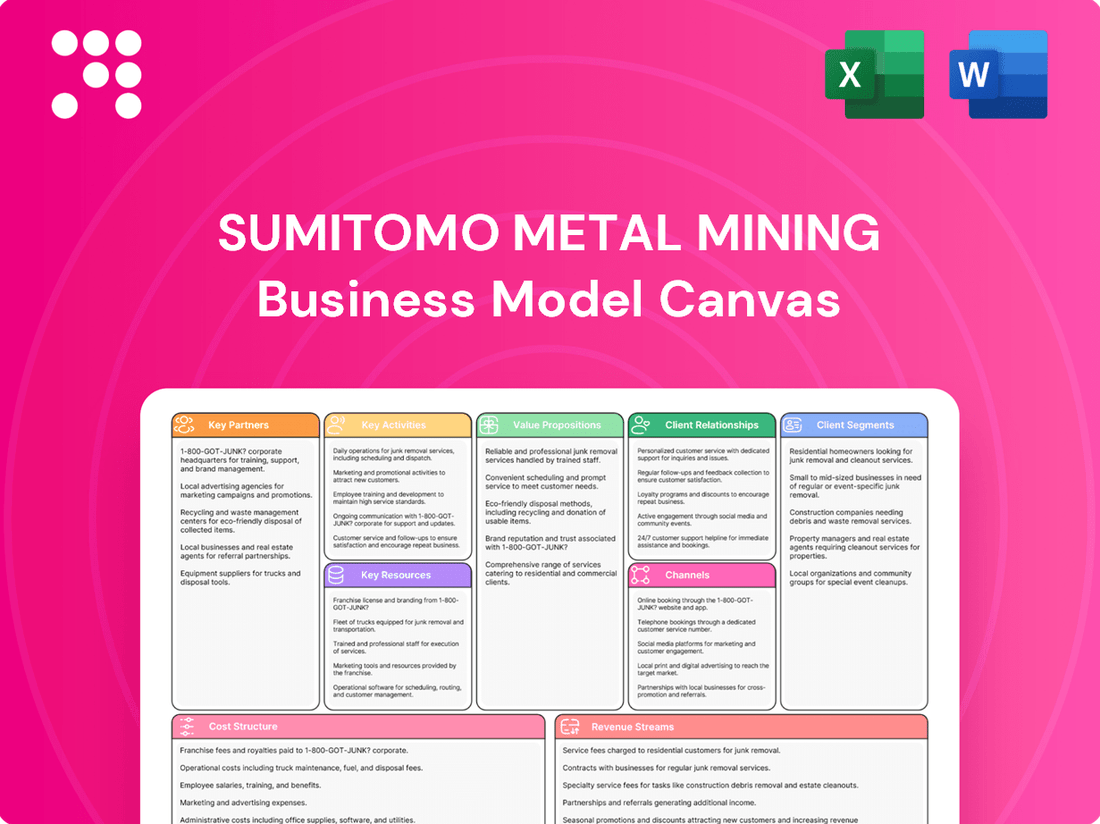

Sumitomo Metal Mining Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sumitomo Metal Mining Bundle

Unlock the strategic blueprint behind Sumitomo Metal Mining's success with our comprehensive Business Model Canvas. This in-depth analysis reveals their core value propositions, key partnerships, and revenue streams, offering invaluable insights into their operational excellence and market dominance. Discover how they manage costs and drive customer relationships to stay ahead in the competitive mining industry.

Dive into the intricate details of Sumitomo Metal Mining's business model with our complete, professionally crafted Business Model Canvas. This downloadable resource provides a clear, actionable overview of their customer segments, key activities, and competitive advantages, perfect for anyone seeking to understand or replicate their strategic approach. Gain a competitive edge by learning from their proven methods.

See exactly how Sumitomo Metal Mining builds and sustains its market leadership. Our full Business Model Canvas breaks down their entire strategy, from resource management to innovation, in an easy-to-understand format. This is your chance to gain a deep understanding of their operations and apply these lessons to your own ventures.

Partnerships

Sumitomo Metal Mining actively pursues joint ventures and strategic alliances with other leading global mining entities. A prime example is their collaboration with Rio Tinto on the Winu copper-gold project located in Australia, showcasing a commitment to shared development.

These alliances are vital for distributing the substantial capital requirements, technical knowledge, and operational risks inherent in large-scale mineral exploration and extraction. Such partnerships also unlock access to promising new geological deposits and bolster the company's international presence.

Sumitomo Metal Mining actively pursues technology and research collaborations to drive innovation in material science and recycling. A prime example is their joint development with Kanto Denka Kogyo Co., Ltd., which has successfully established lithium-ion battery recycling technology. These strategic alliances are crucial for developing advanced materials and enhancing processing efficiencies, particularly for the burgeoning battery materials sector.

Sumitomo Metal Mining depends on a robust network of suppliers for essential raw materials and intermediate products vital for its smelting, refining, and manufacturing operations.

Maintaining a consistent and ethically sourced supply chain is paramount, especially for critical metals like nickel, where global availability is significantly shaped by major producers, such as Indonesia, which accounted for approximately 30% of global nickel mine production in 2023.

These strategic partnerships are crucial for guaranteeing the steady flow of inputs necessary for production and for upholding stringent sustainability and ethical sourcing standards throughout the value chain.

Customers as Development Partners

Sumitomo Metal Mining actively collaborates with major customers in the advanced materials sector, acting as development partners. This is particularly evident in their work with battery manufacturers like Panasonic, a key supplier for Tesla electric vehicles.

This close integration allows Sumitomo Metal Mining to gain deep insights into the evolving demands of high-growth industries, such as the electric vehicle and electronics markets. By understanding specific performance requirements, they can co-develop highly specialized materials.

- Co-development with Battery Manufacturers: Partnerships with companies like Panasonic for EV battery materials.

- Understanding Market Needs: Direct feedback loop to grasp evolving technological requirements.

- Tailored Material Solutions: Creation of advanced materials designed for specific customer applications.

- Innovation in High-Growth Sectors: Focus on materials for electric vehicles and advanced electronics.

Government and Regulatory Bodies

Sumitomo Metal Mining actively collaborates with government agencies and regulatory bodies to ensure strict adherence to environmental, safety, and operational standards. This engagement is crucial for navigating complex permitting processes and maintaining compliance with evolving industry regulations.

The company benefits from governmental support for key projects, such as its recycling plant construction, which received backing through initiatives like the Green Innovation Fund Project, publicly solicited by the New Energy and Industrial Technology Development Organization (NEDO). This demonstrates a shared commitment to national sustainability objectives.

- Regulatory Compliance: Essential for obtaining permits and operating legally.

- Sustainability Goals: Partnerships facilitate contributions to national and international environmental targets.

- Innovation Funding: Access to programs like NEDO's Green Innovation Fund supports advanced projects.

Sumitomo Metal Mining's key partnerships are crucial for shared risk, access to new resources, and technological advancement. Collaborations with entities like Rio Tinto on the Winu project highlight the distribution of capital and operational risks in large-scale mining.

These alliances are also pivotal for innovation, as seen in the lithium-ion battery recycling technology developed with Kanto Denka Kogyo, addressing the growing demand in the battery materials sector.

Furthermore, partnerships with customers like Panasonic for EV battery materials provide direct market insights, enabling the co-development of specialized advanced materials for high-growth industries.

What is included in the product

A comprehensive, pre-written business model tailored to Sumitomo Metal Mining's strategy, detailing its value propositions, customer segments, and revenue streams.

Reflects the real-world operations and plans of Sumitomo Metal Mining, organized into 9 classic BMC blocks with full narrative and insights.

Provides a clear, one-page visual representation of Sumitomo Metal Mining's strategy, simplifying complex operations and identifying potential inefficiencies.

Offers a structured framework to analyze and address challenges within Sumitomo Metal Mining's value chain, from resource extraction to product delivery.

Activities

Sumitomo Metal Mining's core activities revolve around the global exploration and extraction of essential metals. This includes a significant focus on base metals like copper and nickel, alongside precious metals such as gold and silver. They conduct thorough geological surveys and drilling operations to identify and access rich ore deposits.

The company actively manages and operates numerous mining sites worldwide to ensure a consistent and reliable supply of raw ore. This upstream production is crucial for feeding their downstream smelting and refining processes. For instance, in fiscal year 2023, Sumitomo Metal Mining provided production guidance indicating robust operational output for these key commodities.

Smelting and refining are central to Sumitomo Metal Mining's operations, transforming mined ores and recycled materials into high-purity metals. This intricate process yields marketable commodities such as electrolytic copper, nickel, gold, and silver.

Key facilities like the Toyo Smelter & Refinery and the Niihama Nickel Refinery are crucial for these value-adding activities. In fiscal year 2023, Sumitomo Metal Mining reported smelting and refining segment revenue of approximately ¥714.2 billion, highlighting the significant contribution of these operations to the company's overall financial performance.

Sumitomo Metal Mining is a key player in advanced materials, focusing on battery, electronic, and functional materials crucial for high-tech sectors. This requires complex chemical processing and engineering to create premium products.

The company is significantly boosting its battery materials output, reflecting a strategic focus on this growing market. For instance, in fiscal year 2023, Sumitomo Metal Mining reported a substantial increase in its cathode material production capacity, aiming to meet surging demand for electric vehicles.

Metal Recycling and Resource Recovery

Sumitomo Metal Mining is actively expanding its metal recycling and resource recovery operations, with a significant emphasis on lithium-ion batteries (LIBs). This strategic push aims to capture valuable metals like copper, nickel, cobalt, and lithium from end-of-life products, fostering a circular economy and bolstering the supply of secondary raw materials.

The company is investing in advanced recycling technologies to efficiently extract these critical metals. For instance, Sumitomo Metal Mining is constructing new plants specifically designed for LIB recycling, underscoring their commitment to this growing sector. This focus not only addresses environmental concerns but also provides a stable, domestic source of essential battery components.

- Developing advanced technologies for recovering copper, nickel, cobalt, and lithium from used products, especially lithium-ion batteries.

- Contributing to a circular economy by transforming waste into valuable secondary raw materials.

- Investing in new LIB recycling plants to scale up operations and meet increasing demand for recycled battery metals.

- Securing secondary raw material sources to reduce reliance on primary mining and mitigate supply chain risks.

Research and Development

Sumitomo Metal Mining's commitment to Research and Development (R&D) is a cornerstone of its business strategy, focusing on enhancing existing processes and pioneering new technologies. This dedication is crucial for developing innovative materials that cater to evolving market needs, particularly in high-growth sectors. For instance, advancements in battery materials are vital for the burgeoning electric vehicle market.

The company actively invests in R&D to boost extraction efficiency and minimize environmental footprints. This proactive approach ensures sustainability and operational excellence. In 2023, Sumitomo Metal Mining reported R&D expenses of approximately ¥30 billion, demonstrating a significant allocation of resources towards future innovation and technological advancement.

- Improving Extraction Efficiency: Developing advanced techniques to maximize resource recovery from existing and new deposits.

- Environmental Impact Reduction: Researching and implementing cleaner production methods and waste management solutions.

- Next-Generation Materials: Innovating materials for emerging technologies, such as high-performance alloys for aerospace and advanced battery components for EVs.

- Process Optimization: Continuously refining smelting, refining, and fabrication processes to enhance quality and reduce costs.

Sumitomo Metal Mining's key activities include global metal exploration and extraction, focusing on base and precious metals. They also operate smelting and refining facilities to produce high-purity metals, and are a major player in advanced materials, particularly for batteries and electronics. Furthermore, the company is heavily involved in metal recycling, especially for lithium-ion batteries, and invests significantly in research and development to drive innovation and improve efficiency.

Delivered as Displayed

Business Model Canvas

The Sumitomo Metal Mining Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Upon completing your order, you will instantly download this complete, ready-to-use Business Model Canvas, allowing you to leverage its insights immediately.

Resources

Sumitomo Metal Mining's core assets are its substantial mineral reserves, including copper, nickel, gold, and silver, which form the bedrock of its operations. These reserves are not static; they are actively managed and expanded through strategic exploration and partnerships, such as the significant Winu project in Western Australia. As of early 2024, the company continues to rely on these proven and probable reserves to guide its production forecasts and ensure long-term viability.

Sumitomo Metal Mining operates sophisticated smelting and refining facilities, including the Toyo Smelter & Refinery and Niihama Nickel Refinery. These are the backbone of their non-ferrous metal operations, transforming raw ores and scrap into high-purity copper, nickel, and valuable precious metals.

These industrial powerhouses are essential for Sumitomo Metal Mining's ability to produce critical materials. For instance, their copper smelting capacity is significant, contributing to the global supply of this vital industrial metal. In 2023, the company's refined copper production reached substantial volumes, underscoring the operational scale of these facilities.

Sumitomo Metal Mining's competitive edge is deeply rooted in its proprietary technologies and intellectual property. These assets cover the entire value chain, from initial mining and advanced smelting and refining techniques to the sophisticated manufacturing of high-performance materials.

Significant investment in research and development fuels this technological prowess. For instance, their expertise in battery material production, a critical component for the burgeoning electric vehicle market, is a direct result of this ongoing R&D. In 2023, Sumitomo Metal Mining reported R&D expenses of approximately ¥38.4 billion, underscoring their commitment to innovation.

These technological capabilities translate into the creation of high-value products and processes, including advanced metal recycling. This not only enhances their sustainability profile but also provides a cost advantage and secures access to essential raw materials, differentiating them in the global market.

Skilled Workforce and Technical Expertise

Sumitomo Metal Mining relies heavily on its highly skilled workforce. This includes experts like geologists, metallurgists, chemical engineers, and dedicated R&D specialists. Their deep understanding of complex mining, advanced refining, and material science is absolutely essential for the company's success.

This human capital is the engine behind Sumitomo Metal Mining's operational efficiency and its ability to innovate. For instance, in 2023, the company invested significantly in training and development programs aimed at enhancing the technical expertise of its employees, particularly in areas like sustainable mining practices and the development of new battery materials.

- Geological and Metallurgical Expertise: Crucial for identifying and extracting valuable mineral deposits efficiently and cost-effectively.

- Chemical Engineering Prowess: Indispensable for optimizing refining processes to achieve high purity metals and developing new material compounds.

- R&D Specialists: Drive innovation in areas like advanced materials, recycling technologies, and environmentally friendly extraction methods.

- Operational Efficiency: Skilled personnel directly contribute to reducing waste, improving yield, and ensuring safety in all mining and processing activities.

Financial Capital

Sumitomo Metal Mining requires substantial financial capital to support its wide-ranging operations. This funding is crucial for the extensive exploration needed to discover new mineral deposits, as well as for the development and ongoing maintenance of its large-scale mining and smelting facilities. Furthermore, significant investment is directed towards research and development to improve extraction and processing technologies, alongside managing the working capital necessary for its commodity trading activities.

The company’s financial performance underscores the importance of this capital. For the fiscal year ending March 31, 2024, Sumitomo Metal Mining reported net sales of ¥1,295.9 billion. This robust revenue stream directly fuels its ability to undertake capital-intensive projects and pursue strategic growth opportunities, highlighting the critical role of financial resources in its business model.

- Exploration and Development: Funding the costly and lengthy processes of identifying and developing new mineral reserves.

- Infrastructure Maintenance: Covering the significant expenses associated with operating and maintaining large-scale mining and smelting infrastructure.

- Research and Development: Investing in innovation to enhance operational efficiency and discover new materials or processes.

- Working Capital Management: Ensuring sufficient liquidity to manage inventory and commodity trading activities effectively.

Sumitomo Metal Mining's key resources include its vast mineral reserves, sophisticated smelting and refining facilities, proprietary technologies, a highly skilled workforce, and significant financial capital. These elements are fundamental to its ability to extract, process, and market a range of essential metals and materials globally.

The company's mineral reserves, encompassing copper, nickel, gold, and silver, are actively managed and expanded. Their smelting and refining operations, such as the Toyo Smelter & Refinery, are critical for transforming raw ores into high-purity products. Proprietary technologies and ongoing R&D, evidenced by ¥38.4 billion in R&D expenses in 2023, drive innovation in areas like battery materials.

A skilled workforce, comprising geologists, metallurgists, and engineers, ensures operational efficiency and innovation. The company's financial strength, demonstrated by net sales of ¥1,295.9 billion for the fiscal year ending March 31, 2024, supports extensive exploration, infrastructure development, and R&D initiatives.

| Key Resource Category | Description | 2023/2024 Data/Examples |

|---|---|---|

| Mineral Reserves | Substantial deposits of copper, nickel, gold, and silver. | Active management and expansion, e.g., Winu project (Australia). |

| Smelting & Refining Facilities | Sophisticated industrial plants for metal processing. | Toyo Smelter & Refinery, Niihama Nickel Refinery; significant copper production volumes in 2023. |

| Proprietary Technologies & IP | Advanced extraction, smelting, refining, and material manufacturing techniques. | Expertise in battery materials, advanced metal recycling. |

| Human Capital | Highly skilled workforce with expertise in mining, metallurgy, and R&D. | Investment in training for sustainable mining and battery materials development (2023). |

| Financial Capital | Funding for exploration, infrastructure, R&D, and working capital. | Net sales of ¥1,295.9 billion (FY ending March 31, 2024); ¥38.4 billion in R&D expenses (2023). |

Value Propositions

Sumitomo Metal Mining delivers exceptionally pure base metals, including copper and nickel, alongside precious metals like gold and silver. These materials are fundamental building blocks for numerous global industries, from electronics to renewable energy.

The company's advanced smelting and refining processes guarantee the consistent high quality and purity that demanding sectors require. For instance, in 2024, Sumitomo Metal Mining continued its commitment to producing refined copper with purity levels often exceeding 99.99%, crucial for advanced manufacturing applications.

This focus on high-grade metal supply directly addresses the needs of industries where material integrity is paramount, ensuring reliability in their own production chains.

Sumitomo Metal Mining provides advanced materials like battery components and electronic materials, essential for high-tech sectors. These specialized products are designed to meet the demanding specifications of industries such as electric vehicles and semiconductors, offering customers a distinct performance edge.

The company's focus on materials for electric vehicle batteries, a market projected to reach over $1.5 trillion by 2030, directly addresses the surging need for sophisticated components. In 2024, Sumitomo Metal Mining continued to invest in research and development for these critical materials, aiming to enhance energy density and charging speeds.

Sumitomo Metal Mining champions sustainability by recovering critical metals like nickel and cobalt from end-of-life lithium-ion batteries. This circular economy approach provides a reliable, eco-friendly source of materials, aligning with the growing demand for responsible sourcing in the automotive and electronics sectors. In 2023, the company processed approximately 1,000 tons of spent batteries, recovering valuable metals and reducing reliance on primary mining.

Reliable and Stable Supply Chain

Sumitomo Metal Mining's integrated approach, from exploration to finished materials, underpins a remarkably reliable and stable supply chain. This end-to-end control significantly reduces the typical risks associated with global commodity sourcing, ensuring a consistent flow of essential metals and materials to their clients. In 2024, this stability is a crucial differentiator, especially given the ongoing geopolitical and economic uncertainties that can disrupt other suppliers.

The company's extensive global footprint, encompassing mining operations, smelting, refining, and advanced material production, provides a robust foundation for supply chain resilience. This vertical integration allows Sumitomo Metal Mining to manage quality and availability at every stage. Strategic alliances and long-term contracts further fortify this reliability, offering customers predictable access to key resources.

This unwavering commitment to supply chain stability is a core value proposition, particularly for industries reliant on critical metals. For instance, in the burgeoning electric vehicle sector, consistent access to nickel and cobalt is paramount. Sumitomo Metal Mining's ability to deliver these materials reliably in 2024 directly supports the growth and operational continuity of its automotive and battery manufacturing partners.

Key aspects of their reliable supply chain include:

- Vertical Integration: Control from resource extraction to material processing minimizes external dependencies.

- Global Diversification: Operations across multiple continents mitigate regional supply disruptions.

- Strategic Partnerships: Long-term agreements ensure consistent offtake and supply security.

- Risk Mitigation: Proactive management of geopolitical, environmental, and logistical challenges.

Technological Leadership and Innovation

Sumitomo Metal Mining's technological leadership is a core value proposition, built on a deep commitment to research and development. This dedication is evident in their substantial R&D investments, which consistently fuel innovation. For instance, in fiscal year 2023, the company allocated approximately ¥30 billion to R&D activities, a testament to their forward-looking approach.

This continuous investment allows Sumitomo Metal Mining to offer cutting-edge products and process solutions. Their long-standing technical expertise, honed over decades, enables them to tackle complex material challenges. This translates into tangible benefits for customers, helping them maintain a competitive edge in their own markets.

The company's focus on innovation is not just about immediate solutions; it's about shaping the future of materials. They actively drive the development of next-generation materials and champion sustainable practices. This forward-thinking strategy is crucial for addressing evolving industry needs and environmental considerations.

- Technological Expertise: Decades of experience in metal processing and material science.

- R&D Investment: Significant annual allocation, exemplified by ¥30 billion in FY2023, fostering continuous improvement.

- Innovative Solutions: Development of advanced materials and efficient processes that provide customer advantages.

- Sustainable Practices: Commitment to creating environmentally responsible material solutions for the future.

Sumitomo Metal Mining offers high-purity base and precious metals, essential for industries like electronics and renewables, with copper purity often exceeding 99.99% in 2024.

They provide advanced materials, including battery components for the EV market, projected to exceed $1.5 trillion by 2030, with ongoing R&D in 2024 to boost performance.

Their circular economy approach recovers valuable metals from spent batteries, exemplified by processing around 1,000 tons in 2023, offering sustainable sourcing.

Sumitomo Metal Mining ensures supply chain reliability through vertical integration and global diversification, a critical advantage in 2024's uncertain market.

Customer Relationships

Sumitomo Metal Mining cultivates strong customer ties through specialized account management and robust technical assistance. For industrial clients and buyers of advanced materials, this means direct interaction to pinpoint precise technical needs, facilitate product customization, and deliver ongoing support after purchase.

This hands-on approach is crucial for meeting the intricate demands of high-tech sectors, offering them bespoke solutions and expert advice. For instance, in 2024, Sumitomo Metal Mining's dedicated support teams were instrumental in co-developing specialized nickel alloys for a major aerospace manufacturer, directly addressing the need for enhanced heat resistance in critical engine components.

Sumitomo Metal Mining cultivates enduring strategic alliances with its primary clientele, particularly within the advanced materials domain. These collaborations often involve joint product development, moving beyond simple sales to encompass shared research and development efforts and forward-looking market planning.

These deep-rooted relationships are crucial for securing substantial, long-term supply agreements. For instance, in 2024, the demand for specialized battery materials, a key area for Sumitomo Metal Mining, saw significant growth, underscoring the value of these partnerships in ensuring consistent order volumes.

Sumitomo Metal Mining actively participates in numerous industry associations and forums, fostering connections with a wide array of customers and stakeholders. This engagement is crucial for staying abreast of evolving market trends and collaboratively tackling sector-wide challenges. For instance, their involvement in organizations like the Japan Mining Industry Association allows for vital networking and knowledge exchange.

Through these platforms, Sumitomo Metal Mining contributes to shaping industry standards and best practices, which in turn enhances customer trust and operational efficiency. In 2023, the global mining industry saw significant investment, with capital expenditure projected to reach over $150 billion, underscoring the importance of collaborative efforts in navigating such a dynamic environment.

Sustainability and ESG Engagement

Sumitomo Metal Mining actively engages customers on sustainability, particularly those in sectors with high ESG expectations, by offering transparency on responsible sourcing, production, and recycling. This commitment is demonstrated through the sharing of detailed sustainability reports and collaborative efforts focused on circular economy solutions.

This customer relationship strategy aims to build trust and ensure alignment with the evolving ESG objectives of their client base. For instance, in 2024, Sumitomo Metal Mining reported a 15% increase in customer inquiries specifically related to their ESG performance and supply chain traceability, highlighting a growing demand for such information.

- Transparency in Responsible Sourcing: Providing clear data on the origin and ethical sourcing of raw materials.

- Collaboration on Circular Economy: Partnering with customers to develop and implement recycling and reuse programs for metals.

- Sustainability Reporting: Publishing comprehensive reports detailing environmental impact, social responsibility, and governance practices.

- Alignment with Customer ESG Goals: Demonstrating how Sumitomo Metal Mining's operations support their clients' own sustainability targets.

Investor Relations and Shareholder Communication

Sumitomo Metal Mining actively cultivates investor relations by offering transparent financial reporting, hosting earnings calls, and publishing integrated reports. This commitment ensures investors receive detailed financial data, strategic outlooks, and updates on corporate governance, building trust and enabling informed investment choices.

- Financial Transparency: Sumitomo Metal Mining's integrated reports, a common practice in the industry, provide a holistic view of financial performance and sustainability initiatives. For example, in their fiscal year 2023 reporting, the company detailed significant investments in exploration and development projects, alongside operational performance metrics.

- Regular Communication Channels: The company utilizes official channels, including its investor relations website and press releases, to disseminate timely information. This includes quarterly earnings announcements and participation in investor conferences, which are crucial for real-time engagement with the financial community.

- Shareholder Engagement: Sumitomo Metal Mining's approach fosters confidence by clearly communicating its long-term strategy and how it plans to navigate market fluctuations. This proactive communication is vital for maintaining shareholder value and attracting new investment, especially in a volatile commodities market.

Sumitomo Metal Mining emphasizes collaborative relationships, particularly with industrial clients and those seeking advanced materials. This involves direct engagement to tailor solutions and provide ongoing technical support, ensuring precise needs are met. For instance, in 2024, they worked closely with an aerospace client to develop specialized nickel alloys, improving engine component performance.

Strategic alliances are key, moving beyond transactions to joint R&D and market planning, securing long-term supply agreements. The 2024 surge in demand for battery materials highlighted the importance of these partnerships for consistent order volumes.

The company also engages in industry forums, fostering connections and staying ahead of market trends. Their participation in bodies like the Japan Mining Industry Association aids knowledge exchange and standard-setting, building customer trust.

Sustainability is a growing focus, with transparency on responsible sourcing and circular economy solutions being shared with clients. In 2024, inquiries about their ESG performance increased by 15%, reflecting a strong customer demand for this information.

| Customer Relationship Aspect | Description | 2024 Example/Data Point |

|---|---|---|

| Specialized Account Management | Direct interaction for technical needs and customization. | Co-development of nickel alloys for aerospace. |

| Strategic Alliances | Joint R&D and long-term supply agreements. | Securing consistent orders for battery materials. |

| Industry Engagement | Networking and knowledge exchange in forums. | Participation in Japan Mining Industry Association. |

| Sustainability Focus | Transparency on sourcing and circular economy. | 15% increase in ESG performance inquiries. |

Channels

Sumitomo Metal Mining relies heavily on its direct sales and business development teams to connect with industrial and corporate clients. This approach enables them to engage directly, negotiate substantial contracts, and craft customized solutions for customers needing specialized metal grades or advanced materials.

These dedicated teams are crucial for high-value, intricate transactions, fostering enduring relationships with key partners. For instance, in 2024, Sumitomo Metal Mining continued to prioritize these direct channels for its advanced materials segment, which contributes significantly to its overall revenue, particularly in sectors like automotive and electronics where tailored specifications are paramount.

Sumitomo Metal Mining operates a robust network of global sales offices and subsidiaries, crucial for its international mining and materials supply operations. This extensive reach allows the company to effectively serve a diverse customer base across various continents.

These regional presences are vital for gaining localized market insights, streamlining distribution channels, and providing tailored customer support. For instance, in 2023, Sumitomo Metal Mining's overseas consolidated subsidiaries contributed significantly to its revenue, reflecting the importance of its global footprint in generating sales and maintaining strong customer relationships in key markets.

Sumitomo Metal Mining actively participates in key industry trade shows and conferences, such as the Society of Mining, Metallurgy & Exploration (SME) Annual Conference and the International Mining and Resources Conference (IMARC). These events are vital for displaying their advanced materials, including high-purity copper foils and battery materials, and their innovative recycling technologies. For example, in 2024, IMARC saw over 8,000 attendees, providing a significant opportunity for Sumitomo Metal Mining to connect with global stakeholders.

These gatherings are instrumental for Sumitomo Metal Mining to foster relationships with potential clients and reinforce ties with existing partners. They also serve as a critical channel for gathering market intelligence and understanding emerging trends in the mining and metals sector. The company often uses these platforms to unveil new product lines, especially in the realm of advanced materials crucial for the electronics and automotive industries, and to highlight their commitment to sustainable practices through their recycling initiatives.

Online Corporate Presence and Investor Portals

Sumitomo Metal Mining leverages its official website as a crucial channel to share vital information with investors, partners, and the broader public. This digital platform is central to their communication strategy.

Dedicated investor relations portals offer stakeholders easy access to essential documents like financial reports, timely news releases, and comprehensive sustainability data, fostering transparency.

In 2024, the company continued to emphasize its digital presence, with its investor relations section featuring detailed quarterly earnings reports and presentations. For instance, their fiscal year 2024 (ending March 2025) reports would be readily available, detailing performance metrics and strategic outlooks.

- Official Website: Serves as the primary hub for corporate and investor information.

- Investor Relations Portals: Provide direct access to financial statements, press releases, and ESG data.

- Digital Accessibility: Ensures stakeholders can easily obtain up-to-date company disclosures.

Logistics and Distribution Networks

Sumitomo Metal Mining relies on extensive logistics and distribution networks to move its products globally. These networks are vital for getting raw materials to processing facilities and then delivering refined metals and finished goods to a diverse customer base. In 2024, efficient transportation remains a cornerstone of their operations, ensuring materials reach their destinations without delay.

The company manages a complex web of shipping, warehousing, and transportation. This includes everything from bulk carriers for raw ore to specialized transport for high-purity metals used in electronics. Effective management here directly impacts their ability to meet customer demand and maintain a competitive edge in the market.

- Global Reach: Sumitomo Metal Mining's logistics infrastructure supports a worldwide customer base, enabling the delivery of critical materials across continents.

- Supply Chain Efficiency: Managing shipping and warehousing effectively ensures the integrity of their supply chain, minimizing disruptions and optimizing delivery times for both bulk commodities and specialized products.

- Customer Satisfaction: Reliable distribution is paramount for customer satisfaction, particularly for industries that depend on consistent and timely access to metals and materials.

- Cost Management: Optimizing transportation routes and warehousing solutions in 2024 helps control costs, which is crucial in the often volatile commodity markets.

Sumitomo Metal Mining utilizes a multi-faceted approach to reach its customers, combining direct engagement with broader market presence. Their direct sales and business development teams are key for high-value, customized solutions, particularly for advanced materials in sectors like automotive and electronics. This direct interaction fosters strong client relationships and facilitates complex negotiations.

The company's extensive global network of sales offices and subsidiaries is essential for serving an international customer base and gaining localized market intelligence. This presence ensures tailored support and efficient distribution, critical for maintaining competitiveness in diverse regions. For example, their overseas operations were a significant revenue driver in 2023.

Sumitomo Metal Mining also actively participates in major industry events like IMARC, which in 2024 attracted over 8,000 attendees. These platforms are vital for showcasing new products, such as battery materials, and connecting with stakeholders, thereby gathering market insights and reinforcing partnerships.

Their official website and investor relations portals serve as crucial communication channels, providing easy access to financial reports, news, and sustainability data, promoting transparency. In 2024, the company continued to highlight its digital accessibility, with detailed quarterly earnings available for stakeholders.

| Channel | Description | Key Activities/Focus | 2024/2025 Relevance |

|---|---|---|---|

| Direct Sales & Business Development | Personalized engagement with industrial and corporate clients. | Negotiating contracts, customizing solutions, building relationships. | Crucial for advanced materials and high-value transactions. |

| Global Sales Offices & Subsidiaries | Physical presence in key international markets. | Localized support, market intelligence, streamlined distribution. | Drove significant revenue in 2023; essential for global reach. |

| Industry Trade Shows & Conferences | Participation in events like IMARC and SME. | Product showcasing, networking, market trend analysis. | Key for unveiling new materials and connecting with over 8,000 attendees in 2024. |

| Official Website & Investor Relations | Digital hub for corporate and financial information. | Disseminating reports, news, and ESG data for transparency. | Ensured easy access to fiscal year 2024 earnings and strategic outlooks. |

Customer Segments

Automotive and electric vehicle (EV) manufacturers represent a crucial customer segment for Sumitomo Metal Mining. This includes major automakers and specialized EV battery producers who depend on a consistent supply of high-purity nickel, cobalt, and sophisticated cathode materials. Sumitomo Metal Mining's strategic position as a key supplier of these essential battery components, notably to entities like Panasonic which serves Tesla, underscores its vital role in the burgeoning EV market.

The demand from this sector is directly correlated with the accelerating global expansion of electric vehicle production. For instance, in 2024, the automotive industry is projected to see continued robust growth in EV sales, driving an increased need for the advanced materials Sumitomo Metal Mining provides. This trend signifies a significant opportunity for the company to leverage its expertise in mining and material processing.

Sumitomo Metal Mining's customer base within the electronics and semiconductor industries is highly specialized, seeking advanced materials crucial for device performance. These sectors demand ultra-high purity copper foils, sputtering targets, and other functional materials essential for everything from smartphones to advanced computing chips.

In 2024, the global semiconductor market was projected to reach approximately $600 billion, highlighting the immense demand for the high-performance materials Sumitomo Metal Mining provides. This segment's reliance on consistent quality and innovative solutions is driven by the rapid pace of technological evolution, where even minor material imperfections can significantly impact end-product functionality.

Industrial manufacturers, including those in stainless steel and chemical production, represent a core customer segment for Sumitomo Metal Mining. These businesses rely heavily on consistent, high-volume supplies of non-ferrous metals like nickel and copper for their manufacturing processes. For instance, the global stainless steel market, a major consumer of nickel, was valued at approximately $197.5 billion in 2023 and is projected to grow steadily.

The demand from these industrial sectors is intrinsically linked to broader economic trends and significant infrastructure projects worldwide. As of early 2024, global infrastructure spending continues to be a key driver, particularly in emerging economies, directly influencing the consumption of metals like copper used in construction and electrical systems.

Precious Metal Buyers (Jewelry, Investment)

Sumitomo Metal Mining's precious metal buyers segment encompasses a diverse range of entities. This includes the jewelry industry, which relies heavily on gold and silver for adornment and luxury goods. Investment firms and individual investors also form a crucial part of this segment, seeking precious metals as a hedge against inflation and a store of value.

The demand within this segment is closely tied to broader economic conditions and investor confidence. For instance, in 2024, gold prices saw significant fluctuations, influenced by geopolitical tensions and central bank policies, demonstrating the segment's sensitivity to global stability. Silver, while also an investment vehicle, finds additional demand from industrial applications, such as electronics and solar panels.

- Jewelers: Procure gold and silver for manufacturing and retail of jewelry.

- Investment Firms: Purchase precious metals for portfolio diversification and speculative trading.

- Industrial Users: Acquire metals for applications in electronics, automotive, and renewable energy sectors.

- Retail Investors: Buy bullion, coins, and other forms of precious metals for personal investment.

Recycling and Circular Economy Partners

This emerging customer segment comprises companies and industries actively engaged in resource recovery and advancing circular economy principles. Sumitomo Metal Mining's strategic investments, such as its involvement in lithium-ion battery recycling facilities, directly cater to this group by offering a reliable supply of recycled metals and materials. In 2024, the global market for battery recycling was projected to reach approximately $10 billion, highlighting the significant demand for these services.

These partners, including electric vehicle manufacturers and electronics companies, prioritize sustainable sourcing and seek to minimize their environmental impact throughout their supply chains. By providing responsibly sourced recycled materials, Sumitomo Metal Mining supports their clients' sustainability goals and contributes to a more resource-efficient economy. The company's commitment to these initiatives aligns with the growing corporate focus on Environmental, Social, and Governance (ESG) performance, with many companies setting ambitious targets for recycled content in their products.

- Resource Recovery Focus: Companies seeking to reclaim valuable metals from waste streams, such as spent batteries and electronic scrap.

- Circular Economy Initiatives: Businesses aiming to close material loops and reduce reliance on virgin resources.

- Sustainable Sourcing Demand: Organizations requiring materials with a demonstrably lower environmental footprint.

- ESG Performance Enhancement: Partners looking to improve their environmental credentials and meet sustainability targets.

Sumitomo Metal Mining serves a diverse customer base, ranging from the booming automotive and electric vehicle (EV) sector to the highly specialized electronics and semiconductor industries. Industrial manufacturers, including those in stainless steel and chemical production, also represent a significant portion of their clientele, relying on consistent supplies of base metals. Furthermore, the precious metals segment includes jewelers, investment firms, and retail investors, all seeking gold and silver for various purposes.

The company also caters to an emerging segment focused on resource recovery and circular economy principles, supplying recycled metals to partners prioritizing sustainability. This broad customer reach highlights Sumitomo Metal Mining's adaptability and its integral role across multiple key global industries, from advanced technology to traditional manufacturing and investment markets.

| Customer Segment | Key Needs | 2024 Market Relevance |

|---|---|---|

| Automotive & EV Manufacturers | High-purity nickel, cobalt, cathode materials | Driven by accelerating EV sales; automotive market robust. |

| Electronics & Semiconductor | Ultra-high purity copper foils, sputtering targets | Global semiconductor market projected ~ $600 billion. |

| Industrial Manufacturers | Nickel, copper for stainless steel, chemicals | Global stainless steel market valued ~$197.5 billion (2023); infrastructure spending drives demand. |

| Precious Metal Buyers | Gold, silver for jewelry, investment | Gold prices fluctuate with geopolitical events; silver used in electronics/solar. |

| Resource Recovery & Circular Economy | Recycled metals from waste streams | Battery recycling market projected ~$10 billion. |

Cost Structure

Sumitomo Metal Mining's cost structure heavily relies on raw material acquisition, encompassing mining operations, exploration, and concentrate purchases. These expenditures are intrinsically linked to volatile global commodity prices and the inherent challenges of ore extraction, directly influencing the mining segment's financial performance.

For instance, during fiscal year 2023, Sumitomo Metal Mining reported that its cost of sales for the mining segment, which largely reflects raw material and mining expenses, was approximately ¥468.7 billion. This figure underscores the substantial investment required to secure the necessary resources for its operations, with fluctuations in the price of copper, a key commodity, significantly impacting these costs.

Smelting and refining operations are incredibly costly, driven by high energy demands, the need for specialized labor, ongoing maintenance, and strict environmental regulations. For instance, in 2024, energy prices significantly impacted these capital-intensive processes, making efficiency paramount.

These facilities require substantial investment in advanced machinery and a highly skilled workforce to operate safely and effectively. Sumitomo Metal Mining, like others in the sector, faces the challenge of optimizing these expenditures to remain competitive in global markets.

Sumitomo Metal Mining dedicates substantial resources to Research and Development, a crucial investment for its future. In 2024, the company continued to prioritize innovation, especially in areas like advanced materials and efficient resource recycling. These investments fuel the development of cutting-edge technologies and novel products, ensuring the company remains competitive.

Capital Expenditures (CAPEX)

Sumitomo Metal Mining's capital expenditures are significant, driven by the need to develop new mining operations, enhance existing ones, and build new processing plants, including those for lithium-ion battery (LIB) recycling. These are crucial long-term investments aimed at boosting production capacity and modernizing infrastructure.

For instance, the company has allocated substantial funds towards projects like the development of the Hishikari mine and the expansion of its smelting and refining facilities. In fiscal year 2023, Sumitomo Metal Mining reported capital expenditures of approximately ¥135.3 billion, a notable increase from the ¥103.7 billion spent in fiscal year 2022, reflecting ongoing strategic investments in growth and sustainability.

- Mine Development: Funding for exploration and opening new ore bodies to secure future resource pipelines.

- Facility Expansion & Modernization: Investments in upgrading existing smelters, refineries, and processing plants to improve efficiency and capacity.

- New Ventures: Capital outlay for constructing new facilities, such as the LIB recycling plants, to tap into emerging markets and circular economy initiatives.

- Risk Management: Rigorous financial planning and risk assessment are integral to managing these large-scale, long-term capital commitments.

Environmental and Social Compliance Costs

Sumitomo Metal Mining faces significant expenses related to environmental and social compliance. These costs are essential for operating responsibly and maintaining public trust. For instance, in 2023, the company allocated substantial funds towards upgrading pollution control systems at its mines to meet evolving regulatory requirements.

Key expenditures in this area include investments in advanced waste management techniques and land reclamation projects to restore mined areas. Sumitomo Metal Mining also dedicates resources to community engagement, ensuring local stakeholders are informed and benefit from their operations. These efforts are crucial for securing and retaining their social license to operate.

- Environmental Protection Investments: Costs associated with pollution control technologies and emission reduction initiatives.

- Waste Management and Rehabilitation: Expenses for proper disposal of mining byproducts and restoring land post-operation.

- Social Responsibility Programs: Funding for community development, stakeholder engagement, and fair labor practices.

- Regulatory Adherence: Costs incurred to comply with national and international environmental and social standards.

Sumitomo Metal Mining's cost structure is dominated by raw material acquisition, with substantial investments in mining, exploration, and concentrate purchases, heavily influenced by fluctuating global commodity prices. Smelting and refining operations represent another significant cost driver due to high energy consumption, specialized labor, and stringent environmental regulations, as seen with energy price impacts in 2024.

The company also allocates considerable funds to Research and Development for innovation in advanced materials and recycling, alongside substantial capital expenditures for mine development, facility upgrades, and new ventures like LIB recycling plants. Environmental and social compliance costs, including pollution control, waste management, and community engagement, are also critical components of their operational expenses.

| Cost Category | FY2023 (¥ billion) | Key Drivers |

|---|---|---|

| Cost of Sales (Mining Segment) | 468.7 | Raw material prices (copper), extraction costs |

| Capital Expenditures | 135.3 | Mine development, facility expansion, new ventures |

| R&D Investment | Not explicitly detailed but prioritized for innovation | Advanced materials, recycling technologies |

| Environmental & Social Compliance | Substantial, ongoing investments | Pollution control, waste management, community programs |

Revenue Streams

Sumitomo Metal Mining's core revenue generation relies heavily on selling refined copper and nickel. These essential industrial metals are supplied to a diverse global customer base, with their market prices fluctuating based on international commodity trends. For instance, in the first half of fiscal year 2024, Sumitomo Metal Mining reported significant sales volumes of copper, contributing substantially to their overall revenue.

Sumitomo Metal Mining generates revenue from selling precious metals like gold and silver. These metals are often found alongside base metals during mining and refining processes.

The demand for gold and silver is driven by investors seeking safe havens, industrial uses in electronics and jewelry, and global economic stability. For instance, in the fiscal year ending March 2024, Sumitomo Metal Mining's precious metals segment, particularly gold, played a crucial role in their financial performance, contributing to overall profitability and revenue diversification.

Sumitomo Metal Mining's advanced materials sales are a significant and expanding revenue source. This includes critical components like cathode materials for electric vehicle batteries, electronic materials for semiconductors, and other specialized functional materials. These high-tech products typically generate higher profit margins due to their complex manufacturing processes and advanced technological content.

In 2024, the demand for these advanced materials, particularly those used in the booming electric vehicle sector, is expected to remain robust. For instance, the global electric vehicle battery market alone is projected to see substantial growth, directly benefiting companies like Sumitomo Metal Mining that supply key raw materials and processed components.

Recycling and Resource Recovery Services/Products

Sumitomo Metal Mining's recycling and resource recovery services are becoming a significant revenue generator, driven by the increasing demand for critical metals and the global push towards a circular economy. The company is actively expanding its capabilities to process end-of-life products, particularly those containing valuable battery metals.

This segment's revenue is derived from the sale of recovered metals such as copper, nickel, cobalt, and lithium, which are essential components in electric vehicles and renewable energy technologies. For instance, by 2024, the demand for lithium-ion batteries alone was projected to grow substantially, creating a robust market for recycled battery materials.

- Sale of Recovered Metals: Revenue generated from selling high-purity metals extracted from recycled materials, including copper, nickel, cobalt, and lithium.

- Recycling Service Fees: Income from providing specialized recycling services to manufacturers and other businesses that need to dispose of or recover valuable metals from their waste streams.

- Circular Economy Contribution: Capitalizing on the growing market for recycled content, which offers a more sustainable and often cost-competitive alternative to primary mining.

- Strategic Partnerships: Potential revenue from collaborations with battery manufacturers and automotive companies to secure a steady supply of end-of-life products for recycling.

Investment and Royalty Income from Joint Ventures

Sumitomo Metal Mining secures income from its equity in joint ventures, like the Winu copper-gold project with Rio Tinto. This revenue can manifest as dividends from operational profits or as royalty payments. These strategic investments offer a diversified income stream, enabling participation in projects with shared risks and benefits.

- Winu Project Contribution: Sumitomo Metal Mining holds a 30% interest in the Winu project, a significant copper and gold deposit.

- Royalty Potential: Royalty income is generated as a percentage of sales from resources extracted in partnered projects.

- Diversification Strategy: Joint ventures provide exposure to different geological settings and commodity cycles, reducing overall portfolio risk.

- Performance Linkage: The financial success of these ventures directly impacts the investment and royalty income received by Sumitomo Metal Mining.

Sumitomo Metal Mining's revenue streams are diverse, encompassing the sale of refined base metals like copper and nickel, which are foundational to global industries. The company also generates significant income from precious metals, primarily gold and silver, appealing to both industrial users and investors. Furthermore, advanced materials, such as cathode materials for electric vehicle batteries and semiconductor components, represent a growing and high-margin segment.

The company's commitment to sustainability is reflected in its expanding revenue from recycling and resource recovery, particularly valuable metals from end-of-life batteries. Income is also derived from equity stakes in joint ventures, like the Winu copper-gold project, providing diversified income through dividends and royalties.

| Revenue Stream | Key Products/Services | Fiscal Year 2024 Relevance |

|---|---|---|

| Base Metals | Refined Copper, Nickel | Significant sales volumes contributed substantially to revenue. |

| Precious Metals | Gold, Silver | Played a crucial role in financial performance and revenue diversification. |

| Advanced Materials | EV Battery Cathode Materials, Electronic Materials | Demand robust, especially from the EV sector; higher profit margins. |

| Recycling & Resource Recovery | Recovered Copper, Nickel, Cobalt, Lithium | Growing revenue from circular economy initiatives; strong market for recycled battery materials. |

| Joint Ventures & Investments | Dividends, Royalties (e.g., Winu Project) | Offers diversified income and exposure to different commodity cycles. |

Business Model Canvas Data Sources

The Sumitomo Metal Mining Business Model Canvas is informed by a blend of internal financial disclosures, extensive market research on global commodity trends, and strategic insights from industry experts. These diverse data sources ensure a comprehensive and accurate representation of the company's operational and strategic landscape.