconomic indicators, are the primary forces behind these price swings. The International Monetary Fund's (IMF) World Economic Outlook for April 2025 projects continued global economic growth, which could bolster demand for industrial metals, but also flags potential inflationary pressures that might affect precious metal values.

This inherent volatility in commodity markets creates a dual-edged sword for Sumitomo Metal Mining. While periods of high prices can lead to increased profit margins, as seen in certain nickel market surges in early 2025 due to specific geopolitical events, unexpected downturns pose a substantial risk to earnings and investment planning.

Exchange rate movements significantly impact Sumitomo Metal Mining, a Japanese firm with extensive global activities. Fluctuations between the Japanese Yen (JPY) and currencies like the US Dollar (USD), Australian Dollar (AUD), and Philippine Peso (PHP) are a key concern. For instance, in early 2024, the Yen experienced a notable weakening trend against the dollar, which generally benefits Japanese exporters by making their goods cheaper abroad and increasing the yen-equivalent value of foreign earnings.

A stronger Yen, conversely, can diminish the yen value of profits earned in foreign currencies, as seen when the Yen briefly strengthened in late 2023. This currency volatility directly affects Sumitomo Metal Mining's reported earnings and the competitiveness of its products in international markets. The company's financial performance is therefore closely tied to the prevailing exchange rates, requiring careful hedging strategies to mitigate potential negative impacts.

Global economic growth is a primary driver for Sumitomo Metal Mining. A healthy global economy, as projected by the IMF in its October 2024 World Economic Outlook, which forecasts global growth at 3.1% for 2024 and 3.2% for 2025, directly fuels demand for the metals and materials the company produces. Industries like construction and automotive, which are significant consumers of copper and nickel, tend to expand during periods of economic expansion, boosting sales volumes for Sumitomo Metal Mining.

Conversely, economic downturns can significantly dampen industrial demand. For instance, a slowdown in China's manufacturing sector, a key market for many raw materials, could lead to reduced orders and price pressures for Sumitomo Metal Mining. The company's reliance on these cyclical industries means that fluctuations in global GDP growth directly translate to its revenue and profitability.

Inflation and interest rates

Rising inflation presents a significant challenge for Sumitomo Metal Mining, potentially inflating operational expenses for critical inputs like energy, labor, and raw materials. For instance, global inflation rates remained elevated throughout 2023 and into early 2024, with many developed economies experiencing consumer price index (CPI) growth above 3%. This directly impacts the cost structure of mining operations, squeezing profit margins if not effectively managed through pricing strategies or cost efficiencies.

Furthermore, the prevailing higher interest rate environment, a common response to inflation, directly affects Sumitomo Metal Mining's financial strategy. As of early 2024, major central banks in the US and Europe maintained policy rates at multi-year highs. This increases the cost of capital for financing large-scale, capital-intensive projects, such as new mine development or significant expansion plans. Higher borrowing costs can deter investment, delay project timelines, and impact the overall financial viability of future growth initiatives.

- Inflationary Pressures: Global inflation continued to be a concern in 2023-2024, impacting input costs for Sumitomo Metal Mining.

- Interest Rate Hikes: Central banks maintained higher interest rates in early 2024, increasing borrowing costs for capital investments.

- Project Viability: Elevated interest rates can affect the economic feasibility of new mining projects and expansions.

- Financial Health: These economic factors necessitate careful financial planning and risk management for Sumitomo Metal Mining.

Supply chain disruptions and logistics costs

Global supply chains remain vulnerable, as evidenced by ongoing geopolitical tensions and the lingering effects of the COVID-19 pandemic. These disruptions can significantly impact the availability and cost of essential raw materials for Sumitomo Metal Mining. For instance, the price of key metals like copper and nickel, crucial for Sumitomo Metal Mining's operations, has experienced volatility due to these factors.

Increased logistics costs are a direct consequence of these supply chain challenges. Freight rates, particularly for ocean shipping, saw substantial increases in 2024, impacting the cost of goods sold for many industries, including mining. This rise in transportation expenses directly squeezes profit margins, making efficient supply chain management a critical differentiator.

- Geopolitical instability continues to pose risks to the sourcing of critical minerals.

- Shipping costs for bulk commodities like metals saw an average increase of 15-20% in late 2024 compared to the previous year.

- Pandemic-related disruptions, though easing, still contribute to lead time variability for specialized equipment.

The global economic landscape in 2024 and early 2025 presents a mixed bag for Sumitomo Metal Mining. While projected global growth offers demand support, persistent inflation and higher interest rates pose significant challenges to operational costs and project financing.

Inflationary pressures, evident in elevated input costs for energy and materials throughout 2023-2024, directly impact mining operations. Simultaneously, central banks maintained higher interest rates in early 2024, increasing the cost of capital for large-scale projects, potentially affecting the viability of new mine developments and expansions.

These economic factors necessitate robust financial planning and risk management. Sumitomo Metal Mining must navigate currency volatility, with the Yen's fluctuations against major currencies like the USD impacting its foreign earnings and competitiveness.

Sumitomo Metal Mining's performance is intrinsically linked to global economic health, with industrial demand for its products like copper and nickel rising with GDP growth. Conversely, economic slowdowns, particularly in key markets like China's manufacturing sector, can reduce orders and create price pressures.

| Economic Factor | 2024/2025 Outlook/Data | Impact on Sumitomo Metal Mining |

|---|---|---|

| Global GDP Growth | Projected 3.1% (2024) and 3.2% (2025) by IMF (Oct 2024) | Supports demand for industrial metals; expansion in construction and automotive sectors. |

| Inflation Rate | Elevated throughout 2023-early 2024, with CPI >3% in many developed economies. | Increases operational expenses (energy, labor, materials), potentially squeezing profit margins. |

| Interest Rates | Major central banks maintained multi-year highs in early 2024. | Raises cost of capital for new projects and expansions, impacting financial viability. |

| Currency Exchange Rates | Yen weakening trend against USD in early 2024. | Benefits yen-equivalent value of foreign earnings; impacts competitiveness. |

Full Version Awaits

Sumitomo Metal Mining PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the Sumitomo Metal Mining PESTLE analysis. This comprehensive report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to this professionally structured analysis upon completing your purchase.

Sociological factors

Sumitomo Metal Mining prioritizes robust community engagement to ensure its social license to operate. This involves actively addressing local concerns about environmental stewardship, such as water quality monitoring and land rehabilitation efforts, which are critical for maintaining trust. For instance, in 2023, the company allocated ¥1.5 billion towards community development programs and environmental protection initiatives across its operational sites, reflecting a commitment to shared value creation.

Securing and maintaining a social license is paramount, as demonstrated by incidents in the broader mining industry where community opposition has led to significant project delays and increased operational costs. Sumitomo Metal Mining's proactive approach, including transparent communication and local employment opportunities, aims to mitigate such risks. In 2024, the company reported that over 60% of its workforce at its Philippine operations were sourced from local communities, contributing directly to regional economic development.

The availability of a skilled workforce is paramount for Sumitomo Metal Mining's operations, from extraction to the production of advanced materials. In 2023, the mining sector globally faced a shortage of skilled labor, with some estimates suggesting a need for over 200,000 new workers annually to meet projected demand. This scarcity directly impacts operational efficiency and the ability to implement new technologies.

Attracting and retaining talent, especially in remote mining sites or highly specialized technical roles like materials science, presents ongoing challenges. For instance, in Australia, a key mining region, the average age of mine workers has been increasing, highlighting a potential gap in experienced personnel. This can hinder Sumitomo Metal Mining's capacity for innovation and expansion.

To counter these issues, Sumitomo Metal Mining, like many in the industry, continues to invest in robust training and development programs. These initiatives aim to upskill existing employees and attract new talent by offering clear career paths and exposure to cutting-edge technologies, ensuring a pipeline of qualified professionals for future growth.

Growing consumer awareness around ethical sourcing and sustainable production is significantly shaping product demand, impacting supply chains across industries. This trend directly influences how companies like Sumitomo Metal Mining operate, pushing for greater environmental responsibility.

Sumitomo Metal Mining's focus on responsible mining practices, minimizing its environmental footprint, and maintaining transparent operations is crucial. For instance, by 2023, the company reported a 15% reduction in greenhouse gas emissions compared to its 2013 levels, demonstrating a tangible commitment to sustainability that resonates with increasingly eco-conscious consumers.

Public perception of mining industry

Public perception of the mining industry, including Sumitomo Metal Mining, remains a significant sociological factor. Concerns about environmental impact and resource depletion often lead to public scrutiny. For instance, a 2023 survey indicated that 65% of respondents expressed concern about the environmental footprint of mining operations. This sentiment can translate into increased regulatory hurdles and affect investor confidence, as demonstrated by a 10% dip in ESG investment inflows for companies with poor environmental records in early 2024.

Sumitomo Metal Mining actively addresses these concerns through its corporate social responsibility initiatives. The company's commitment to sustainable practices, such as reducing greenhouse gas emissions by 20% by 2030 compared to 2019 levels, aims to foster a more positive public image. Furthermore, community engagement programs and transparent reporting on environmental remediation efforts are vital for building trust and mitigating reputational risks. In 2024, Sumitomo Metal Mining reported investing over $50 million in local community development projects across its operating regions.

- Environmental Scrutiny: Public concern over mining's environmental impact is high, with a 2023 survey showing 65% of respondents worried about it.

- Investor Sentiment: Negative public perception can impact ESG investment, which saw a 10% decline for companies with poor environmental records in early 2024.

- CSR Efforts: Sumitomo Metal Mining is investing $50 million in community projects in 2024 to improve its public image and social license to operate.

- Sustainability Targets: The company aims for a 20% reduction in greenhouse gas emissions by 2030, a key metric for public and investor perception.

Health and safety standards for employees

Ensuring employee health and safety is a fundamental social responsibility for Sumitomo Metal Mining, directly impacting operational efficiency and public trust. Adherence to stringent safety protocols, ongoing enhancements to workplace conditions, and proactive risk mitigation are crucial for sustainable operations.

Failure to maintain high health and safety standards can result in severe consequences, including substantial regulatory fines, disruptive production halts, and significant damage to the company's reputation. These issues can erode employee morale and diminish investor confidence, affecting overall financial performance.

In 2023, the mining industry globally saw a continued focus on safety, with organizations like the International Council on Mining and Metals (ICMM) reinforcing commitments to zero harm. While specific Sumitomo Metal Mining incident data for 2024/2025 is not publicly available, the industry trend indicates a strong emphasis on reducing lost-time injuries and fatalities, with many companies investing heavily in advanced safety technologies and training programs.

- Regulatory Compliance: Adherence to national and international occupational health and safety regulations is non-negotiable, with potential fines for non-compliance reaching millions of dollars.

- Operational Continuity: Safety incidents can lead to temporary or prolonged shutdowns, directly impacting production output and revenue streams.

- Reputational Risk: A poor safety record can deter talent, alienate local communities, and negatively influence investment decisions.

- Employee Morale and Productivity: A safe working environment fosters higher employee engagement, leading to increased productivity and reduced turnover.

Sociological factors significantly influence Sumitomo Metal Mining's operations, particularly concerning community relations and workforce dynamics. The company's commitment to social license to operate is evident in its substantial investments in community development and environmental protection, with ¥1.5 billion allocated in 2023. Furthermore, prioritizing local employment, as seen with over 60% of its Philippine workforce being local in 2024, strengthens community ties and mitigates operational risks.

The mining industry, including Sumitomo Metal Mining, faces challenges related to public perception and ethical sourcing, with 65% of respondents in a 2023 survey expressing concerns about mining's environmental footprint. To address this, the company is actively pursuing sustainability targets, aiming for a 20% reduction in greenhouse gas emissions by 2030 and investing $50 million in community projects in 2024 to enhance its public image.

Employee health and safety remain a critical sociological aspect, with industry-wide efforts to reduce accidents. While specific 2024/2025 data for Sumitomo Metal Mining is pending, the broader trend shows significant investment in safety technologies and training to ensure operational continuity and maintain employee morale.

| Sociological Factor | Impact on Sumitomo Metal Mining | Supporting Data/Initiatives |

|---|---|---|

| Community Relations & Social License | Essential for operational continuity and reputation. | ¥1.5 billion allocated to community/environment in 2023. Over 60% local workforce in Philippine operations (2024). |

| Public Perception & Ethical Sourcing | Influences investor sentiment and regulatory environment. | 65% public concern over mining's environmental footprint (2023 survey). Aiming for 20% GHG reduction by 2030. |

| Workforce Availability & Skills | Crucial for operational efficiency and technological adoption. | Global mining sector faces skilled labor shortages. Investment in training programs to upskill and attract talent. |

| Employee Health & Safety | Impacts productivity, regulatory compliance, and morale. | Industry focus on zero harm. Investment in advanced safety technologies and training. |

Technological factors

Technological advancements are reshaping the mining landscape. Innovations like automation, remote operation, and sophisticated data analytics are proving crucial for boosting efficiency, enhancing safety protocols, and improving the amount of valuable resources recovered. For instance, autonomous haul trucks and drilling systems are increasingly common, reducing the need for human presence in hazardous environments.

Sumitomo Metal Mining is well-positioned to capitalize on these trends. By integrating technologies such as AI-driven geological modeling and predictive maintenance for equipment, the company can streamline its mining processes. This optimization is key to lowering operational expenses and unlocking the potential of ore bodies that were previously considered too costly or difficult to extract, ultimately leading to greater overall productivity.

The relentless pace of innovation in battery and electronic materials is a significant technological driver. The development of next-generation batteries for electric vehicles (EVs) and grid-scale energy storage systems, alongside advancements in semiconductor and display technologies, directly fuels demand for specialized metals and materials. For instance, the demand for lithium, a key component in many EV batteries, is projected to reach over 2.4 million metric tons by 2030, a substantial increase from recent years, highlighting the need for advanced material sourcing and processing.

Sumitomo Metal Mining's strategic investment in research and development for these areas is paramount. Their work on high-purity nickel, cobalt, and other critical battery materials positions them to capitalize on the growing EV market, which saw global sales exceed 13.6 million units in 2023. This focus ensures they remain competitive and can seize opportunities in rapidly expanding high-tech sectors.

Advancements in metal recycling technologies are crucial as the global economy shifts towards a circular model. Sumitomo Metal Mining is actively engaged in recovering valuable metals from sources like spent batteries and electronic waste. This focus on recycling helps secure raw material supply chains sustainably, lessening dependence on new mining and boosting overall resource efficiency.

Digitalization and data analytics for operations

Sumitomo Metal Mining is increasingly leveraging digitalization and data analytics to refine its operations. The integration of the Internet of Things (IoT) and big data analysis across its mining, smelting, and manufacturing facilities is a key focus. This technological shift aims to unlock substantial improvements in operational efficiency and output.

Real-time data monitoring, coupled with predictive maintenance strategies, allows for proactive identification of potential equipment failures, minimizing costly downtime. Furthermore, advanced analytics enables optimized process control, leading to enhanced resource utilization and improved product quality. For instance, in 2024, the mining industry globally saw investments in AI and data analytics for operational efficiency increase by an estimated 15-20% year-over-year, a trend Sumitomo Metal Mining is actively participating in.

- Enhanced Efficiency: Digitalization drives streamlined processes, potentially boosting output by 5-10% in pilot projects.

- Reduced Downtime: Predictive maintenance, powered by data analytics, aims to cut unscheduled downtime by up to 25%.

- Improved Decision-Making: Real-time data provides actionable insights, leading to faster and more informed operational adjustments.

- Cost Savings: Optimized resource allocation and reduced waste contribute to significant cost reductions in production.

Investment in research and development (R&D)

Sumitomo Metal Mining's commitment to continuous research and development (R&D) is crucial for its future. This investment allows the company to pioneer new materials, refine current production methods, and secure its position at the forefront of technological innovation. For instance, in fiscal year 2023, the company allocated approximately ¥23.8 billion (around $160 million USD based on average 2023 exchange rates) to R&D activities, a significant portion dedicated to future growth areas.

Key R&D focuses include:

- Developing advanced battery materials: Sumitomo Metal Mining is actively researching and developing next-generation cathode materials for electric vehicle batteries, aiming for higher energy density and improved safety.

- Improving resource extraction technologies: The company invests in innovative and more environmentally friendly methods for extracting valuable metals, enhancing efficiency and reducing its ecological footprint.

- Enhancing material properties: R&D efforts are directed towards creating high-performance alloys and functional materials with superior characteristics for various industrial applications.

- Digital transformation in operations: Sumitomo Metal Mining is exploring the integration of AI and IoT to optimize its mining and refining processes, leading to greater operational efficiency and cost reduction.

Sumitomo Metal Mining is actively integrating advanced technologies to enhance its operational efficiency and competitiveness. The company's focus on digitalization, including IoT and big data analytics, is designed to optimize its entire value chain, from mining to manufacturing. This strategic adoption of technology is expected to yield significant improvements in productivity and cost management.

The company's investment in R&D, totaling approximately ¥23.8 billion in fiscal year 2023, underscores its commitment to technological innovation. Key areas of research include developing advanced battery materials to meet the growing demand from the electric vehicle sector and improving resource extraction technologies for greater efficiency and sustainability.

These technological advancements are crucial for Sumitomo Metal Mining to capitalize on emerging market trends, such as the increasing demand for specialized metals in high-tech industries. By staying at the forefront of technological innovation, the company aims to secure its competitive advantage and drive future growth.

| Technological Focus Area | Key Initiatives | Impact/Goal |

|---|---|---|

| Automation & Remote Operations | Autonomous haul trucks, drilling systems | Enhanced safety, increased efficiency |

| Data Analytics & AI | AI-driven geological modeling, predictive maintenance | Optimized resource recovery, reduced downtime |

| Battery Materials | Next-generation cathode materials | Meeting EV demand, higher energy density |

| Metal Recycling | Recovery from spent batteries and e-waste | Sustainable supply chains, resource efficiency |

| Digitalization (IoT) | Real-time data monitoring across facilities | Improved process control, operational insights |

Legal factors

Sumitomo Metal Mining navigates a complex web of environmental regulations, impacting everything from air emissions to water usage and land reclamation. These laws are not static; they are continually updated, demanding ongoing adaptation and investment in compliance technologies. For instance, in 2024, Japan's Ministry of the Environment continued to emphasize stricter controls on industrial wastewater discharge, a key area for mining operations.

Adhering to these stringent environmental standards, both within Japan and in the global locations where Sumitomo Metal Mining operates, necessitates substantial capital expenditure and rigorous monitoring systems. Failure to comply can lead to severe financial penalties, such as the ¥20 million fine levied against a similar Japanese mining company in early 2025 for improper waste disposal, and can also inflict significant reputational damage.

Sumitomo Metal Mining's operations are heavily influenced by mining laws and concession agreements in its host countries. These legal frameworks dictate everything from exploration rights and extraction permits to royalty payments and environmental compliance. For instance, in 2024, Peru, a key mining jurisdiction for many companies, continued to refine its mining regulations, focusing on community engagement and environmental safeguards, which can affect project timelines and operational costs.

The stability and predictability of these concession agreements are paramount. Any adverse changes, such as unexpected increases in royalty rates or stricter permit conditions, can significantly alter the economic viability of Sumitomo Metal Mining's projects. For example, a proposed revision to royalty structures in Chile during 2024, while not fully enacted for all operations, highlighted the potential for legal shifts to impact profitability, underscoring the need for robust legal due diligence and ongoing monitoring.

Sumitomo Metal Mining must meticulously follow labor laws concerning working hours, wages, and union rights, a commitment reflected in their global operations. For instance, in 2024, the International Labour Organization reported that compliance with these standards is crucial for maintaining stable industrial relations and employee morale across sectors.

Given the high-risk nature of mining and smelting, stringent occupational health and safety (OHS) regulations are paramount. In 2023, the World Health Organization highlighted that the mining industry globally saw a significant reduction in fatalities due to improved OHS practices, underscoring the importance of Sumitomo Metal Mining's adherence to these critical standards.

Failure to comply with these legal frameworks can lead to substantial fines and severe reputational damage. In 2024, several major mining companies faced legal challenges and public scrutiny for OHS violations, demonstrating the direct financial and reputational consequences of non-compliance for companies like Sumitomo Metal Mining.

International trade laws and sanctions

Sumitomo Metal Mining navigates a complex web of international trade laws and sanctions, which directly impact its global supply chains and market access. For instance, in 2023, the United States and its allies continued to enforce sanctions against various nations, affecting the sourcing of raw materials and the export of finished goods for companies with extensive international operations like Sumitomo Metal Mining.

Compliance is paramount to avoid significant disruptions and financial penalties. Failure to adhere to customs regulations can lead to delays in shipments, increased costs, and even seizure of goods. Economic sanctions, particularly those targeting key resource-rich regions or major trading partners, can severely restrict a company's ability to conduct business or access critical inputs.

- Global Trade Regulations: Sumitomo Metal Mining must comply with a multitude of trade agreements and tariffs, such as those governing the import and export of metals and minerals.

- Sanctions Enforcement: The company is subject to sanctions regimes imposed by entities like the UN, EU, and individual countries, which can restrict business with sanctioned entities or nations.

- Customs Compliance: Adherence to import and export declaration requirements and duties is essential for the smooth flow of materials, with customs penalties potentially reaching millions of dollars for non-compliance.

Intellectual property rights and patent protection

Sumitomo Metal Mining's advanced materials segment, particularly its battery and electronic materials, is built upon a foundation of intellectual property, including patents for innovative technologies. Protecting these patents is paramount for maintaining its competitive edge and preventing rivals from leveraging its proprietary advancements. For instance, in 2023, the company was involved in patent litigation concerning cathode materials, highlighting the ongoing need for vigilant IP enforcement.

Legal frameworks surrounding intellectual property and patent protection are critical for Sumitomo Metal Mining. These regulations safeguard its investments in research and development, ensuring that its unique material compositions and manufacturing processes remain exclusive. The company actively monitors the global patent landscape to identify potential infringements and to secure new patents for its ongoing innovations, which is vital for future revenue streams.

The cost and time associated with intellectual property disputes can significantly impact financial performance. Sumitomo Metal Mining dedicates resources to legal teams and patent attorneys to proactively manage its IP portfolio and to defend its rights when necessary. A strong legal defense strategy is essential to mitigate risks and to ensure the continued commercialization of its high-value advanced materials.

Key aspects of Sumitomo Metal Mining's legal strategy regarding intellectual property include:

- Patent Filing and Maintenance: Continuously filing for new patents and maintaining existing ones globally to cover its innovations in battery cathode materials and other advanced components.

- IP Enforcement: Actively monitoring for and pursuing legal action against any unauthorized use or infringement of its patented technologies.

- Licensing Agreements: Strategically entering into licensing agreements to generate revenue from its IP while controlling its application.

- Trade Secret Protection: Implementing robust internal measures to protect confidential information and trade secrets related to its material science breakthroughs.

Sumitomo Metal Mining operates under a strict legal framework governing mining concessions, environmental protection, and labor practices in all its operational jurisdictions. For example, in 2024, the company's compliance with Peru's updated mining regulations, which emphasize community engagement, directly influenced project development timelines and associated costs.

The company must also navigate international trade laws and sanctions, as evidenced by the ongoing enforcement of trade restrictions by global powers in 2023 and 2024, impacting supply chains and market access for critical minerals. Failure in customs compliance alone can incur penalties potentially reaching millions of dollars, as seen in various international trade disputes.

Intellectual property laws are crucial for Sumitomo Metal Mining's advanced materials segment, necessitating vigilant patent protection and enforcement, as demonstrated by its involvement in IP litigation concerning cathode materials in 2023. The company's proactive IP strategy includes continuous patent filing and monitoring for infringements to safeguard its technological innovations.

Environmental factors

Global and national climate policies, such as the EU's Carbon Border Adjustment Mechanism (CBAM) and the US Inflation Reduction Act, are increasingly influencing the mining sector. These policies, including carbon pricing and stringent emission reduction targets, directly affect Sumitomo Metal Mining's operational costs and investment strategies. For instance, initiatives aiming for net-zero emissions by 2050 require significant capital allocation towards cleaner technologies.

Sumitomo Metal Mining faces mounting pressure to decarbonize its extensive operations. This necessitates substantial investments in energy efficiency upgrades, the adoption of renewable energy sources like solar and wind power for its mining sites, and potentially the exploration of carbon capture, utilization, and storage (CCUS) technologies. Meeting these evolving regulatory and stakeholder expectations is crucial for maintaining social license to operate and long-term financial viability.

Water is absolutely essential for mining and smelting, and how much is available and how clean it is pose major environmental challenges, particularly in areas already facing water shortages. Sumitomo Metal Mining needs smart plans for using water, like reusing it and conserving it, to handle risks from not having enough water and to follow tougher rules about water use.

Sumitomo Metal Mining's operations inherently affect local ecosystems. The company is committed to biodiversity conservation and responsible land use, aiming to minimize its environmental footprint. This involves thorough environmental impact assessments and dedicated post-mining land rehabilitation efforts.

Waste management and tailings storage

Sumitomo Metal Mining, like all players in the extractive industries, faces significant environmental considerations related to waste management, particularly tailings and slag. The sheer volume of material processed means substantial waste generation is unavoidable. For instance, in 2023, the global mining industry produced an estimated 15 billion tonnes of tailings, a figure expected to grow. Ensuring the safe and secure storage of these materials is paramount, as failures can lead to severe environmental damage and safety risks. This includes robust design of tailings storage facilities (TSFs) and continuous monitoring.

The evolving regulatory landscape is a critical factor, with governments worldwide implementing stricter rules on waste disposal and management. For example, new regulations in jurisdictions like Chile, a key copper-producing nation, are mandating higher standards for TSF design and operation, often requiring advanced dewatering techniques and improved containment systems. This necessitates ongoing investment in technology and processes to comply with these increasingly stringent requirements. The potential for reprocessing waste materials to recover valuable by-products or reduce the overall volume of waste is also a growing area of focus, offering both environmental and economic benefits.

Key aspects of Sumitomo Metal Mining's approach to waste management include:

- Tailings Storage Facility Design: Implementing robust engineering designs for TSFs to ensure long-term stability and prevent environmental contamination.

- Waste Reprocessing: Exploring and investing in technologies for the recovery of valuable minerals from existing waste streams or by-products, such as slag.

- Regulatory Compliance: Actively monitoring and adapting to new and evolving environmental regulations concerning waste disposal and management globally.

Transition to renewable energy in operations

The global drive for decarbonization is significantly impacting the mining sector, pushing companies like Sumitomo Metal Mining to adopt renewable energy sources for their operations. This transition is crucial for reducing greenhouse gas emissions and meeting increasingly stringent environmental regulations.

Sumitomo Metal Mining's strategic integration of renewable energy, such as solar, wind, or geothermal power, into its energy portfolio offers substantial benefits. It diminishes dependence on volatile fossil fuel markets, potentially leading to lower and more predictable operational costs over time. Furthermore, it bolsters the company's environmental, social, and governance (ESG) profile, aligning with the expectations of investors and stakeholders committed to sustainability.

For instance, in 2024, the mining industry saw a notable increase in renewable energy investments. Major mining companies reported that a significant portion of their energy needs were being met by renewables, with targets to further increase this share by 2025. Sumitomo Metal Mining's proactive approach in this area is therefore a key factor in its long-term operational resilience and market competitiveness.

- Reduced Carbon Footprint: Transitioning to renewables directly cuts Scope 1 and Scope 2 emissions, crucial for meeting net-zero targets.

- Cost Savings: While initial investment is required, renewable energy sources offer stable, often lower, long-term operating costs compared to fossil fuels.

- Enhanced Reputation: Demonstrating commitment to sustainability improves brand image and stakeholder trust, vital in today's market.

- Regulatory Compliance: Proactively adopting renewables helps companies stay ahead of evolving environmental regulations and carbon pricing mechanisms.

Sumitomo Metal Mining must navigate increasingly stringent environmental regulations globally, impacting everything from emissions to water usage. For example, the EU's Carbon Border Adjustment Mechanism (CBAM) and the US Inflation Reduction Act are already reshaping operational costs and investment priorities, pushing for cleaner technologies and significant capital allocation towards net-zero goals by 2050.

Water scarcity and quality are critical environmental challenges, especially in water-stressed regions where mining operations are common. Sumitomo Metal Mining needs robust water management strategies, including reuse and conservation, to mitigate risks and comply with stricter water usage regulations.

The company is also focused on minimizing its ecological footprint through biodiversity conservation and responsible land use, conducting thorough environmental impact assessments and implementing post-mining land rehabilitation. Waste management, particularly tailings and slag, presents a significant challenge, with the global mining industry producing an estimated 15 billion tonnes of tailings in 2023 alone, necessitating safe storage and compliance with evolving disposal regulations.

The push for decarbonization is driving Sumitomo Metal Mining to integrate renewable energy sources like solar and wind into its operations. This transition not only reduces greenhouse gas emissions and enhances its ESG profile but also offers long-term cost stability and operational resilience, with many major mining companies significantly increasing their renewable energy use in 2024.

PESTLE Analysis Data Sources

Our Sumitomo Metal Mining PESTLE Analysis is informed by a comprehensive review of official government publications, financial reports from international organizations, and leading industry-specific research. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in verifiable data.