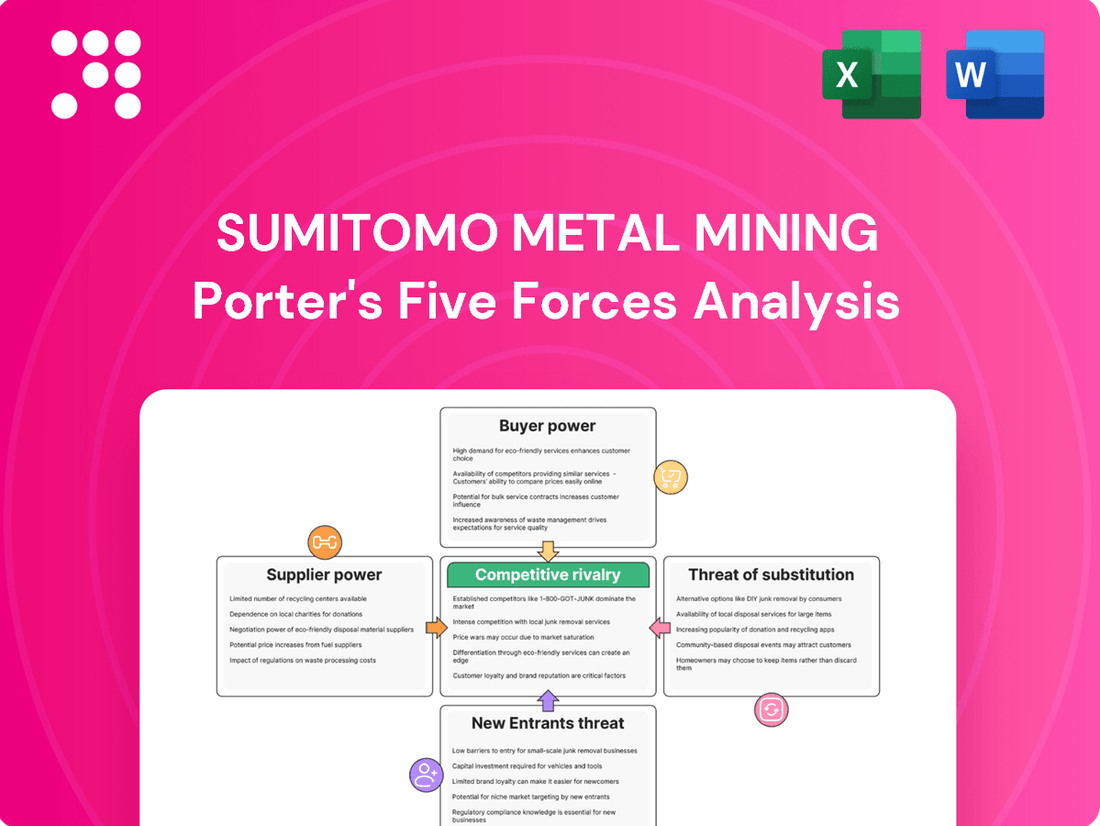

Sumitomo Metal Mining Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sumitomo Metal Mining Bundle

Sumitomo Metal Mining navigates a complex competitive landscape, influenced by powerful suppliers and intense rivalry. Understanding the threat of substitutes and the bargaining power of buyers is crucial for their strategic positioning.

The complete report reveals the real forces shaping Sumitomo Metal Mining’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Sumitomo Metal Mining's access to crucial raw materials like copper, nickel, gold, and silver is often tied to specific geographic locations and a limited number of mining operations. This concentration means that if these sources are controlled by a few dominant suppliers, their ability to influence prices and terms for Sumitomo Metal Mining is significantly amplified. For instance, Indonesia's role as a major nickel producer means that any shifts in its production levels or export policies can directly affect global nickel supply and, consequently, the costs incurred by companies like Sumitomo Metal Mining.

For its advanced materials, such as those used in batteries and electronics, Sumitomo Metal Mining (SMM) may depend on highly specialized chemicals or components. If only a limited number of suppliers can offer these unique inputs with the necessary quality and specifications, those suppliers gain considerable influence over SMM concerning pricing and delivery terms. This situation is especially pronounced for novel materials where alternative options are scarce.

Sumitomo Metal Mining (SMM) faces significant supplier bargaining power due to high switching costs in the mining and advanced materials industries. Changing suppliers often necessitates extensive re-qualification of materials, which can take months, and may require costly reconfigurations of production processes. For instance, a shift in a key metal supplier could mean recalibrating smelting or refining equipment to accommodate slightly different material compositions.

These considerable switching costs directly empower existing suppliers. SMM would likely incur substantial expenses and face operational disruptions if it decided to change its primary sources for critical raw materials like copper or nickel. This situation is exacerbated by the specialized nature of many advanced materials, where finding equally qualified and reliable alternative suppliers is a complex and time-consuming endeavor.

Supplier's Ability to Forward Integrate

Sumitomo Metal Mining (SMM) faces a significant threat if its key raw material suppliers possess the capability or strategic intent to engage in forward integration. This means suppliers could start processing or refining metals themselves, potentially transforming into direct competitors or limiting the supply of essential materials for SMM. This capability inherently boosts their bargaining power during negotiations, as SMM might find itself reliant on suppliers who could also become rivals.

For example, if a major copper concentrate supplier in Chile, a region critical for global copper supply, were to invest in its own smelting and refining operations, it could dictate terms more aggressively. In 2023, global copper concentrate treatment and refining charges (TC/RCs) saw significant volatility, with spot TC/RCs falling to multi-year lows, indicating a tightening market and increased supplier leverage. Should such a supplier integrate forward, they could capture more of the value chain, leaving SMM with fewer options and potentially higher input costs.

- Forward Integration Threat: Suppliers processing or refining metals themselves can become competitors.

- Increased Bargaining Power: This capability allows suppliers to demand better terms.

- Market Dynamics: Volatility in TC/RCs in 2023 highlights how supplier leverage can shift.

- Strategic Impact: SMM could face reduced material availability and higher costs if suppliers integrate forward.

Labor and Energy Costs

Suppliers in the mining and metals sector are experiencing significant upward pressure on labor and energy costs. This trend directly impacts companies like Sumitomo Metal Mining (SMM), as these increased operational expenses are frequently transferred to buyers. For instance, global energy prices saw considerable volatility in 2024, with crude oil prices fluctuating, impacting transportation and processing costs across the industry.

This dynamic significantly bolsters the bargaining power of these suppliers. In a competitive global market where rising labor and energy expenses are a common challenge, suppliers are better positioned to dictate terms. Data from the International Energy Agency indicated a general trend of higher energy costs for industrial consumers throughout much of 2024, a factor that directly influences mining operations.

- Rising Labor Costs: Global labor markets in 2024 continued to see wage inflation in many regions, particularly for skilled workers essential in mining operations.

- Energy Price Volatility: Fluctuations in oil and natural gas prices in 2024 directly increased the cost of energy-intensive mining and smelting processes for companies like SMM.

- Supplier Leverage: Increased operational costs for suppliers translate to greater leverage in negotiations with buyers, potentially leading to higher input prices for SMM.

The bargaining power of Sumitomo Metal Mining's suppliers is considerable, driven by the concentrated nature of raw material sources and the specialized requirements for advanced materials. High switching costs, coupled with the potential for supplier forward integration, further amplify this power. Rising operational costs for suppliers, including labor and energy, are also being passed on, strengthening their negotiating position.

For instance, the global demand for critical minerals like copper, essential for electrification, remained robust through 2024. This sustained demand, often met by a limited number of major producers, gives these suppliers leverage. The cost of energy, a significant input for mining and processing, saw continued upward pressure in 2024, impacting supplier operational expenses and subsequently, their pricing power.

| Factor | Impact on SMM | 2024 Data/Trend |

|---|---|---|

| Raw Material Concentration | Increased supplier leverage on pricing and terms | Continued high demand for copper and nickel from key producing regions. |

| Specialized Inputs | Suppliers of advanced materials have significant pricing power | Limited number of qualified suppliers for battery-grade chemicals. |

| High Switching Costs | Deters SMM from changing suppliers, empowering existing ones | Months-long requalification processes for new material sources. |

| Supplier Forward Integration | Potential for suppliers to become competitors, reducing SMM's options | Industry trend towards value-added processing by raw material extractors. |

| Rising Operational Costs | Suppliers pass increased labor and energy expenses to buyers | Global energy prices and wage inflation impacting mining sector costs in 2024. |

What is included in the product

This analysis of Sumitomo Metal Mining's competitive landscape reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and their collective impact on profitability.

Instantly identify and quantify competitive pressures with a dynamic Porter's Five Forces model, enabling Sumitomo Metal Mining to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

Sumitomo Metal Mining's (SMM) diverse customer base, spanning high-tech sectors like automotive (particularly electric vehicles), electronics, and construction, significantly mitigates individual customer bargaining power. This broad market reach means SMM is not reliant on a handful of major clients, diffusing the leverage any single buyer could exert.

Customers in sectors like electronics and automotive, facing intense competition, are highly price-sensitive. This sensitivity allows them to exert significant pressure on suppliers like Sumitomo Metal Mining (SMM) for lower prices, especially when SMM's materials are a substantial part of the final product's cost.

The availability of alternative materials significantly influences customer bargaining power for Sumitomo Metal Mining (SMM). For instance, in electrical applications, customers can opt for aluminum instead of copper, a substitution that gained traction in 2024 due to copper price volatility. This provides a tangible lever for buyers to negotiate pricing or switch suppliers if SMM's offerings become less competitive.

Furthermore, the evolving landscape of battery technology presents another avenue for substitution. The increasing adoption of Lithium Iron Phosphate (LFP) batteries, which do not rely on nickel, directly impacts the demand for nickel-rich battery materials that SMM produces. As LFP battery production continues to scale, projected to represent over 30% of the global EV battery market by 2025, customers gain greater flexibility and leverage in their material sourcing decisions.

Customer's Ability to Backward Integrate

Large industrial clients, especially those in the automotive and electronics industries, often possess the financial muscle and strategic foresight to pursue backward integration. This means they might look to secure their own raw material supplies or even handle some metal processing themselves.

This capability significantly enhances their bargaining power when negotiating with Sumitomo Metal Mining (SMM). For instance, a major automotive manufacturer could invest in exploration or processing facilities, reducing its reliance on external suppliers like SMM.

For 2024, the trend of large corporations seeking greater control over their supply chains intensified. Companies like Apple, for example, have been actively exploring direct sourcing of critical minerals, impacting their negotiations with mining and processing firms.

The potential for customers to backward integrate presents a constant pressure on SMM's pricing and contract terms. This threat is particularly relevant for high-volume contracts where the customer's scale makes integration more feasible.

- Customer Scale: Large automotive and electronics manufacturers often operate at a scale that makes backward integration economically viable.

- Financial Capacity: Significant capital reserves allow these customers to invest in securing raw material sources or processing capabilities.

- Strategic Imperative: Gaining control over critical inputs can provide a competitive advantage and mitigate supply chain risks.

- Negotiating Leverage: The credible threat of backward integration empowers customers to demand more favorable terms from suppliers like SMM.

Demand Trends in End-User Industries

The burgeoning electric vehicle (EV) and renewable energy sectors are significantly boosting demand for non-ferrous metals such as copper and nickel, alongside essential battery materials. For instance, global EV sales were projected to exceed 14 million units in 2024, a substantial increase that directly fuels demand for these metals.

- Growing EV Market: The rapid expansion of the electric vehicle market is a primary driver for copper and nickel demand.

- Renewable Energy Integration: Increased adoption of solar and wind power also requires significant quantities of these metals for infrastructure.

- Battery Material Needs: The production of advanced batteries for EVs and energy storage systems creates intense demand for materials like nickel and cobalt.

Sumitomo Metal Mining's (SMM) customers, particularly those in the automotive and electronics sectors, wield considerable bargaining power due to their price sensitivity and the availability of substitute materials. For example, the increasing use of aluminum in electrical applications in 2024, driven by copper price fluctuations, gives buyers leverage.

The push towards LFP batteries, which bypasses nickel, further strengthens customer negotiating positions, as these batteries are expected to capture over 30% of the EV battery market by 2025. Large industrial clients also possess the financial capacity and strategic drive to consider backward integration, a move that directly enhances their ability to negotiate favorable terms with suppliers like SMM.

This trend was evident in 2024 with major corporations actively pursuing direct sourcing of critical minerals. The potential for customers to integrate backward, especially for high-volume contracts, exerts constant pressure on SMM's pricing and contract conditions.

| Customer Influence Factor | Impact on SMM | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Price Sensitivity | High pressure for lower prices | Customers in competitive sectors like electronics and automotive are highly price-conscious. |

| Availability of Substitutes | Provides negotiation leverage | Increased adoption of aluminum for copper in electrical applications (2024); LFP batteries gaining market share (projected >30% of EV market by 2025). |

| Backward Integration Potential | Threatens supplier reliance | Large corporations exploring direct sourcing of critical minerals (2024); financial capacity and strategic imperatives drive this trend. |

Full Version Awaits

Sumitomo Metal Mining Porter's Five Forces Analysis

This preview shows the exact Sumitomo Metal Mining Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape and strategic implications for the company. You'll gain a comprehensive understanding of the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This professionally formatted document is ready for your immediate use, offering actionable insights without any surprises.

Rivalry Among Competitors

The global non-ferrous metal and advanced materials sectors are populated by a significant number of domestic and international competitors. This means Sumitomo Metal Mining faces a crowded marketplace.

Key rivals for Sumitomo Metal Mining include major players such as Glencore, BHP Group, and Mitsubishi Materials. These companies are substantial in size and have a strong presence in the industry, intensifying the competitive pressure.

The processed non-ferrous metal and advanced materials markets are showing robust growth, fueled by demand from automotive, electronics, and renewable energy sectors. For instance, the global advanced materials market was projected to reach over $200 billion in 2024, with continued strong expansion expected. This growth, while generally beneficial, can intensify competition as firms battle for dominance in these lucrative, expanding segments.

Sumitomo Metal Mining (SMM) benefits from product differentiation through its integrated operations, spanning from raw material extraction to the creation of advanced materials. This allows SMM to offer high-quality, functionally specific products that stand out in the market.

However, for its commoditized base metals like copper and nickel, differentiation is significantly more challenging. In these segments, competition often boils down to price, leading to more intense rivalry among producers.

For instance, while SMM's advanced materials might command premium pricing, its copper business, a significant revenue driver, faces direct price competition. In 2023, the global average price for copper cathode was around $8,500 per metric ton, a benchmark against which SMM's copper sales are largely measured, highlighting the price-sensitive nature of this segment.

Exit Barriers

Sumitomo Metal Mining operates within industries characterized by substantial exit barriers. The immense capital outlay required for establishing and maintaining mines, sophisticated processing facilities, and specialized machinery makes it exceptionally difficult and costly for companies to leave the market. This financial commitment means that even when market conditions are unfavorable, firms may continue operating to recoup their investments, thereby prolonging competitive pressures.

These high exit barriers can significantly influence competitive rivalry. Companies are often compelled to stay in the market, even if profitability is low, leading to a more intense and prolonged competition among existing players. For instance, in 2023, the global mining industry saw continued investment in exploration and development, with companies like Sumitomo Metal Mining focusing on long-term projects, underscoring the sticky nature of capital in this sector.

- Capital Intensity: The mining and smelting sectors demand massive upfront investments in infrastructure, such as mines, refineries, and specialized equipment, creating significant financial commitments.

- Specialized Assets: Assets are highly specific to the industry, with limited alternative uses, increasing the cost and difficulty of liquidation or repurposing.

- Regulatory and Environmental Obligations: Companies often face ongoing environmental remediation and regulatory compliance costs even after ceasing operations, adding to exit expenses.

- Labor Agreements: Long-term labor contracts and the need for specialized skills can also present challenges and costs associated with workforce reduction during an exit.

Global and Geopolitical Factors

Geopolitical tensions and evolving trade policies directly influence the competitive rivalry for Sumitomo Metal Mining. For instance, the ongoing trade disputes and the imposition of tariffs on critical raw materials can significantly alter cost structures and market access for global players.

Supply chain disruptions, exacerbated by geopolitical instability, create a volatile operating environment. The reliance on specific regions for key minerals, such as nickel from Indonesia, means that any political or social unrest there can directly impact production and pricing, intensifying competition as companies scramble for stable supply sources.

In 2024, the global mining sector is navigating these complexities. For example, the International Monetary Fund (IMF) has highlighted that geopolitical fragmentation could lead to a more costly and less efficient global economy, directly affecting the cost of capital and operational expenses for mining giants like Sumitomo Metal Mining.

- Trade Tariffs: Increased tariffs on processed metals can favor domestic production, shifting competitive advantages.

- Supply Chain Vulnerability: Reliance on single-source or politically unstable regions for essential minerals creates significant competitive risk.

- Resource Nationalism: Countries asserting greater control over their mineral resources can lead to policy changes that impact foreign investment and competition.

- Geopolitical Alliances: Shifting global alliances can influence trade agreements and access to markets, reshaping the competitive landscape.

The competitive rivalry for Sumitomo Metal Mining (SMM) is intense, driven by a crowded global market for non-ferrous metals and advanced materials. Key rivals like Glencore and BHP Group possess significant scale, intensifying pressure, especially in commoditized segments like copper where price is the primary differentiator. While SMM's advanced materials offer differentiation, its base metal operations face direct price competition, with global copper cathode prices around $8,500 per metric ton in 2023 serving as a benchmark.

High exit barriers, stemming from massive capital investments in mining and processing, compel companies to remain in the market even during downturns, prolonging competition. For instance, the mining industry's continued investment in long-term projects in 2023 underscores this capital stickiness. Geopolitical factors and trade policies further complicate the landscape, with tariffs and supply chain vulnerabilities, particularly for minerals like nickel, creating volatile conditions and impacting cost structures.

SSubstitutes Threaten

The availability of alternative metals poses a significant threat to copper. For many applications where general metallic properties are sufficient, aluminum often serves as a viable substitute. This is largely due to aluminum's lower cost and lighter weight, although its electrical conductivity and tensile strength are typically inferior to copper. For instance, in 2024, the price differential between copper and aluminum remained a key driver for substitution in various industrial sectors.

Coinage also presents an area where substitutes are emerging. Various steel alloys are being actively explored and implemented as more economical alternatives to traditional copper-nickel compositions. This shift is driven by the desire to reduce production costs for currency, reflecting a broader trend of seeking cost-effective material solutions across industries.

The rise of lithium-iron-phosphate (LFP) batteries presents a substantial threat to Sumitomo Metal Mining's (SMM) nickel-rich cathode materials. LFP batteries, which notably exclude nickel and cobalt, are gaining traction, impacting demand for SMM's core offerings in this segment.

Furthermore, ongoing research into sodium-ion batteries (SIBs) signals another potential substitute. SIBs are being developed as a more sustainable and cost-effective alternative to current lithium-ion technologies, potentially disrupting the existing battery material market.

Ongoing advancements in material science pose a significant threat of substitution for Sumitomo Metal Mining's (SMM) products. Researchers are continuously developing novel materials with superior performance characteristics or more economical production methods. For instance, breakthroughs in areas like advanced ceramics or high-performance polymers could offer viable alternatives to SMM's copper or nickel products in various industrial applications.

The emergence of new materials, such as the development of nickel-gold alloys for thermoelectric applications, presents a direct challenge. These innovations can disrupt established markets by offering comparable or enhanced functionality at a potentially lower cost or with improved environmental profiles. SMM must closely monitor these R&D trends to anticipate shifts in demand for its core offerings.

Furthermore, innovations in battery technology, utilizing nanomaterials or entirely new chemistries, could reduce the reliance on traditional metals like nickel and cobalt, which are key to SMM's business. For example, solid-state batteries, which are seeing substantial investment and development, may require different material inputs than current lithium-ion technologies, impacting demand for SMM's battery-grade materials.

Recycling and Circular Economy Initiatives

The growing emphasis on recycling and circular economy principles poses a significant threat of substitution for Sumitomo Metal Mining. As more industries prioritize sustainable sourcing, recycled non-ferrous metals like copper and aluminum can directly replace primary metals extracted from mining operations. This trend is driven by both environmental concerns and the potential for cost savings in certain applications.

For instance, the global market for recycled aluminum alone was valued at approximately $50 billion in 2023 and is projected to grow substantially. Similarly, copper recycling rates are increasing, with initiatives aimed at improving collection and processing efficiency. These efforts directly divert demand away from newly mined materials, impacting the volume and pricing power of primary producers.

- Growing Demand for Recycled Content: Companies are increasingly setting targets for using recycled materials in their products, reducing reliance on virgin resources.

- Cost Competitiveness of Recycled Metals: In many cases, processed recycled metals can be more cost-effective than primary metals, especially when factoring in energy costs and environmental compliance for new extraction.

- Technological Advancements in Recycling: Innovations in sorting, refining, and processing technologies are making it more feasible and economical to recover valuable metals from waste streams.

- Policy and Regulatory Support: Governments worldwide are implementing policies that encourage recycling and the use of recycled content, further bolstering this substitution threat.

Functional Substitutes from Different Industries

Beyond direct material substitutes, functional substitutes from entirely different industries pose a significant threat to Sumitomo Metal Mining. For instance, advancements in wireless power transfer technology could diminish the need for certain conductive materials currently used in wired charging infrastructure. Similarly, the development of novel energy storage solutions, such as solid-state batteries or advanced supercapacitors, might reduce reliance on traditional battery chemistries that utilize materials like nickel and cobalt, key products for Sumitomo Metal Mining.

These emerging technologies, while not direct replacements for the metals themselves, can erode the demand for the end products that incorporate them. Consider the burgeoning market for electric vehicles (EVs). While EVs currently drive demand for battery metals, breakthroughs in battery efficiency or alternative propulsion systems could alter this landscape. For example, hydrogen fuel cell technology, if it gains widespread adoption, could reduce the overall demand for lithium-ion battery components. In 2024, the global battery market was valued at over $100 billion, with significant investment flowing into R&D for next-generation technologies.

- Wireless Power Transfer: Emerging technologies could reduce demand for conductive materials in charging infrastructure.

- Advanced Energy Storage: Innovations like solid-state batteries may lessen reliance on traditional battery metals like nickel and cobalt.

- Alternative Propulsion: Widespread adoption of hydrogen fuel cells could impact demand for EV battery materials.

- Market Dynamics: The global battery market's growth highlights the potential for disruptive technologies to shift material demand.

The threat of substitutes for Sumitomo Metal Mining (SMM) is multifaceted, encompassing both direct material replacements and functional alternatives. The increasing availability and cost-effectiveness of materials like aluminum, as seen in 2024's price differentials, directly challenge copper's market share in various applications. Furthermore, advancements in battery technology, such as the rise of LFP and sodium-ion batteries, are creating significant substitutes for nickel and cobalt, key components in SMM's portfolio.

The growing emphasis on recycling and circular economy principles also presents a substitution threat, as recycled metals can directly displace primary resources. For instance, the global recycled aluminum market was valued around $50 billion in 2023. Additionally, functional substitutes like wireless power transfer and alternative propulsion systems such as hydrogen fuel cells could reduce the long-term demand for SMM's core metal products.

| Substitute Category | Example Materials/Technologies | Impact on SMM Products | Key Drivers | 2024 Market Context/Data |

|---|---|---|---|---|

| Direct Material Substitutes | Aluminum, Steel Alloys, Advanced Ceramics, High-Performance Polymers | Reduced demand for copper, nickel in various industrial and coinage applications. | Cost, weight, performance characteristics, material science advancements. | Aluminum vs. Copper price differential a key factor. |

| Battery Technology Substitutes | Lithium-Iron-Phosphate (LFP) batteries, Sodium-Ion Batteries (SIBs), Solid-State Batteries | Decreased demand for nickel and cobalt in battery cathodes. | Cost, sustainability, performance improvements, R&D breakthroughs. | Global battery market over $100 billion in 2024; significant investment in next-gen tech. |

| Recycled Metals | Recycled Copper, Recycled Aluminum | Displacement of primary metal demand, impacting volume and pricing. | Environmental concerns, cost savings, improved recycling technologies, policy support. | Recycled aluminum market valued at ~$50 billion in 2023. |

| Functional Substitutes | Wireless Power Transfer, Hydrogen Fuel Cells | Erosion of demand for conductive materials and battery metals in end-products. | Technological innovation, efficiency gains, shift in energy infrastructure. | EV market growth drives battery metal demand, but alternative propulsion poses future threat. |

Entrants Threaten

The mining and smelting sectors, where Sumitomo Metal Mining operates, are characterized by exceptionally high capital intensity. Establishing an operation requires massive upfront investment for exploration, securing land rights, developing mines, and constructing sophisticated processing and smelting facilities. For instance, developing a new copper mine can easily cost billions of dollars, a figure that presents a formidable hurdle for potential new competitors.

This substantial financial barrier means that only well-established companies with significant access to capital, like Sumitomo Metal Mining, can realistically enter or expand within these industries. New entrants would need to secure enormous funding for initial setup, making it difficult for smaller or less capitalized firms to challenge existing players.

New entrants in the mining sector face significant challenges due to extensive regulatory hurdles and the need for numerous permits. For instance, in 2024, the average time to obtain all necessary permits for a new large-scale mining project in many developed nations could extend to several years, often exceeding five years. This complex web of environmental impact assessments, land use approvals, and safety regulations acts as a substantial barrier, deterring potential competitors by increasing upfront costs and project timelines significantly.

The threat of new entrants for Sumitomo Metal Mining, particularly concerning access to raw materials and reserves, is significantly mitigated by the capital-intensive nature of exploration and extraction. Established players, including Sumitomo Metal Mining, benefit from decades of investment in geological surveys and the development of mining infrastructure, securing access to proven reserves. For instance, Sumitomo Metal Mining's operations, like its stake in the massive Cerro Verde copper mine in Peru, represent long-term, secured resource access built on substantial prior investment.

Newcomers face the daunting task of identifying and acquiring new, economically viable mineral deposits, a challenge amplified by the increasing scarcity and rising costs associated with greenfield exploration. The global demand for key metals, such as copper and nickel, continues to rise, driven by electrification and renewable energy initiatives, making the acquisition of new, high-quality reserves a fiercely competitive and expensive endeavor for any potential entrant.

Technological Expertise and Intellectual Property

Sumitomo Metal Mining's deep-rooted technological expertise, honed over centuries in metal processing and refining, presents a significant hurdle for new competitors. Their mastery extends to advanced materials manufacturing, requiring substantial investment in research and development to replicate.

The company holds numerous proprietary technologies and specialized knowledge, which are protected and difficult for new entrants to acquire or develop independently. This intellectual property acts as a strong deterrent, safeguarding their market position.

- Proprietary Technologies: Sumitomo Metal Mining actively patents its innovations in areas like hydrometallurgy and pyrometallurgy, making it challenging for newcomers to bypass these established processes.

- R&D Investment: In fiscal year 2023, Sumitomo Metal Mining invested approximately ¥35 billion in research and development, a testament to their commitment to maintaining a technological edge.

- Skilled Workforce: The company employs a highly specialized workforce with unique skills in materials science and engineering, which are not easily transferable or replicable.

Established Supply Chains and Customer Relationships

Sumitomo Metal Mining (SMM) benefits significantly from its deeply entrenched global supply chains for essential raw materials. These established networks are critical for securing consistent and cost-effective access to resources, a hurdle that new entrants would find exceedingly difficult and expensive to replicate. For instance, SMM’s long-standing partnerships ensure a steady flow of copper and nickel, vital for its operations.

Furthermore, SMM boasts strong, long-standing relationships with a diverse customer base across various demanding industries. Building this level of trust and demonstrating consistent quality and reliability takes years, if not decades. New competitors would struggle to penetrate markets where established players like SMM are already preferred suppliers, especially in sectors where product integrity is non-negotiable.

- Established Supply Chains: SMM's global sourcing networks provide a competitive advantage in raw material procurement.

- Customer Loyalty: Long-term relationships with clients in sectors like automotive and electronics create significant barriers to entry.

- Market Trust: The company's reputation for quality and reliability, built over many years, is a key deterrent for new market participants.

- Cost of Replication: The sheer capital and time investment required for new entrants to build comparable supply chains and customer bases is substantial.

The threat of new entrants for Sumitomo Metal Mining is considerably low due to the immense capital required to establish operations in the mining and smelting sectors. With new mine development costs easily reaching billions of dollars, only highly capitalized entities can realistically enter the market. Furthermore, navigating complex and lengthy regulatory processes, which can take over five years for permits in 2024, adds another significant deterrent.

Established players like Sumitomo Metal Mining have secured access to proven reserves through decades of investment, making it difficult for newcomers to find and acquire economically viable mineral deposits. The increasing scarcity and cost of greenfield exploration, coupled with the high demand for key metals like copper and nickel, further elevate the entry barriers.

Sumitomo Metal Mining's proprietary technologies, deep R&D investment (¥35 billion in fiscal year 2023), and a highly skilled workforce create substantial technological hurdles for potential competitors. These factors, combined with entrenched global supply chains and strong customer loyalty built over many years, significantly limit the threat of new entrants.

Porter's Five Forces Analysis Data Sources

Our Sumitomo Metal Mining Porter's Five Forces analysis is built upon a foundation of robust data, including the company's annual reports, investor presentations, and filings with regulatory bodies like the SEC. We also incorporate industry-specific market research reports and data from reputable financial information providers to capture a comprehensive view of the competitive landscape.