Sumitomo Metal Mining Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sumitomo Metal Mining Bundle

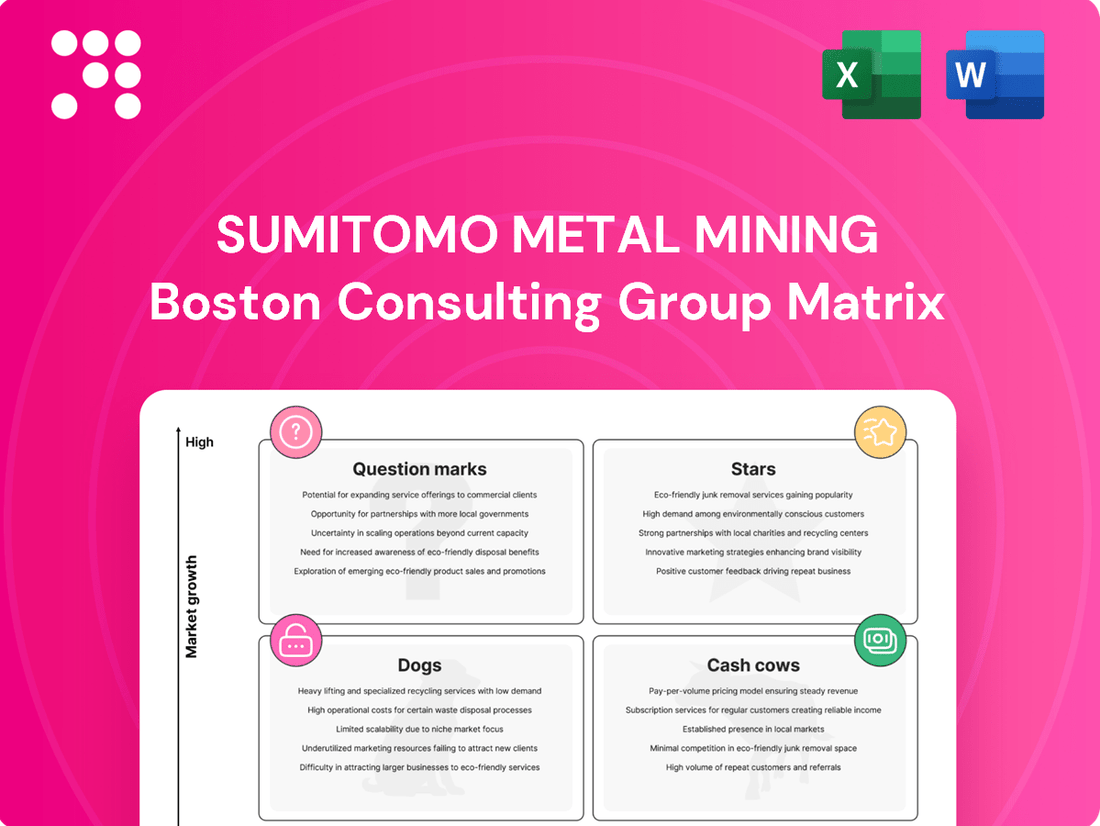

Uncover the strategic positioning of Sumitomo Metal Mining's product portfolio with our comprehensive BCG Matrix analysis. See which ventures are poised for growth, which are generating consistent returns, and which require a critical review. This glimpse is just the start of understanding their market dynamics.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Sumitomo Metal Mining (SMM) is a key player in the electric vehicle (EV) battery materials sector, particularly as a major supplier of cathode materials. Their products are essential for lithium-ion batteries, famously powering Tesla vehicles through their partnership with Panasonic. This positions SMM directly within a critical and rapidly expanding segment of the automotive industry.

The demand for lithium-ion battery materials is surging, fueled by the global shift towards electric mobility. Projections indicate substantial market growth by 2029, underscoring the strategic importance of SMM's focus. For instance, the global battery materials market was valued at approximately $25 billion in 2023 and is expected to reach over $100 billion by 2030, showcasing the immense opportunity.

To capitalize on this trend, SMM is making significant investments to boost its production capacity for these vital battery components. This proactive expansion strategy reinforces their strong market standing and commitment to meeting the escalating needs of the EV market, solidifying their role as a star performer in this high-growth industry.

Copper mining and concentrates represent a significant area for Sumitomo Metal Mining (SMM). Global demand for copper is projected to see a substantial increase, driven by its essential role in various industries, particularly metal manufacturing. SMM's own copper production is on an upward trajectory, with expectations of growth leading into 2025.

Key developments bolster SMM's position in the copper market. The Quebrada Blanca Phase 2 Copper Mine, in which SMM has a notable stake, recently reached commercial production, a crucial milestone. Additionally, SMM's strategic move to acquire a 30% interest in the Winu Copper-Gold Project in Australia further solidifies its commitment to expanding its copper asset portfolio for future growth.

Sumitomo Metal Mining's Advanced Electronic Materials segment, encompassing electronic and functional materials, is experiencing robust growth driven by the expanding digital economy. The company is investing heavily in capacity expansion, exemplified by its 8-inch Direct Bonded SiC Substrate line, signaling a strategic push to capture a larger share of the high-tech materials market.

This segment is a significant contributor to Sumitomo Metal Mining's profitability, fueled by the ever-increasing complexity and demand for advanced electronic components. The ongoing development and adoption of sophisticated electronic devices worldwide directly translate into higher sales for these specialized materials.

Lithium-ion Battery Recycling

Sumitomo Metal Mining (SMM) is making significant strides in lithium-ion battery recycling, a sector poised for substantial growth. The company is actively constructing new recycling facilities, with a projected completion date of June 2026. These facilities are designed to recover critical metals such as copper, nickel, cobalt, and lithium from end-of-life batteries.

This strategic investment aligns with the increasing emphasis on circular economy principles and evolving environmental regulations worldwide. SMM's commitment positions them as a key contributor to sustainable metal recovery, a market expected to expand dramatically in the coming years. For context, the global lithium-ion battery recycling market was valued at approximately USD 2.4 billion in 2023 and is projected to reach over USD 15 billion by 2030, growing at a CAGR of around 28%.

SMM's approach is further strengthened by strategic partnerships aimed at building a complete recycling supply chain. This collaborative effort enhances their capability and potential within this high-growth segment.

- Investment in New Facilities: SMM is investing in new lithium-ion battery recycling facilities, with completion targeted for June 2026.

- Metal Recovery Focus: The facilities will recover valuable metals including copper, nickel, cobalt, and lithium.

- Market Growth Driver: The initiative capitalizes on the rapidly expanding market driven by circular economy principles and regulations.

- Strategic Partnerships: SMM is forming partnerships to establish a comprehensive recycling supply chain, bolstering its position in this high-growth area.

Strategic Investments in Battery Value Chain

Sumitomo Metal Mining (SMM) is strategically positioning itself within the burgeoning battery value chain. The company's proactive investments underscore a commitment to securing a comprehensive presence, from raw materials to advanced technologies. These moves are aimed at capitalizing on the significant growth opportunities presented by the electric vehicle (EV) and energy storage sectors.

Key strategic investments include a 9.9% stake acquisition in FPX Nickel Corp, a company focused on nickel development, and a significant investment in Nano One, a developer of advanced battery cathode materials. These actions demonstrate SMM's forward-thinking approach to bolstering its supply chain and technological prowess in critical battery components.

These investments are crucial for SMM's long-term strategy, ensuring access to essential raw materials and cutting-edge cathode technologies. By integrating across the value chain, SMM aims to enhance its competitive advantage and meet the escalating global demand for batteries.

- Nickel Resource Acquisition: SMM's 9.9% stake in FPX Nickel Corp highlights its focus on securing nickel, a vital component in many EV battery chemistries.

- Cathode Technology Investment: The investment in Nano One signals SMM's commitment to advanced cathode material innovation, crucial for battery performance and cost reduction.

- Value Chain Integration: These strategic moves reflect SMM's objective to build a robust and integrated position across the entire battery materials supply chain.

- Market Growth Capture: By investing in these high-growth segments, SMM is poised to benefit from the rapid expansion of the EV and energy storage markets.

Sumitomo Metal Mining's (SMM) cathode materials business is a clear star in their portfolio, directly benefiting from the booming electric vehicle market. Their role as a key supplier to battery manufacturers, including those powering major EV brands, places them at the forefront of this high-growth sector. SMM's strategic investments to expand production capacity further solidify their position as a market leader, ready to meet the escalating demand for essential EV battery components.

The company's advanced electronic materials segment also shines brightly, driven by the relentless expansion of the digital economy. Investments in cutting-edge production lines, like their 8-inch Direct Bonded SiC Substrate, underscore their commitment to capturing a significant share of the high-tech materials market. This segment's profitability is directly tied to the increasing sophistication and demand for electronic devices globally.

Furthermore, SMM's venture into lithium-ion battery recycling is rapidly ascending, marking another star performer. With new facilities set to be operational by June 2026, SMM is strategically positioning itself to recover valuable metals from end-of-life batteries, aligning with circular economy principles and robust market growth projections. The global battery recycling market is expected to surge, highlighting the strategic foresight of SMM's investments in this sustainable sector.

What is included in the product

The Sumitomo Metal Mining BCG Matrix offers a strategic framework for analyzing its diverse business units based on market growth and share.

It guides investment decisions by categorizing units as Stars, Cash Cows, Question Marks, or Dogs, enabling optimized resource allocation.

The Sumitomo Metal Mining BCG Matrix provides a clear, actionable overview, relieving the pain of strategic uncertainty by visually categorizing business units.

Cash Cows

Sumitomo Metal Mining's established gold mining operations, exemplified by the Hishikari Mine, are robust cash cows. These mature assets consistently deliver a stable volume of gold sales, providing a predictable revenue stream for the company.

In 2023, the gold segment of Sumitomo Metal Mining reported operating profit of ¥128.4 billion, a significant increase from ¥78.6 billion in 2022, largely driven by higher gold prices and stable production volumes. The average selling price of gold in 2023 was approximately $1,943 per ounce, up from $1,790 per ounce in 2022, directly boosting profitability from these established mines.

These existing gold mines, like Hishikari, require comparatively minimal capital expenditure for ongoing operations and maintenance, especially when contrasted with the substantial investments needed for developing new mining projects. This efficiency allows them to generate substantial free cash flow, reinforcing their status as key cash cows for Sumitomo Metal Mining.

Sumitomo Metal Mining's traditional copper smelting and refining operations are a classic cash cow. These activities have a significant market share within the industry, reflecting years of established processes and strong customer ties.

In 2023, Sumitomo Metal Mining reported that its smelting and refining segment contributed significantly to its overall revenue. The company consistently achieves high operational efficiency, translating into robust profit margins for this mature business line.

Sumitomo Metal Mining, Japan's largest nickel smelter, operates its existing nickel smelting and refining facilities as a significant cash cow. These operations benefit from a strong market position and substantial processing capacity, ensuring a steady generation of cash flow despite broader market dynamics.

While the global nickel market, particularly for Class 1 nickel, is experiencing a surplus, Sumitomo's established smelting operations, especially those focused on Class 2 nickel, are anticipated to maintain a balanced supply and demand. This stability underpins their role as a reliable cash generator for the company.

Silver Production

Silver production at Sumitomo Metal Mining often arises as a co-product from their extensive base and precious metal mining activities. This consistent output, though not always the primary objective, provides a reliable and stable revenue stream, bolstering the company's overall financial health.

The mature operational status of these silver-producing assets typically necessitates reduced new capital expenditure when contrasted with ventures in high-growth sectors. This characteristic aligns with the definition of a Cash Cow, generating consistent profits with minimal reinvestment.

- Stable Revenue: In 2023, Sumitomo Metal Mining reported total revenue of approximately ¥1.5 trillion, with their metals segment contributing significantly. While specific silver revenue isn't always itemized separately, its co-product nature ensures a steady contribution.

- Low Investment Needs: Existing infrastructure for base metal extraction means that incremental investment for silver recovery is often minimal, enhancing profitability.

- Mature Operations: The established nature of these mines signifies predictable operational costs and output, characteristic of a mature business unit.

Ferronickel Production (Existing Capacity)

Sumitomo Metal Mining's existing ferronickel production capacity, while anticipating a dip in output for 2025, remains a significant cash generator. The company has a robust history of ferronickel production, demonstrating its established market presence.

These mature facilities, coupled with a loyal customer base, continue to provide a steady stream of cash flow, even amidst evolving market dynamics. This segment is characterized by its stability, necessitating ongoing operational upkeep rather than substantial expansionary capital.

- Established Operations: Sumitomo Metal Mining's long-standing presence in ferronickel production signifies a well-developed infrastructure and operational expertise.

- Consistent Cash Flow: Despite market fluctuations, the existing capacity and established customer relationships ensure a reliable cash flow generation.

- Maintenance Focus: The strategy for this segment is centered on maintaining current production levels and efficiency, rather than pursuing aggressive growth initiatives.

- Market Position: The company's historical output and customer loyalty solidify its position in the ferronickel market, making it a dependable contributor to overall revenue.

Sumitomo Metal Mining's established gold mining operations, like the Hishikari Mine, are prime examples of cash cows. These mature assets consistently generate stable gold sales, providing predictable revenue. In 2023, the gold segment's operating profit surged to ¥128.4 billion, up from ¥78.6 billion in 2022, fueled by higher gold prices, which averaged around $1,943 per ounce. These mines require minimal capital expenditure for upkeep, allowing them to produce substantial free cash flow.

| Segment | 2023 Operating Profit (¥ billion) | Key Characteristic |

|---|---|---|

| Gold Mining | 128.4 | Stable production, rising prices ($1,943/oz average in 2023) |

| Smelting & Refining | N/A (Significant revenue contributor) | High operational efficiency, strong market share |

| Nickel Smelting (Class 2) | N/A (Reliable cash generator) | Established operations, balanced supply/demand |

| Silver Production | N/A (Co-product revenue) | Consistent output, minimal new capital needs |

| Ferronickel Production | N/A (Steady cash flow) | Established capacity, loyal customer base |

Delivered as Shown

Sumitomo Metal Mining BCG Matrix

The Sumitomo Metal Mining BCG Matrix you are previewing is the complete, unwatermarked document you will receive upon purchase. This comprehensive analysis, meticulously crafted for strategic insight, will be immediately available for your use. It provides a clear, actionable framework for understanding Sumitomo Metal Mining's product portfolio, enabling informed decision-making for resource allocation and future growth strategies.

Dogs

Sumitomo Metal Mining's ferronickel production guidance for 2025 indicates a decline from 2024 levels, signaling a shrinking output. This trend points to a low-growth market, potentially with a decreasing market share for Sumitomo Metal Mining in this product line, positioning it as a potential candidate for divestiture or reduced investment.

The global nickel market surplus, a factor contributing to the challenges faced by ferronickel, further underscores the strategic considerations for this segment.

Coral Bay Nickel Corporation, a subsidiary of Sumitomo Metal Mining, recorded impairment losses in 2023, signaling underperformance in its nickel smelting operations. This situation points to a potentially low market share within a difficult or saturated nickel market.

These underperforming units can tie up significant capital without delivering adequate returns, making them candidates for a thorough strategic assessment. For instance, Sumitomo Metal Mining's consolidated financial results for the fiscal year ended March 31, 2024, showed a net loss attributable to owners of the parent, partly influenced by such factors.

The global nickel market, essential for stainless steel production, is currently experiencing a significant oversupply, especially in Class 1 nickel. This surplus is largely driven by a substantial increase in production from Indonesia, a major nickel supplier.

This oversupply environment puts pressure on Sumitomo Metal Mining's (SMM) nickel production, particularly that which is destined for the stainless steel industry. Reduced profitability and heightened competition are likely outcomes for SMM in this segment.

The stainless steel sector itself is characterized by low growth, which further exacerbates the challenges for SMM's nickel operations. This situation could lead to increased pressure on maintaining market share.

For context, global nickel demand was projected to grow by approximately 3.5% in 2024, but supply increases, particularly from Indonesia's laterite nickel pig iron and mixed hydroxide precipitate (MHP) projects, are outpacing this growth, leading to a projected surplus of around 200,000 tonnes in 2024 according to some market analyses.

Older, Less Strategic Mining Assets

Older, less strategic mining assets within Sumitomo Metal Mining's portfolio, while not always explicitly named, can be categorized as dogs in the BCG matrix. These are operations that may be struggling with rising extraction costs, declining ore quality, or depleted reserves in established mining regions.

Such assets typically exhibit a low market share in their respective segments and contribute little to the company's overall growth trajectory. They also risk becoming cash traps, requiring ongoing investment without generating substantial returns.

For example, in 2024, the global mining industry faced persistent challenges including inflationary pressures on operational expenses and the increasing complexity of accessing new, high-grade ore bodies. Sumitomo Metal Mining, like its peers, would need to carefully manage older assets that fall into this category.

- Low Growth Potential: These assets operate in mature markets with limited opportunities for expansion or increased demand.

- High Operational Costs: Older mines often incur higher expenses due to aging infrastructure and the need for more intensive extraction methods.

- Declining Profitability: Falling ore grades and increasing extraction costs can squeeze profit margins, making these assets less attractive.

- Potential for Divestment: Sumitomo Metal Mining might consider divesting or restructuring these underperforming assets to reallocate capital to more promising ventures.

Nickel-based Special Alloys for Aircraft Engines (Vulnerable to Economic Slowdown)

Sumitomo Metal Mining views nickel-based special alloys for aircraft engines as a potential question mark within its portfolio. The company recognizes that a significant economic downturn, particularly in the U.S., could dampen demand for these specialized materials.

This segment, though currently niche, faces the risk of becoming a low-growth, low-market-share category if its primary market experiences a contraction.

- Economic Sensitivity: Aircraft engine demand is closely tied to global economic health and travel patterns, making this alloy segment vulnerable to slowdowns.

- Potential for Stagnation: A prolonged economic slump could shift this product line from a specialized offering to one with limited expansion prospects.

- Market Share Risk: If demand falters, maintaining or growing market share in a shrinking aircraft engine market becomes increasingly difficult.

Assets categorized as Dogs in Sumitomo Metal Mining's BCG matrix are those with low market share in low-growth markets. These operations often face challenges like high operational costs and declining profitability, potentially leading to divestiture. For instance, older mining assets struggling with rising expenses or depleted reserves fit this description, demanding careful capital allocation.

These segments, while perhaps historically important, are no longer significant growth drivers and may even consume resources without adequate returns. The company must strategically assess these units to avoid them becoming cash traps.

The global nickel market's oversupply, particularly impacting ferronickel for stainless steel, exemplifies a low-growth environment where Sumitomo Metal Mining's market share could be challenged, pushing such operations towards Dog status.

Sumitomo Metal Mining's ferronickel production guidance for 2025, showing a decline from 2024, signals a shrinking output in a low-growth market, positioning this segment as a potential Dog.

Question Marks

Sumitomo Metal Mining's commissioning of a vanadium flow battery in 2024 marks a strategic move into the burgeoning energy storage sector. This technology is pivotal for integrating intermittent renewable energy sources like solar and wind, a market poised for substantial growth.

Given the early stage of this market and SMM's recent entry, its current market share in vanadium flow batteries is expected to be minimal. Capturing a significant portion of this high-potential market will necessitate substantial capital investment in research, development, and manufacturing capacity.

Early-stage new mine developments, like Sumitomo Metal Mining's investment in the Winu Copper-Gold Project in Australia, are classic examples of potential Stars or Question Marks in the BCG Matrix. These projects require significant upfront capital for exploration and initial infrastructure, with Sumitomo Metal Mining acquiring a 30% stake, indicating a substantial commitment. While holding high growth potential, they currently generate little to no revenue, demanding considerable investment before any production begins.

Sumitomo Metal Mining (SMM) is actively exploring new advanced materials for niche applications, moving beyond its traditional electronic materials base. These innovative products target high-growth sectors like specialized aerospace components or advanced medical devices, where demand is projected to expand significantly. For instance, the global advanced materials market was valued at approximately $100 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 8% through 2030.

While these new materials represent substantial future potential, SMM's initial market share is naturally low as they work to establish broader industry acceptance. The company's strategic focus on research and development, coupled with targeted marketing efforts, will be critical in driving adoption and transforming these nascent products into future market stars. Continued investment in R&D for advanced composites and functional coatings, for example, is key to unlocking their full market potential.

CO2 Reduction Photocatalyst Development

Sumitomo Metal Mining is actively engaged in the joint development of photocatalysts designed for CO2 reduction. This aligns with the burgeoning sustainability and environmental solutions market, a sector poised for significant growth. While the technology holds immense promise, the company's current commercial market share in this nascent field is likely negligible.

This venture represents a strategic, long-term investment for Sumitomo Metal Mining. Significant research and development, coupled with extensive market cultivation, will be essential for this initiative to evolve into a substantial contributor to the company's revenue streams.

- Market Potential: The global carbon capture, utilization, and storage (CCUS) market, which includes photocatalytic CO2 reduction, was valued at approximately $2.5 billion in 2023 and is projected to reach over $10 billion by 2030, indicating a substantial growth trajectory.

- R&D Investment: Companies in this space typically invest heavily in R&D, with early-stage projects often consuming a significant portion of capital before commercial viability is established.

- Technological Advancement: Breakthroughs in photocatalyst efficiency and scalability are crucial for widespread adoption, with ongoing research focusing on improving quantum efficiency and material stability.

- Strategic Positioning: Early involvement in CO2 reduction photocatalyst development positions Sumitomo Metal Mining to capture future market share in a critical environmental technology area.

New Exploration Ventures

Sumitomo Metal Mining actively pursues new mineral exploration ventures, a critical component of its long-term strategy to secure future resource pipelines. These endeavors represent high-risk, high-reward opportunities, demanding substantial capital investment with no certainty of successful commercialization.

These exploration projects are essentially question marks within the BCG framework. While they hold the potential to uncover significant new ore bodies, like the ongoing exploration work in the Andes region, they require extensive geological surveys, drilling, and feasibility studies before any return on investment can be realized. For instance, in 2023, Sumitomo Metal Mining allocated approximately ¥30 billion towards exploration and resource development, a significant portion of which would be directed towards these nascent ventures.

- High Risk, High Reward: Exploration ventures are characterized by the possibility of discovering substantial new mineral deposits, but also by the significant probability of failure and the loss of invested capital.

- Long-Term Strategic Importance: These activities are vital for replenishing the company's resource base and ensuring sustained operational capacity for decades to come.

- Capital Intensive: Substantial upfront investment is required for geological assessment, drilling, and initial feasibility studies, often running into millions of dollars per prospect.

- Uncertainty of Commercial Viability: Success is not guaranteed; many exploration projects never reach the production stage due to insufficient ore grades, unfavorable geological conditions, or economic non-viability.

Sumitomo Metal Mining's ventures into advanced materials for niche applications and its development of CO2 reduction photocatalysts are prime examples of Question Marks. These initiatives are characterized by high growth potential within emerging markets but currently hold minimal market share and require substantial ongoing investment for research and development.

The company's exploration projects, such as those in the Andes region, also fall into the Question Mark category. These are capital-intensive, high-risk endeavors with uncertain outcomes, critical for securing future resource pipelines but generating no immediate returns.

Similarly, the vanadium flow battery project, while targeting a high-growth energy storage market, is in its nascent stages for Sumitomo Metal Mining. Significant investment is needed to scale production and capture market share, positioning it as a Question Mark with considerable future upside.

These Question Mark initiatives, while demanding significant capital and carrying inherent risks, are crucial for Sumitomo Metal Mining's long-term diversification and growth strategy, aiming to transform them into future market leaders.

| Business Unit/Initiative | Market Growth Potential | Current Market Share | Investment Required | BCG Classification |

|---|---|---|---|---|

| Advanced Materials (Niche Applications) | High (e.g., Aerospace, Medical) | Low | High (R&D, Market Cultivation) | Question Mark |

| CO2 Reduction Photocatalysts | High (Sustainability Market) | Negligible | High (R&D, Scalability) | Question Mark |

| Mineral Exploration (e.g., Andes) | Variable (Discovery Dependent) | None (Pre-production) | High (Exploration, Feasibility) | Question Mark |

| Vanadium Flow Batteries | High (Energy Storage) | Minimal | High (Manufacturing, Market Entry) | Question Mark |

BCG Matrix Data Sources

Our Sumitomo Metal Mining BCG Matrix is constructed using a blend of internal financial disclosures, detailed market research reports, and publicly available industry performance data.